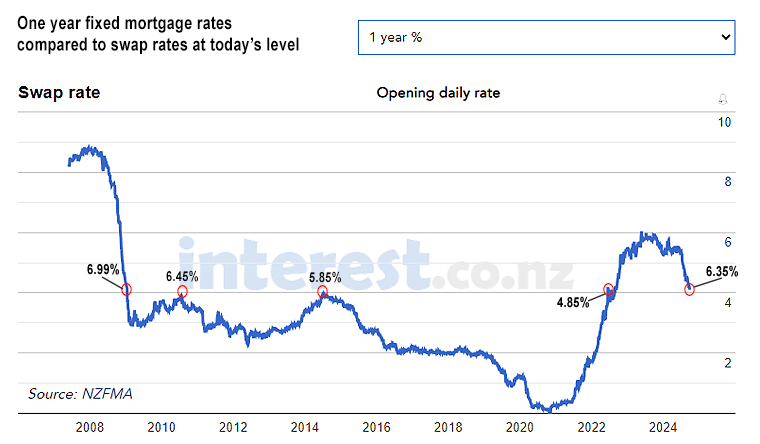

Swap rates are falling fast. In fact, since the beginning of June, they have fallen at their fastest rate since the rapid retreat of the Global Financial Crisis (GFC) in 2008.

And more is expected. Wholesale markets are pricing in almost a full 50 basis points drop in the Official Cash Rate on October 9, followed by a similar drop on November 27. More is priced in for 2025.

So it seems timely to take a look back at where both mortgage interest rates (and term deposit rates) were when swap rates were last at these levels.

Our look is just for the one year duration, the one most influenced by the Reserve Bank's OCR. (Longer terms are increasingly influenced by global forces.)

The current rate has some way to fall to match other periods when swap rates are at this level. Interestingly, when the last fast-falling period was underway in 2008, rates back then were 65 basis points higher than now.

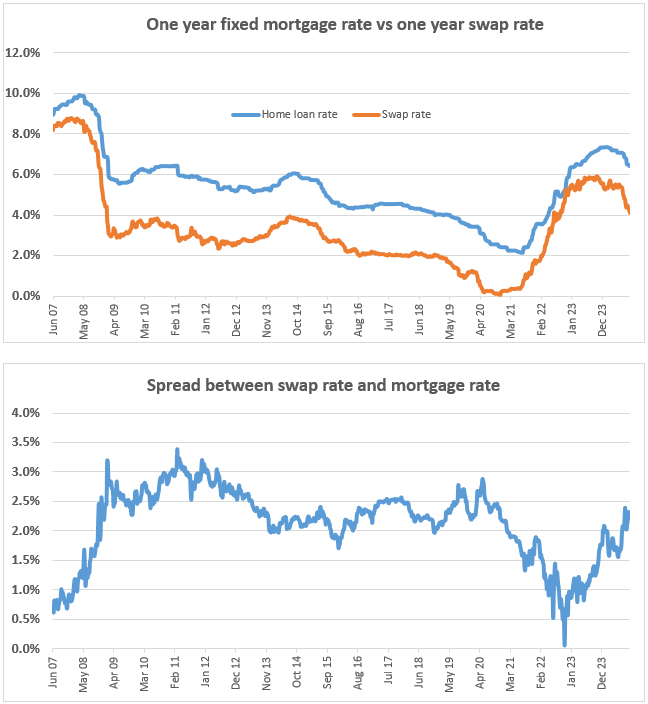

A broader, holistic look at these rates shows that margins now are little different to their long-run average. The times the margin was unusually low were first in the silly pre-GFC bubble, and secondly during the equally silly pandemic bubble.

The good thing about this view is that it shows - even for a one year fixed home loan rate - the wholesale swap rate is a good real-time indicator of the retail mortgage rate offer tracks.

We should expect rate offers to reduce soon. And if the financial market pricing of a further 75 basis points to 100 basis points reductions before the end of 2024 actually happens, then this rate could be as low as 5.75%. We'll see. Financial market pricing is very fickle and shifts quickly as new influences arrive. It is not a predictor.

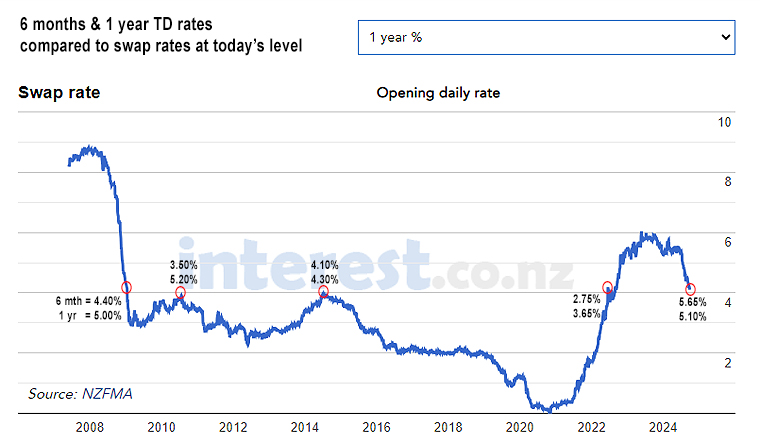

Term deposits

And here is the same situation for one year term deposits. We include the six-month rate as well, because that is more popular for savers.

Current term deposit rates are unusually elevated based on these comparatives, especially the six month rates. So perhaps they have further to fall.

16 Comments

Another 50bps drop at the next announcement now looks guaranteed. I expect banks to now start pricing it in before we even get there.

I can sense your excitement and anticipation Z. And why not? I'm not a fortune teller but I would not be surprised if the Anglosphere heads into one of the most spectacular melt-up booms we've ever seen. Can't attach a probability to it. But I tell you what, there is no way the central bankers are going to let anything fail should the numerous Black Swans reveal themselves. The response will be unparalleled in human history (as they all are now). Assets priced in fiat will be going to the moon.

Not excitement for me, I live on my TD but my partner is still paying a mortgage on her place so great news for her come February.

Not excitement for me, I live on my TD

Term deposits? Like throwing money on to a bonfire.

For me its more like throwing money on a photocopier.

Why don't you use your TD to offset your partner's mortgage? That's a sure way of saving money!

"I expect banks to now start pricing it in before we even get there."

The banks will say it's already priced on.

Look at that post GFC margin between swaps and bank rates. Very tight through 07/08, 23/24. Wherever the OCR lands, bank rates could have a 2.5 - 3% margin judging by that chart alone. So given where interest rates are, how much cutting is already priced in? Will interest rates follow the OCR all the way down from here? I don't know. But the comment in the article, if 75 to 100bps cuts before the EOY, there may be a 60bps reduction in interest rates (6.35 -> 5.75) suggests it's likely not going to be 1:1 here on out.

Next question, Nicola. Not a big spender. We know National spent and spent and spent through GFC, but it's not looking likely this time. Is this going to be the final hurrah? One last pump and dump before we realise how indebted New Zealand really is and beg the govt for a jubilee?

Interest rates tend to follow the swap rates. If you look at the 2 year mortgage interest rates, they have come down, in the last 2 months, from 7.25% to 5.75%, a drop of 150bps at a time when the OCR only fell by 25bps. Adrian Orr doesn't like to hear this, but the OCR follows the market.

National spent and spent and spent through GFC, but it's not looking likely this time

Net Crown debt was ~6% when Labour left office in 2008, giving Key and English plenty of headroom to spend up large.

This time around, Labour were already on a spending spree and forced Luxon's hand to instead promise to reign in public spending.

Luxon went way overboard in his campaigns calling his party the "grown ups" who were going to be very frugal with taxpayer money.

what I can see is that Mortgage rates always increase before SWAP rates increase, and also drops after SWAP drops.

Could create a temporary blip of confidence like there was in Feb this year - before the reality of job security, negative population, DTIs and a badly performing economy bring us back to reality

The badly performing economy is the recession created by the Reserve Bank. When the OCR starts crashing down towards a neutral rate of 2.5%, things will start to kick off again.

If that’s right and there is a 100 point OCR cut by the end of this year with more to come then that will to some extent ignite the property market.

Thanks David for this great article, going back literally to the root of "Interest"

Barfoots auctions 37.6% success rate this week is still rather low given the latest interest rate reductions.

Suspect we will need to see 1 year fixed mortgage rate below 5% for it to make much difference to house prices.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.