House prices are rising aggressively. No news there.

The level of economic output in our economy is rising too, and the V-shaped recovery puts that 'growth' in a category of 'quite fast'.

There is no special linked relationship between the two, but it may seem that they are complementary.

However, house price growth is in another realm.

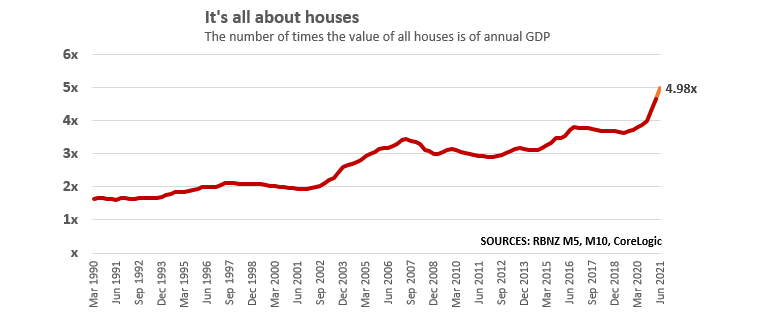

For the 12 years from 1990 to 2002, the value of all New Zealand houses was about twice the country's annual economic output.

Then there was a burst until 2007, in the pre Global Financial Crisis frenzy, when these values rose to more than three times annual economic output. That was a jump of $350 billion of house price value over five years.

Following that there was another seven years when things flattened out, only to start rising again in 2015 through to 2016 with another $250 billion surge to then exceed $1 trillion.

That was followed by another flat period of about four years through to the easing of the pandemic.

Since then however, house values have risen $520 billion in just one year, the fastest jump in the shortest period.

From July 2020 to June 2021, total nominal annual GDP has been about $331 billion, a rise of $14 billion. During the same time, house values have risen to $1.65 trillion, a rise in the same year of $420 billion. In that year, the rise in house values will have exceeded the rise in economic activity in the country by an eye-popping 30 times.

It is little wonder there is growing scepticism about this renewed frenzy and where it's taking us.

91 Comments

how much US dollars printed and being printed now?

not surprise.

What is remarkable with the New Zealand housing numbers is that based on very ( historically) low turnover. sales/stock.

And Knight Frank with the global list.

https://content.knightfrank.com/research/1026/documents/en/global-resid…

Brisbane posting a 5% increase over 12 months despite coming off a lower base compared to Auckland and Wellington.

Time to say goodbye to more young Kiwi talent!

Indeed.

Being geographically isolated, young Kiwis value their "OE".......

But most return and for all manner of reasons - not just economic and financial ones.

TTP

Another truely profound gem.

As New Zealand hurtles towards its dystopian future, most won't.

I've not seem much data on the percentage of returnees from overseas, everyone says that most return is this in fact true? Where is the data?

No it is not true. There are more than 1/2 a million kiwis living in Australia alone. Most of whom left in the last 40 years.

Cheers, so a bit like 'world famous in New Zealand', just another oft repeated fallacy, repeated endlessly to self-confirm their own world view.

https://www.stats.govt.nz/experimental/covid-19-data-portal

Already happening - not many travel bubble connections, select travel then compare arrival and departure numbers

Current situation in Australia might make some hesitant however that won’t last. Also when the world is vaccinated don’t expect it to return to normal on the travel front…ever

great link, thank you

LOL I actually laughed out loud at this:

...4. Istanbul, 5. Seoul, 6. Halifax, 7. Moscow, 8. St. Petersburg.

9. HAMILTON

Hahahaha you can't make this s*** up! Hamilton has indeed become a world class metropolis.

This is a good metric / ratio to use for some perspective. The general vibe from Granny Herald is that this is all quite natural and Robbo / Xindy don't seem to give a rats. I'd say that even in the epic Japan bubble, the value of housing to GDP never got to these kind of levels. The 30x larger than economic activity should raise a few eyebrows around the BBQ or water cooler. Like a DGM's trump card.

I think Grant and Jacinda care. They just know that any measure that actually reduced the cost of housing would make them unelectable. We’re getting the leadership we deserve, good and hard.

I think Grant and Jacinda care.

Sure, they may care even if it may look like they don't. Also, they are possibly so hopelessly out of their depth in their abilities to bring solutions to the problems.

they care about looking like they care , not much else

I don’t doubt their compassion, tbh. Their competence, yes; their courage, absolutely.

Maybe you are hopelessly out of your depth in your reckons about the competence of this government?

I am bothered by your name calling, which I suggests undermines any strength that may be in your opinions.

I am bothered by your name calling,

If you're referring to my use of 'Robbo' and 'Xindy', I suggest that you're probably a little thin skinned. I also refer to Key as 'Lord Key', ACT as 'the pretend libertarians.' And Judith Collins as 'Chucky.'

Name calling is a classic Trump characteristic, and in my opinion evidence of a narcissistic, psychopathic personality to seeks to belittle the subject they are addressing or talking about. It is uncalled for and unnecessary if you have a credible perspective to put forward. If not, just keep doing it because it tells the rest of us who to ignore.

Call it what you like. I personally believe that the public should be allowed to caricature the ruling elite. It's nothing new. The media has done it since for a long time. No reason why the hoi polloi cannot do the same. Take for example the name 'Xindy'. This is just a play on Ardern's refusal to criticize China on a range of issues, even if it is at odds with her so-called kindness agenda and the wellbeing of the NZ public.

What about caricatures? Are they OK? Some brilliant ones of Hitler and Tojo, or is that unacceptable? Next this will fall under hate speech and Emerson will be locked up for his cartoons. I'm frequently labelled a racist, privileged, boomer, stale white male on this site. Can't argue with facts.

Nothing wrong with a stereotype. They exist for a reason =)

Offended on behalf of others.

to murray86 - first time on the internet?

:)

Would have been much farer to have distributed helicopter money evenly to all. But the global reserve banks decided to enrich assets and their holders. One word ‘criminals’

Thats unfair Bugger , the RBNZ has concluded its unclear if there is a relationship between low interest rates and wealth inequality

https://www.interest.co.nz/news/110370/rbnz-concludes-based-inconclusiv…

https://www.rbnz.govt.nz/research-and-publications/speeches/2020/speech…

https://www.rbnz.govt.nz/research-and-publications/analytical-notes/202…

I know, laughable isn’t it. Hence ‘criminals’ seems to be the appropriate word I stand by.

Just imagine if we had taxed just a fraction of this wealth...we could actually have functioning social services in this country and still have money left over for productive investment

Oh that is still to come isn’t it. First the Greens announce a wealth tax. Second build up property values massively. Third form a coalition government with the Greens. Fourth acquiesce to the Greens wealth tax out of ‘coalition necessity.” Finally reel in the tax on all of that wealth, ie capital gain, you have created. QED!

There was a meeting you should have attended, last night in Gore. Right up your conspiracy-theory alley.

Up $520 billion in just one year. Unprecedented, and on top of a passage of prior extraordinary increase(s.) If any intent ( ie as per the Greens manifesto) to tax those gains retrospectively, proves to be only a conspiracy then cannot imagine that you of all people would be happy about that. :)

House still earning more than my salary.

I don’t want to even think about it. It’s depressing.

My house earned $150,000 last year. Lazy bugger didn't even do anything to earn it.

My lazy bugger house $200k. Always so smug when I get home from my 10hr day and they've just sat there doing nothing all day and earnt more.

My business earnt me 3x ish that last year, in actual tax paid cash !! I purposely dont own a home. Admittedly I had to show up 5 days a week to do that, more the fool me.

I don't even check my payslips anymore. I log into my ANZ banking app once a month and check the Corelogic valuation.

"Unprecedented rise in the total 'value' of our housing stock over the past year sees it streaking up 40 times faster than the rise in total economic activity, even though it too has jumped in the pandemic recovery...."

Hi David, Why is anyone surprised....is this not what likes of Robertson's and Orr's of NZ wanted. Otherwise every week new data suggests that housing market is touching new height still no action and following wait and watch policy. So am surprised as to why you are surprised and wondering where it will all lead.

"It is little wonder there is growing scepticism about this renewed frenzy and where it's taking us."

It is taking us to the moon, exactly where Jacinda Arden government and Mr Orr wants it to go.

Wonder, why are you surprised.

Da

Quite right, this is the outcome they planned for knowing it would keep the economy pumping, I bet they are starting to worry at the consequences of their actions now, as the economy over heats and they might have to stop being so "kind"

No bubble has lasted forever in economic history - not one. Once the housing Ponzi starts showing some cracks, the fun will start. The only difference between the various types of bubbles is how big they inflate and how long they last before they inevitably pop.

Right, because if they didn't pop then they weren't bubbles. It comes down to definitions.

One interesting thing to me is that Treasury and the Reserve Bank seem to consistently under-estimate house price rises. Clearly their models are broken or very incomplete but they are never asked to account for their massive errors. They may as well be throwing dice at this point given their forecasting ability.

Treasury's admission that officials use "professional judgement" to predict house prices, rather than a solid economic model, has shocked Green, National and ACT MPs, who are demanding answers.

https://www.newshub.co.nz/home/politics/2021/07/treasury-s-professional…

WTF.

I feel sad.... and let down. :-(

So they have 11 people sit in a room and guess, then take the average of the guesses.

I mean none of us should not be at all surprised. It's like a skit out of a comedy show. Unfortunately it is real life.

Not surprising really, technocrats who believe they know better than elected officials doing their usual stuff.

Given the low bar set by our elected officials, Treasury probably do know better than them.

Oh the old neoliberal argument about public institutions not working. Keeps popping up every now and then but it is just another way of favouring the private sector, however in this case is a dangerous thing to do since it directly attacks trust in democratic institutions. Must be careful with that since that's how populist are born.

I have heard through the grapevine (I work in FS) that economic models did predict the house price increase off the back of the interest rate manipulation (est ~+20%). But they chose to overwrite that number because they expected covid to have a more adverse impact (just koz). What they failed to consider was that people seek 'safe haven' investments during times of uncertainty, real estate being one of those. They should have just trusted their models, without throwing some unfounded 'professional judgement' into the mix.

Oh wow! So the grapevine says they played a "Koz Covid" wildcard.

They may yet be right, but on a disastrously wrong timescale.

Second guessing is still guessing. The fact we are in this scenario indicates that Treasury has organisational issues that need to be addressed, we can't rely on an non-performing department.

Not only Treasury, but Immigration NZ for continuing to import migrants on a record scale despite the Government publicly stating that they wish to reduce migrant numbers. Why did Immigration NZ not listen to the Government?

Denominate in Bitcoin, and watch house prices continue to slowly crumble over the next 2 decades.

Missed out again today on a house. I bid more than 1.3 million and I'm 47 years old. The house was pretty crap.

Don't worry, Wombling is free

Did you miss out by much or a lot... must be a frustrating process. So that's why, despite having determined competition I just kept bidding, 6 weeks ago. I felt at the time I had overpaid, the selliing agents even kept rubbing it in, but not worried about it now. Anyway, it was 20 percent... not much... over 2018 CV, and 250k under estimated market value which is still rising

Just think it might have been for the best, there are always new houses coming on sale every day anyway.

Sorry to hear that UB. It's mentalling exhausting.

Similar. 95 square metre very modest but nice 1969 house on a 600m section in Birkdale, needing lots of upgrading went for almost $1.37million last night. Would have been hard to develop section without demolishing house. Agent said interested parties mostly were family home seekers rather than investors or developers. The 2 bidders left at end well outbid a group of Chinese buyers, and looked to be older gen x types. It’s mania out there.

Those lower shore “affordable” suburbs are in huge demand as they are close to the CBD, public transport, Beaches and there is very limited land to keep developing.

I've noticed this demand also. Some of it surprises me. Was it able to be developed? Best to avoid sections that are zoned for high density.

That's a shame. It seems to be the rule rather than the exception now that's there's too much money from QE, chasing too few properties as a result of a decade at least of poor planning. Also with much reduced options for safe investments providing a reasonable return and hedge against inflation, property was logical.

There are a load of highly paid civil servants who's job it is to match infrastructure and social requirements against immigration planning and population trends. Clearly they've either failed to do the numbers properly or they have but they've been ignored by successive governments.

Jeeez, 1.3m - what a dump that place must have been.

Housing is the economy.

Until deglobalisation happens. We will know how fragile it is.

What bubble????

Love the quotes around 'value' from the headline.

You call Robbo / Xindy criminal or deceiver, they don't give a dam.

They can fool kiwis with there PR strategies and come into power again. So it doesn't matter to them, even if house price double in next 5 years.

From houses, to petrol, to brocolli.....its all going up. With all the QE/printing, governments cant do a thing

about it. Zimbabwe 2.0.

Fiat currencies are, and will, continue to loose value, pushing prices up for everything.Wage and salary earners need to start demanding way way more to keep up.

Yep I think the inflation train is only just starting to gather momentum...soon we have two trains out of control, the housing one with the inflation one right up it's rear.

Seems the dole is now also a viable career option with numbers well up despite 80000 jobs advertised on trademe, and a lack of people willing to pick produce earlier in the year. Who'd have thunk.

There seems to be an aspect of the NZ political scene that is not being noticed or discussed much. National seems to be the party for the wealthy. they actively promote and suck up to big money in all of it's forms. They do try to sound like they are for the ordinary Kiwi, but even the barest of scrutiny's reveals their inability to deliver.

Labour , however, the traditional supposed representative of the working classes, has become more an agent for the dependent classes. But while they are doing this, they too are sucking up to the wealthy, apparently ignorant of Maggie thatchers aphorism; "The problem with socialism is that sooner or later you run out of someone else's money!"The pathway that Labour is taking, I suggest, is more dangerous than Nationals, in that by seeking to increase dependency, they are entrenching demands for Government handouts, att eh expense of building substantial, robust economic growth.

This leaves the working classes mired in the middle with no one effectively representing their interests. since the 1980's working conditions, and wages have been systematically undermined and pulled down. Inequality, and the gap between the wealthy and poor has soared. Political alternatives such as TOP, only offered policies that supported the upper end, but would have increased costs for the middle and lower echelons of society. It seems we are tracking inexorably towards George Orwell's 1984!

They have become an agent for marginalized minorities.

Nothing wrong with that, but it detracts from their needed focus on a large proportion of the population.

Not sure about that TOP conclusion?

An asset tax accompanied by a reduction in personal tax designed to be neutral for middle class but capturing the wealthy asset owning classes - such as land bankers.

The TOP policy as I understood it applied an imputed rent on the family home which resulted in a tax for home owners. "Wealthy Asset owning classes" is a term that opens the door to jealousy based policies, but increased costs too broadly to people who were not wealthy. To suggest a home owner is wealthy because they own their own home is a specious, seriously flawed position. Many home owners, myself included are far from being wealthy, and such taxes would effectively force them into poverty, possibly pleasing a few.

The theory was murray that for the average working home owner the tax affect would be nil - or that was the goal.

The other 'fairness' was that non home owners with equivalent cash invested were paying tax on interest and paying rent with taxable income.

A home owner pays no interest on the income invested on the home.

An alternative to imputed interest on the home would be to allow tax free investments up to the value of a home for a non home owner.

It' about correcting a blatant unfairness that exists against non home owners.

And forcing land bankers to either sell or develop.

"And forcing land bankers to either sell or develop". Quite different to the current position of exploiting those that don't own assets.

Yep. I don't quite understand why those without hard assets (many of whom comment on here and who I have huge sympathy for) are not going all out to get TOP across the line. They have a solution...unlike Nat & Lab.

The assumption was that homeowners only experience financial benefits from living in their homes. But this is not the case. All home owners as a minimum face rates, insurance and maintenance bills. Most also have mortgage payments too. For an arrogant political party to come along and say there should be an imputed rent for which you should be liable is unconscionable, and establishes a precedent hat literally has no bounds. If they got away with that, what would stop them saying to car owners, that there is an imputed taxi fee that they should be responsible for?

What they are ignoring is many home owners, myself included, sacrificed an awful lot in lifestyle to get to own their home. They are responding to people who are saying "I chose a fun lifestyle, but I think it is unfair that someone who forewent that life style now has their own home but I do not." This is just a sense of entitlement and jealousy, and is frankly BS, and should never get past a start line.

I get it that today many non-home owners are on the short end of a stick, but that largely is not the fault of home owners but of the Government for not effectively managing the economy.

But what you and the boomers forget Murray was that you were at the start of the line with little or no hurdles and the property ladder laying at your feet. Those coming after you had to jump higher and higher as all sorts of hurdles were placed in front of them, had to run faster and faster, and then just when they thought they arrived at the "property ladder" you pulled it up higher- always out of reach.

Not to disagree, but seriously. Would you like to be coming out uni now, with no savings, a 50k student debt and house prices (in Auckland) like 12x the average household income?

When my parents (boomers) were early 20s a 2nd working parent was a lifestyle choice. Now people are choosing not to start families because they simply cannot afford it vs the property dream.

We existing asset class holders, whilst perhaps not directly responsible, need to be very socially aware that we are benefiting hugely in this money scramble at the expense of a massive sacrifice and disadvantage of the young. This is also before we factor in the upcoming costs of climate change etc.

Directly or indirectly we are screwing them over. Just my opinion but This country is fast becoming ripe for a new political movement.

"But I only have 1 rental, to supplement my income, I'm not the problem". x 100,000

Boomers voted Muldoon in a sweeping victory because he campaigned on abolishing a superannuation scheme that would have seen them putting a little bit of their own money away for retirement. Many of these very home owners today have decided that the right to shelter is their superannuation scheme, funded by the next generations, because "oh shock horror the pension doesn't pay enough".

It the only party that has the lead policy targeting debt speculation on land. Their party vote last time was low and have to say the media certjanly didnt help get their message out.

Speculators will never vote for TOP, but they dont vote Lab either and that is democracy. It's a solid option for those being held hostage by the ponzi (renters, fhb'ers etc). Also those that own their own home and want their grandparents kids to be in NZ.

This "wealth" is about as paper as you can get. To access this wealth you need a willing borrower and willing lender with space on their balance sheet and there is no plausible case where this could total 1.65t. We would need a 6 fold increase in housing lending (at 5 times GDP income can't really offset this) to cash everyone out.

You have to be in first or wait your turn to get access to this "wealth", around 10b a month is what can currently be accessed.

Interesting point, thanks for calling this out. This is where the bottle neck will come when Gen X start trying to cash out of their investments to diversify or fund early retirement.

Sooner. Boomers are starting that process now.

Also as a gen x/y, when I consider my friends/family, most own property, but most if not all have been given money from boomer parents at some point. We have created a society separated by class along property lines.

Still prices won't move down unless the money printer stops.

My opinion is that it's likely going to come hand in hand with a wider asset/bond collapse, so careful what u wish for and all that.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.