There has been a strong lift in the number of Auckland CBD apartments being listed for sale and no shortage of buyers willing to snap them up, with Chinese buyers to the fore.

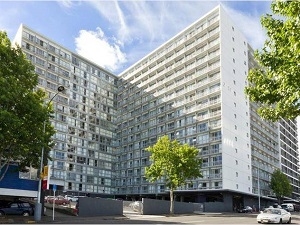

New listings at real estate agencies City Sales and Ray White City Apartments, both specialists in the Auckland apartment market, have taken a big jump in the last few weeks, with the increase in activity most noticeable at their regularly scheduled auctions.

Damian Piggin of Ray White City Apartments said the number of apartments being auctioned by the agency had more than doubled over the last few weeks and very few remained unsold at the end of each auction.

City Sales director Martin Dunn said new listings at his agency had also increased strongly in recent weeks.

However the extra supply did not appear to be dampening buyer enthusiasm and there was strong competition between bidders when they came to auction.

At this week's regular Ray White City Apartments auction, 12 apartments were offered for sale compared to the normal five or six and 10 sold under the hammer, with another selling by negotiation later the same day.

Next's week's auction will be even bigger with 14 apartments due to be offered for sale.

Piggin said many of the vendors were investors who had owned their apartments for many years when there hadn't been much movement in prices, and they were now taking advantage of recent price rises to exit the market.

Some had been stung when they had purchased apartments through the notorious Blue Chip investment schemes and were taking the opportunity to recoup their losses, he said.

However it appears that others had purchased their apartments only recently and were giving them a quick flick.

At this week's auction a two bedroom apartment in the Federal City apartment complex on Federal St, that had been purchased for $395,000 in April sold under the hammer for $487,500, a price gain of $92,500 (23.4%) in four months (see results below).

Another that was sold for a sharp increase in price was a unit in the Zest building on Nelson St which had been purchased in January last year for $296,500 and sold under the hammer at this week's auction for $439,000.

Piggin said he did not think that new loan-to-value ratio (LVR) restrictions and pending changes to tax rules on residential investment properties, were having any effect on the market.

"We'll have to wait and see if it does [have an impact ] but at this stage I haven't seen much effect from it," he said.

Another noticeable feature of recent auctions at both Ray White City Apartments and City Sales was a big increase in the number of Chinese people attending.

Although Chinese buyers have long been a significant part of Auckland's CBD apartment market, their participation at auctions seems to have increased sharply in the last few months.

At recent apartment auctions at both Ray White City Apartments and City Sales that were observed by interest.co.nz, it was estimated that up to 80% of those attending were Chinese people and their bidding was fiercely competitive.

See below for the full results of this week's apartment auction at Ray White White City Apartments:

- 1013/85 Wakefield St. Tetra House. A 39 square metre one bedroom, two bathroom unit, under a management contract returning $1581 a month. Sold for $248,000. Rates were $2535 and the body corporate levy $4881. According to QV.co.nz the unit was originally purchased for $294,000 in 2006 and resold for $328,220 in 2007. The agents were Daniel Horrobin and Damian Piggin.

- 1104/17 Vogel Lane. The Alpha building. A 56 square metre, fully furnished, two bedroom unit, with a good sized balcony and harbour views. Vacant. Sold for $507,000. Rates were $1644 and the body corporate levy $5369. According to QV.co.nz the unit had been purchased in June last year for $419,000. The agents were Krister Samuel and Mitch Agnew.

- 707/207 Federal St. Federal City building. A 61 square metre, two bedroom unit with balcony. Vacant. Sold post auction for $487,500. Rates were $1397 and the body corporate levy $5140. According to QV.co.nz the unit had been purchased in April this year for $395,000. The agents were Ryan Bridgman and Mitch Agnew.

- 2115/10 Waterloo Quadrant. The Quadrant building. A 32 square metre, fully furnished,one bedroom unit rented at $420 a week. Sold for $306,000. Rates were $1183 and the body corporate levy $4189. According to QV.co.nz the unit had been purchased in 2012 $225,000. The agent was Victor Liu.

- 502/53 Cook St. Aura building. A 49 square metre, two bedroom unit with balcony. Vacant. Sold for $380,000. Rates were $1023 and the body corporate levy $4317 which includes hot and cold water charges. No sales history available. The agent was Dominic Worthington.

- 1135/72 Nelson St. Zest building. A 48 square metre two bedroom unit with harbour views. Vacant Sold for $439,000. Rates were $1224 and the body corporate levy $4984. According to QV.co.nz the unit had been purchased in January 2014 for $296,500. The agents were May Ma and Mark Li.

- 203/7 Eden Crescent. The Crescent building. A 37 square metre, one bedroom unit, with a management agreement currently returning $350 a week. Sold for $200,000 plus GST. Rates were $1337 and the body corporate levy $4180. The agent was James Mairs.

- 34i/16 Gore St. Harbour City building. A 38 square metre, one bedroom, furnished unit. Vacant. Sold for $280,000. Rates were $2967 and the body corporate levy $2899 plus a special levy of $2010 which is to be used to fund a $10 million High Court claim the building's Body Corporate is bringing against Auckland Council and 11 contractors involved in the building's construction, regarding alleged defects. However the building is not subject to a Weathertightness Homes Resolution claim. The agents were Daniel Horrobin and Damian Piggin.

- 7B/88 Anzac Ave. Harbour Royal building. An 89 square metre, two bedroom unit with a car park, rented at $500 a week. There were multiple bidders for this property and when bidding stalled at $665,000 the auctioneer made a vendor bid of $700,000, but when there were no further bids it was passed in for sale by negotiation. Rates were $1767 and the body corporate levy $6889. According to QV.co.nz the apartment had been purchased in 2008 for $363,000. The agent was James Mairs.

- 1D/17 Scanlan St, Grey Lynn. A 70 square metre, one bedroom unit with a balcony and two car parks. Vacant. Sold for $475,000. Rates were $1327 and the body corporate levy $4487. According to QV.co.nz the apartment had been purchased for $297,000 in 2007. The agents were Donald Gibbs and Liam Kyle.

- 26 Te Taou Crescent. Grand Central Campus. This was four separate flats and a car park, each on their own leasehold titles in this student accommodation complex, which were offered for sale as a single lot. Leasehold. The lot sold for $142,000. According to QV.co.nz they units had all been purchased separately between 2010 and 2012 and their combined purchase prices came $392,000. The agent was James Mairs.

- B301/130 Anzac St, Takapuna. An 81 square metre, two bedroom unit with two bathrooms and a tandem car park and storage locker. Rented at $550 a week. Sold for $642,000. Rates were $1796 and the body corporate levy $5183. According to QV.co.nz the unit had been purchased for $502,250 in 2004. The agent was Ryan Bridgman.

53 Comments

THIS IS GOING TO END SO WELL!

And soon to all be paying tithes to King Kumara - tis surely a skit from Billy T James, beyond the grave? What a hoot.

Chinese buyers? Huh? How do you know that, could it be their names?

..funny how it is now accepted as a given that our Chinese friends are the drivers...funny how things change after an initial outburst of alleged racial profiling nonsense. Can it be the 'denial' is over?

This article is racist.

would you prefer the politically correct description as follows

of the attendees

20% were of Caucasian appearance, some wore black shorts with black singlets and gumboots

None were of Pacifika or Maori appearance

The other 80% were not caucasians or eskimos or north American Indians or Australian aborigines and none wearing Hawaiian shirts or skirts, and none were wearing hijabs or burquas or tea-towels

Yeah, I thought we weren't allowed to use the C word in conjunction with property buyers. Wait till Susan Devoy hears about this.

Ridiculous really, and all the faux pain from certain quarters sounds just plain wet when you hear about what is going on in Africa. Want to know what real racism is?

http://www.dailymail.co.uk/news/article-1063198/PETER-HITCHENS-How-Chin…

Please can someone explain to me.......in simple terms so that I understand....why they are fighting over these apartments. I just don't get it. Am I missing something?

Land could be a problem, but apartments are solid and about the same price range.

Given how the Chinese stock market is performing and NZ's guaranteed tax free capital gains it's not a bad investment - free from the fuss of Auckland houses.

Moving to a city, moving to an apartment has become de-rigour for the Chinese. Just like living in the country is for the British. Or living on a beach is for NZ or Aussies.

Two things come to mind. Trying to hide dodgy money from overseas or earnt in NZ and not returned for tax/gst and plain old greed.

Chinese, British, Kiwi wherever they are from......my heart bleeds for first time buyers. The sad thing is that a damaging crash is their only hope for living in Auckland. They can't compete against this crazy behaviour.

C68, don't fret for them, Ist timers are well off out of it.

Perhaps but many don't see it that way. They are cross

Give it a year and they will be the ones laughing all the way to the bank

Thanks Clarence! Appreciate the sentiment - a lot of Aucklanders are complete w@nkers about it... "work harder" "make bigger sacrifices" even my own brother! And he was gifted a huge deposit from his in laws... I work 50 hour weeks and I now have huge savings but now it doesn't feel right, there's so much misinformation and self interest out there. I don't quite understand why kiwis have become such c&nts!!

It wouldn't bother me so much if renting wasn't so massively in the landlords favour - they do what they want. If you don't like it then you're kicked out.

Musical chairs. Stay well clear of this game....to be seated will not be very good for your health...

"I don't quite understand why kiwis have become such c&nts!!"

Welcome to Neo-liberal NZ!

just not needed.

It was said out of frustration.... but I do feel callousness has crept into the psyche of the majority.

For a small society like ours with an abundance of milk and honey it's pretty sad.

I agree. Its a viscous cycle. Ppl can only be as mean to others as they feel others have been to them. In NZ the injustice likely started with low wages for work ppl see getting paid a third more just a couple of hours away in aussey.

They feel they're always beening ripped off and this feeling gets passed on to those even lower in the pecking order in n.z eg their tenants.

John Key blantently doing nothing about auck house prices while manufacturing deals with higher than international interest rates is another.

The top brass need to be fair as that's where it starts from. Going higher JK most likely experienced injustices as a currency dude in the UK and feels its ok to lord over everyday kiwis. Find out where his blind trusts are invested and you'll likely see he's worth a lot more than the 55mill ppl think.

Not only do they need to be fair, but they need to be seen to be fair, which is a higher burden but needed.

Renting is actually massively in favour of the _tenants_.

You have huge savings, so go on put it into residental PI (or worse, commercial); and find out just ignorant you've been.

You do understand that all other ongoing contracts tend to have termination clauses.

As a landlord if my tenant is paying rent and isn't going to cause immediate damage to my property I must give minimum 90 days notice, in writing, and have the final date in the legal document - if I get it wrong then the document is void (and trying to edit it will bring fraud charges, _legal_ document).

things are so much "in the landlords favour" that the tenant must give 14-28 days notice. And they can do so even if "they just don't like it". And the landlord can't force them to stay or fight the leaving in court. Unless the tenant did a fixed term tenancy, which is _their_ choice.

My rental agent emailed me on recently on a Friday night. They wanted to renew our lease, which expires in October. They said we had until Tuesday to sign and return the attached form otherwise they'd start advertising the place by the following Monday. It's not a long time to make an important decision. And I don't have a fax machine! It would've taken too long to send it in the post so I delivered by hand, with an hour to spare.

A lot of landlords just cite the "family's moving in" clause and then they just have to give you one month. We complained to a landlord once about the shower leaking into the room below, he wouldn't fix it. He replied by evicting us, saying a family member was going to live there. He made the eviction date Christmas Eve. The stress was huge. The couple I lived with broke up and I moved in with family. That landlord is actually a current member of the NZ government.... so that sums it all up for me basically.

Trouble is Clarence, a damaging crash will have other effects apart from house prices, think of employment prospects for example...... JKs Ponzi is one of the main pillars of the AKl economy.

Yep I don't want a damaging crash either just slower growth in line with salaries, but too late now....

It will be interesting to see what the Auckland real estate data for August will come out at. Will it continue to tend soft.

It will be interesting. I know that some areas seem to still be going up (Glenfield, Sunnybrae for example the auctions are still crazy apparently) but I think it is definitely slowing in areas that are less appealing to the people with the ready cash. But this is just anecdotal evidence so who knows....

Ready cash or ready loans?

The best and brightest have had enough, off to pastures were a house is a roof over ones head and not a casino.

Good move

We at mezze bar , arcade were driss has ahop

as long as the capital is not borrowed from NZ banks I'm ok with that.

Enjoy them if you can.

For those who are claiming landlords charging too much:

value,rates,b/c,rent, insur@1% !!, repairs @ 1% !!, total deduct, annual income on 100% occupancy,

248k, 2535, 4881, 365, 2480, 2480, 12376, 18980

306k, 1183, 4189, 420, 3060, 3060, 11492, 11492

200k, 1337, 4180, 350, 2000, 2000, 9517, 18200

700k, 1767, 6889, 500, 7000, 7000, 22656, 26000

642k, 1796, 5183, 550, 6420, 6420, 19819, 28600

home, inc , deduct, diff, rough net NBIT yield

248k, 18980, 12376, 6604, 2.7%

306k, 21840, 11492, 10348, 3.4%

200k, 18200, 9517, 8683, 4.3%

700k, 26000, 22656, 3344, 0.5%

642k, 28600, 19819, 8781, 1.4%

Costs do not include agents collection costs, or such things as section or extra fees (eg legal actions),

is all pre -taxes, includes zero interest charges, and no provisions for capital upgrades of any kind.

So all those complaining about how landlords are ripping people off for where those people want to live, look at those NUMBERS, and tell me how you're getting the raw end of the stick again??

I think you miss the point. Landlords are ripping off the young by virtue of tax deductibility of home ownership costs, out bidding aspiring owners due to such advantages and paying zilch tax. Therein is the problem...

Which numbers are incorrect? They're straight of the market prices.

What paying zilch tax? I pay full price for everything I consume in my home, and didn't get tax deductibles for my home. In buying investment property the rates, insurance, interest, legal are deductible to everyone, just as they are in any business.

The landlord pays the same rates and interest as everyone else, and pays higher insurance, takes more risk, has more upkeep and repair costs, and has property management costs. Sure they're deductibles but we don't deduct them FROM our taxes, we deduct them from our REVENUE !!

And we pass them on to the tenant _without_markup_ (unlike other businesses). All those cost numbers were quoted exactly as disbursements, no margin there at all !! Exactly the same costs as "aspiring owners"

...look at it this way.

Investor and first home buyer both have same paye, both have same deposit, at this point .everything is equal.

But..investor can pay more for house because...interest, rates, r&m, home office, share of phone, vehicle, lawnmower etc is all deductible. He also leverage's and gets the tax loss to refund his paye.

All things being equal, the investor has a financial advantage due to our 'system'.

The first home buyer is at a permanent disadvantage, maybe not insurmountable in the past, but now at a point where this disadvantage has become grossly unfair - keeping our young as prey to the parasites. I wish the young would revolt...organise a nationwide rent strike via social media - they gotta do something because this system is obscene..

Those numbers don't work, because they're too expensive and NZ does leasehold badly.

Those numbers are THE numbers, right off the sales figures quoted in the above article. the property companies are not legally permitted to misquote the rates or body corporate fees, the interest and repairs costs I've guessed at, on the _low_ side. 1% for each, good luck finding cover for that. and yes the repairs often come under 1% on a good year, and can be 10-15% on a bad year.

but they _are_ the numbers. Feel free to get _real_ numbers from anywhere else and prove me wrong.

No, I am not disputing your numbers, thanks for working it out.

I am just saying as a investment they don't add up.

There is the capital gain, though prices are increasing faster than wage growth, so the yield is only going to get worse

If a landlord buys a property 3x the economically sustainable price, don't expect a tenant to be thankful for only paying 2x the economically sustainable price.

http://www.interest.co.nz/property/house-price-income-multiples

Stop your whinging about 2-4% yields - Landlords/'investors' are clearly, CLEARLY, in it for expected capital gain now.

There is no other way to put it. The IRD should be crawling over every 'investor' in Auckland. If you're buying a property in full knowledge that there is only a 2% yield then there is no argument, you're reliant upon speculative gains - ergo you purchased with the intent to sell and therefore your gains are taxable.

Otherwise you're totally irrational - why invest in a risky asset yielding 2% when you could put your money in a term deposit for c.4%?

I've had a guts full of landlords acting like they are doing God's work and these ridiculous claims that you should be charging more. You CAN'T charge more. The incomes aren't there to justify it - these calculations only prove you're a mug for getting in at today's prices.

"Stop your whinging about 2-4% yields - Landlords/'investors' are clearly, CLEARLY, in it for expected capital gain now."

NOT SEEING YOUR NUMBERS.

Com'on, outside of Auckland ... let's see it.

I bought a place it took 12 years to double in value. less the real estate agents 4% cut and advertising fees, cleaners. That's 5.8% gross yield - woo hoo... at least we can get under that mortgage loan rate now, it wsa 6.8 - 7% at the time. Not including the tens of thousands spent in redoing the roof, garage, plumbing, air con. The final calculation came out around 2% per annum.

Bought two other places with the cash. One for 190k - now worth 170k; another for 150k now worth 145k, 10 years later. real estate agent fee 4.5% + advertising and open home fees, negative yields.

So are you saying the _only_ place to get capital gain is in Auckland?

Why do you say the prices are "out of line" or a bubble in Auckland, when it's the _only_ spot in the market with positive action? There are tenants wanting to live in a place which is the _only_ capital gain in property in New Zealand, and they complaining about the prices????

Landlords CAN'T charge less - you saw the numbers. You admit yourself why only make 2% !

Yes, _my_ gains _are_ taxable. my earlier ones weren't because I bought to hold, and someone offered me a fistful of ca$h for one place, the other above mentioned 12yr double was my family home where my son was born but tenants kept trashing it (lousy property managers at the time)

Daft things is, I was going to hold those places, but ended up selling for other unexpected reasons. The places I have now, are declared "sellable" but chances are I won't liquidate them because their location is much better and the cost of selling is so high.

Tenants incomes have _nothing_ to do with rents. I have no idea what my tenants incomes are and consider it none of my business. The price is set by the value of the houses and adjusted upwards by excess demand to the agencies. If I have lots of amenities/nice house/perfect location I'll add a little more. If they're good tenants I'll hold it down.

The property managers are a little more diligent in their fixing of the levels, but they tend to use a rolling average. Most of the time it's just about passing on rising paperwork, rates, services, insurance costs.

As to the "why"

It depends completely on the investor.

For me:

(1) I don't like large corporations - supporting a small business means the profit margin, is food on their table, their kids having clothes, their bills paid, hiring more people. Paying to corporate banks means they have richer shareholders, nicer BMW's, fancier suits, bigger Trust funds, nicer foreign holidays.

(2) I can leverage property, I can't leverage a Term Deposit.

(3) It builds security for future loans and investments. When I started a small business I needed to borrow $300,000. Without property or some other solid "off-farm"/external assets for security purposes I would have never have been able to borrow so heavily.

(3a) A massive advantage of earning property, is I can take the aforementioned loan/security and the properties will still be earning full rate. I can't do that with cash, sure the cash earns interest, but where can I go that will give me more interest for _my_ cash, than I have to pay to borrow. So leveraging with cash security makes no sense. And with cash, as you use it the income from it goes down, so less compounding (this action is why interest is charged in a macroeconomic sense).

(4) The more more small landlords like me the more control and stability there is in the market. Also I can decide to waive small damages or emergency circumstances where an employee and corporate holding seldom has that leeway. Although that varies from landlord to landlord, most get jaded after being ripped off or cleaning up too many disgustnig messes.

(5) My asset returns 2%. I can leverage that to higher, but it is diminishing return, and involves _long_ term planning, mostly multi-generational stuff. I'm not investing for myself, I'm investing for my grandkids, so when they get made redundant or want to go to university, there will be passive income coming in.

(6) store of value. Most of the "capital gain" (outside Auckland style action) is from the devaluation of currency, inflation, and environmental factors. Government loves to add more bureaucracy (The bureaucracy is expanding to meet the needs of the expanding bureaucracy); they call this job creation. but that adds expenses, and all your expenses eventually boil down to the landlords because they are the sitting ducks, everyone else is mobile, so the landlords are the ultimate price-followers - which is why farmers are also ultimate price-followers because they have several mash-up businesses (landlord to their business, the business of primary resource production, harvesting and selling that production). The store of wealth means my 190k pried property will eventually come back to that price - and if not - I can guarantee, by the structure of the economy, everything else will be similarly depressed until then. And unlike doing the "Long Hold" in other assets, my property will still be earning at its current market level. Doesn't work like that for shares or FX - does for bonds though.

(7) Loans are liquidity. Very easy to get cash loan against a house. Much harder to do with other security types.

(8) In my grandkids future, housing will be more expensive. Rents will be higher. This means that the income produced from rents will keep pace. This doesn't happen with "non store of value" assets. Try that with your TD?? even at 4% compound, even with inflation at a theoretical 0.5% in 40 - 60 years time what is the payout? And what use do you have of the money in all that time?

(9) If prices go too high or low, and times get tough, the kids/grandkids can always move into a house or even convert a commercial property. The tougher the times the vauable the rear guard action.

But you really do have to grasp. Rents have little to do with tenants incomes - the only link there is via the empty rentals rate (wait time).

Adding additional supply will help with that. But. To do so, the incoming supply must create a downwards pressure on prices. The higher the value of the incoming supply, the higher the value of the area, and so rents will rise to meet those values.

This is from new houses setting an upper limit/cap on the second price market. Why buy a second hand house if a new one isn't much more. But if a new house is 50% more then those who can't afford new will bid higher on the second hand house - because demand is higher and supply is scarce. That will set the market value in that area - if the property is too empty then the owner will likely be forced to liquidate their liability position, rather than budget for a lower yield (as they have such a slim margin to begin with).

And the ability to buy, is also set by incomes that have nothing to do with landlords. But having rich foreigners buy into Auckland pushes the house prices up up up, so the rents go up up up - or the owners will liquidate to preserve or capture their short term "fist full of ca$h" gain (30% p.a. in my case IIRC, net all costs) - the new buyers, set the value of the market because they will either make the normal 1 - 5% yield, or the "fist full of ca$h" will represent 10 - 20 years worth of rents and they'll sell, resetting the market values at the new level. As long as the government lets outside wealthy buyers into the market that will continue - exactly the same process as Southern Finance buying it's child companies shares, and getting more valuable from the rising in share price - then the child company buying it's parents performing shares, creating more lift. ....except the foreign owners have no care about the properties staying empty, nor any interest in how the area performs as a community, and they can sit out any local "bubble pop" (being perfectly poised to vulture in on any such "pop" and scoop up double handfuls of the locals if it does pop - the more locals that get cuckoo'd out of the market before then the better for them)

Those are what sets your prices and rents. not your income - which is why many people (myself included) think that 3 - 4 times local income is the correct "living level" of homes, and about 0.1% to 0.2% of that market value; are the correct marker points.

But if people want to live in a speculator location, they have to pay for that decision.

"Tenants incomes have _nothing_ to do with rents."

That comment has _nothing_ to do with reality. There are few greater drivers of rental pricing than income - a cursory glance at Auckland should tell you it's of far greater influence than property value. You may not directly apply that in your pricing decision, but you can bet your bottom dollar if you charge significantly above market rent, you will have either an empty property or sub-par tenants.

I have identified the "empty property" factor - which -is- a factor, where as actual "Tenant income" is not.

The two are not directly coupled. Understanding such decoupling factors is important when someone is analysing that specific area in the market.

Gee that sounds just terrible, you poor thing. Why don't you just sell up and get out of the game, if it's all so bad? Become a renter like the rest of us.

By the way, you don't have a dog, do you? Or a cat. Or a goldfish. Or like to host small gatherings for your friends. Or want to mount things on the walls. None of that will be allowed, naturally. No, no, the house doesn't have a clothesline. No you can't install one, it'll spoil the look of the back yard. Oh and the house isn't insulated and gets pretty damp - can you make sure you leave all your windows open 24/7 over the winter? Otherwise the landlord will be subtracting the cost of mould treatment from your bond. Naturally.

Actually that's all irrelevant now because your landlord has decided to cash up and sell the house. You don't mind having to shift your entire family and all your possessions with six weeks' notice, probably during the month for which you'd already booked and paid for a much-anticipated overseas holiday (sod's law), do you? Oh, and strangers will be trouping through between 12 and 1 every Saturday and Sunday from this weekend onwards. It'd really be a lot easier if you could pack up the kids and clear off during that time. Don't worry, I'm sure nobody will pinch anything.

So... when are you joining us renters?

The problem is those ppl have an income that is too small, ergo they see a huge slice of their income going on rent and are not happy. You should see how it dominates the Green news feed, rents should be way cheaper and the houses should be modernised to 2015 standards etc etc...just how un-realistic it is is concerning for when the Green's/Labour win an election.

That's why I keep pushing for numbers, but governments don't like highly intelligent populations, only ones that are correctly educated.

And the more costs they pass on, the more foreign "investors" the blasted OIO let in, the less far their incomes will go. Also the less small businesses because how can a small business survive when foreign multinationals get in, and local collectives do the same service for zero margin - and rely on government forced revenue gathering to prop up their peoples' income.

Which greens news feed?

Yields on term deposits are terrible. Investors get a better yield on residential property. Life's still good in landlord land.

Life looks better over in Oz for those of us in tenant land...

Sure... I hear some of those historical protected properties have cheap rent.... how about you do some of that "research" stuff _before_ flapping your fingers.

Apartments moving from investor bought only to owner occupiers is good for 50% of the increases we are seeing in apartment prices.

The generation that grew up watching 'Friends' actually want to live in apartments esp nearby (walking) to work and other friends who have bought apartments to live in too.

This generating are now late 20s and so for the first time we are seeing buyers who actually view apartment living in a very favourable light.

Things are definitely better over here in OZ land for us. Been 8 years now always thought we would come back one day but don't think so now. Its a shame because we are proud Kiwis and would have loved our kids to have been the same.

Chinese are going to buy one of the countries biggest dairy group in norhtland

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.