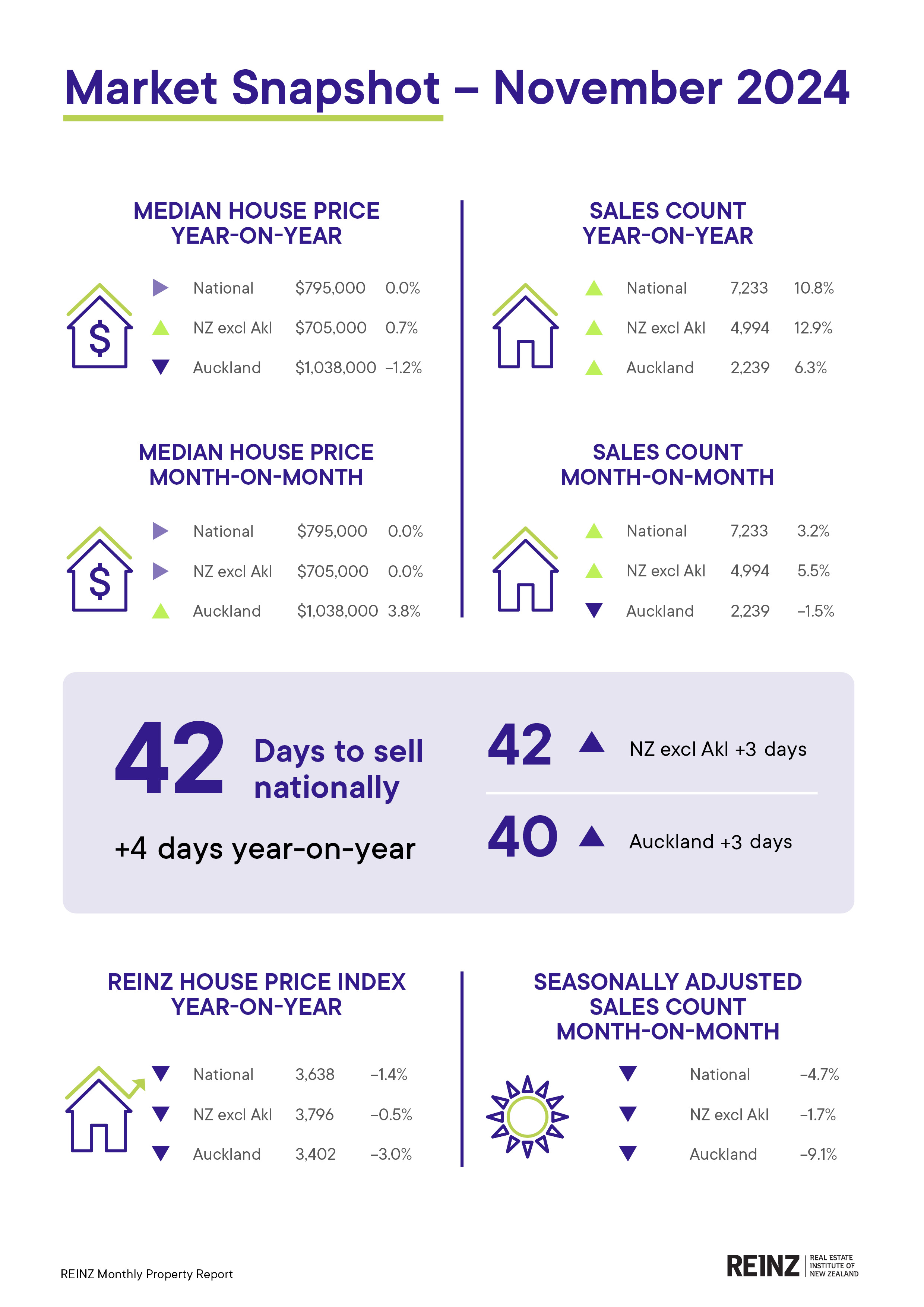

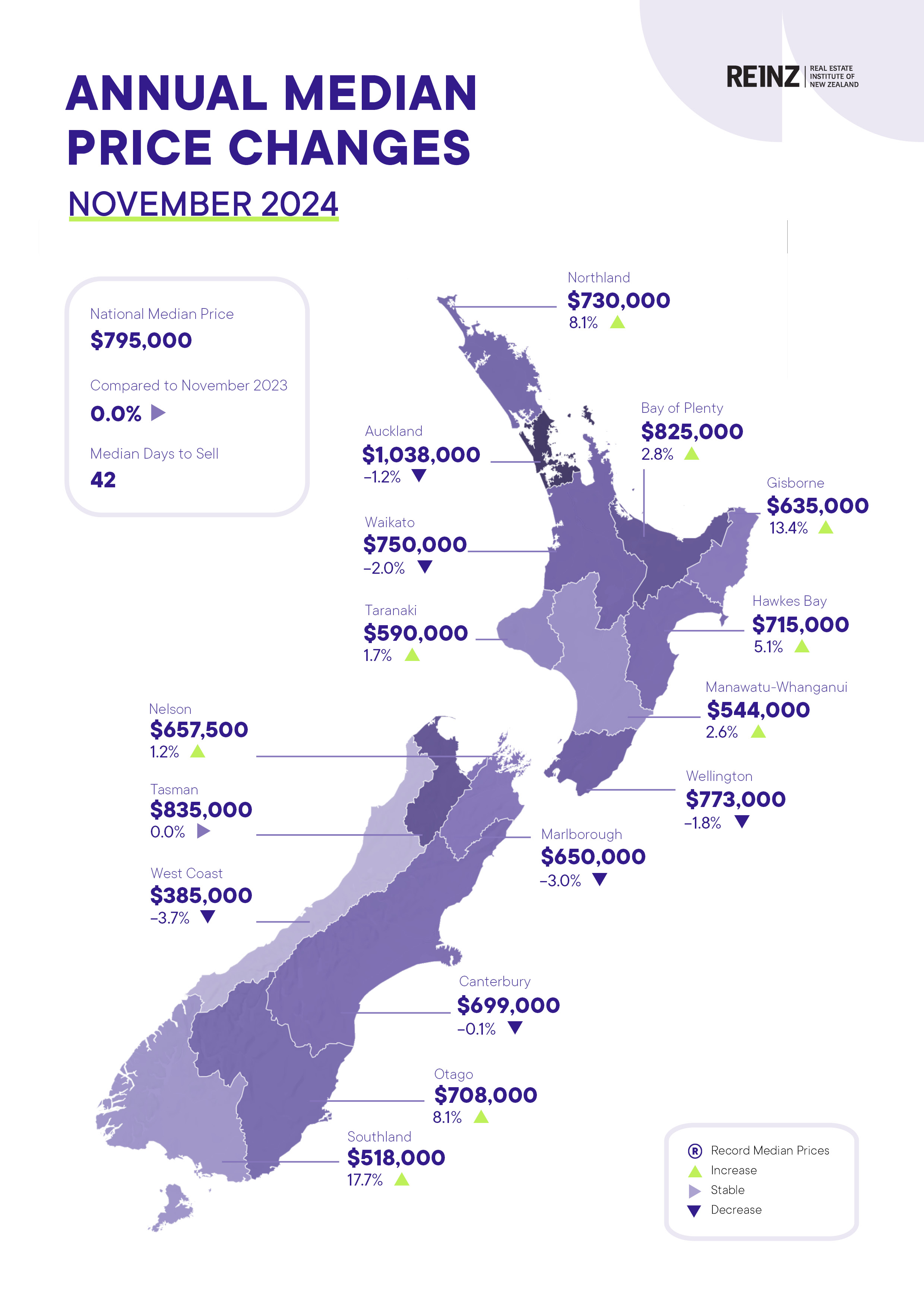

November was a month of ups and downs for the residential property market, with sales up, but not everywhere, and prices flat, but not everywhere.

The number of properties sold usually increases between October and November and so it was this year, with the Real Estate Institute of NZ reporting 7233 residential sales throughout the country in November. That was up 3.2% compared to October.

However, it was different story in the country's largest property market, with sales in Auckland declining by 1.5%.

Excluding the Auckland figures from the national total, sales around the rest of the country rose 5.5%.

That is perhaps not so surprising because the Auckland market has been particularly weak for several months thanks to an especially generous supply of properties for sale in the region.

On the price front, the national median price was completely flat at $795,000 in November, unchanged from October and from November last year.

But in Auckland, November's median price of $1,038,000 was up 3.8% compared to October, but still down 1.2% compared to November last year.

The REINZ House Price Index (HPI), which is widely regarded as the more accurate indicator of market price movements, increased 0.6% nationally between October and November, but was down 1.4% compared to November last year.

Around the main centres, the HPI was up in November compared to October in Auckland 1.2%, Hamilton 0.4%, Tauranga 0.7%, and Christchurch 0.3%, was unchanged in Wellington and declined 1.0% in Dunedin.

'After a challenging year, recent data indicates promising signs of increased activity, which we hope will continue into 2025," REINZ Chief Executive Jen Baird said.

"This is a good time to make transactions, as prices remain stable and interest rates decrease," she said.

The comment stream on this story is now closed.

Median price - REINZ

Select chart tabs

Volumes sold - REINZ

Select chart tabs

REINZ House Price Index - November 2024

82 Comments

Auckland prices up 3.8% in a month!

Merry Xmas property investors, the hardworking backbone of NZ!

🥂

Wow! That's over 50% on a compounding annual basis!

...

Am I doing it right?

In terms of house prices, Auckland tends to lead the pack when the market moves into recovery mode. Other regions typically follow Auckland ......

Note that the number of dwellings for sale in Ponsonby, Freemans Bay, St Marys Bay and Herne Bay has gone into sharp decline in recent weeks.

TTP

Too many dreamers late to the party wanting 2021 prices and pulling their listings in a humph when they don't sell.

Is the " hardworking backbone" in the room with us currently?

Auckland sales down stock up.

2025 summer going to be very entertaining particularly when new Auckland CVs come out.

...they'll just keep delaying releasing them.

Probably only need to delay until July 2025.

If they don't get them sold by July 2025, they'll be holding them all through winter when prices are likely stagnate or fall.

My idea of entertaining summers typically involve time with friends, beaches, bbqs and a glass or two. Open homes and obsessing about house prices - not so much. But different folks etc.

What's the expectation with CVs, Increase/decrease? Assume decrease hence repeated delay?

Delayed because the Valuer general wanted them redone because they weren't consistent enough.

Ignore the tinfoil hatters and their conspiracy theories.

The council doesn't want to be on the receiving end of devaluing it's rate payers assets. Hence, waiting, hoping, sale prices come back to 2021 levels.

Tinfoil hat looks good on you.

I mean... is it that far-fetched?

"Valuer general wanted them redone because they weren't consistent enough" ...consistent enough with 2021 CV values.

My prediction is ~25% drop for Wellington. Variations either side depending on suburb but somewhere in that ballpark overall.

WCC advises new valuations now out in Feb 2025.

Currently my home (Miramar) shows a 32% drop since 2021 on QVNZ (where Council values are sourced)

25% drop for Wellington?? Think again.

25% increase?? More likely.

TTP

Wait...you think the RV on my Wellington property, when announced in February 2025, is more likely to be up 25% on its September 2021 RV than down 25%?

I thought again, and I'll stick with my original prediction, thanks. Please explain yours.

Flatlining ... Get used to it.

Agree. It will be similar to the late 70’s period.

Sales volumes returning to normal, interest rates lower, prices stopping decreasing and even increasing in most regions.

Last chance to buy before a steady increase back to 2022 prices over the next couple of years.

I know people with very decent budgets, around the $700K mark struggling to get unconditional already, the competition is increasing.

New listings continue to hit record highs with no slowdown in sight. Thousands of withdrawn listings from 2022/23/24 are still being put back on the market.

My prediction for the first quarter of 2025 will be an absolute avalanche of new listings. Breaking all previous records for the period.

i have witnessed a decrease in the listings.

An avalanche might be overstating it - but I think the number listed will likely rise.

Well, I have to admit that my prediction, of a 10% fall over the 2024 year, made in January, was wrong.

it's not like you to admit you are wrong...

Bad luck Yvil, looks like my prediction for 3 to 4% gains in Tauranga for the year is going to be on the money. Bit of a late run and a photo finish but the DGM's are a lap behind.

What numbers are you reading?

The tauranga hpi above shows a 1.2% fall for the last 12 months.

Check the reckonometer.

BOP on the pic up 2.8%. Its going to cruise into the 3% plus this month. One Roof price is already trending up, another rise this month.

The most dependable, consistent, stats through all of 2024 was record high new listings, record high listings and record high withdrawn listings. Which will continue to exert downward pressure on values.

Because the most important consideration for buyers and sellers is "how many listings" ? Not how much will I pay or receive for the purchase or sale. 😅

LOL

🥂

The same therefore must be true when there's a "housing crisis" and a shortage of properties?

I went to the bank yesterday for a loan to buy a house. The bank didn't ask about price, how much of a loan I needed or how much deposit I had, they just wanted to know how many listings. Actually they said we will charge you 10% interest of the number of listings in the area. Amazing !

the absolute crap that comes out of your mouth........................

"the absolute crap that comes out of your mouth"

My mouth didn't utter a single word, but my fingers typed some pretty pertinent sentences, exposing the "crap" about the claimed over importance of "listings".

Starrider

Your comments today are utter rubbish.

For example current stock are not record highs - between 2007 and 2016 they were considerably higher - and in 2010 they were twice current numbers.

Yes, they are up compared to the last few years but no need to make such exaggerated claims.

Starrider

I see after wetting yourself with excitement, you have since edited your post. Not surprising.

I added to my comment. Specifically, "...downward pressure on prices." My original comment is unchanged.

Starrider

Not quite correct.

That is not the figures I am seeing. I keep a separate track of trademe listings and Auckland in particular is at record levels of listings. Plus TM has 3,800 new build homes listed, and I would argue that when someone has 10 townhouses to sell they list one. So the 3,800 new builds could be 10,000 listings alone.

Ex Socialist

My data is based on REINZ data (and as used by ANZ). I wouldn’t put too much weight on TM historical data; it is only within recent times that REA are using TM to the extent that they are currently doing so and for a period boycotted TM over their fees.

Been hearing some rumours about why Auckland central houses and upper north shore prices are increasing disproportionately. Looks like watercare’s wastewater network constraint is swaying investors into areas where development is still possible (Auckland central/upper north)

Apparently lots of consents are being denied now, so a supply shortage could be looming in the future.

Indeed. if you bought land in the areas on stop service for new development, you could be stuck or facing a significant Watercare payment. Can see both sides of the argument.

https://www.oneroof.co.nz/news/watercare-blindsides-auckland-developers…

Developers paid a premium for these developable sites, he said, so if it could not go ahead then he would have to sell it at a loss.

He said most people who had a development site in the red zone would not be able to hold them for 10 years because it would not make financial sense.

“They would have lost money on the value of the site plus they would have lost all of the expenses they have spent on the resource consent including council fees and the like.”

Alexander said it should have been a two-year lead-in so there was a transition period rather than putting a blanket ban on development in some areas without any warning.

“Basically it creates this massive uncertainty and Watercare all of a sudden become the master of where development can or cannot occur in Auckland.

“What council entity can justifiably do this sort of thing that just blindsides a complete industry.”

Be a few decent size Whangapora sites going cheap...

Yes it's bad luck for those investors. But my point is this isn't good overall for our housing supply, and points to the problems within our water infrastructure that needs attention, not whether specuvestors get caught holding the bag or not.

The answer is

- Higher developer contributions

- Higher Water care bills

- Higher Rates

All these reduce yield or returns

Milldale has serious water issues, low pressure and sewage problems, there was talk of an additional levy on all property owners, not sure what legal basis this could be applied.

It seems that Mayor Brown has managed to offload Watercare's need for further funding off the Councils books

Well played that man.

I understand that no new building consents are being issued in that area for at least another 5 years. Shouldn't think existing home owners are going to get whacked more money, they already have their own independent pumps and holding tanks which must have cost a small fortune to install and they are very expensive to get repaired and cleaned.

you need to do more research

Not only that, but many central and North Shore locations are not subject to the massive in development contributions proposed for some areas across the city

Not in this article but Wellington's turnover was up just over 26 percent month-on-month. Not bad for a city apparently on its knees and under water.

I expect there are some bargains to be made in Wellington, especially if a new mayor is brought in who can actually manage the city and it becomes desirable again.

This will require back to back to back huge rates increases to pay for infrastructure. Or a Xmas miracle...?

Owning WGTN will feel like owning a leasehold property soon.

" if a new mayor is brought in who can actually manage the city"

Not how it works in most Councils, Rookie. The mayors sets the goals & direction but the actual management is done by the CEOs. Most Council CEOs are paid exceedingly well but keep their heads down so we frequently never hear from them. But I'd put good money them be pretty influential in everything you hear from mayors.

a new direction would help out wellington i thinks.

The council appoints the CEO. Wellington have just replaced theirs.

https://wellington.govt.nz/news-and-events/news-and-information/our-wel…

Lets look at the big picture and consider the house prices index over the last five years being. This is plus 4.6% for NZ, being dragged down by Auckland which is 3.1% over the same period. Lots of crowing by the usual leveraged suspects.

You do realise that inflation in the same five year period was 23%. #notwinning.

The only metrics you need to look at is the house price and your total income. Inflation is kind of irrelevant in making the maths work.

So return on total capital is irrelevant. Wow.

Just like term deposits.... right?

Gold. To The Point right there.

Oh dear.

Yes, and for those who think house prices double every ten years - the next five years are going to have to be spectacular.

I think house prices are going up at a little less than inflation. So if you take the covid bump out and think about 3% per annum since 2018 it is pretty close to current market levels.

You realise the 5 year figure is annualised right?

The spin v the reality in the Auckland Market for 2025:

New listing when actually Relisted for the 3rd time

A balanced market when actually so much stock that will take years to sell

Busy open homes like bees around honey - actually all conditional buyers that can't sell their houses

Interest rates dropping v currently still an increasing average interest rate on existing loans with average interest rates dropping less than you would expect

Increased buyer confidence v fraigle and weary of paying too much

All good points.

Can see many Aucklanders looking across at Sydney and wondering just how far it might fall.....

The joy of renting as the house sale cash goes back into a new TD, additional interest from the last 6 months and an increased ability to save.

Buying power increasing on all three fronts.

Do not see the point in continuing to put housing down without anything constructive as to where people should invest!

The reality as I have said previously that the housing market is not just Auckland, and you need to get out more and see where the more clever investors are actually making good money and I am not talking new apartments!

At the end of the day we all make our own financial decisions that determine our position.

I can assure you that there is opportunities in every market snd location and you need to seize them if you are in a financial position to do such.

Whether you do is a matter of mindset and if your mindset is like so many on here is, then yes sit rhere snd do nothing and let the good investors take them up.

exhausting

Kings Quarry

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.