The Government’s being urged to take a breather before passing a law to stop investors using losses from their rental properties to offset their income tax.

Some tax experts, who have submitted on a bill to introduce the ring-fencing of rental losses, say implementing this rule would be a waste of time if a capital gains tax (CGT) on investment property was also introduced.

PwC director Sandy Lau and Chartered Accountants ANZ’s John Cuthbertson believe having both ring-fencing and a CGT would be an overkill.

Ring-fencing would see property investors limited to offsetting their losses against the income they earn from their property portfolios.

Lau explained in her submission on the Taxation (Annual Rates for 2019–20, GST Offshore Supplier Registration, and Remedial Matters) Bill that a CGT would see ring-fencing “effectively become obsolete as the perceived tax advantage will no longer be available”.

“In our view, to require taxpayers to comply with such complex rules for a potentially short time before they are replaced is inefficient and results in undue compliance costs.”

Similarly, Cuthbertson said: “In the case of the loss ring-fencing rules, the same objective could arguably be achieved by introducing a tax on capital gains on the sale of land, as this would prevent the mismatch of deductions with no corresponding taxable income, because the corresponding income would be taxable…

“If the Government decides to introduce a tax on capital gains, the loss ring-fencing regime would be redundant and would likely be repealed, resulting in uncertainty and complexity for taxpayers as they transition between regimes.”

TWG: Case for ring-fencing reduced

Cuthbertson and Lau noted that even the Tax Working Group (TWG) questioned the need for ring-fencing in the event of a CGT being applied.

The TWG, in its final report, said: “A key argument for the planned introduction of residential rental loss ring-fencing rules has been the lack of a tax on capital gains on rental properties. Landlords are currently able to claim tax losses when they are making untaxed economic profit owing to capital gain.

“The case for residential rental loss ring-fencing is reduced if the taxation of capital gains is extended to cover residential rental investment property. Gains will be taxed when properties are sold although there will still be some timing benefits for landlords if losses are not ring-fenced because gains are taxed only on realisation.

“To the extent the taxation of capital gains could put upward pressure on rents, the removal of ring-fencing on residential rental property may aid in limiting potential rent increases.

“The Group suggests that the Government consider whether or not it wishes to remove loss ring-fencing on residential rental property if the taxation of capital gains is extended to include residential rental investment property.

“The cost of this policy change is approximately $830 million over five years and would need to be balanced against the Government’s other priorities.”

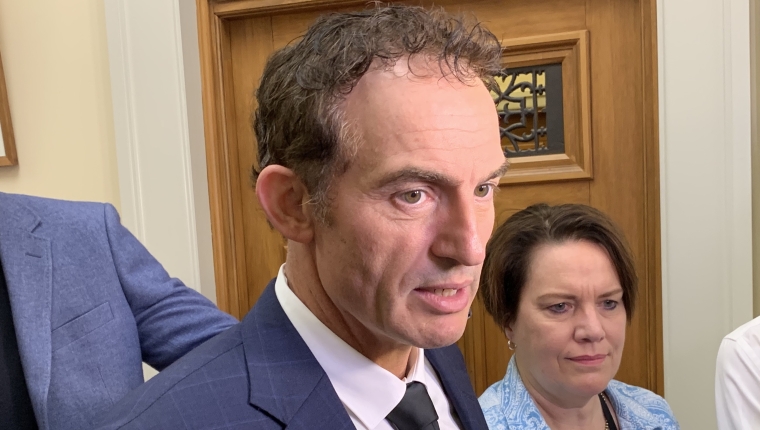

Nash: “I don’t deal in hypotheticals”

Revenue Minister Stuart Nash is mindful of the concerns PwC and Chartered Accountants ANZ raised in their submissions.

Yet he wouldn’t comment on whether he’d hold off progressing the Bill, currently before the Finance and Expenditure Committee, stressing the Government hadn’t finalised its response to the TWG report.

He brushed off criticism it was a waste of time considering ring-fencing rules, saying this assumed the Government had made a decision on the TWG report.

He wouldn’t be drawn on whether having both the ring-fencing of rental losses and a CGT was an overkill.

“I don’t deal in hypotheticals,” he said.

Prime Minister Jacinda Ardern provided a similar answer when questioned by interest.co.nz.

The Government is expected to announce its response to the TWG report before the end of April. Any law changes won’t take effect until April 2021.

The ring-fencing of rental losses was a key policy Labour campaigned on in the lead up to the 2017 election.

Pushing pause on ring-fencing also pushes pause on GST collection

While the likes of PwC and Chartered Accountants ANZ want the Government to push pause on the Bill until it knows what it’s doing with a CGT, there is another case for the Bill to be passed with some haste.

It also proposes introducing a regime for applying GST to low-value goods New Zealand shoppers buy online from overseas suppliers, as of October 1.

However, as interest.co.nz reported last week, overseas retailers and online marketplaces like eBay and Alibaba, responsible for collecting this GST, want more time to get their systems set up to do so.

The Government could therefore expect to face considerable backlash if it shortened the time between the Bill being passed and the GST rules becoming operative.

Extending the timeframe for the rules to implemented would also see it lose a relatively small amount of tax revenue. Around $278 million of additional GST revenue is expected to be collected by 2021/22.

Ring-fencing fundamentals called into question

Coming back to the ring-fencing of rental losses, the Inland Revenue Department, in its regulatory impact statement, said it had a “low” degree of confidence in this improving first home buyers’ abilities to compete with investors, improving housing affordability, and increasing the share of New Zealanders who own their own homes.

It cited "significant uncertainty" over the net impact of the policy, especially on the rental market.

“Overseas experience underlines the uncertainty in the direction and magnitude of housing market impacts. For example, negative gearing was banned in Australia between 1985 and 1987, and while rents spiked in Sydney during this period, they were flat or falling across much of the rest of the country," it said.

“The exact relationship between the tax changes and observed changes in rent is unclear.”

The IRD said 40% of taxpayers with rental properties recorded losses at any one time. On average they enjoyed a tax benefit of $2000 a year.

Fundamentally, PwC and Chartered Accountants ANZ are opposed to ring-fencing because it treats losses from rental property differently to the way it treats losses from other investments.

Lau pointed out negative gearing occurred elsewhere, like in farming and business, so it would be unprincipled for it to be treated differently when it came to property.

Cuthbertson raised the point mum and dad investors would be hit hardest, as they wouldn’t have the large portfolios bigger-time investors have to offset their losses against.

The Finance and Expenditure Committee is due to report back on the submissions it's received on the Bill by June 11.

*This article was first published in our email for paying subscribers. See here for more details and how to subscribe.

37 Comments

Experts? Tax Experts? We ain't got no Experts! We don't need no Experts! I don't have to show you any stinkin' Experts!

the question is will we have a CGT anytime soon, are this party brave enough to get voted out next election

or will they hold off until the end of their next term before they even try to implement one

If there’s ever to be a CGT in NZ, it will be a very diluted version of any of Cullen’s proposals.

The current government has done ok to date - not fantastic, but passable.......

Certainly, it won’t want to shoot itself in the foot before the next election - or the following one if it gets re-elected in 2020.

TTP

Slightly difficult to say they are passing when they gutted Taranaki without so much as an impact report.

Even with a CGT there is a timing issue. An investor could deduct expenses against income now, and not pay a CGT until 20 or 30 years in the future. That would still give the investor a cash flow advantage compared to an owner occupier. Ring fencing is required.

Ring fencing losses brings investors onto an equal footing with family trusts. Ring fencing also disincentivises ponzi borrowers. I don't quite get why the two taxes are mutually exclusive, they seem quite different? (edit) - click! I get it now. Its because the losses are carried forward.

Both ring-fencing and a CGT need to be brought in to residential property urgently to curb investors from competing with home buyers earning average incomes and the massive social problems and damage we have now. Better to incentive productive economic growth rather than speculation.

Housing is a productive asset, it produces cash flow for the owner and it produces shelter for the renter.

I dont think thats the case here. The ring fencing gets rid of the speculative buyer who is betting on capital gains and runs their business at a loss on purpose. There are plenty of these. It is totally unproductive.

You are not discounting future cash flow correctly. A small loss today is not a loss in the future as rents will rise. Housing produces, fundamentally shelter, but in terms of been a productive investment it produces cash flow, emphasis on the flow as it denotes it is a time function. When calculating the value of a flow you must discount its future value in to the present. After doing this you will find almost all rental property is in fact productive from the investors stand point.

You need to read the definition of "produce", perhaps you mean provides, a similar but distinctly different word.

https://dictionary.cambridge.org/dictionary/english/produce

https://dictionary.cambridge.org/dictionary/english/provide

A house is shelter, it does not produce shelter. A builder produces shelter, a house is shelter. And a house does not produce cash flow, it diverts cashflow from the renter to the landlord. A house produces nothing.

Productive assets are assets that produce 'income'. Unproductive assets, like bare land, do not produce income and are non-productive. Production of shelter, or 'provision of shelter' if you so prefer, is what your asset trades in order to produce income and shelter is very valuable.

By economic definition housing is not productive investment. There is no debating that.

Productive investment is defined as an investment that increases MPL. Owning an additional house does not increase productivity in workers. Investing an extra dollar in the housing market does not increase productivity. Hence any superfluous investment in housing has a huge opportunity cost.

So, housing.

Yes. It is important.

No. It is not a productive investment in any economic sense.

Yeah i see your point, she is talking about the productive economy and im talking about productive investments.

I'm just not sure why they keep hammering residential property investors.

- Ring fencing losses

- CGT/brightline

- Changes to the tenancy act that favours tenants

- Forced property standards

I realise there is a "housing crisis" they are try to solve but it's not just investors causing it, it's multifaceted.

- RMA

- Councils

- Building costs/duopolys

- Immigration

- Low interest rates/QE

The majority of RPI are middle class families just trying to get a little extra for retirement. A few changes are fair enough but it's just been one after another which has only served to increase the state housing waiting list by 70% in the last year.

Because on average owner-occupiers have a higher standard of housing than those renting do. So it's a two-pronged approached:

1. Discourage houses being used as rentals -> the same houses don't disappear from the market, instead they are sold to owner-occupiers who will invest in the properties to improve their standards.

2. Enforce better minimum standards on the quality of houses that are used as rentals so the gap between rental and owner occupier is not so large.

This is so as a country we live happier, healthier lives, which is actually the goal of economy. Looking at everything through simple dollars and cents as you are explains why you don't understand what this government is doing.

would it not be better to offer a carrot for investors to buy new build for rentals rather than competing with the FHB for existing stock

You dont house a population by discouraging rentals, that makes no sense at all as the number of occupants per house drops as they are sold to owner occupiers. In order to house a population you must build as many houses as the population growth requires, there is no other possible way to achieve your desired outcome. Punishing rentals will not solve fundamental shortfalls in supply.

Oh, that old trope again. Heres a hint, an middle class early 30s couple with or without kids is unlikely to live with others whether they rent or own, so them buying will not change the occupancy ratio of housing. And the price to income ratio is going to have to change quite a lot before the lower income couples that might well have flatmates are going to be able to afford to buy.

Not to mention, with over 14000 properties houses for sale on RE.co.nz at the moment, there really isn't a shortage of houses. Just an affordability problem.

There is a shortage of housing and that contributed to the high prices we see and is one of the main reasons that prices are not falling as you would otherwise expect. Fixing affordability wont actually solve the fact that we under built for too long.

Private landlords have been a very important sector in providing housing.

Even at the moment with there is little incentive for landlords to invest; very very low yields, high LVR, increasing compliance requirements, legislation that has been essentially anti-landlord, and the future possibility of both ring fencing losses and capital gains tax. RBNZ mortgage figures confirm this.

The renters will be scoffing at this with glee; however, the reality is that landlords are not social providers of housing and there is little incentive to invest unless there is to be a very, very significant increases in rent.

Ring fencing is only a disincentive to landlords who are geared up the wazoo, and who purposely lose money on their "business" betting on a future increase in value. The low yields are due to excess demand as the sheeple have piled into the aforementioned business plan with glee - its a sure thing mates, forcing prices up. The yield will only get better if prices drop, rents will never catch up, unless we can magic up 20% a year in wage increases.

You clearly have not done the maths on this as its quite the opposite even at 100% leverage. You may have a massive misunderstanding about the yields most investors are buying.

Comments like 'its a sure thing', only shows you are projecting a fantasy of ignorant investors been the main stay, they are not. Investors are on average wealthy, high income and educated.

Heres one example of many, a house in my street sold for 1.4m. It is now being rented out at $800 a week giving a return of 2.97% Gross. At 100% finance, and interest only please tell me how the wealthy, high income, educated investors are turning this into a golden goose. Is it based on yield, or speculation.

I also have a friend who split up with his wife. He was looking after their child fulltime. After all her rental losses impacted on her income, she was reporting income of less than 60k which is what he was earning, so she was paying no child support. Such a productive part of the economy.

Example A) would need to know how much land it had as that rent to price ratio is out way outside the norms for investments. Most investments would cost more like $300,000 to $900,000 and have a gross yield of about 4.5% to 8.5%. Never the less ill use your figures:

The break even at 15% costs is 19 years at 3.5% rent growth and time to go debt free is 49 years. So if you are 0% down, then thats a pretty nice deal. Debt peaks at 1.65 million in year 19.

A more typical example at 4.5% gross, 15% costs is break even in 3 years and debt free in 29 years, shit for 0% down thats amazing :-)

Example B) Her capital gain should be considered income and included in child support payments, sad story though, poor guy.

Example A) at 300,000 to 900,000, the yields would make sense. Except the market for the last few years have priced in never ending capital gains. Hence 1.4 mil. Now that the gains have stopped, the owner is trying to salvage yield. Except wages haven't kept up. The owner can't simply double rent to get reasonable yield on the 1.4mil as, if they did, there'd be no renters that can afford it, and the house would sit empty for indeterminate number of months costing more money for the owner every passing month.

Example B). Interesting comment "Her capital gain should be considered income". Yes, totally agree. And income should be taxed - at appropriate personal income tax bracket.

As an aside.

Is all well with Stuart Nash? This photo - and his appearance on TV last night - show what appears to be a considerable loss of weight, a haggard look, and considerable aging. Stress or sickness?

Might have transitioned from bulking to cutting? :)

Careful what you wish for folks. If CGT introduced on rentals it will be the thin end of the wedge. Once legislated it will only be the stroke of a pen before it is applied to the family home, only a matter of time, government wont be able to resist. Be interesting to see how people feel about their estate going to government instead of their children inheriting it?

Housing is arguably a consumptive (consumer) product. 'Ring-Fencing ' helps house-price-discovery, it encourages buyers to consider a houses' value based on rental yield - not speculation which is often very abstract.

Ring-Fencing will make taxation a little simpler and more transparent. I say give it a chance.

If there is no community support for the capital gains tax then the government should back off and implement a land tax for a start. Its the housing market that's the main issue.

The taxation of property then needs to be split between local government and central government.

1) one arm of government should tax on the land value only, and

2) the other arm of government on the improvement value only.

Sounds good.

and the evidence of "community support" for a land tax is ? Right , did not think so .

*raises hand*. Much better idea than a CGT full of exemptions and loopholes with massive compliance costs. (Assuming the land tax is done properly)

Yay a land tax. We could be like Hong Kong where the economy is "balanced"so that govt revenue comes from taxes on property (all land is leased from govt). Although Hong Kong also has by far the worst housing costs in the world...

Hong Kong also has restrictive zoning with less than 4% land area zoned for urban accommodation.

Well from my personal situation a land tax would not be good.

I am not cash rich enough to be able to pay that annually (if that is how it would work?).

Would that not be a double dipping of rates? Except one goes to council for services and other to govt for more services.

Why own property when you never really own it.

Are people really that keen for more taxes?

I already have a sore back from bending over.

How do you know you can't afford it if you don't know what % the tax is?

Current land taxes against rates are something like 0.3% which are too low to have significant positive impacts on landholding incentives and prices.

If you own land but can't afford the land tax, then you've either got too much debt, or you're not utilising that land productively/efficiently.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.