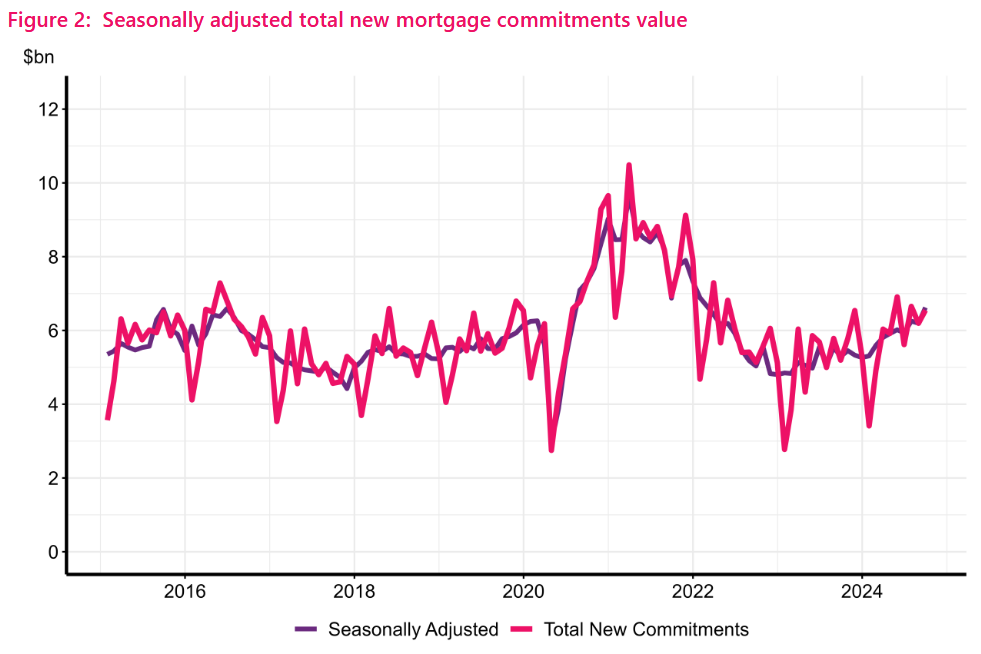

The value of new mortgage commitments rose 6.9% in September compared with August, according to the latest figures from the Reserve Bank (RBNZ).

The strong seasonally adjusted rise in the figures follows on from the RBNZ's decision in August to cut the Official Cash Rate (OCR), which has been followed by a further cut in October - taking the rate down to 4.75% from 5.5%.

Banks were already cutting their mortgage rates ahead of the RBNZ's move to start easing the rates and have continued to do so subsequently.

According to RBNZ's mortgage by borrower type figures, total monthly new mortgage commitments (these figures NOT seasonally adjusted) were $6.548 billion, up 5.7% from $6.194 billion in August.

The September figure was up 26.1% compared with the same month a year ago.

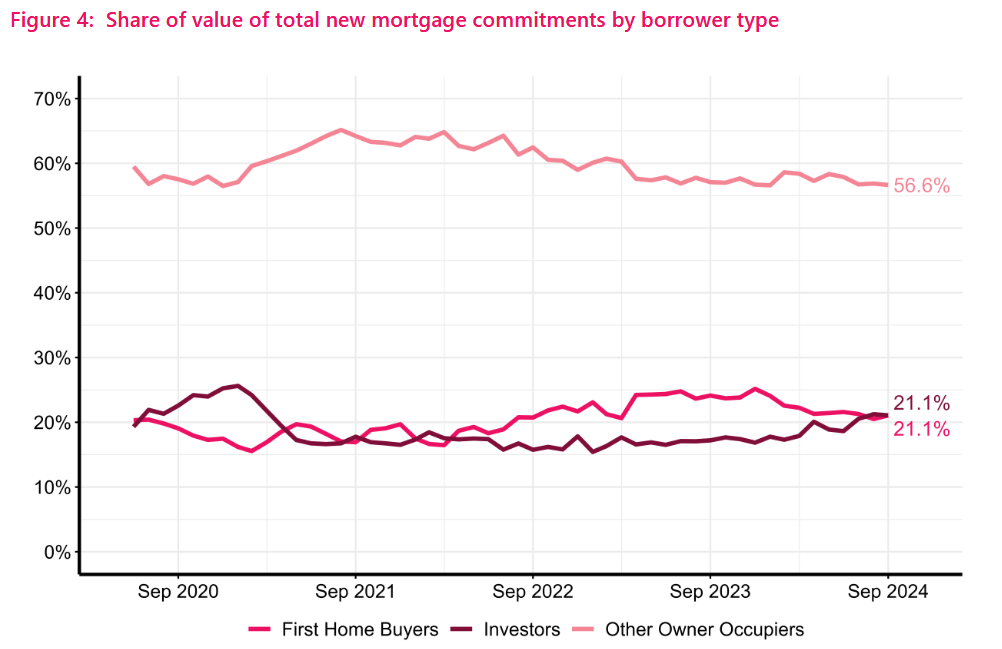

First home buyers (FHBs) saw a surge in their share of the spoils in September after several months of gradually declining share.

The FHBs, hit a high-water mark of a 25.2% share in December 2023, but this has been declining since and in August the long-since sideline-sitting investors actually got a bigger share than the FHBs for the first time in about two-and-a-half years.

In September, the FHBs and the investors actually took exactly the same amount of mortgage money - $1.379 billion, giving them both a 21.1% share of the overall money advanced.

For the FHBs the share was up from 20.5% in August, while for investors this groupings' share was down just slightly from 21.2%.

However, the amount borrowed by the investors in September was up a whopping 54.4% compared with the same month last year.

The rise for the FHBs compared with the same month a year ago was a more modest 10%.

The RBNZ said that in total there were 17,298 new mortgage commitments in September, which was up 2.6% from 16,865 in August.

In September 2023 there were just 14,969 commitments.

While the renewed surge of activity from the FHBs in September saw a slight reduction in the share of the mortgage monies advanced to the investors, the latter grouping has definitely perked up in terms of activity compared with recent years.

The last time the investor grouping was getting a share of the mortgage money of over 20% was during the huge surge in activity that started in 2020 after the RBNZ had temporarily removed loan to value ratio (LVR) limits.

This time the incentive seems more the fall in interest rates that's already been observed plus the likelihood of continued falls in coming months.

29 Comments

It's quite incredible, at the first sign of lower interest rates, borrowing goes up.

It's not just rates. Lending restrictions have eased- low deposit lending, CCCFA, LVR restrictions etc... Tax rules have also changed.

is this suppose to happen though? otherwise there is no need for a central bank or OCR.

Well, of course one would expect more borrowing as interest rates drop, but these figures were for September, after only small decreases in interest rates. I would have expected that such a significant increase in borrowing would only occur after the rates were cut by at least 1% or more.

Testing rates started coming down much earlier and considerably. I was tested at 9% in May 2023. I expect the test rate is about 7% now

8+% currently

There are plenty of Kiwis who think the housing market is about to trend upward.

In fact, those who are trying to pick the trough of the cycle may well have missed it.

TTP

There is definitely enough belief of an upward trend in the collective to generate an uptick in the market, which I was expecting... Whether or not this uptick is indicative of a sustained renewal in the market is another story altogether.

My prediction is for another month or two of upward pressure, followed by release into a further weakening, with the same cycle repeating in late summer. In other words, there will be multiple "bottoms". Then the typical winter lull will occur, with meaningful, yet slow, recovery beginning in the following spring.

There is much water to flow under the bridge yet, and the potential for a hugely inflationary middle east conflagration is very present right now. It is noteworthy that Orr is signalling caution around the rate of interest rates decreases in a recent US visit. Either it's just another intentional market manipulation, or potentially it's a word in the ear from those who know what's coming.

Bottom line, is the future is unknown

Mortgage rates have been cut by more than 1%. The one year bank mortgage interest rate was 7.35% in January and now its 6.03%. The banks have front run the RBNZ and borrowers are responding accordingly.

https://www.interest.co.nz/charts/interest-rates/fixed-mortgage-rates

It's quite incredible, at the first sign of lower interest rates, borrowing goes up.

Maybe need a few more data points before getting too excited P. Total borrowed is basically the same as in Sept 2016.

Total borrowed, but by fewer folk now I'd imagine given average house price comparison between the two.

Are you really surprised ? I'm not I said the market would turn on a dime. I have decided to bail out from here as soon as my property hits the $1M on one roof which coincidently should be March 2025.

What's it now? $1.2M?

$965K

" I have decided to bail out from here as soon as my property hits the $1M on one roof which coincidently should be March 2025."

Just wondering - if you believe house prices will continue rising into the future, then what are the circumstances and reasoning that have led to your decision to sell?

$1M is a magic number, you know.

He's just waiting to join the 50k other people with the same plan, whose fear of future falls are currently being overriden by their greed for future gains. It's just .. so .. close .. if I only .. hold .. on...

I though a few would read it wrong, I don't mean bail and sell the house, I mean bail from interest.co.nz. My prediction is my place will be at $1M on 1st March 2025. House prices will just continue to rise in this country. There are factors that most people are not even thinking about like climate change and wars. You are going to want to be as far away as possible from high population density countries.

Edited - NZ Herald reported investors borrowed 5% more in September 2024 than they did in August 2024.

The upturn is arriving sooner and stronger than many anticipated.

🥂🎁✨

And yet days to sell and inventory are both increasing.

🥂

The ship’s about to leave…again.

Yep the same people left standing on the shore.....again.

Sadly so, Zwifter.

It will be a damned disgrace if they come here whinging and moaning. After all, they've had ample opportunity to purchase a property over the past three years - while the market's been correcting in a downward direction.

TTP

What will happen if OCR drop .75? I have been politely mentioning buy when you can - however falling knives and what not.

It will also be about timing, will make a difference if its November rather than into next year.

When the bank lends more, people don't debate it. They just take it.

Meanwhile, the Australian Labor Govt rules out any changes to negative gearing or CGT discounts

“One of the reasons why we’re not going down the path of changing the negative gearing arrangements, abolishing negative gearing or abolishing the capital gains tax discount, is because we haven’t been convinced that that would have positive consequences for supply.

“There aren’t enough homes for Australians to live in. The housing pipeline is not anything near what we need it to be.”

https://www.afr.com/politics/federal/not-convinced-chalmers-kills-off-n…

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.