It's spring.

Not only do you know that from the weather change and faster grass growth, but the real estate industry is trumpeting the change, saying "things have turned up" and "now is a good time to buy".

But is it?

There is extensive paid publicity from those who stand to benefit. Perhaps the most shameless is this tabloid effort. But paid voices from a wide range of conflicted players are reinforcing the message. Everyone says they are "genuinely dedicated to helping New Zealand homeowners".

The list of conflicted businesses seems endless, so there is little real pushback to the hot spruiking. They include:

- real estate agents (Harcourts, Barfoots, Bayleys, Ray White, and hundreds of smaller players).

- listing portals (TM Property, realestate.co.nz, and especially OneRoof).

- media who rely on their advertising (everyone who takes advertising. That includes us. The worst are those producing property porn and passing it off as 'reality').

- social media (probably where spruiking peaks, including TA, Opes, etc. and a wide range of podcasts and short video 'influencers').

- property coaches - say no more.

- analytics companies who sell data to the industry (CoreLogic, QV, Velocity, etc).

- lenders (all of them).

- insurers (all of them, led this season by AA Insurance).

That is an intense set of voices with vested interests in getting buyers back into the housing market. Are you buying it?

Of course, no-one knows the future, including those promoting the FOMO story, so it would seem sensible to set some benchmarks so we can judge the data that does emerge against objective standards.

And, the "housing market" isn't a homogenous thing. It is the sum of thousands of small local markets. So what follows is broad and suffers from that broadness. Also, the real nature of these myriad micro markets enables the industry to ignore the weak bits and reinforce their stories with some self-selected 'good bits'. Even though it's problematic to make generalisations, we are going to anyway. We need some benchmarks.

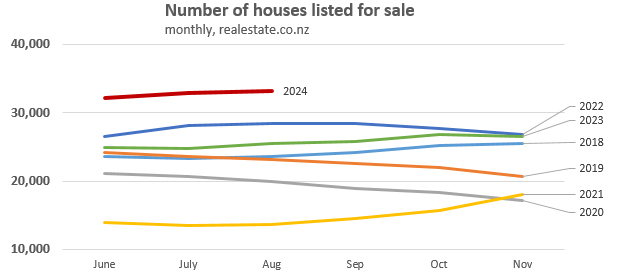

The current housing market is characterised by an unusually high number of houses for sale.

There were more than 33,000 houses listed for sale at the end of August 2024, according to the realestate.co.nz portal. And that is not only the most in seven years, it is +40% more than in August 2019, the last 'normal' pre-pandemic year. An extra +10,000 houses on the market will have a strong overhang effect.

But will it be enough to bring out the buyers? Of course, some will emerge, But it is hard to see an extra 10,000 new buyers jumping into a market that is exhibiting falling values.

It is not enough to have headlines that show median or average prices 'rising'. In a market where more top-end houses sell, but buyers hold back buying at the middle or first-quartile levels (which is where first home buyers enter the market and are the net drivers of activity), it is not hard to see that this will distort transaction medians or average. (In Auckland only about one in five sales are for homes that sell for $750,000 or less. The rest are in the churning portion where buyers and sellers are essentially exchanging residences).

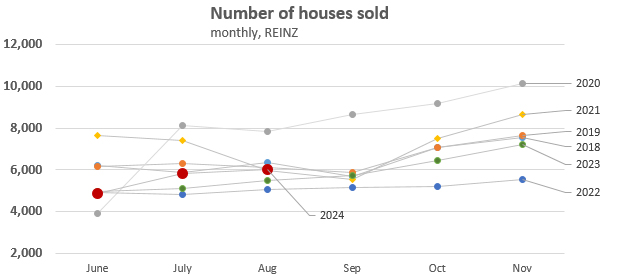

2019 levels seems to be the benchmark. Unless 2024 sales rise to absorb more of the listing overhang, it will remain a buyers market. The volumes needed to do that are surprisingly large. Buyer choice is actually enormous. Buyers who hold back are not hurting themselves by waiting. Or by bidding low.

On the other hand, sellers are in an unusually fierce competitive position. Even if sales levels hold at about 6000 per month in September and rise seasonally towards the 8000 level, that will have little impact on the mismatch between listings available and buyers ready to buy. Only sales levels well above 10,000 per month - in other words, above prior record levels in the 2020/21 pandemic bubble - would move listing inventories down and start to make a meaningful dent.

That seems unlikely. The lid on house prices and 'values' seems more likely to stay in this spring selling season.

Readers are welcome to suggest how they would benchmark the September to November housing market sales. Above what, makes it a recovering market? Below what, makes it a market still struggling?

97 Comments

Thank you David.

Good article to remind readers of the huge potential conflicts of interest to be aware of for owner occupier buyers and the vast vested financial self interests at play.

Owner occupier buyers: CAVEAT EMPTOR.

From the frenzied desperation of the Spruiker comments?

-10% Dec 2023 to Dec 2024

@ IT GUY

From the frenzied desperation of the Spruiker comments?

-10% Dec 2023 to Dec 2024

Hi IT Guy - what does above mean/relate to please? Also please speak slowly I am a stupid spruiker?

Buyer choice is actually enormous.

from a price perspective, yes. from a quality perspective, no.

my partner and I are casually looking to buy a slightly bigger house at the moment, but nothing would suit our "a 3 bedroom with a drive way on a flat section' requirements. mostly because not too many flat bits in wellington, or no drive way in inner city, or quality too poor that requires significant work to how where would like it.

once in a blue moon appears a good house to the market, and the prices would be 200k over our budget.

all I can see is a tsunami of bad houses, no real good ones.

as for general market trends, I'd say, many people have got burnt badly, especially ones who bought 2021-2022, they've lost their down payment. because of that, they will need at least another 3 years to buy again (if they are lucky).

I won't expect market rally again, best scenario, things go flat.

Similar issue here in Chch.

Plenty of GOOD choice if you want to spend north of $1 million. Plenty of choice if you just want a comparatively cheap roof over your head, as there are squillions of Williams/Wolfbrook new build rabbit hutches now the capital gains aren't there for over-leveraged investors.

However, we haven't been impressed to-date looking in the ~$800k bracket (moving up from first house, not looking for some 'dream home') in established areas. Lots of dodgy do-ups done cheap, older places you've got the risk of the neighbouring properties being bought up by townhouse developers and ruining your view/privacy, generally mediocre buying.

If we went to one of the new subdivisions e.g. out Halswell way there is buying aplenty, but we really want to avoid moving somewhere where you have to drive to get anywhere (we are walking/biking distance to many amenities) and from a 'investment' perspective there's the bigger issue that there is always another, newer house of similar nature springing up just down the road.

So you want an inner suburb where you are walking distance to all the amenities, but you don't want to be near townhouses. Bit of a contradiction there. To live central you trade land for amenity. If you could get the same land for the same price as the outer suburbs, well everyone would want that and bid up the price.

I live in a townhouse right now, love it and have no need for a lot of land (just need a bigger one living space-wise for expanding family reasons). However, it's a townhouse that very much predates the likes of Williams & Wolfbrook, in a small development with adequate parking, good maintenance by all owners etc. The way it has been built nobody really overlooks anybody else, you'd never really notice that you're living with a shared wall ... it's fantastic apart from the now inadequate size.

If I look at houses in some more established areas of town, I could buy a doer-upper (or already done up) older single level house with a bit of land. However, you peer over the fence and see a run down old place next door, and you know next time it goes up for sale some type in a leased Ranger and RM Williams boots will be buying it, slapping a bunch of dog boxes next door, most of which will go to investors who probably can't afford to care who is living in the house as they need to max out the rent, and that ultimately diminishes the enjoyment and value (not necessarily $-wise) I get from my place ... not to mention loss of off street parking etc.

I have absolutely nothing against townhouses, but I do have something against buying a place at what remains vast expense, only to discover that shortly afterwards I wind up losing privacy by being overlooked by a bunch of townhouse units. I'd buy a place if all the development around me was done and I knew what I was getting in for - as I already have - but as NIMBY as it sounds having seen some of the impacts of these Williams/Wolfbrook developments with parking issues, endless tenants coming and going, noise etc I don't want any of that smoke.

I know, isn't it terrible when a renter moves in next door. Knocks 100k off your valuation.

I never mentioned anything in terms of dollar valuation. All my neighbours on both sides are renters, and I've managed to survive this long living next to them ... although I'll be the first to admit that I'm not really in a position to go about willingly losing money on property if I can avoid it. So yeah if some manky-before-its-sold development next door is going to affect me $-wise I'll be against it, if only because I can't afford not to.

But to my previous comment, finding a multi-unit, multi-storey dog box development next door doesn't just affect you $ wise, there are other implications such as:

- Enjoying a certain level of off "reliable" street parking (for yourself or for visiting friends/family) that is then removed. Suddenly you find the mother-in-law has to park a great distance down the road and it is your fault, because all the off street parking is taken up by the people living in the units built with inadequate off street parking. Not their fault, but also a loss of amenity which I don't have to be happy about either.

- Diminishment of peace and quiet, e.g. people coming and going all hours - particularly where there are short-term/Air BnB rentals (a friend of mine is experiencing this exact issue, with several units near him used as Air BnB party houses)

- Reduction of privacy, e.g. suddenly not being able to do your usual nude Interest.co.nz commenting session in the back garden because there are 10 master bedroom windows peering down on you.

Sure, all of these have a $ implication (potentially) but in the first instance it's more about the day-to-day enjoyment of your property.

There is a 'plus side' though.

If THs are being built on your boundary, it generally means that your land has gone up in value while you weren't watching. Not saying you'd have missed this, but most do.

Not necessarily:

- the building on the boundary might cast deep shadows into your property

- your property may be too small to redevelop in a similar fashion: a significant proportion of Auckland sections are 400 sq m or less, or townhouses, flats or apartments

- your property may have slope or hazard issues that make it hard to develop

- your property may have a different zoning

etc etc

Haha love the RM Williams comment, spot on.

There are quite a few family homes in St Albans at the moment going for under $800k, all nicely renovated and move in ready. I've been surprised. Maybe not at the Merivale end of it, but elsewhere.

Got any examples? I'm really not built for this property searching business ... I find property all rather tiring.

Great family houses tend to be rarer to find during downturns, was the same after the GFC. The bargains tend to be land value situations (poorly maintained etc etc leakies ), and above say 2mil, forced auctions.

Wouldn't rule out a 2 storey house unless you are old and have mobility problems. I really wanted single level as well but in the end the perfect house was a 2 storey. Its all about the design, you can really optimise your views and get all the living space on the second level.

A great article that highlights all the parties that are set to benefit from a potential demand uplift. At a much micro level, I see a four bedroom house which is on market in our street attracting at least four families per open home. Few months ago even the agents didn't turn up for open homes. It seems demand is growing amongst the population which has employment certainty.

Number of people turning up to open homes doesn't correlate to demand.

Yep, plenty of people watchlisting cars on trademe.

Like houses, they still ain't selling.

I watchlist every listing in my town and the trademe app then gives me all the updates to sales methods and when asking prices drop which helps give a feel for what's happening. Doesn't mean I'm interested in buying.

In spruikerland, built on copium and dreams, folks turning up to an open home is a clear sign of an unconditional cash offer incoming (no matter the asking price).

When we sold our last house in 2016 we had nine parties through the open home, and eight were nosey neighbours. Two of the three offers we received came from private viewings.

Buyers who hold back are not hurting themselves by waiting. Or by bidding low

I certainly concur!

Had to check the author of this article, thought it could of been you...

A very generalized statement that could lead some to miss out on opportunities.

Like the opportunity to lose their deposit - yes everyone needs to ‘be quick’ to throw away their deposit in this bad jobs market in a falling housing market with rising business failure with a yield curve inversion only comparable to just prior to 1929..but best listen to the property experts with a vested interest in selling as many homes as possible (and with no care about your personal financial interests).

While they wait a very short time for another opportunity which are coming thick and fast in a falling market as boomers, who see the writing on the wall (big untaxed capital gains are history), sell up.

Yes demographics are (in my opinion) going to influence the market in the coming years. On my street of 10-12 properties around 75% are widows in 70+ age group. All 3-4 bedroom homes on 500sqm or thereabouts. One old guy around 90 has just recently moved into care leaving his home empty (but is now selling). One of the other older couples husband just had a heart attack last week leaving the 80 year old wife at home by herself so soon it might be closer to 80% single widows on the street. One widow around 75 has now decided her place is too large after her husband died about 2 years ago so is going to move and downsize into a 2 bed on a much smaller section in the coming months - see hopes to sell it to a young family.

If my street is representative of society at large there are big changes coming in th next 5-10 years potentially with a lot of 3-4 bedroom family size homes going to be available as the remaining boomer demographic downsize.

I think you are on to something. The boomer generation was the first to be able to own multiple properties and reap the rewards of stupendous, once in a generation, tax free capital gains.

End result - wealthy enough to not have to downsize for retirement. The knock-on effect is instead of young families being able to buy a house with a moderate, or short commute, they are forced further and further out into the suburbs. Thus, more congestion and poor quality of life for families. Meanwhile the 70+ year olds remain in neighbourhoods prime for short commutes and close to good schools.

Historically retirees had to sell the family home and downsize in order to release the equity in their home. Then the banks/finance companies (everyone's best friend) said - "we will give you loads of cash and you don't need to pay us anything till you sell your home (or die)" thereby sending a massive amount of wealth to the banks in form of compound interest.

Wait until the penny drops that the only way they are going to receive quality aged care until they die is to be in a retirement village, as the Govt isnt funding rest homes and hospices. Being stranded in your 4 bedroom family home at end of life with nowhere to go, will not be a pleasant experience.

For alot of owner occupied home buyers quality properties in desirable areas aren't coming thick and fast...

For alot of investors, properties that are yeilding a good return aren't coming thick and fast...

When these type of properties do present themselves you probably don't want to be 'holding back' & 'low bidding' unless you enjoy wasting time at open homes, talking with RE Agents & scrolling aimlessly on trademe...

"For alot of investors, properties that are yeilding a good return aren't coming thick and fast..."

Indeed.

If 'investors' can not banks on lovely big untaxed capital gains then the equation gets real hard at current prices.

One hopes OOs and FHB also see that big untaxed capital gains aren't going to reappear for many years too.

Boomer here....I'm not selling, in fact I'm building another house.

Capital gains aren't far away now, early next year you'll see prices edging up.

Still dependant on another couple of OCR drops but another 100bps it will be all on like Donkey Kong.

Judging by your and Wingmans repetitive statements I'm guessing you think Tauranga and Riverhead are the bellwether areas for the NZ property market.

Go to Westgate, Riverhead and then up to Waimauku on SH16 and report back.

Haha there's a big wide world out there beyond your little bubble. How's the aviating going?

I finished aviating a few years back.

Property is my major interest now.

Whenuapai Air Base?

Nope, worked for 3 different airlines.

It's your intense interest on only West Side property gave me reason to think you worked on the Base.

Lived out West most of my life, I like to keep my finger on the pulse.

Capital gains aren't far away now,

Nor is capital gains tax

100%. Not forgetting DTI's - there's a reason they've given themselves the ability to crank the ratio's down severely if need be. They are going to be damned if they allow a repeat of 20/21.

Yet the quote includes ‘bidding low’, which I have been advocating FHBs do for the last 12 months.

Of course it’s a nuanced, case by case assessment of what is ‘too low’ or ‘not low enough’

I'm not sure that number of sales is best to measure a turnaround. Theoretically it is possible to see an increase in properties selling while prices remain depressed or continue to decline due to factors like emigration, investor capitulation, etc.

I would suggest a better indication of a turnaround in the market might be found in some measure of private debt. I find it hard to imagine a scenario where property prices start rising without the money supply increasing. The historical correlation between the money supply and property price increases is pretty strong.

In relation to David's question, what we need to see are the quartiles.

Whereas the median has 50% of sales above and 50% of sales below, the quartile figure are the 25/75 and 75/25/ equivalents.

FHB's should be following the lower quartile (25/75).

Also sales in relation to rating values are close to meaningless unless the year of the RV is known.

KeithW

Yes, It would be helpful. But REINZ doesn't release that detail. We pay them to supply the lower quartile price data but we are not allowed to release it. We use it to however to generate proper FHB affordability tracking and publish that work. But the supplied data does not include the number of lower quartile transactions. I presume we could buy more data from them, but sadly there would be no commercial justification for us, and I doubt we could get permission to release that data in a story.

Because it might tell an unpalatable story, or because it might divulge too much of its intellectual property?

An NDA has the unfortunate inference that the data is being withheld because of the damage it could cause the business model...

David

I wonder whether any Govt agency has these data? LINZ? Presumably any sale of a house has to be registered somewhere and these sales are what determine changes in RV.

It is in the public interest that such information is available.

KeithW

It is in the public interest that such information is available.

This is New Zealand - all the public need to know is that property doubles every 7 to 10 years!

Great to see you commenting again Keith.

unfortunately in NZ the thinking seems to be that public data is to be tightly guarded and released only for payment, used to offset the cost of collecting said data and thus reducing the level of public funding needed.

Other jurisdictions see public data as public, collected on behalf of and paid for by the public through their taxes, and thus to be shared with the public at no cost. This allows much more innovation when you take away the barriers, and i'd suggest this benefits the economy far more than slightly reducing the cost of public services.

And over in Aussie,

Westpac allegedly played down warnings of fraud and other crimes in mortgage broking subsidiary RAMS Home Loans for more than a year, with the audit and risk executive who raised concerns claiming she was bullied by other senior managers who labelled her a troublemaker.

Samantha Aitken, the bank’s head of risk and treasury audit, is suing her employer in the Federal Court, alleging she was sidelined and prevented her from raising her concerns with regulators in 2022 and 2023.

If the Aussie and NZ Ponzis begin to crumble, mass fraud at banks and a lot of dodgy lending that shouldn't have been made will become apparent. Similar to what we saw elsewhere in the GFC. Maybe greater.

https://www.afr.com/companies/financial-services/westpac-allegedly-bull…

More of the RAMS whistleblower case. It seems like there could be potential mortgage fraud.

But the documents show that the group reviews resulted in concerns from the company relating to “purported anomalies relating to the authenticity of documents submitted by staff” and/or instances of possible fraud by the applicants” for certain products.

The documents show that the reviews also raised some concerns in relation to “high rates of suspected false company tax returns and financials, misrepresented savings, undisclosed liabilities and savings that could not be validated”; and multiple occurrences of purportedly “suspected false company tax returns and financials, suspected false personal tax returns and savings and incomes that could not be validated”.

https://www.lawyersweekly.com.au/biglaw/39791-franchisees-of-westpac-ow…

There have been some anecdotal reports of questionable behaviour on mortgage applications by some mortgage originators in NZ so that the mortgage originator gets financially compensated.

If we are to consider mortgage fraud, consider the number of people 2020-2023 who signed legal documents stating they will be having a boarder and charging them [with no intent of actually doing this], in order to access the level of mortgage they needed to purchase a house at very high prices. I know many via friends of friends, and colleagues of that era did this wen caught up in the FOMO, and they were advised by mortgage brokers to do this.

"they were advised by mortgage brokers to do this."

Someone commented a few years ago that this was common.

Another case of mortgage fraud by non owner occupiers. There have been others.

https://www.stuff.co.nz/business/117647504/four-auckland-property-inves…

Its going down. Especially the value of those 2 bedroom townhouses that have sprung up everywhere.

A Williams Corp townhouse in Merivale has been on the market for three months now. Originally asking $750k, then $730k, currently $715k. It will need to have a 6 in front of it to sell now. Purchased in 2020 for $640k.

Four developments on the same street down the road from me. The first has taken all year to sell the six townhouses. The second one across the road has been listed for months now, they have sold 1 from 6. The third has just hit the market (another 6 townhouses) and the fourth is yet to complete.

Then one street over from those 4 developments is another one with 43 townhouses in the complex, all built on a tiny cul-de-sac that used to just have just 10 houses on it (and a bowling club which is what the development has been built on). It looks as awful as you can imagine, crammed in like sardines in a can. They are asking $739k for the lowest spec one.

Meanwhile, investors (the target market for these crapboxes) can buy older units for $450k-$500k and get a 5% gross yield on them (compared to the 4% yield of these new townhouses).

Interest rates are plunging. That'll get us spruikers going.

https://tradingeconomics.com/new-zealand/deposit-interest-rate

The 2 markets I watch are Coatesville and Riverhead. Up 47% and 4.5% respectively in the last 12 months.

(crickets chirp and a lazy tumbleweed blows across riverhead)

We supply that data, via our detailed feeds to the RBNZ.

homes.co.nz shows my walking-distance-to-CBD Wellington property up 33% since September 2023. You should get in there while you can.

Coatesville 15 sold in last 12months....lol Median 'ask' has plunged 1Million since start of year... I suspect the majority of 3 Million plus buyers wont be fhb's.... But I get the healthy commission a 3 mil sale would bring ..... If i had 3 million to burn id probably be looking at hooking 2 houses in Westmere over 1 in Coatesville. Chances of squeezing that into a deal are slim but who knows whats ahead....

https://www.realestate.co.nz/insights/auckland/rodney/coatesville

Coatesville is NZ's most expensive suburb.

There's a good reason for that.

Haha wingding you crack us up…

He's just status seeking. Couldn't afford to buy in Coatesville (like most of us) so bought a section on the flood plain 15 minutes down the road and wants to run around telling everyone that he's affluent. "Aspirational Addressing".

Someone in real life asks him where he's building/lives, it won't be "Riverhead" but "just outside Coatesville". Like people from Glenn Innes who say they live in St Heliers.

That's how you make money, a new concept to you for sure, but Coatesville is NZ's most expensive suburb.

And it'll probably spillover into adjacent properties. Riverhead pricess are up in the last year, not down.

Still lots of vendors in denial and expecting above market prices - which flows onto agents having to quote inflated prices and struggle to sound like they believe its worth that much in todays market

I've made a few offensive offers around Northland, no bites as yet. All I have offered on still on the market. I won't be blinking first.

Just brought a commercial property, 69m2 light industrial unit in Hobsonville. Paid $300k. Spoke to the neighbouring unit yesterday who paid $500k 2 years ago off the plans. 40% discount must be near the bottom of the market.

That's about the same size as my garage.

What sort of yield do you get compared to units like GMT and PFI?

Answers to the question:

- HPI drops a further 1-3%: struggling

- HPI drops 0-1%: stabilising

- HPI increases 0-2%: recovering (unlikely

Answers to the question:

- HPI drops a further 1-3%: struggling

- HPI drops 0-1%: stabilising

- HPI increases 0-2%: recovering (unlikely

Could that approach lead to a false positive? Some people used the above approach in calling the bottom last year.

I don’t think so.

I correctly called late last year a dead cat bounce, which was a minority view. Because the trend wasn’t supported by fundamentals, including the likelihood that meaningful interest rate cuts were far away.

Interest rate cutting is now with us, and will continue apace over the next 9-12 months

interesting to note even in 2019 the number of house listed for sale (20,000+) was greater than the house sold (<8000), so there has been an accumulation over the past 5 years, i assume also some of these were listed for sale but taken off the market also.

2019 levels seems to be the benchmark. Unless 2024 sales rise to absorb more of the listing overhang, it will remain a buyers market.

So in 2019 2.8 x house were listed compared to how many were sold. 2024 30,000 house were listed so 10700 would need to be sold to bring the market back to balance (I can now see where David got the 10,000 number from).

Or houses listed for sale would need to drop to 11,000 per month, surely they will meet in the middle somewhere.

for house listings not sold, they simply delist or list again months later.

Spruikers, Trollers, Boomers, Pessimists, Realists, Fantasists, Aviators all having fun.

A good article. Other real estate conversations tend to be one-dimensional. It's like people talking about the stock market. The average or median is going up or down. It's much more nuanced as you outline.

Places in demand of high quality are few and far between and will sell.

Churn is a fact of life, and is often mistaken for trends.

Oodles of brand new townhouses all coming to the market at the same time will ... (depreciate like EVs?)

First-home buyers face a money mountain to climb indentured for long periods and if they buy the wrong one when they churn they lose (apartments off the plan anyone?). And they're too busy working to pay the mortgage to take on a doer-upper.

Reporting by quartile might be the easiest way to make sense of it.

The exchanging residences part gets me, with no value added it's just banks, brokers and REA making the only real profit here, from their pushing of ever-larger loans and inbox-clogging 'market insight' emails.

It occurs to me that the hollow expectation of prices going up is what causes people to pay more, not anything measurable. Information overload is a main driver.

If you said to many of our youngsters today that the place to buy a house is in Otara, Massey, Mangere or Papatoetoe, because it's affordable, they'd turn their noses up and wonder what planet you came from.

The fact is that buying in cheaper suburbs can be very profitable, I've done it. And lived there.

Roughing it and inviting your mates over for a BBQ in Otara would be very uncool indeed in 2024.

It's nothing to do with how cool it is, the primary issue is the proximity to jobs and how much it reduces your flexibility in changing jobs.

I was born out West and lived there for a long time, and the main issue even my mum has had is how difficult it can be to find certain kinds of work that are within a reasonable driving distance. Spending hours of your day in traffic is both grating on a personal level and acts as a genuine drag on the wider economy. Think of the amount of waste we have from people being stuck in cars for hours a day, time that now can't be used for other functions.

Being out West, it's an absolute nightmare if your job isn't also out West, and I am speaking from experience here. Previously, cheaper suburbs wouldn't have has as much of an impact on your time as buying further out does now. You only get to live once, so it's pretty understandable that people don't want to spend literal weeks of their life dealing with traffic or public transport because the only affordable property is so far from where the jobs actually are. It might be cheaper to buy but there is still a very real cost to living further out, and for some that time can be the difference between seeing your kids at night or not.

And this is coming from someone who actually likes West Auckland, the Waitakeres are great, West is Best, but you are being obtuse when you think it's a catch all for everyone and that there are very real issues that come with pushing people further and further out.

Roughing it and inviting your mates over for a BBQ in Otara would be very uncool indeed in 2024.

Expanding on the above, the reason people don't want to do that isn't because it's "uncool"; it's because it's just straight-up difficult. If you invite your mates over to Otara and they live out South, how exactly are they supposed to get home? It would already take 45 minutes+ to get there, and then you can only have two beers. So, your options are either an Uber/Taxi, which is going to cost you $70+, or public transport, which will likely take 2+ hours and aren't even guaranteed to be running later at night.

Like seriously dude, do you actually think about the stuff that you type out? I question what world you are living in because it certainly isn't the one the rest of us are living in.

Billions of dollars are pouring into the West, I've listed them here occasionally.

Go to Westgate. It's chaos.

I didn't buy places that were handy for my mates to pop over for a beer, I bought them to make money. And I did.

There's a fundamental difference between the way you and I think.

Roughing it and inviting your mates over for a BBQ in Otara would be very uncool indeed in 2024.

You're the one who brought up inviting mates over though? You have also completely ignored the first comment which brings up the much more salient issues.

Definitely, we eventually worked out that it was just cheaper to move more centrally and rent in a decent area with a 10-15min commute, then put up with the NW Motorway slog everyday wasting petrol and hours of time. Life improved 10 x over.

Mate, your kids turned their noses up on the whole country did they not?

wingman: "If you said to many of our youngsters today that the place to buy a house is in Otara, Massey, Mangere or Papatoetoe, because it's affordable, they'd turn their noses up and wonder what planet you came from."

You presume so much.

Back in my day when Ponsonby was looked down on by older people, it was young people that snapped up the bargains and worked hard to turn Ponsonby into a great area. Nothing the mater with Otara, Massey, Mangere or Papatoetoe. They'll have their day - just like Ponsonby did. Simple economics will speak louder than bigoted opinion.

Simple economics is already speaking louder than bigoted opinion. Young people simply cannot afford the "cheap" areas anymore, that's why they aren't buying. Slash the price and demand would return.

"Slash the price and demand would return."

Dreams are free.

How will prices be 'slashed'? Any ideas?

And you got 6 thumbs up for that piece of rambling nonsense.

"How will prices be 'slashed'? Any ideas? "

The same way that you were able to purchase your section at a large discount from the previous owner.

There will be many current vendors in similar circumstances.

Off you go then, make your fortune.

The cost of developing land is going through the roof with local body requirements, burgeoning council fees, discussions, or payments to the local maori, environmental regulations and a plethora of other rules.

I can list some of them if you like.

Is no one going to mention the crime in these areas as to why they might not also want to live there...

Yeah, but I guess one could argue that there was quite bad crime in Ponsonby / Grey Lynn back in the day, although I doubt anything like today in Mangere etc.

I worked in Ponsonby, Parnhell as I call it, and some of Auckland's older suburbs many years ago stripping off wallpaper, scrim, and wainscoting and nailing up gib board. Many of those places were disgusting hovels.

Some made fortunes, but many lost all their money discovering some of the more unpleasant aspects of property speculation.

Like rotten piles.

Above what, makes it a recovering market? Below what, makes it a market still struggling?

Capitulation. I'd predict, much higher sales (a recovery in transaction numbers) accompanied by much lower prices.

People will just want to get moving - be they seller or buyer. But buyers are wise to prices falling and so the market recovery is totally dependent on seller price capitulation.

GV revaluations of those set in 2021 (both Auckland and Wellington city markets, for example) will add great momentum to that capitulation.

The article makes some good points but perhaps this website also needs to look in the mirror a bit.

The FHB affordability report published here could be considered a form of spruiking by making affordability appear better than it is with nonsense assumptions like FHB age being 25-29.

’spruiking’ is probably unfair of me. But it certainly doesn’t make sense to stubbornly persist with the ridiculous age assumption (given the data shows average age of FHBs is now around 35)

perhaps someone from the website could explain the persistence with this assumption

Lets also not forget that we have a mass exodus out of New Zealand. Many home owners will be selling up, they won't be buying back into the market, they will be taking the cash and leaving. Many foreign immigrants coming into New Zealand won't be replacing the numbers who sell up and leave as many may only have short term working or student visas. Even those that manage to get PR may not be in a position to buy and if people are coming from the 3rd world, then they buying power is going to be less simply because of the exchange rates. So the housing market is going to face less buyers, not to mention that many people are losing jobs, NZ in some type of recession and so banks are less willing to loan, or people are less willing to take a risk and borrow as rates are still high as well.

Agree, there is no reality in anything you read. Even before this crash/downturn. NZ Herald's One Roof was one of the worst. Too many media releases. It pays to do the hard yards and your own research as there is too much vested interest behind any of the above commentary. Property turned away from homing people into an industry and consequently greed. The reality is the value is in what someone will pay for it.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.