The housing market is "desperate for some oxygen" but there's no immediate sign of things getting better, property valuer QV says.

According to the QV House Price Index for August, the average house value in New Zealand had fallen by some $89,917 to the end of August (down 8.5%) compared with the January peak - which is a rate of some $424 of lost value per day.

In the country's largest housing market, Auckland, the average value has slumped $157,500 (that's 10.2%) since the January peak. It equates to a drop of $743 per day between the end of January and the end of August.

But the capital, Wellington, has actually fared worse. The average value in the Wellington region has plummeted 14.7% since peaking in January. This is a $160,941 drop, which works out at $759 a day.

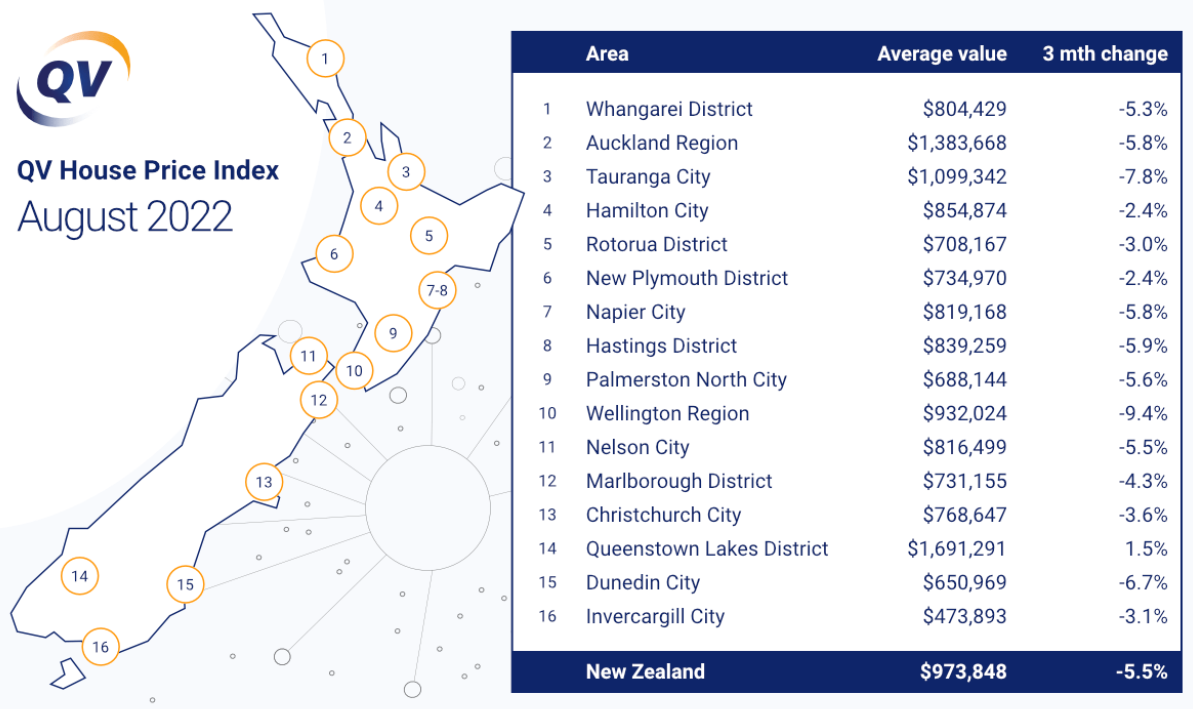

QV said the average home decreased in value by 5.5% nationally over the past three-month period to the end of August, weakening further from the 4.9% decrease in quarterly value change seen in July, with the national average value now sitting at $973,848.

A year ago the national average sat at $963,046, so, the average annual increase is now just 1.1%, down from 4% annual growth last month.

In the Auckland region, the average value now sits at $1,383,668, falling 5.9% over the last three-month period, with the average value comparing with $1,368,252 a year ago and annual growth also dropping to 1.1%, down from the 4.3% QV reported in July.

Wellington and Tauranga showed the largest three-month value reductions of the main urban areas with falls of 9.4% and 7.8% respectively. Dunedin is not very far behind with a 6.7% reduction in average home value this quarter.

On the national housing picture, QV general manager David Nagel said tight credit conditions and rising interest rates means fewer buyers are competing for an oversupply of stock. This continues to put downward pressure on prices.

"We’re starting to see some pretty significant value reductions now, especially in the main urban areas where value growth was previously so strong. Market gains from August 2021 have largely been eroded from the falls in the first seven months of 2022," he said.

"The residential market is desperate for some oxygen, with a dwindling pool of buyers spoilt for choice with an oversupply of listings. There’s no immediate sign of things getting any better, with interest rates likely to rise further and business confidence starting to wane."

There are, Nagel said, mixed views on the extent of further interest rate rises, as well as how these will impact house prices over the next 12 months.

"Some economists are suggesting we’re close to the peak of mortgage interest rates, while other commentators are predicting house prices may fall a further 25% over the next 12 months."

Nagel said it looks as though it’s going to get tougher before it gets any easier for sellers.

"First-home buyers will continue to struggle for finance, with tight credit conditions and affordability constraints. Plus there’s still plenty of new homes in the pipeline, which will add further to oversupply, putting further downward pressure on prices."

Only eight districts recorded positive home value growth in the past three months, with Otorohanga (2.9%) in first place. It was followed by Central Otago (2.3%), Hurunui (2.2%), Waitomo (1.6%), Queenstown (1.5%) Ruapehu (1.3%), Hauraki (0.6%) and Ashburton (0.1%).

Throughout the first eight months of 2022, Opotiki (7.1%) tops the list for most home value growth on average. It’s followed by Central Otago (6.4%) and Kaikoura (6.2%). The largest declines during this period were in the Wellington region.

QV's full release, including regional breakdowns, is here.

- You can have articles like this delivered directly to your inbox via our free Property Newsletter. We send it out 3-5 times a week with all of our property-related news, including auction results, interest rate movements and market commentary and analysis. To start receiving them, register here (it's free) and when approved you can select any of our free email newsletters.

175 Comments

The pendulum always swings.

These figures are getting through to mainstream media. When the general population are reading that the house they’re looking to buy will be a grand cheaper tomorrow, it will become more and more just a waiting game.

The waiting game sucks.

Let's play Hungry Hungry Hippos.

God save the Q̶u̶e̶e̶n̶ Housing Market...

Too soon?

England's last vestige of credibility just left the building.

Hard charging trooper right till the end.

Pa1nter,

Is there any chance that NZ will now politely ask to leave the table and become a grown-up country? We really don't need Charles as our Head of State.

You wouldn't rule it out over the next 10-20 years.

How are we less 'grown-up' by having an offshore Head of State?

Imagine someone like Mallard as President? I’m not convinced.

Republics are just more unstable than Constitutional Monarchies. It seems to dampen the God complex of sociopaths like Mallard to some extent.

It's also kinda weird that religious observance is much higher in the US, a republic, than the UK, a monarchy where your leader was supposedly chosen by God.

Totally agree, I would rather have the monarchy as opposed any of the current leaders. But wait did I hear John key put his hand up for president? Ok, I'm in

It’s quite efficient for us to keep it. The British pay the cost.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3746086

A simple approach to having a NZ Head of State

A healthy drop is to be expected following the grossly overheated monetary reaction to Covid. But looking ahead in the coming year it will be the NZ economies ability to support people in jobs and to maintain mortgage payments that will either normalize house prices or send them plunging to exacerbate an economic downturn. Hopefully this period ahead is a great opportunity for those people wanting to purchase a house for the first time, but either way Labour will be voted out and we will all cringe when we look back at the simplistic stupidity with which this government managed the national finances.

I doubt if things would be any different if we had been through the pandemic with a National government and Joyce. Same RBNZ. One thing for sure is that going from their response, most of us would have lost elderly relatives and the hospital system would be decimated.

Yeah Labour aren't my cup of tea but the Nats would've denied reality longer and we would've been worse off in pretty much every way except we could go on overseas holidays earlier.

Is the government so hopeless that we have to make up situations in which they are better than National?

Also, the idea that Bill English, who notoriously has strong views on the sanctity of life and who is married to a GP, would throw Kiwis to the wolves during a pandemic, is a pretty hard sell. The current mob I wouldn't trust to sit the right way on a toilet seat, but the actual PM in charge when Covid first hit in hypothetical National-land in 2020 would have been English, not one of the disasters that followed him.

If you dont think National would've taken more time to act "for the sake of the economy" that's up to you, that seemed to be the case for many of their overseas contemporaries, and a decent amount of their local voter base also.

They are generally slow to react to any scientific information that potentially jeopardizes the status quo.

I genuinely do not. At least not that particularly PM and Senior Leadership team, which is the one that actually would have been making those calls. I think people forget how good English was in the PM role, but that's understandable given the shitshow that unfolded after he left.

I suppose this is the point where I point out that we didn't actually move that fast to begin with either and our government took their sweet time?

They kept Covid out of the general population in the initial stages of the pandemic, where plenty of other countries' governments failed.

Obviously everyone has their opinions about covid, but for me that's an effort I'd call "good enough". As opposed to, you know, telling everyone it's no big deal and wiping out quite a few citizens, then locking down.

Covid not running wild in the initial stages (Feb - April) was dumb luck as much as anything else. Apart from signs at the airport for people travelling from Italy or China, there wasn't really much of of a response until early March. We didn't even test people coming through MIQ at all until late April/May. If they'd kept Covid out of the general population to that extent, we wouldn't have needed huge national lockdowns.

The early days of our pandemic response start to make a lot more sense when you consider the track record of our government in pretty much every other area, which is defined by endless policy resets and announcements until no one can keep track of what you said you would do but didn't.

I guess we've done ok compared to some other western countries but that isnt really saying much.

Other that the clear advantage with our borders allowing us effective lockdowns, we copy and pasted everything the US was doing, and that came with a huge price tag.

If we had been free thinking, actually investigated potential treatments, a didnt go with a one size fits all approach, we could have ended with a better economic outcome as well as health wise.

I give them a 3/10

Expert in hindsight. Do you have an example of potential treatments that we could have investigated? Or are you advocating for chasing ghosts during a global pandemic?

I thought the "huge pricetag" everyone goes on about is due to lockdowns, yet you're saying we could have had effective lockdowns. What do you mean? We're not the only country in the world that has borders capable of effective lockdowns. What about Australia? Ireland? UK? They're all surrounded by water.

Labour actually screwed up the first lockdown was at least 2 weeks late.

They would have also gone on just as much, or more of a borrowing spree I would imagine. For example, we had a "GFC" and some earthquakes. Time to fire up the printing presses and borrow $50b. Despite the Earthquakes having a total estimated cost of $40b (RBNZ Bulletin Page 3), and by 2015 $26b of that was paid out by insurers (Page 5). Were they helping bail out American banks?

https://www.rbnz.govt.nz/-/media/project/sites/rbnz/files/publications/…

Please for the love of god vote based on policy, not people, and let's all shift the power away from the classic red and blue pendulum in this country. The more differing views we have in parliament the better we are all represented, and neither National or Labour have any appeal this election so far regardless. Times have changed dramatically, as needs to be the way we vote. Better living everybody

Party politics shouldn't even really be a thing anymore, there should be some sort of technocracy where government focus is closely correlated to majority whim in conjunction with open factual information.

Professor Forbin would like you to consider the colossus project.

labour decimated the health service before covid -- less than 2% of people waited more than 4 months for a specialist appointment when they came to office -- and it was stable immediately after before their nonsense reforms started and drove people out of the health service and out of the country -- the months BEFORE the first lockdown -- almost 15% of people were waiting over 4 months for such an appointment --

As a Social Worker -- and very senior manager of a healthcare company -- the damage was already beign done long before Covid -- just like it was in many other areas -

Covid was a saviour for this government not a cross -- and been a convienient excuse for their massive increases in public sector borrowing expenditure, staffing levels delays in healthcare, housing lists and homelessness - -etc -- most of which were already well underway beforehand

Not true. Magical metrics that doctors decried as encouraging only work-to-number rather than enabling delivery of appropriate healthcare is not a fix and did not result in decent healthcare. One might need to be willfully ignoring reality to suppose that the health system was in a decent state before they came to power.

I had seen and heard so many doctors and nurses complaining of the dire state and of the complete numbnuttery of magical metrics that in some cases resulted in them being forced to do the medically worse thing for the patient, to satisfy management lest they be hauled up again on not keeping the numbers high. And magical metrics were no replacement for adequate growth in healthcare investment in the face of an aging population - something National did not do.

The idea that it was all great and then suddenly went to pot...absolute dreamland.

Doctors and nurses are not inefficient or lacking knowledge in how to do their work. Investment is needed. And realistic wages and living costs are needed. So long as we support high housing costs and low wages via policy, we're going to struggle with staffing. Prospects for building a life are better overseas.

Unfortunately both National and Labour seem committed to supporting high housing costs, and National to making working doctors and nurses pay higher taxes so property speculators can be exempted from reasonable taxation.

it wasnt great -- it was creaking -- - but we were all managing and there was plenty of new and innovative work that was improving efficiency across much of the DHB and certainly in the NGO sector.

When labour came to power it cancelled 100m of innovative Mental Health pilot projects -- targeting Youth, Maori and Pacifica and the rainbow community -- projects that had been developed by those of us who worked int he sector -- and wasted nearly 2 years on a review that told them nothing that was not already glaringly obvious -- the end result --- well we are still waiting for it -- apart from Awhi Ora -- a great initiative -- there is nothing to show - -6 new high care beds, of which only 4 are open due to staffing shortages --

It also cancelled much needed 1800 new prison beds at Waikaria - again on principle and has ended up paying 75% of the cost for only 600 beds and a 100 bed Health facility -- again unlikely to open given they cant currently staff their much smaller health service currently -- these beds were desperately needed to replace failing infrastructure and units throughout the country - and would have provided far more facilities for education, training, interaction with families and Kaupapa services

So i accept 100% that the issues have been building for 30 years or more of underinvestment -- but boy have they accelerated it -- and creating a new Healht Authority in the middle of a Pandemic -- when every health service has been under the pump for 2 1/2 years is ludicrous -- and is adding to the mass exit of staff -

Its not all their fault -- but if there was a way to make thigns worse -- they sure worked hard to find it!

People forget that NZ in October 2019 got slammed by a review on our pandemic preparedness. An MOH overseen, by the way by St Ashley.

That was all talk. If Joyce was running things, it would’ve been a similar strategy to Labour’s, but with far better execution.

Haha, good one.

And I thought you were paid by the word.

house prices will continue to slide even with full employment. Soon some people won’t be able to afford servicing their property even while employed. Prices would just slide quicker with job loses.

And crucially I think you’re confusing who’s responsible for monetary policy in NZ - it’s the reserve bank not the government you should be pointing the finger at. I hope I’m not right that this govt is going to get voted out by those who blame the wrong people for causing this bubble.

The government has also played it's part with lousy fiscal policy, immigration, infrastructure and planning etc etc etc.

Exactly. Their wasteful overspending has helped create the current inflationary environment, whose effect will be significantly higher interest rates for the years to come. This does not justify the terribly stupid, utterly unsustainable and deeply shortsighted ultra-loose monetary policy of the RBNZ of the last 2-3 years, of course.

Also literally changed the remit to include full employment in the first term. And has an absolute majority in the 2nd and made no changes, despite the inflation running riot and the total lack of accountability. Remind me again, which minister does the Governor serve at the pleasure of?

But sure dude, nothing the Government could have done. At all.

The change to the RBNZ remit has been one of the most moronic moves in the history of the modern NZ economy.

Swingtrader - lets not get mixed up over verbalage.

We can all appreciate that the RBNZ manages monetary policy and their desire to lower interest rates (down to nothing) during Covid was (IMO) fuel on the fire. But I refer to the Labour Gov. as managing the national finances and setting the bonfire to begin with. As others have pointed out this was a free-for-all of borrowed (printed) money thrown wildly around to over-inflate our economy, keeping zombie companies 'alive', filling the profits of some very greedy corporates and in essence an action by a few simpletons in the NZ Gov who couldn't care less about the debt they have racked up for generations to come. And whilst some handouts were needed in many ways, even Mr Robinson himself recently admitted they overcooked it.

To be fair, many governments globally over-stimulated the now blown out global economy, but the lack of accountability to this current Labour lot as they recognize they will likely be voted out in the future gives me a great sense of frustration. I have respect for Jacinda - but the leadership of her Government and the quality of her broader team equal a zero out of ten. Unfortunately we need two strong and opposing parties, currently we have none but National stacks up at least some semblance of commercial savvy.

So lets hope - as I suggested earlier - that house prices do drop and enable ordinary people to be able to afford a home in the years ahead, knowing they will be saddled with high taxes for their entire working lifetime to pay off a Labour 2yr spending party.

Hulk..

rubbish...the problem isn't the govt,its the people who thought a house in papatoetoe was worth a mill an a bit

Hulk, you are too kind to say Labour managed the finances. All they did was spend. Labour is running huge deficit right now and we are out of Covid. There should be spending cute to help reduce inflation not spending increases and handouts which eventually prolong the inflation problem. And our bucktooth prime ministers smiles won't fix that. They should have had the election campaign slogan "let's fuck this" because that's what they have done

Couldn't agree more - although I have no doubt Jacinda is a very well meaning person, if her and her team were managing a company instead of the Government it would be bankrupt and failed 10x over during these last few years.

Anyone can hold themselves to account in the face of a massive challenge (Covid, ChCh shootings) but you also need to hold your team to account when managing a country and an economy, this is where tangible and sustainable leadership should be seen. Unfortunately it is nowhere to be seen.

To “normalise” means they must plunge. They are not different alternative paths but the same…normal must be far lower, which normal people can realistically afford. This will make for a stronger long term economy after sort and medium term pain

What it is getting, and what it needs, is some Ozone (O3) - one of the most potent disinfectants known.

For the record... Ozone is an oxidant.

It's not oxygen the housing market needs, it's rehab.

Indeed. Cheap debt, now removed, has the debt stacking junkies on rehab.

Most forum members will be aware of a certain Property Broker who's been administering verbal mouth to mouth to an ailing housing market for some time now. If he's now absent in this more critical time of need (given up), it might mean it's time to reach for the defibrillator💙

TTP has DHB (dropped his bundle)

But first there will be a significant withdrawal period

FHB buyer here, exxxxxcellent (strums fingers and grins menacingly like monty burns). Still seeing houses listed AT OR ABOVE September 2021 RV's, the denial in sellers is showing through something wicked. The more these articles hit the media, and the more sellers talk to each other around how their houses are not selling, the longer the average house stays on the marker, the better things get from my view.

Through most of last year my modest Wgtn home valuation (QVNZ) was increasing by around $50k/month. Over 2020 - 2021 it went up by $600k (80%) to $1.35M. In the last 8 months it dropped $300k (22%). Still a long way to go down, thankfully I have no mortgage debt.

I live in the Eastern Suburbs, over the ridgeline from one of the priciest suburban areas Seatoun. On my regular walks down to the beach there I see a few houses that have been on the market for most of this year, approx half listed not selling within a couple of months.

certainly no hurry for FHB to enter the market place, another thing to consider is after many year of solid gains Kiwi saver balances are now declining...........this makes a difference to the many FHB who use this scheme to save for a house deposit. I suspect this latest media news will filter through to the masses rather quickly and help the down turn even lower. Why the hell would you buy a house in a market place that is cost you up to $5000 a week in capital. Probably got another year to run before we meet a balance.

In Auckland the average house price is around 11 x average wage couples income, so overvalued compared to income. At 4 x two persons income they would need to earn around $335k between them to buy just a average home in Auckland. So from wages only top 3% of population could buy average home in Auckland from scratch. This housing market is toast the large price falls will continue until average wage couples are able to purchase a home. So this is just the start with rates and inflation climbing and NZD tanking the price drops will accelerate over coming months.

How many years has the Auckland market been unaffordable yet people continue to buy?

How many of those purchases utilised boomer equity as a deposit, and interest-only loans, while interest rates trended down 2008-2021 and the government allowed them to write off their interest?

It was affordable while prices were rising and rates were dropping - the banks only real risk in approving loans was if they turn bad, and in NZ that requires bankruptcy.

Many people renting today could afford mortgage repayments up until the RBNZ fail of 2020 - what they can't afford is the deposit.

I'd say nearly 2 decades now.

What'd be more significant is if a lot less people actually wanted to live there, that'd drive down prices.

Where are the people coming from? That would be a question worth asking.

Some from their mummies tummies and the rest because Auckland seems to be the most attractive place for migrants both internal and external to settle.

Why would you buy into an unaffordable market when house prices are tanking.

If the right property came up and you were after something more specific than cookie cutter suburban housing.

Exactly. Your not buying an indexed fund of the New Zealand property market.

Value can differentiate enormously.

True, but there will be far better value in a year than there is now.

Depends on the individual deal.

Depends how specific you are on what it is you are looking for. Just because houses have come down doesn't mean you can find one you want to buy. It took me 12 months to find my place, its truly unique. The more I think about it now the more mental I was looking for one like this that ticked all the boxes, they simply do not exist in the burbs.

For once I agree with you.

Values are subjective.

I am too more than keen to overpay for something that I really value.

People who purchased years ago have made a small fortune I know my first house I purchased when I first arrived is now eight fold what I paid around 20 years ago at that time is was easy to pay. Now I would have no chance of buying that same house from scratch the deposit would be more than I paid originally. If most of the countries population can not buy a house from scratch thats a sure sign it’s overpriced now rates are normalising the wheels will come off and anyone who purchased in last seven years will see paper losses and be in negative equity for a number of years.

We also haven't even started to see the effect of the interest deductibility phase-in.

Just rent to HNZ bro, interest deductibility back on.

And risk getting your house significantly damaged.

They manage it and pay for any damage.

Everyone wins, except for non-beneficiary renters.

For those that hold out hope of a change of Government next year reversing any changes to the property market that the current Government have put in train, and thereby adding that missing oxygen, here's a thought:

- Adrian Orr is reappointed for 5 years ahead of next year's election. That will allow a neutral RBNZ to squeeze the monetary daylights out of any initiative designed to derail the current settings, and 'encourage' whoever win to get on with crucial fiscal reform. He's now showing us he's up for it.

As I say, just a thought, of course.

If National get in there will be an army of advisors and consultants deployed to engineer the demise of Mr Orr and Mr Coster.

Not before time, although trying to find one in Wellington will be a big ask https://www.stuff.co.nz/national/politics/118333829/government-departme…

And an army of working groups, as followed their last being elected. Just what the parties do.

I bought a house in Wellington in October 2021. Pray for me.

Praying isnt gunna help

I had friends who bought a house in Queenstown during the 2007 peak. They now say it was the best decision they ever made.

Just be patient.

The fact that 6 months either side and I borrow 150k less kind of stings but its all good really.

My personal circumstances dictated that I needed a house. I don't plan on moving for at least a decade and while I paid at peak of index, I know the agent was a tad disappointed with what I 'won' with.

Also, I like living here.

Yep. People who only want to do things at the "right time" generally get less done.

This is the best comment here!

Best is the enemy of good.

Would you call right now good?

It will sting more in another six months.

It wouldn't, he is keeping it for a long time so it will recover eventually. In the mean time he can enjoy his own house with no cause to move and building an asset that can be sold later.

Did this for my first in November 2007

8% interest on 420k, no deposit. Dropped 10% in less than a year. Just hang in there if you can. It'll turn out fine in the long run

Correct I was on 8.6% for $255K back in 2005, worked out just fine for me even though that's just a few years before the GFC.

I'm starting to see asking prices come down to a "realistic" level, some 30-40% below peak on Homes. Here's one in Wgtn that has a BEO of $745k, 45% below peak. This is what I regard as a someone serious about selling in the current market. Of course, the house sold for $388k in 2011, so BEO is still nearly double that in 11 years. Relative to incomes, it's still maybe 50% above where it should be.

https://homes.co.nz/address/wellington/strathmore-park/74-raukawa-stree…

$745k for a postage stamp on a post-it note? Woof.

True. But not long ago homes thought said postage stamp on a post-it note was nearly $1.4m.

Homes have also promoted an article (littered with typos) claiming over half of New Zealand home owners were millionaires.

I don't believe a word they say, all credibility out the window.

We'd see some sort of intervention before prices would ever hit that level. Discretionary spending would collapse, there'd be be a huge number of home owners underwater, the country would basically grind to a halt well before we got there.

The subtext to these types of arguments seems to be "bad things aren't allowed to happen, so someone will prevent them from happening". If anyone had the ability to do this, we would never have recessions, depressions, financial crises or crashes.

Mum's gonna fix it all soon.

Welfare for us wealthy folk, that's all good. We deserve to have our "investments" subsidised and bailed out. It's the gross poor people who are the real beneficiary problem. Now subsidise my investments, exempt me from tax, and hand me my pension from young folks' wages.

Not "deserve", Rick, "expect".

The subtext is actually "pretending there would be no adverse consequences to prices unwinding back to 2011 levels almost as stupid as thinking house prices should or could keep increasing forever" - unless our new thing is to only ever talk about the winners in a given scenario and totally ignore the downsides.

Man stands in middle of road, yelling: "Stop pretending that it dosen't hurt to get bowled by a car!"

Pedestrians on sidewalk nod their heads and say: "Yes, we know."

I'm not the one saying where prices "should" be.

I specified relative to (average) incomes, which is about as basic a fundamental as one could find.

Also, saying that the $745 BEO is maybe 50% higher than it "should" be implies a value of around $500k, still a substantial increase from 2011.

Doesn't change my underlying point: If that's where we land, we'd see huge destruction of consumer spending and widespread employment issues as people tightened their belts or fought to get out of negative equity. There would almost certainly be some level of intervention as you'd rapidly reach a point where this threatened the financial stability of the country - not at first, granted, but it would eventually happen. Either low interest rates or some other bailout mechanism, who knows.

I wasn't saying "WE CAN'T LET HOUSE PRICES DROP" but I don't think NZ is ready for a return to the low-spend high cost ways of the early 1990s. We may not have much say in the matter.

the govt and RBNZ has used up all its ammo, its now time for pain or Zimbabwe.

Printing $$$ = inflation and devaluation of NZD

Devalued NZD = More inflation

Inflation = higher interest rates

Moral of the story - Live within your means!!!!

Actually, that depends a lot on debt concentration. Interest rates have negligible effects on renters (1/3 of household), and at least 2/3 of mortgage payments are HALF the average rent, and significantly paid ahead (ANZ).

How many of the remaining 2/9 actually have expensive mortgages costing more than, say, rent? That number will be rising as interest rates increase and deductibility phases out.

Demand destruction is going to be a slow process, and rates will probably need to go significantly higher to achieve it, given how relatively few people they actually affect.

That would be true if higher interest rates only effected house prices. They also tend to impact discretionary spending, which has implications for anything financed against housing, and people also snap their wallets shut, so less food, drink and entertainment. So things like hospo etc are in for a pretty hard time. The demand destruction will come when people start getting made redundant because their industry has been living on the fumes of people effectively borrowing against the house. I don't think we're too far away from that as things stand.

I don't deny that there will be many people negatively affected if we were to see a further significant drop in house values, say 33%-50% from here. However, there are many more (and disproportionately younger) people negatively affected by the recent house price explosion, even after the recent drop. Current average prices for houses and rents are still far too high and are not, in my view, sustainable at current income levels.

Housing has been a bona-fide crisis in this country for some time, not least for renters who have had seen ever-smaller chances of becoming owners. Yet this fact has received very little attention even from the current Labour government, never mind the opposition. You talk about financial stability being threatened if prices drop a lot further. I say, we have relentlessly been approaching systemic instability over the past decade or two. House prices returning to affordable levels may well be necessary for avoiding it.

If they could intervene, they would be doing it now (before market sentiment turns). They know this all ends badly. They would not be hiking the OCR and suffering the drop in dollar if they wanted to save this. I would not be happy paying more for gas so some can keep their house prices.

It's too expensive to bail out, the best they could do would be to give everyone interest deductibility (more inflation, so more hikes are needed). They are just hoping to get lucky and rates go back down quickly without a bad recession and if not blame it on global factors.

There's no urgent pressure... yet. Prices are down but people aren't being laid off and houses aren't being force-sold to protect the bank profits. The question is really 'Do you trust those in charge to pull the right levers in a timely fashion if things do get to that stage?' and the last few years of OCR decisions and LVR revocations should tell you all you need to know to answer that question.

Interest deductibility is a hard one. It rewards those who borrowed stupid amounts while those who tried their best to live within their means get less out of it. A really visionary Finance Minister would be looking into a Fanne Mae/Freddie Mac style federalised loan program as a means of offering some form of assistance - arguably this is where FLP should have been pointed at, not underwriting super-profits for Australian banks. I suspect we will not get a visionary outcome.

Why is interest deductibility an okay thing for Landlords who borrow too much, but not FHB or Owner Occupiers? Interest Deductibility "rewarded" Landlords but not FHB.

I understand "businesses" derive their income from costs such as loans, therefore it should be tax deductible, but does an Owner Occupier not derive an income from having somewhere to rest after 8 - 10 hours a day?

In the US, the law is basically the opposite of what it has been here: you can deduct the mortgage interest from your primary (or secondary, though that wasn't always the case, I believe) residence, up to $750k, but not on investment property.

Yes, and while they have 30 year fixed terms, anyone that does see a rise in interest rates can just increase their deductions, so the impact on rising interest rates is somewhat more tamed than here.

I think deductions for landlords at a time where houses were/are in short supply was a pretty immoral situation so I'm kind of happy that's gone.

My basis for that is there's almost no business logic to taking on an asset at huge cost, use external underwriting (tax concession on interest) to finance a cashflow negative pattern for years at a time and then cash out to realise a tax-free gain without ever having turned a taxable profit, unless that's the whole point of the exercise. At that point, you're not in the business of providing accommodation or investment property, you're in the business of producing capital gains and profits should have been taxed as such.

Whereas to an owner-occupier, a house is just a house. It produces food and shelter and you mop up all the financing and running costs instead of renting.

Also as landlords are a business, providing a valuable service to the needy, why don't they have to register as a business? (and apply for business loans, and GST register over $60k turnover etc etc)

The RBNZ has no direct mandate on house prices. However they do on employment and financial stability.

So they won’t, or at least shouldn’t, cut the OCR to save the housing market.

However they will cut the OCR if one of the consequences of a crashing housing market is soaring unemployment.

They means the RBNZ, government and treasury. They can change or reinterpret the mandate to get the policy they want. I don't think there is any good argument that the RBNZ have the independence to go against the government. The bank knocked 7 percent or off the "sustainable" house price level the moment it was necessary.

Yep, all happened in Ireland 2007-12. Intervention only means government bankruptcy and IMF get added to your list. Don’t rule it out…house prices in Ireland 2007 were not as crazy as NZ in 2021….

I notice it says "enquiries over 745k"...I hate that. If it sold for 388k in 2011 going by the old rule of a doubling every ten years 745k sounds about right considering market conditions currently.

"Better"? If the price of carrots increases, that isn't "better" for anyone without some context. It's worse for consumers—unless somehow the carrots are also tastier, more nutritious, last longer, are pre-sliced, or are obtained more conveniently. It's neutral for producers, without information about their costs, since the price could go up but profit remain constant. Houses prices are like that, too. There is no universally "better" price, so can we please stop using that term in relation to house prices? They are what they are at any given moment, and hopefully they are an actual reflection of reality.

You have to imagine that the media and politicians all have significant financial interest in carrot farms. Suddenly, high carrot prices are a sign of success!

The vast mass of simple carrot-consumers can go screw themselves.

I live in a north island regional capital. On Wednesday a prominent agent from our city rang me to discuss a property that was coming up for sale. One of the comments he made to me in our conversation was that there are currently no investors in the local market. Does that mean investors think the market will fall further or they cannot get finance or both?

Surely the investors are after the long-term cashflow and income that comes from the actual rent generated? Surely it wasn't about the capital gains after all, and the scarpering from the market en masse when they are no longer on offer would be saying the quiet part out loud? What a turn-up for the books.

The massive amount of tax evasion we've seen from folk pretending not to have bought and sold for capital gains...

A moral/ethical problem. Just bad character in a segment of NZ.

Investors are not immune to the data, the market is falling buying now is not logical, selling if you have to as early as you can.

Houses still too expensive.

I biked past a new townhouse development this am in a decent part of Chch (Barrington for anyone with local knowledge).

A new row of townhouses have just been finished that I had assumed were sold "off the plans", but they all now have for sale signs up. What's interesting here is the development was reported as sold out on the developers site, but now a bunch of for-sale signs are up.

The cheapest one is $575k for 2 bedrooms, 1 bath and a separate toilet, no garage, not much outdoor space from what I can gather.

2.5 years ago we paid the same for a 3 bed, 3 bath, 2 car garage in a nicer part of town, and even that felt painful.

Houses need to be cheaper. Money wasted on housing needs to go into more productive sectors of the economy.

Wait for the policy announcements April ish 2023 regarding Kiwibank integrating all first home buyer assistance with government backed lower rate lending on terms more favorable then Aussie banks. That is what will be required to restart the housing market and maybe stave of electoral defeat in the spring.

Most people want house prices to go down. One of the main reasons I won't vote Nat/Act is because they plan to revoke the tax changes around residential housing investment, which is the best policy NZ has seen for a long, long time. (The other reasons - I don't want religious fanatics in power, and I don't like the plan to sell off even more of NZ to the highest bidder.)

Much needed. Here's some data from RBNZ C31, 2014 to 2017. There were 2.5x more investors than FHB taking out mortgages over this period.

Total Lending per month

- FHB Average $656m

- Investor Average $1.6b

Total Number Borrowers per month

- FHB Average 1800

- Investor Average 4700

For perspective could you include how many mortgages went to Owner Occupiers (non FHB)

Total Lending per month

- FHB Average $656m

- Investor Average $1.6b

- OO Average $3.2b

Total Number Borrowers per month

- FHB Average 1800

- Investor Average 4700

- OO Average 20,000.

The bright line test extension is good but it should go to 99 years/infinite imo. Binding caps (i.e 10 years sell tax free, 9.9 sell and pay tax) just distort activity at the margin.

But if you genuinely think that removing interest deductibility off existing investment properties is the best policy NZ has seen for a long, long time, then you're an absolute sucker for policies that treat symptoms, while ignoring the causes of problems.

Sure it's treating the symptoms, but in the absence of any political will from any political party to make meaningful structural changes it will have to do.

Same here - National clearly have investors interests at heart rather than the majority of NZers, regardless of what story they tell. Luxon needs to drop his rental portfolio and his pro-investor policies, it's a terrible look.

Just bring in DTi.

Absolutely. Add that into the list and I'd seriously considering voting National, after voting Green the last couple of elections.

I would also have to be confident National will stick with the carbon emissions cap and trade scheme.

If we ever want to be able to means test the aged pension, we need retirees to have asset bases from which they can derive an income. A successful private rental market is key to that, alongside making KiwiSaver compulsory. Secondly, I would prefer the Govt to not have to spend billions on paying for emergency housing in motels, or buying/building a house for each of the 32,000 people currently on the public housing waitlist. Under National those people were housed in the private sector, now we are wasting taxpayer funds on them, while the health and education systems fall apart due to lack of money. People who think Labour's interference in the rental market is a good thing are very, very shortsighted. Hopefully when they need cancer treatment but can't get it for 6 months (by which time it will be too late) because the hospitals are all broke, the penny will drop.

Nothing will save them in the spring of 2023. They are toast. Their general incompetence is now well known and acknowledged by the general public. All of the failures to date, and then the last KiwiSaver debacle, the cost of living payment shambles, and the 3-waters and co-governance things will sink them completely. I personally think they will not proceed with 3-waters or (any more) co-governance to try and save themselves, but, I think they are too far gone. It's a real mess now, and an incoming National Government along with Act are going to need some time to fix this, and it will be quite painful for some.

Doing something with KiwiBank to help first-home buyers will be a net vote loser, just like writing off student loans. Too many people have worked too hard to a) pay their student loan back, and b) buy a house. Writing off student loans and giving people effectively free money to buy houses by a bunch of useless incompetents trying to hold on to power is going to go down like a bag of cold sick. Maybe they are stupid enough, but it won't save them.

This price crash we are seeing now, was always going to happen. It's simple maths that an asset that is worth 500,000 at a borrowing rate of 5% is with a million at 2.5% or thereabouts. Back at 5% again, and the asset is worth 500,000 again, so, the drop is 50%. That is where this is going to end up. Prices are going to settle at the price per covid, plus an allowance for inflation, which so far is 2% + 2% + 7%, so you are looking at pre-covid + around 10% for where prices will settle.

If interest rates continue to climb above pre-covid rates, then the drops will be more. This is the same for any asset class. Shares are directly affected by interest rates. If you own the whole asset, with no debt then you are fine all the way up, and all they way down, if you make a debt funded purchase at the top, then you are toast. This is how this works. If you can afford to pay to be in negative equity then you do, if you can't you get out. There are always winners and losers. and you cannot start bailing our the losers. I find it hilarious that market commentators try to say maybe the drop will be 2 or 3 or 5 % overall and start rabbiting on about nominal versus real, the market is toast, it is way out of balance and all those covid gains are going to evaporate, they were not real, and they are vanishing quickly, and there is still a long way to go.

Typical right wing comment. Shambles, incompetent etc etc. Just because you don't agree with something does not make it wrong.

Just because you don't agree with something does not make it wrong.

Please supply list of successes, with evidence. Will be an interesting list.

PS: Promises to do something without any action or success, are not actually success by the way.

https://www.labour.org.nz/our-record

Depends how far back you want to go. They gave you ACT in case you have forgotten.

Not willingly they didn't. Some sensible people that happened to be part of Labour decided Labour were losers and went and started their own party, as far as I remember.

Similarly, Jim Anderton decided that Labour were not incompetent enough for him, and so he left and created something even worse than Labour, the Alliance.

It's a ramble but you surely must agree that the commentator reflects most of what people feel.

Well I mean a lot of it is the usual Hyperbole. Kiwisaver "shambles" well it was a policy announcement which they backtracked on based on the feedback, i.e. they listened. Would people rather they just steamrolled on with it? What part of it was a shambles?

As for the Cost of Living payment, is it really a political party issue or an IRD issue? I mean do we blame National or the Ministry of Education for the Novopay shambles?

Also Co-Governance is what National is all about, they reinforced this when signing the UN Rights Declaration for Indigenous People in 2010.

The statement in support of the declaration:

- acknowledges that Maori hold a special status as tangata whenua, the indigenous people of New Zealand and have an interest in all policy and legislative matters;

https://www.beehive.govt.nz/release/national-govt-support-un-rights-dec…

What part of it was a shambles?

It wasn't announced at all. I would have thought the most open and transparent government would have been a bit more open about the fact they were going to implement a policy that was going to have a material effect on some people's retirement savings, rather than treating it as a remedial matter and attempting to steamroll it through before someone asked the question.

So perhaps not a super strong one to lead with.

It was most certainly announced, no differently to how the increase of GST to 15% was announced in 2010. If it wasn't announced, they'd have just gone and said "we're applying GST to Kiwisaver providers effective from x date, thanks bye".

- Govt makes U-turn on KiwiSaver fee GST proposal https://www.1news.co.nz/2022/08/31/govt-makes-u-turn-on-kiwisaver-fee-g…

-

Definition of proposal - 1: an act of putting forward or stating something for consideration

That's not how it happened. They introduced the legislation. It wasn't a proposal. You don't take a 'proposal' into the House.

https://www.scoop.co.nz/stories/PA2209/S00046/annual-tax-rates-and-reme…

Here's them saying they'll reintroduce sans the Kiwisaver change, which they did not mention it when they introduced it the first time and got found out.

It was a bill. Do you know what a bill means in politics?

https://www.legislation.govt.nz/glossary.aspx#:~:text=B-,Bill,How%20a%2….

Bill

A Bill is a proposed Act that has been introduced (although not all Bills will become Acts). Bills change as they go through the legislative process—see Bill number. For information on the legislative stages a Bill passes through, see How a bill becomes law

They’re objectively incompetent. They routinely fail to meet their own targets by a wide margin.

House prices were already out-of-whack before Covid. Our bubble has been recognised as far back as 2006. It was stagnating 2017-2019, then Orr dropped the interest rates again (because the Fed did) and that helped push the crash into the future. Then it was looking dicey again, and Covid came along and gave an excuse to really throw caution to the wind.

I don't think the fall will stop at pre-Covid prices, and at our levels of DTI history elsewhere suggests we're looking at a very significant fall indeed. And re:interest, the OCR today more than double what Orr started with, and everyone is still raising.

Here, unemployment is still low enough that the over-indebted can increase their income through secondary employment (which is what the long-term property investors in my family have done). So, I won't be holding my breath for rate cuts any time soon, myself.

A nation attached to its bubble

At heart, a bubble of Entitlement Mentality

I'd rather have co-governance than have water (and everything else) privatised and sold off to the highest bidder. That is ACT policy and I'm sure it will appeal to Luxon also, a short term injection of funds to pay for his tax cuts.

Plenty of "wealth" destruction happening here. I suspect we will see plenty of trading down for other non-housing consumption.

Let it asphyxiate. I’m not even gonna take a look until Tammy Wells starts appearing in the ads. Wait for the 50% off sale. Don’t let the boomers cash out.

Tauranga down 7.8% over 3 months, ouch!!!!!

What do you have to say Carlos67??? This totally dismisses the BS you have been spouting about Tauranga's property market resilience.

And Christ, Wellington even worse DOWN 9.4% OVER 3 MONTHS.

Categorically a CRASH.

Those 3 month percentages are higher than Ireland's first 12 month declines in their market, which went on to be down nearly 70%.

Do people actually think it'll be a short, swift, hard correction and then the bullet proof housing market will roar back into life in a month or 2?

The only people who think that are those with obvious vested interests. You know, the likes of T. Alexander and a handful of desperate spruikers who hang around here.

My mortgage free house is still a million bucks mate, do I look like I care ? Also its not for sale so the price currently is irrelevant really. Might be a problem for me in 10 to 15 years when I shuffle off to a retirement village but who knows what houses will cost then.

It’s not about whether you care. You have been spouting off for the past year how prices won’t fall in Tauranga and may even rise. I never thought it was credible and so it looks like proving.

wasn’t a good call at all. Hopefully us DGMs here are keeping FHBs skeptical.

Aged like milk......

https://www.interest.co.nz/personal-finance/117490/asb-has-raised-two-f…

by HW2 | 8th Sep 22, 12:34pm If you get a chance to listen to bernard hickey talking to Jamie Mackay at the Mainland property conference, do it. It will blow out your DGM brains

by Carlos67 | 8th Sep 22, 1:38pm HW2, you forgot, DGM's don't have any brains.

The people with brains bought their house almost exactly 2 years ago or longer. It still has miles to fall before it gets back to what I paid for it and I have not been paying down a mortgage or paying rent so that's like $600 to 800 a week for 2 years I didn't have to find. Do the math.

Carlos… no one is talking about YOUR financial position. They are talking about YOUR terrible predictions. Show some humility for once

What about those younger than you who bought a year ago as it was their first opportunity to do so after putting together the necessary deposit. You were not being clever buying more than two years. You were just lucky. I bought my current home for $490k in 1996. Now they say it is worth around $3m. I have not been clever. Just lucky.

Lucky is winning Lotto. I made a commitment to buy a house and put everything I earned to paying off the mortgage early, that's not luck. You don't get to retire in your 40's just by luck, you have to make the hard decisions and life choices along the way.

And young people are making the exact same decisions you were doing and will likely be screwed financially as the market unwinds.

The people with brains bought their house almost exactly 2 years ago or longer.

People with brains realise that some people weren't in a position to buy 2 years ago, due to being too young, not ready to settle yet, not pregnant yet, still saving up the deposit, etc., etc.

He certainly does not understand that people enter the property market at different times through date of birth. Should those at university two years have bought their first homes. They would not have been able get finance as at best they were working part time. Carlos I have close friends in Tauranga who are both self employed. They say the housing market there is currently dead. You showed your lack of financial skills with your earlier predictions. All markets have their good times and bad times. Housing is in a bad time and it has some distance to go downwards. People are struggling to pay their basics. Housing is the last thing from their mind in terms of upgrading or investing. In saying that some will need to sell or will be forced to sell as they have too much debt.

The boomer generation is doing themselves no favours with spectacularly moronic statements like these. Way to create distance between them and the younger generations (who'll soon be the ones feeding them and changing their diapers in old age homes).

In this type of market, it's worth emphasizing that although some people need to sell, almost no one needs to buy. If that thought becomes common knowledge, all bets are off as to where this market ends up.

We haven’t even unwound the pandemic party. This isn’t oxygen being turned off more like the windows being opened to let the laughing gas out.

Kiwisavers decreasing effecting FHB's ability to enter the market???

This must depend on which provider you are with and the fund of choice, as my kiwisaver has dropped early in the year but come back up to December 2021 level and rising. Pray the global crash doesn't wipe it out come mid 2023 or after as reading the writing on the wall, the modern word is doing one of 3 things:

1./ Burying its head in the sand that a crash could happen

2./ Actively buoying confidence through false articles to try and prevent the inevitable crash or

3./ Keeping quiet and pulling all their investments into as low risk assets as damn well can before the house of cards comes topplings down.

Myself and many of my friends are all FHBs and we can all see this a mile off. When it comes to the global economy you can powder coat it as much as you like, but something stinks and as time goes on the stench will become apparent to all. The general population are starting to wise up to how unnaturally optimistic the media are around the housing market, and selective in thei covring of global events. As the saying goes, you can't polish a turd

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.