Mortgage brokers are growing in significance in New Zealand's housing market with an increasing number of banks' mortgages originated by brokers.

So how many brokers are there, what percentage of loans do they originate at the key banks, and how much money do they make?

Helpfully some of the major banks are quite transparent about broker originated lending. And that's the basis of our new all-industry estimate of the level of mortgage broker fees paid.

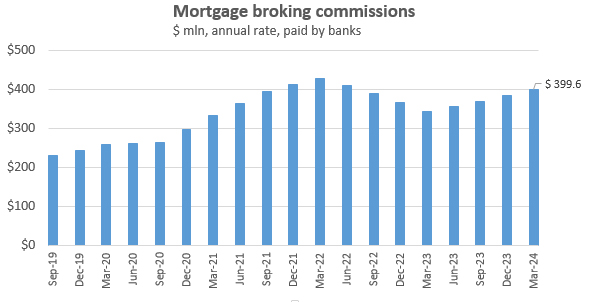

We estimate this industry earned about $400 million in the year to March 2024, a rise of 16.8% from the same quarter a year earlier.

Obviously mortgage lending didn't grow that fast. So why are mortgage brokers' fees swelling impressively?

The answer is banks are doing less direct home loan business with borrowers and more through mortgage brokers.

We should note they prefer to be called "mortgage advisers", and the Financial Markets Authority (FMA) is currently in the process of registering them under that name. Sadly, however, the recent Commerce Commission draft report on competition for personal banking services found, although they should bring better outcomes for their clients, there is actually no evidence this is happening overall. So we are staying with the mortgage broker label. 'Advice' is currently an unproven attribute. (The Commission's 16 draft recommendations include one about broker commissions plus one related to FMA guidance for brokers and their compliance).

To calculate the flows from banks to brokers, we started with the Reserve Bank's C5 "housing loan" data.

From this we can calculate that more than 92% of all housing loans are with the big five banks. This gives us high confidence that what follows is accurate and comprehensive.

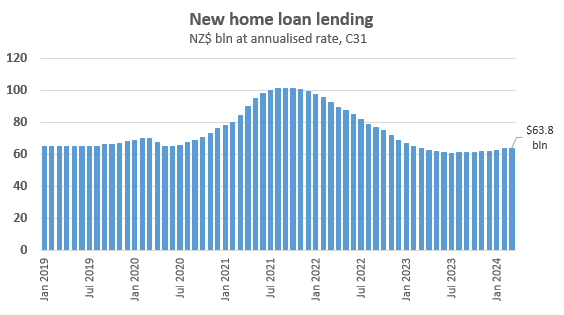

But mortgage broking fees are mostly paid on the "flow" of current transactions. The Reserve Bank's C31 series wraps up this data. ANZ and ASB, the two top mortgage banks, only pay upfront commissions, each at an 85 basis points (bps) rate.

BNZ and Kiwibank pay a 55 bps upfront commission plus a 15 bps "trail commission". That might seem less than the ANZ/ASB rate but the trail is paid for the life of the loan, and not just the current interest rate contract period.

Westpac is more generous, paying 60 bps upfront and a trail commission of 20 bps. And these higher levels means the Red Bank pays brokers nearly as much for their loan generation as ANZ does, almost certainly topping ASB.

To build our understanding within the C5 and C31 sector fencing, we turned to disclosures from the banks themselves.

ANZ is very open. At each group corporate results announcement it discloses the proportion of the home loan portfolio that was broker-introduced. And ANZ discloses the proportion of the recent lending flow that came from brokers. For ANZ NZ this flow is a rather remarkable 61% in the half-year to March 2024. That is a huge step-up over the past five years; in March 2019 it was 41%.

BNZ is equally transparent. For it 'only' 47% comes via brokers currently.

Westpac however is much less transparent, only disclosing portfolio levels at 53%. We use some other metrics to estimate Westpac's flow rate is probably close to 61%, similar to ANZ. (Although just as likely to be a bit more).

Kiwibank has told us separately its broker channel flows, in conversation, but have not released strictly comparable data. We have asked, but it has not arrived yet. We assume the March 2024 half year is at 62.5%, which ties into Kiwibank's earlier portfolio disclosures.

ASB is the least transparent, and probably has the highest broker-introduced levels. That's because it has traditionally had an aggressive home loan strategy which is very focused in Auckland-where brokers are most active. We have asked ASB for comparable data too, and it hasn't responded yet. For this review we assume ASB gets more than 65% of its current home loan flow via brokers, including its AIA channel. We also impute the ASB levels to match the March/September schedule of the other main banks.

All of these levels are sharp increases from five years ago.

So even though new home loan growth itself (Reserve Bank C33) is currently quite low, brokers have done better by writing more market share, and that is bolstering the sector considerably.

Mortgage broking is on the rise. Many of the largest mortgage broker groups are consolidating, and that gives them more negotiating power with the lenders.

We actually don't know how many mortgage brokers there are, but that level will be disclosed soon; the FMA will have a tally when its regime becomes effective. We expect it to be about 2,000.

If that is in fact the level, then the $400 million annual gross commission works out at $200,000 per broker. But just like real estate agents, it's likely a smaller subset does an outsized share of the business.

Further, mortgage brokers do more than just 'advise' on home loans. They also sell insurance, and they broker personal and commercial loans too. Earnings from these other activities are not part of our study here.

We are keen for feedback on this estimate. We intend updating this work every six months, after the latest bank disclosures are released.

*This article was first published in our email for paying subscribers early on Tuesday morning. See here for more details and how to subscribe.

24 Comments

Buyers Retreat Further....

I think you missed the point of this article.

If I'd listened to my broker 3 years ago my mortgage would be in the 6s and 7s now, rather than still on 3.19%. I also had to push her to go back and get another 20bps off the rate (it had just gone up to 3.39%) as she was of the opinion the bank wouldn't move. They did.

Maybe it's just my experience with this one broker, but so far I consider them only helpful to those who are not confident in pushing banks for a better deal. Which I guess puts them on about the same level as real estate agents.

I think that's most of them. Potentially more useful in the acquisition stage, but absolutely no use when it comes to refixing. The advice is always a 1 or 2 year fix regardless of the economic indicators..

Not to mention the inherent conflict of interest.

Good for them. In general anyone decent at their job at a bank will be promoted to solve something within 6 months, leaving you with a new face to "build a relationship" with. My broker has been the same fella for 15 years.

100% ! I get frustrated that my bank manager and their assistant change all the time. You try to build a relationship, then they're being replaced, very frustrating.

Showing your age? Most people in my age group dont need a Bank Manager or assistant to deal with. It's called the internet.

Try running a business without a good bank relationship. The internet is a waste of time. Picking up the phone is where it's at.

"although they should bring better outcomes for their clients, there is actually no evidence this is happening overall"

How disappointing.

Only reason I used a broker was the bank's lending team were not available at hours that suited us due to my work commitments. Required both my wife and I to be on the phone at the same time, even for just a quick mortgage top up.

So far as I can tell brokers are just protection to enable banks to lend irresponsibly. They are subcontracting the job of turning a blind eye to risk. If it's the broker who tells you to sell your vehicle for cash and spend that money so your recorded outgoings look smaller - well, not the bank's fault they were "duped".

Realistically they know this is happening, and like it - it's not them who lose if the risk goes bad.

by Averageman Hide All | 14th May 24, 10:38am

Oh the humanity for the Debt Grubbing Middlemen, you are just the risk proxy for endless bank profit. As you are about to find out...

That post from yesterday didn't age too well...

An article about Mortgage Advisers without having interviewed any. David, since you have a significant voice, with that comes the responsibility to have journalistic integrity.

My suggestion for future articles is to invite comment from all sides, so readers can make up their mind on the data and commentary. Otherwise, it's strictly an opinion piece which brings disrepute to an industry that does far more good than you've alluded to in your comments. Interest.co just becomes an echo chamber for people to be angry about all things...

1) Under FSLAA 2019 'Mortgage Brokers' are Financial Advisers hence why the FMA requires the term Mortgage Advisers. They don't hold client monies so are not brokers - it's a bit of a redundant term and a relic of the past where it was strictly transactional.

2) If you factor inflation into account, commissions have actually not kept up - the primary driver of industry revenues increasing is a client preference to work with advisers which has led the market growth. Increased complexity of lending and client choice to work with advisers is what has led the rise. To give you some context, ANZ & ASB pay $150 to support clients during refix time. This number hasn't changed in 20 years. Despite this, advisers still place business with them despite earning less - goes to show how advisers aren't simply chasing the $ but looking at the clients best interest on average.

3) The commerce commission chair has already apologized for the misleading summary in the report, as it's factually incorrect. Based on data from another country, with assumptions proven wrong already. It's a draft for a reason - and public consultation has proven how innacurate it is.

4) Yes the industry pays out $400mn in commissions, across approx. 2,000 advisers, and approx another 2,000 assistants and loan-writers. Also have to pay for compliance specialists, CRMS, etc. Generally speaking allow 20% of those commissions to cover basic costs to operate. Suddenly, the average MA is now sitting on circa $100,000, which if you look at Seek Job data, that's roughly the range most advisers are in.

5) Mortgage Advisory businesses have consolidated due to the cost of operating as a single adviser under the new regime. Having said, that most businesses are still small with <10 people.

6) Mortgage Advisers keep the banks honest in terms of competition - without any pressure on them it would lead to worse outcomes for consumers. It's simply a cost of business for banks to not have an established banker distribution centre. People prefer dealing with their advisers simply put which is why that ratio has risen so high.

DRCR, whilst I agree that, sadly, the Interest comments section is "an echo chamber for people to be angry about all things property related" I don't think DC is casting a bad light upon mortgage brokers in his article above, apart perhaps from one line: "although they should bring better outcomes for their clients, there is actually no evidence this is happening overall". DC is just factually reporting that an increasing number of mortgages are done though brokers.

Good call. Mortgage advisors/brokers have saved me more money than banks ever have.

Agree with a lot of what you say, although I doubt the voracity of DCs figures when a few banks don't report flows.

One thing I need to disagree on is that commissions haven't kept pace with inflation. They have outpaced inflation, as have real estate commissions, because they are percentage based, and house prices + loan sizes have grown way faster than inflation.

Many customers won't have done the maths on the commission - 0.85% on $1m loan is $8,500 ... now has there been 85 hours of financial advice @ $100/hr? Not sure. This cost just gets added on to the costs of all borrowers to subsidize. With regards to the $150 refix advice fee... seems generous, if almost all advice is to fix short (as commentators have noted). Given most people surely just fix on their apps, there doesnt seem to be much work here.

The ComCom report clearly refutes your point number 6. There is no differential outcome between advisor loans and direct loans.

Great research and article, thanks DC.

Are the mortgage brokers qualified in anything or overseen by any government body or are they all merely ex bank workers let go. Either way it’s more parasitic drain on the economy clipping the same ticket providing no economic growth

Read DRCR's post above in its entirety, for the answer.

This was not unexpected. Thanks to CCCFA, that bank worker is no longer incentivised to sell anything, so they no longer push hard to sign up new loans or accounts, instead spend more time on stapling papers and try to look busy 😉

The answer is clear & simple get rid of the CCCFA

It’s unnecessary

Tell that to all the people the banks would be foreclosing on now were it not for the CCCFA !!!

The CCCFA contains this neat little definition of how lenders should be acting. They should "exercise the care, diligence, and skill of a responsible lender." Where they fail to do so ... in either accepting or denying lending ... they are immediately on the back foot.

I fully expect the bank's lobbyists will ensure that definition is removed, or watered down to make it insignificant, and the banks will - once again - become laws unto themselves with nasty fools excusing their profit-above-all-else behavior by blaming everything on the borrowers.

I enjoyed the story DC. Thanks. DRCR's comment was also informative & appropriate in our situation. Good to see you are planning more on this topic.

On 3) from DRCR regarding the Commerce Commission's John Small, I asked the Commission about this a while ago and got the following response;

The Commission is engaging with a range of stakeholders following the release of the draft report, with the preliminary findings and draft recommendations now subject to consultation. In this case, an individual has chosen to share part of a private conversation in which the Chair of the Commission was responding to direct feedback. The excerpt reflects the Chair’s keenness to genuinely engage and understand the full spectrum of stakeholder views. Our final report is due to be published in August.

It will be interesting to see the Commission's final report in August.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.