A surge of new listings onto the housing market in September pushed up already high stock levels, meaning buyers will continue to have plenty to choose from as the market pushes through spring.

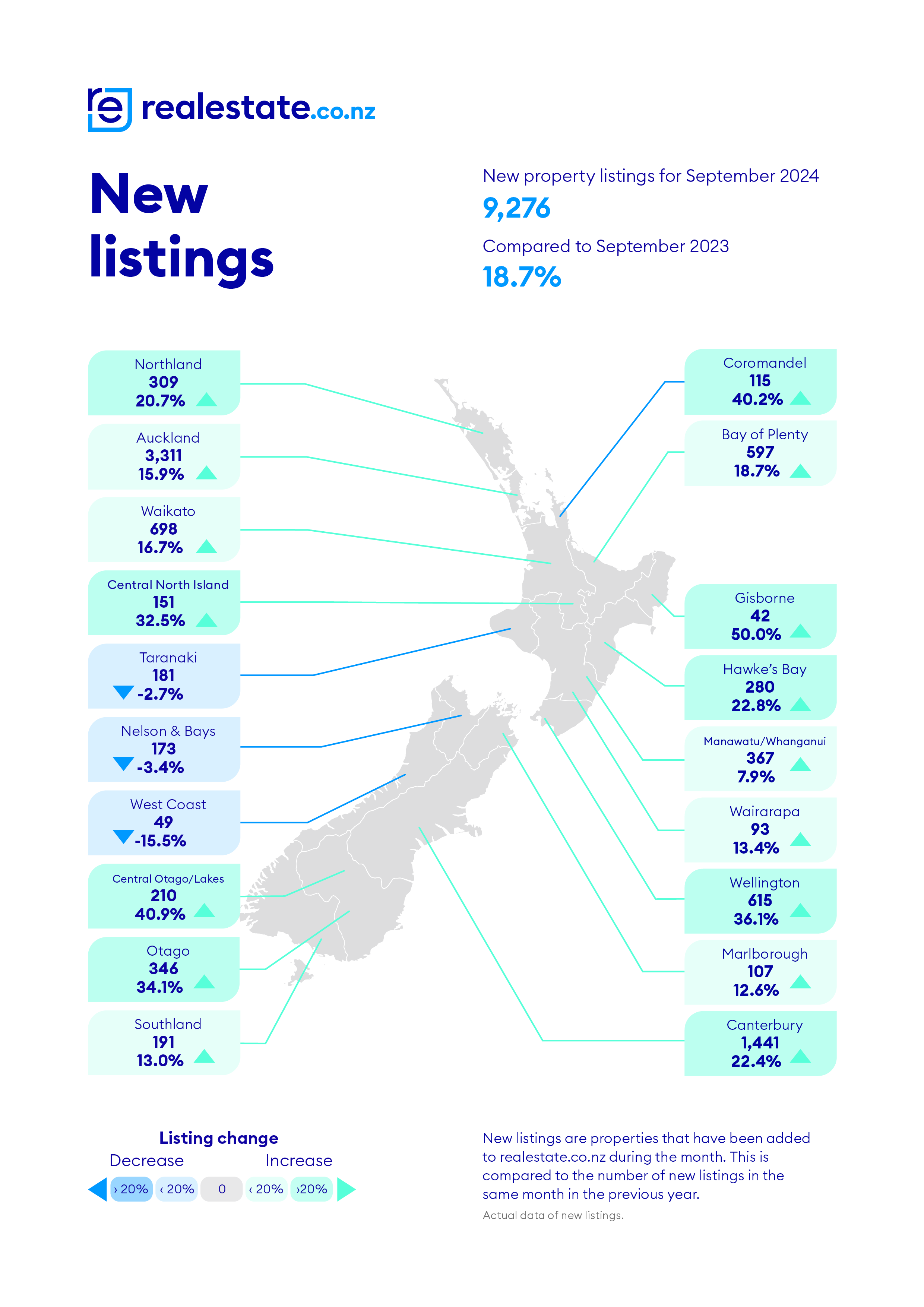

Property website Realestate.co.nz received 9276 new listings in September. That was up 15.3% compared to August, and up 18.7% compared to September last year.

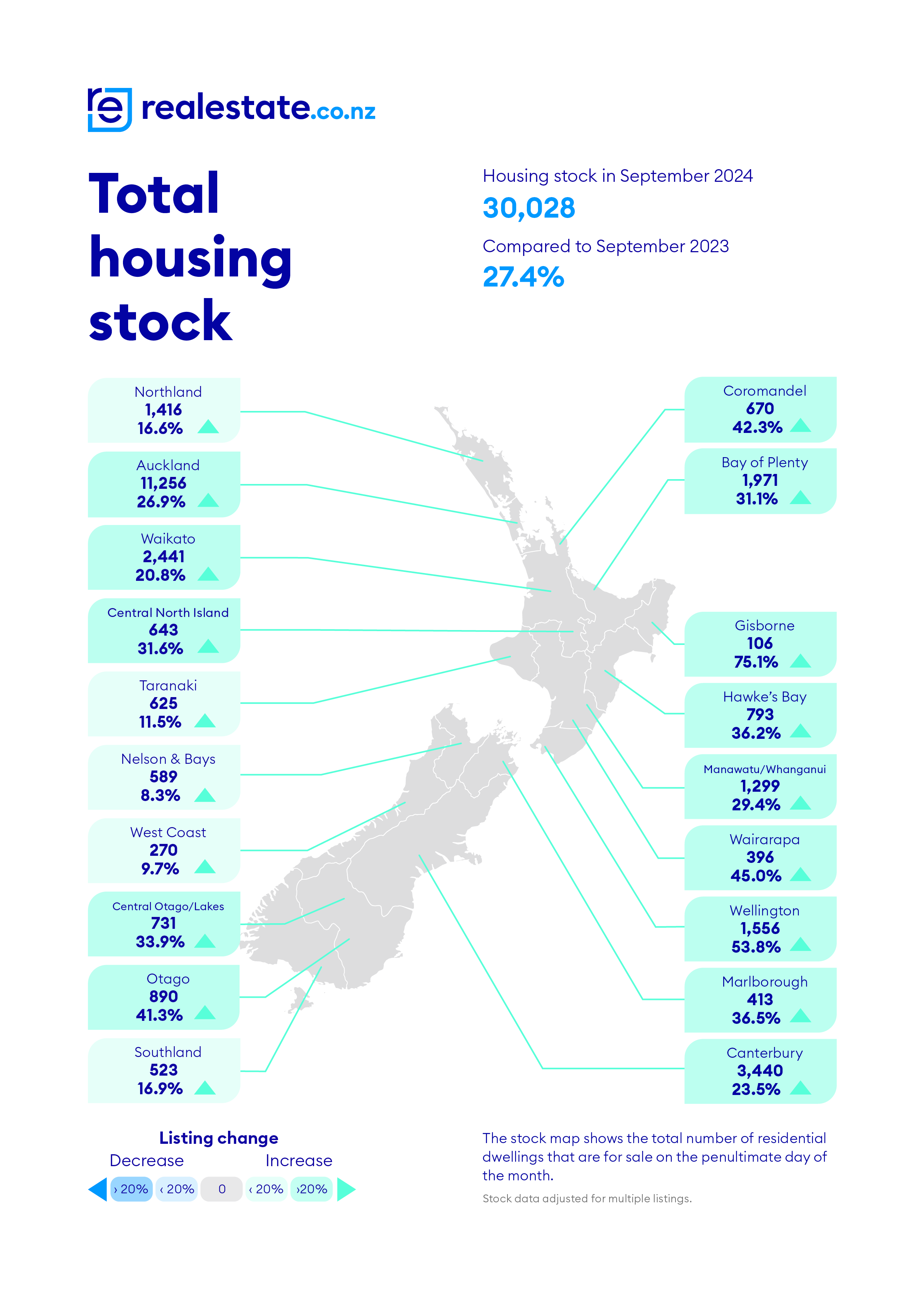

That pushed the total stock of residential properties available for sale on Realestate.co.nz to 30,028, up 1.5% compared to August, and up a whopping 27.4% compared tp September last year.

This means the total stock of properties for sale on the website is at a 10-year high for the month of September.

The national average asking price of properties on the website remained within its recent range at $870,110.

"For almost two years our national average asking price has hovered between $860,000 and $890,000," Realestate.co.nz spokesperson Vanessa Williams said.

That's the longest stretch of price stability on the website since its records began 17 years ago.

"We've never seen prices remain flat for this long," Williams said.

The combination of high overall stock levels, plenty of fresh stock and flat asking prices, suggests buyers are spoilt for choice.

However, while the latest figures from Realestate.co.nz suggest there are plenty of people wanting to sell their properties, we will have to wait another week or two when the Real Estate Institute of NZ's sales figures come out, to know if the apparent enthusiasm of vendors wanting to sell is matched by action from people wanting to buy.

The comment stream on this story is now closed.

You can have articles like this delivered directly to your inbox via our free Property Newsletter. We send it out 3-5 times a week with all of our property-related news, including auction results, interest rate movements and market commentary and analysis. To start receiving them, register here (it's free) and when approved you can select any of our free email newsletters.

30 Comments

Longest period of stability....

Having ever increasing prices without supporting national prosperity is stupid. All it achieves is larger and larger mortgages turning working kiwis into endless debt slaves for global banking interests.

"All it achieves is larger and large mortgages turning working kiwis into endless debt slaves for global banking interests." ...... @Averageman ....NAIL ....HIT .....ON ......HEAD !

And this is not a productive asset - it's a place where people live.

Exactly correct I think/

Total stock available has sky rocketed, economy in the doldrums, migration turning.. all points to a weak housing market

Up 2.7% on the month.

Ka pai! 🥂

In this continuing NZ Wide housing crash, the flaccid market is having the resident SuperSpruikers and REA shrews going floppy.....Zwiffingerinthebreeze, Wingingit and TTPonziisme.

There's never been a better time to punt on property.

And that's confirmed by all the bearish comments here.

Great wingman - so have you maxed out all your mortgages, to grab that next Riverhead bargain ! Good luck to ya mate !

From those numbers deduct those houses that are leaky, on flood plains, been rented for a long time, are new builds of poor quality, have non consented work and there isn’t much decent stock in Auckland unless you go way out.

It's true, there is a lot of low quality stock around making it very hard to find a good house in central Auckland. Feels like the market is very nuanced and really depends on local demand, suburb by suburb, street by street. A good home still fetches good money. But a dud home may now not sell at all.

And it's only the good homes that show up in the sales stats, so people celebrate a shift upwards in average prices.

Looking at these figures, I am having a very hard job understanding where so many on here are saying that there is this housing crash??

As you can see Christchurch is in positive territory and there is nothing surer than prices are going to increase.

We sll know Auckland snd some other places are overpriced snd difficult to buy into, but moaning snd groaning about them is not going to improve your own situation.

You're 100% correct, it's not a crash, it's in their heads.

It doesn't matter how bad the market is, there's always pockets where there's value. Elevated interest rates that are on the way down and lots of choice.

The best time to scout around in decades.

Yeah...Wellington is going gang busters...tui. Take your self interest blinkers off, its not all just about where you have leveraged interest.

Still in denial I see. I thought all the spruikers had finally woken up.

This "crash" that isn't, according to the sea level dweller north of Auckland, was estimated to last 5 to 10 years (by savvy commentators in 2022). So I don't expect to see 2021 peak pricing till 2027 at the earliest and 2032 on the outside.

Here is a prime example of the current state of the market. Property details for 25 Jervois Road, Jervoistown, Napier, 4112 (propertyvalue.co.nz)

2013 - Sold $900k

2020 - Sold $1.95m

2024 - Sold $1.5m (172 days on the market)

Considering realtor fees and inflation, the vendor lost over $600k.

2020 buyer paid way over the odds for that one.

Considering they also put in a new wastewater system the pain will be even greater.

You know those are asking prices, right? Just checking.

Look at the quote I got at the bottom of this article:

One common way of judging whether housing's price is in line with its fundamental value is to consider the ratio of housing prices to rents. This is analogous to the ratio of prices to dividends for stocks.

~ Janet Yellen

Seems too difficult to understand for some here.

How do you spell "bubble" indeed. All about tax free gain.

House stock still going up.

Price discovery coming to a desperate vendor near you.

I could fix the NZ housing situation today !

1. Eliminate the accommodation supplement - if a property has to be rented out at well above its "market rate", that renters can't afford, its taking money out of the economy and putting into landlord's pockets - which goes straight to the banksters !

2. Capital Gains tax - on all property, all the time - except the family home and of which there is only ONE with no exceptions ! - then put that money to fix all those potholes etc etc !

Capital Gains Tax also means Capital Losses Tax. If there was one, right now, the govt would be coughing up billions.

What universal law states that a Capital Gains Tax must be offset by a Capital Losses "Tax"? When you call it a tax, are you saying people are also taxed on their losses?

But anyway, I know what you mean. They won't be paying out billions because it'll be called "losses carried forward" and being ringfenced the only way someone could realize this capital loss "tax" is by selling another property for a profit and reducing their taxable income by offsetting this brought forward loss.

No capital gains (or losses) on the family home wingman ......while why would you be worried at all about the govt forking out billions for capital losses, as according to your good self, there will never be any capital losses in Riverhead !!!

They literally already are, did you not read the Budget? There is not enough money being generated for favored capital gains regime, so the governments hand is forced to spend billions more than they campaigned on.

Not to mention Accom Suppliment which exists to cover a gap between what fools borrowed and what the market has capacity to pay.

Why on earth would that money need to be funneled directly into the pockets of asset holders? Why should it?

Abolish zoning

Apart from farming and Australian money going into Queenstown, I can't see there would be enough buyers out there for all this housing stock.

I think the economic indicators point to this being a disappointing summer selling season overall. I’m sure it will vary from market to market, and may increase slightly up if the sales volumes rise, but overall this won’t be the start of the next upwards cycle.

This is way too balanced and unemotional.

Have you thought about picking a side (DGM vs Spruiker) and getting stuck in?

Both Auckland and Wellington have high stock of smaller apartments

Houses in Wellington seem to be selling well, apartments and those under body corporates are suffering with high insurance costs.

Wellington seems to have a lot of central student flats also sitting on the market.

With a one percent drop in interest rates you may see houses pulled and rented and the market change to sellers quote quick

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.