By Jenée Tibshraeny

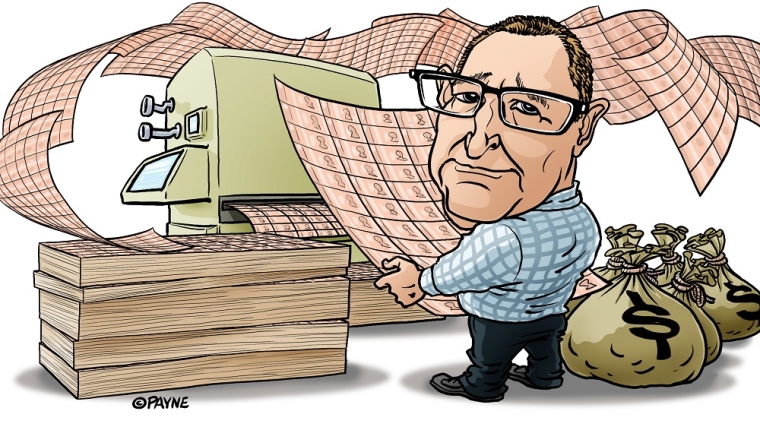

The Reserve Bank (RBNZ) has been making headlines, as the actions it’s taking to lower interest rates are contributing to soaring house prices.

The situation has prompted National’s Andrew Bayly to make his first splash as Shadow Treasurer by calling for the Government to “rein in” the RBNZ.

Specifically, Bayly wants Finance Minister Grant Robertson to get the RBNZ to put conditions on its Funding for Lending Programme (FLP) due to launch in December.

Bayly says banks that draw down on the $28 billion being made available to them by the RBNZ, should have to use this funding to lend to those investing in “productive” parts of the economy, not just housing.

Robertson has responded: "In the end it is the retail banks who will ultimately decide if this money is used and where it is allocated.

"I encourage them, if they take part in the programme, to focus their lending to support investment in the productive economy including in supporting our small businesses."

The politics

Bayly's suggestion has cornered Prime Minister Jacinda Ardern politically.

The “left” has for some time been coming at Ardern for not doing enough to address rising inequality stemming from asset price inflation.

The Green Party last week renewed its call for the introduction of a capital gains or wealth tax. It also supported pleas by 40 welfare and poverty organisations for the Government to increase income support payments.

Meanwhile the “right” - namely ACT’s David Seymour - has been calling for the Government to add asset price inflation to the RBNZ’s monetary policy mandate. This would be an impediment to the RBNZ slashing interest rates - something Seymour wants to coincide with heavily reduced government spending.

Now, Bayly is leading a call from the “centre-right” for Ardern to address inequality by getting the RBNZ to direct more of its newly-printed money towards businesses and less towards the housing market.

Ardern hasn’t caved to pressure. Rather, she on Monday and Tuesday resorted to defending the independence of the RBNZ, likening the interference Bayly is calling for to that of former Prime Minister Robert Muldoon.

Monetary policy is finally on the radars of politicians and the mainstream media. This is great in terms of creating necessary (hopefully high-quality) policy debate.

But it’ll prove a headache for the RBNZ, which will have to work harder to maintain its social and political licence.

Key questions

National speaking out on monetary policy raises two questions:

- At a high level - how closely can and should the government work with the RBNZ?

- At an operational level - would putting conditions on the RBNZ’s FLP reduce its potency?

Robertson suggested conditions be put on the FLP

To deal with the first question, Ardern’s comments are overblown and hypocritical.

While she said Bayly’s call represented a “significance departure” from "long-term consensus" around government/RBNZ separation, she failed to recognise Robertson made similar comments a couple of months ago.

Speaking to media on August 26, Robertson said: “One of the issues we want to work through with the Bank is how it [the FLP] would work; what kind of conditions they might place on that lending.

“That’s a discussion that we’re still having and the concern you’re raising [the prospect of that funding flowing straight into housing] will be one of the issues that I’ll talk to the Bank about.”

Asked what kind of conditions he wanted to see the RBNZ put on the scheme, Robertson said: “What we want to do is ensure that it supports productive growth in the economy - that’s what we always want to see; that it makes sure that the financial system remains liquid and that our banks are stable and able to lend and help boost the economy...

“My understanding from the Reserve Bank is they understand this shouldn’t be a carte blanche scheme; that it should be one that is dedicated to those sorts of goals.”

Put to him that the RBNZ had in fact talked about having few conditions on the scheme, Robertson said: “That’s the discussion we’ve got to have. For me it’s early days, it’s a proposal."

Asked on Tuesday what input, if any, he had in the creation of the FLP, Robertson said: "The RBNZ consulted with my office as it formulated the FLP, as is standard practice.

"Decisions on the implementation of the programme are taken solely by the bank itself."

But as per the above, Robertson "encouraged" banks to "focus their lending to support investment in the productive economy".

Even traditional former central bankers support more communication

Blogger, Michael Reddell, who used to hold a number of senior positions at the RBNZ, believed the Bank would’ve “guarded jealously” its power to conduct monetary policy independently (the FLP is a monetary policy tool).

Because FLP loans have to be secured against high-quality collateral, Reddell believed the Crown’s balance sheet wouldn’t be exposed. Therefore, the Finance Minister wouldn’t need to provide an indemnity as it has for the RBNZ’s quantitative easing programme.

The RBNZ subsequently confirmed this, saying: "We did share our assessment of the fiscal and balance sheet risks of the FLP with the Treasury after the decision by the MPC was announced on 11 November, as requested [by the Finance Minister]."

Consultant Geof Mortlock, who like Reddell spent a number of years at the RBNZ, said it would’ve been “entirely proper” for Robertson to sit down with the RBNZ - not to interfere with its operational independence - but to voice any concern over the impact monetary policy is having on asset price inflation.

Mortlock said Robertson and Treasury should be meeting with all members of the Monetary Policy Committee. He said Robertson needed to provide the RBNZ with clear expectations.

Indeed, Bayly wants Robertson to give the RBNZ a "letter of expectations".

“It has been a raucous cacophony of silence from them [Monetary Policy Committee members]. They should be more transparent,” Mortlock said.

Government technically has the power to intervene

He also pointed out there’s a provision in the Reserve Bank Act that enables the Governor-General, by Order in Council, on the advice of the Finance Minister, to direct the Monetary Policy Committee to target different economic objectives.

Under Section 12, the Minister can direct the Committee to only target one of its two objectives - inflation and employment - or an objective in addition to, or instead of, either of these objectives.

The Order can last for up to a year.

Mortlock said this provision has never been used, and wasn’t suggesting it be used now, but noted the narrative around complete RBNZ independence was technically untrue.

Where Bayly and the RBNZ would clash

Now to the second question Bayly’s comments raises - would putting conditions on the RBNZ’s FLP reduce its potency?

The RBNZ would argue yes.

By lowering the cost of bank funding, the RBNZ hopes banks will be able to lower their lending rates. If they can rely less on competing for funding from term deposits, this will give them even greater scope to make rate cuts across the board.

The idea is that even if banks don’t take up all $28 billion on offer, knowing cheap funding (at the rate of the Official Cash Rate: 0.25%) is there, will give them confidence to lower rates.

Ultimately the goal is for this to encourage more borrowing, investment and spending to boost inflation and employment.

The RBNZ has avoided putting conditions on the FLP, because it doesn’t want to inhibit its take-up.

It is at this point that Bayly’s call for the FLP to be directed towards productive parts of the economy, particularly business lending, clashes with the RBNZ’s position.

What if businesses, which haven’t shown a great appetite to increase their borrowing since the onset of Covid-19, continue to remain cautious? Would the FLP be a flop?

Bayly said it was understandable for, say, a business under pressure to be cautious about using their house as security for a new loan. But he maintained the view there was little demand by businesses for credit was a “heroic assumption”.

Asked whether he believed there would be a problem if the FLP wasn't as stimulatory as it might’ve been without conditions, Bayly said: “The big thing is making sure there’s enough liquidity in the banking sector. That’s what the RBNZ’s role is… The issue of interest rates will be a natural consequence of it."

Once again, the RBNZ would have a different view. It has already made other moves to support liquidity - of which there is ample. The primary purpose of the FLP is to lower interest rates to boost inflation and employment.

Demand for credit by businesses could be picking up

Coming back to this notion of whether businesses want to borrow - the jury is out.

The total value of outstanding bank loans to businesses has been declining from the onset of Covid-19 until September (the latest available RBNZ figures) to $110 billion.

The bright spot in the business lending category is investment property and commercial property development. Everything else is down, even lending for residential property development. Agricultural loans are also down, largely due to banks continuing to reduce their exposures to dairy. Lending for horticulture and sheep, beef cattle and grain farming are up.

However, there's been an uptick since September in the amount lent under the Government’s Business Finance Guarantee Scheme. This scheme, which has been broadened a number of times, sees the Crown underwrite 80% of eligible bank loans to businesses.

Furthermore, there's been high uptake of the Government’s Small Business Cashflow Loan Scheme, through which businesses can get small interest-free loans directly from the Government. Around $1.6 billion has been lent through this IRD-administered scheme to date.

The RBNZ’s chief economist, Yuong Ha, last month noted that while property buyers are borrowing now, businesses might have a greater propensity to borrow once economic growth picks up.

76 Comments

My only disappointment is that we didn't have this debate prior to the election.

Great to see Orr, Ardern & Robertson getting real heat on this issue.

Yeah its great to see. Hopefully the pressure doesn't let up.

Mate it was a joke how little meaningful policy analysis and debate there was prior to the election.

Ain't that the truth.

Was crying out for someone to corner them on this issue and the MSM just did not seem the least bit interested.

MSM have their favourites and will let them away with murder. They loved John Key, they loved Jacinda, they hate Trump etc...

Could be different next time but by then the social damage will be huge... such weak responses by Robertson in answer to clear questions on how the FLP will be used.

Bayly is is just point scoring while he can knowing full well that the ruling elite has a firm demarcation between the political arena and the central banks who are protected by an ideological union in many of the developed countries, particularly the Anglosphere.

No he is highlighting what is wrong

No he is highlighting what is wrong

No he's not. He's a defender of the status quo.

I didnt vote National this time around, but well done Judith Collins for your comments on the RBNZ today. It is becoming blindingly obvious that Orr has gone too far with QE, and too low with the OCR. Everything in moderation is a proven axiom. Spraying cheap money blindly in all directions is not the answer, look at the housing market, its blindingly obvious.

Yeah but before the election, she didn't want to rock the boat and was singing from the same songsheet as Ardern, from memory when questioned about it, her response was: "They must maintain political independence". Now she is in opposition, oh "ACTs idea about changing the RB Act have merit..."

Full employment was made the responsibility of the Reserve Bank by some very dumb politicians ... Clue its the same ones who currently run the country. What was the justification for that decision and who's heads will roll??

Full employment is very easy to achieve. We have nearly half a million migrants in the country at the moment. Remove the right to work and there will be sufficient work for NZ citizens.

True... but the task has been given to the rbnz, the rbnz will choose lower dollar (high dollar slows exports) and more spending and investment... the answer both times is low/lower interest rates which is low ocr and loose monetary policy.

Very true. I am going to vote for whoever is ready to undo this madness and recklessness of ultra-loose monetary policy.

In more general terms, an urgent change to the RBNZ mandate, an immediate increase to interest rates, proper and significant taxation of speculative housing, removal of landlord welfare and immediate introduction of at least 50% LVR limits for speculators would be a good starting point.

The government should also remind Orr that fundamental part of his mandate is the financial stability of the banking system, and that he is in material breach of this component.

The mood on Ardern is changing rapidly. People are waking up to her true nature as a human lie factory.

She's thick as mince and will be goneburger at the next election. The covid boogeyman is going to be yesterday's news soon enough.

Best thing that could happen to her is a stupendous property crash. Nobody could blame her then.

The answer to more debt is more debt, until it's not.

If massive QE & artificial low rates (from a low base, unlike 2008) aren't making businesses borrow to invest (except refi), nor consumers borrow to spend (all for sensible reasons), and it's all piling into an epic debt/housing bubble, who will be the unlucky government giving the battered can (now tanker-sized & leaking) the last kick before it explodes on them?

Both options lousy politically, because fixing it still has to deal with spillage & a firestorm, albeit smaller tackled earlier. Either way, odd to think after Labour's handling of ChCh & Covid (& 'unfair' because previous Govts also just kicked the can) that this could be what defines this Govt for a generation. And millions of Kiwis lives affected by it for a generation, either way.

If the Government does not immediately remind Orr that he is in material breach of the part of the RBNZ mandate related to the stability and soundness of the NZ financial system, they are as culpable as Orr and equally responsible for the resulting serious structural long term financial, economic and social damage.

Interesting research that the "Fed put" really exists. Seems the Fed really does follow the stock market as if it is the economy, and researchers modelled that 10% fall is followed by 32bp rate cut at next FOMC meeting. Other C/Banks may not do it as directly, but following the Fed's playbook might help explain why it has the same effect: ramping up asset (stock/house) prices without much affecting the real economy, massively expanding wealth inequalities, and pushing asset prices further from fundamentals. [Chillingly, other research over a century shows it always reverts to value, eventually, and with the longest divergence ever the reversion to mean will be especially brutal]

https://www.barrons.com/articles/yes-the-fed-put-really-does-exist-that…

https://academic.oup.com/rfs/advance-article-abstract/doi/10.1093/rfs/h…

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2951402

@ Brock Landers "She's thick as mince .."

She is NOT thick. All people who gain power run up against their hubris eventually. It creeps up on you as your material realities improve.

She mixes in different circles and lives a different life-style to most Kiwis. She is failing to paint a clear vision/path-forward for New Zealand. Speaking smooth waffle about 'inequality' and banging on abut Climate-Change/Covid is NOT the same as presenting a Vulcan like plan to move NZ forward. To people and businesses trying to make rent, it's agitating.

Labour are particularly vulnerable concerning social mobility and housing. National are no better. I BELIEVE most working age people who aren't property owners think, if anything, National are slightly against them. Do National realize this?

She's politically astute (an amalgam of Clark's control & Key's 'everyman' persona plus an 'X' factor) and a stunningly effective communicator. Interesting that Labour's actions are now right of centre & Nats in response to ACT are now a little more right. Maybe that leaves room for Greens to finally split their factions, because there might be open space for an Alliance-like party on the left for ordinary people (if Labour doesn't claim it back). The remaining 'real' Greens could appeal to a broader party vote base, consistently 15% like 'proper' Green parties. They might supplant ACTs role as potential queenmaker next time, and evermore. Funny enough, Nats might even encourage Greens to grow to their proper place. Interesting times.

I like TOP, their UBI has promise, they are just ragamuffins though. Gareth Morgan needs to stop being so jaded towards them.

- Let me at the UBI, I'd call it a Citizens Dividend, à La employment insurance. Pensioners still retain the pension but if they're property owners it goes towards their 1% property tax (primary residence).

- Councils get half of construction GST to fund infrastructure

- Cannabis legalized to boost my equity holdings and for it's economic/medical benefits

- First home buyers grant is a subsidy, but if it stays, I'd make single people receive $10.000 assistance, as couples do.

- Extract more resources and buy a large stake in Tiwai Point

- Charter Schools - the more, the BETTER !!

- etc, etc .. haven't even really stared on monetary policy .. got to GO out . just scratching the surface of what is possible.

So... you'd drop the pension by the tax equivalent of the new cost you've just loaded against pensioners? This isn't a neutral transaction if it's taking away cash they have now to cover a new tax you've introduced. It's just a new tax and a drop disposable incomes?

Don't think she's 'thick' but I wouldn't say she's much above average intelligence.

She's certainly a cunning and clever politician.

Jacinda is more than intelligent enough, you seem to have a Darwinist take on intelligence. We all have gifts which can compliment each other and in some ways unlimited potential.

Let's not forget, Jacinda was thrust into power after taking over from Andrew Little. Mmmmm, a confounding Esther like figure. She wasn't groomed for the role in the traditional sense.

In so, sooo, sooooOoo many ways, Jacinda has done amazingly! However, I do remember her embarrassing GDP gaffe. It was clear her monetary understanding was weak. Again, 'HOWEVER' she has made great strides in her knowledge base .. she can speak competently and understand primary financial jargon.

She currently has cannabis enthusiast, renters and first-home-buyers off side - politically dangerous. She hasn't got cypher punks upset yet, which is a positive for her.

Ardern fanboy alert!!!

Each to their own.

lol if you read down a few posts I pretty much say Jacinda should step down as leader.

The Western World has become very humanistic. It's amazing how much smack talk about our leaders we get away with. I recoil from the direct rule of monarchs, but surely if NZ had the traditional, direct-monarch-rule-of-old, some of us (me included) would be traveling a head liter.

It's important citizens obey the laws-of-the-land AND not let a rebellious spirit sweep our nation. The "Team of 5 Million" (though painfully corny) showed we can come together for a common good. I don't want Jacinda to fail and become U-Turn Ardern, shying away from needed changes.

Until Labour come out with a convincing road map, smack talk away, but calling her 'thick' and the like is a lie and more hateful than helpful. I think legalizing cannabis AND introducing say a .. 'Mortgage Deposit Savings Fund" exclusively for FHBs would go a long way to improving public sentiment.

Intellect wise I see her as more Polytech than Harvard.

Great work Jenee & team on a critical issue long missing from debate outside these pages. No reason not to discuss whether central banks should even be independent.

Good arguments for it, but circumstances changed post-2008 with unprecedented C/Bank impact on economies, & post-Covid vastly bigger again. Distortions so big they can't wind them back & just keep digging, inflating debt/asset bubbles overwhelming fiscal responses by governments. Tail already wagging dog in US with (unelected) Fed telling (elected) Govt need more stimulus to keep up with its unilateral actions causing distortions ironically increasing financial instability. With NZ's comparatively outsized QE and artificially slammed rates likewise, Bloomberg called out the looming 'Japanification' of NZ economy. The impact of good intentions by unelected officials immune from diversity of thinking outside dogmatic bubbles risks overwhelming governments for a generation. That's political.

What will be achieved by earmarking the FFL to business if business dont need/want to increase their debt?

The RBNZ are underwriting the banks to prevent collapse and where the support ends up is of secondary import

Andrew Bayly is right, this cheap money needs to be targeted to productive businesses, not the tax free housing market pyramid game. By the way, any rent increases from here will be largely paid for by the tax payer via the accomodation supplement.

This suggestion shows that you don't understand the current role of the central bank. RBNZ doesn't lend to h'holds or small businesses.

They don't but they set the capital adequacy framework that massively favours lending against residential real estate (i.e. lower RWA ratios).

So any stimulus into the NZ commercial banking system will always heavily favour that asset class, all things equal & without constraints.

".. sparking necessary debate over RBNZ independence"

See, I don't think Jenee and the contributors at interest.co.nz are fooled by Jacinda.

Jacinda says things like; 'That's up to the RBNZ', 'The RBNZ are independent', 'It's detrimental for government to get involved', etc, etc

Reality IS: The Reserve Bank has repeatedly asked the Government TO GET INVOLVED. The government's job is to look out for OUR, the CITIZEN'S interests. U-Turn Ardern's reasoning quickly breaks down.

Something has to give, even if it means Orr or Jacinda stepping down. Each of them saying it's the other's fault makes both their positions look untenable.

Reality IS: The Reserve Bank has repeatedly asked the Government TO GET INVOLVED

For ex, how have they asked the govt to get involved? By fiscal stimulus?

Fiscal Policy

The voters had spoken.... take your medicine now

Michael Reddell weighs in....Not doing their Core Job. RTWT.

There is simply no sign that they take their own rhetoric seriously. There is no sign of a central bank acting as if it really believes it would be better to run the risk of a temporary overshoot of the inflation target. There is no sign of a central bank that acts as if it thinks cyclical unemployment is a scourge that should be countered aggressively, at least while the inflation outlook allows it. And there is no sign of a central bank acting as if it takes the slump in inflation expectations as something it needs to take seriously.

Labour are finding themselves in the exact same position National were in after they last gained power. They won the election on a promise of sorting out house prices then found themselves in a period of price stagnation and global uncertainty and got complacent. Now it’s all going nuts again and it will be very hard to reign in.

The only chance they have is to influence the RBNZ. They have already ruled out tax, there is no way anyone can build enough in time, and FHB subsidies will just make it worse. They took the easy way out too many times; cancelling kiwibuild and capital gains tax were huge mistakes. The worst thing is you know National will never do either also.

I believe National couldn't bring themselves to say "Housing Crisis" .. a label which seems to have gone by the wayside under Labour. Though I suppose labels are for cans?

I cannot see our two overriding problems (housing and immigration ofc) ever being seriously addressed until neither labour or national hold power. And when all the current alternatives are even worse it shows just how much trouble we are facing. The 2020s will not be remembered fondly.

Ahh, I see this is playing out exactly as I thought. The more questions thrown at the government, the more they will claim RBNZ "independence" and their unwillingness to get involved. Then blow some bulls(*t in there to try and scare everyone. In doing so, they are abrogating their responsibility to do what they are literally elected for - good governance. It's truly crazy stuff, they talk about resetting inequality and bringing house prices under control, then refuse to pull the levers that will do just that. THEN, they get re-elected by a landslide because the leader has a nice smile. Why would they change anything?

These parties don't have the ability to sort it out, neither the intelligence nor the will.

You nailed it.

'Neither the intelligence nor the will'

Exactly right. As you said, they are abrogating their responsibility to do what they are literally elected for - good governance.

It is not that dissimilar to the age old good cop, bad cop routine.

Is there any good reason why Ardern couldn't announce an urgent review of the legislation governing the RBNZ? With the end result potentially being amending the legislation and the bank's mandates?

I'm sick of her rabbiting on about the bank being independent. We all know that, and know that's a good thing but it's their mandate that is the key issue here. And the government can change that.

As specified in the article, there is a specific provision in the act to allow the finance minister to create a new target for 12 months. Nothing that says that cannot roll over. Hence Orr, GR and by extension JA are pretty much lying through their teeth about not being able to do anything and spouting the same nonsense that they need to be completely independent. If they need to be independent, then you must admit there is a rogue agency in NZ that holds more political and economic power than the government. And they are powerless to do anything about them.

Let's see how voters respond to hearing their destinies are not controlled in the slightest by the government they just elected, instead they are controlled by a rogue agency, working off outdated assumptions complicit in destroying their future.

Yes, thanks for pointing these things out. I hope there is further grilling of the two phoneys Ardern and Robertson on this in coming days.

Yip monetary policy appears to have far more impact to me than fiscal policy so where do I vote for the policies that the RBNZ are making that are screwing a significant proportion of our population over (current and future)?

It’s like central banks have become some form of communist dictatorship operating by stealth within free/western/democratic societies - and their goal is to make asset holders wealthier while destroying the financial future on non-asset owners.

I completely agree.

The reason why Ardern is not doing it is that this government does not have the balls to do it. I find it supremely ironic that, by doing nothing, Labour is destroying the very part of society that they are supposed to defend.

It is extremely urgent that the current RBNZ policies be reversed, and possibly somebody more competent and flexible than Orr be installed at the helm of the RBNZ.

It is time to stop screwing the whole productive part of the NZ economy so that a minority of self-serving unproductive house speculators can keep inflating this gigantic housing Ponzi.

Its a pity politicians (Bayly and Robertson) actually try and read the Reserve bank Act, stripping away the independence mask conveniently used by politicians who don't want to take action. The Reserve Bank Act has quite a few clauses allowing the Minister of Finance to have a greater input than let on either by Robertson or Orr

Again I repeat no mention of the RBNZ Board who could persaude/coerce Orr to change path as well.

It's great to see Jenee being brave and calling out Ardern on her BS and hypocrisy. Keep it up! She's had a far too gentle ride.

JA when started was fine but has one not heard that power corrupts.....

Adrian Brr

Whether the Government wants to address housing affordability or not the issue is being driven to a head by RBNZs relentless pursuit of inflation through credit creation policies. Every goal this government has on creating a fairer, more equitable society is being systematically undermined by its inability and unwillingness to confront the housing issue.

Monetary policy gets more political.....IT SHOULD.

TOTALLY AGREE

In a land of:

a) rising real house prices since the 1970s/80s

b) inelastic RMA

c) very limited wealth or capital gains taxes,

d) lack of a population strategy

e) falling interest rates since the 1980's boosting asset prices,

monetary policy is a sledgehammer and simply driving house (LAND) prices to even more unsustainable levels.

Sorry, but given the huge systemic distortions above the argument for the government not to be directive towards the RBNZ holds absolutely no weight.

The pumping up of real LAND prices since the 70s/80s is the most unproductive use of capital possible (we just get rich real estate broker middlemen who add nothing to the economy) & part of the reason NZ living standards have fallen substantially over the same period.

Given the totally unproductive use of capital to bid up land prices, the RBNZ is going against its mandate as required by law to consider employment, by not restricting its FLP lending to productive enterprise.

The government could:

a) ban recourse mortgages to rebalance the risk between mortgage lending and business lending

b) require banks to reweight the risks between house lending and business lending

c) either through discussion or legilisation require the RBNZ to set certain LVR or income related levels for mortgage lending

The government must:

- fix the systemic distortions a)-d) above.

We got the Labs because the Nats did not campaign on this - or on housing.

It takes months if, if not a year of hourly pounding the issue before it starts to sink in with enough voters. But it would sink in, and the Labs will be doomed.

But it won't happen, the Nats don't have the wit.

This arguably already falls under the RBNZ's mandate to ensure the financial stability of the country. The level of debt young Kiwis and other owner-occupiers are taking on should be seen as an existential threat to the financial security and prosperity of our country in the medium term and managed accordingly.

You can’t be the arsonist and fireman at the same time - unless you’re a central banker...

Property investor here. I hope FLP doesn't do into housing, that aspect of our economy needs no support.

I would also be not unhappy happy to see an inflation adjusted CGT. In the long run the market would absorb it, but in the short term it chase a lot of people away and get the rental market back to what it should be, the business of running rentals. Unfortunately Cullen and co rather botched that exercise.

aghh..chickens coming home to roost ..and wait until the broke councils start to increase rates 10-15%..hope the retirees have a big stack of cash tucked away.

NZ Orr bust

What is even the govts role these days when they palm everything off to the rbnz to look after... people expect them to be in charge but instead they give weak and aimless responses.

Mind you the PM by claiming the RBNZ is oh so independent, means the ooooonly thing "to do" is.....

A wealth tax.

And like clockwork....

"I think the best solution would be comprehensive tax change" - Westpac's chief economist Dominick Stevens

https://www.rnz.co.nz/news/political/430866/no-controls-on-how-trading-…

Stevens, who believes a wealth tax will be introduced at some stage, said in the last 30 years house prices have risen much faster than rents so that means financial factors such as interest rates and taxes have played a dominant role in driving them up.

If houses are the issue, then tax the people who are hoarding houses. Then the people who made tax-free gains from hoarding houses and got out. Then tax the central bankers and policy wonks who strangled supply and got us into this mess. And then, maybe then, you can think about taxing people who have never horse traded in property in their lives, whose wealth represents accumulated income taxed at source. A wealth tax is using a nuclear bomb to go after a fly, but politically it's a great sell because everyone loves it as long as they don't think they'll be hit by it. Until they're hit by it.

“It has been a raucous cacophony of silence from them [Monetary Policy Committee members]. They should be more transparent,” Mortlock said.

Put them under the microscope of public scrutiny immediately.

Fostering asset bubbles is not a solution to our financial woes.

What really is QE? It's a story to get you to believe the future is inflationary so that you will act today on the belief and in doing so make the future inflationary.

The real toolkit is fin media writing 'money printing' over and over when QE isn't.link

Always hear about how interest rates have nowhere to go but up, yet interest rates are always lower than when we hear heard it last time.

Vaccine won't change why yields are the way they are. And it has nothing to do w/QE (except how QE doesn't work).Link

Robertson and Orr organised this a couple of years ago:

https://www.rbnz.govt.nz/news/2018/03/new-pta-requires-reserve-bank-to-…

So........what was Arden trying to say again?

ACCIDENTAL DUPLICATE POST

I find it hilarious that politicians want to absolve themselves of responsibility for asset price inflation by blaming the rbnz and vyint to make it their problem

Asset price inflation is triggered by multiple factors most of which are controlled or influenced by government, the rbnzs main focus is providing liquidity, price stability that impact costs & inflation - their tools are simple and limited which are mainly OCR % and LVR restriction rules for banks

Blaming them for asset inflation caused by years of global falling interest rates, rising immigration, HNZ stock liquidations, increasing rent subsidies and social payment increases seems a little bit of a stretch

Realistically it is the 'Objective' or 'Intention' that comes first and this should be driven by Government, and then policies across all public bodies should be aligned to that as a multi faceted approach

Trying to blame one public body for a lack of a coordinated policy response is irresponsible and simply finger pointing to avoid taking responsibility for tackling the main issue which is lack of leadership regarding housing

The dog wags the tail, not the other way around...

As a number of you rightly point out, the key question is - what has the Government done to address the country's housing crisis? I ran through what Labour delivered vs what it promised at the 2017 election and put it in a story here ahead of this year's election.

Regarding the article's title, monetary policy as such is always political, the problem is we have a non-democratic institution making political decisions that affect us all, this must change.

Instead of FPL, they could have used Helicopter money to increase the spending power of the people, which would go to help small businesses who will benefit from the spend. Easy and more effective and no pick and choose by Banks.

Yes. The helicopter money that could have ended up in everyone hands, to support local businesses, essentially is going to end up in pumping up house prices, making house owners feel rich. But are they going to then spend as a result , when we may have many rainy days ahead? Many businesses are currently struggling as a result of events this year, and may not qualify for any help.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.