The value of non-performing housing loans has topped the $2 billion mark and is running at an 11-year high, according to the latest Reserve Bank (RBNZ) loans by asset quality figures.

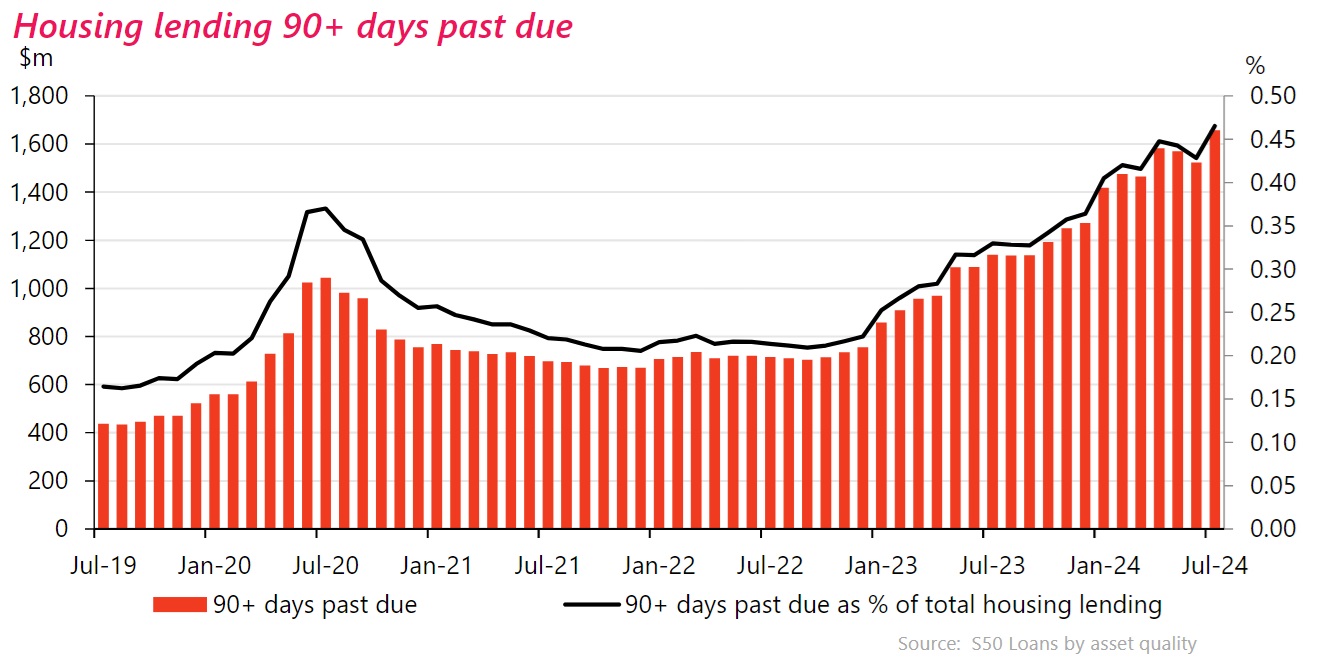

The figures show as of July a total of $2.048 billion worth of housing loans was non-performing - either categorised as 'impaired' ($391 million) or '90 days past due' ($1.658 billion).

In July the non-performing tally took a sudden jump, up $141 million (7.4%) after the total had appeared in recent months to be levelling off.

The increase in July was the biggest monthly increase since January, when the non-performing housing loan total had increased by $161 million.

With the latest increase, the total is now some 54.7% higher than it was as of July 2023. And if we go back two years the total is up some 152.8% ($1.238 billion).

What all this means is that the percentage of non-performing loans of the total outstanding mortgage pile ($356.335 billion) has now risen from 0.5% in June 2024 to 0.6% in July. It means the percentage of non-performing housing loans is now at its highest since July 2013, when it was also at 0.6% in the aftermath of the Global Financial Crisis.

The below graph from the RBNZ's asset quality summary, shows the 90 days past due figures.

In the immediate aftermath of the GFC our non-performing housing loans hovered around 1.2% of the total between 2009 and 2011.

So, we are a long way from that. But nevertheless, the troubled loans tally has risen pretty quickly from very low levels. In July 2022 the percentage on non-performing housing loans was just 0.2% of the total. So, effectively it's tripled in two years.

There's still nothing in these figures that is likely to be surprising either the banks or the RBNZ, however.

In its May Financial Stability Report the RBNZ stated that the country's banks were estimating that the non-performing housing loans ratio would reach 0.7% by the end of the year.

Will that still happen?

The RBNZ cut the Official Cash Rate on August 14 (from 5.5% to 5.25%). This cut came about a year earlier than the central bank had been forecasting as recently as May. In addition, the banks had been cutting ahead of the OCR drop in anticipation, after the RBNZ had explicitly changed to a much more 'dovish' position in its July statement.

Other RBNZ data shows that the country's mortgage holders are very ready and prepared for rate cuts.

As of July 2024 just over three-quarters of the whole outstanding mortgage pile was either on floating rates or fixed durations of no longer than a year. So, in other words, that's three-quarters of the mortgages by value that will get interest rate relief in no longer than a year.

This is not an accidental thing, either. Go back a year to July 2023 and just 63.3% of mortgage money was either floating or fixed for a term or less. So, folks have been deliberately 'going short' in recent months to ensure they get maximum impact once rates start coming down. Now they are about to get the reward.

And in fact, as of July 2024, nearly half of the mortgage money wass either floating or on fixed terms of no more than six months.

So, with banks starting to cut mortgage rates actively from July onwards, it means a substantial proportion of mortgage holders stand to get interest rate relief either by the end of the year or soon after.

The big question therefore is the extent to which the relief flowing through from lower rates will be sufficient to de-stress those who are getting into difficulties with their mortgage payments.

Elsewhere among the latest RBNZ data releases, it's worth noting that non-performing business loans have in July just blipped up to 1% ($1.225 billion) of the $125.83 billion outstanding. That 1% is the highest level since 2015. By some means of meaningful 'hard times' comparison, following the GFC that percentage got as high as 3% in 2011.

Among the businesses, it's the small and medium sized enterprises (SMEs) that appear to be particularly struggling. Another $41 million was added to non-performing SME loans in July, taking the total to $943 million, which is 1.2% of the $78.242 billion total. Twelve months ago that percentage stood at just 0.5%.

The RBNZ doesn't have specific data on SMEs going back to the time of the GFC, so, we don't have a direct comparison with how the small businesses were faring specifically at that time. But the current data series dates back to 2018 and the current 1.2% ratio is the highest in that time.

Again, time will tell the extent to which the rate relief that is now coming - and with more OCR cuts expected before the end of the year - will help people out.

47 Comments

When will the banks do their jobs....oh wait cannot expose the truth of the ponzI.....

Not sure what the banks have done wrong? I never thought we’d survive such an interest rate hike without significant mortgagee sales, we seem to be doing pretty well so far.

Bank seeing increasing non-performing loans: "Just smile and wave boys, smiiiiile and wave"

I believe the banks had done their bit. if you happen to have read the past 2 years annual reports, they've already kept aside large chunk of profits for non-performing loan defaults.

When you look at the perfect storm of:

* High interest rates

* High cost of living

* Unemployment increasing

* Record high housing prices

Having only 0.6% of all issued housing debt as non-performing I'd say is actually pretty low and acceptable personally.

lower than Australia.

Hmmm...356 billion. Yeah...just a tinsy winsy gully.

"Non performing loans 50% lower than GFC levels"

It’s hardly a surprise when interest rates have increased so much.

"Non performing loans 50% lower than GFC levels"

Turd polishing? Could be a comms role for you somewhere in one of those govt depts.

Sorry, not doomy gloomy enough. You need to mention PONZI, CRASH, and infestors a bit more.

(Although I won't be surprised at all if we get to the GFC peak level towards the end of next year, the crunch isn't over just yet)

How’s work prospects in surveying right now, out of interest

I'm not a surveyor so I wouldn't have a clue...

They should be doing pretty well, I got quoted over $3000 for them to come out and put in ONE missing boundary peg. I just printed off my site plan and got out the tape measure.

You may not be aware but if a surveyor has to put in a marked official boundary peg, $1500 goes to Linz so the surveyor is costing you $1500 and at about $200/h, that's 7 and some hours. If you live in Timbuktwo relative to the surveyor you are paying for time travel and travel kms as well. Allow about 1h prep and 1h post survey work plus time on at site and that's about how long it'll take. I was quoted by one surveyor $1200 for a non official survey but went for a rate and time basis. Worked out to about $700.

edit

I was the staff man which saved some time

Apologies, for some reason I thought you were

Nope, industrial automation systems is where I earn my crust.

Changing classification of 'defaults' to 'captiatalising interest' means under reporting is rife.

Not pulling the mortgagee sale trigger to keep the Ponzi alive

That would be a very risky strategy. Much better to get a few mortgagee sales out the way now than to let them all pile up.

They probably have valid fears of a class action, CCCFA was meant to mean the banks could only lend what was affordable.....

Aotearoa needs to look to China where they are considering a plan to allow homeowners to refinance as much as $5.4 trillion in outstanding mortgages, aiming to lower borrowing costs for millions of families and boost consumption. This move would enable homeowners to renegotiate terms with their current lenders before January (when banks typically reprice mortgages), and also allow them to refinance with a different bank for the first time since the GFC.

This refinancing plan is part of China’s efforts to reduce mortgage costs - already at record lows this year. However, most households have not benefited from these low rates since banks do not reprice existing loans until next year. By allowing refinancing, China hopes to ease mortgage burdens faster than expected, potentially saving homeowners around 300 billion yuan ($42 billion).

https://www.bloomberg.com/news/articles/2024-08-30/china-mulls-allowing…

The indicators of deepening recession come in a fairly predictable sequence. The fact that commentators dismiss the first signs of trouble by pointing at reassuring data from the indicators that lag badly is reckless / negligence.

The deepening recession we are in has been building for 24 months and will last as long as it takes for Govt to recognise the need to take action.

Yip looks like yield curves are normalising so I think it’s possible/likely we have 12-24 months of difficult times ahead of us (even though the ‘bottom’ is in and we are now in a ‘recovery’ - sarc).

Just another reason more interest rate cuts are coming before Christmas. its going to be a happy New Year.

Rates get cut because the economy is getting worse…the more cuts required the worse Xmas is going to be as a reflection of just how poorly the economy has become.

It’s amazing how irredeemably thick people are when it comes to this reality IO…

For someone who is already very comfortable financially, but seeks to exploit their good fortune by using debt to stand on the shoulders of young working kiwis.. anything that reduces their personal costs is the only thing they care about.

Rates get cut because inflation is back in target band. Not GDP, not unemployment, inflation (CPI).

True but how did we get inflation back into the target band? By systematically destroying the economy with restrictive rates (which you appear to be ignoring in the comment above). So we aren’t cutting now because rates are back in the target band…we are cutting rates now to avoid overshoot and entering into a deflationary recession/depression. Ie we are cutting because if we do nothing, the economy is toast…not because inflation is currently in the target band - ‘hey everyone we are cutting rates because inflation is in the target band..! Yes but how did we get here and what damage has been done?’

"... we are cutting rates now to avoid overshoot and entering into a deflationary recession/depression."

Um. So where are we now then? LOL. Nov '23 was the time to avoid overshoot.

Destroy is a strong word. I guess everyone's definition is a little different, but what we have in front of us is a flat GDP, historic low unemployment, and soaring consumer and business sentiment on the back of a measely 0.25 cut. What makes you so confident a deep recession will definitely happen just because history showed recessions occurring after yield curves normalizing. I find the logic on this site amusing. When good data comes out on here we have people saying inflation to the moon. When bad data comes out we have people saying the economy is toast. No scenario in the middle can even be considered because it wouldn't cause asset price destruction which 90% of people on here want.

"What makes you so confident a deep recession will definitely happen just because history showed recessions occurring after yield curves normalizing. I find the logic on this site amusing."

https://www.chicagofed.org/publications/chicago-fed-letter/2018/404

https://www.investopedia.com/articles/basics/06/invertedyieldcurve.asp

I am amused that you are amused. ;-)

Some observations:

- Banks have been cutting both short term as well as long term mortgage rates the recent weeks.

- A 3 year interest period mortgage is still considerable cheaper than the 6/12 months version at all banks.

- In the international money markets the swaps on 1 year and shorter periods are still much higher than 2 year and longer. This includes a number of markets where their version of OCR has already been cut like Canada as an example. (https://tradingeconomics.com/canada/government-bond-yield)

Only time will tell whether keeping the majority of the mortgages on 1 year and shorter was the cheaper option. I believe the shortage of short term credit, banks reluctance to lending, and the lack of quality colateral will keep shorter end interest rates higher than the longer ones even with both coming down the next years.

This needs to be kept in perspective. NPLs are still very low as a share of outstanding loans.

Marginal seller sets the price. That's what you need to keep in perspective.

Thanks for the economics lesson but prices are set by both buyers and sellers.

But rising at $2m per day. That's some perspective...

I think there are issues

- NPLs

- Negative equity loans but performing

- Negative equity loans not performing

Venn diagram issue, banks can accurately identify NPLs.

Banks do not really know negative equity loans with any degree of accuracy. The scale of there position IMHO cannot be given with any certainty..

So a buncha mortgagee sales summer is coming!?🤔

With the Austere Government running amok with new spending, $36b for Roading ect... with more to come. Where does that leave inflation looking ahead? Stagnant or something else 🤔

spending is not a problem, spending billions and nothing to show for it is.

spending on infrastructure eventually improves efficiency of an economy.

Efficiency improves long term if:

- The spending is on the travel mode with the greatest benefit profile and

- The spending releases capacity at bottlenecks and

- The increased capacity doesn't induce demand that then negates the efficiency improvement

I'm still looking for any of the proposed projects in Simeon's announcements that meet all of the criteria.

The $943 million that is now marked as non performing SME business loans is more than likely secured against property. Banks don't like lending against much else as security in NZ. So assume close to 3 Billion of loans with property as security. Also assume for now that there is enough equity for the banks to get the majority of their money back. But the mortgagee sales process takes a long time and is a bad look all round. The banks would be doing all they could to not go through with a forced sale. Imagine the carnage if they had to start liquidating 70-100 properties a week. Wouldn't do great things for the values of all the other properties that are the collateral for the other 350+ billion of mortgage lending.

like settling a war veteran claim book.... time is your friend

Extend and pretend is alive and well in the banking industry. They are in the business of hope, and if the fear starts becoming widespread and contagious, they will be in for it.

Yes but if things get bad enough they are the on transmission channel the RBNZ have for the problem....

if things got bad enough and the RBNZ took OCR negative enough eventually the bank would pass that on, then your mortgage would get smaller each month due to negative interest... as I have said before there is no limit to their F.....y

During the height of the covid mania, globally there were $18 Trillion in negative yielding bonds!

If that doesn't show you how fd the current system is the enjoy the rest of your nap.

53 mortgagee sales on TradeMe at the moment, up from 15-20 in 2020

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.