At an event for the Young International Fiscal Association, the Revenue Minister, Simon Watts announced the Government's Tax and Social Policy Work Programme. These work programmes are a working document updated frequently so that after a change of government they reflect the new government's priorities in tax policy and social policy areas.

According to the speech made by the Revenue Minister, the work programme under the current government is designed to support rebuilding of the economy and improve fiscal sustainability by simplifying tax, reducing compliance costs and addressing integrity risks.

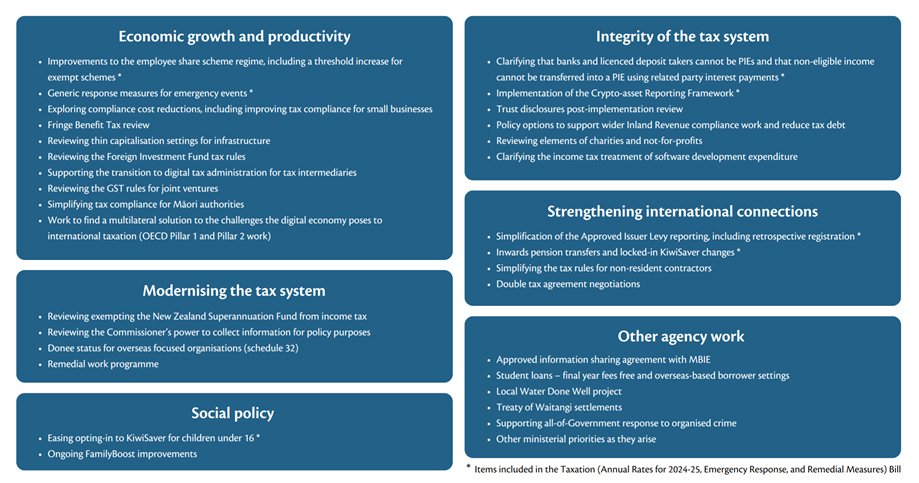

There are six areas of priorities going forward: economic growth and productivity, modernising the tax system, social policy, the integrity of the tax system, strengthening international connections and other agency work.

Out with the old, in with the new

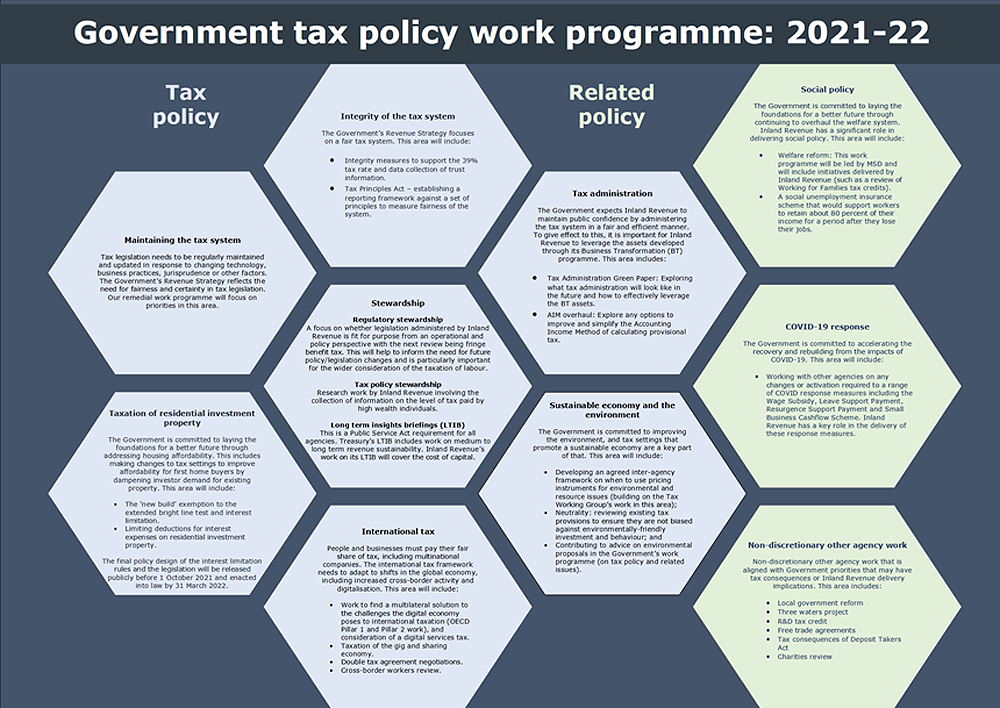

It's interesting to have a look at what changes have been made since the programme was last officially updated back in 2021-22.

There under the Labour Government, there were 10 work streams of tax policy and related policy matters some of which overlap with the updated programme. Social policy integrity of the tax system, maintaining the tax system were all part of the 2021-2022 work programme and they'll be part of every work programme going forward.

On the other hand, the COVID-19 response and the taxation of residential investment property were two major areas back in 2021-22 which are no longer there. As is well known the current government when it came in repealed all the work in relation to changes to the taxation of residential investment property.

Tax policy changes already happening

Drilling into the latest workstreams, some of them are already underway such as improvements to employee share schemes, implementation of the Crypto-asset Reporting Framework, simplification of the Approved Issuer Levy reporting including allowing retrospective registration and changes to inward pension transfers. All these are in the current tax bill before the House.

The other interesting things they've added in here, which we'll watch with some interest, are exploring compliance cost reductions, including improving tax compliance with small businesses. Now you recall last week in my review of Inland Revenue’s annual report one of the areas Inland Revenue felt that business transformation hadn't delivered as much as had been hoped for, was in reducing compliance costs for small businesses.

I totally support what Inland Revenue are doing, but the issue that they've run up against is that sometimes it has to accept the trade-off between good tax policy and the risk of tax seepage around the margins. If a policy allows a deduction or other benefit for taxpayers such as SMEs that meet certain criteria, you get certain deductions, Inland Revenue is always concerned about people exploiting that. The question that arises is does the wish to reduce compliance costs outweigh the risk that some of those measures might be abused?

A place where talent wants to live?

An interesting one that caught my eye was their plan to review the Foreign Investment Fund rules. This is something that was mentioned in passing by the Minister of Revenue at the recent New Zealand Law Society Tax Conference. This looks to address the issues raised by the report The place where talent does not want to live in relation to the problems the Foreign Investment Fund regime causes for investors migrating here.

Another interesting one is reviewing the thin capitalisation rules for infrastructure. That’s almost certainly tied up to the desire to have public/ private partnerships help build infrastructure in the country. What it would almost certainly mean is that the current thin capitalisation rules (which basically limit interest deductions for international multi-nationals, which have more than 60% debt asset ratio) would almost certainly be relaxed.

In terms of other agency work Inland Revenue is considering, is an improved information sharing agreement with the Ministry of Business and Innovation and Employment, student loans, the question of final year fees free and overseas based borrower settings, the highly topical Treaty of Waitangi settlement Local Water Done Well and supporting the all-of-Government response to organised crime. (Organised crime often represents tax evasion so it will always fall in the ambit of Inland Revenue).

Changes to the taxation of the Super Fund?

A big work programme, probably in terms of modernising the tax system, would be exempting the New Zealand Superannuation Fund from income tax. This would be quite significant as the New Zealand Superannuation Fund probably contributes $1 billion a year in company income tax. On the other hand, theG will probably then be able to dial back completely its contributions to the scheme. In other words, the fund would now be expected to be self-funding going forward, which is quite possible now it's reached a near critical mass of at least $70 billion in value.

The document’s fairly light on detail, just a one pager, but it gives you an insight as to where the priorities are right now. There are no real big surprises and we’ll watch and bring developments as these policies mature and are brought to fruition.

Student Loan Debt – Inland Revenue ups the ante

Moving on, last week I talked at some length about Inland Revenue’s actions around the collection of student loan debt and it so happened that yesterday Inland Revenue’s Marketing and Communications Group Manager Andrew Stott appeared on RNZ's 9:00am to Noon with Catherine Ryan. They discussed what Inland Revenue is doing with its extra $116 million of funding over the next four years. This Includes an additional $4 million for recovering overdue student loan debt.

Quite a lot of interesting commentary came out of this interview. One of the first surprises was that many young people going overseas don't know that their student loan debt, once they leave the country, starts to accrue interest. Therefore, they get behind surprisingly quickly. As is known, only 29% of overseas based borrowers are making repayments at the moment, and the student loan debt is now up to $2.37 billion, $2.2 billion of which is owed by overseas borrowers. A substantial number of whom are based in Australia.

So that’s now obviously a focus both operationally and in the latest work programme. I'm particularly interested to know more about what is planned in the overseas based borrower settings. What does Inland Revenue consider it needs to improve its ability to collect debt under the student loan scheme?

Inland Revenue has been allocated $4 million in funding to get cracking on recovering debt and it's expected to produce a four to one return this year, which is expected to rise to eight to one next year. It will meet those targets pretty comfortably I'd say. Apparently in the first quarter of its new financial year – 1st July to 30th September this year it’s already collected $60 million in overdue debt up 50% from last year.

A surprising statistic

I guess the big surprise that came out of the interview was when Mr. Stott commented noticed that most of the debt is owed by people in their 40s or 50s who had never got round to repaying Inland Revenue. These people had been much younger when they went overseas with student loan debt which then accumulated as interest and penalties were added. This does beg the question that if people went overseas in their 20s and we're now chasing them in their 40s and 50s, what was Inland Revenue doing in between?

As I said in last week’s podcast, relying on late payment and interest charges for enforcement just doesn't work. We know from research in other areas when a person’s debt blows out (and probably the threshold is as low as $10,000), people will put their head in the sand and not take action because the matter feels too big to manage. Mr Stott mentioned that there's several debts running into tens of thousands. I have seen one where it's over $100,000. The average debt owed is about $17,000, but it’s the old overseas debtors, obviously larger debts, that Inland Revenue is going to be targeting.

As part of this it is talking to anyone who returns to New Zealand who has a debt of at least $1,000. They can now identify such persons thanks to the information sharing that goes on between New Zealand Customs and Inland Revenue.

Inland Revenue also have the ability to detain/prevent someone from leaving until they have a conversation about payment of debt. According to Mr Stott the group being targeted are those who have persistently not engaged with Inland Revenue. They have not responded to Inland Revenue at all. They've simply just said now go away, I'm not going to talk to you and ignored them. They will be fined and will find themselves having an extra stay at the airport just prior to departure.

Deducting debts from overseas salaries?

Inland Revenue has the ability to issue deduction notices requiring amounts to be withheld from payments to Inland Revenue debtors. (According to an Official Information Act response I got from Inland Revenue, it issued over 42,000 such notices in the year ended 30th June 2024).

Mr Stott was asked whether it could do the same in Australia? Can Inland Revenue ask the Australian Tax Office (ATO) issue the equivalent to a deduction notice so that an employee working in Australia has part of their salary deducted to pay student loan debt. The answer is yes it can, but it's not easily done. It’s termed a “garnishee order” in Australia and requires a court order. Consequently, Inland Revenue hasn't really used such orders. done that.

It seems to me that that is something Inland Revenue really will need to look at closely, because if you've got 70% non-compliance and you've got an estimated 900,000 Student Loan debtors in Australia it would be worthwhile establishing a process to enable garnishee orders to happen more frequently.

It may be that they have to ask the ATO to amend legislation, which would delay everything. But it would appear that they have the tools already, so it will be interesting to see if that's employed more frequently.

Increased audit activity

The other thing Inland Revenue has ramped up is audit activities. It has apparently already launched 2,000 audits in the first quarter of its new financial year. This is up 50% on the previous year. Incidentally, 10% of those, are targeting the largest companies in the in the country.

As previously mentioned, Inland Revenue have recently targeted bottle stores and the construction industry. The next group of people that they're going to be talking to now are vape stores, nail salons and hairdressers. Because in all cases they suspect cash income is not being declared, so these businesses will be the subject of unannounced visits.

The focus in Inland Revenue now is on enforcement and debt collection and there are more signs of it. So, I'll repeat what I've said previously. If you have debt with Inland Revenue approach them to discuss it. You will find that if you take proactive action, it will be reasonable in most cases, unless you have a history of non-payment In which case good luck. Taking proactive action is the best approach, because tax debt is something you simply can't put your head in the sand and hope it goes away. It won't. Inland Revenue has got many more resources now, and the net is closing.

Why we might need to pay more tax

Finally, earlier in the week, I was one of several commentators Susan Edmunds of RNZ spoke to for a story on why we might need to pay more tax. Her story picked up the recent speech by the Treasury's chief economic adviser Dominick Stephens which noted that the country appears to be running a fiscal deficit of 2.4% of GDP - that's about $10 billion – and the pressure that's building on demographic change, the ageing population, and rising healthcare costs. The article also referenced, Treasury’s 2021 Statement on the long term fiscal position He Tirohanga Mokopuna. I repeated that I think it is a matter of when, not if, the tax take has to rise when you put all these factors together.

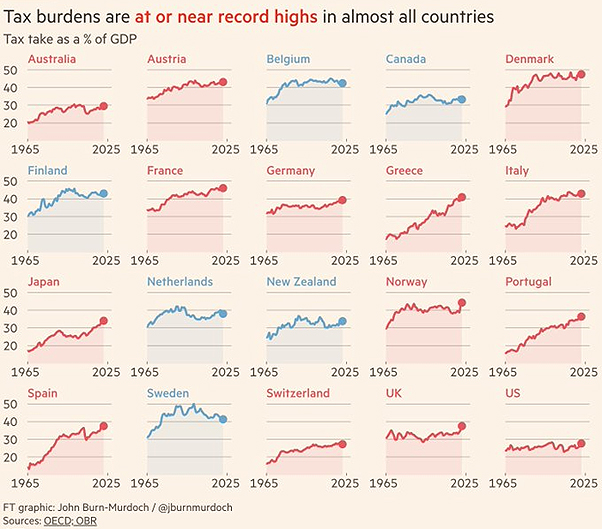

It’s also worth noting that the recent UK budget I covered a couple of weeks back increased taxes. Subsequently, the Financial Times had a very interesting graphic noting that tax burdens as a percentage of GDP for the last 50 years are at all-time highs in 14 of the 20 countries highlighted.

The pressure on tax revenues is a global problem, so we are not alone in trying to deal with these issues.

I think the break point, so to speak, will be the increasing cost of dealing with the damage as a result of extreme weather events. And I note that last week the Helen Clark Foundation released a report on the question of climate change and insurance premiums. My personal view is we need to get moving on this sooner rather than later, because that will help ease the transition.

Other jurisdictions we compare ourselves with such as Australia and the UK, have a 45% top rate. And of course, in Europe the rates are much higher, still around 50% so. I remain firmly committed to the broad-based low-rate approach, which means if we do broaden the base, we can hold tax rates down below these levels.

More tax, or less costs?

There was a nice to and fro in the comments on the LinkedIn post I put up with one commenter noting that we also need to reduce costs. Managing our expenses is part of what we have to do here, but if we're talking about 2.4% of GDP, I think the pressures are too great for such a big gap to be easily closed just by better enforcement and cost management.

University of Auckland Professor in Economics Robert McCullough, thinks that this tax debate will define the next election in terms of “if we've got these expectations, how are we going to pay for everything?”

We shall see. And as always, we will bring you developments as they happen.

And on that note, that’s all for this week, I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients. Until next time, kia pai to rā. Have a great day.

15 Comments

On those climate costs, it's obvious there's going to be a double-whammy from private insurance increases and now tax increases to cover the costs.

Households can generally only live off their net income, so taking more off them to cover escalating Crown costs at a time other costs are also rocketing puts an even greater emphasis on the question of how sustainable the efficiency of the state is in its current... state. Making tough choices is something households are doing every week, we cannot ringfence the government from the reality facing the people who are expected to contribute to it.

Suddenly it becomes painfully obvious that for most countries, having a large bulb in population followed by the subsequent generations having less children, exposes the fatal flaw in the system, that there would always be the next generation to lump everything to, and the resources would always be there to use.

As for the student loans, I'd be all for greater coordination with Australia to recoup these loans as they are a debt to the country. I know o one person from high school who racked up around 30k student loan as well as things on HP, then left for Oz never to return. 70% non-compliance is a call for change, especially in the current climate given it may be low hanging fruit.

Wholeheartedly agree. 10-20 of my High School year have lived overseas since completing degrees and I’m fairly sure they have not made payments. Time to take it seriously and impose some real consequence to debt avoidance.

On the subject of climate change and tax, there seems to be a hidden carbon cost to taxation.

Our economy has a carbon impact and our government consumes a third that economy. Therefore the carbon footprint of taxation may be considered a third of total carbon.

Our governments treat the carbon footprint of taxation as being non-existent. Allowing the increase of government spending every year to be considered non-impactful. However the resulting taxation burden requires more carbon derived economic activity being needed to pay for it.

This seems to be a large feedback loop that can only result in more climate change.

Solution... Carbon tax? In all honesty we should have done a carbon tax instead of emissions trading scheme.

Also the other obvious solution to a tax shortfall is to bring back land tax. There's a whole lot of economic and lifestyle benefits that come with shifting tax burden onto land. The banks, landlords and real estate agents would hate it though.

As is known, only 29% of overseas based borrowers are making repayments at the moment, and the student loan debt is now up to $2.37 billion, $2.2 billion of which is owed by overseas borrowers

Nominal balance for overseas-based student loan borrowers increased by 8.1% from $3.7 billion in June 2023 to $4.0 billion in June 2024.

Statistics on student loan balances

I think they're talking about overdue debt there.

Otherwise, for a single year's investor tax rebate, we could free up 12% of a lot of young people's income with a one-off loan forgiveness.

I don't see how a garnish through the ATO will help when IRD currently don't recognise student loan repayments from NZ-derived income towards meeting your minimum overseas payment requirements.

E.g I paid my full year's requirement in advance after I left NZ (but possibly crucially in my first 6 months), then got a letter when they realized I wasn't coming back asking for the first 6 month's payment! Which to me, I had already paid. "No, you paid it from a NZ-derived income so it doesn't count".

I knew a woman who was a highly paid contractor for over a decade and managed to write off close to 70000 of tax a year by leveraging and borrowing to purchase rental properties. This was prior to ringfencing deductions from rental income. She owned 7 properties - she said you need to always be negatively to minimise the tax burden. I'm thankful that they did away with the ability to deduct expenses from all income but they really need to get rid of interest only loans and the incentives to continuously leverage debt. I would be incredibly curious as to what amount is paid in tax on rental income and how much policies like interest deductibility cost us. Many investors will never pay any tax on rental income because of negative gearing. What percentage of dwellings are owned by investors? What is the average number of rental properties per investor and are we seeing fewer investors owning more properties?

My brother lives in a house bought by an investor in a very bad part of Auckland for close to 800 k a couple of years ago. His landlord says without the accom supplement his tenants couldn't afford to live in a rental property. However no one who could afford to pay what he wants would ever consider living there. All of his tenants have received the accommodation supplement. It's totally market distorting - it doesn't matter to my brother whether the rent is $1000 or $600. It only matters to the landlord. The same landlord is being forced to sell the property for negative cash flow. I read that two thirds of mortgage holders are now in some form of mortgage stress. Yet policies that made it harder to borrow were considered nanny stateish. When actually people need to be saved from themselves and if left to their own devices will take on too much debt and expose the country to financial risk.

We've incentivised the worst kind of investment (private rent seeking, extremely low productivity) through both allowing massive leverage and also subsidising it through the very expensive accomodation supplement. It's now entrenched and many in both major parties are taking advantage of this situation.

A country like NZ cannot afford to make poor decisions like this, and yet here we are. It's a cancer on the economy of NZ, draining funds from productive work and enterprise. The real winners are the aussie banks.

I am shocked by how easily led New Zealander's are and how complacent. I have an aunt in a pensioner flat with terrible health problems who is having a nightmare of a time with the health system and all she can do is blame labour beneficiaries and maori. She thinks Maori are getting special treatment. She is very pro investor despite not owning a home and thinks young people are lazy good for nothings. Meanwhile she is a very expensive drain on the health system and didnt work a lot of her life. She demands services but doesn't want to pay for them. She said if I can get out of poverty anyone can it's a personal choice. She thinks everybody is like her. She doesn't realise the trauma being carried around by some of these people. I knew about 10 or so people who committed suicide when I was growing up and a lot of kids that experienced horrific abuse and neglect - before they even start school they are so behind. It's rare that you will see a kid from a poorer community who does well academically. To say people have an evening playing field is so far from the truth.

re the comment: "I remain firmly committed to the broad-based low-rate approach, ..." I assume you mean a capital gains tax.

A broad-based CGT, for example, on small business, farms, kiwisaver, commercial property, family home will probably be too unpopular to succeed.

A CGT only on investment residential property may get across the line.

The ironic thing is that there is unlikely to be any capital gain on residential property for the foreseeable future, it is likely to be flat or falling in real terms for sometime (5-10 years?). Also, investors are likely to be getting out of the market, and the total number of rental houses are likely to fall for sometime.

It is also interesting to note that the cost to build a townhouse has actually been falling, integrating the supply chain, standard designs, improved project and risk management, larger development projects and future changes to consenting will likely see this continue.

The problem is that a CGT only on residential investment property is unlikely to provide much tax revenue, if any.

There was a time when most sales went to investors and there was a lot of churn. Every time that house changed hands there was an opportunity to collect some kind of tax. Unfortunately any introduction of a new tax treatment will require lead in time and national will bin in it as soon as they get back in. There is pretty much zero attempt to increase home ownership rates right now but interestingly they actually went up recently. I can only imagine this is because first home buyers have been very active investors less so and more people are finding affordable housing outside of the main cities and working remotely. Meanwhile the government was to crack down on remote working for its own selfish and misleading reasons. https://www.thepost.co.nz/politics/360488191/minister-told-hybrid-worki… According to documents, at an August 14 meeting Willis told MBIE officials she intended to raise with Cabinet that the reduced workforce had led to surplus office space - if they can't find people to lease the office space give it to an NGO for free.

I think you assume wrong. He more likely means to broaden taxes over a number of areas to keep the rate low rather than concentrate the tax take in a narrow area at a high rate.

Probably correct but what area of income or activity remains to be taxed - breathing perhaps?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.