Air New Zealand (AIR) is not offering any profit guidance for the new financial year after a year just completed in which it made, to all intents and purposes, no profit in the second half.

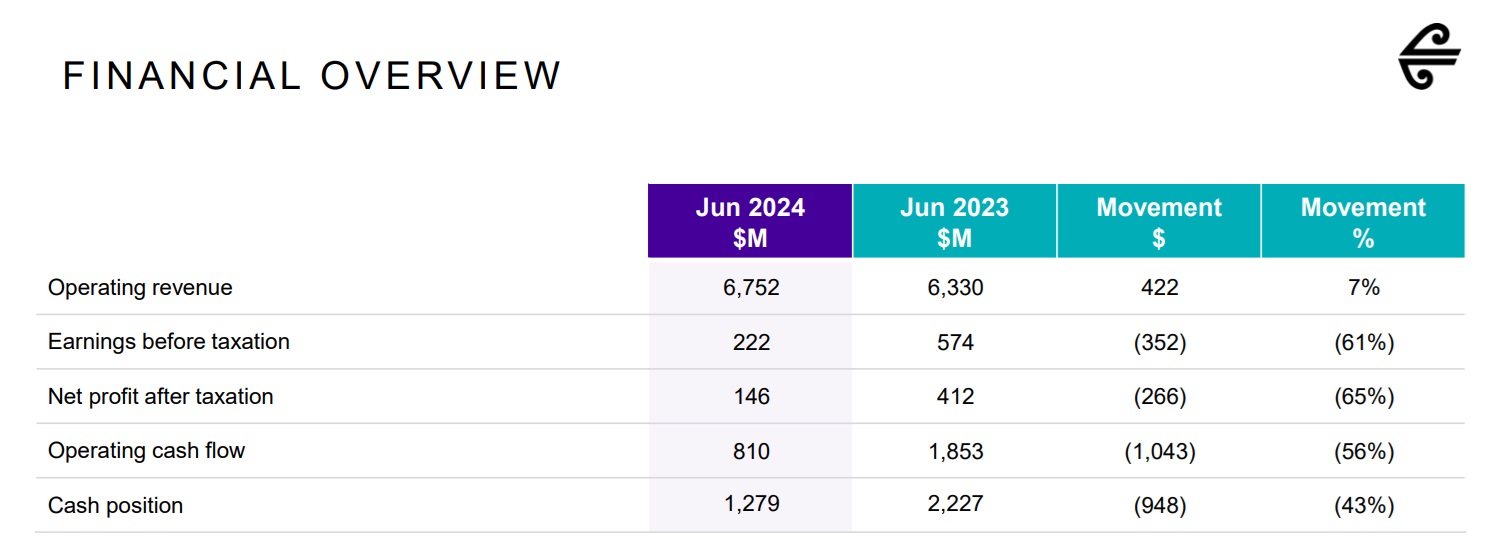

Our national carrier has reported a plunge in after-tax profits to $146 million in the year to June 2024 compared with last year's second-highest ever profit of $412 million.

In the first half of the 2024 year the airline reported after-tax earnings of $129 million, but it had warned of "markedly lower" profits for the second half.

The picture would have been worse if Air New Zealand had not included $90 million of "credit breakage" for unused customer credits - mostly related to Covid-period cancellations - that the airline said were "considered highly unlikely to be redeemed". (The airline still has about $96 million of these 'flexibility policy credits' with an expiry date of up to January 31, 2026 outstanding and says they "could potentially be subject to further breakage either in FY25 or FY26".)

The airline is paying a final dividend for the year - of 1.5c a share - "based on the airline’s balance sheet strength and the result announced today", making a total payout for the year of 3.5c a share.

In highlighting some of the challenges it faced, Air New Zealand said the tougher economic backdrop in New Zealand drove a deterioration in domestic demand in the second half, particularly for corporate and government segments.

"Accelerated maintenance requirements for Pratt & Whitney PW1100 engines worldwide have meant that up to six of the airline’s newest and most efficient Airbus neo aircraft have been out of service at times. Ongoing additional maintenance requirements on the Trent 1000 engines that power the existing Boeing 787 Dreamliner fleet and reduced levels of spares in the market have meant that up to three Dreamliners are also on the ground at times.

"These issues, alongside elevated competition from US carriers and the cumulative effect of high inflation, have had a significant impact on the airline’s operational and financial performance for the 2024 financial year."

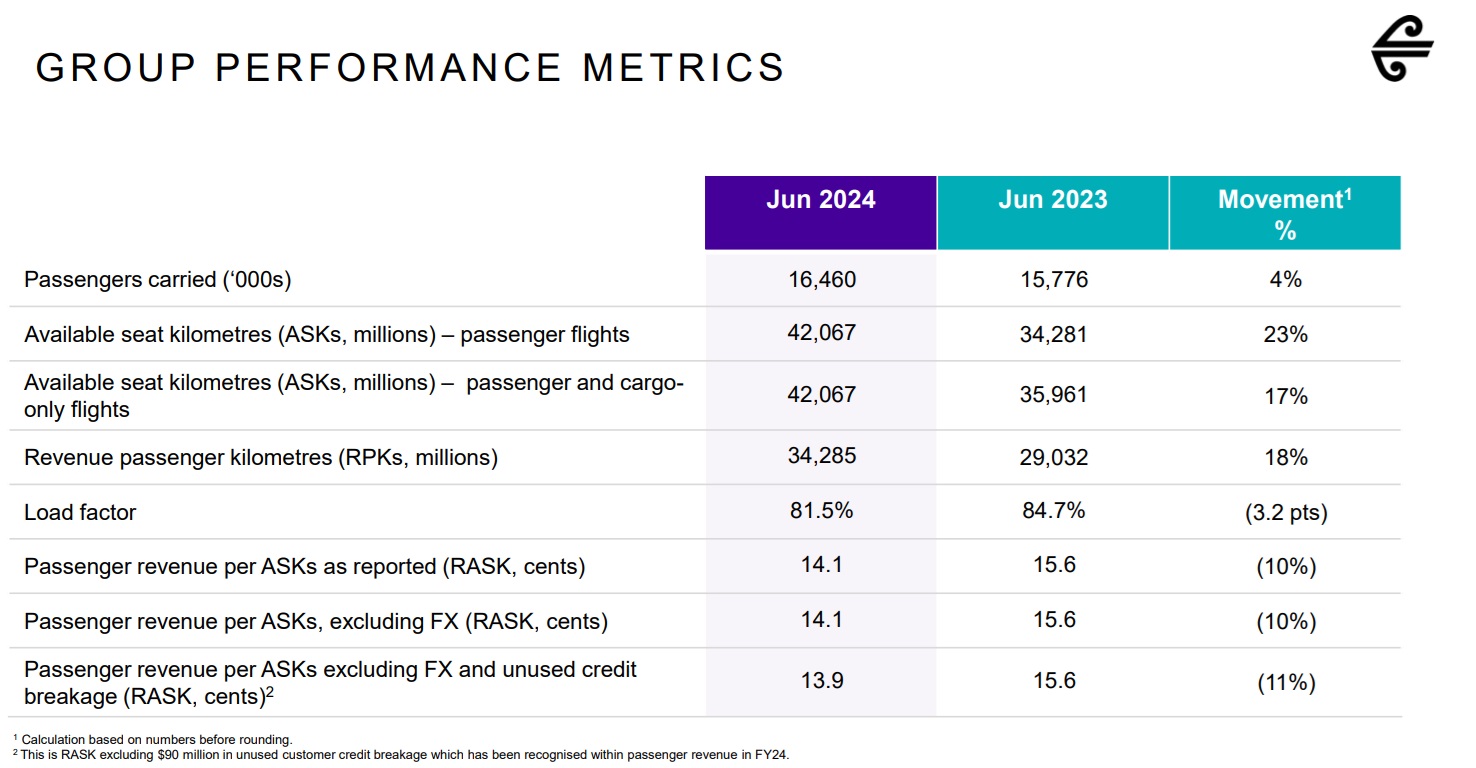

Air New Zealand's passenger revenue increased 11% to $5.9 billion, driven by a 23% ramp-up in capacity, primarily across the international long-haul network. "This was partially offset by the weaker demand environment and higher levels of competition."

The airline said while average jet fuel prices were slightly lower for the year, total fuel costs increased by around $190 million, driven by capacity growth across the network.

"Non-fuel operating costs increased faster than revenue, also driven by the increase in capacity, as well as broad based inflation across the cost base.

"Non-fuel operating cost inflation of approximately $225 million was a significant drag on the airline’s financial performance. With landing charges, air navigation fees and engineering materials leading the increases, the non-fuel operating cost uplift of 6% for the year brings the cumulative impact of inflation across the past five years to 20%-25%.

"While growth in the network has provided some scale benefits, productivity remains below the levels achieved pre-Covid as the airline carries extra costs to help manage ongoing disruptions in the supply chain."

Air New Zealand chair Therese Walsh said without such challenges the company's pre-tax earnings of $222 million (down from $574 million last year) "would have been around $100 million higher, net of compensation, had we been able to operate our aircraft and schedule as intended".

The airline's key operating metric of revenue per available seat kilometre (RASK) dropped overall by 10.9% from the high levels that were seen 12 months ago as the airline then enjoyed the post-Covid 'revenge travel' boom.

However, RASK on Air New Zealand's domestic operations improved 2.1% in the latest year.

Air New Zealand chief executive Greg Foran said a key priority for the company continues to be delivering "excellent customer service and a range of competitive fares".

"This requires ongoing discipline around our cost base, and you will see us make targeted adjustments, including around a 2% reduction in headcount [total headcount is currently given as 11,700], as well as pursuing improvements in the controllable cost base," he said.

The airlne remained "committed to investing for the future", with expected aircraft-related capital expenditure of $3.2 billion over the next five years.

"This includes a significant, multi-year interior retrofit programme on our 14 existing Dreamliner aircraft. We anticipate delivery of the first new GE-powered Boeing 787-9 aircraft towards the end of the 2025 calendar year, which will provide options for continued growth, cost efficiencies and network expansion opportunities."

Air New Zealand was "focused on operating effectively through the current economic and operating conditions, which are expected to continue through the first half of the 2025 financial year", Foran said.

In its brief 'outlook' section, therefore, Air New Zealand says it has outlined a number of trading conditions that have significantly impacted the result for the second half of the 2024 financial year, in particular the tougher economic backdrop in New Zealand driving softness in demand, the cumulative impact of inflationary cost pressures, the impacts of aircraft availability issues and significant competition on its US network.

"Air New Zealand expects these trading conditions to remain similar through the first half of the 2025 financial year. Given the ongoing uncertainty, the airline is not providing guidance at this time."

22 Comments

I guess this is reflected in the current share price. Ouch!

Time for another Rights Issue at, say, 21 cents then?

They can amend the same template from the last one at 53 cents in 2022!

"a two-for-one pro-rata renounceable rights offer at 21 cents apiece, a 61% discount to the $0.54 current share price"

Having dealt with their obstructive back office staff over a corporate account, I have little sympathy for them.

I'm sure they'll do their best to make it back by reaming regional travelers.

The problem is easy to see.

Auckland to Shanghai $800 rtn with Chinese airlines.

Auckland to Shanghai $2000 rtn with Air NZ.

Problem is not so easy. Even if the prices were switched, you would still purchase a flight with the alternate airline.

A couple of the big issues I see are,

- Fare types - they are trying to be both a budget airline and a full service. Pick one and do that better. If I want full service, there are better options, if I want no frills there are cheaper options.

- Explicit exclusion from CGA and other consumer focussed legislation. The consumer needs more protection. EU and US consumers getting refunds where Kiwis can't.

- Rorting of the regions. They loss lead until the competition is killed off.

- General treatment of consumers - they suck to fly with.

- Shoddy airports, and general air travel issues - flying as a whole sucks now with anyone. Cramped seats, tortuous queues, overzealous border control.

100% agree. They have become lazy and complacent in their approach to service provision and have fallen behind the competition. They no longer offer a point of difference while charging like they still do.

Yes, trading on reputation, without realising they lost it a decade or so ago.

In addition. The change in baggage allowance was a terrible move. Based on number of pieces rather than weight.

I've flown internationally with Qantas regularly because of this and its been an amazing experience and far cheaper.

Despite there being no Singapore airlines credit cards available in NZ it is extremely tempting to join the PPS club instead of Air New Zealand simply because as we transition from a young family that flies economy to a middle aged one that flies business the Singapore airlines program just has more useful perks and the Singapore airlines business class product is simply superior on all routes from NZ to Asia, Africa & Europe. Air New Zealand’s niche of economy travellers who want something better than a budget carrier doesn’t really leave much room for margin, except on routes with little to no competition.

Air NZ's getting smaller and smaller.

It used to service such destinations as Frankfurt, London, Buenos Aires and Bangkok. But no more, just a Pacific carrier, beset with engine problems.

Middle Eastern carriers are picking up the slack. I've just been to Paris, and back from Brussels on Qatar Airways.

Out of curiosity, when did Air New Zealand fly to Bangkok? I've had a long association with Thailand going back 30+ years and don't ever remember Air New Zealand flying there. Was it before the mid '90s?

They flew there in the 767 from Singapore.

One wonders if Willis's Budget spreadsheet had the reduced profits (and taxes) from Air NZ factored in.

[Gets out calculator]

- 2% reduction in headcount

- total headcount 11,700

234 more jobs gone. Edit: And that's just directly employed by Air NZ. How many will go at Air NZ's suppliers?

Hope it keeps falling I'm looking to buy it a bit lower....

Layoffs and future rehires are the pattern in Air NZ over decades - predicably so.... Its a super cyclical business, but likely needs restructure internally to align revenue and expenses to maintain a sustainable profit and appropriate service level

Air NZ is great - especially their happy hour flights - but domestic flights are expensive relative to international travel (cheaper to fly to gold coast than AKL-CHC sometimes) - especially to regional areas and unlikely to sink into bankrupcy with the government as a major shareholder

I thought Air NZ was on the cusp of becoming a major carrier a few years ago when the current PM was running the show. Alas, more problems with engines, pulling out of destinations like London.

Air NZ pulled out of Frankfurt and they had 100% load factors. Unbelievable.

I wouldn't throw any of my cash at it. Decades of terrible management. With one exception, when Luxon was boss. And another one...Ralph Norris.

Norris rescued Air NZ after Brierleys destroyed it. But to be fair, many carriers have different labour laws than NZ. Like retirement age and taxes.

As recently as 5 or 6 years ago they were actually my preferred carrier.

You do remember it was Luxon that pulled out of London...

Lets get this right, Luxon took over from Fife, he brought Airnz into a first class airline with great culture and replaced all the planes to new nice cabins. Luxon cut everything and milked what Fife did and then quit, what did Luxon actually achieve?

He achieved millions in bonuses by cutting everything and making short term decisions that maximised profits during his tenure...likecyou said,Norris and Fyfe did the mahi,Luxon cashed in.

Fife was all about being a showman, he cashed in on Norris's achievements.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.