By Ian Robertson*

From the outset the new Reserve Bank of New Zealand (“RBNZ”) Governor has demonstrated a more forthright approach to his communication of monetary policy. Relative to many of his global central bank peers this governor leaves much less to suggestion.

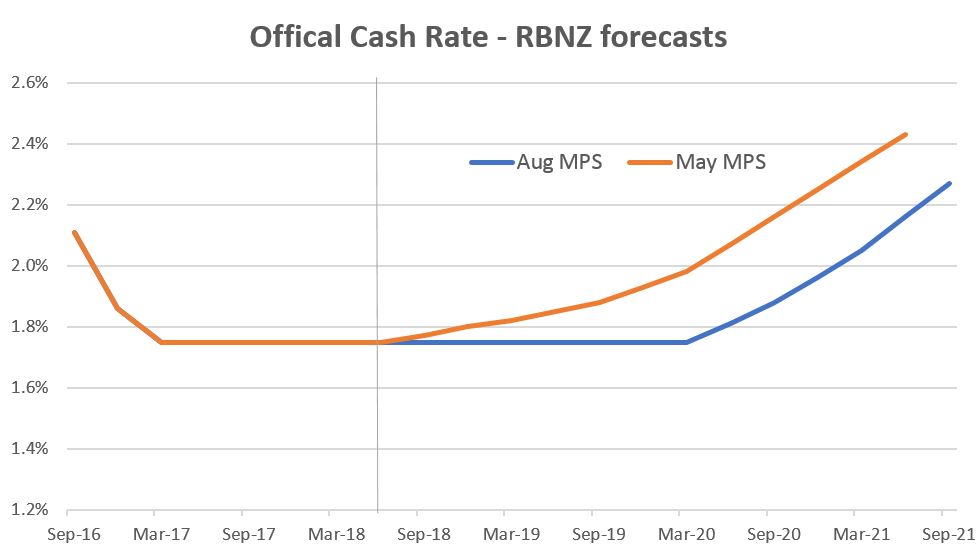

This was demonstrated in the August 2018 Monetary Policy Statement. While the Official Cash Rate (“OCR”) was kept on hold at 1.75%, the first line of their press release specifically stated that the RBNZ now expects “to keep the OCR at this level through 2019 and into 2020”. Previously its central forecast indicated a move higher in late 2019.

The RBNZ also reiterated previous guidance that the next move in its OCR could be up or down. To illustrate, it provided a simple scenario analysis for two possible tracks for the OCR:

- A 0.50% increase to 2.25% by 2021 if inflation is higher than expected

- A 1.00% cut to 0.75% if annual GDP remained below 3.00%

All this points to a dovish tendency, i.e. a willingness to keep rates lower, highlighting its willingness to support the economy. This may reflect its broadened mandate (discussed here) which now includes supporting maximum sustainable employment in addition to targeting Consumer Price Inflation (CPI) inflation.

In aggregate, the incrementally dovish move appears to reflect increasing concern at the RBNZ for the economic outlook. It is likely that was underpinned by falling business confidence, and other factors including wariness with respect to housing and the timing of government spending.

The change in RBNZ tone was considerably more aggressive than interest rate and currency markets had been expecting. In response the market lowered its expectation of future interest rates (now pricing a possibility of OCR cuts) and the NZ dollar weakened.

The below chart shows the RBNZ’s August 2018 forecast for an increasing OCR towards 2.00% in late 2020 is now roughly a year later than the RBNZ was forecasting in its May 2018 statement:

Source: August 2018 Monetary Policy Statement

What does this mean?

The OCR is just one of myriad factors influencing bond yields and bank mortgage/deposit interest rates, some of which we have discussed (here). Nevertheless, in simple terms:

- For borrowers, floating and short term fixed interest rates will likely remain lower for longer. It would not come as a surprise if banks contemplate reducing some fixed mortgage rates. After a slew of headwinds facing housing prices this may provide a modicum of relief.

- For bond investors, the prospect of new NZ bond issuance at higher interest rates looks to be some way off. The same can be said for term deposits. The flat OCR outlook should, however, support the prices of existing bonds in the secondary market. An important caveat is that longer dated NZ interest rates are also influenced by events offshore. There remains a risk offshore yields increase further into next year which should put upward pressure on NZ’s longer dated interest rates.

- For NZ shares, the development should provide some support through a) monetary policy underpinning the economy, and b) benefiting income shares which provide a large portion of the NZ share market.

As described in Milford’s bond fund Monthly Review commentaries, although we have recently extended our interest rate exposure, we continue to limit the absolute level of our exposure, mindful of this upward pressure.

*Ian Robertson is a senior analyst at Milford Asset Management. This article first appeared here and is used with permission.

23 Comments

"The RBNZ also reiterated previous guidance that the next move in its OCR could be up or down"

So why is the graph of the OCR forecast pointing towards a rise only?

The talk of rates going down is simply that, talk. The aim of the governors comments were to try and lower the value of the dollar without collapsing it. Which is what happens if rates were to actually be cut. We'll have a weaker dollar, import some inflation for a while (a necessary evil) before the inevitable need to raise rates. I still believe that before the end of 2019 rates will be on the rise. In the meantime though banks will try and compete for lending, by lowering mortgage rates to attract share of a reducing number of 'willing/able' house buyers and to secure the better provisioned (higher equity) 're-mortgage' market. When the reserve bank rises the lenders may still keep rates low (on reduced margins) to retain the stability of their loan books and to try and avoid mass defaults. It's going to be a challenge to replace the foundation of 'foreign cash' that has underpinned the market and every tool will be used to slow down the rate of decent in house prices which will correct to more normal levels over several years.

Nic, You still have hope eh ? Good on you . I have lost the hope of analytical/logical reasoning in the system..its ONLY speculation.. and just "kicking the can as long as they could"

In the meantime that banks will try and compete for lending, by lowering mortgage rates to attract share of a reducing number of 'willing/able' house buyers and to secure the better provisioned (higher equity) 're-mortgage' market..

How could the bank keep on lending more and more ? Do we miss another vital thing of capital ratio or lender's leverage ? I thought that NZ banks are very much over-leveraged . Did the RBNZ eased capital-ratio as well ?

Greg

The banks are overleveraged, but they can't stop lending or the whole thing falls over. What will happen is that those that are in a sticky mess will sell up and redeem their loans to the banks. Others with higher equity levels will buy but with reducing amounts of debt and at lower prices. The market will slowly deleverage as it is in Australia. The falls in values will continue but it needs to be managed. If everything was all of a sudden worth 30% less tomorrow then the whole economy falls apart... But if that 30% comes off slowly over 3 years then the pain will be far less for the general economy (which is far more important than houses because that is where the money comes from to support the debt). That's the plan anyway, will it pan out that way? God only knows. I still think that there is a big risk of the antelopes all running away from the water together because the lion has appeared at the water's edge. Markets are very difficult to control as we've seen during the boom times, sentiment may dictate that the Reserve Bank has to think of other things.

At the end of the correction, don't be surprised to see new tools in place to stop it happening again. Removal of interest only loans, (like in Aussie), mortgage debt to incomes limits at 4 or 5 times rather than 7 and 8. And probably the removal of negative gearing to end the silly speculation by people who don't understand maths but were handed a cheque book to buy. None of these can be implemented now because that just hastens a collapse which the Governor needs to be a slide rather than a cliff edge drop.

Great comment. I'm not sure if you're right or wrong, but that is beside the point. I think that you miss one element in that there seems to be a message from the institutional leadership that we need to "wait for incomes to catch up," however it's not clear how that is going to happen. However, the questions remain as to whether or not this becomes a Japan scenario with a few lost decades. In reality, the Anglosphere has far exceeded the excesses of the Japan bubble (the same could probably be said for China). I'm still convinced the "great unravelling" (if it is undeed to happen) will be related to consumption. That is the driver of the economy and if people start saving; spending less; and become price senstive, that will feed into asset deflation. This phenomenon has been seen globally, regardless of the "feel good" stories from the U.S.

Hi JC

Inflation measures were always too focussed on commodity prices and have never properly factored in the growth in asset prices, as a result interest rates have been held far too low for far too long. The same will be the case on the way down, where deflation in asset prices will be neglected so as to spare the 'panic' that would be caused if the 'D' word were ever to be used in the mainstream media. The world was pumped with money to stop deflation after 2008, but it is a force that will have its impact at some point and we appear to be nearly there, but staring at it from a higher point than before. Incomes can't catch up in the West because they are being undermined by 2.5 billion Chinese and Indians, the wonders of Globalisation of the last 30 years is no different to the end of Imperialsim. We pumped up our theoretical value/wealth with a misguided assumption on asset prices always going up.. but fuelled that appreciation with debt rather than production which needs to be re-balanced. Likelihood is lower living standards in the West in the years to come with Europe and the States leading the way.

Thanks Nic; your comments always on the theoretical/logical/ analytical side . But manipulated market will always win ( atleast in short term)

At the end of the correction, don't be surprised to see new tools in place to stop it happening again. Removal of interest only loans, (like in Aussie), mortgage debt to incomes limits at 4 or 5 times.. the removal of negative gearing ..

If RBNZ is keen on reducing overleveraged debt, they should instruct banks to reduce % of interest-only loans *NOW* ...right ? thats a safe thing to do , I guess....OR atleast some kind of instruction not to increase riskier debt !

And regarding negative-gearing, aren't the govt already going to take the tax benefit , step-by-step in 5 years or so ? or did they stepped-back on that ??

Hi Greg

All will happen in time and it would be fun to watch if they all happened at the same time, let them rip off the plaster and see whether it opens up the wound with it.. However so many people have got themselves in a pickle (many don't even know what a pickle they're in,yet, but will when refinancing time comes around), so it has to be done slowly, very very slowly just one thing at a time, otherwise we're jumping out of the plane without attaching the parachute. foreign buyer ban was the first step, people now need time to adjust that and reassess their situation before the next step which I think will be tax related rather than reserve bank dictated and will likely be around negative gearing.

Oh yeah, I forgot to add, the reasons it won't be interest only lending next is for two reasons

1) That's a large part of what is propping up current price levels... Don't be surprised to see the banks slowly reducing the availability of who gets it even if the reserve bank don't regulate it.

2) It would have a crushing effect on the very recent first home buyers who have borrowed using this mechanism to compete in the final years of the frothy market. They need a bit of time to wake up and realise that they need to pay off a bit more capital.. Falling prices are a great motivator to pay down debt so interest only lending will be in place for a wee while longer still.

banks slowly reducing the availability of who gets it even if the reserve bank don't regulate it...

Nic, I don't think the banks would control interest only loans, UNLESS reserve Bank instruct them to do so.

Interest only loans are good cash-cows for the banks

Speculation - I agree. Wasn't there just a short time some news from Australia reporting that the actual interest rates started to diverge from the RBA OCR? One would have to conclude that Reserve Banks are not always in the driver seat, and that off-shore events are often setting the tone - for banks, interest rates, business confidence, etc.

But it is so much easier to put all the expectations or blame to the RBNZ and the current government. If only it was sooo simple.

An excellent feel-good article which supports the view that the RBNZ/Adrian Orr is managing the economy well.

Businesses should be happy. The RBNZ clear signal that the OCR will remain low - and consequently most likely interest rates - should give businesses more confidence to borrow to invest at least in the short term. The continuation of a low OCR - while US Fed rate have increased - has driven the NZ dollar down to the advantage of exporters.

Homeowners with mortgages should be happy. The continuing low OCR is maintaining low mortgage rates (although, as noted, this is not that only factor involved) and providing some stability in the housing market and the value of their homes.

In the RBNZ mind will be that continuing low interest rates will help avoid a significant fall in house prices as it will see tightening of consumer spending due to perceived decline in personal wealth and consequently flow on effects to the wider economy (Remember all the criticism that the economy over the past decade was fueled by the bull housing market - well the opposite applies also.) Use of LVRs will - thankfully - ensure that there is no further take-off in that market.

FHB should take some assurance in the stability of both mortgage rates and the housing market in the short to medium term. An opportune time to enter the market but looking to be buying "below market value" (talk to a long term investor as to what this means) with the view that they are likely to maintain their equity but a need to pay down the mortgage as quickly as possible while low rates remain.

Most - and very real risks - appear to be those off-shore; this includes trade wars, the state of emerging economies, off-shore interest rates and consequently NZ bank funding rates, and NZ immigration levels. It is these factors that are likely to have a negative effect on the NZ economy and ones that the RBNZ has no control over - but at least they are positioning to minimise the effects of these.

On balance - we are in fair weather but still some dark clouds on the horizon. However, RBNZ are managing things such that the risks of train crash scenario for NZ are less likely.

RBNZ have previously been a little hawkish and they are likely trying to take a more neutral stance. Admittedly it probably doesn't help that their forecasting tends to be very optimistic.

Mortgage interest rates - lower for longer.

And short-term fixed: even lower.

Resistance is futile.

Interesting how most central banks are focused on increasing rates or normalizing. Loading their guns, one would say, for possible global economic deterioration, while NZ is hinting stimulus with a full % point cut. Clearly contrarian and should an economic global recession occur after the bank has cut so much with no more room for stimulus. It could easily be caught with its pants down and left barking at the moon.

which is why a cut won't happen!

NZ Reserve bank already has a QE based gameplan in case stimulus needed with an OCR nearing 0%. Money will be printed to purchase NZ govt and trading bank bonds, driving down banks borrowing costs and hence mortgage rates. Mortgage rates won't rise for any prolonged period of time. If mortgage rates rise, reduced spending tips Auckland and the aggregate NZ figures into recession and then the Reserve Bank is forced to cut the OCR, and if required electronically print dollars to provide trading banks with a low cost source of financing to roll over mortgages.

Gameplan is stable property prices, and suppressed interest rates to allow the paying down of debt principal. Key is we live in a world where what "should" happen based on old models is not happening. The major fear of politicians is the loss of power, and this occurs typically with recession. So interest rates will remain low.

NZ household debt servicing as a percentage of disposable income is at 8.2% this year, versus 14% in early 2008, ie 41% lower. Households have plenty of disposable income. And the govt is encouraging this money to go into the paying down of principal.

'NZ Reserve bank already has a QE based gameplan in case stimulus needed with an OCR nearing 0%'

Did you really post that? The NZ Reserve Bank is not the Fed, BOE, Bundesbank, or BOJ.. we're a tiny little economy, smaller than the value of Apple and our Reserve Bank has very limited options... Please stop posting.. NZ local government debt could not allocate a debt sale today.. We start suggesting that we may print money and your interest rate on your portfolio doubles in the blink of an eye... For the good of the country, please stop posting.

Nic,

I also doubt if the RB has a gameplan for QE,though it remains a theoretical possibility. We certainly live in interesting times and all i can do at 73 as a long-term stockmarket investor,with a rental property and no debt,is to read the entrails as best i can.

I have taken the view for some years that interest rates and inflation will remain lower for longer. I believe this to be structural. I have in front of me graphs showing that inflation was falling in the US and the UK as far back as far back as the 80s and here from the early 90s. Globalisation,technology and deregulation have all played a part in this. In his book,Shifts and Shocks,Martin Wolff wrote this;"There was also the shift into structurally low inflation. Globalisation seems to be one of the most important explanations for this development. kenneth Rogoff of Harvard for example,argued in 2003 'that the most important and universal factor supporting world-wide disinflation has been the mutually reinforcing mix of deregulation and globalisation and the consequent significant reduction in monopoly pricing power. The Second Machine Age by Brynjolfsson and McAfee is worth reading on technology.

I think we will/must see subdued global growth and it could easily get much nastier,if the major powers play their cards badly. When i read that our world is much too inter-connected for war to happen,I just look back to the world just prior to WW1.

I have no doubt that another financial crisis will hit us,but I have lived through many and expect/hope to do so one more time.

Great post mja, you have a great understanding of what is happening, please DO keep posting despite Nic wanting you not to

3.99 and 4.29 carded at main banks is already a reality.

Lower than 12 months ago.

Really all it shows is there is little point trying to predict future rates. As long as there are contingency plans for it moving in EITHER direction you have the bases covered. Fact is NZ is so small we are a leaf in the wind when it comes to world economics. We are subject to change from the likes of the USA and China and even a ripple effect starting with Turkey or Venezuela.

Well for me it has been very beneficial to go against the grain and predict that rates won't rise. I have fixed my mortgages for 1 year in the very low 4% for the last 3 years and saved a considerable amount of $ over fixing for 3 years at over 5%

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.