This Top 5 comes from interest.co.nz's Gareth Vaughan.

As always, we welcome your additions in the comments below or via email to david.chaston@interest.co.nz. And if you're interested in contributing a guest Top 5 yourself, contact gareth.vaughan@interest.co.nz.

'Please give up this seat if an elderly or infirm person needs it'

My latest cartoon for tomorrow's @Telegraph

Buy a print of my cartoons at https://t.co/ILFJjPmckxOriginal artwork from https://t.co/bVPAkgE34y pic.twitter.com/7OnIwUQnwL

— Matt Cartoons (@MattCartoonist) June 28, 2024

1) Gisborne: Anatomy of a housing crisis.

My colleague Greg Ninness' most recent write-up of the Tenancy Services rent data was an eye opener for me.

That's because it showed median residential rents in April were higher in Gisborne than in any other region of New Zealand except Auckland. That's right, Gisborne's median residential rent is higher than Wellington's, Christchurch's, Bay of Plenty's, Waikato's, Tasman's, or Hawke's Bay's.

The Gisborne Region has a median weekly rent of $640. That's after a $90, or 16%, increase year-on-year. The Auckland region's is $660, after a $20 annual increase. Third is Bay of Plenty at $630.

Talk about a housing crisis. How did Gisborne come to have the second highest rent in Aotearoa?

According to a Gisborne housing stocktake for Manaaki Tairāwhiti done by consultants Sense Partners, there are a range of factors behind it.

One of the things Sense Partners points to is an acute shortage of rental properties, despite increasing building activity.

Population growth is a factor with building activity battling to keep pace. Cyclone Gabrielle also didn't help, damaging a significant number of homes, with 51 properties classified as category 3, the highest risk level where the risk of flooding is too high to safely manage, and a further 770 as category 2A requiring further assessment, leaving a sizeable bill.

A local source with knowledge of the Gisborne housing scene, speaking anecdotally and thus being treated anonymously, says the peak Covid-19 period saw an influx of people to Gisborne, some of which was people returning to homes they'd rented out. This meant some families living in rentals had to move.

This displacement drove up the value of rentals as the demand for properties skyrocketed over a few months, and the current market rate, (which is actually dropping currently but not to affordable rates), stabilised at this rate for a long time. What we're seeing reflected in statistics isn't a sudden rise in Gisborne rental costs, it's statistics catching up to a reality that has been slowly building for a long time.

This isn't to say the floods didn't affect the market, it probably prolonged it...rather than caused it.

Gisborne has had an influx of people moving to the region due to Covid, returning home to avoid international and national lockdowns and settings, as well as immigrants to work in the agricultural industry.

Council has neglected our waterways for many years. This was exacerbated with the cyclone, when they were heavily damaged. Council is reluctant to consent to too many builds because the waterways cannot handle the excess and power grids are nearly at capacity. Gisborne needs a full infrastructure overhaul before builds on the scale needed to meet population demand can even begin. Council doesn't want to wear this cost.

According to the 2023 Census, the Gisborne region's population is 51,135. That's up 3,618, or 7%, since the 47,517 recorded in the 2018 Census.

As with other parts of the country, housing woes lead to more homelessness, people sleeping rough, and some living in cars and tents.

The number of applicants in Gisborne on the social housing register was 638 as of March this year, noting an applicant can be a family or a single person. This comes after a more than doubling to 484 from 235 between June 2019 and June 2020. And as of December 2023, there were 4596 people in the region receiving the Accommodation Supplement.

Sense Partners notes Gisborne's an expensive place to build with high labour costs and companies struggling to find the scale to reduce costs.

As the chart below from economist Shamubeel Eaqub demonstrates, there's a lot of work ahead to improve the Gisborne housing situation. Fingers crossed progress can be made soon.

2) The NZ credit landscape & what has changed over five years.

A consumer credit/debt research report done by Verian for the Ministry of Business, Innovation and Employment (MBIE) looks at New Zealanders' experiences with debt last year in comparison to 2019. The idea is to look at changes since the December 2019 passing of the Credit Contracts Legislation Amendment Act, which aimed to better protect New Zealanders from debt spirals and predatory lending.

Conducted in January, the online survey with 1,179 respondents, targeted people aged 18+ who have either applied for credit in the last 12 month, or held a loan in the last 12 months.

The survey suggests;

•Just over half (53%) of all New Zealanders applied for at least one type of credit in 2023.

• Approval rates remain high. Almost all who applied for credit were approved for at least one type of credit, however decline rates have increased since 2019, with around a quarter declined at least once.

• Buy-now-pay-later is the most common type of credit applied for, which has seen an increase since 2019. Meanwhile, applications for hire purchase and both long/short-term loans have declined.

• Alongside increasing decline rates for long-term loans, those who were approved received a lower median value than 2019, with more New Zealanders now saying they were approved for a lower long-term loan amount than they were seeking.

• Conversely, the median approved overdraft limit has increased.

• Increasing living costs since 2019 appear to be driving changes to attitudes and sentiments. New Zealanders are increasingly worried about their ability to repay their debts in the future and more are feeling the impact of their struggle to make repayments on their day-to-day lives.

• A quarter of New Zealanders with credit in 2023 defaulted on a loan and almost half had to reduce spending on important living expenses to avoid defaulting. Reduced spending in particular has increased since 2019.

• New Zealanders are also increasingly missing repayments, having money directly deducted from their accounts to repay debts, or having legal action taken against them by lenders.

• Those struggling to repay debts are more likely to attribute this to increasing expenses in 2023, including both regular and unforeseen costs.

• When declined for an overdraft or credit card, New Zealanders are more likely to say this was ultimately a good thing than a bad thing. However, across all other credit types, New Zealanders are more negative about being declined than positive.

Of those who applied for credit last year, 94% were approved at least once versus 93% in 2019, Verian says.

The average decline rate rose to 23% in 2023 from 17% in 2019. This is a weighted average across all six types of credit.

Meanwhile, confidence to repay debts has fallen.

3) Governments and 'shockflation'.

The global cost of living crisis, amid the highest inflation in decades over the past two or three years, has seen politicians cop blame, contributing to changes of government including here in New Zealand.

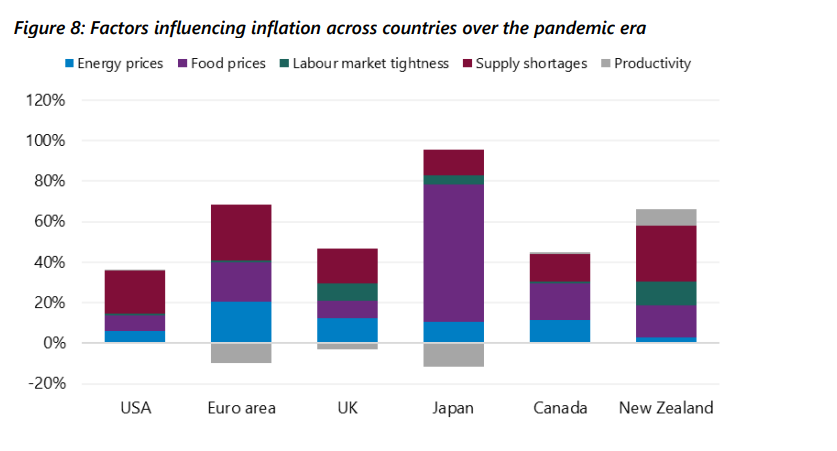

However, the central banks western countries have outsourced monetary policy to, such as the Reserve Bank of New Zealand (RBNZ), are the ones tasked with fighting inflation. Supply and demand dynamics, plus supply shocks caused by the massive disruption of the Covid-19 pandemic and Russian dictator Vladimir Putin's invasion of Ukraine, contributed noticeably to global inflation.

Mehreen Khan, Economics Editor of The Times, highlights the role governments can have in creating buffer stocks of key staples to help avoid future supply shocks.

Central bankers will chafe at the notion that politicians, rather than their institutions, are in sole control of prices. They are wrong. By their own admission, monetary policy is impotent in the face of the seismic supply shocks we've seen since the pandemic. Voters are right to point the finger at governments, who do have a role in ensuring no repeat of the "shockflation" that has rocked economies this decade.

An enhanced role for the state is laid out by economists Isabella Weber and Jens van 't Klooster, who call on the EU to embrace price stabilisation measures such as creating buffer stocks of food, energy, and raw materials to protect against future supply shocks. This is alongside more monitoring of prices in the economy and a role for competition policy to ensure consumers are not at the sharp end of corporate pricing.

The last three years of geopolitical flux show that price control cannot be ceded entirely to the realm of monetary policy. If governments are being blamed, they have a responsibility to ensure price moderation in key sectors of the economy that matter most for households.

Here the RBNZ dogmatically strives to get inflation down to 2%, pushing up unemployment, in the face of stubborn inflationary hold-outs such as rents, insurance premiums and local government rates which it has little or no influence over.

Nonetheless the RBNZ recently suggested supply shortages have played a not insignificant role in NZ inflation, highlighted in the chart below. Last year I put together a stocktake of New Zealand reserve stocks that aim to mitigate our exposure to international disruptions. There's certainly scope for more to be done.

4) EV wars.

In the latest episode of our Of Interest podcast I spoke with James Foster, who runs the EVDB website, about electric vehicles (EVs). In preparation for the podcast one of the articles I read was The Chinese EV dilemma: Subsidized yet striking, by Scott Kennedy of the Center for Strategic and International Studies.

Chinese EVs are taking the world by storm. Bloomberg recently said Wang Chuanfu, founder of Chinese EV maker BYD, could be China's version of Henry Ford given his company is;

further disrupting China’s EV industry with cars costing less than $10,000, bringing affordable transport to the masses.

Kennedy's article notes rising international tensions with tariffs imposed on imports of Chinese EVs and EV batteries by the United States and European Union, and tallies vast Chinese government support for the country's burgeoning EV sector over recent years.

China’s trading partners argue that these tensions are the result of Chinese industrial policy and unfair trade practices. China argues that its growing exports reflect the country’s natural comparative advantage and the high quality of its companies’ products. The reality – and what makes this a difficult challenge – is that there is some truth in both perspectives. Chinese EVs have benefitted from massive industrial policy support, and their quality is improving, making them attractive to domestic and overseas consumers. An effective response by the U.S., Europe and others must take account of both facts.

Kennedy makes the very valid point that China's EVs are good. If they weren't the West wouldn't be so concerned. My sister-in-law bought a BYD earlier in the year. And from what I can tell Kennedy's right. It's a nice car.

If Chinese EVs were pieces of junk, then they would not be a serious challenge to the rest of the world’s automakers. For many years Chinese auto firms languished far behind the global trendsetters in Europe, East Asia and North America. But Chinese firms have narrowed the gap in autos in general and moved ahead in EVs.

5) Private jetting away from a firestorm.

A fire rips through 300,000 square metres of a rocky island during a heatwave amid allegations the fire was started by fireworks launched from a superyacht, or by people from the yacht who went ashore. Authorities arrest 13 crew members from the luxury yacht, while the passengers, guests, aboard the yacht leave the country via private jet. This, according to the Organized Crime and Corruption Reporting Project (OCCRP), is what has recently played out in Greece.

The fire was on the island of Hydra.

"The municipality is waiting for the final result of the investigative process to take action against everyone responsible and claim compensation," Giorgos Koukoudakis, the mayor of Hydra, told OCCRP’s Greek member center, Inside Story.

Guests on the yacht, the Persefoni I, included seven Kazakhs, according to a manifest obtained by journalists. Among them were Daniyar Abulgazin, one of Kazakhstan’s richest men.

The day after the fire, flight records show that a private jet regularly used by Abulgazin left the Athens airport and flew to Almaty, Kazakhstan’s biggest city.

Marine tracking data shows that the yacht the Khazaks were aboard was off the coast of a remote area of Hydra at the time of the fire, although Greek officials have not publicly accused them of starting it.

According to subsequent reports, Greek prosecutors have now charged eight Kazakh passengers aboard the yacht, Persephoni, which can be rented for €250,000 a week, with complicity in arson. The yacht’s captain and first mate have been detained, with other crew members released on bail. bulgazin, described by the BBC as a major figure in the Kazakh petroleum industry, rented the yacht. Abulgazin says neither he nor his guests did anything that could have caused the fire. He has promised to cooperate with the investigation. Kazakhstan has no extradition agreement with Greece.

5+1) Marking their own homework.

A late edition here from The Australian Financial Review. In a Top 5 last month I featured what was described as "Wall Street's buzziest asset class," private credit. Now, the AFR's Aaron Weinman and Jonathan Shapiro have written about what they describe as "Australia’s $200 billion unregulated private credit boom."

High returns, high fees – life is good in private credit. A once unloved investment class has turned hot property as cashed-up families and asset managers chase yields from floating-rate loans that have risen in lockstep with interest rates.

But behind the euphoria and the rush – firms from David Di Pilla’s HMC Capital to Phil King’s Regal Partners are piling in, bringing new products to their backers – is plenty of disquiet.

It sounds interesting, shall we say.

An investigation by The Australian Financial Review has found evidence that funds are reluctant to write off badly performing loans – and tell those invested. Others are paying themselves in fees more money than they hand over to investors. Some are even lending to companies that promptly go broke, raising questions about the thoroughness of due diligence.

Like banks, private credit funds lend money. Rather than raising money through deposits, they source it from investors seeking higher interest rates on their capital and loan money to businesses and property developers. The sector has grown since the Global Financial Crisis, the AFR reports, with investors generally wealthy people seeking high returns on their savings without the volatility of share markets.

And as base interest rates have gone higher, more investors and large institutions have been lured by double-digit returns.

Private credit funds are loosely regulated, particularly if they are sold to so-called sophisticated investors where disclosure requirements are limited.

From a financial stability perspective, the Reserve Bank of Australia says private credit's not big enough to worry about.

The AFR quotes Blackstone’s head of private credit in the Asia Pacific, Mark Glengarry, saying the Aussie market lacks the transparency of the US, with some private credit funds "marking their own homework" rather than having independent third party valuations.

Then there is the question of fees. There are plenty of private credit funds charging an upfront arranger’s fee to the borrower – which the fund manager keeps. While these fees happen overseas, they are usually paid directly to the investors to avoid potential conflicts of interest.

Watch this space.

23 Comments

Supply and demand dynamics, plus supply shocks caused by the massive disruption of the Covid-19 pandemic and Russian dictator Vladimir Putin's invasion of Ukraine, contributed noticeably to global inflation.

And who could forget "The Secret War" - 'the history of America’s secret war in Laos.... the CIA-led campaign that made it the most bombed nation in history, the effects of which are still felt by Laotian Americans today.' Just one of many others.

https://www.nbcnews.com/news/world/preserving-history-americas-secret-w…

Operation Gladio, Operation Timber Sycamore, Air America, Bay of Pigs, Operation Northwoods, etc. And these are just a few of the ones we know about publicly. God knows what else they've been up to over the years.

When questioning Gisborne rents it may be worth considering what happened to Canterbury rents post quakes when their rents were (often) paid by insurance policies and emergency support payments from gov and community groups...have a look again in Sept or Oct when those payments have run their course.

After the Chch earthquake there was also a lot of rental houses that were shifted from long term rentals to the furnished short-medium term rental market which rented for higher rates, as people had to move out of their homes while they were repaired.

Also, we should have learned by now that when you dump hundreds of millions of dollars into a small area, inflation happens.

the result of Chinese industrial policy and unfair trade practices

the point is that, other countries could have had industrial policies too, but they didn't. now when Chinese EV industries has grown to be competitive, and suddenly it's 'unfair'.

It's impossible to overestimate the USAs capacity for self righteous hypocrisy when telling others how they should behave while doing the opposite themselves.

cf. Tiktok

Can you TikTok in China??

The Chinese version, Douyin, is very similar to Tik Tok but a completely separate system. The Chinese don't tolerate on Douyin the youth destroying perverse crap that is permitted on Tik Tok. Something worth thinking about.

And it's not like the US and EU don't subsidise their car manufacturing industries too.

There's a variety of reasons that things are cheaper to make in China than the West, cars are just joining the mix

Exactly. Japan, South Korea and Taiwan also had strict and effective industrial policies where their industries were heavily protected and subsidised until they were competitive enough to compete internationally.

Between 2018 and 2023, Gisborne had a population growth of 7.5% and a net increase in dwellings of 4.5%. Auckland by comparison had a population growth of 5.5% and a net increase in dwellings of 12%. These two facts are of course linked - high rents / house prices in Auckland and changes to zoning encouraged lots of building in Auckland between 2017 and 2020, but people then up and left Auckland in large numbers during COVID - with many returning home to families in the regions.

One thing not to miss though is that Gisborne is one of only a couple of places in the country that are broadly weathering the recessionary storm (Hawke's Bay is another). Anyone that can hold a shovel can get work there at the moment, and insurance / Govt money is keeping the local economy moving (just).

What this means is that you have the perfect recipe for rent boom:

- A larger population

- Higher disposable income across that population

- Short and inelastic supply of rentals

People often focus on (1) and (3), but (2) is really important.

This recipe means that people bid the price of rents up as they commit as much of their disposable income as they can to keeping their landlord in pinot.

People sleeping rough at the Gisborne railway station. Lucky it has a long platform and shelter.

3 - some folk take advantage at these times; Naomi Klein's Shock Doctrine is an excellent read.

5 - 2008 on steroids.

Hold onto your hats....

Have you ever noticed that despite the green/red govt banging on about CC, the 40000 state houses are by and large barren of plants

Incentivise the tenants to plant something and achieve two goals. Supply the plants

Did Jfoe ghost-write section 3?

Lol. I assume Gareth reads papers by economists that actually know what they're talking about.

NZ is in a housing crisis, and this government has done only a little to address it, e.g. granny flats:

a) 100,000 homeless* (* this is wider definition than those living on the streets ex HUD)

b) highest rents/income ratio in OECD (NZ). Gisborne will top this NZ average ratio

c) approx 25,000 on the social housing waiting list & only 1,500 social houses committed over next 3 years

d) approx 1,500 in emergency housing

e) unsustainable net inbound immigration rate run by successive governments

f) house price /income ratios still roughly 40%-60% higher than the 3-4 target

You do know how a - f was finally achieved though...?

Hint: the current Govt has been in power just 9 months, remember who was in Govt the previous 6 years

...creating buffer stocks of food, energy, and raw materials to protect against future supply shocks.

Well there's already a strategic oil reserve, we could easily add food and other commodities.

The problem is most of these aren't real reserves, they are backed by paper futures in international markets. In the event of a major event, like a major war or volcanic winter, I think you'd learn a lesson in counterparty risk. You'd pick up the phone and the company recievers would have an automated voicemail message.

'Much of NZ’s 90-day oil reserve is actually held overseas through ‘ticket’ supply contracts. The rest consists of on-shore inventories held by oil companies.'

Good luck with that...

yeah it's madness. Singapore has done well from this model though. It happens to hold much of those physical reserves for other countries.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.