My guest this week is Andrew Paynter, a policy advisor at Inland Revenue and co-winner with Matthew Seddon of this year's Tax Policy Charitable Trust Scholarship. The Tax Policy Charitable Trust was established by and its founder Ian Kuperus to encourage future tax policy leaders and support leading tax policy thinking in Aotearoa.

Andrew Paynter’s proposal is to increase the rate of GST to 17.5% and introduce a GST refund tax credit for low-and middle-income individuals.

I should make it clear here that everything in Andrew Paynter’s proposal and what is in this podcast represents his views and not those of Inland Revenue. Kia ora Andrew Paynter, congratulations on your win and welcome to the podcast. Thank you for joining us.

Andrew Paynter

Thank you. That's very kind. And yes, it's great to be here and I'm really excited to have a chat with you.

TB

Me too, it is a very interesting proposal. And so how do you land on choosing this? There is a pretty free rein in choosing topics for the scholarship. But what drew you to this particular proposal? .

The background

Andrew Paynter

Yes, sure. For me, something I've been interested in ever since I've worked in the tax space is the New Zealand Crown's long term fiscal position. And we know from the New Zealand Treasury’s most recent long-term insights briefing He Tirohanga Mokopuna 2021 that as we look into the future, the Crown is going to be spending at quite a higher rate than it is getting revenue.

And for me, I think that puts New Zealand in quite a weak position to manage its daily societal needs. But also to manage future disasters, pandemics and economic shocks. And we know that these things are going to happen more often and probably at a greater severity than they have in the past. So that was sort of my starting point. I guess that was the thing I was interested in, and I wanted to try and develop some form of solution to that.

TB

Yes, I mean, this is something long-time listeners to the podcast keep hearing me banging on about Treasury’s statement on the long term fiscal position. I also note in its briefing to the new Finance Minister, Treasury says there is a structural deficit of 2.4% of GDP. So we have a fiscal gap already, according to Treasury. I mean people talk about reducing expenditure, but that will only take you so far, particularly when expenditure is going up faster than you can reduce it, to be blunt. So why did you land on GST?

Why increase GST?

Andrew Paynter

I think there's quite a few reasons that I landed on GST. I guess the two main points are about finding a revenue raiser that embodies good taxation principles.

And then the second part is trying to find a revenue raiser that I think has better impacts than other revenue raisers, particularly in relation to effectiveness and efficiency.

So, on that first point, embodying good taxation principles. It's really important that any revenue raisers that we choose are aligned with broad-based low rate, and that's ensuring that we maintain f broad-based low rate at an entire tax system level, and at a regime level.

Of course, when we look across the New Zealand tax system, I think we can all agree that one regime in particular stands out as being super broad-based and that's GST. We know GST has few exemptions and exclusions, but it also has the highest value added tax revenue ratio score in the OECD by quite some margin.

TB

Yes, that's quite a stat. In fact I think only Chile raises a higher proportion of tax from GST than ourselves?

Andrew Paynter

I'm not entirely sure if that's correct, but I do know for the revenue ratio score, I think Luxembourg has the second highest score in the OECD. But we outscore Luxembourg by quite some mark. And I think we have double the OECD average in New Zealand. So, it's quite a difference.

GST – the broad base, low rate exemplar

TB

That's taxing everything. It's as you say, it's the exemplar in the system of the broad-based low rate. Even if you're you're proposing to raise it to 17.5%, even then, that would still be below the OECD average, isn't that right?

Andrew Paynter

Yes. The OECD average rate is 19.2%, so 17.5% is still nearly 2% below the average.

TB

How much would that raise? This is the thing the politicians say. OK, how much would we get if we increased it by 2.5 percentage points. What's the potential take?

Andrew Paynter

Yes, I think obviously it depends on a huge raft of dynamic factors like inflation and consumption patterns. If the rate was applied in the 2023 tax year it would have raised an additional $4 billion in revenue. So that gives like a proxy for what's possible.

TB

Wow. I mean, that's one percentage point of GDP. So that is a significant amount. But the question is, as I said, why GST? There's a lot of debate around capital taxation as well, wealth taxes, capital gains tax and occasionally, not so much though, estate duty/death duties/inheritance tax. In your paper, you talk about GST being a one-off taxation on the wealthy. Can you elaborate on this?

How GST represents a one-off tax on the wealthy

Andrew Paynter

Two interesting parts to that really. I was again looking to this future fiscal deficit and trying to think of revenue raisers that suited that future context. And one thing that we know is underpinning part of the deficit (obviously it's not the whole thing, but part of it) is having this ageing population. And so, is there a way to leverage revenue from an ageing population? Of course, as the population gets older, a higher percentage of the population is earning less taxable income, but they are consuming often more than the means of their income as they're drawing down on savings. So, increasing the rate of GST becomes in a way an effective one-off taxation on all the current and future wealth that exists in New Zealand so long as that wealth is then consumed in New Zealand on taxable supplies.

TB

So if the ageing population skips off to spend its money overseas that is outside the GST net. But the likelihood is, as you say, they'll consume more and more of it in New Zealand effectively because their income has declined.

Andrew Paynter

Yes.

TB

This means the GST relative to what their income as a proportion of the total tax they might pay, will rise on under this measure. Yes, so interesting analysis there but we don't have a lot of evidence.

Andrew Paynter

That's correct, yes.

TB

Maybe we don't have as much statistical evidence as we would like. The empirical evidence to talk about, the behavioural impacts of this. But GST's not really subject to the same behavioural impacts as other taxes, because you can either spend it in New Zealand or spend it offshore. And as we said, your opportunity to do that has become limited because physically you may not be able to travel, or it becomes too expensive to travel.

Andrew Paynter

Yes, that's right. Some interesting analysis is that when you do increase GST or just a VAT or consumption tax in general you do get potential behavioural responses. You know, substitution effects, price elasticity responses, etc. But some of the academic analysis I found was that when you introduce a rate increase alongside a compensation measure, those behavioural responses are often quite muted. So you don't actually get the same response that you would if you just did a GST rate increase by itself. And obviously, this proposal does have a compensation measure aspect to it.

What about inflation?

TB

Yes, we’ll come to that in a minute. One of the other things that may come into play around a GST increase, is it's potentially inflationary. How do you deal with that effect, how have you calculated that potential effect and how long would it last?

Andrew Paynter

It's quite interesting. I think we have some precedent in New Zealand that we can look to. For the 2010 GST rate increase, the government of the day had modelled that the inflationary response would be about 2% immediately after the introduction of the new rate. That was reflecting an immediate 2.5% price increase on all taxable suppliers, and then some form of future and lagged response on non-taxable supplies like rents, but those are a lot harder to quantify.

So, you certainly do get a significant inflationary impact, but I think that because the Reserve Bank has the discretion to look through temporary inflation shocks in the way that it sets its monetary policy, in theory it shouldn't have very significant economic consequences. And again, I think, we can look back to 2010 and see that.

TB

Yes, we want to avoid that horrible double whammy - prices have gone up and then interest rates go up, that is a real nasty spiral.

Andrew Paynter

Yes, that's right.

TB

And as we mentioned before, GST is as incredibly efficient tax. Businesses were collecting it and everything fell into place very smoothly. I've been around long enough to remember that after the 2010 increase things fell into place pretty smoothly.

But the big downside though for GST, (and the last Tax Working Group touched on this) and the taking GST off food was a partial response, is that GST is actually a regressive tax. Particularly for the lower- and middle-income earners. And the second part of your proposal deals with that. What are you proposing there?

Ensuring equity through a targeted GST refund tax credit

Andrew Paynter

As we noted before, the inflationary impacts of a GST rate increase means that businesses are passing on the full cost of the GST rate increase to final consumers.

And so that means prices are going to immediately increase relative to incomes. That's obviously a problem. We have relatively high levels of inequality in New Zealand, so low to middle income New Zealanders don't necessarily have the means needed to absorb that price impact.

Then on top of that, as you mentioned, GST is regressive. I know it's argued that it's not necessarily regressive over an entire lifetime, but I think the fact that it's regressive, at least at a point in someone's life, it can impact on their economic position, which can then have lifelong implications on them economically. To address that I'm proposing that a targeted GST refund tax credit should be introduced to offset that impact.

TB

How would that work?

Andrew Paynter

It's a very good question. We were touching on it in a conversation we were having off-air earlier, with all social policy initiatives when you're choosing a compensation measure or when you're just designing that compensation measure, it's all about trade-offs and deciding on what values and objectives you value more than others and what you're trying to achieve.

We can discuss the design parameters for the credit in a second, and I'm sure we will. But I guess I just wanted to highlight that this is just one way to do it. It's not necessarily the only way and it's not necessarily the only “right” way to do it. It really depends on what you're trying to achieve.

TB

Because there's quite a bit of interest around this sort of mechanism around the world, isn't it? The IMF released a working paper in April just as you were writing your initial proposal. But that was completely different. And that was a refund that comes through as point-of-sale credit. You mentioned in your paper that Canada has been doing it.

Andrew Paynter

Yes, that's right.

TB

So, similar to what you're doing?

Andrew Paynter

Yes. As you said, the IMF compensation measure is completely different to a tax credit like I've proposed. Whereas Canada's example is a tax credit, as they call it, the GST/HST refund tax credit but the design parameters reflect the realities of the governmental and tax systems in Canada so it's quite complicated.

Although we could look to these examples for some inspiration, I think that the parameters that we select for the New Zealand context should be rooted in the realities of our government structures, and also our transfer system and our tax system.

Resolving the problem with abatements and marginal tax rates

TB

You note in the paper that transfer payments have been sliding lower relative to median incomes over time. Then what you're driving at is that one alternative might be “let's increase the alternative transfer payment”. But they all come with heaps of abatements as you point out.

I was reviewing Inland Revenue’s annual report before today's podcast and a stat that jumped out at me on this point was that only 22% of people receiving Working For Families credits do not have an abatement. That threshold is $42,700, which means 78% are being abated, and that's at 27.5%.

So, you want to avoid that because it just increases this whole problem of effective marginal rates. How do you intend to do that? You're taking what they call a fiscal cliff approach. Is that right?

Andrew Paynter

Yes. Part of the design of the credit that I'm proposing is to use a cliff face approach. As you touched on, abatement is where your entitlement, whatever that may be, is decreased by a specified percentage for each dollar you earn over whatever the threshold is.

So, when you compare that to a cliff-face approach (which is where your entitlement just ends once you hit the threshold) you don't get the same impact on effective marginal tax rates.

You still get work incentive impacts, but those are a lot sharper and shorter. So given as you say, there’s lots of interacting abatement payments in the New Zealand context, for those reasons I'm proposing that the credit utilise the cliff face approach.

TB

Yes, you've also said it's to be individual, so it's not calculated like Working for Families on a collective family unit. It's on an individual basis because the evidence shows you wouldn't be getting much potential abuse of the credit. Why an individual credit rather than a family credit?

Andrew Paynter

It’s various factors. I think one point is again touching on that Canadian example. In Canada, I believe you can file as a family or as a couple. Whereas in New Zealand, all of our filing is individualised. The administrative realities are that unless you're in a regime like Working for Families, you don't necessarily have those connections within the tax system to your partner.

Individualising the credit therefore aligns with the individualised nature of New Zealand's tax system. It means that you don't need information from your partner in order to get the credit. Which means that you can automate it because you don't have to have an application process that says, this person's my partner and this is their income. On top of that I was looking at the Household Economic Survey and it really looks like consumption patterns don't vary greatly between one person household consumption data versus two person households. Consumption is quite an individualised thing.

TB

That's encouraging, because the simpler this is, the better in my view.

Andrew Paynter

100% agree.

What’s the threshold?

TB

And so, the threshold you were talking about would be about $69,000.

Andrew Paynter

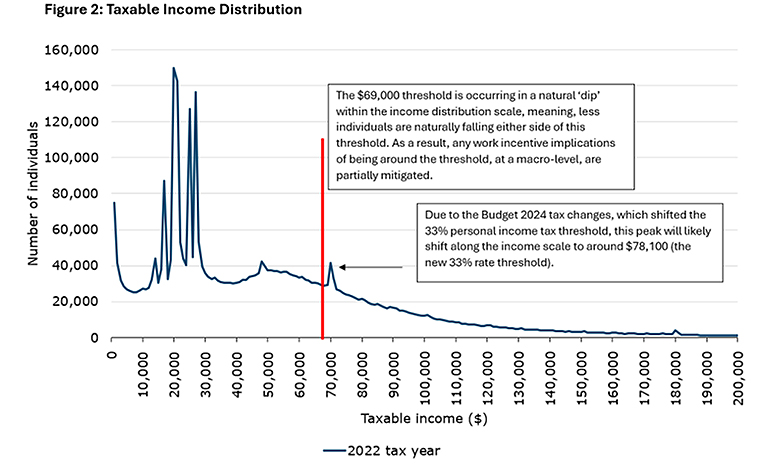

Yes, I'm proposing that the threshold for the payment is $69,000, which is the median income from salary and wages. Obviously, it can be quite hard to define what we mean by low to middle income. But I think choosing this middle point makes sense for this notion of low to middle income.

You have less people naturally falling in that $69,000 space comparative to other parts of the income scale. And that means that those work incentive impacts that we talked about, are affecting less people, which I think is quite important from a macroeconomic perspective when compared to other parts of the income scale where you could put the threshold.

TB

Yes, we see distortions around thresholds all the time. It's quite blatant actually. You can see spikes in your graph at $70,000 and then $48,000. Don't know what they have to do with it other than threshold increases.

Andrew Paynter

Yes. That's right.

How frequently?

TB

This credit though, it would be payable quarterly. Is that correct?

Andrew Paynter

Yes, I've chosen a quarterly model for paying and that quarterly model is full and final and that was to balance a few factors. It was to ensure that people are actually getting the credit close to the point in which they're incurring the increase in GST, versus if you did a year, you might incur some form of increased cost towards the start of the year and you're waiting quite a significant amount of time to get the payment. And again, given that this is targeted at low- or middle-income individuals, that sum of money is quite important.

Also, if you had a shorter time period, such as a week, it might be a bit more administratively difficult. For example, it’s hard to know how much people are actually getting paid as if a weekly model was chosen people's pay periods might not align with that.

Having a quarterly full and final model also means that there's a low demand for reassessments and that's going to be important from an administrative perspective for Inland Revenue. Also, debt situations are avoided because you're doing a lagged income model and that means people don't have to guess what their income is going to be.

TB

I think that's incredibly important because when you see the stats, the debt’s building up. I mentioned earlier about the abatement issues for Working for Families and you say it's full and final. So, in the quarter a person earns below the threshold, they get that payment and then for the next three quarters, they're well above that.

But there's no requirements to say, for example, they're total income for the year was $80,000. But for the first quarter, they were within that $69,000, but that's they received a final payment then and that's it. No going back. No “backsies” from Inland Revenue to go back and re-assess.

Andrew Paynter

Yes, that's right.

TB

And because as you say, the cliff face approach takes care of that because they get cut off, but hopefully their earnings have risen enough to mitigate the impact of the inflationary increase in GST.

Andrew Paynter

Yes, that's right.

TB

I'm all for keeping it as simple as possible, otherwise the system gets bogged down with a lot of resources chasing relatively small sums of money. I think there are mechanisms to deal with that, and that's the other part in here.

You've set out some different things you're basically trying to automate as much as possible within Inland Revenue’s existing processes.

Definition of income?

Andrew Paynter

Yes. Again, having the credit individualised as we touched on earlier, means you don't need partner information. I also propose that the credit is based on a definition of taxable income, not something of a broader like economic income, which agencies like the Ministry for Social Development use for benefit payments. Inland Revenue already holds taxable income information in the course of its usual tax activities.

And then because it's individualised and you don't need partner information, it should in theory just be this really automated process where you know, me as an individual earns salary and wages and as long as I'm under the threshold for the quarter, as long as Inland Revenue has my bank account information, I will just get the payment.

TB

I like that approach. Obviously you've got great feedback because you've won. But what feedback have you received from that? Is there a potential that your proposal might be taken further? Did Nicola Willis come up and say “ “Come and have a word with me I like this.”

Andrew Paynter

Obviously everyone's been very kind and very supportive, but whatever happens with my proposal, I've simply just come up with the idea. I'm obviously proud of my idea and all the work I put into it, and I have simply just put the idea out into the world.

TB

That's fantastic. Any final thoughts on what's next?

Andrew Paynter

What's next? I'm not sure. A bit of relaxing I think. I guess one thing I would just say is if there's any younger tax professionals listening to the podcasts or want to be tax professionals, it’s a really awesome competition and it's a great opportunity to tackle some form of issue that you're passionate about.

You've got the time and the space to develop a solution that you really care about and then you get to have it tested by leaders in the tax space. And I think that's a really cool opportunity. So I heavily encourage anyone who meets the eligibility criteria to apply.

TB

I thought the standard this year was extremely high and I'm very grateful to yourself, Matthew, Matthew and Claudia for all coming on and talking about your proposals

I think that seems to be a good point to leave it here. My guest this week has been Andrew Paynter, co-winner of this year's Tax Policy Charitable Trust Scholarship, and we've been talking about his proposal to increase GST and have a refundable tax credit.

Andrew, it's been a great privilege talking to you about that. Congratulations again. Have a well-deserved rest and onwards and upwards. I'll watch with interest.

Andrew Paynter

Thanks, TB. I really appreciate it. Thank you for having me on. It's been great.

TB

Not at all. Thank you. And on that note, that’s all for this week, I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients. Until next time, kia pai to rā. Have a great day.

155 Comments

Interesting, I was literally thinking of something like this in the weekend

It's a friggin' obscene idea.

Yet another smokescreen formulated by the wealthy to ensure they continue to benefit from low taxes.

The con that 'we all use it, so we should all pay for it' is just that - a con.

The wealthy derive far, far, far more benefit from public assets than 90% of the tax payers ever do.

"The wealthy derive far, far, far more benefit from public assets than 90% of the tax payers ever do."

Please explain this for those of us struggling with the logic.

Without the infrastructure their investment vehicles don't work so well...

I hope thats not the best/only response (ROFL, still awaiting CONF)

Chaosinflesh has neatly and succinctly summed it up. Although were I to be picky, I'd suggests it reads ...

Without the publicly funded infrastructure their investment vehicles don't work so well...

I don’t follow. You are saying that without the publicly funded dole (us relying instead on private income insurance similar to ACC) I would not be able to buy the S&P 500?

Not sure why, but you seem to have ignored the term infrastructure that the previous commenter specifically used. Also, many corporate and retail businesses plus landlords rely on the dole for their income. Many goes around and around, you know.

Because they inherently use less public infrastructure? Private health insurance instead of public hospitals, private schools instead of public ones, Ivy League Universities instead of local public ones, etc. I genuinely do not understand what public infrastructure item a rich person uses more of than a poor person does .

Where do businesses derive their electricity from to operate, and the transmission lines to get it to them, then the roads, etc.

Private lines companies, electricity generators & retailers most of whom are traded on the NZX. Roads are paid for by whomever uses them through a special tax on petrol and a road user charge. How does a rich person get more benefit from a road than a poor person? I would argue that the wealthy spend less time on roads than average, with some opting to use yacht and helicopters instead.

A rich person depends on a lot of poor people going to work every day to make their money. Having good infrastructure helps productivity, and the wealthy take the largest slice of the pie.

Nobody lives in a silo, we live in a society.

Without the capital investment of the wealthy, there is no infrastructure. It's circular, and wealth will always concentrate in the hands of the sucessful. That's what sucess and failure in business does.

"Without the capital investment of the wealthy, there is no infrastructure."

That's true.

Now a question for you to answer ... Who is by far the biggest capital investor in NZ? (And also the wealthiest!)

(I can hear you choking on your own bile from here ... ;-)

Apple is by far the wealthiest investor with capital in NZ, the way that you have framed your question implies that you also believe them to be the biggest investor in NZ (which depends on your definition- they are the biggest investor with a presence in New Zealand). The problem with New Zealand being so small is that many companies are worth more than all of New Zealand’s assets combined.

"Who is by far the biggest capital investor in NZ?"

The NZ Government is the biggest capital investor in NZ ... By a country mile !!!

The same goes for all developed nations.

Or put another way ... We, the taxpayers, pay for the capital investment ... But the wealthy derive much more from that capital investment than 90% of the taxpayers do.

Interesting, Treasury estimates that net crown assets are about half a trillion NZD, whilst stats nz data suggests total value of all assets in NZ might be about 2.5 trillion NZD. The Apple hedge fund is worth about 3 trillion NZD. This calls into question the definitions that you have elected to use, could you please supply them?

Apple Sales New Zealand Limited had total fixed assets of ~$7.4m at 30 June 2024. The New Zealand Government’s balance sheet shows PPE at 30 June 2024 was ~$284b.

Not really comparable. You may have missed the point.

Apple’s stock price is about as relevant to this conversation as the price of fish.

wealth will always concentrate in the hands of the successful

Wealth begets wealth. If one inherits $10m and another inherits $0, it is far more likely that he who inherited the 10m would become far more wealthy than he who inherited $0 by virtue of compound interest. This is why we need to ensure wealth does not accumulate too heavily at the top end of society as it comes at the expense of the middle otherwise.

That is like saying the problem of wealth inequality is that people are allowed to save money. Put $1,000 into a growth kiwisaver with average returns and your money should double every 6 years, or be doubled 10 times in 60 years. This means that an 18 year old who forgoes a new phone and instead saves will have about a million when he is 78 if he never again saves a dollar ( because of how compound interest works ). The wealth inequality between him and his mate who bought that phone will be staggering. All due to 1 teenage decision to save once. Those who opt not to save will always be less wealthy.

There have been many studies showing that most wealth does not survive 2 generations and almost all is gone within 3 generations. Like how The vast majority of the royals separated from the main line by 3 generations have no greater wealth than the general populace.

https://heritageinvestment.com/5-myths-about-generational-wealth-youve-….

They always seem to miss the obvious solution, a UBI. Use the UBI as the progressive part of the tax system, and implement flat tax after that.

- The cost savings from running MSD / having multiple tax rates / tax evasion / etc would be huge

- It will feel much fairer to everyone

- Personal responsibility would apply (I would cull MSD as much as possible, maybe only for special cases)

- More incentive for people currently on benefits to work (earning does not reduce your UBI like it does your benny)

Looks like a good UBI amount to start with would be $353.46 a week, the current job seeker benny. Probably best to do it in a way where most people don't feel much change, for example:

- Increase income tax so that the average person pays $353.46 a week more in tax than they do now, but then gets $353.46 a week back in UBI.

- Decrease benefits / NZ super etc by $353.46 a week, but then get $353.46 a week back in UBI.

- Eliminate the job seeker benefit. This should result in a massive saving for MSD, no longer having to register / monitor / manage thousands of people.

Then over time the UBI / tax thresholds / GST levels could be tweaked to achieve more of the advantages above.

Here's a cool calculation for you JJ ...

If we scrapped all benefits, including universal superannuation, and replaced them with a single UBI scheme ...

a) how many public servants would lose their jobs & how many less offices (security guards, cleaners, etc.) would be required?

b) how much more could be added to the UBI pool?

I expect JFoe could come up with a number. (I also expect it'd be under the likely amount. ;-)

Yes 🙌

So progressive income taxes when I earn it, and then a progressive tax when I spend it.

I mean, it's beautiful in its symmetry, I'll give it that, but that's about the only positive thing I can say about it. We should be addressing the abatements regularly, as we should be doing with the tax thresholds themselves. No point in reconfiguring existing tax if something basic like adjusting them for inflation more than once a decade ends up in the 'too hard' basket.

Paid quarterly based on that quarters income? How would that work for self-employed? ( What proportion of tax payers are self-employed?)

Does seem a bit contradictory in that it lessens the broad based intentions by loading up a tax that already makes up a huge proportion of the tax take. And it adds a complication to a tax lauded for it's simplicity.

So anything except making the rich pay their fair share, ay Mr Paynter?

Let's not forget their wealth increases very year by much more than the other 90% from using stuff everyone (including the very poor) is taxed to pay for, e.g. roads, schools, healthcare, public spaces, public transport, police, etc. etc.

The wealthy in NZ, and most other OECD countries, are heavily subsidized by the 'collective' already. When are people going to figure this out?

I'm sick of paying high taxes so the wealthy can derive even more wealth from the stuff every tax payer pays for. It's a friggin' con.

Surely you must be mistaken

'their wealth increases very year by much more than the other 90% from using stuff everyone (including the very poor) is taxed to pay for, e.g. roads, schools, healthcare, public spaces, public transport, etc. etc."

I see it repeated on here and elsewhere ad nauseam that the poor pay no net tax. So obviously your wrong and the rich are much poorer or are richer by their own hard work.

Sarc

GST is the most effective way of equalising tax paid by rich and poor.

The current belief that GST is anti poor is a perfect example of very efficient media campaigns to brain wash the masses.

100% agree. Rich pay GST on a new Audi. Poor buy cheap cars (like my Honda 2002). Rich buy expensive wines and visit upmarket restaurants, the poor? KFC.

The rich tend to have better health and are more likely to have private medical insurance. De facto they subsidise the poor who use state care.

The rich don’t get WFF or KO housing. I think they’ve done their share (and I’m not rich by any stretch).

"GST is the most effective way of equalising tax paid by rich and poor. "

And you have expert evidence to back that b.s. up with?

Just math. If you raise GST by 5% then every dollar ever saved by anyone with wealth will functionally be taxed another 5% when they spend it. Those with no savings are not impacted by this tax on ALL accumulated wealth, every one then equally pays GST on every new dollar earner as they spend it. This means that GST hikes are a one off tax on all accumulated wealth. As a bonus tourists who pay no income tax will also pay GST, as will the shadow economy of cash jobs and drug trade!

"This means that GST hikes are a one off tax on all accumulated wealth."

100% incorrect. They are a tax on consumption. The wealthy never spend all their accumulated wealth, or they would be poor again. So they dodge the tax by passing on their wealth to the next generation. They live on the income their existing wealth brings them. The poor however spend their pay packets completely by necessity, so pay more tax proportionately.

If that wasn't the case, why would right leaning governments and their supporters ever be keen on raising a tax rate? Any other tax suggestion and they are all Taxinda this and envy that! In that vein I will leave this discussion now, as I don't believe you are discussing this topic in good faith.

The vast majority of wealthy people become poor again at some point in their life. What is the point of accumulating wealth if you never spend it? If someone does genuinely accumulate wealth and never spend it then that wealth is locked up in investments, New Zealand is a capital shallow market that needs all the investment it can get.

Simply because one side or the other of a political spectrum supports a particular policy does not inherently change how good the policy is. I would say I am fairly center in my politics and I think that a gst increase is the most fair way to raise taxes, in part because it taxes the shadow economy (undeclared jobs done for cash) & criminal economy (sale of drugs, theft, etc), lowering the tax burden on law abiding citizens. On top of this is it simple, easy to administer, difficult to avoid & hits anyone who uses their wealth ( If a parent hoards their wealth, never spending any of it, their children tend to get estranged or lash out at the miserly lifestyle and then squander their inheritance to make up for the lack of use of that wealth during their childhood. A person with 3 kids divides their wealth by 3 when they die, leaving 3 middle class families, if all 3 of those kids spend none of that wealth but have 3 kids themselves the wealth is split 9 ways after 2 generations and possibly 27 ways after 3 generations. Ie. A million dollar inheritance drops to 3x,xxx ish per person in 3 generations, if each generation has 3 kids. It is incredibly difficult to ensure that wealth survives generations). GST would effectively extract that wealth with the least amount of squealing. People on both sides of the political spectrum have been known to support GST, which was in fact introduced by Helen Clarke who was a labour prime minister at the time!!!

What's your opinion of an Inheritance/Gift tax Chris?

Should be taxable in the hands of the person that did not earn it. Ideally based on a sliding scale starting at zero tax to something like 50%.

And what, pray tell, has the government done to earn it?

Provide services, like they do for every other tax?

See my posts above ... The NZ Government is the biggest capital investor in NZ by a country mile. However, the wealthy derive far more benefit from that capital investment than do 90% plus of the people (i.e. taxpayers) that paid for it.

It’s equivalent to eating carrion. Picking over a dead corpse.

Anything to feed their desire for a bloated state - spending money is what matters, not what it gets you, nor who you take it from.

As long as someone else pays, it's a good idea.

Just bring in a land tax and reduce/remove income and consumption taxes. That's equitable and will serve to:

- Drive productive use of land,

- Incentivize housing density e.g. an apartment's land tax is divided by the number of dwellings,

- Stable Government tax receipts/revenue

If you took the Government's annual tax receipts of about $110b, divided by just NZ's urban land mass of 5078 km2, it's about $22 per m2. Someone with a 500m2 section would pay $11k p.a, the same as the PAYE on a single $65k salary.

Sounds like TOP's policies except worse. A pensioner with a house would lose their house in the name of productive land use.

It would drive behaviours like pensioners selling their houses, distributing the funds to their children, then renting and claiming the Accommodation Supplement and becoming an even greater taxpayer burden.

..or the debt accumulates payable when vacated and the value of the property declines to reflect the new financial ownership cost. Great way to free up 5 bedders occupied by one.

Taxes that require citizens to take out reverse mortgages with the state just to live in the house they already own? To pay down a debt that will also drive down the underlying value of the asset leaving people with even less when the dust settles?

Yea I can definitely see people voting for this in droves.

Or in my comment further down, if you're on Super and no longer employed in full time work then your tax burden switches from land tax to tax on Super?

And what if you are a single parent on the single parents benefit and living in the family home? Are you going to force Mum & the Kids out of their house and on to the street because they can't afford to pay the tax out of their benefit? Are low income single parents going to have to send their kids to school starving and unclothed because 80% of their income is needed to pay Council rates and Land tax on top of a mortgage?

You could also apply a tax switch to all main benefits? So the SPB, JSB etc are taxed on income and exempt from land tax. Super is exempt if the recipient is no longer employed full time.

I do like your highly emotive "kicking the single mum and starving kids out on the street" bit though.

But now you have all these special exemptions, which makes the tax highly inefficient and very costly to collect. We will have to move from not having to file a tax return to everyone having to file a tax return, so you can declare your house value and claim your exemptions. Thats thousands to be spent on valuations and accountants, and govt bureaucrats and tax auditors.

And you still havent answered the low income single parent left in the family home post divorce situation - an all too common one. If one parent doesnt earn enough to pay the taxes where do you think they are going to live? Paying $10k a year in extra taxes is quite literally taking food out of the mouths of babes. And often selling the house and splitting the funds between two parents in a matrimonial property agreement leaves both parents with not enough money to buy another house - so they effectively become permanent renters and puts them further into poverty (whilst still paying the land tax through increased rents).

Not that complex. Are you receiving a main benefit or Super? Yes/No. Hell, one's IRD account would be enough of a clue. Note, I also said a Land Tax not a Land Value Tax, so land area x $$ land rate = annual land tax.

The Land Tax replaces income taxes, it's not an "extra tax". So the low income single parent post divorce would have no PAYE, instead a land tax. Note, my $11k for a 500m2 was based on urban land taking our full tax burden. If you applied a zoned land tax across the country (businesses, agri etc) you might find that urban rate becomes $5k or less. A minimum wage earner pays nearly $7k per annum in PAYE.

Why would you do your land tax based on area rather than value? That doesn't make any sense to me.

Because then you don't have to talk about why efficient medium density housing in Auckland would pay many thousands more than houses on inefficiently huge sections in provincial backwaters, who would also get the same benefit from lower income taxes but a fraction of the additional burden of the land tax that urban Kiwis do.

The economic importance of the land affects the value. In other words how much economic utility you can get from the land should decide how much tax that parcel of land should shoulder. That way every parcel of land is still worth owning by the most suitable landholder. It's not just arbitrary, the market literally decides how much land tax each parcel of land pays. It's the only efficient and sensible way to tax land.

There is a lot of additional expense in living rurally as you have to travel a lot further to access different components of the economy. That costs you in time and money and time is money. That is why that land is worth less and why it can't afford the same amount of tax per m2.

If you tax land based on arbitrary m2 rates a lot of land would end up abandoned. And a lot would end up significantly unfairly undertaxed.

I'm not talking about taxing economic utility though. Otherwise why not have different tax rates for different jobs/industries?

As I said in my other comment, it's to replace all income taxes with a land based tax. I guess in a way it's akin to leasing land from the Government instead of paying income taxes. Benefit is if someone wants to work over time, or a business does exceptionally well one year, they get to keep more of their money.

Could also be done on area, it doesn't have to be a blanket flat rate across the whole country. Which then technically makes it a land value tax, although to keep it simple you wouldn't drill down into the individual land value to derive a rate.

My land tax idea replaces all taxes, so the owner who presumably derives an income from somewhere else pays a land tax and doesn't pay an income tax. It's not to tax the value potential of the land, it's to replace income taxes that in reality 99% of people who own land and aren't landlords would be paying anyway.

rastus : "..or the debt accumulates payable when vacated ... "

So an inheritance tax built in too?

"Think of the (middle-aged) children!"

Tax burden relies too heavily on the paye system making it difficult for the have nots to get anywhere. I suspect this is why we have so many who are unmotivated.

Need some balance in the system. One role of tax is to redistribute wealth so it does not all end up in the hands of a few.

The sole purpose of tax is to raise revenue, originally to fund wars, and then the keep. Where do you think "earning your keep" originated? Ones labour was also a tax to fund the landowner, after the theft of communal land. Then the idea was to use it to balance government money creation. In modern times it's ideally to fund the commons, the provision of social benefits for the collective.

Tax does not redistribute "wealth", only money. And that redistribution is set out by other policies.

Using tax to manipulate behaviour is the grossest, authoritarian abuse of power. Using tax in attempts to solve society's issues is the least intelligent solution. It's simply saying we don't want to understand the root causes, but here's a band-aid.

Using tax to manipulate behaviour is the grossest, authoritarian abuse of power.

Tax has always, in a way, been a behavioural manipulation means, as humans always try their best to avoid it at all costs. Why else would so many have been investing in property for the last 30 years: Tax free capital gains. If this weren't the case then we would likely have seen other investment avenues become more popular.

Avoiding tax, if the loopholes exist, is not the same as using taxes as a manipulation tool to encourage better behaviour. Modern tax law was always written to tax the workers not the owner. Rules for thee, not for thy.

Removing the loopholes only negates the imbalances, it won't encourage better behaviour regarding greed, selfishness etc. One can still invest for capital gains, they'll just have to pay taxes.

Those other "investment" streams already exist. They're just not available for the average Joe.

Does taxing incomes encourage people not to get jobs? No because there are underlying drivers.

Has taxing cigarettes really solved the smoking problem? No, but there's a revenue stream the govt. can't afford to lose.

The tax issue is just another symptom of dysfunctional, unhealthy humans.

Avoiding tax, if the loopholes exist, is not the same as using taxes as a manipulation tool to encourage better behaviour. Modern tax law was always written to tax the workers not the owner. Rules for thee, not for thy.

Removing the loopholes only negates the imbalances, it won't encourage better behaviour regarding greed, selfishness etc.

Removing tax free capital gains would make it less attractive to invest in property and thus impact investment behaviours, which would likely be part of the rationale for a CGT. It is the same thing.

Has taxing cigarettes really solved the smoking problem?

The rate of smoking in NZ has been on the decline for years now, so I'd say yes, it incentivises many to think more on the cost of their habit, thus manipulate behaviour.

Removing tax free capital gains would make it less attractive to invest in property

So you are for tax deductibility on capital losses incurred on rental properties? That seems fine to me.

I was fine with the removal of this for rentals as i incentivised new builds and added to the housing supply which needed expansion. Adding it back I wasn't entirely happy with, but they need a GCT or LVT to offset the tax rort that is property investment.

Rather than manipulate behaviour, one needs better support and guidance to address the causes of their behaviour, and it applies to everyone, not just smokers

Underneath it all are psychological and emotional drivers.

The same goes for "investment" and especially the "value for money" dogma. It's why the marketing and sales tactics work so well, people buying more than they needed or wanted, because they think they saved money. It's why someone can come home with a new gadget they never needed or wanted, and be more excited about how much they saved than what they're going to use it for. It's why whenever the numbers on a screen go down everyone is screaming about all the wealth that has been "lost". Why people project thoughts of envy and jealousy here. Why everyone fears they're going to be poor when possible solutions are offered.

The $$ cost/gain/loss is a flawed economic rationale. It has limited and is limiting us to make real changes. It has far bigger "costs" and impact to individual and collective well being. Economics has been used to justify and manipulate human behaviour. It's a gross form of power and control.

The root of all of it is fear. And the fear has been stoked considerably for a number of years.

Yes, if the tax policy were strictly done without assessing means there'd be victims. My example is worst case scenario, if we loaded all debt burden on our urban land areas without any other consideration.

There's going to be finer details, maybe pensioners switch to tax on Super instead of a land tax for their home. Same would have to apply for unemployment benefits too I would imagine. Then you have landlords with all their cashflow tied up in interest only mortgage payments. I don't have months of design work behind this, but I think it would be workable.

Spreading the burden to agricultural land would reduce the urban tax rate, but farms would need to have a fractional rate.

This would be a good thing. Because you could provide a "poor" retiree deduction as long as they are living in a dwelling that is less than 80m2 and on less than 150m2 of land. Realistically the size of the house/unit should be smaller (less maintenance, less heating cost etc etc).

A massive problem around the country is baby boomers refusing to sell, their 4 bed family home on a 1000m2 section, or move from prime school/commuting zones due to a general attitude of "I got mine" or "NIMBY" and they are mortgage free and there is zero incentive to downsize.

The net result is the current social environment going up in flames. Literally, boomers would rather burn it down then give their kids/grand kids a fraction of the good fortune they received (housing 1x or 2x their income in the 80's).

We're in a 1920's villa on 1/4 acre within 300m of a primary school and 700m from a couple of high schools (private and public). A good number of the people I've seen in my 3 years of ownership when walking the dog are well past retirement. Meanwhile when I walk my child to/from school, the streets are swamped with double parked cars

I wouldn't say they're refusing to sell or that it's a middle finger to the kids, just that there's no incentive for them to sell.

Perhaps they simply dont want to deal with the trauma and declines in health that is caused by uprooting their life from a familiar place.

https://companionsforseniors.com/2021/01/relocation-stress-syndrome-cos…

It's very on-brand for NZ society that we would prioritise sparing the elderly from a one-off move, at the expense of children living less stable lives renting in the suburbs and having to be driven to school.

Ah gotchya. Rather than provide some robust counter-points on the substance of my idea, you just descend into an emotionally charged red herring. At least twice now on this article.

How is it a red herring? Moving house is one of life's most stressful events. Thats why people as they get older want to avoid it. Its traumatic. You want to force people to suffer trauma in order to free up houses for people who can go buy or build something else somewhere else. What's next? Forced evictions of old people, round them up, transfer them to Govt housing and sell their houses out from under them?

https://www.psychologytoday.com/nz/blog/state-of-anxiety/202307/how-to-…

Inflating the price of houses, loading up the debt on the next gen, making it harder to have the security of a home, is also stressful/traumatic.

Moving home by choice probably isn't so bad, but a sudden force to, not so great.

Did you miss the bit where I said you could carve out exemptions for NZ Super, where instead of a Land Tax they are taxed on their Super? If they're still working, they stop paying income tax and start paying land tax.

But here you go again with the highly emotive hyperbole, making it sound like we're shipping them off to a camp. They should be encouraged to down size, I thought they were the tough as nails generation they'll be fine.

Aren't you moving to Australia KW so you will be dealing with the "trauma and declines". Or maybe you just talk a lot about moving to Australia and aren't actually going to do it?

Jealous? Christ it is their house. If 2 retirees want to live in a 5 bedroom house on a 1000sqm then god bless them. You probably want wealth taxes and death duties. Country is riddled with jealousy and envy.

You must hate this 'income tax' thing I keep having to pay - it's all based on jealousy over my high salary. And then when I go and buy myself a little treat I have to pay tax on that too - why is everyone jealous of me?

Or is asset envy somehow different to income envy? It'd be really useful to categorise which taxes are based on envy and which are not - preferably based on first principles rather than what is the status quo.

I thought about avoiding this whole income tax thing by quitting my job, but then I read all the comments on here showing disdain towards unemployment beneficiaries.

Yep if it looks like you are getting ahead of everyone else, you need to be smashed back inline with Joe Average.

How about paying for your super and the health system with the millions of real-estate net worth.

Crazy, I know.

It would certainly drive up demand for lifestyle blocks!

You would have to make the charge based on the value of the land. Land in Auckland's CBD should not have the same tax as Eketahuna.

What would a pensioner in Remuera end up paying? Although maybe they should be incentivised to live elsewhere and allow someone more productive to use that land.

Of course. It's just an idea, I haven't got a fully fleshed policy to introduce to parliament. But the beauty of it, is that you can tailor the rates to suit locality.

Would also incentivize high density living, where the land tax is divided among multi-story dwellings on the same parcel.

I think you'll find LVT is a far simpler and more effective idea than LT. Look into Henry George's proposal and reasoning.

"Drive productive use of land" Really. I'd like to make my residential property more productive by demolishing my single story 3 bed 155m2/31m2 house/garage and put up two or three 3 storey units. Once I'm allowed to do that without a resource consent which would require discretionary approval and likley be rejected, then I might consider a land tax to be beneficial.

Too many thinking of a land tax at a stroke of the pen without realising the devil's in the detail. How are you going to tax, as an extreme example, Mt Cook or something similar that is not owned by the govt?

Why would you need to include a National Park within an assessment area? Are we then going to include the bottom of Lake Taupo? Maybe the crater floor of White Island?

Give the councils a cut of that land tax, maybe apportioned based on the number of dwellings on a parcel, and sure as hell they'd be approving your development.

"......or something similar that is not owned by the govt"

"maybe apportioned based on the number of dwellings on a parcel, and sure as hell they'd be approving your development."

Its a land tax, not an improvements tax. You'd still pay the council a development levy and sewerage and water services for all the dwellings whether there's a land tax or not.

It's the devil in the detail which no-one will know in advance and only find out once it reaches select committee stage. No political party would be able to come with any semblance of detail. Probably take Treasury a year or to two to analyse. In any event a complete re-work of the Ratings Valuations Act would be required before any land values are determined. This is required even now for reasons which would take a short article.

It's a land tax that should substitute PAYE. And I've demonstrated numbers wise that it can be done. The problem is it'll capture tax revenue from people that pay zero tax on their hobby businesses (landlords for example) and they tend to get shouty over contributing even 1 cent.

Just throwing the idea out there. It's great that people think any new initiatives would be riddled with fish hooks, but this motivated skepticism will just keep us in the status quo. A form of Stockholm syndrome?

No it shouldn't. I don't paye PAYE at a different rate to someone in Eketehuna but you want my contribution to come from the land value, which I don't control and is going to be vastly higher. Well, fine then, but the abatement in income taxes should be higher in the cities than it should in the provinces.

I've never said Land Value Tax. I've said Land Tax. And my numbers were initially based on Government revenue divided by urban land mass, a flat rate.

Others have piped in saying it should be adjusted for land values but I'm not sure, because we're not trying to tax the land's economic utility we're trying to remove the burden from workers.

Why can't we tax multinational corporates on revenue earned in New Zealand?

It might put up the price of a phone or one of the FAANG companies will have a tizz about it but someone will step in and provide the services they no longer want to.

Oh no, in todays day and age everyone must pander to the companies and keep dropping corporate tax rates to incentives foreign businesses to operate here or we'll be left behind and they'll all pull out (sarc)

Taxing companies on revenue is the start of a slippery slope that would end with local business being taxed at the top and not the bottom lines.

Businesses should be taxed on profit, not assigned profit.

Why?

Wages are taxed on gross, why not businesses?

As a for instance. An SME has revenue of 6m, after direct expenses (COGS etc) it has 2m Gross, after expenses, lease costs, power, vehicles, paying staff and the like it has 500k net profit that it currently pays 140k in tax. If it paid 10% on the revenue it would pay 600k, more than it makes. So to make it profitable, prices have to go through the roof.

I find a lot of people look at the top line and believe SME owners make moonbeams, it isnt the case. Your thought bubble is completely unworkable.

Where do you think rents would go ? House prices would have to be 20% of what they are to make it even look like working.

Because there's a stack of businesses making single-digit NPBT returns on sales and you'd wipe them out - whole industries even - overnight.

And there's a stack of businesses shifting all the profits to other jurisdiction's paying no tax in NZ for massive returns. Yeah sure low margin businesses would struggle but that still doesn't answer the question of why wages are taxed on gross while business is taxed on net.

I'd certainly like to know just how low the rate could be if it was on gross revenue.

GST is functionally a revenue tax, just 1 that isn’t permitted to accumulate based on the number of companies between the manufacturer and the retailer. A revenue tax without the deductions available via GST would effectively eliminate all smaller players in favour of vertically integrated multinational mega corps who will not have to pay the revenue tax multiple times as they can handle the entire transaction from manufacturing to distribution and sale, whilst a smaller manufacturer who uses distributors and retailers would pay the revenue tax once at manufacture, once per distributor and once per retailer In the supply chain.

Timing is key inflation-wise, which tells us now isn't a good time.

GST is literally the worst tax for economic performance in a country. It directly disincentivises trade. Every single trade is less likely to happen because the gap between buyers and sellers is increased by the % of GST.

If you want to tax and maintain or even improve economic performance. You need land tax. Land tax disincentivises inefficient and unproductive landholdings. Makes land cheaper to buy, so we carry less debt and have less interest going to banks. And frees up capital for buildings instead of burying it into land without one iota difference to the utility. Land tax increases housing supply which reduces rents. It literally makes your economy more competitive and affordable. The amount of land is fixed, so the only thing that happens when you tax it, is that it decreases the price of land.

All great points.

"Every single trade is less likely to happen because the gap between buyers and sellers is increased by the % of GST" - surely that is the case for any tax. If you tax my income I can't buy as much, same as if you tax sales I can't buy as much.

Land value tax is an example of a tax that carries no deadweight loss.

The impact of income tax is that it widens the gap between employers and employees, meaning that less labour can be employed. That doesn't directly impact trade like GST does. GDP is trade. I do however agree that income tax is still a crappy option compared to LVT, it's just not quite as bad as GST, especially considering that GST is a regressive tax it punishes the poor the hardest. What hasn't been mentioned is that GST and Income tax simply get spent by the government instead. So that money still flows, just elsewhere.

As someone else has pointed out. LVT is the only tax that carries no deadweight loss. With LVT you actually get more for your money in the economy, and it unburdens income taxes and/or GST.

There is a need for more tax. Raising GST and having a credit back for those that cannot afford it is just plain crazy. It simply fuels more govt drones, and punishes those that don't qualify for the rebate process. I can see a lot more cash transactions, or stuff done in bitcoin or similar. The sacred cow of some sort of land tax should occur before a GST increase.

Land tax. Simple. Unavoidable. Regular. Would force a redirection of capital into productive activity and or land use.

If I cannot subdivide my land why should it be taxed as if I can?

We are dancing around the CGT handbags here....

Whatever you can do to your land is factored into the value of the land, which is factored into the LVT.

CGT's incentives are economically counterproductive. It disincentivises people from buying and selling land, so land is more likely to remain in the hands of those who are not the optimal holders of any parcel of land.

LVT does the opposite. It essentially pressures landholders to utilise their land productively and efficiently or sell it to someone who will.

Exactly. Squatter like land bankers must pay the premium to "do nothing" rather than lazily wait for their tax free upside.

Whatever you can do to your land is factored into the value of the land, which is factored into the LVT.

Unless you completely remove all zoning rules, then this doesn't work. The value of my land is set by what the inner city suburbs don't let happen there, which stokes demand further out, and the Auckland Council for strangling supply to the extent they can't hook new water connections up in other areas.

The idea that land is all about the individual development potential of each individual lot is a fallacy, or else we wouldn't have $200K townhouses on $800K sections.

The way your land is valued by the market changes under an LVT paradigm.

If you removed all zoning rules, you're right land values in the fringes would fall, as people wouldn't need to sprawl as much. This doesn't change the effectiveness of LVT in pressuring landholders to utilise their land as productively and efficiently as possible under whatever laws are implemented at the time and place. This would also mean that rents fall, and our economy becomes much more efficient.

None of that means anything unless things like scarcity are addressed. Tell me how owners of townhouses in medium density developments are meant to use their land more productively or efficiently?

Will there ever be enough tax revenue? Or will we keep finding ways to make our services even less effective no matter how much we take from people?

That depends what you want to be achieved. I think the best way to judge if a society is taxing too much or too little is to look at the successful economies and see how much they spend via government as a percentage of GST, and try and maintain a healthy percentage. It looks like 40% is a healthy ratio. Then you can simply focus on what is the best way for your economy to achieve that revenue (which is obviously the Friedman/George way: https://www.youtube.com/watch?v=yS7Jb58hcsc ).

https://en.wikipedia.org/wiki/List_of_countries_by_government_spending_…

Ensuring that the money is spent productively and efficiently is a separate issue. And I think what Elon Musk is doing in the US, might be something that needs doing every now and then, maintenance like pruning a crop.

"... what Elon Musk is doing in the US... "

He hasn't done anything yet - except make outrageous claims.

Once he starts hitting the vested interests in Congress he'll quickly find he'll be taking money from other extremely wealthy people. And they won't like that at all. They'll win. Their collective wealth is way, way higher than his.

What it will do is increase the division in the USA as the public will blame every other person, group or state on the 'other side' for nothing much happening. And, as per usual, government will be blamed for being useless. Musk will use X to ensure everyone else but him is blamed for little to no action. The plutocracy will get stronger.

It was obvious from the get go that the only convenient way to pay for National's tax cuts for the weathy was to eventually raise GST. This discussion is the prelude.

Indexing tax brackets for inflation once every 10+ years is not a 'tax cut'.

Not even close.

In theory, the optimal taxation system would be a progressive GST (consumption tax) based on income and/or wealth. However, this would be difficult to implement in reality due to arbitrage opportunities (someone poor buys something for a rich person and pays the lower rate). It would also require knowledge of everyones income and wealth and a payment system capable of handling it.

Paynters proposal to increase an already regressive GST would further screw over the poor and those on benefits unless welfare and tax changes were made. An end of year tax credit is insufficient.

NZ has much bigger tax problems with no comprehensive CGT, no gift tax and no inheritance/death tax. The rich continue to be heavily subsidised by the middle class and poor who pay income tax. Fix this problem first and then we can talk about GST.

This is exactly why Govts want to implement a digital currency - its completely programmable, and Govts can implement social credit rules that dictate how much your digital dollar is worth when you go to spend it. Eg. Two people both have $100 in the bank, but if you are Maori the Govt could decide that each of your digital dollars are worth $1.20 so you pay less for things, while if you are European your digital dollar is only worth 80c so you pay more. And thus second class citizens are created and controlled.

but if you are Maori the Govt could decide that each of your digital dollars are worth $1.20 so you pay less for things, while if you are European your digital dollar is only worth 80c so you pay more.

While I'm not in favour at all for any digital currency for various reasons, that is a wild assumption that isn't in any way necessary.

K.W. your understanding of how 'digital currencies' work is laughable.

For example, the ethnicity of the currency holder is an attribute of the holder ... not the currency. Crypto currencies were invented to completely 'hide' the holder's identity, ergo no crypto currencies will ever be invented that identifies the race of the holder. 'digital currencies' would almost certainly not contain attributes of the holder either.

I can imagine a 'digital currency' that would provide 'discounts' based on certain factors. However, that wouldn't happen at the point of sale. It'd happen as some sort of rebate in a back end system, e.g. in IRD's. Oh. Look. We're kind of all ready doing that! But not around ethnicity - it's being done based on social needs.

Anyone with money should simply just give up on this country and move to Australia. Its gone to the dogs, and its not coming back. Between them coming for your taxes and punishing you for your race, what is there to stick around for? The more NZ taxes, the cheaper Australia looks. And at least in Australia, you have equal access to the things that your taxes have paid for, like healthcare and education.

Cheery ooo then KH...

Your taxes haven't paid for it, it is getting paid from govt expenditure that tax simply cancels out. The greater pension spend and healthcare spend, the greater need to cancel out this spending via tax, hence why the young generations will be taxed far more than their parents.

Australia is the land of taxes! State taxes, stamp duty, land tax, etc. Our tax system is way more simplistic...

Its also the land of tax loopholes. Like self managed super funds, and the ability to negative gear.

Hate to break it to you KW but Australia has an Indigenous Australians' Health Programme.

No. GST is simple. Leave it alone.

An eye watering alcohol tax ....give folks something to drink about ....lol

Alcohol Sales in Russia Reach Record High in 2024 – RBC (And that's on a population that's been falling since 1995.)

Yep. I don't understand why alcohol is so sacrosanct. Enough evidence to suggest it's the worse drug.

Simply stupid. A blinkered approach.

For low income earners and self employed whose income isn't automated, cashflow is paramount. Many already just making ends meet, and your telling them to spend more on day to day necessities. But it's ok they'll get a refund at the end of the quarter. And some will have to wait a year.

So someone on $70k who isn't really getting ahead after tax, will now be further behind?

Retirees spending their savings (it's money, not wealth), could likely be under the income threshold, and having to be refunded. So no real tax gain from them.

Any tax professional with some intelligence should realise that the spike at $69k, if it's threshold related, is because many have been able to "hide" their income above this point. Will they be getting refunds?

You'd be better off with a low flat rate financial transaction tax, but only if you can reduce or remove other taxes.

Thankfully someone who mentions the cashflow issues with a high gst rate. It makes doing business hard. There has to be more money available for stock purchases. I didnt think it would make much difference going 10% to 12.5. It did. Then 12.5 to 15...ergh. We are a nation of little businesses...having 17.5 % on top of your purchases outstanding will be inflationery. The bank will want their interest on od.

Meh, the financial transaction tax you mention is the answer, (to getting rid of other taxes - not increasing them ), but people just don't seem to get it.

Tax ultimately isn't the answer for anything, but it's probably the best tool a primitive civilisation can work with.

Raise GST to 25%.

Pay a UBI.

Remove entry level benefits and superannuation. (Now covered by UBI)

Adjust tax thresholds (add tax free bracket, raise the lower brackets)

Incentivise any other benefits (eg keep 50% for each dollar earned)

Tax companies on profits made in NZ not based on international performance (IE tax money when it moves offshore)

Last one will get the most angry comments here 😉, but also the least important on the list.

Ever increasing input costs dont bode well for an economy seeking to increase export receipts.

Why do I need to pay more taxes?!

Take more taxes from immigrants before NZ become India2. Instead of $2K for resident visa take $10K or even 30K.

If the GOV increase the GST, I'll reduce my purchases

See my comment above, increased government expenditure will lead to the need for more cancellation via tax, and we have a guaranteed increase in expenditure for healthcare and pensions that needs addressing, as well as an allocation of resources in NZ. We will not see the lats 50 years repeat itself, life will change, and many won't like it, but it will come from necessity or public demand, which of the two is up to us.

Public demand seems to be driven by the idea that someone else should pay for everything, to the extent we have a very small group of someone elses and it still isn't enough.

Agreed. We want everything at the best of the best but aren't willing or wanting to pay for it, and we now have younger generations waking up to how they have been duped by the way the systems have been set up, which favoured their predecessors, but in no way favours them across their lifetime.

Rather than look for ways to raise revenue, instead look to what can and should be cut from the expense column.

Reintroduce superannuation surcharges.

Welfare should be reserved for those that genuinely need it, and we should return to being a society where people are ashamed to be taking more than they need, I see those working high paying roles and collecting nz superannuation as no less shameful than those who line up for food banks when they only want to save on their grocery bill.

But superannuation is a loyalty rewards scheme for reaching a certain age. People even go so far to imply those high income earners or mega wealthy deserve it more because their incomes enabled them to pay more tax over their life time.

There's something wrong with the way these people think. The likely cause is cognitive impairments from exposure to lead based products during childhood, resulting in callousness, reduced prosocial behavior, and lacking in empathy.

The entitlement to Super at a certain underpins the social contract that facilitates taxing people to pay for it.

Try an experiment: Tell people currently working that they have to pay super for current retirees, but won't be able to access it themselves. See how that works out for us, when we have far better retirement options in other countries with similar cultural values a two hour flight away.

Tell people that if they earn over a certain amount per year post 65, they won't receive Super until they actually retire. It is welfare of course, and this should've been the condition 30 years ago.

Can you earn over $100k p.a. and claim Government Age Pension in Australia? Here's some clues:

https://www.australiansuper.com/retirement/retirement-articles/2019/06/…

https://www.australiansuper.com/retirement/super-and-the-age-pension/in…

...and do we have 12% contributions to super schemes, or salary sacrificing for higher earners? Context matters. It turns out if you have a rational super savings culture, you can do things like means-test pensions.

We, on the other hand, don't. But as always, context is usually left out of these discussions in a bid to justify extracting more and more out of people, while ignoring the practical aspects that allow for the kind of buy-in you need for changes to social contract issues like the pension.

Yes we do. It's just our minimum threshold for Kiwisaver is 3%, nothing stopping you from setting it to 12% if you wanted to. But I get your point, because our previous generations were pretty terrible savers the idea of means testing pensions is a bit more difficult.

You can still income test though. Someone earning over $100k p.a. doesn't see their living costs increase overnight when they hit 65. As a matter of fact, most people don't. I don't think an income test would serve to demotivate someone to do well in their career, for fear when they reach 65 they don't get a taxpayer funded tax kick back. I'm certainly not demotivated about that idea, but maybe I don't think about what's in it for me.

Income testing is easy. MSD and IRD are already in each other's pockets because of the need to manage beneficiary abatement.

Given that super is a benefit (paid by today's taxpayers and distributed to today's superannuitants) it could be abated at the same rate as the dole. $ for $ once you get over about 450/week I think. I can hear the howls on that one.

I am 79, have a reasonably prosperous business and get super. Madness, but it's there and I take it. what I do with it is my business.

If the self employed were to be paid quarterly such that the pay for the first quarter is on the first day of the second quarter and the pay for the second quarter is on the last day of the second quarter effectively pushing 2 different quarters pay together would they effectively be creating 2 quarters a year where they qualify for the rebate? How about directors who take a drawing as their sole income but do so annually after the company accounts are finalised? Would partners in accounting & legal firms who get the majority of their income from an annual partnership disbursement qualify for the gst rebate?

It's an exercise in how complex we can make life at every level to justify [insert something here]. Complete waste of effort, a bit like that series on how to tax kiwisaver - I guess someone got a job out of it but let's not pretend there is any value-add involved in fiddling with this sort of thing compared to the elephant in the room of a land value tax.

UBT. Universal Basic Tax

1% tax on every financial transaction.

No exemptions. None.

No other taxes.

Sorted. Call me when you guys get stuck again. I will be at the beach.

Ahh. Don't you love Chardonnay socialists. Always scheming how to slice and dice the existing (shrinking) pie rather than how to grow the pie for all. OECD average GST 19% eh. Well, the countries we identify with (and lose our young people to) like Canada (5% GST) and Australia (10% GST) are the countries I want my grandchildren to aspire to emulate. 17% GST! What an uneducated joke.

Good stuff - why limit the rise to 17% - another good reason to exit NZ.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.