Nicola Willis said National would work to pay down pandemic-era debt and rebalance the budget, if elected, but warned it wouldn’t happen overnight.

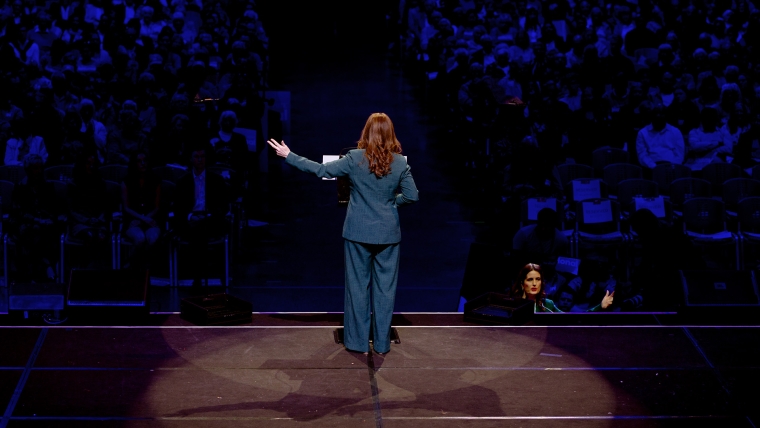

The party’s finance spokesperson made the remarks in a speech to the Auckland Business Chamber on Tuesday, which set the scene for a full fiscal plan due later in the week.

Willis also admitted, in a recent debate, that National would not achieve an operating surplus until 2027, the same year as currently forecast in the pre-election update.

She said this was still sooner than Labour as she didn’t believe Grant Robertson would actually be able to stick to the future operating allowances he had set.

Much of her speech on Tuesday appeared to be lowering expectations for what was possible in the soon-to-be-delivered fiscal plan.

“To understand the task that lies ahead of us you must first understand the size of the hole Labour has dug for us,” she said.

After significant spending during-and-after the pandemic, the Government is on track to run seven consecutive deficits — one year longer than National did between 2008 and 2014.

Willis said “big-spending budgets” had lifted net debt from $5.4 billion in 2019 to $73 billion today, with forecasts for it to rise to $100 billion by 2025.

“Labour don’t like to talk about any of this. When they do, they blame Covid,” she said.

“Don’t get me wrong — Covid has definitely contributed to New Zealand’s ropey books. But there’s more to it than just Covid.”

A total of $70.4 billion was allocated to Covid-19 initiatives, including an initial package of $12.1 billion and then $58.4 billion Covid Response and Recovery Fund.

Almost $20 billion was spent on the wage subsidy alone, but the money also covered health costs, managed isolation facilities, and billions in direct business support.

Other Government spending has added to total debt levels, but the pandemic has been the largest contributor by a significant margin.

For reference, National’s 2020 fiscal plan was to get net core Crown debt to $172 billion (50.6% of GDP) this year, which would’ve been $10 billion less than was forecast at the time.

Net core Crown debt was actually $155 billion, or 39.5%, in 2023, according to the unaudited result in Treasury’s pre-election fiscal update.

But, even assuming National kept debt $10 billion below this final result, net core Crown debt would still have more than doubled since 2019 — due to the pandemic.

Baked the books

In her speech, Willis said Labour had “baked in much higher levels” of Government spending even after the wage subsidies had ended.

She said the Government would be spending $30 billion more next year than it was in 2020 and 80% more than it was in 2017, or $1 billion extra each week.

These numbers are accurate but they are nominal figures, meaning they don’t account for inflation, a larger economy, or population growth.

Core Crown expenses were 34.3% of gross domestic product in 2020 and will be 33.5% next year. This is the same level of spending that occurred after the global financial crisis and the Christchurch earthquakes.

However, it is much higher than the 28% level that spending was at in the years prior to covid.

Willis said the pre-election fiscal update showed the Government wouldn’t get back under 30% ever again, despite setting that as a target in its 2017 election manifesto.

She said Labour would exceed its spending promises if reelected and risk triggering a “debt spiral”.

“Labour will soon present their fiscal plan. Some media and commentators will be tempted to take it seriously and to compare it with ours. But the truth is it won’t be worth the paper it’s written on”.

Willis said National’s fiscal plan would reduce taxes, fund public services and infrastructure, while still getting the books back in order.

However, she warned it wouldn’t be possible to balance the budget or pay off the pandemic debt during the next Parliamentary term.

“National knows that New Zealanders don’t expect us to fix Labour’s mess in year one. But we must chart a better way forward and use the next three years to exert more control over spending and debt”.

She said New Zealanders deserve tax relief, but that schools and hospitals also needed more funding. Future budgets would have to make room for both of these priorities.

National’s tax plan identifies roughly $14 billion in new revenue and cost savings across four years that will be used to lower income and property taxes.

It is designed to not worsen the debt, but it does prioritise tax cuts over reducing debt or balancing the budget.

Some economists have also warned revenue from the foreign buyers tax could fall short by $500 million, which would add to the debt or prompt extra spending cuts.

74 Comments

She's going to lower taxes, get the books in shape, and deliver?

All based on a total fake - the idea that you can tax some other people who aren't us?

Bollocks.

Only the stupid...

Oh - and it wasn't Labour - it was the Limits to Growth, coming to a place near you, now.

Labour has a plan that's "...part of our discussion".

"Hipkins said Labour's policy for this election was very clear..." same as last elections then...Co government, 3/10 Waters, unelected local authority representation, racist healthcare...

This Labour's government has been one of the worst in modern NZ history. A complete failure from almost every perspective.

The worst government ever sold most of our future energy generation, turned Christchurch into a parking lot and build a couple of conference centers. Lets no forget the meths testing.

Or the increase in GST that we were promised wasn't going to happen.

But let's not forget in Christchurch, the stadium and convention centre were opened in 2017 as Key and Brownlee promised

Oh wait...

Worse ones (in order, worst first) - 4th National Government, 5th National Government, 4th Labour Government, 3rd National Government, 5th Labour Government

I think its been referred to as the Bermuda Triangle of economics?

Countries that have run zero fiscal surpluses since 2005 (or well before) are listed below. Our obsession with returning to surplus is next level stupid. We run consistent trade deficits because we don't make anything particularly valuable here, so for Govt to run a surplus, the private sector (us) has to go further into debt (or hand over their savings to the Crown). We used to understand this. Indeed, it's why National used to argue against running surpluses!

- USA

- UK

- Italy

- Spain

- Mexico

- Portugal

- Israel

- Hungary

- Japan

- Etc...

So even National is admitting their "we'll save you" nonsense was, in actual fact, just that, nonsense?

Why am I not surprised?

So their budget is just as pie in the sky as Act's, NZ First's and most of the minor parties.

Thus far, the only believable budgets are from the Greens, TOP, and (sadly) Labour.

But if we're looking for ingenuity and vision we're down to TOP and the Greens.

Well that got a lot easier.

If you think the Greens have such vision, then would you please explain how their leader failed to see a fleet of motorbikes heading towards her?

A wealth tax that will cripple the country is not a vision. It is stupidity. That is TOP and the Greens.

You need to break some eggs to make an omelette.

If there’s no hope for our youth, they leave.

That’s a bigger problem then some wealthy folk coughing up an affordable amount that would still see them paying less tax proportionally to other working kiwis.

You guys keep saying a wealth tax will only affect a few wealthy people that nobody cares about.

I believe that you are all wrong. It will have much wider effects.

Do you honestly think crashing house and farm prices will have no serious negative consequences ?

And if/when we get the downturn, foreigners will be waiting at the farm gate.

"Working Kiwis need to keep carrying the load and supporting property because we're too big to be allowed to lose money"...

Not sure that the prospect of people losing money on land is sufficient reason for productive working Kiwis to be carrying them.

I don't think a wealth tax is stupidity. It's economic suicide.

The only difference between the Greens and Communist is that their color.

Land Value Tax on the unimproved value of land is so much better and simpler anyway.

Importantly, we need to stop the present paradigm of welfarism for property off the back of working Kiwis.

Agreed. TOPs policy around Affordable Housing (including LVT) is much more palatable: https://www.top.org.nz/affordable-housing

That "much more palatable" explains why TOP is at just 1% (margin of error of 3.1 percent at the 95 percent confidence interval) in tonight's poll.

Yeah, nah.

Now, let's be crystal clear how National will reduce the debt. It's actually a very easy 5-Step Plan....

- You stop using the power of the Govt purse to finance major infrastructure projects

- You offer sweet PPP deals to your investor buddies - "chunk in a few billion Blackrock and we'll give you premium returns longtime".

- Keep the net debt definition the same so that the PPP liability doesn't register as Crown debt (just a call on future revenue budgets)

- Stage the PPP payments so that they start small and don't pull too hard on the revenue budget for the first few years.

- Hope nobody notices as more and more of the revenue budget flows to overseas hedge funds and investors.

Sounds like the play as explained in "Confessions of an economic hitman".

And i agree with you.

Jfoe +1

and load up taxpayers to the hilt with user pays fees

Increase GST?

I don't think they'll need to. People do not appreciate (yet) just how austere the most recent Labour budget was. The National plan will be to bank Labour's considerable (real terms) savings over the next few years, slash the public service (starting with the already announced 8.5% cut to 'back office'), outsource public services, hold benefit payments down, and hope that their 'off the books borrowing' for major infrastructure projects gives the economy a boost and gets the tax take back on the rise.

Labour's big miss this election was going all cautious on infrastructure spending - they should have laid out a 10 year plan of new infrastructure, solar, cheaper elec bills, managed retreat etc. Everyone knows it needs doing.

Labour should have laid out that infrastructure plan for 2020s election when sovereign debt interest rates were at their all time low, unlike today; however back then they had their secret co government agenda priorities.

It's going to be interesting to see spending on external consultants soar while they're having to pretend to cut expenditure. As they gut public sector capability they'll be needing to outsource it to someone else at a higher rate.

Plus the 25 year PPP contract ( financing & maintenance) results in a total cost at least 3x the original upfront $ which zero politicians & MSM ever point out.

Fascinating read, thanks.

"The cash payments will be around $125 million per year, starting only when the project is finished and open for use, and lasting for 25 years. This stream of cash payments brought back to today’s dollars is $850 million and is the “net present cost”.

125x25= $3.125 Billion

In a past life I used to do npv calcs to justify business cases: all about selecting the right discount rate. We always had to have the raw payback period shown as a sensecheck.

And 6. Declare bankruptcy like Sri Lanka.

Rubbish , whoever wins , we are nowhere near that level of debt .

Solar - you DO represent a GND mindset. Money is issued as debt and there has never been more debt than now. Energy underwrites money 100%, and there has never - since we tapped into the fossil stock - been less remaining potent energy. Nor have there ever been less remaining planetary resource-stocks.

We are in debt-repayment overshoot, collectively. How it pans out, is moot; maybe a collapse, maybe rampant inflation, but reconcile it will. And in that light, default is almost guaranteed.

- Tax cuts for all ✅

- Reinstate mortgage deductibility ✅

- Increased funding for schools and hospitals ✅

- Pay down Government debt ✅

All paid for by foreign buyer stamp duty?

“For our next trick, we’ll cut our own policy in half but keep our promise to foreign buyers!”

They can promise what they want. They only have to be seen as being 'better' than the status quo, and as has been shown in the past, promises can be broken and blamed on the previous government. We have seen this all before and it is just going to happen again and again. In NZ government lose elections, rather than there being a good alternative. But although I don't think Labour should get another term, and they won't, at least their costings and promises are probably more realistic.

Is this the same Nicola Willis who incorrectly stated that QE had flooded the economy with money. I doubt that she could even define what government debt is or how the government finances its spending or what sectoral balances are and what happens to household finances if the government runs surpluses. A frightening prospect to have as a minister of finance.

The same Nicola Willis who when asked what the net result of her FBB repeal policy would have on house prices stated "I don't know"... there were a few aghast looks even from the very loyal Queenstown crowd.

What is the effect of the Green party wealth tax policy on house prices?

What is the effect of that on small business?

What will that do to employment?

What about farming?

Why does a policy from the Greens get no scrutiny when it will be likely to become law if Labour were able to form a coalition?

Why do you have a bias you can drive a bus through? And wrongly-based, I'll be bound (you'll be a believer in everlasting growth and the efficiency of markets, I'm guessing? Flat earth territory, in essence. And from that POV...

Tl... to the best of my knowledge Nicola Willis is correct ...QE...which in NZ was mostly LSAP, does increase Money supply.

The whole QE thing had 2 aims.. One to influence longer term interest rates and secondly to provide liquidity...

QE reduced the amount of money held in the form of Govt bonds and increased the amount of money held in the form of settlement account balances or cash. The bond market is so liquid that cash and bonds are close to being the same thing.

Jfoe ....that is incorrect.

The settlement acct balances is just an intermediary step.

The final step is....Private Banks created deposits to pay the firms that sold assets to the Reserve Bank. ( increase in Broad money supply )

eg.. A Kiwi saver fund that Sold bonds to the Reserve Bank was paid in the form of a newly created deposits in its Bank acct.... Its Bank , eg. BNZ, was paid by the Reserve Bank by a credit to its settlement acct. ( increase in bank reserves )

The only way that money held in bonds can be reduced is if the Bond is repaid...and no longer exists.... as far as I know.

Except the RBNZ bought over $50b of government bonds, that is where the majority this governments “wasteful spending” debt exists. They bought and will sell/are selling these bonds on the secondary market. Except the price at purchase was high due to low interest rates, pushed lower by the purchase itself, and now, hey presto, interest rates are heading north and the bond price south. Good time to sell. So where is the balance? They spent $50b and need to balance the books on bonds worth what, $20b? Less? $30b+ in extra mortgage payments. They shorted themselves on the securities of future mortgage payments.

Yes, I said increase in settlement account balance or cash. If a bank owned the bond the increase is just to their settlement account balance. If a pension fund owned it, yes they get the cash (*and* their bank's settlement account balance increases).

Obviously this is just the reverse of a bond sale - the broad money position returns to where it was before the bond was sold.

I see cash and credit as being different.

Anyway...My post was to say that Treadlightly is wrong to malign Willis.... as He is the one who does not understand the nature of QE.

One thing I'd add....is that in a Crisis Bonds are not like cash.... Fear can cause liquidity to disappear.....and some Bonds are not so easy to sell.

.

Yes, a difference in terminology rather than understanding. Note that the Fed accepted US bonds at par value as collateral during the recent banking mini-crisis.

Yes.... Central Banks can buy anything.... I recall during the GFC they even bought " troubled assets".... and probably paid the "asking price" (par ? )

Financial sector have been large beneficiaries of this "friendliness".

Back in the day.... Central Banks provided liquidity at punitive rates. ..... which is how it should be ....in my view.

“Well… I do have the definition and model of how government debt is created and paid. I have it right here.”

*points to a one line sentence on a print out, which says ‘Money machine go brrrr’*

Nicola,

the books could be balanced a lot more quickly if National stopped bashing beneficiaries and introduced a capital gains tax on the freeloading subsidised wealthy.

Also, in terms of beneficiaries, the capitalism system we run requires a % of the workforce to be unemployed. It is this completely illogical and immoral to put the screws on them.

The real benefits that need looking at are the ones over 65's receive regardless of need. That would be a start. Wouldn't even need a tax cut, just bring in a means threshold and redistribute the savings to those who truly need. If it's $18b p.a. that's what it is. But at the moment it goes to all and sundry regardless of how many rentals or millions they have in the bank. A return ticket on the Waiheke ferry is $50, but free offpeak with a gold card. $50 would go a long way to a struggling pensioner's heating bill.

I’d like to see the unmeans tested age of eligibility raised to 67.

Super should be claimable from 65 but only if aren’t working.

We created a "surplus to requirements" role in our company as a succession plan for a very good young employee, because the 2 other positions are occupied by superannuants who now have a very low work ethic, just there to ride the bus while claiming their super, company health insurance and full personal use company vehicles.

No. Just income test NZS and have it paid via IRD. IRD get fortnightly (well, they’re supposed to) PAYE records so can easily extrapolate yearly earnings from that. If in any given fortnight the extrapolated earnings are more than say, $250k per annum, then no super is paid.

Would mean the likes of Winston Peters can’t get his parliamentary salary & Super.

Means testing is punitive. It means the 70 year old widow with no other income living in a mortgage free house in Manurewa worth more than say, $500k would get no super. The means testing crowd would tell that widower to sell the house and move, and live off the sale proceeds, completely ignoring where the widower would be able to move to, and maintain their community links. The older one gets, the more those community links matter.

Means testing is income testing. What you're referring to is an asset test.

A means test is a test in which your income is calculated in order to decide whether you qualify for a grant or benefit from the state.

https://www.collinsdictionary.com/dictionary/english/means-test

No. Over time the means test has been conflated to include both assets & income.

https://www.tewhatuora.govt.nz/for-the-health-sector/specific-life-stag…

https://www.servicesaustralia.gov.au/residential-aged-care-means-assess…

Doesn't change the definition. It's just they're using both Income and Assets to test eligibility.

Even that Te Whatuora link provides a distinction not only in the header "Income and asset testing" but in the income test section "Income test (financial means assessment as to income)".

Otherwise, we better write to Collins dictionary and make them aware people are conflating.

The clue is in the HNZ/TWO page heading: "The financial means assessment has two components: an asset test and an income test."

Fair call. I suppose we are talking about bureaucrats, one must take literal correct definitions at their peril.

You pay tax if you earn and collect super. It’s not a free lunch.

It's a free lunch.

Boy Labour are really panicking. Never seen so much nonsense on this site Go National

Forgive me if I’m way off on my thinking, but the majority of covid debt, was that not the RBNZ buying bonds as part of the LSAP? 50b or so out of 100b on offer, which is now valued at much MUCH lower, the RBNZ choosing to sell these off gradually could quite easily “inflate” the debt away by simply eroding it. My guess is rates will remain high so long as these debts remain, as they’re gradually eroded while not effecting the financial systems.

Grant was right, it’s all slogans and words but underneath the hood both parties have the exact same job to do. So what you’re really voting for is do we want some money flowing through our public services or private services.

Not a good time to hold debt either way, you’re the chosen one it would seem to pay for covid.

I'm increasingly convinced that Nicola Willis has been sent by a higher power to cause the greatest possible increase in the combined blood pressure count of the Interest.co.nz commentariat.

I think you are giving her way too much much credit. Chloe Swarbrick would tie her up in knots with her understanding of economics.

I think you might have misconstrued my comment as being positive about Willis!

Translated: "There is a whole lot of stuff that we want to spend your money on - tax cuts for the wealthy, Redundancy payments and golden handshakes for staff who were clever enough to get those in their contracts. And ou... the tax cuts are way more important than balancing the books and paying down debt."

Be interesting to hear what sort of reception she got.

Or what some of the crowd thought.

Clearly she thinks the general population can be satisfied with a tax cut, and are not to bothered how it is paid for. This crowd would be a bit different, I would think.

She is financially illiterate.

"Willis said National’s fiscal plan would reduce taxes, fund public services and infrastructure, while still getting the books back in order."

Tax cuts. Fund public services. And getting the books back in...

Tell me what is wrong with this 'picture?'

Tell me lies , tell me sweet little lies.

what's wrong is, according to the polls , its working.

Nothing wrong with the picture if you are into surreal art :-).

Buttering us up for increasing GST to 20% to pay for their tax cuts. John Key showed how it can be done, Willis is just following his lead.

she was the one that suggested it to JK so only following her previous plan

National's fiscal plan ( much tweaked I suspect) is coming out this week. According to today's media reports.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.