The Reserve Bank (RBNZ) is warning banks and government arms such as Treasury that, in effect, the punch bowl is being taken away.

The RBNZ is foreshadowing the end of the "abundant" cash settlement levels seen since the onset of the Covid pandemic to be replaced with merely "ample" cash.

And this change may be in full effect by as soon as the second half of next year.

The transition from the "abundant" to "ample" eras was outlined on Tuesday by RBNZ Assistant Governor Karen Silk, who cautioned that the reduced levels of liquidity in the system "will place greater onus on market participants to understand, forecast and manage their individual liquidity needs than has been necessary during the abundant liquidity era".

"...In an ample era, market participants need to be ready to be more active in their management of cash."

Silk, who is also General Manager of Economics, Financial Markets and Banking, and sits on the RBNZ's Monetary Policy Committee (MPC) told a CBA Conference in Sydney on Tuesday there is "no historical precedent for the level of decline in settlement cash that is underway".

The RBNZ defines "settlement cash" as the surplus cash it holds in Exchange Settlement Account System (ESAS) accounts at the end of a banking day. The ESAS is the system for processing and settling payments between banks and other financial institutions. It's a real-time gross settlement system with the infrastructure owned and operated by the RBNZ.

Those with ESAS accounts include ANZ, ASB, ASX, BNZ, Bank of China, China Construction Bank, Citibank, HSBC, ICBC, Kiwibank, NZX, the RBNZ, TSB, CLS (Continuous Linked Settlement), the Local Government Funding Agency, Treasury's Debt Management Office, the NZ Super Fund, Rabobank and Westpac.

Balances in ESAS accounts attract interest at the same rate as the OCR. The amounts being paid became quite considerable during the recent OCR hiking cycle.

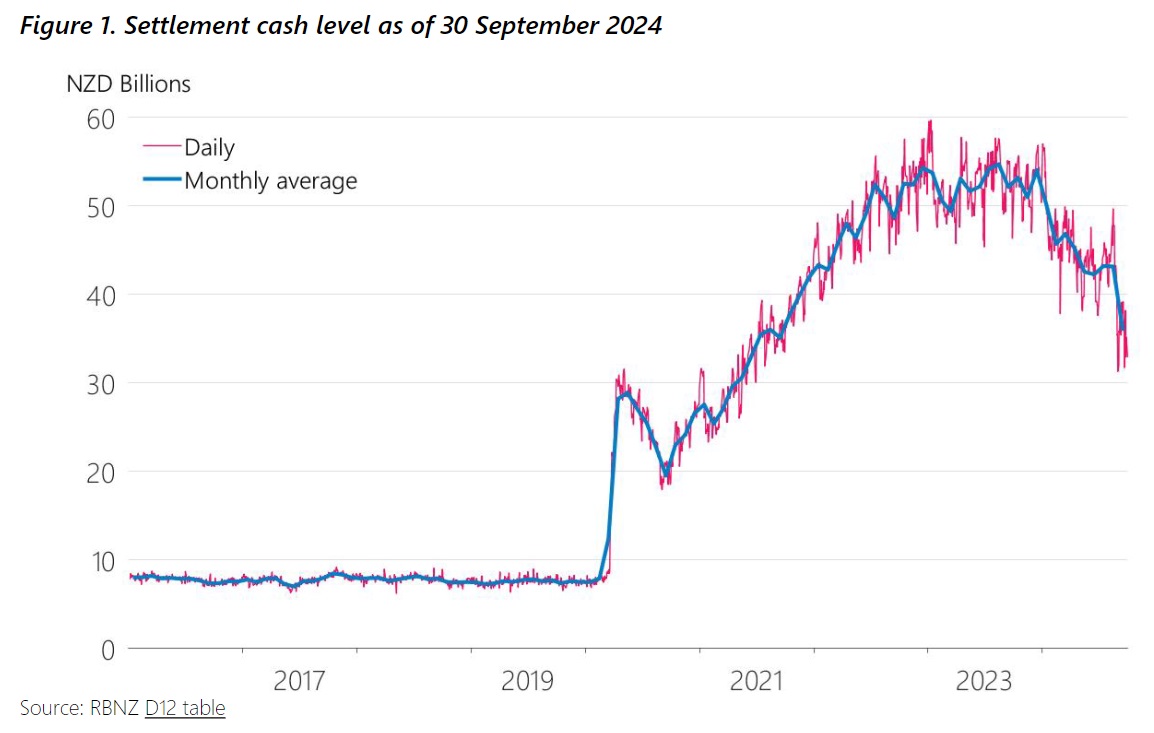

Up to March 2020 settlement cash balances averaged around $7 billion to $8 billion a day, but that absolutely shot up as there was a wave of stimulus once the pandemic started.

The RBNZ launched its large-scale asset purchase (LSAP) programme, which saw it issue a significant volume of settlement cash in order to buy government and local government bonds. The RBNZ's subsequent Funding for Lending Programme (FLP), through which it loaned banks $19 billion at the OCR, further increased settlement cash balances. Government debt has increased, which has also had a big impact.

Settlement account balances peaked at nearly $60 billion in January 2023, but remained as high as over $56 billion as recently as in January this year. They've since declined as unwinding action, such as the RBNZ selling down its LSAP government bond portfolio to Treasury's NZ Debt Management unit at a rate of $5 billion per fiscal year, continues.

Currently the settlement account balances are averaging a little over $40 billion a day.

Silk is not putting numbers on the sorts of balances the RBNZ expects to be seeing once "abundant" cash becomes "ample" cash next year.

"Our intention to maintain settlement cash at an ample level is an easy statement to make," she said.

"However, what constitutes an ample level is uncertain and may change over time.

"There is also no historical precedent for the level of decline in settlement cash that is underway.

"Current internal estimates of ample carry a wide range, reflecting the inherent uncertainty surrounding the many factors that can influence the demand for settlement cash.

"As a consequence, we do not intend to publish a point estimate of ample but will monitor indicators and market intelligence to maintain it. To borrow a phrase, we will know the ample settlement cash level by its works."

Silk said more "active management" of settlement cash is required by the Reserve Bank at the intended 'ample' level.

A decline back into 'scarce' levels would result in short-term interest rates rising above the OCR.

"This occurs because market participants would be willing to pay more for settlement cash to meet their liquidity needs. This would result in small movements in settlement cash causing large movements in short-term interest rates."

In terms of managing the transition to 'ample' levels of settlement cash, Silk said approaches to liquidity provision have begun to be characterised in the central banking community as ‘supply-driven’, ‘demand-driven’, or a ‘hybrid’ of the two.

"In a supply-driven approach, the central bank determines the quantum of liquidity required and supplies that amount. This essentially reflects the RBNZ’s current approach and in our case is largely achieved through transacting in the FX swap market. We do not currently foresee a need to use additional asset purchases to form part of our supply-driven toolkit as is being contemplated in other jurisdictions.

"In a demand-driven approach, the central bank provides cash through regular collateralised lending operations or standing facilities. In the New Zealand context, a feasible way to do this would be through our existing Open Market Operations.

"We believe that the most pragmatic and flexible way to provide liquidity in New Zealand is to use a hybrid approach, combining supply- and demand-driven elements. This should require only a modest adjustment to our current framework." Silk said operational details are "now under development".

In reference to the moves to reduce the size of the RBNZ's balance sheet - which has grown enormously since Covid - Silk noted the fact that simultaneously the RBNZ's MPC was now starting to cut the OCR.

"A natural question people might ask is whether the MPC is intending to continue with balance sheet reduction during an easing cycle," she said.

"The answer is yes. The wind-down of the Large Scale Asset Program is consistent with the MPC’s stated objectives of minimising impact on monetary stimulus; avoiding harming the efficient functioning of financial markets; and ensuring the MPC has the capacity to use the LSAP tool effectively again, if it were ever warranted.

"We do continue to monitor for any impact, but the normalisation of our balance sheet is generally not indicative of our monetary policy stance. The monetary policy stance will continue to be communicated via changes to the OCR and the MPC’s communication around the outlook for the economy and the policy rate."

*This article was first published in our email for paying subscribers. See here for more details and how to subscribe.

6 Comments

Great party, tax-payer funded profits for the Aussies..

The 'financial free for all party' is winding down, prudent dancers are moving to the exit door in advance of the rush.

translation, 'Higher for longer'.

by higher I mean comparing to the the decade after 2008.

So if I have got this right banks will have to manage themselves a little better or will face increased costs if they need to borrow to cover liquidity / compliance levels?

Will this in effect be another motivation to ensure spreads don't shrink too much?

Good.

Of course printing money has no effect on its abundance.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.