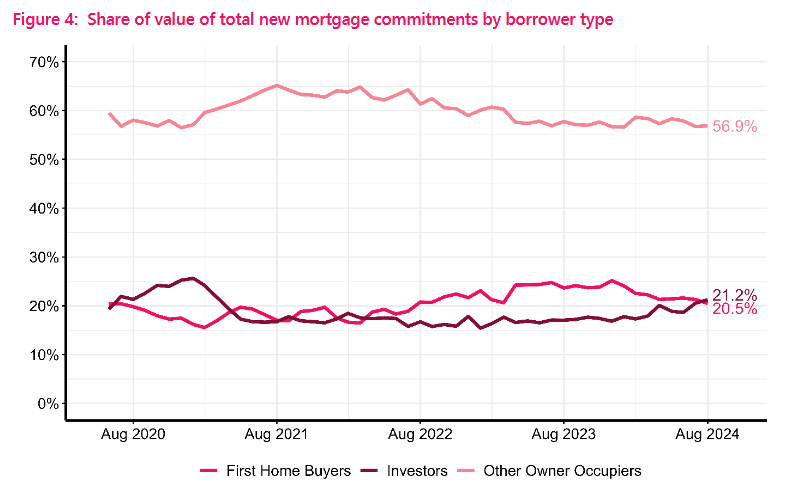

Investors had a bigger share of mortgage money than first home buyers for the first time in about two-and-a-half years last month, according to the latest figures from the Reserve Bank (RBNZ).

The August figures also show that the 21.2% of the committed mortgage money the investors took was the largest percentage for that grouping since the 21.8% recorded in March 2021.

The last time investors took more mortgage money in a month than first home buyers was in March 2022.

We should be careful about drawing big conclusions from the figures, since the RBNZ's separate lending by purpose data series is showing currently a high proportion of 'new' mortgage money is being generated by switching of loan provider.

Of the total $6.194 billion 'new' mortgage money in August, some $1.58 billion was attributed to a change of loan provider, representing 25.5% of the total. That's not a record high percentage in a data series dating back to 2017, but close. In fact the record percentage was just one month earlier - in July - when it was 26.2%.

So, what proportion of this 'swapping' money might be investors can be speculated on.

What is not questionable though is that the first home buyers (FHBs) are seeing a decline in share.

The $1.27 billion taken by the FHB grouping in August made up 20.5% of the total monies, down from a 21.3% share in July. The FHBs hit a high-water mark of a 25.2% share in December 2023.

It is not just a question of share. The amounts are going down too.

A year ago, in August 2023 the FHBs borrowed $1.368 billion, which represented 23.7% of the total borrowed that month.

For the investors the $1.316 billion of mortgage money taken in August compared with a tally of just $986 million (17.1% of the total) taken in August 2023.

While the figures don't look definitive at this stage, particularly with the amount of loan provider swapping going on, they do at least suggest the long dormant investors are twitching again.

Economists believe that any upturn in the housing market (which most expect) next year will likely be led by investors.

There are now more favourable conditions in place for the investors under the Coalition Government with restoration of interest deductibility and a shortening of the bright-line test timeframe.

Loan to value ratio (LVR) restrictions have been loosened as well, and while debt-to-income restrictions have now been put in place, the most recent figures on DTI ratios supplied by the RBNZ showed investors are currently well within their limits - as indeed are other categories of buyer.

86 Comments

the tide is turning

Seen multiple sold houses end up on trademe as rentals recently. Tides definitly turned.

What spin will Gecko put on this?

They don't put a spin on it, they go into hibernation for years and disappear until what looks like the next downturn and they magically reappear.

Spruikers have predicted 5 of the last 0 upturns. Careful guys, you’re outpacing economists predicting recessions!

SKF

Sometimes REALTY is harsh

I don't particularly want to do the DGMs work for them, but seeing total mortgage lending fall by 7% from July to August doesn't exactly scream 'spring bounce' to me. Even investors borrowed less in August than in July.

Thats because they can buy existing housing at far cheaper prices rather than buying those ridiculously overpriced brand new dogboxes.

And what changed in this respect between July and August?

Gecko revels is your calling of the fourth or fifth market bottom.......

Gecko looks forward to still more egg dripping from Specuvestors faces and their Crown Price, Tony Alexspruikuvestor.

FYI I have not called a market bottom, I just see what is happening in the market and what I am seeing is an uptick in sales.

Plenty of money building up on the sidelines sweating on spec capital gains. Go you good things.

But but this time it’s different for the cry babies.

by Iceman | 29th Jul 24, 10:45am

Don’t think anyone smart is expecting a quick turnaround, these things take time, sentiment change takes time too. Nothing exciting until towards the end of the decade in picking and that’s OK.

Flip flop flippity flop.

Retaeded Poopy with nothing better to do. Mindless idiot.

As an investor, why would you celebrate more investors in there market? More competition, right?

Would only make sense if you're in the decumulation phase.

Only a herd of sweating leveraged bag holders would celebrate this. It's a concern that FHB's share of new borrowing is falling at a time that coincides with falling house prices and borrowing rates. I think it's more a story of growing job insecurity now and that's entirely understandable. For FHB's, it's wise to take the time to build up a large deposit to ensure financial wriggle room should something go wrong. Consider various scenarios before committing. There is no hurry unless you're a Spruiker.

Its because NZ is finally running out of immigrants to buy houses.

I would argue the points you've made are prudent no matter what state of housing market.

But at what point is it prudent to jump in, how and when can you actually know the right time to make the leap? At 30% equity/40%?

At 1/3 of your income on mortgage payments, at 1/4?

People hate the concept of calling the housing market a ponzi - but it does have some characteristics of it. In relation to the above, the idea I that once you have bought into the ponzi it is in your vested interest to promote the ponzi to anyone and everyone for your own self interest. If people stop buying into it (and the narrative of future gains by more people buying into it is lost) then one mist go to extreme measures to push the narrative even more upon the population. ‘Everyone buy now because I purchased last week!’ Anyone who suggests otherwise must be silenced and discredited as a ‘Doom Gloom Merchant’ as they may shift the narrative away from ‘buy buy buy’.

Moral of the story is anyone who calls a person a Doom Gloom Merchant is terrified they might be right in their views. Otherwise why go to such effort to discredit their views by calling them silly names?

Not always the case though that if you buy into it you then have a vested interest. I see the reality that house prices cannot continue on the trajectory of the last 30years. It isn't sustainable, and there will be changes either made by choice proactively, or by necessity such as a CGT and certain changes to NZ super. I care not for growing the value of my house for my retirement, as I'll be dead and gone one day, and there are many other ways of generating income. I care about my future children, as with everyone else's. The current youth have grown up in a world of technology where they can't escape bullying at school anymore due to social media, and everything around them is trying to extract something from them; their attention, their money, their time, more so than any generation before them, and this has had detrimental effects that have not yet fully played out in society. We need to give them a chance, instead of pilfering their future for our own in the name of retirement.

A Ponzi is a fraud where you need new investors to pay old investors. There is no intrinsic value in the "thing". Whether house prices are too high or low, there is value and therefore it is NOT a Ponzi scheme.

But...the fundamentals

But this time it’s different! Oh wait

The best time for FHBs was yesterday. Those who have bought will be relieved next year when the market has truely shifted The market is certainly warming up here. Curious to see auction stats this weekend as seeing a lot sold on the auction page.

Heard the same story last year.

I mean this is the coalition's objective, when you give a 3 billion dollar tax break to landlord's at the expense on FHBers it's to be expected that investors would start to outbid people trying to buy their own home.

Back on track.

Is it more a surge in investors or a decline in FHBs? It’s still horribly unaffordable for the latter, then factor in the exodus of younger people etc etc

Apparently you celebrate if less FHBs are buying but more investors are - you know because the country is better when more investors are bidding up the price of shelter.

you know because the country is better when more investors are bidding up the price of shelter.

Be better if you could just trade the houses online with the ability to lock in your gains at the push of a button.

Funny you should say that given some of the conversations I’ve had with people the last decade. Saying oh I just casually took on another $500,000 debt and purchased another rental.

Its all been completely bonkers in my view - people treating buying houses and loading up with debt like playing on the pokies. She’ll be right mate - can lose with bricks and mortar.

its not a tax break at the expense of FHB, it didn't cost FHB.

the rhetoric from a lot of DGM's here was FHB should wait another 12-18months until prices drop to 2012-2016 prices, don't buy in to the ponzi.

where in reality FHB who want a home should take the opportunity when they can afford, or someone else will.

I was advocating quite strongly that FHBs who *could*, *should* buy over winter.

Having said that, I don’t think prices are going to rise much at all between now and next September. But I *do* think the number of bargains will start to fall away.

Haha bargains..at 7 or 8x household incomes or whatever the current ratio is.

Sure

But so what? There’s almost no chance those ratios will fall much lower

i know a fhb who bought a 3 bed townhouse 2 months ago in an ok centralish suburb for about 800k. Peak value was about 1.2 million

I hope there’s not many FHBs reading this website who are buying the extreme DGM calls of 40-50% falls, like I bought Hickey’s terrible predictions in 08-09

Don’t repeat my mistake

Fair enough - nobody knows for certain what the future holds - although it appears you do as you have decided to take a ‘no chance’ view to some outcomes.

There is still a chance - it is possible you could be wrong twice. Once by listening to Hickey then and once by calling an early bottom now.

(I’m not ruling out being wrong btw - but I still think we need to come out the other side of this yield curve inversion by 12-18 months to see what the world really looks like).

I’ve always thought 40-50% in real terms was a possibility - I think we must be about 30% now (or more in some laces, less in others). Another 10-15% in nominal term (or real terms) isn’t about of the question in y opinion (but it’s just an opinion like all others).

If a FHB buys now (or bought in the past 6 months) is it the end of the world if prices fell a further 5-10%? No it isn’t (at least for most)

There is a much greater opportunity cost if they don’t buy and prices are 15-20% higher in 2-3 years

Depends if they keep their job or not.

If prices are 20-30% higher in 2-3 years more will leave the country.

Will they though? By then prices might be 30-40% higher in Aus, and NZ will be back in an economic growth phase.

Says the guy who purchased at the peak and is terrified of getting any further into negative equity.

It is not a tax break whatsoever!

Penalising people who provide homes for people to rent is a business and as such all expenses are claimable!

Robertson was totally wrong for removing it as an expense and has forced up rents for tenants.

If it was a so called tax break how come other Labour governments did not see it as such?

If being a landlord is a business, and want to claim interest as a business expense, then they should pay capital gains tax and borrow at business interest rates.

borrow at business interest rates

The definition of a business does not depend on what interest rates you pay.

Other Businesses do not pay capital gains tax when they sell their business!!

We pay plenty of tax on rental profit.

Other business is not based on an asset appreciating to make money, A productive business has positive cashflow, and no need for "top ups". They directly employ people. They can not carry the monumental debt that property investment can. If they did would be classed as technically insolvent.

Other business pays tax on their profits.

All businesses are based on the value of the business appreciating to make money. Otherwise why would you invest in one? The sharemarket exists to provide capital to businesses to grow - which means appreciating in value. Many of them carry a lot of debt - look at Fletchers or Ryman. Many businesses are cashflow negative for years - see Xero. In your funny little world, most of the businesses that exist today would have never got off the ground, attracted capital, or grown.

As for paying "tax on profits" - do you understand what a profit is? Its revenue minus all expenses including the cost of financing. Its also minus things like depreciation and amortisation - things that residential landlords cant claim either.

We pay plenty of tax on rental profit.

(Said while having the house under a trust or company to minimalise tax to say, 33%, instead of the 39% it would be if under their own tax liable personal income, while also and claiming depreciation and costs for work done on the house to again, minimalise tax paid, and expecting to sell the property with tax-free capital gains). My heart bleeds for you, so much voluntary contribution to society.

No GST paid for the service they provide either.

Hi there is no capital gains tax for anybody in NZ , investors have the two year tax now and most banks charge commercial rates to property investors already .

And its working. Rental inventory is at record levels. Rents are now falling. Whocouldathunkit that reducing regulations and costs to landlords would reduce the cost to tenants and increase their rental choice???

https://johnbutt.substack.com/p/inventory-charts

Only Labour/Greens hate tenants so much that they want them all in emergency and social housing.

Is this the reason though, I think it's more likely people leaving for Australia and other countries creating more supply along with less demand for Airbnbs which returns properties to the rental pool. In addition, townhouse developments housing a lot more people on one or two sections than standalone houses ever could, and more KO housing as well.

May the trend continue. Landlords were severely hard done by and it's great to see their dignity slowly being restored.

The NZPIF should pursue the matter further, there are some FHB that bought in the last couple of years who only managed to do so because of Labour's punitive changes, they should be prepared to relinquish the titles of those ill-gotten properties to the Lords.

Investors = the smart money.

If you think it's expensive here, try Sydney, Melbourne or Brisbane.

Smart money sold in 2021

The smart money have been buying over the last 2 years.

No. The smart money has been buying last 6 months

You don’t know that yet - it is an assertion vs the truth.

The truth will be known in 2-3 years from now.

Like HouseMouse you don’t know that yet - so this view of yours is fictional until we know the market has turned (ie it is what you want to believe vs what we know to be true - there is a big difference in these positions - like the difference between an ideology and a truth - you have decided that what you want to be true is the truth - instead of what is proven to be true being the truth).

Just as we didn’t know the smart money left the market in 2021 until we got into 2023 or now, we won’t know until 2025 or 2026 if now was a good time to buy.

For you to say with 100% certainly that you know now the smart money is buying means I know you are a liar or a BS artist 🤥 A truthful person would say ‘now could be a good time to buy but because I can’t see into the future with complete certainty, there is a possibility that I might be wrong. So the smart money might be buying now but it might not be also’.

If prices fall for another year which is certainly a possibility your statement above will be proven to be a falsehood - despite you claiming now that it is certainly the truth.

Gosh

If FHBs were to worry about every single eventuality then they would NEVER buy!

Yes who bloody knows, there might be some global mega event and prices fall a further 15-20%. I would say that’s less than a 10-15% chance

Probability wise I would say it’s more than 80% likely that prices won’t fall any further, or fall 5% further at most

anyway, tiresome conversation

People throwing out assertions with complete confidence but no factual basis to back them up with other than a hunch (or self interest) is also tiresome. They are misleading and often hide the authors true intent - they are often marketing for their own gain, instead of assessing what is really happening.

Wouldn't it be more useful to know the number of houses rather than the $ value of lending, especially given the loan swapping. Also, FHBs may buy cheaper houses than investors so they could be buying more houses than investors but investors are borrowing more $.

Yes, percentage shares of things are meaningless. But the media love it because they can say "oh, FHB getting stiffed again". Never any mention of absolute numbers, to see if actually there are less FHB buying, or more investors buying. Maybe FHB are buying cheaper properties. Maybe investors are buying more expensive ones. House prices are falling, immigration has gone negative, FHB are leaving for Australia. But hey, lets all attack the nasty investors!!!

Well I know I was one of them last month.

We should be careful about drawing big conclusions from the figures

Especially in an environment of rising job insecurity and weak loan demand.

Let the investors have at it. Provide the banks a nice way to unwind the balance sheet if need be.

Investors understand risk and can take the fall should prices continue to go down and people continue to leave.

Guess who’s back, back again!

Guess who's back, back again?

Greedy's back, tell a friend.

Guess who's back? Guess who's back?

Guess who's back? Guess who's back?

Guess who's back? Guess who's back?

Guess who's back?**

I’ve created a monster,

'Cause nobody wants homes, just your profit roster.

Well, if you want dollars, here’s what I’ll give ya,

A little more greed mixed with some false vigor.

You raise the rents, it’s a hard hit,

While the folks on the streets are just trying to exist.

Got your cash flow while they struggle to breathe,

You’re the king of the hustle, no heart on your sleeve.

Enjoy your losses lol

Yes great to see the "canny investors" slowing the precipitous fall of the well honed housing markets crashing knife.

The butchers block is still far, far below and well away.

Specuvester roaches, cheering this outbidding of the weak FHBs, do so at their eternal and natural peril.

Real case to point out:

House nearby sold to investor and would attract $700.00 week rent. They looking to develop it in 2 to 3 years (avoiding BL CG tax of course:) - Antonia from ANZ, well said!!!

Fully financed+Insurance+rates cost per week $1,190.00 week. (not accounting for any repairs/maintenance!!)

So only an effectively a $490.00 weekly topup.

$25,480.00 LOSS per year.

Winning investment ........ buy up lads!!!

When their speculating hands get further bloodied and mauled into 2025 and 2026 and 2027, no one really cares.

You forget the people that are cash buyers now TDs are loosing their lustre and there are plenty of those.

NZGecko, this new normal world void of capital gains only ensures the intolerance towards these "top-ups" only grows and further feeds the inventory. Landlords are unable pass these top-ups onto tenants. There are many caught in this predicament and it must be highly frustrating.

Then the LandLord expects an assured right to sainthood as they portray they are generously subsardising the poor tennant....all the while milking the taxpayers teat through the stupid accommodation supplement and tax breaks.

All, as they overspent, chasing the smokey dragon of CG.....

Yes these short sighted precious providers of an essential social service are indeed a blight on society. However, the more seasoned investor takes a longer term view, knows the market has ups and downs, doesn't sweat it and in my view more of a positive and stable contributor to society.

I guess supermarkets should be providing free food, how dare they run a business and make a profit.

How dare they run a business and make a profit

The elephant in the room is that many short sighted Speculords aren't making a profit hence the necessity for top-ups. In any case, there's no 100% surety that any capital gains celebrated actually get banked.

Comparing hundreds of thousands of Mum and Dad property investors to large scale supermarkets in an oligopoly is a ridiculous argument.

Would be like a few thousand people going around all the supermarkets first thing each morning, buying up all the baby formula on their credit cards, and then selling it on the footpath for a profit.

Yes agree and want to be admired for the service they are providing - despite not realising that if they left the market, society would be better for it. (resulting in lower house prices and higher rates of home ownership among those who are currently struggling to aspire to home ownership - or who are stuck in the rut of welfare because they have completely lost hope of creating prosperity for themselves).

Don't forget the removal of the FHB grant - while good from a market distortion perspective, it was often the difference between a FHB and a specuvestor on smaller new builds.

At 10k for a qualifying couple, that's 100k less they can offer and/or more time to build up their deposit (a year at $200/week).

Even as a property investor I know this is just so bad for NZ as a country, our kids, our society. Anyone who thinks otherwise should really get their head checked out.

"Economists believe that any upturn in the housing market (which most expect) next year will likely be led by investors.There are now more favourable conditions in place for the investors under the Coalition Government with restoration of interest deductibility and a shortening of the bright-line test timeframe."

So investors are expected to charge forward gallantly and drive the market to new highs ... good luck with that idea ... knock yourselves out and go on a buying spree....with unemployment rising / other costs unstable and the tide apparently turning you might be biting off more than you can chew....lol

Thats because FH buyers have all shifted to Aus and London

This simply re-enforces the idea that FHBs need to possibly look at leaving New Zealand because the government is simply going to do what they have always done, allow the market to rocket up again and be taken over by investors.

But we are also told that we could have net zero immigration next year and yesterday's news showed stats NZ data that immigrants with work visas or foreign students were often leaving soon after they arrived. This maybe because they can't get work in a recession and needed that work to survive.

With a exodus of kiwis also leaving the country and selling up, who's gonig to replace the buyers, I suspect the gov will allow foreign buyers back in with some favaroable terms, at the expense of FHBs again.

But there is also a possibility that the market does in fact crash, one can hope but they will screw over locals before they let that happen.

Or the reason why there are less FHB is because they have already left NZ and therefore are no longer in the market?

Percentage share is meaningless. If there are less FHB buying, look at the reasons why. Lower immigration, running out of the Ardern's 210,000 new permanent residents, FHB leaving for Australia, bank credit tightening up, high mortgage rates - none of these things are the fault of an investor.

Running out of Jacinda Ardern's 210,000 newly granted permanent residents and other recently arrived immigrants who were all given residency visas for working in a liquor store. Maybe actual New Zealanders can buy some houses now?

How does that relate to the topic at all? Are you inferring that investors are the true New Zealanders?

There's 40,000 empty houses in Auckland.

Landlords can't be bothered with the hassle of tenants.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.