BNZ intends to launch what it says is the first comprehensive open banking payments and point-of-sale product in New Zealand next year, with an app for consumers and a back-end system for merchants.

Called Payap, the app is compatible with all the major banks, with the drawcard being much lower merchant fees than usual - 0.39 per cent as opposed to 1 per cent on average. BNZ said this would save a business with a $100,000 monthly turnover up to $7,320 on an annual basis.

BNZ said the e-commerce fees are around 80 per cent lower than typical providers.

Payap was built for BNZ by Auckland's Centrapay. The chief executive of Centrapay, Greg Beehre, said Payap is New Zealand's first comprehensive digital payment service that leverages the power of open banking to fill a clear gap in the country's market.

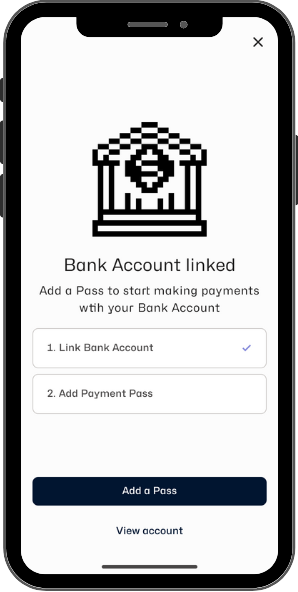

Adding Payap looks like a fairly frictionless experience for merchants and their customers.

The app operates by customers scanning quick response (QR) codes generated on electronic funds transfers at point of sale (EFTPOS) terminals. This transfers payments instantly from customers' bank accounts.

Update: While funds are withdrawn instantly from customers' accounts, the payments land in merchants' accounts the following morning.

As Payap bypasses traditional payments processing systems, it provides a low-cost e-commerce solution, BNZ said. Steep merchant fees which other systems such as Paywave charge which businesses often add to purchases as a surcharge at the point of sale have become a contentious issue in New Zealand, with the government threatening regulation.

"Payap works with approximately 90 per cent of existing EFTPOS terminals across New Zealand, so no need for new hardware for the vast majority of merchants," BNZ's spokesperson Will Edmonds explained.

Edmonds added that Payap's security is built into the payments process.

"When customers scan a QR code, the merchant's name appears in the app for verification," Edmonds said.

"The QR codes are dynamically generated through payments terminals with the same strict security and access controls as existing EFTPOS and card payment systems," he added.

BNZ said Payap merchants can create and manage loyalty programmes to reward customers. The system also provides enhanced visibility over transactions and the ability to manage discounts and refunds through a dedicated portal, BNZ said.

Furthermore, Payap will come with a store finder map with location information, business details and the ability to add special offers for app users.

To make Payap attractive for consumers, BNZ and CentraPay said the app can be used to manage bank accounts, loyalty and gift cards in one place. Payap also supports payments split across multiple sources with different bank accounts, debit cards and/or gift card balances seamlessly.

Bills can be split easily, and Payap also supports expenses shared with friends, through peer-to-peer payments which will be added later next year. Payap also keeps receipts in one place and BNZ said the app will provide insights to provide a view users' spending patterns.

Merchants can register their interest in Payap now, but the consumer launch won't take place until March 2025. At that point not all features will be available in Payap, but core payments, acceptance and rewards features will be.

Although Payap's not released yet, industry organisation Retail NZ has come out in support of the digital wallet and PoS app.

“This is an innovation that New Zealand retailers have been waiting for,” Retail NZ chief executive Carolyn Young said.

“Demand for secure, fast and convenient digital payments is increasing in New Zealand but to date, we have had limited access to the latest technology in this space. We are looking forward to seeing the impact that Payap and other new providers will be able to offer," Young added.

10 Comments

Seems like a 100% copy of the Indian UPI payment interface

So the app is actually for the end consumer to install and not the merchant? Can imagine a bit of chicken-egg here.

Or the QR code just goes to a webpage for approval?

I've asked for a technical demo from BNZ. Stand by.

I'd have to see details of the back end systems such as switching and settlement processes to form an opinion as to whether or not this sounds like a long-term viable idea. There's a lot of marketing hype and obfuscation going on around costs and convenience here.

For instance, it says the funds are transferred instantly from the customer's account, but are they instantly deposited to the merchant's? Or are they batched and settled in the same way as current card payment systems, through back office issuer/acquirer accounts?

I also don't see someone with a $100K/mo purely EFTPOS turnover facing a 1% merchant service fee - if their hypothetical merchant is achieving that through also processing Visa/Mastercard scheme cards then this system won't save them anywhere near as much as suggested. This will have to be a solely debit-only system so you have to have the funds in your account before you can spend them. Not a bad thing of course, but still another limitation.

I have many questions...

Good points, thanks. Will check on them.

According to this BNZ page https://www.bnz.co.nz/business-banking/payments/payap the merchant is paid next day so it is definitely being batched at Centrapay's end

Thanks for the link. This struck me:

Accept payments at less than the usual cost of a contactless payment on your terminal.

Well, yes, of course it'll be cheaper, because contactless payment uses EMV systems, which is where all the cost comes in. Swipe your EFTPOS card and that cost is not introduced.

This seems to be trying to replicate contactless phone payments without using the Schemes, which is exactly what a common or garden variety EFTPOS transaction already achieves. I guess if someone has a phone but not a card then there's a purpose, but EFTPOS cards are free, accepted everywhere (not just BNZ merchants who have signed up for this service), and don't take up any appreciable amount of space.

I'm still interested to know what the back end system is. I can see how it can run without using BNZ's existing Connex system (do they still use that?) but if they've gone ISO20022 then it could run through the same switch as other ATM and POS transactions, and slot into existing Bacho settlements.

I might have to go digging myself.

So So behind time...QR code payments are all over Asia, even the street peddler uses them...all the way back to alipay some 10 years ago..

and there is also money transfer by mobile contacts/Unique ID..

So much fintech out there in Asia with no need to reinvent the wheel here..

But there is no competition or the RBNZ to push them is there?

This has been ripe for an innovative solution to make it cheaper for all.

Especially that it’s cheaper.

Allowing payment by phone without the need for payWave, apple or any terminals would be the logical next step.

is there any movement in that direction with open banking?

Will this only be available to BNZ merchants? I realise at the consumer end you don't need to have a BNZ account but what about the merchant? If consumers can only use it at 20% (that's a guess) of stores, that will definitely affect uptake. It's based on Open Banking so shouldn't be bank-dependent - if BNZ do limit it they'll potentially hurt not help the eco-system and be operating against the spirit of open banking.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.