Both ANZ and ASB on Thursday raised their term deposit offers. These come after BNZ and Westpac did the same earlier.

But since we last reviewed term deposit rate levels in February, there has been relatively little movement in these rates following the February 50 basis points Official Cash Rate increase, and the Reserve Bank Governor's pointed remarks that banks should be passing on these rises to savers.

They are still dragging the chain.

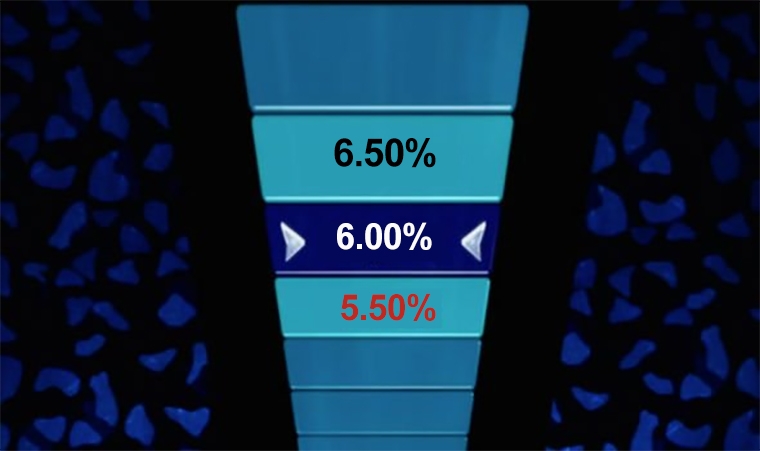

The above chart is after this latest round of term deposit rate rises. They haven't reversed the downward trend the Governor was calling out. Since the low point in August, the main banks haven't improved their offers any more than the minimum OCR rate change, locking in the long gradual decline that started way back in 2015.

If the premium to the OCR was now the same as it was just at the start of 2022, then today's six month main bank offer should be about +50 bps higher (that is 5.50% or so) and the one year term deposit offer +70 bps higher, so about 6.20%.

Challenger banks are offering broadly fair rates with Heartland and Rabobank both with 6% one year TD rates in the market, SBS Bank has ended theirs, although you might argue that even these could be at the 6.5% level if main banks were offering a more 'normal' 6.2%.

The banks will say that the lending situation does not justify higher rates. The loan demand is not there. No doubt they will be right when they look at the very large home loan market. But business demand is strong and rising according to RBNZ data (C5).

Low bank term deposit offers does encourage savers to shift funds to the corporate bond market where yields on offer are well over 6% for investment grade bonds. Still this is a place most savers don't want to go. They like the short stuff. Perhaps until savers learn how to access the bond market, bank low-balling will stay.

An easy way to work out how much extra you can earn is to use our full function deposit calculator. We have included it at the foot of this article. That will not only give you an after-tax result, you can tweak it for the added benefits of Term PIEs as well. It is better you have that extra interest than the bank, especially if you are in the 39% tax bracket - PIEs are taxed at 28% flat.

The latest headline rate offers are in this table after the recent increases.

| for a $25,000 deposit March 16, 2023 |

Rating | 3/4 mths |

5 / 6 / 7 mths |

8 - 11 mths |

1 yr | 18mth | 2 yrs | 3 yrs |

| Main banks | ||||||||

| ANZ | AA- | 3.80 | 5.00 | 5.25 | 5.50 | 5.25 | 5.20 | 5.10 |

|

AA- | 3.80 | 5.00 | 5.25 | 5.50 | 5.30 | 5.30 | 5.30 |

|

AA- | 3.80 | 5.00 | 5.25 | 5.50 | 5.30 | 5.30 | 5.30 |

|

A | 3.80 | 5.00 | 5.10 | 5.40 | 5.25 | 5.25 | |

|

AA- | 3.80 | 4.80 | 5.20 | 5.50 | 5.30 | 5.30 | 5.30 |

| Other banks | ||||||||

| China Constr. Bank | A | 4.40 | 5.30 | 5.70 | 5.80 | 5.55 | 5.35 | 5.35 |

| Co-operative Bank | BBB | 3.80 | 5.10 | 5.20 | 5.55 | 5.35 | 5.30 | 5.30 |

| Heartland Bank | BBB | 3.90 | 5.30 | 5.80 | 6.00 | 5.25 | 5.25 | 5.25 |

| HSBC | AA- | 3.70 | 4.75 | 5.10 | 5.30 | 5.15 | 5.10 | 5.00 |

| ICBC | A | 4.20 | 5.10 | 5.50 | 5.75 | 5.40 | 5.35 | 5.30 |

|

A | 4.20 | 5.30 | 5.75 | 6.00 | 5.85 | 5.40 | 5.40 |

|

BBB | 3.70 | 4.80 | 5.20 | 5.35 | 5.25 | 5.25 | 5.25 |

|

A- | 4.00 | 5.00 | 5.15 | 5.40 | 5.20 | 5.25 | 5.25 |

Term deposit rates

Select chart tabs

Term deposit calculator

54 Comments

If the Reserve Bank are serious about this, why don't they increase the interest rates on Kiwi Bonds, effectively increasing the 'risk free' rate. Wouldn't this 'encourage' banks to move their rates higher?

Because higher TD rates = higher mortgage rates (than they currently are, notice the pause in mortgage rate increases) = more pain.

But don't the banks operate under a fractional model? I suspect a ratio of about 5:1 is in use meaning that for every dollar in deposit (capital) they are lending 5. Thus with mortgage interest rates around 5%, for every dollar deposited they're actually pulling in 25%. To offer only 5% is nothing but a rip off of depositors.

I think you may be confusing bank capital with funding.

Most banks are holding capital of around 13%-16% against minimum required of 9%.

This is being increased to a minimum of 18% by 2028 for the big 4, 16% for the rest - they will end up holding more than the minimum I'm guessing.

RBNZ requires core funding (stable funding in place for at least 1 year) of 75% of loans, but according to latest RBNZ data banks hold circa 90% core funding at present, measured on a rolling monthly basis.

Core funding will be a mix of direct customer deposits and bonds issued by the banks. Noting a portion of deposits won't qualify as core funding as it will be less stable i..e call money or short dated deposits.

https://www.rbnz.govt.nz/statistics/series/registered-banks/banks-core-….

https://bankdashboard.rbnz.govt.nz/capital-adequacy

Kiwi Bonds are issued by Treasury, but yes, you are dead right. They have not raised Kiwi Bond rates since the beginning of December, and are doing banks a favour by keeping them there.

Thanks for the clarification

Re: Perhaps until savers learn how to access the bond market, bank low-balling will stay

So where to learn? Bonds = loaning to an unregulated corporate? Does the saver need to use a broker? Is it harder to assess credit risk putting your money into a corp bond than a bank TD? Is it harder to get funds out if needed I.e. someone else has to buy your bond ? Is being in cash bond managed fund equivalent? Etc etc

Audaxes gave a link to govt T bonds the other day.

Possible to make money over time selling them when rates decline again?

No idea. Anyone else know?

You SHOULD be able to for sure, that is the basically the only reason anyone buys bonds. Now in reality, is that available to general investors like ourselves? or only to larger traders who need some sort of ISDA (or equivalent) to access the secondary bond market?

I am in the short term TD market until my mortgage comes up for renewal in December. But only if the rate is higher than my current mortgage of 4.3% after tax, or 6.14%.

ANZ actually let you repay up to 5% of your mortgage early each year without additional fees so I might do that.

How good are bank bonds these days LOL

Perhaps until savers learn how to access the bond market, bank low-balling will stay

A throw away comment if ever there was one.

Savings deposits are by and large less than those who borrow for a house.

Shop around for the best deal would be my advice.

Remember that executives cannot buy bigger yachts unless record profits continue to be made

You need not worry about them.

NZ has so many oligarchies that all move in lockstep they'll all be fine.

If banks aren't able to write mortgages they aren't exactly screaming out for funding for that lending, so no great surprise they aren't fighting for it with high interest rates on TDs.

Edit: comparing TD rates to OCR when most of the banks lending is fixed rates seems a little off, should we be comparing the margin between TDs and swap rates (1y or 2y)?

As a non financial type person, yes I would like to look at bonds and to switch banks for TD but seems that changes in access now makes this difficult. Looking at shifting money between banks - setting up new accounts etc - has proved very complicated. Partly because we live in a provincial area so both call centres and small bank branches have proved very difficult to deal with, plus AML requirements have meant that opening accounts and moving money is no easy task, we are needing significant input from our accountant. Seems it’s easier just to leave your money were it is. This is to the great advantage banks and means there is no need to give competitive TD rates as people aren’t moving.

Maybe that’s a good reason for banks for banks to make access to “ bank managers” very hard …. Oh unless it’s a loan manager you want, they are super easy to get hold of.

I'm surprised at the AML requirement as your current bank should have vetted you. I can only think you've not been with your current bank long enough or they haven't updated your status.

"Both ANZ and ASB on Thursday raised their term deposit offers."

Regardless of the level, the question ought to be "Why today?"

Because given the GDP figure today one might argue that the OCR has to rise further than projected to protect the level of the NZ$ to mitigate any future increase in Imported Inflation? I guess we are about to find out.

I'll wager yes, further increase in the OCR to protect our dollar. How much further and for how long? Who knows. At some point rates will be cut however this may be staved off due to deposit protection in bank failures so far preventing the runs. When rates decrease in NZ it may coincide with one or two lower tier non-bank lending failures. I can see this on the cards, alongside unemployment. If that's the case, the buy out of existing loans may tick over the ledger and these loans will be closed, further mortgagees and liquidations. Long story short, there is unavoidable pain coming no matter which path is taken.

Regardless of the level, the question ought to be "Why today?"

Maybe it's because BNZ raised their rates on Tuesday, and ANZ and ASB have worked out that if they leave their rates low for longer than it takes someone to open an account elsewhere, they start to lose the deposits?

They are not in a hurry to be raising money from depositors when they cannot lend it out right now without taking more risk.

This is why you have serious competition at the moment for the highest quality borrowers with low LVRs and stable jobs.

I wonder if we're seeing the effects of the baby boomers leaving the workforce.

If they're leaving paid employment and too many of them are parking their money in TDs then banks will have no reason to be be competitive as the bb have nowhere else they want to go.

Of our 8 uncles/aunts who collect super, a grand total of 1 has retired. How many other baby boomers are doing likewise? They're being given a UBI, they continue to collect salaries, and they own their houses mortgage free. Life is fine and dandy.

This won't stop until they actually start dying - and that won't be for another two or three decades.

Time the age of super was raised.

Needs means testing. Or treated as primary source of income, all other income taxed at a secondary rate. Not sure of the answer, but dealing with the largest group of longest living humans in history is costing this nation severely compounding amounts of money.

Yea, see the problem there is you're telling millennials to pay down massive mortgages, to pay for everyone else's retirement and then that the same pension they're underwriting on a universal basis is going to be means-tested when then they get there. That's a shitty deal, given they are halfway through their working lives, and the odds of saving to the extent you can live off them without any pension at all in your senior years are probably getting pretty small.

Then there's the ethical dilemma of why people who have gone without and saved during their working lives should miss out, while people who didn't get the spoils. The universality addresses this, or else there's a major incentive to just game the system (or just get on the bags in a huge way and make sure you're as close to that threshold as possible by retirement age).

Yea, see the problem there is you're telling millennials to pay down massive mortgages, to pay for everyone else's retirement and then that the same pension they're underwriting on a universal basis is going to be means-tested when then they get there.

Not just millennials - it would be everyone who hasn't received non-means tested superannuation.

Other than that I agree with the sentiment of your comment though. Who wants to pay high income taxes all their working lives, contributing to a benefit that gets cut before they qualify for it?

By the time millennials retire there won't be the income tax to support it. It's growing at an unsustainable rate, expected to outpace the economy at 1.5 times over the next 20 to 40 years. Some comments projecting that come 2060 there will be one retiree for every 2.2 workers.

Years ago I (millennial) adjusted my retirement plan with the intention of zero reliance on superannuation because I doubt it will still be available come retirement. Not without significant government debt left behind to be paid for by the next generations. Then who pays their retirement?

You have to ask what's worse? Paying tax your whole life and still paying tax if you choose to earn a significant amount after the age of 65? Or paying tax your whole life, also paying off debts for the previous generations retirement as well as paying off their nest egg to then retire at 70 with nothing to show for it but a few hundred dollars in the bank each week.

I see what you're both saying but the current model is a worsening raw deal for each successive generation.

I see what you're both saying but the current model is a worsening raw deal for each successive generation.

Yes indeed, as the age old assumption is that there would always be a larger generation to pay for the previous. Good thinking of the time in, say the 1950's, but with the birth rate declining, it is no longer possible to structure superannuation on this basis, or a model of never ending economic growth. Genuine wonder what would happen if a political party came out soonish and said they would means test super. We would see just how popular this is, if the genX, millenial, and GenZ's realised how much of an uphill battle they are realistically looking at over the next 20+years

Exactly - I don't understand why people repeatedly fail to see this. There's pretty much no chance that any changes that take place won't a. include grandfathering in and b. include a long lead in time. The last time the pension age was raised for example it took 9 years to fully phase in. The youngest boomers are now 58, so changes aren't going to affect the generation with the most wealth - they are going to affect the generation coming behind.

As for income testing, as well as discouraging saving, it also (yet again) privileges those who have their wealth in assets as opposed to those who might be trying to make up for their lack of assets by continuing to earn into retirement. So again, hitting the wrong group. I don't see why someone who made $500k by selling their home and downsizing should get a full pension, but someone who did not have an asset to sell so keeps working until they are 70 should get their pension docked simply because they are making their money from their hard work rather than from having owned something.

Do you have the same view re tax?

I don't see why someone who made $500k by selling their home and downsizing should get a full tax relief, but someone who did not have an asset to sell so keeps working should get their income docked simply because they are making their money from their hard work rather than from having owned something.

Yup. I think income is income. It seems like any time we need more money for anything the solution is to tax income gained from working more. But given distribution of assets (older people generally have more of them and less income), this just ends up increasing the very intergenerational inequalities we are trying to address.

Time to phase out super all together and get young people investing in Kiwisaver like schemes more asap.

Kick the old people out on the street if they don't have money or family you think?

Back to the future. We did away with annuity pensions the last time the Govt run out of income tax

Chaos,

Keep your hands off my Super. Without it, I might have to buy lower quality wines and you wouldn't want that on your conscience, would you?

Lower quality or lower quantity? ;_;

Is that you Dad?

Buy cleanskin, the modern day equivalent of having a flutter every week

Age of super should be raised - slowly say 1-3 months per year so planning for retirement is defined. Asj yourself why are we boomers staying at work - answers - we are still fit healthy and want to continue to be productive, population demographics show a coming decline globally so keeping us oldies going buys time to train youngsters or find other solutions -robotics/Ai. The UK has found that encouraging retirement at 55 plus has created labour issues and many corporates and Govt depts offering incentives for the retired to come back and work yes actually turn up and work.

What do you expect with the 4 main banks holding an 85% oligopoly in the market.

Roll on open banking. Then I can sit there at the computer and shuffle money to the highest term deposit rate.

Yeah open banking vs AML , interesting to see the solution.

You should only have to do AML once per year. It could be an institution independent online document set owned my the user, that the user can give authorisation to access.

Just get kiwibank to hi ball it Mr Robertson.

That would build savings and kill house speculation

Perhaps until savers learn how to access the bond market, bank low-balling will stay.

If only there were some kind of financial advice website that could teach savers how to do this. It would make a very interesting topic for an article...

If this bank failure things really gets going and interbank lending dries up, as it did in 2008, then demand for liquidity is going to rise i.e. the banks will start to compete with each other for your money if they can't get it from each other.

Interesting times.

Any interbank lending is made by using their reserves and not deposits. Reserves are made up of the governments sovereign currency which mostly comes from the governments spending via the central bank.

Maybe. But if ANZ won't lend to Westpac out of repayment fear when they call up and ask for their 12 month depo rate -"Sorry. Credit line full", then what?

I know! Create more Public Debt and fund the reluctant banks that way. But isn't that what got us all here in the first place?

Reserves have nothing to do with funding as they are not lent out. Banks only need reserves to operate the payment system between themselves. There are always more reserves in the system than are required and this depresses interest rates and this is why the government reduces them by issuing bonds and the central bank will always supply whatever reserves are required to maintain the payment system.

What did QE do but massively increase bank reserves to help reduce interest rates by converting bonds back into reserves. https://www.hks.harvard.edu/sites/default/files/centers/mrcbg/programs/…

"The banks will say that the lending situation does not justify higher rates. The loan demand is not there".

This sentence suggest that the banks lend out their deposits but this is not so as it is the act of lending itself which has created the deposits in the first instance, The Bank of England has explained this and it now common knowledge except among economists who have fixed ideas about banking which were wrongly taught at university using outdated economics textbooks that include theories such as the money multiplier and loanable funds.

We (the NZ Public) always get rorted.

Although it is good to see Interest.co.nz is finally in agreement. Better late than never I guess.

Of course they are. For 3 years the Govt made available almost free money to banks under the Funding for Lending programme, which meant that they didnt need to pay better interest rates to savers to attract deposits, they already had access to cheap money. And now that the FFL programme has been finally wound up (about a year too late) the demand for mortgages has dropped off a cliff, so once again, they don't need to pay higher interest rates to attract deposits. You can sheet this particular problem directly home to the Labour Govt and the Reserve Bank. Retail banks will do what they need to do, and won't do what they don't need to do. Its hardly a coincidence that the only ones offering decent rates are the ones that did not have access to the Funding For Lending programme.

Low balling us? Answer, Yes. They made so much money from the FLP they don;t need to encourage saving so much as they have the profit as a buffer. NZ suffers, bankers are laughing all the way to the....

Just like any other business, banks are going to go for margin if volume has been wiped out, as is the case with the huge slump in mortgage applications.

There's also no mention of the absurd lending rules implemented by the RB and government back in 2021. A bit rich of the RB to complain deposit rates are lagging mortgage rates if banks are forced to operate under tight lending restrictions.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.