Here's our summary of key economic events over the weekend we are ending the year with mostly a strong international economy, but worries are growing about prospects for 2025. If both China and the US turn down together, then all bets are off.

But right now, it's going to a relatively quiet week ahead as you would expect with major holidays in some of the largest financial markets. But we will get data from Singapore (CPI), Thailand (exports), Taiwan (retail sales and industrial production), China (industrial profits and their MLF interest rate), Canada (PPI), and the US (durable goods orders, new home sales, jobless claims and some regional factory surveys). So enough to keep an eye on while we relax. Nothing locally of course except the November data dump from the RBNZ tomorrow.

In the US, there was a last-minute avoidance of their shutdown as conservative Republicans were not prepared to give the incoming President the blank cheque of a suspension of their debt limit. Trump lost that one by quite a wide margin, so it may not be plain-sailing for the Trump/Musk presidency.

Meanwhile, the widely-watched US PCE measure of inflation came in at 2.4% in November, up a tick and to its highest since July. Core PCE inflation stayed even higher at 2.8%. But these results were actually a tick less than expected. The 2.8% inflation level is what the University of Michigan consumer survey also reported.

American personal disposable income rose +2.6% from a year ago, a slight undershoot. But personal spending remained strong, up +2.9% and similar to the gains over the past six months. Personal saving as a percent of disposable income rose marginally to 4.4% from the prior month and ending the longish decline from the start of the year when it ran at 5.5% of personal disposable income. The 4.4% level is where it ran for most of 2023.

Across the Pacific, Taiwanese export orders stayed elevated, up +3.3% from the same month a year ago which itself was elevated.

China reviewed its loan prime rates on Friday and kept them unchanged - at record lows. It's MLF rate will be announced this coming week.

In China, there have been recent reports of officials calling in bond traders to lecture them about 'responsible trading' - and the consequences for not. Chinese bond yields had fallen to record lows, as readers here who tracked our monitoring of the Chinese 10yr yield below will know. But today, the fear of losing money is winning out over the fear of officialdom's wrath.

China’s one-year bond yields broke below levels last seen in the GFC to the lowest since 2003, driven by bets on aggressive policy easing and demand for safe haven assets. The yield on one-year government debt plunged 17 bps yesterday to just 0.85%. The ten year is down to 1.69%. While it might be too harsh to call it 'panic mode' there is certainly a hard edge here, in fear of where the Chinese economy is headed.

Japan reported November CPI inflation, and that rose again, now at 2.9%, with the widely-watched core inflation rate at 2.8%.

Japan also said its population fell to just under 124 mln, a fall of -325,000 in a year, and -3.1 mln in a decade. Now 29.3% of that population is 65 year and older, with only 11.1% under 15 years. In China, which is also thought of as having a similar demographic problem, those spread details are 14.3% over 65 years and 16.8% under 15 years.

Following the recent +200 bps out-of-cycle interest rate rise in Russia and the central bank guidance then, they were expected to raise their policy rate by another +200 bps again overnight to 23%. But they didn't. Apparently the Kremlin isn't keen on the independence of the Russian central bank governor any more.

And perhaps we should note that nickel prices have hit a four-year low, on the combination of low demand and surging Indonesian supply. Russia is no longer a force in nickel supply. Prices for rough-cut diamonds are also plunging, this time on low demand out of China and their acceptance of artificial alternatives.

The UST 10yr yield is now at just on 4.53%, and up +2 bps from this time Saturday but that is a net +16 bps rise for the week. The key 2-10 yield curve is still positive, now by +21 bps. Their 1-5 curve inversion is +13 bps and more positive. And their 3 mth-10yr curve is also more positive at +23 bps. The Australian 10 year bond yield starts today at 4.50% and up +3 bps. The China 10 year bond rate is now at 1.69% and down another -3 bps from Saturday to a new yet another all-time low. The NZ Government 10 year bond rate is now at 4.65% and unchanged.

The price of gold will start today at US$2622/oz and down -US$3 from Saturday. But that is down -US$36 from this time last week.

Oil prices are unchanged at just on US$69.50/bbl in the US while the international Brent price is still just under US$73. A week ago these prices were US$71 and US$74.50 respectively.

The Kiwi dollar starts today just on 56.7 USc and unchanged from Saturday. But that is down almost -1c from a week ago (57.6c USc). Against the Aussie we are holding 90.4 AUc. Against the euro we are still at 54.3 euro cents. That all means our TWI-5 starts today at just on 67.1 to be unchanged from Saturday at this time but down -50 bps from a week ago.

The bitcoin price starts today at US$95,659 and down another -1.5% from this time Saturday. A week ago it was at US$101,536, so down -5.8% from then. Volatility over the past 24 hours has been modest however at +/- 1.5%.

Daily exchange rates

Select chart tabs

The easiest place to stay up with event risk is by following our Economic Calendar here ».

34 Comments

The shutdown contest I read as a win for the Republicans. It's one of those negotiation techniques, ask for something so outrageous that all your other demands seem insignificant. From what i read the democrats lost allot of their wins from the original bi-partisan bill, but the republicans lost nothing.

The republicans have have control of the house..deeply embarrassing to have a bipartisan deal fall through at the last minute due to unelected wanna be oligarch. The Dems lost nothing the republicans split further.

Next year going to be a fight or flight

> The Dems lost nothing

The deal removes measures sought by Democrats in the first version of the bill, including the first pay rise for lawmakers since 2009, healthcare reforms, and provisions aimed at preventing hotels and live event venues from deceptive advertising.

Some of those provisions actually sound beneficial - or do the Republicans support deceptive advertising.

Deceptive advertising sounds like the sort of thing Trump will claim with pride to have invented.

you missed the Child Cancer research funding of $190mil - let the nickel and diming commence

The republicans lost removing the debt ceiling.....which is a joke anyway. Trump's tax cuts for the rich expire early next year..,...Musk will want them extended..

they didn't lose that, it was never in the original bill.

Whatever ...

amazon v aliexpress

lesson: stick with amazon for xmas presents next year.

Funny how the customs delay doesn't affect amazon.

Ordered Promised Arrived

amazon 12/12 20/12 17/12

amazon 18/12 30/12 23/12

aliexpress 28/11 13/12 8/12

aliexpress 30/11 17/12 no - customs delay

aliexpress 2/12 19/12 cancelled by sender 20/12

“Strong” international economy?

where except USA?

If we take strong to mean GDP growth over 2% which major country has that?

prior to 2008 strong was 3%

Agree, an odd comment. It’s most certainly weak, overall

USA = +3.1%

China = +4.6%

Australia = +0.8%

Singapore = +5.4%

Malaysia = +5.3%

Taiwan = +4.2%

Vietnam = +7.4%

India = +5.4%

Brazil = +4.0%

Mexico = +1.6%

Canada = +1.5%

and together that is a key 46% of the global population.

(Europe is irrelevant for us.)

Irrelevant? Exaggeration. And Europe is part of the ‘international economy’ which is what your comment related to. Where’s Japan?

And our two major trading partners? Very weak by their recent standards

They're only 5-6% of our exports and many of their economies and populations are dieing on the vine. They're not quite a footnote for NZ, but they're also not a key market.

The EU, as a trading block, is NZ’s fourth largest trading partner. So is definitely not irrelevant.

A collection of around 30 countries is 4th after 3 individual countries. Commercially, that's not a priority.

Whatever… your smart ass contrarianism gets really boring

Am I the contrarian, or are the views I often critique contrary to reality. There's no smart arse intended, if you're taking personal offense at someone offering a counter argument, that's on you.

I am simply agreeing with David. If you were running a business, a customer like "Europe" would be a low priority.

There is only one customer that counts in the current setting...the one with access to USD. Who can create USD at will and who decides who has access to it?

Entities around the world can create USD, more are generated outside the US fed than by it.

If they are confident that the ability to repay in same exists....when that confidence disappears then there is but one source.

That fine, but then you want to talk about the economy of our trading partners, not of the "international economy"

Yes

And my point above is, if it’s reframed to our key trading partners, our two biggest are weak, not strong!!!!

Thanks for replying and the stats David

But China as you are aware , are not to be trusted with figures or truth

EU is about a quarter of world GDP. May not “count” for NZ but you did refer to the world.

I also said “major” economies

Precarious would be a more accurate descriptor, especially given the interconnected nature. Importantly China which has driven growth for so long is struggling at 4% and its construction sector is around 30% of GDP....and that is only going in one direction.

Prospects are grim.

The question I have is how do people consume when we are all broke......

But we do. And at near record levels.

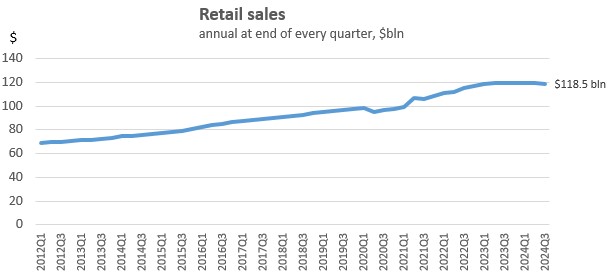

No one is saying the current situation is great, but is easy to apply hyperbole. Sure some people (too many) are struggling, but clearly most aren't. Apply inflation, and/or convert to per capita, and the chart won't look as strong. But that won't alter that retail sales are still running at nearly $120 bln per year, far higher than just 5 years ago, and back on the same track we have had since 2011..

Also begs the question, are we broke because we are over consuming.

There's some lessons about finances and the environment that collectively we are ignoring.

Or are we not so broke at all, but a very vocal minority have an undue amount of media exposure? I'm not saying there aren't many poor struggling, but I will point out RBNZ stopped publishing debt concentration a few years ago...

Or is GDP a misleading measure?....Id suggest it is.

We (the world) have been using monetary expansion to cover up the output weakness and bending over backwards to avoid defaults....the dam will break.

How much of this is paid for by personal debt (credit cards , Afterpay and the like) . My question is not really for today but the future. Does NZ (or any other country) get to the point where there is so much debt that people can't consume beyond the basics because of debt servicing. At that point what happens ( the government just prints and gives away money to consume?, do company's go bankrupt?) . People don't have to consume beyond the basics.

Looking at the almost complete about-face in a majority of the recent voting patterns in the USA, neither party can lay claim to any of their once dominant [voter] sectors. It is a near complete 180 since I've been interested which is almost 50 years now. Trump 2.0 will take a leaf from Macron's playbook, who took a leaf from Trump's 1.0 playbook - executive orders [or there-abouts].

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.