By Mark Tanner*

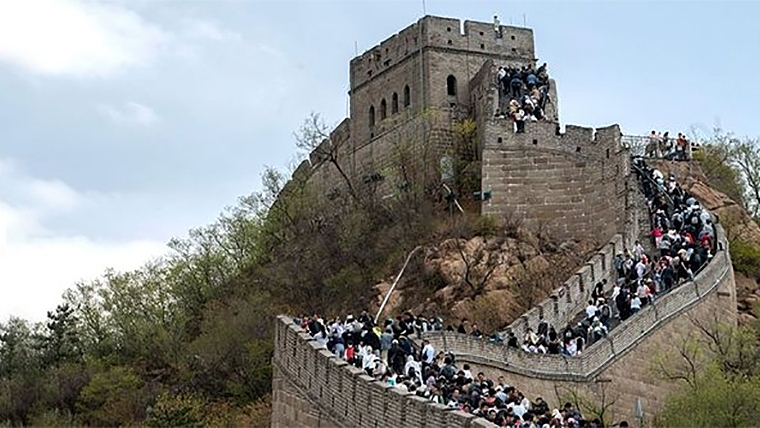

May has started where April left off, with Chinese consumers spending more than they have in a long time - and there has been no shortage of merriment from media and businesses alike. Consumers celebrated the five-day Labour Day holiday by jumping on planes, trains and automobiles to take more trips than they did in the pre-pandemic years. 274 million people went on trips within the mainland – 19% more than the same period in 2019. Chinese flocked back to cinemas and theme park visits have bounced back. Travel spending on Alipay grew 70% and WeChat Pay tripled pre-pandemic levels.

Whilst there’s no discounting the news is positive, the soaring spending on Alipay and WeChat is partially representative of just how many more people are using their mobile wallets to pay for everything since the pandemic. Overall, travel revenue was up just 0.7%, indicating that domestic travellers spent 18% less per person than in 2019.

International travel data was, as expected, less rosy. International flights during the holiday recovered to 40% of the bookings seen in 2019. The lack of overseas flights and subsequent high fares, coupled with the limited supporting infrastructure and backlog of passport issuances, show that it will be some time before Chinese tourists return to the volumes we saw late last decade.

However the interest in travelling abroad was notable. Overseas-related search volumes were up to 60% of the levels seen pre-pandemic, with many not booking put off by the high fares. Of those booking overseas trips, they appear to have shopped around a lot more, with searches exceeding 2019-levels for nine of the top-10 booked destinations. Chinese who travelled further afield paid notably more than before - flights to Europe over the May holiday were up to 80% more expensive than pre-pandemic, with the US even higher still – seeing the less price-sensitive travellers spending more on average than before Covid.

Despite the headline May holiday numbers being not as glossy as they first appear, they represent an overall trend of an uptick in Chinese consumer spending, particularly as other major markets start to splutter. This sentiment is not lost on brands exporting to China. The latest AmCham China survey found some 59% of members expressed positive views on China’s domestic market growth, up from 42% in a survey released in March.

A more comprehensive Alibaba-Censuswide survey of more than 9,000 European exporting businesses found that 70% expect their exports to grow next year. That growth won’t come without challenges. 20% cite supply chain and logistics challenges as the biggest barrier to exporting and 19% believe it is a lack of cultural awareness/familiarity with overseas markets.

Digitalization and online marketplaces are seen by businesses as a key way to expand into new markets and has been a key driver in their overall digital transformation. 61% of companies work with online marketplaces to boost exports and minimize the upfront investment of building out a footprint overseas. That's where China Skinny can assist.

The survey’s 40-page report provides plenty of nuggets and advice for exporters, and how it has transformed businesses and made them more resilient and digital-centric. It’s a valuable read, not just for European exporters, but exporters in general. In an indispensable section of the report, China Skinny’s Andrew Atkinson provides five tips for success in exporting to China, one of which recommends decisionmakers to “get on the ground.”

Since China opened up this year, we’ve seen a spike in stakeholders returning to China. It is one of the most important things a leader can do to see how the market has evolved and support teams and partners on the ground, so we applaud all those getting back up here. From the many visitors we’ve spoken to, and our own experience, we’ve compiled a list of five key things businesspeople visiting China should know. It will be really helpful if you’re planning a trip up to China or know someone who is. You can read the recommendations here.

*Mark Tanner is the CEO of China Skinny, a marketing consultancy in Shanghai. This article was first published here, and is re-posted with permission.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.