Well, you could certainly see this one coming.

It didn't look like a good idea when the Labour Government announced in 2022 that it was using taxpayer money to take 100% control of Kiwibank. I expressed my opinion on it at the time.

I think the shortest explanation you could give for the Labour Government's actions were that they reflected a type of ideology.

Just as I think you could now put current Finance Minister Nicola Willis's rather strange flagging of the idea of flogging off at least part of Kiwibank - (almost throw-away-like comments in the midst of a speech to National Party faithful at the party's annual conference) - down to ideology. But very different ideology.

Hence we have different ideologies coming into play from two different governments within the space of two years that could - I think - have the potential to deprive taxpayers/superannuitants of maybe hundreds of millions of dollars.

Now, I can never back up that claim because I can't construct a meaningful counterfactual of what could have happened if Labour hadn't done what it did two years ago.

But in essence, the NZ Super Fund, that body that is charged with helping us out with our future pension requirements, was prepared to take ownership control of Kiwibank - but only if it was able to employ an exit strategy of bringing in outside investors. So, Labour did what it did.

I admit to being an unabashed fan of the NZ Super Fund and what it has achieved. I trust the judgement of the highly skilled people within that organisation. The unpleasant truth is that if those people could not see a way of maximising returns from Kiwibank that DIDN'T involve an exit to a third party then there probably WASN'T a good way of getting good long term returns from the day-to-day running of bank.

So, this idea now of Kiwibank somehow as a 'disruptive competitor', a maverick bank that's going to roll up its sleeves and get a better deal for all consumers - I just don't see it. As my colleague Gareth Vaughan recently canvassed, the obvious difficulty is trying to balance the cash hungry requirements of a growing bank with the cash hungry (for dividends) wants of any outside shareholders that might be brought in.

It would be an unsolvable riddle. You could not balance pumping in the sort of capital required to grow a bank - that by implication is going to be 'competitive' and therefore undercutting other banks in what it charges - with the 'need' to pay dividends. Not happening.

While the current Finance Minister couched bringing outside investment into Kiwibank in positive terms as something that would enable this 'disruptive competitor' role, I suspect a bigger consideration is for this Government to avoid as much as possible having to pump more taxpayers' money into Kiwibank - as it would otherwise have to do on an ongoing basis.

This of course is a Government that through ideological reasoning has given us symbolic tax cuts that the current fiscal position says we arguably cannot afford. So, yeah, stumping up more money to bankroll the bank that the previous Government saddled them with could be inconvenient.

Hence then the ideologically suitable idea of bringing in outside shareholders.

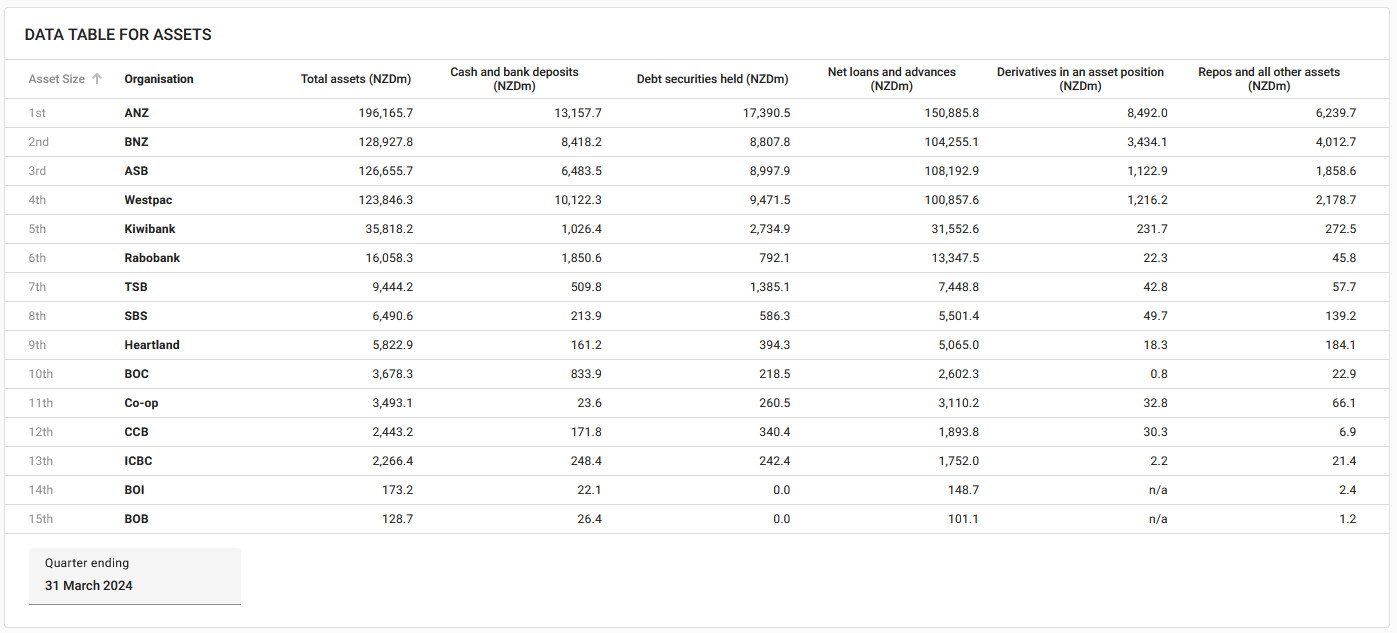

While it all might sound good, I think the reality is that this would probably, eventually, lead us to Kiwibank being bought by one of the existing big banks. The below chart, taken from the Reserve Bank's 'financial dashboard' shows quite clearly that while Kiwibank is 'number 5' in terms of size, it's a long way behind 'number 4'.

Now, okay, it's possible there might be an overseas bank somewhere not currently with a presence here that's interested in getting into New Zealand and might be keen on Kiwibank. That would be good for us. Great. Increased competition and all that. But really, why would some offshore bank be enthusiastic about getting into a new, small, market and being only 'number 5' in that small market? That's nowhere city, as far as I can see. Why would you bother?

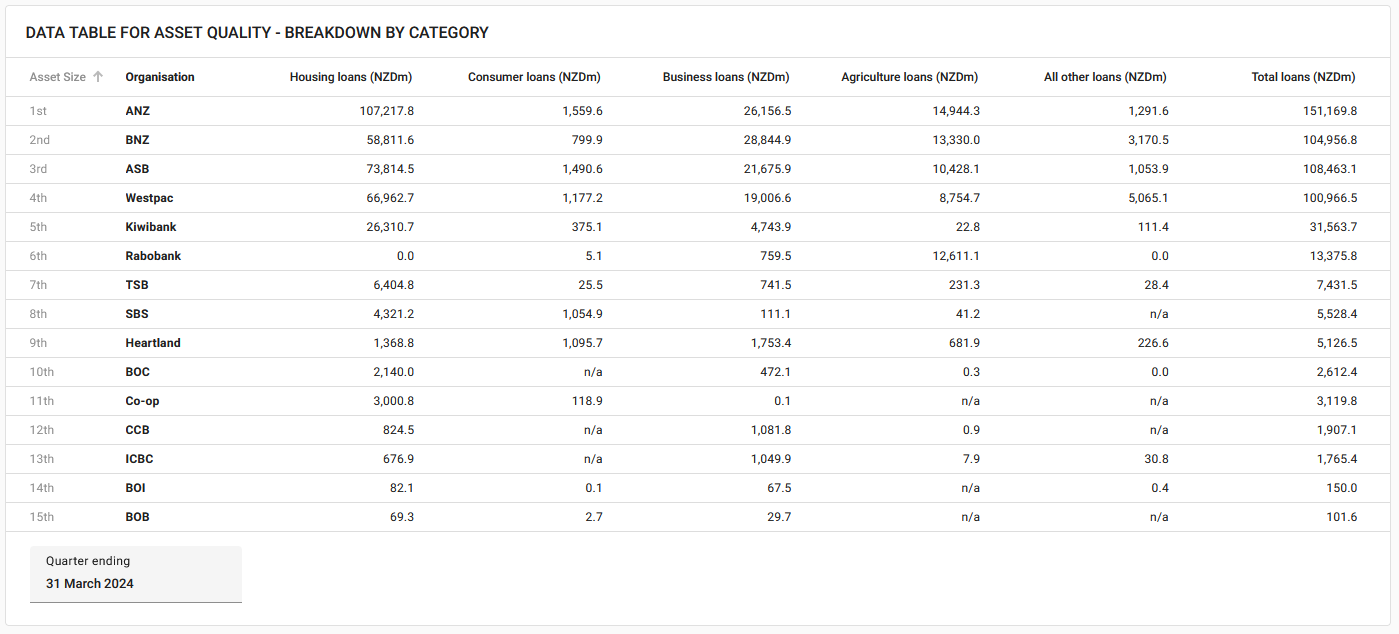

More likely, as an ultimate outcome, is that someone - and probably one of the 'Big 4 Aussies' - would be interested in picking up Kiwibank's mortgage portfolio, which as of March of this year was worth about $26 billion.

Another chart from the RBNZ's dashboard shows the Kiwibank mortgage portfolio in comparison with the other banks. And you can see from this that the Kiwibank mortgages would be an attractive pick-up for one of the big four.

This would likely result in dismantling of Kiwibank as it is now.

Of course, this wouldn't happen overnight. If Kiwibank were to be swallowed up for its mortgage portfolio then that would only occur after the Government had first opened up ownership of the bank. And this would have to assume as well that there wouldn't be at some stage another change of Government and a reversal of of ideology into one that says thou shall not sell state assets. Again.

If that were to happen, I think it would be a double blow to the NZ taxpayers.

As I said at the top of this article, I think with NZ Super in the Kiwibank driver's seat the taxpayers and superannuitants might have stood to benefit well from an eventual sale of Kiwibank. It would have been carefully phased, it would have been well done. We could have done well out of it.

I don't think the same could now be said of what might likely happen in a sell-down process with a Government that's trying to avoid having to pump in capital to Kiwibank.

To me it just highlights the perils of moving rapidly from one ideology to another and the kinds of financial wastage that can occur as a result. If there is a plan, stick with it. To keep chopping and changing is only going to waste time and money. Our money.

Assuming that this Government does push ahead with the idea of a selldown of Kiwibank, I hope it's very carefully examined first. I hope that outside expert advisers are brought in to have a very good look and to see just what exactly is feasible. I don't sense that the Government has a realistic view of the situation at the moment.

For the record I'm not supportive of the Government simply retaining ownership of Kiwibank. That's not unless someone decides that there really could be a public benefit in running a bank that does undercut other banks - and is therefore probably marginally profitable at best. If we took that course we would have to believe that the using of taxpayers' money in such a way was sufficiently worthwhile. But would it be? We would in my view have to tolerate losses. Would we be prepared to do that?

The big danger is that with any sale of Kiwibank that might be conducted, the taxpayer will not get an adequate return. And let's face it, this kind of thing happens too often. What do they say? Privatise the profits and socialise the losses?

Personally, I think for an issue such as this it would be very good to see support across both sides of Parliament before anything is done. It would have been a very good idea for Labour to have done this (seek cross-party support) before deciding to saddle the Government/taxpayer with an ongoing future liability just two years ago.

As for trying to make the best of the current situation, I actually think the best course of action from here would be for the Government to simply look for a 100% sale and see what sort of bids are attracted.

That's not an ideal solution by any imagination. But as I say earlier up the article, I think the previous Government chucked away the best solution - certainly in terms of potential cash in our pockets - two years ago.

*This article was first published in our email for paying subscribers early on Wednesday morning. See here for more details and how to subscribe.

18 Comments

KB is equivalent to Gull or Waitomo fuel. Minor impact, the big boys rule

At its conception, a concession to Jim Anderton, both Michael Cullen and Helen Clark expressed concern as to the long term viability and that concern has remained a reality. It’s a pity the next Labour government did not pay heed to that and take the opportunity to ease the problem as explained in this column. Likely if a National led government is returned there will be a 50/49% model arrived at and the question then is what exactly will make up the 49%.

kiwibank has a major impact. Do you not remember paying transaction fees on every single eftpos payment prior to KiwiBank introducing it's fee free account?

Probably cause Visa has got you used to paying a fee on every transaction again. Only this time it's going to the merchants bank instead of the customers bank.

One way or another the banks will extract their rent. Kiwibank is needed to keep a check on that.

yep - just like Gull has a local effect on the cartel pricing of Z, BP and Mobil

Local impact - big boys lower their prices in the immediate vicinity of a Gull.

How exactly will kiwibank disrupt? Especially when the likes of sharsies, robinhood, wise, dosh, and many crypto apps exist already...

Bitcoin exchange and custody?

Longer term mortgages?

Brokerage and online trading platform?

Insurance?

A way to differentiate Kiwibank would be to reshape it as a cooperative rather than as a LLC, where profits get returned to customers as equity holders, and it can enable lower costs and margins while sustaining decent returns for the coop members. The model is already in use in NZ.

Given that kind of collaborative idea is anathema to the monetarism that rules our policy making, I'd give that essentially zero chance of happening.

I'd guess the bank will be floated, and die by the death of thousand "repositionings" and "refocussings" and "sale of operational units to return to core business" until the remains get absorbed by one of the major overseas banks.

"die by the death of thousand "repositionings" and "refocussings" and "sale of operational units to return to core business"

Ah, yes. The Warehouse Model...

You are describing https://www.co-operativebank.co.nz/

Hence my statement: "The model is already in use in NZ." But not only them. https://nz.coop/

"Now, okay, it's possible there might be an overseas bank somewhere not currently with a presence here that's interested in getting into New Zealand and might be keen on Kiwibank"

Unfortunately the RBNZs BS11 rules make that pretty unlikely. Any attempts at efficiency gains by utilizing the new parent banks tech, ops etc are now complex to the point its not worthwhile.

Good point

No need for govt to be in the banking sector.

Sell Kiwibank.

Strengthen the competition laws so as to stop any potential takeover by the big four banks. Or this could be achieved by the govt holding 1 special share.

The outcome we want is unconcentrated competition. 6 to 7 banks with roughly equal market share.

Why did the government need to set up a bank to compete with other NZ owned banks? Seemed at the time it actually created a government bank to compete with local banks. How did that help these other NZ banks? Is this just a remnant concept from the socialism concepts of the past? Maybe they should have helped the NZ (not OZ based banks) banks grow more rather than compete with them.

When KiwiBank was formed in 2001, by then there were no NZ banks of scale. KiwiBank was setup to compete against overseas banks utilising the NZPost branch network.

What sort of support could the govt have instead provided to the likes of TSB, and the Co-op?

It will depend upon what you perceive the role of Kiwibank as....was it ever intended to compete on an equal footing with the big 4?...I would suggest not.

Its role was to provide a (patriotic) alternative and to place a floor/ceiling under/over the practices of the big players in terms of access and charges.

If by chance it received greater than anticipated support from the banking public then perhaps its role may have been revisited meanwhile I suspect it has achieved its role to date in moderating the big 4s practices.

What that has been worth in dollar terms to the NZ economy is an unknown.

exactly.

I don't think it follows that NZSF wanting the ability for a private exit strategy to mean that is the only way for Kiwibank to be profitable.

Remember that the NZSF is not intended to be a perpetual fund, it is being built up at the moment and is intended to wind down over the next 50-100 years.

Suppose NZSF purchased Kiwibank and built it up from it's current $2 billion valuation to a $10+ billion true competitor to the big Aussie banks, but was unable to sell to private investors. Now what would they be expected to do in 2060 when they are divesting assets and winding down the fund? They would somehow need to sell the bank back to the government, or another SOE. You see the problem here?

NZSF wanting to be able to sell it is required by the purpose of the fund itself, not necessarily because it can't see a route to further profitability without private investment.

The purpose of having a NZ owned bank is to add competition to the market and in theory drive interest rates lower - exactly what happened the day it opened and I opened an account to support that. Kiwibank is not and never should be viewed as an investment but as a state tool to assist working kiwis to be able to borrow money at resonable rates. Maintaining sovereignty over banking conditions should not be measured in terms of % gains or losses. I shake my head at the type of people that write these articles - no wonder theres no trust in media these days.....

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.