June was a pretty grim month in New Zealand as we are finding out.

Now in company with various dire high frequency data that shows various business figures diving in June we can add in a slump in the number of new mortgages.

The 14,590 new mortgages in June 2024 was the smallest total for a June month since the Reserve Bank (RBNZ) started issuing the current monthly mortgage data series in 2015. The RBNZ has issued this summary of the latest figures.

The RBNZ data shows that the new mortgage number was down some 6.2% on the 15,498 mortgages in June 2023. And it's certainly salient to point out that the housing/mortgage market was far from flying last year.

If we go back to June 2021 when the housing market was still amid the pandemic frenzy the number of new mortgages was a whopping 26,048, while the highest number of mortgages recorded for a June since the data series started was a massive 33,157 mortgages in June 2016, some 127% more than total in June 2024.

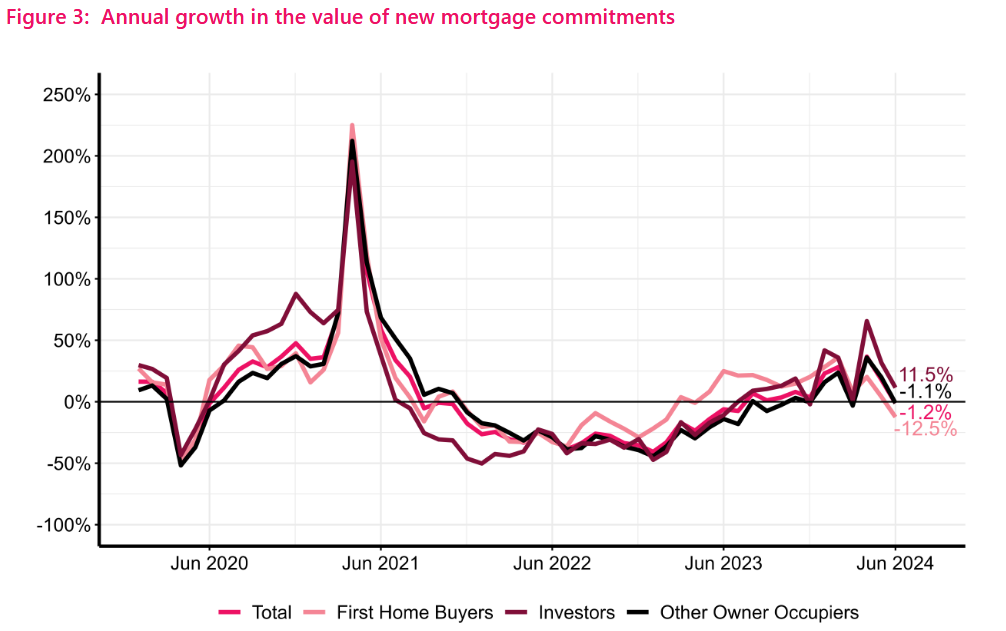

The fact that house prices have risen so much and therefore so have mortgage sizes, over the years, means that the figures for amounts of mortgage money advanced tend to somewhat belie the ups and downs in activity.

However, even looking at the amounts doesn't put June 2024 in a great light.

The $5.617 billion worth of mortgages signed up for last month was down on the $5.686 billion in June 2023 and is the lowest total for a June month since 2020, at which point we were just emerging for the first big pandemic lockdown. In June 2021 at the pandemic peak the mortgage total was $8.526 billion.

Looking at the breakdown of the various groups last month, we can see that the first home buyers (FHBs) took $1.212 billion of mortgages, which made up 21.6% of the total.

It's been a consistent theme of the downturn in the housing market that the FHBs have remained active and have been taking historically high shares of the mortgage money.

The 21.6% taken by the FHBs in June 2024 was slightly higher than the 21.4% in May.

However, since peaking at an all-time high of 25.2% share in December 2023, the FHB grouping is now giving the appearance of perhaps having reached its limits.

But talking of limits, if we go back to the 2016 period, the sky was the limit for investors, grabbing shares of the mortgage money of in and around 35%.

Since those times though, things have fallen off the cliff and the investors have looked to be firmly on the sidelines during the downturn.

There's been a lot of interest this year in whether the start of the progressive reintroduction by this Coalition Government of interest deductibility for investors was going to make a difference.

And for a while it looked as though it might be.

In April the investor grouping took 20.1% of the overall mortgage monies advanced, which was this grouping's highest share in three years.

However, in May the percentage share fell to 18.9% and for June, the total taken by the investors, $1.047 billion, was 18.6%. So, the 'rally' is looking a bit short-lived, although the percentage share is up compared with just 16.5% taken by the investors in June 2023.

But there's no doubt it's pretty quiet out there. It may be time for the banks to drop their rates to drum up some new business. Oh, hang on...

91 Comments

But there's no doubt it's pretty quiet out there. It may be time for the banks to drop their rates to drum up some new business. Oh, hang on...

This is what Milton Friedman called the interest rate fallacy, and it indeed refuses to die. We can tell what monetary conditions are in the real economy, as opposed to financial liquidity, though the two can be linked, by the general level of interest rates. When money is plentiful, interest rates will be high not low; and when money is restricted, interest rates will be low not high. The reason is as Wicksell described more than a century ago:

[The natural rate] is never high or low in itself, but only in relation to the profit which people can make with the money in their hands, and this, of course, varies. In good times, when trade is brisk, the rate of profit is high, and, what is of great consequence, is generally expected to remain high; in periods of depression it is low, and expected to remain low.

When nominal profits are expected to be robust, holders of money must be compensated for lending it out by higher interest rates. Thus, the same holds for inflationary circumstances, where nominal profits follow the rate of consumer prices. During the Great Inflation, interest rates weren’t low at all, they were through the roof well into double digits and higher by 1980. At the opposite end in the Great Depression, interest rates were low and stayed there because, as Wicksell wrote, the rate of profit was low and was expected to be low well into the future. High quality borrowers were given as much money as they could want while the rest of the economy was deprived of funds; liquidity and safety being the only preferences in what sounds entirely familiar. Link

Hold the line boys. Deploy capital.

It’s funny how Harry Dent looks more and more plausible everyday….

If you believe Harry Dent, you'll believe in the fairy godmother.

How's that great crash of Harry's coming along he predicted in 2012?

https://www.amazon.com/Great-Crash-Ahead-Strategies-Turned/dp/1451641559

What’s the saying….

Even a broken clock is right twice a day….

Your reaction is understandable, the mere consideration would be Kryptonite for the over leveraged of course.

GREEN SHOOTS

As interest rates fall, new mortgages will increase - and so will house prices……

It probably makes sense to start looking for a house now - before the rot sets in again.

TTP

As businesses fail, people lose jobs and a recession starts to set in both in NZ and other countries around the world people will be saying:

Bugger the fact that I don't have a job anymore, a mortgage just got $30 a week cheaper - lets buy a house!

Please take your own advice and go purchase more investments as the music stops.

Yep that’s the reality ahead unfortunately.

I believe they won’t increase. Property is priced at the moment for borrowing costs of about 2%. Until bank rates get to that mark, then house prices are still over valued in comparison to the current cost of borrowing.

Simply put, house prices aren’t going anywhere.

Agree.

There is a lot more happening in nz and the world that will also affect house prices.

The exodus of young skilled kiwis is a major issue which will continue until the structural issues around our economy (housing, jobs, public services etc) are solved. This will mean our pool of people who can afford to rent and buy houses will decline.

The US is more likely than not heading for recession which will have a knock on effect.

Our exchange rate is heading the right way to drive inflation.

Unemployment is growing minor tweaks to ocr won't prevent it. and people need job sec unity to borrow.

Fomo won't return until house prices rise. Til then not many fhb will enter the market.

Changing the ocr will affect house prices more than it will help the economy. Driving inflation and more kiwis overseas.

If banks keep dropping rates there is less incentive for rbnz to drop the ocr.

Wars, deficits, overpriced shares, climate events... the list goes on.

There is a chance house prices will rise. But it will be short lived.

Investing is houses now is unwise and very risky. Plenty of better opportunities out there.

Very well said.

You forgot one massive factor which is that in a falling market there are fewer unrealised capital gains to leverage into further purchases. In fact, many of our most aggressive investors are sitting on big losses and will be forced to sell before they have a hope of hitting again.

The mania in 2021 was massively exacerbated by the snowball effect of investors leveraging new capital gains. Allowing borrowing against unrealised gains - without any checks and balances like DTIs - was always a recipe for instability, and here we are on the uncontrolled downswing.

Like the investor Michael in the NZ property investors group the other day. Young fella gloating about how he's accumulated 17 properties from May 2018 to Today. Started with $300k down and this is what he's currently sitting at:

$5.9m in aggregate value, $3.89m in mortgage debt, $440k gross rent, $57k gross free cash p.a. All mortgages on Interest Only. Some sketchy numbers around overheads/maintenance, pointed out a few times as far too low. Thinks interest rates will fall and the market will take off again.

Sounds awesome - he has all his money on black.

Let's see how things look in 2 years from now.

They might be awesome..

"he has all his money on black"

He has 295% of his money on black ($5.9mn portfolio / $2mn equity)

He has $2mn of his equity, financing a portfolio of residential real estate with current valuation of $5.9 mn, the remainder financed by debt.

$3.9mn of debt vs $5.9mn portfolio value is 66% LVR. Leverage not only magnifies the price rises but also the price falls as many highly leveraged buyers in the 2021 - 2022 period are now finding out firsthand.

$440,000 gross cashflow on a $5.9mn portfolio is a gross yield of 7.45%.

$57,000 of annual cashflow after expenses and interest is 2.85% return on the equity value of $2mn, and less than 1% on the portfolio value of $5.9mn.

10 year NZ government bonds are risk free and currently yielding 4.43% p.a for 10 years.

Without capital gains he is losing to inflation.

Indeed. With capital loss he's is taking a bath and runs the risk of bankruptcy. Each to their own.

You go for it...I aint. The best is yet to come.

And the award for the most arrogant comment of the day goes to.......

Just the hint of them lowering rates has sent the NZD tumbling if they really do lower rates inflation will come back very quickly and probably be in double digits.

Don't mention green shoots we'll get all the donkeys in the dunny start braying.

Like Green Fairies?

Maybe the banks should start passing on some of the reductions to wholesale rates...

"yar dreemin mate"

Lets face it, there is more than just one Elephant in the room now.

There must be a whole herd at your place.

STILL searching for your zoo?

No found the Zoo a long time ago on here, mainly full of Monkeys throwing peanuts at one another.

Still high if you ask me at current rates, anyhow rates are set to move down so it will be interesting to see lending trend up again. 14,590 new holders in a single month, but probably not one of them commenting on here.

I wouldn’t hold your breath

Give it another 12 months

The issue will be an emotion called confidence. Confidence that interest rates will drop, that people will keep their jobs, that inflation won't go up again. It will take about two years...

Oh I agree a proper recovery is 2 years away. But I think green shoots might start to appear in 12 months, as retail mortgage rates fall below 5.5%

Even if/when they do drop, the current property market is priced at 2% to 3% interest rates.

Let me be clear- the 2021 peak is not going to be exceeded in the next 5 to 10 years, unless mortgage rates drop back below 3% or wages increase by a huge amount. But either of these events will be inflationary, so I can't see the mortgage rates dropping that low any time soon.

Each of you Spruikers must be represented multiple times on that list, you must have to push the sale and purchase agreements off your desk to make space to post here.....

How about; and I know this is way out in left field, the banks start lending to things other than property speculation to get their turnover going? I mean, there's got to be more of a margin in lending to real business rather than just property speculation, doesn't there? Get the RBNZ to twiddle the knob a few lending ratios etc.

Nah. Just go back to what New Zealand does best - farms the next generation for higher property prices to make the current holders rich, because lending to real business is far too risky...

The problem is we have hit a tipping point where for the skilled next generation moving to aus is way more attractive financially andf for the infrastructure, public services etc... than building a career and raising a family in nz.

This will have the biggest single impact on our economy and related policy decisions over he next 10 years.

A lot has to change to make nz attractive for the population we need.

sure as long as you use property as security

@bw

Banks do lend for businesses as well as home loans. Where are you getting your data?

Meanwhile KS withdrawals are at an all time high.

Big drops in house prices unstoppable.

And that will apply at both ends of the spectrum - the young; to fund a home and the elderly, cashing-out to fund their remaining years.

And it's that last group that's going to be the catalyst for property price falls. Not only will they cash-out their Kiwisavings, but also look to cash-out that property portfolio they've been building for 40 years. And as each day passes, there will be more of them - everywhere, not just here.

Excellent point. There is a vast amount of property that must change hands over next 10 years as the generation that disproportionately owns it checks out. And the price will be set by what the market can afford….

KS withdrawals will naturally go higher as time goes by.

Even the Town Crier sees what's happening:

"The proportion of all investors saying they plan to keep their asset for at least 10 years or never sell is steady at 52%. But this latter measure was 65% two years ago, and it looks like the ageing of the investment property-owning group .... is contributing to a structural rise in the desire of many to place their funds elsewhere".

And if the next 2 years mirrors the last, then ~13% of ageing property owners are going to look to quit the market.

https://www.oneroof.co.nz/news/tony-alexander-banks-worried-were-not-bo…

Wealthy oldies are selling up.

Smart youngsters are leaving.

Sounds a perfect storm

On the topic of decreasing numbers of purchases. We are now getting this at the top of RNZ:

"Why keeping your house on the market could be expensive"

This is the most overt messaging to keep your house off the market if you don't need to sell, I have seen. Keep believing those offers were not the market prices for your house and don't subject your moral to watching it decrease month on month.

"We had one agent for three months then switched to a new agent who said we had to be more realistic because we had been on the market for three months, we had to drop the price. I get that but at the same time, the house hadn't lost value just because it had been on the market three months."

Lol no dear, it hasn't lost value because it was on the market for three months. It is because it was never worth that much to begin with!

Yip. And because the average price of all houses dropped over those 3 months.

The longer you wait to sell.. the less u get. For the next 2to3 years

Exactly. People dont seem to realise that their very large illiquid 'asset', is only worth exactly what someone is prepared to pay you for it. There is no current market price like a share or a bitcoin. Each house is a one off.

Those two 'low' offers they recieved is EXACTLY what their house was worth. Given they rejected them, it's likely less now.

People dont seem to realise that their very large illiquid 'asset', is only worth exactly what someone is prepared to pay you for it. There is no current market price like a share or a bitcoin. Each house is a one off.

You understand well young Jedi

and you only need 1 idiot to hold your bag

Don't worry, the Government are making changes to save the day... including CCCFA adjustments to make it alot easier for banks to approve loans...watch this space.

"Watch this space" ( )

No, oh-hang on - this space ( )

Try this one ( )

Sorry, was that meant to be funny 🤔.... Have any comments on the pending CCCFA changes?

Nifty1, you’ve made what I believe to be an unqualified statement in the sense that it’s only borne of your own unique perception (or wish) there’s been a massive relaxation of lending standards (just more Spruiker pumping on a different day). You’re trying to convince others here there’s some mass avalanche of money imminent to quickly return asset prices to where they were ("watch this space"). Firstly, banks still need convincing their money will be repaid with sufficient security to back the advance in the first place. Reckless lending is reckless lending no matter the times. No bank CEO wants to be fronting media being accused of reckless lending practices on a mass scale. Secondly, in sufficient numbers, are customers confident enough to borrow and spend when job insecurity is front of mind - no. Retailing is dead.

Lastly, if your statement carried any weight, to be ahead of these changes, activity would be rising now, driven by those “smart ones” buying in to be ahead of the curve.

The "smart ones" are sweating bullets, as they scurry about the place, trying to pump the market, trying to mint a new set of Useful Idiots to offload their now very soggy Bags of property to.......while some capital gains (slimmer by the day) are still to be made.

Soon they will seek escape, limiting capital losses!

RP - you comment on every article trying to talk down the market... for what reason... who knows? Maybe boredom and a lack of things to do.

I think you'll find what I've said is facts on what's happening - due to role out 31/07/24 that will impact bank lending. I've mentioned previously the other changes the Govt and RBNZ are implementing this month which will have an impact in the coming months.

( )

Another waste of comment space brought to you by Retired-Poppy...

"you comment on every article trying to talk down the market."

So if you think that those are the motives of Retired Poppy, are you trying to talk up the market (to promote your vested financial self interest)?

Noone knows the motives of Retired Poppy. All we know is that he is not a Poppy and he is not retired. Oh, and he lives in his own home and he hates property investment. He likes to get into spats with people on this forum, and he is always right.

I suspect he is bored and spends all day on the computer.

So the banksters have finally reached that "capitulation" point.

As there is no point in investing in residential property, as rental return is just pitiful vs. all the expenses, also rents have now reached their "ceiling" pardon the pun - and the double whammy of now capital losses, when it was ALWAYS based on capital appreciation anyway !

While FHB's are locked out of the market, with "still" expensive prices, while home ownership in NZ keeps decreasing.

So who are they going to sell their mortgages to now and extract money out of the general populace ?

They have finally overcooked the goose - it had to happen !

Orr has forced the hand of the greedy banksters and finally got them to "play ball" and meet the market.

Come on banksters, the "gravy train" of low interest rates and useless capital appreciation is over !

Now you can get out there and play in the "free market" and get a taste of what it's like to do business in this current economy - like everyone else.

The tide has turned banksters - so get out there with your big boy pants on and stop extracting as much tax paid cash as you can from the working population of New Zealand !

PS you can start by getting rid of those EFTPOS charges every time we use our debit/credit cards ! - your greed never ceases to amaze me !!!

So the banksters have finally reached that "capitulation" point

Not at all. Borrowers are still repaying their loans. Banks don't hire behavioral economists so there's a bit of the ol' reckon as to how the market responds going forward.

No worries. Central bank has their backs, followed by taxpayers (in the unlikely event it all goes to seed).

"No worries. Central bank has their backs, followed by taxpayers (in the unlikely event it all goes to seed). "

So, why should it be the taxpayers ??? ....also what about people that have been paying excessive rents lately (some already topped up by the taxpayer with the AS), also others that kept well out of the PPP (Property Ponzi Party) ?

You obviously have forgotten about "Occupy Wall St" ..... or do you work for a bank per chance ?

So, why should it be the taxpayers ???

Because if the Ponzi goes, it all goes. Remember the words of the ASB CEO on the funding for lending program: "FLP was never there to help banks. FLP was there to help investment for New Zealand."

https://www.interest.co.nz/banking/117126/ceo-vittoria-shortt-says-asb-…

Borrowers are still repaying their loans

Is that a Tui billboard?

Company insolvencies and liquidations up, 474,000 people now behind on payments | RNZ News

Is that a Tui billboard?

Servicing the debt on their loans is probably more accurate.

Banks continue to make insane profits and people here are saying they've reached that "capitulation" point LOL.

Mortgage books decreasing ....their business model relies on ever increasing growth.

"Desperation is a stinky cologne".

Casino: "Thanks you for your stay, and remember the house (bank) always wins sir"

Love your work Crazy Horse

Everyone always thinks of the poor hard working REA's in times like these but we also need to spare a thought for the bankers whose bonuses will likely be effected by this downturn in lending.

Buyers should not be fooled by currently high asking prices.

The dead cat bounce is confirmed as done, finished and now moves into the downslope of the "main event" - of the current NZ Property crash.

The "return to normal: Deadcat, phase is done and FEAR is about to show.....Then the capitulation phase, to set in from 2025/2026.

This main event market capitulation, will take another 2 to 3 years to play out to bottom.

Expect to see many future prices transacting at the previous 2012 and 2015 valuations at the end of this once in a generation crash. Don't be the current, stupid bag holders, Useful Idiot.

Just for reference, 2012 was the "take off" phase, when the lunacy of the masses repumped the property Ponzi (that should have been killed dead in 2008/2009) from high valuations, to a blow off Ponzi-Popping-Top in 2021/2022.

Nervousness re asset prices, everywhere? Just now:

"Gold price is trading at around $2,380, having seen a steep fall to $2,370 after bulls failed to defend the $2,400 level. There are no fresh catalysts seen behind this move..."

If we do see a really bad storks day like down 5% do not be surprised if gold also falls, its normal, as in many peoples margin accounts its the easiest asset to sell in a crash. BUY THE GOLD DIP on crash day, its just margin selling

Will banks once again mass lend "courageously", with "reckless abandonment" and from zero deposit down? Unlikely. There's also another big reality. Those who are fortunate to have jobs need to feel secure in those jobs to a point they feel confident to borrow big from the future and spend today. Not so long ago talent of nearly every kind was in short supply and employees felt secure. Now that's all changed.

The longer this downturn drags on, the more likely it is the next generation won't follow the same path expecting quick riches and overcommit themselves. This is a classic vicious cycle scenario in the making.

When I read all these bearish, depressing comments, I know for sure I made a 100% correct decision to drive a hard bargain and buy a chunk of dirt on the outskirts of Auckland.

Buy in gloom, sell in boom.

Talk to me in 12 months ....all will be revealed, while I sincerely hope it does work out well for you :)

Wingman, what words of wisdom did you share with those who bought in 2019, 20 and 21?

Lets be honest. You've only regurgitated this well worn internet saying once this downturn became a reality.

I don't give advice, let the buyer beware. As the NZ property market reached a crescendo about 3 years ago, it was terrific time to sell. Which I did.

Now it isn't.

What you don't seem to get is that we are nowhere near the doom phase yet we are just transitioning.

We are at the point where the coyote finds treading air don't work.

When you are crying in to your spilt milk, that will be the time to awaken and analyse whether it is a good time to buy, or perhaps wait a year or two.

Yeah the pissed vendors sick of this market headline screams denial.... the summer drop will be bargaining ( crazy people taking those offers) then the anger will set in, its all THERE FAULT... makes for very interesting Xmas lunch with overleveraged family if you have.

Maybe ham and chicken.... roll.

Might have to be a packet of rice crackers and a jar of mayo XD

Gee Scotty, you're psychic.

This is always the case whenever Nats elected they screw the economy

It was so Tip top princess Cindy did a hop skip and a jump to another planet.

It's the debt leveraged against everyone unable to access it that's screwing the economy.

Central Auckland vendors and real estates agents are still in denial about the true market situation

Just been into Westgate to do a bit of shopping and have lunch.

Counted 4 cranes, new buildings on the way, traffic jams, gantrys, new industrial and residential subdivisions, newly completed fast food restaurants. Drove out through Kumeu to Waimauku and there's colossal roadworks, a few new buildings, new intersection, massive retirement village under construction, brand new McDonalds, and road widening.

Where did you guys say Great Depression 2 is underway in NZ?

Scotty thinks that coyote is treading air, and you will be crying into your milk!

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.