The retail spending slump is getting worse, with sales figures falling for the fourth consecutive month - and the latest fall is the biggest of the four.

Statistics NZ says that on a seasonally adjusted basis, total retail spending slumped 1.1% in May 2024 compared with April, while 'core' retail spending - which excludes fuel and vehicles - fell 0.8% on a seasonally-adjusted basis last month.

This worsening slump in spending comes following a period of sharp price rises and now amid the high interest rates that have been engineered by the Reserve Bank (RBNZ) as it strives to get inflation back into its 1% to 3% target range. The higher cost of living and the high interest rates are clearly taking their toll, and with the RBNZ currently forecasting that it won't be reducing the Official Cash Rate (at 5.5%) till the second half of 2025, there's no immediate respite in sight.

In the past fourth months the total retail spending figure movements have fallen by, in order, 0.8%, 0.7%, 0.4% and now 1.1%. So, the latest month is the worst in that sequence and is the worst since the 1.3% fall in December of last year. Apart from a surprise 1.0% rise in January of this year, it's been downhill all the way for retail sales in 2024.

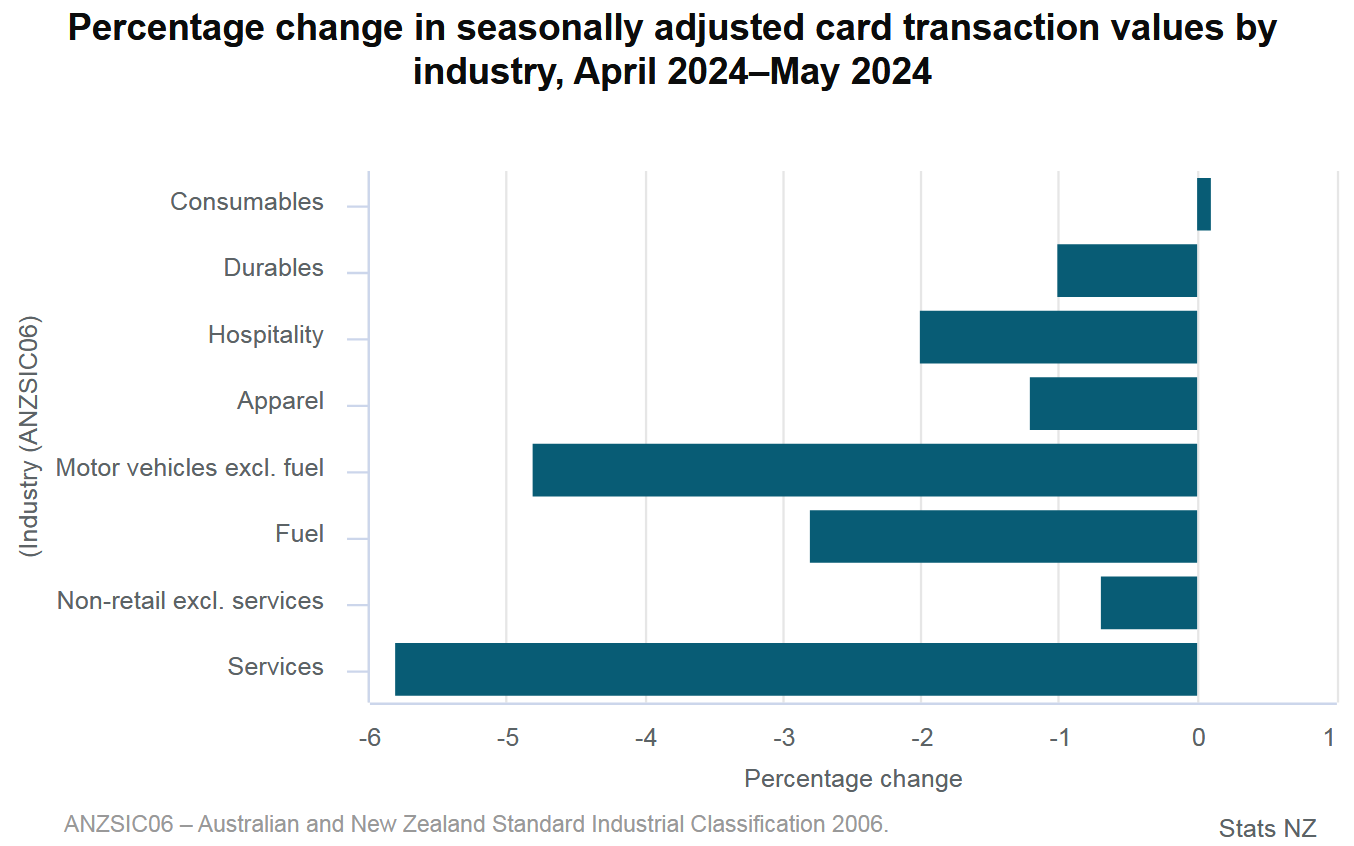

Stats NZ said specific movements by retail spending category in May 2024 (seasonally-adjusted) included:

- hospitality, down 2.0%

- fuel, down 2.8%

- durables, down 1.0%

- motor vehicles (excluding fuel), down 4.8%

- apparel, down 1.2%

- consumables, up +0.1%

Comparisons with a year ago are pretty unflattering as well.

The May total retail figures were down some 1.6% on those for May 2023. The figures aren't inflation adjusted so, all things being equal should rise from year to year. Annual inflation in the year to March was running at 4.0%.

Westpac senior economist Michael Gordon said retail spending levels have fallen over the last year despite some strong population growth, "which points to an even sharper fall in per-capita spending".

"In large part that’s been a result of continued increases in living costs that are squeezing households’ spending power. Those pressures include increases in the costs of necessities like rent and utilities which are draining cash from households’ wallets, even though we’re now seeing more modest increases in retail prices," Gordon said.

"We expect household spending will remain soft over the coming months. Households’ budgets remain under pressure from continued high interest rates and still-high inflation. At the same time, the labour market is softening. Those conditions mean that spending appetites are likely to remain weak for some time yet. On the more positive side, income tax cuts may give spending a temporary boost through the back half of the year."

ASB senior economist Kim Mundy said New Zealand’s retail environment "is very weak".

"Households are battling rising cost of living pressures (including higher mortgage interest rates) and have pulled back spending as a result.

"More recently, the weakening in the labour market and rising unemployment rate [to 4.3%] has added to consumer caution. Indeed, consumer confidence has retreated again in recent months," Mundy said.

"With headwinds facing consumers unlikely to abate any time soon, we expect to see more of the same over the coming months. Tax changes may not provide too much relief if cautious consumers opt to save a chunk. Weak consumer demand is a prerequisite to RBNZ rate cuts, but at this stage, it’s proving slow to translate into sustained lower inflation. OCR cuts will remain a distant prospect until inflation cools further."

Stats NZ said the non-retail (excluding services) category decreased by $16 million (0.7%) from April 2024. This category includes medical and other health care, travel and tour arrangement, postal and courier delivery, and other non-retail industries.

The services category was down $22 million (5.8%). This category includes repair and maintenance, and personal care, funeral, and other personal services.

The total value of electronic card spending, including the two non-retail categories (services and other non-retail), decreased from April 2024, down $81 million (0.9%).

In actual terms, cardholders made 164 million transactions across all industries in May 2024, with an average value of $55 per transaction. The total amount spent using electronic cards was $9.0 billion.

89 Comments

I can hear a whoop whoop noise coming through the cockpit doors?

Maybe a hermit on a mountaintop might be surprised and unaffected. The powers that be,crashed dived interest rates, encouraged folk to borrow to spend, got that well underway and then strapped interest rates to a rocket. At the same time the RBNZ wilfully printed money and the 6th Labour government wilfully spent it, either with neither thought nor care to inflationary consequences. And here we all are now, over extended mortgages and empty pockets.

Some of us sold assets at the top and got rid of debt so that they could take advantage of the coming bust......

Not Spruikers though as they never sell.....

not sure how they take advantage of the coming prices?

What's your plan to take advantage IT? When will you buy?

He’s done that already; when nobody noticed and everyone was debt binging: “sold assets at the top and got rid of debt so that they could take advantage of the coming bust......”

He will buy at the bottom of course, because he's the only person in the world who knows when the top and bottom are without the benefit of hindsight.

Doesn't really matter whether the bottom is just that you buy as green shoots take hold - there is rarely a rush at that point and it's a long way off.

Taking accoun of inflation and our exchange rate we are 30%+ down from the peak. I reckon 20% to go to hit prices people want to pay in a prolonged recession

Yes, sold or own (previous) house with mortgage at the top, looooong settlement and bought back in without mortgage when the market was on a slide and loan market gridlocked. House purchased had multiple offers 5-10% above asking price and all fell through. Scooped it up for 7% below asking price.

It kinda sounds like you believe this to be an issue unique to NZ. You are aware that many other countries 'printed money' and experienced high inflation, right?

Indeed. Many countries made the mistake of simultaneously stimulating aggregate demand through both fiscal and monetary policy with insufficient coordination between the two branches. There should be lessons here for a lot of monetary and fiscal policymakers but most refuse to admit it. But just because others made the same mistake, doesn't make it less of a mistake.

Few countries however:

1) stimulated it to the same extent,

2) were forced to raise interest rates as fast and as quickly,

3) have experienced the same deep per-capita recession,

4) and have experienced inflation as deep, persistent, and domestically driven (non-tradables) as New Zealand.

Heck, on top of all of that, Europe had one of it's key sources of energy cut off when Russia invaded Ukraine. Talk about inflation! ... and after the economically crippling removal of Russian gas, Germany has sub 3% inflation rates...

Yes but Finance Minister Robertson persisted in assuring us all that not only was inflation transitory it was imported. Would imagine he is likely still stuck in the groove of that even today.

Yes....but he didn't know any better. He wasn't really that bright when it came to mathematics or economic type things. He managed to borrow and spend 100b in exchange, for well, almost nothing. He was successful in making the price of everything go up, and making his supporters poorer. Very good at that he was. Now he is off to ruin one of the better Universities in NZ and getting well paid for that too.

He managed to borrow and spend 100b in exchange, for well, almost nothing.

Sure, if you believe the economy would be in exactly the same place as it is right now, without the government wage subsidy programme during the COVID lockdowns, then indeed nothing was achieved with that money.

If, however, you realise that the economy would be in a far worse state with unemployment a lot higher, then you realise a lot was achieved with that money.

Contradicted somewhat then by RBNZ stated policy involving leveraging unemployment up as a tool to combat inflation. Well that aligns with the May 2023 Monetary Policy Statement for example.

If, however, you realise that the economy would be in a far worse state with unemployment a lot higher, then you realise a lot was achieved with that money.

Very few people are aware of the potential counterfactual if the government stimulus had not occurred.

Whether it was spent effectively is an entirely different question.

He didn't spent 100b on COVID. 100b was borrowed and spent sure, but not all on COVID. The amount spent on subsidies etc was less than 20b. The rest was borrowed under the guise of covid but mostly wasted.

Such as identified by the Auditor Generals scathing report in December 2023 concerning $15 billion infrastructure spend up, uncontrolled, purposeless and unaccountable. Well at least ex Finance Minister Robertson could only agree and did begrudgingly apologise before he jumped ship.

And....Germany makes and sells stuff the rest of the world wants to buy aka they have pricing power. Milk Powder and logs obviously are lacking that.

Are you saying no one wants to buy milk powder and timber ?

You skipped over the "aka they have pricing power" part.

Many countries made the mistake of simultaneously stimulating aggregate demand through both fiscal and monetary policy with insufficient coordination between the two branches.

But as I understand it some countries did co-ordinate fiscal and monetary policy by implementing communist style restrictions like rental caps and excessive profits tax and price caps, stuff that would have been unacceptable here on ideological grounds as being too left wing. And it could explain why they bounced back quickly.

Jfoe and CONF can explain better than me.

There were freezes on rents increasing during lockdowns here was there not? Many sold their homes and stuck not being able to move into the new one, unable to get renters out to move in themselves due to being unable to evict anyone? Sounds ideological and draconian to me. Where I have a stick, is the likes of supermarkets and banks getting huge profits form getting an unfair advantage during lockdowns over other businesses who were unable to open by force of government, that are now still reaping record profits and having absolutely no handicap added by govt.

Completely agree: NZ must go through a difficult and unpopular transition to get rid of excessive printed money and wasteful, over-abundant government spending. Loosen the reins too quickly, and NZ will be back to square one.

Watching recent political polls, Kiwis seem to have a remarkable short and selective memory when it comes to the parties that deliberately have inflicted all the damage. Instead of focusing on re-distribution of the already dwindling wealth via all sorts of proposed new taxes, NZ should reinvigorate its economy into an innovative, competitive and flexible powerhouse comparable to the ones of Singapore, Scandinavia, South Korea, Switzerland and the Netherlands. That should be the priority of this government and will go a long way to fixing the economic and societal issues that we are facing now.

But no one has any money? So that printed money has gone where? This article say retail spending down. If so much money was printed then shouldnt we all still be spending more?

I think a lot of people spent / overspent in 2021/2022. I put myself in that category. And I have most definitely shut my wallet over the past 6 months.

Luckily when I spent in 2021/2022 it was *mostly* on essential things like clothes, key home appliances etc. which means I won’t suffer from not buying these sorts of things in the next 1-2 years as I am well stocked

Not my experience at all. I shut my wallet as soon as COVID hit because it was obvious that shutting down the global economy would have negative repercussions. I have plenty of discretionary money todat. Furthermore there are absolute bargains to be hard on home appliances, retail clothing ect. But I still do not understand the argument that because money was printed we now need to raise interest rates because everyone had it too good. What I seen during covid was all of the money going to the very top and those in the middle were crushed. Our material lives did not change one iota. We have been in a cost of living crisis since 2021 haven't we?

In fact even if people overspent in 2021 as you argue, how has this lead to a cost of living crisis.

But I am not arguing that people spending up in 2021-2022 has solely lead to a COL crisis. Although it was a contributing factor. As it contributed to inflation.

As JFoe argues, much of our inflation was imported.

Ok fair enough, I will ask though, do you think that a contributing factor to the COL crisis today is due to peoples overspending several years ago. If so how has that come about?

Yes. Post- covid lockdown splurges were undoubtedly inflationary. That contributed to soaring interest rates which are a significant factor in the COL crisis.

Ok but what sort of things are you saying people splurged on?

Property for a start! And home renos. Cars

I don’t know what the data says but I know I and many of my acquaintances spent a lot on hospo post-lockdowns.

You know, actually being able to go out and eat nice food at nice restaurants.

Don't forget everyone buying up o larger items like fridges etc etc due to constantly rising prices. Buy now when retiring so you don't have to pay 20% more in 12months time.

It is very clear where the money is!!! Total NZ bank balances have increased by around $70bn since March 2020 and private sector holdings of NZ Govt Bonds have increase by around $70bn. This total is about the same as the increase in mortgages and govt debt. Why? Because the former is a consequence of the latter.

Now, what could we do to balance things out I wonder?

Excellent comment.

My friend shut down a chain of furniture stores a year ago because this was just starting. Smart move!

Family of 3 here, teenage kid. We get given a lot of clothes for him and since Christmas I've bought new:

Basketball shoes for junior, 70% off.

A t-shirt from farmers clearance rack.

Some fire stuff as we were running just a heat pump but trying the fire this year for fun.

2 very cheap pairs of prescription glasses for junior.

Racking my brain here... maybe some pegs? Oh yeah, a new pillow for guests. Again, clearance.

Living large.

I live in work clothes or Ridgeline Fleece

Maybe I should show both your posts to my wife, LOL

Crank that fire, you'll never get a better heat on a freezing day. Gotta love the smell of Macrocarpa and gum

No house equity to stick the lifestyle on..who saw that coming...and yet still today I see ads for a holiday company urging people to stick it on Laybuy. I know who I wouldn't want to get Layd Buy.

I suspect laybuy are turning down a lot more applications these days.

Who needs layby when you have Temu and Aliexpress these days.

Love AliExpress there is always something I have on order with them that's on the way. Not everything is way cheaper on there, recently looked at 2 core cable but bought 30 meters on a roll locally.

Amen, and they wonder why retail spending goes down in NZ when you can order so much for a fraction of the cost from overseas . With purchasing power being eroded by the day, price is king.

Ran this by the water cooler crew. Mixed responses from the ubiquitous 'yeah nah' to someone reckoning many craft beers are overrated anyway. Personally I'd like to see iPhone sales growth - value, volume, and velocity.

As a certified BCJP beer judge I agree about some so called craft beers. I have seen a massive supermarket shelf reduction even at pak n save, suggest people moving to faux craft 6packs like boundry rd....

I was lucky to be invited to a tasting of Dom, Krug and Cristal. A connaisseur described each champagne at length, until we almost fell asleep. Then, finally, we blind tasted them, the connaisseur got 0 correct ! LOL

Far too many hazies around for at least 2 years now, I overdid them before they even became huge here (brewing a couple of tasty 6.5% batches does that). Bring back the bitterness please! I'd love to see more styles represented in NZ like Marzen (Oktoberfest), porter and stout, and more British ESB's.

. double post

"The May total retail figures were down some 1.6% on those for May 2023"

Anyone want to calculate what that is adjusted for inflation and population growth?

Add 4%

That covers inflation, what about population growth?

Another 2.3% I believe

PB Tech stocks products I'm willing to buy. Maybe other retailers could try the same strategy?

While I'd imagine the majority of the decline in retail is owing to the customer facing a financial beating, I do think that a lot of Kiwi retailers seem to miss the mark on ranging, and also having a willingness to move on poor selling stock even if it's being sold for less than you'd like.

I recall working in the "back office" for a leading NZ retail group (whose useless CEO has not long resigned) and in my business unit one of the merchandisers had purchased several hundred thousand dollars worth of parallel imported, several seasons old Adidas apparel ... the sort of stuff you'd find a stereotypical East European gangster wearing.

Rather than saying "whoops this was a mistake" after it didn't sell and then cutting the price to clear the stock, merch dept. just let it sit with a tiny price cut until it was even more seasons out of date and in the end we actually had to dispose of it (for no money) to free up space.

If you can sell an entire retail chain for a dollar. Why not a few tracksuits for a dollar?

Because the tracksuit is useful ,whereas the retail chain will be losing its buyer tons of money.

Same goes for supermarkets. Clearance bakery goods at 30c off??? In the UK they clearence 7 pound items for 50p to get rid of them, where as in NZ they throw good food in the bin. I seem to remember a bloke in Dunedin who was grabbing the 'out of date' bread rolls from the countdown bin out back to feed his flat and was prosecuted multiple times for theft because technically it was still the supermarkets property.

So hospo spending is down around 10% in real terms over the last two years and 6% in the last year.

So RBNZ is crushing inflation, right? That reduction in demand must be sending prices through the floor?

No, sorry, last data (April 24) showed an inflation-exceeding 6% annual increase in hospo prices.

Ah, so hospo must be facing big cost pressures, which are forcing them to cut their profit margins to secure customers? Yes - they are facing rising costs in many areas, but that is not forcing them to reduce profit margins. In fact, margins in hospo at the aggregate level went up from just over 6% in 2022 to around 10% in early 2024 (while demand fell). Margins are now back to where they were in 2019.

Obviously, there are plenty of hospo businesses in trouble, but the idea that this leads to a firesale of pizza and beer (falling prices at the aggregate level) is fanciful. Our inflation is subsiding because import prices are falling and this will, in time, take the pressure off other prices and wages. Now, what could RBNZ do to help tackle the cost of living crisis?

Hospo has a number of problems, firstly people don't have the spare money, and secondly increases in staff and food costs have put the prices out of the range of those that remain with money to spare.

Yes, I agree with all of that. My point is that demand is falling, price growth is strong, and margins are increasing. This combo is considered basically impossible under the economic models used by central banks etc.

you are missing jfoe's point that the high school economics view - as demand dropped prices would drop

does not occur in many NZ service business..... Hospo is already competitive

Oh - the concept of marginal utility. But...prices cannot drop in Hospo unless you have real high turn over. Dropping prices would lead to many going broke.

That's the likely outcome unfortunately. Businesses need to really have a grip on costs now.

Exactly. In the US, price rises moderated as demand went up. Economies of scale, higher spend per customer, etc.

Central bank econ models assume that inflation is a sure sign that the economy is at 'full capacity' - meaning that any additional unit produced will cost more to produce. Clearly this is nonsense. Good job we don't base any important decisions on their reckons. Oh... wait.

Real rock and hard place territory for hospo. For example, I am occasionally partial to a Hell's Pizza (the bases are awful but they have some nice toppings and it's convenient to my place). Sort of thing I might get once every month or so when my wife and I are feeling lazy and we haven't done the groceries.

However, it's the best part of $30 for a pizza now. 2 pizzas and a side is pushing $60, which is just too much for the quality. Of course the quality can't improve or else the margins would presumably erode too much, but if the price went up more I'd be even more into "think about it twice" territory.

Same goes at the local cafe where a scone + coffee - perfect work-in-the-cafe morning tea - used to be $10. But now it's almost $15, and the quality has gone downhill on the food so I just get a $5 long black instead.

Yes, I have heard dozens of stories like this. Hospo, retail, reno firms etc are responding to the downturn by downsizing and scaling back - with relatively minor discounts on prices (e.g. when company sales targets need to be hit).

We've started doing pizza night at a friends who have a cheap gas pizza oven. They make the dough and everyone brings something to add on top, makes for a good and tasty, cheap evening.

I'll bring the bottle of Chianti

Obviously, there are plenty of hospo businesses in trouble, but the idea that this leads to a firesale of pizza and beer (falling prices at the aggregate level) is fanciful.

During Covid, Heineken hiked its prices in ASEAN markets by up to 20%. I was screaming about the risks. They went ahead anyway. Sales dropped off a cliff for HNK and Tiger. Mars Wrigley did the same with Snickers. Same result. This led to fierce discounting to meet sales targets. Coca Cola's prices for Diet Coke didn't change except in stores with higher net-worth shoppers. Sales remained steady.

Many large product manufacturers engaged in shrinkflation - same selling price, smaller size.

How many consumers noticed this covert technique?

Mars and Snickers did this to a ridiculous degree. Both used to be quite satisfying. Now both are tiny, in terrible packaging, and simply not worth the price.

How many consumers noticed this covert technique?

In North America, 59% of consumers notice. People are sensitive to shrinkflation in different categories. FMCG is where people notice it most.

https://foodinstitute.com/focus/report-consumers-taking-notice-of-shrin…

Perhaps as USA has product sizing in excess so in a physical sense they are seeing large items drop in size so easier to spot?

I've actually made a bit of a sport out of spotting sneaky marketing when I do a supermarket shop, I quite enjoy it. An easy spot is packaging that is an odd weight like 190grams, you can pretty much guarantee that it was once 200grams.

But but.... how can the speculords keep putting the rent up?

All full time workers are about to get a $20 per week tax cut. Those unlucky enough to be renters will have that hoovered up by their landlords quick smart. 7 Houses Luxon and his sycophants know this all to well.

Usually by post, although email is common these days.

They can't. Numbers of houses to buy and to rent are high.

If landlords bought at or buy at low prices they can afford to drop rents to win tenants (or face empty houses)... those who can't afford it will be forced to sell at. Low price to those who cashed up or fhb.

how can the speculords keep putting the rent up?

Non owner occupier owners can charge what the market will bear. They can also move their property into different markets to maximise their rental income (especially if under cashflow stress).

1) rent in the long term market

Meanwhile renters will adapt. When rental prices rise, more rent payers squeeze into the residential dwelling.

Here is an example from 2019.

https://www.stuff.co.nz/business/property/109960285/aucklanders-share-b…

Look at what has been happening in South Auckland for many years.

2) rent in the short term market such as Airbnb, etc

3) do modifications to the property and increase rental income

The equity plug has been pulled .... thousands that bought at peak have their deposits wiped out ... (nzh today) Chilling winter with frosty bites ahead for some .

Devastating, especially if they might have to sell.

Depressing that we don’t have any media that present an objective view on property prospects. It’s all about status quo vested interests.

Yeah. But the prices will fall anyway.. sooner or later everyone will work it out.

I reckon renters will start moving for lower rents soon.. and those most leveraged will start to sell at crazy prices just to escape suffering every month.

i had to search for that article.....

This is the original article being redistributed on other platforms / outlets

Thousands of first-home buyers have deposits wiped out | RNZ News

Westpac - lol! Mention increasing rents but not mortgage payments.

And do they REALLY think the tiny tax cuts are going to stimulate discretionary spending when there are so many compounding cost of living pressures???

🤡🤡🤡🤡🤡🤡🤡🤡

Tax cuts are just gonna keep OCR HFL to fight the tax cuts impact on inflation. Total waste of time

This is is a good thing and the only power we have left over this stealing we have been subjected to by Banks,Supermarkets,Building supplys,insurance and other corporates and cartels in this country.

We all have the power to stop this nonsense just all stop spending and hopefully these companies will pull their heads in and stop ripping everyone off.

Use the power you have stop spending that hard earned money.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.