Last week a single house purchase in Australia knocked the cost-of-living crisis and the Gaza/Israel/Lebanon nightmare off the headlines. Not just any house purchase but Prime Minister Anthony Albanese’s purchase of a $4.3 million mansion on the cliff above Copacabana Beach north of Sydney.

Some commentators were outraged that a Labor PM could splash that much cash at a time when so many Australians are either struggling to make their mortgage payments or finding it impossible to even get a foot on the home ownership ladder.

Other commentators saw nothing wrong in principle with a highly paid politician buying a dream home but questioned his political judgement in doing so with an election due in the next six months. Many interpreted the timing as a sign the PM is preparing for life after politics, not a good look shortly before an election.

Inevitably, Albanese’s house purchase focused attention on Australia’s housing crisis. It’s a crisis driven by ongoing high interest rates, elevated immigration levels, high construction cost inflation, and record house prices across the country. It will be front and centre in the 2025 federal election.

Australian Bureau of Statistics figures released this month reveal that the total value of Australia’s housing stock is approaching $11 trillion. In the June quarter the mean house price rose by 1.6% to nearly $975,000.

The ABS figures for the last five years show rapid house price growth from the start of the Covid-19 pandemic, a temporary dip from March 2022 to March 2023, and then a return to steadily rising prices.

The total value of dwelling stock

Source: Australian Bureau of Statistics

According to CoreLogic’s data, house prices grew a further 1% in the September quarter. The figure for the annual growth rate is 6.7%. That is down from the recent high of 9.7% in the quarter to March.

Of course, the growth is not even across the country. Perth is the standout capital city with house prices rising 24.1% in the year to 30 September to reach a record high. Brisbane was up 14.5%, Adelaide up 14.8%, and Sydney up a more modest 4.5% in that period. All three cities hit all-time highs. Melbourne and Hobart are the exceptions with both enduring quarterly and annual value drops.

Melbourne is now down 5.1% from its high in March 2022. This translates to a major change in recent years in the price relativity between Melbourne, Brisbane and Sydney.

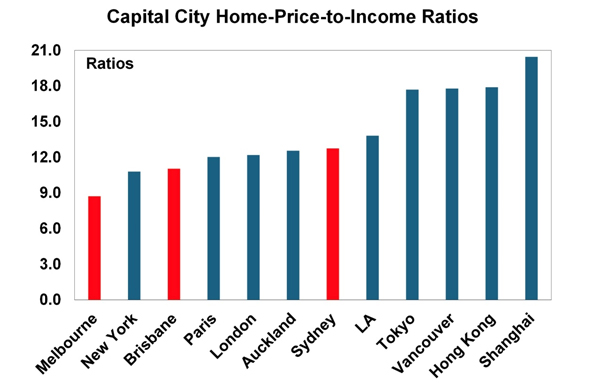

An analysis of global housing trends from AMP this month ranks the three capital cities in terms of ‘price-to-income ratios’, a key test of affordability. With a ratio of 12.8, Sydney is Australia’s most expensive housing market, although it’s only marginally more expensive than Auckland. Brisbane is more affordable than Sydney but now noticeably less affordable than Melbourne, a big shift in the last few years.

Source: AMP

The bottom line for the Albanese government is that these ratios make home ownership unachievable for many Australians. Housing affordability, or the lack thereof, spells political trouble six months out from an election. The government’s dilemma is heightened by the significant increase in rents in recent years.

There’s no easy solution to the housing crisis. Existing homeowners and landlords like rising house prices and rents. Prospective homeowners and renters do not. In that environment, there’s more downside than upside for the government.

Interest rates, immigration, housing construction, and tax policy are the key issues.

The government is desperate for a drop in interest rates. However, the Reserve Bank of Australia is in no hurry to lower them given its concern that inflation is still a threat to the economy. Two of the obstacles to a rate cut are high government spending at both state and federal level and a very resilient labour market. The latest unemployment statistics show that unemployment remains relatively low at 4.1% and the participation rate is rising.

Immigration continues at high levels and is taking longer than expected to bring under control. A constant stream of new arrivals exacerbates the housing shortage, particularly in Sydney and Melbourne.

At the last election, the government committed to an ambitious target for the construction of new housing. That target is looking increasingly unachievable and may well come back to haunt Anthony Albanese. (He should have seen from the experience of the Ardern government that setting ambitious housing targets is a risky strategy.)

There are increasing calls from some quarters for changes to the tax regime to make housing less attractive to investors. That would involve stopping negative gearing (the ability of landlords to offset losses from their rental activities against other income) and reducing the ‘capital gains tax discount’ (the 50% discount from the tax for gains made on property held more than twelve months).

The problem for the government is that such tax changes would be deeply unpopular in ‘middle Australia’ where owning one or two investment properties is widespread. To date Albanese has ruled out such changes for fear of the electoral consequences.

In short, the housing crisis is a major political problem for the government but many of the possible solutions are fraught with political risk.

In the meantime, house prices in most of Australia look set to continue their rise, albeit at a slower pace than in 2023/2024.

The top end appears particularly strong. Take the case of Scott Farquhar, the billionaire co-founder of software giant Atlassian. In 2017, he set the Australian house price record when he paid $71 million for a Sydney waterfront mansion. This month, having abandoned plans to renovate the property, he unloaded it for $130 million. But don’t worry, he’s not homeless. At the end of 2023 he purchased another Sydney pile for $130 million.

It puts Prime Minister Albanese’s $4.3 million purchase in perspective.

*Ross Stitt is a freelance writer with a PhD in political science. He is a New Zealander based in Sydney. His articles are part of our 'Understanding Australia' series.

26 Comments

"Existing home-owners and landlords like rising house prices..."

And why would that be? Perhaps because the amount of exiting Debt, underpinning property prices, can only be repaid from prices continuing to rise?

And therein lies the problem. What happens if prices fall, for one of many all too obvious reasons?

Answer: All that Wealth that owners think they have stored in their property 'investments' evaporates in a balance sheet correction, and is seen for what it really is - not Wealth at all, but Debt. Debt that the lenders will demand be repaid, one way or another.

"the amount of exiting Debt, underpinning property prices, can only be repaid from prices continuing to rise"

How many home owners do you think are funding their mortgage payments from house sales? That's surely only a small subset of the population reserved for developer/investors.

The average joe/jane sitting in their house just keeps paying down their debt. Perhaps if your equity drops below 10% there's potentially a servicing issue, but with the testing rates banks had applied that shouldn't force many sales. Wouldn't you say whatever your house price is on any given day is irrelevant to a single owner occupier?

If there’s a major correction in house prices, what do you think will happen?… All the existing homeowners, the smart ones at least, will limit all spending so they can focus on rebuilding equity in their property. This means a major downturn in the economy, then job losses, then many can no longer afford to service their mortgage. It’s a domino effect, a bit like the Covid boom, but in reverse.

I’m seeing it in my community, people with very little financial knowledge buying rental properties because of FOMO. “You can’t lose”. I recommend reading about the Great Depression of the 1920’s. There was a very similar mindset in society at the time.

But why? Why would they refocus on rebuilding equity if house prices drop. They're still building equity from their usual payments, why do they need to speed it up just because on paper their house is worth less?

He’s another phoney leftie

The top end appears particularly strong. Take the case of Scott Farquhar,....

A 0.1%er buys properties at prices at high prices that only 0.1%ers can buy.

There's your evidence folks that 'the top end appears particularly strong.'

So Australia's CGT ain't working actually none of their taxes on property is. Yet people on here spout on how we need a CGT here obviously we dont

Capital Gains Taxes just like any tax pushes prices up.

Always has and always will, as the sellers always want more if they have to lose some of the inflation related increases.

The thing is it is only an ENVY TAX wanted by those that it will not affect much.

If they are ever stupid enough to implement a CGT it would need to go on owner occupied houses as well.

Owner occupiers are the ones that force up house prices not investors so they need to be paying it as well.

They couldnt back date it anyway so they have missed the boat and there would be so many that just could not afford to pay rent.

Far too many consequences for it to work in NZ.

You sound worried. I say bring it on. Property will drop, no longer seen as a viable investment. Vendors won’t be passing on the increase because no one will be buying, look at the new generations coming through…they have empty pockets. Wait for that elephant to hit the market. Especially with baby boomer down sizers coming on stream….things are going to get interesting.

@ Blackbeard - What are you talking about? My wife & I are part of the next generation & plenty of our friends are buying. Admitingly they're not buying their first home at 19yo & their first rental property at 21yo like the Boomers were, but they are buying. Plenty of them are using mortgage brokers now, something that wasn't very common in our parents generation, but is well needed now to help get yourself over the line.

The only ones not buying are the ones listening to the last governments propoganda about it being their landlords job to financially assist them into homes, so they don't need to do any of the actual work or personal sacrificing, just simply wait for a hand out. This mindset is also not just a generational thinking either, plenty of our parents live in poverty due to believing that it's everyone else's job to financially assist them into a home, & they take no responsibility at all for personal sacrafice.

There's a high price to pay for financial ignorance. That's the elephant in the room that no one wants to address - personal accountability for ones financial choices & goals. It's not your bosses job, it's not your landlords job, it's not even the government's job. That's your job. It sounds as though it is you that is worried that the younger generation are catching on to the pitfalls of their parents, & surpassing them in wealth & in knowledge too.

I get it, must be a little embarrassing having younger people more financially flush than ones self. Hence why all the financially ignorant scream out "must be nice to have rich parents", because for them, having someone else financially assist you into a home is the only way they believe is possible. The thought of actually having to personally sacrafice for a few years short term for the long term goal of ownership is too hard, easier if my greedy landlord just do it all for me aye.

Well at least it gives the government more revenue to spend on semi-decent infrastructure, unlike the rubbish we have here.

it is more equitable too.

@ HouseMouse - more equitable?

You advocate for the wrong thing, equality of outcome, rather than equality of opportunity.

Equal outcome is a fools erin. It disencourages personal growth, as it will just be taken off them to those who are waiting for their hand outs. We saw this happening en mass during the Ardern years.

Equal opportunities does not guarantee Equal outcomes. Some don't realize the outcomes infront of them, some squander the opportunity, others use the opportunity to enhance their lives.

We should be incentivizing personal growth, not complaining we don't recieve enough hand outs coz our greedy neighours have more than us.

You have completely missed the point. I am talking about equitable taxation Ie. my productive salary income is taxed, yet your unproductive capital gains aren’t.

That ain’t equitable, and it incentivises the wrong thing.

You are completely wrong HM.

We pay more than our fair share of tax on our rental income, especially since Robertson removed the interest deductibility.

It should not be for the harder workers to be funding the lifestyle of those that contribute nothing to NZ by taxation.

I can assure you that as investors in property any capital gains we achieve are deserved because we do a lot of work and put in time that we dont get financially compensated for.

@ HouseMouse - No, I haven't missed your point at all. Again, you don't advocate for "equality", you advocate for tall poppy syndrome & envy. We can break this down here with your "equal tax system" you suggest:

Both Tax & profits unlike peoples opinions are not biased as to who makes it, and how. This means that a true fair & non biased equalitable tax system would either tax all forms of profits, regardless of how it's made, or none at all.

This means that along with taxing property investors, a tax must also be applied to primary family homes, intergenerational family farms, kiwisaver, inheritance, stocks, bonds, mutual funds, crypto currency, and any other form of profit you can think of. Since I'm sure you will not agree that a tax should be applied to capital gains of a primary residence, your biased tax system you suggest is no more "equatiable" than the current tax system we have now. You cannot bleat on about fairness & equality & then suggest favourong one entity over another, simpky jusy because you just dont like the fact that one entity is further ahead than another. Facts not feelings HouseMouse.

A capital gains tax also already applied to property investment called The Brightline Tax. It's been around for nearly a decade now. Do try keep up. A lot has changed in a decade.

The Bright-Line Property Rule (also known as the "bright-line test") is a law that determines if tax needs to be paid on profits made when a property is sold.

Like a capital gains tax, the bright-line rule calculates the difference between what you bought and sold a property for. It then applies an income tax charge on qualifying homes.

https://www.moneyhub.co.nz/bright-line-test.html

HouseMouse I'm really surprised that you didn't know this? Doesn't leave you with much credibility when you believe that a capital gains tax does not exist in this country, when it's been around for nearly a decade now. The fact that it captures properties only within 2 year period is irrelevant also. You don't get cheaper homes by taxing them. You also don't get more homes hitting the market by taxing them indefinitely. Your suggesting of tax "only the greedy investor indefinitely & no one else" is nothing more than another envy tax, ill thought out, rought with further unintended consequences that you have not considered at all. Too busy on your envious landlord witch hunt to apply a little basic common sense to the situation.

We have seen the negative effects of trying to punish those who have more, for the sake of those who have less, over the last 6 years under Labour, that's pretty much all they did. This directly resulted in the largest rise in both property prices, rents, government emergancy social housing wait lists, devide by the fastest rate in this countries history. Weve had 6 years to prove tgay punishing those who have more works as a viable solution, & it failed by epic proportions. Not a single person now feels better off than they did 7 years ago. Time for a new approach - incentivize those who have more & motivate those who cant be bothered and expect it is their landlords job to do it for them.

Incentivize, not penalize is the way forward. "Lets do this".

An interesting contrast..

Australia's PM is investing in the local property market whereas our PM is divesting from the local property market...all while we have a transfer of (skilled) labour from one to the other.

You assume our PM hasn't bought again he might have in a trust or company rather than own name so don't assume

He may have...I note however it is curious that the fact of the sales appeared to be willingly and rapidly made public and no mention of repurchase has followed.

Perhaps he purchased in Australia?

@ Letmebefrank - What has the current PMs personal decision to buy or sell his personal property got to do with anything? Ardern brought a Mcmansion during her 6 year reign & no one deared question her motives.....

Do only National MPs buy property? Does only National MPs buying or selling property matter?

"Do only National MPs buy property? Does only National MPs buying or selling property matter?"

I have reread my posts and struggle to see what may have driven your belief that such a point was made....no political party has been referenced.

@Letmebefrank - "He may have...I note however it is curious that the fact of the sales appeared to be willingly and rapidly made public and no mention of repurchase has followed."

So? Again, what's the private sale of Mr Luxons property got to do with the Australian housong market, or even our housing market? Is our housing market influenced by this one man's sale of one property?

Your confused on my post...I'm confused on yours - I struggle to see what may have driven your belief that Mr Luxon selling his property has any relivence at all. If you believe that Mr Luxon having sold one of his properties has some sort of major impact on our housing market, or the Australian housing market, or that somehow this is some encrypted sign that our housing market is about to do something, could you please explain further? You've left this up to great interpretation, & it would be good to grasp where your coming from.

Further more, is it only Mr Luxon that has this impact on the NZ & Australian housing market by either selling or buying & the timing of such activity? Or are other mps that may buy & sell property within NZ or Australia perhaps also some sort of encrypted message to either "get in, or get out" of either property market in either property? Such as our previous PM Ardern? If you believe that Mr Luxon holds the key to what's going to happen in the NZ property market or Australian property market, could you please share this knowledge with us so that we may also be informed?

If it's neither of the above, then I struggle to see how Mr Luxon selling his property bears any relivence in any way to this article, or to the NZ & Australian property market. Surely this is not just another envious dig at the PM for selling one of his properties? If your going to pull that trick out of the bag, you have to make it relevant, otherwise it's just a bad joke, and noones laughing. If this was the intentions of your comment, it was very poorly timed, & very poorly explained. Though, if you know something thag we don't, thag relates to Mr Luxon selling his property, please share this knowledge.

"Prime Minister Christopher Luxon has put another of his rental properties on the market, moving to sell a third property in his mortgage-free portfolio."

https://www.rnz.co.nz/news/political/530493/christopher-luxon-puts-anot…

If a long term shareholder and recently appointed CE of a company began divesting themselves of the company shares I would suggest your interest may be piqued...what that information may mean or what action you may take would be entirely up to you , but I would suggest turning a blind eye may not be the wisest of moves.

@ Letmebefrank - So the Prime Minister sells three of his properties, & that's enough to make you worried about the housing market?

Worried enough to do what?

Selling his 3 properties means what in the big scheme of things?

Its not like a sharholder of a company at all. For a start, there are not generally hundreds of thousands of shareholders to pne particular compant. According to MBIE, 49% of the population own their own property. Of that, there are 120,330 residential LLs in NZ. And you are worried about just one of those property investors? Heck, he must be quite the property investor to have made such an impact like that.

Did it ever occur that maybe hes just freeing up capital? The Prime Minister's salary is set at $470,000, & he's likely to govern for at least 2 terms minimum. If he had 7 properties, are all of those debt free, including his owner occupied? Perhaps he's selling several to pay down debt, to increase his cashflow to future proof himself when he finally steps down from the PM role. Perhaps he wishes to use some of that capital to enhance his life in some way, perhaps towards some nice vehicles? Or to help his family out, or maybe he wishes to liquidate some of his properties to have cash surplus for an early retirement after he steps down as PM?

It's a rather bold assumption that just because one property investor out of the hundreds of thousands has recently just sold up just 3 out of his 7 property portfolio. Could mean any number of things, least of all that he knows something about the real estate market that absolutely no one else in the industry does. What do you feel it could mean? I'm interested to hear your take on this, perhaps I'm being too nieve & I may be missing something?

The recent price surges in Australia show that another property boom is inevitable in NZ. Just when the consensus is that prices can't rise any further, away it goes again - especially once NZ starts to look cheap relative to Australia.

Not really, our potential 1st home buyer generation have left and bought in Oz, hence the positive demand, price curve. How do we copy that? No one is coming back to nz for many, many years. Nz is just a giant retirement village after all.

Capital gains tax, Stamp duty Tax, Land tax, etc. etc. and still Australia's house prices are going up even though they are already more unaffordable than in NZ (using Auckland vs Sydney metric).

Perhaps this is a case in point for those who believe that introducing a CGT in NZ will keep house prices down, and for those who want to move to Aus for "cheaper" house prices.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.