Auction room activity bounced back last week after the stunted Matariki-shortened prior week.

And it might have bounced back a bit more than you would expect.

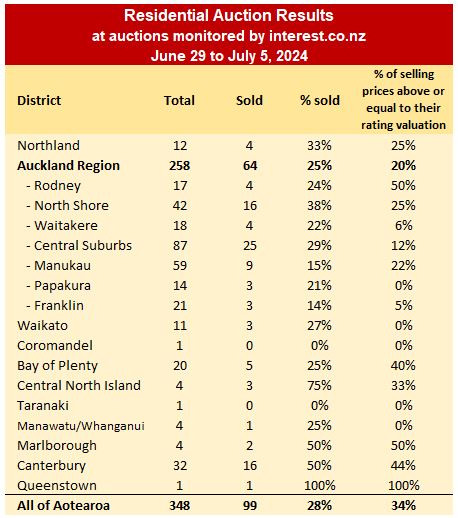

There were 348 residential auctions last week. That was not only a big rise from the 194 in the prior Matariki-affected week. But it was also a good rise from the 236 in the week before that.

And it was more than +100 higher than the 230 in the same week a year ago.

But the results weren't as positive.

Only 99 sold last, giving a sales rate of just 28% and that is historically very low. Last week the sales rate was 33%. In the week prior to that it was 35%. In the same week a year ago it was 45%.

The proportion selling at or above rating value was down to 34% last week after 36% in the week before, and 35% in the week prior to that. A year ago however it was only 28%. (Rating valuations in some cities changed over the past year.)

In Auckland the sales rate fell to a very low 25% (one in four) and the proportion of those sales that achieved rating valuation was down to just one in five.

Nationally, only 26 of 348 properties auctioned achieved rating valuation - just 7.5%.

The Queen City contrasts markedly with the Garden City. In Christchurch the sales rate last week held a high 50% with 44% of those selling at rating valuation. The auction scene in Christchurch is holding up well.

So there's currently more auction activity compared to last year, but sales are harder to achieve, which likely means more downward pressure on prices.

The chart below shows last week's district-by-district auction results.

Details of the individual properties offered at all of the auctions monitored by interest.co.nz, including the selling prices of those that sold under the hammer, are available on our Residential Auction Results page.

•You can have articles like this delivered directly to your inbox via our free Property Newsletter. We send it out 3-5 times a week with all of our property-related news, including auction results, interest rate movements and market commentary and analysis. To start receiving them, register here (it's free) and when approved you can select any of our free email newsletters.

129 Comments

Pretty dismal at the B&T auctions this week. The Wednesday Highbrook auction had 22 properties on offer and only one sold on the day. A few buyers looking for bargains and making reasonable offers on the low side, however, most properties not even getting a bid.

Properties in very good areas tend to sell okay as they always do. Location, location, location are three good rules to follow in good times and bad.

Unsurprising given the brightline changes

The only question is if the flooding of the market with properties for sale is merely a temporary bump after the legislation changes or the augmentation of a trend

My money's on the latter

There will also be a few that wait until the warmer period to list.

There's certainly a glut of overpriced homes. Vendor's chasing constantly retreating buyers. I recall one priceless post from Sept 2021, ""NZ house prices are increasing - on a sustainable long-term trajectory"

What we are witnessing now is the fallout of foolishness.

https://www.youtube.com/watch?v=JnxTT7XXMPA&ab_channel=TheEdSullivanShow

There are now multiple fundamental reasons that will be motivating vendors to exit, many are still stilling on substantial equity worth banking. This downtrend could easily have years to run before it's out of puff.

The 1890s witnessed Australia’s worst ever house price decline. Not only did Melbourne’s prices fall more than 50% in real terms, but Sydney’s also fell 36%. House prices then went nowhere for 60 years. In other words, an adult at that time often didn’t see a time when property was a good investment.

https://www.morningstar.com.au/insights/personal-finance/232688/lessons…

Worth a read if you mistakingly believe property prices always bounce back after 30%+ crashes caused by building booms on the back of high immigration.

Thanks, an interesting read - especially noting the causes.

Your opportunity to buy at a discount....no one knows where the bottom is.

It could have been yesterday. Bottoms are always apparent in retrospect.

...at least you're acknowledging the downtrend, that's one feather for you.

I got a colossal discount on the bit of dirt I bought last year. Where some see disaster, others see opportunity.

I'm sleeping very soundly.

Flax grows really well in swamp. Is there a commercial potential yet?

A sluggish, lower-price housing market is Shangri-la for counter-cyclical strategists - otherwise known as bargain-hunters.

Indeed, let's pay homage to the cyclical nature of asset markets - and the joys they can bring......

And well done to savvy investors with mortgage-free property - quietly reaping the benefits of high rental yields. 😁

TTP

I hope it's not where a thousand other block are going to be released to fulfil the new Chris Bishop "30 years worth of stock" mandate. Could prove tricky to sell, if so.

It's where there's going to be loads of development. I've posted it here before.

Bishops wish-list will probably never happen, it's going to take years. And they're going to have to purchase this land from existing owners, who aren't going to give it away.

There's probably a number of reason why the Vendor agreed to the 'discount' that you got for the Land. But, generally, "because they think the price is going up from here" isn't one of them. And also, generally, any price paid isn't at a 'discount', it's just 'market price'.

The classic comment on auctions comes to mind. "At an auction, you get to stand up in public and pay more for something than anybody else thinks it's worth"

The vendor needed the money. I do lots of research, I haven't made any mistakes yet - I bought my first property in 1975.

If I've made a mistake, this'll be the first one. One thing I've never done is follow the herd.

Which puts you, and many ageing multi-property owners, into their 70's. And guess what? They are going to start dying off at ever-increasing rates, and what happens to their assets? They get disbursed; sold off, to be divvied up amongst the beneficiaries of the Will. I know that seems cold, but the property owning class is dying, many of them having leverage that 1975 property up into today's gross portfolio Debt, and the supposed younger buyer can't afford what they have to sell. The result? More sellers, than buyer - as each day passes.

"the average age of first-home buyers has climbed from 25 in 1970 to nearly 37 now"

Do you think the vendor knew there was an oversupply coming to Riverhead or do you think you were just unlucky?

Riverhead properties are up 10% in the last year.....so where's this terrific crash I've been hearing about?

Fortune favours the brave, not those that go on to chatrooms and tell anyone who'll listen how bad it's going to be.

no they are up 200%

Property Investors Chat Group NZ

Anonymous member

· ·

I would love to hear from anyone who has an investment in Papakura. In particular an apartment. How are you finding it? We purchased a new build a couple of years ago, and have been in touch with a real estate agent who informs me that, Papakura is a dying area, full of crime, and $2 shops. She said our apartment will never get it's value back because no one is interested in apartments in Papakura. Nobody wants to live in a big concrete block of ugly apartments.

She was surprised at the valuation we got and wondered how it got valued so high ..

Yes it's dropped quite a lot in value since purchase.. We did get it through a investment property advisor, who told us Papakura is redeveloping itself. But apparently it's not.

I'm feeling rather deflated and worried.

"We did get it through a investment property advisor, who told us Papakura is redeveloping itself. But apparently it's not."

They got sold a product by a self labeled investment property 'advisor', who had a vested financial self interest in the transaction. Unclear whether the advisor earned a commission or were selling their own product.

CAVEAT EMPTOR. There are property promoters using self labels that make them seem independent to their customers but in reality have HUGE conflicts of interest.

Property promoters are non fiduciaries and do not owe a duty of care to potential buyers.

Yes the property pumpers and propellorheads (Development sales people) are very close to being financial scammers.

The FMA should send a rocket up them for the bad, bad advice that they have given gullible people over the last 5 to 10 years.

Many thousands have destroyed their financial futures, aided by the bad advice from the Propellorhead types.

Yet they still get away running ( "investment seminars") WTF!!

Walk around papakura and you can tell it’s a shithole

When it comes to research, sometimes you only need observation. You can tell what a bit of bare land is like by just looking at what is growing on it. Various types of grass tell you a lot and there are types of grasses here in NZ that only grow in continually wet and damp low lying areas.

You can buy properties based on the type of grass, I bought in Riverhead based on 19 different developments and improvements.

Zwifter's type of grass involves hydroponics, a small room and possibly a back-up generator.. Wingman owns the land.

Haha, I do enjoy your wit RP 😂

The land can be so shit it should have remained a park to walk the dog on in the summer. If you have lived rural in a few places in Auckland then you will recognise land that should never get consent to build on. There are no end of places in NZ that should never have had a house put on it unless it was on 12 foot high poles. Think its still not happening ? Think again there are plenty of new builds in places that make me cringe.

Drive through old Albany village heading north, as you cross the bridge look left.... nuts

Exactly we are still building houses in holes over here. Seen it more than once, those sudden "Infill" sections that have been left for 50 years are suddenly being built on. My advice is to get on your GPS and check the elevation, its free and its the first thing you should do. Anything a few meters above sea level or by a creek is a no go.

Just have to overcome the Riverhead Community Association's fairly vocal opposition of PC-100.

I doubt they've got the clout or bank balance of Fletchers, Matvin and Neils.

Is this the Riverhead Botanic timeline?

- Fast track approval granted April 2023

- Wingman buys land

- Auckland Councillors reject application June 2023.

- Submissions on PC-100 May 2024. A very comprehensive list of concerns around the impact on surrounding infrastructure that's already at capacity from local residents, submitted to councillors that already knocked back the application.

Anyway, good luck hope it all works out.

I've already had a chat with the Botanic. It was originally fast-tracked, now the usual resource consent process applies.

I don't know if Wingman's audacious venture is going to bear fruit or not. But I don't understand people who are so intent on killing someone's hard work and dream. Why try so hard to destroy someone else's endeavours? What's in it for the "anti" people? Given the cynical posts, it surely is not trying to protect Wingman, it feels much more like they are trying prove him wrong and mock him, and possibly make themselves feel better for not having the courage to undertake such an audacious undertaking.

Because Wingman has been on here for several months trying to pump Riverhead as good place to invest. He's not doing it because he actually thinks it's a good place to invest.

By his own admission it's only worthwhile if you spend extensive amounts of time doing detailed research (well actually his wife did the research apparently so really you need to have a wife who knows what she is doing), have over 30 years experience understanding what to look for (in his own words), manage to buy a property at 30% less than it real value, ignore the signals that the government is sending about releasing supply, ignoring the local concerns that have opposed development in the area, ignore the insurance industry's messages that they are about to get tighter on insuring in flood prone areas, assume that people will be happy spending hours commuting when there is about to be a flood of new properties come onto the market closer to public transport and jobs, expect immigration to reverse trend and for more people to come in, accept his claim that all property in the area is selling over CV despite other places in Auckland doing the opposite, accept that the council and government will suck up the new infrastructure costs of the development in the area does happen, accept that the country is in a good economic place and the recession will be short lived and we will return to boom soon, accept that the RBNZ will not put in controls to stop the property Ponzi re-inflating once it finishes crashing, accept that banks will be willing and continue to be able to lend to support house prices growth and capital gains.

I mean given all that, it's a bold punt and it could pay off but if it does, what is the learning for others? He seems to be saying Riverhead is a good bet because he's made that bet. It's the same argument you get in a Ponzi. Like I've said before people who have secret successful investment strategies tend to keep them to their selves. His constant selling of Riverhead smells of desperation as someone who wants to try to get a bit of excitement going so they don't lose too much.

"Because Wingman has been on here for several months trying to pump Riverhead as good place to invest."

So ? That's not a good reason to tear him down. Do you work Agnostium ? Or even better do you own a business ? If so do/would you not promote what you're doing ? Of course you would. How would you then feel, if everyone told you that what you're doing is sh!t and that you're going to fail ?

Plenty of us on here own actual businesses. I haven’t really seen anyone push or promote themselves to any meaningful extent, in fact most of us would rather not promote ourselves here.

But the old title squatters will make sure to shove their precious TGA or Riverhead in everyone’s face till the cows come home.

Apparently these special areas will be immune.

Convenient.

I don't need to pump Riverhead, it's done that on its own. The median sale price 3 years ago was $1.4m, the latest is $2.87m.

To be fair, some of that I'm sure is spillover from properties in Riverhead that are adjacent to Coatesville, NZ's most expensive suburb. The median sale price in Coatesville in $3.11m.

Wow that sounds bad, If I had bought there I would be smoking a bit of my weed and change the pump to a jump off a bridge.

Wingman has been talking incessantly on here for months about how good a decision buying land in Riverhead was. It initially sounded like a great "financial decision" so I looked into it further.

It seems so far it's not the great investment plan that he's making it out to be, he's bought a piece of land on the premise that he'll see value uplift from a large scale development that has been knocked back. All I've done is present the facts to date, to "help people make financial decisions".

That isn't true, there's several large projects on the go there, so which one are you referring to exactly?

I mentioned Riverhead originally because there's hundreds of posts here telling us all about the great NZ property collapse. It might be tanking in some places, but not all. I've done my homework and hammered my stake in the ground.

You guys are the ones who keep resuscitating Riverhead, not me.

Yvil, as the resident hall monitor I’m sure you would agree that if wingman wants to advertise his betting operation, sorry “business”, on interest.co then he should pay an advertising fee.

Given he’s so intent on promoting this area of development people have a right to do their own research and report back their findings. I endorse this given how many people get suckered in to bad property decisions based on poor advice from vested interests. As it were.

At this point it most certainly warrants “BUYER BEWARE”, as others have noted with valid reasoning.

Huh….fletchers are running out of cash and have just had to rearrange their current borrowings, all 2$billion.

I wouldn’t be surprised to see them offload sites the same way Ryman has.

but I don’t begrudge you and wish you well.there is risk in everything

Fletchers aren't the only ones involved, there's 3 major developers.

Every wingnut spruiker is going to tell you now is the bottom of the market - the want to create FOMO

www.opespartners.co.nz are probably the biggest - their property investing podcast is NZs No.1 business podcast

The funny thing is if you put ‘bottom of the market’ in their search engine you get 277 results of articles and podcasts going as far back as 2022 when the crash first started.

Why are Kiwis so goddam dumb?

They've got your attention and you're linking their website... win for them.

They first got my attention when I heard their economist spouting property nonsense and I wondered who the hell he was.

When I looked him up it turns out he’s never worked as an economist before.

Charging people money for property seminars is an old model.

Alan Bond started it in the 80s in Aus when he was property developing. He ended up in jail.

Opes provide clients a 'wealth plan' for free and make their money by charging the property developer their clients buy from, a commission - that they call a 'marketing fee'.

So it's going to be interesting to see where this one all ends.

"Opes provide clients a 'wealth plan' for free and make their money by charging the property developer their clients buy from, a commission - that they call a 'marketing fee'."

They have other businesses related to property. I believe they they have a mortgage broker business to assist buyers to finance their purchases. A property investor / mentor / property developer recently turned mortgage broker has recently joined their mortgage broking business.

Unsure if they're monetising their podcast, but I wouldn't rule it out.

Their economist has an undergraduate degree in music and arts and a post graduate diploma in economics from what I can tell. Unclear if he has undergraduate degree major in economics or if it was just a couple of first (and second) year papers. From what I can see, he has never worked previously in a financial organization.

If you know what you're looking for, Opes do have some great data available on the residential real estate markets.

I don’t mind the Opes podcasts as they generally provide data sources you can validate against certain claims. They were very quick to call the bottom last year and might have to walk that back very soon.

I try to get my information from as many sources as possible and I have to say they are the worst: so much wishful/vested interest talking, with the typical mehod of taking the smallest subset of data that fits their narrative and suggesting it's a global trend.

When I said back in 2021 the housing price crash was coming and to expect a 50% drop over next few years most people were under the impression rates would stay low forever now many are refinancing and having to pay much more while the people who purchased end of 2021 are already in negative equity and many more are going to be in same position.The crash is starting to speed up now people taking a hair cut before losing much more

You are great at predicting things, 3 years after they have happened.

Yvil did you not read what the comment said 2021, has not come down the 50% from highs yet but it will. No sure why my comments trigger you so much, but me and many others told you and others a huge downturn was coming yet you are still in denial.

Yes I too warned friends not to frenzy buy in 2020 to 2023. Some listened, many did not.

THEY ARE ALL IN PAIN.....

There was nothing wrong with buying a house in 2020, I did. It went bad for about 18 months and that's about it. Anyone who bought out side the Covid frenzy is doing just fine. Buying in 2020 was still better than buying even right now.

Tops are too - and actually points of inflection also.

Building standalone houses doesn't work anymore at this point either. Our recently completed house cost ~$1.4m (land plus build) and was just RV'd at $1.2m. Similar up and down our new subdivisions street, most building has stopped and land huge land sales with some half finished houses stopping too.

That flood of housing promoted by Bishop... how is anyone going to afford to build them?

To answer your last question - as I said a day or two ago, they won’t. Well not in very large numbers. Bishop’s announcement got beaten up by some as pro-sprawl but really it is quite the opposite. It’s actually very clever.

As I said the other day, many greenfield developments won’t be profitable or feasible if the developer has to pay all infrastructure costs. This has been picked up, correctly, in a great article in today’s NZ Herald by Thomas Coughlan.

With less artificial restriction, land prices should come down at least. I'd also expect some wider disinflation in construction costs as monopolists and middlemen realise they can't get any business charging what they do now. Let's face it, construction prices are high because they involve too many rent-seeking parties currently getting rich off other people's enormous debt. Take away that and in time (2+ years) we may find that it doesn't cost so much to build a house after all.

Agree. But even if costs come down 10%, it’s going to be hard for developers to build and sell (with profit and GST added) a three bedroom house on the edge of Auckland for anything less than $1.3 million.

At those prices, the realisable demand in the market is pretty limited, especially at current interest rates. But also, to be honest, at a retail interest rate north of 5%.

It will be interesting to see what impact National & RBNZ July policy changes make:

CCCFA easing end of July (easier approvals for bank lending), LVR restrictions eased up (lower deposit required for investors & more low deposit lending available to FHBs), Interest deductability back (better investor returns), Brightline adjusted 2 years (better for speculators), OCR likely to be cut, rates easing with a DTI so high that it does nothing...

Don't be fooled by the distraction this week from Bishop about flooding the market with cheap land - which would take years if it even happened. The only flooding they've been doing is with immigration...putting more upward presure/demand on housing.

If your pro-property arguments were credible today, then we wouldn't have just witnessed a Dead Cat Bounce. If there really are cherries "supposedly" ripe for the picking, investors would be out in force pushing up sales volumes and a sustainable price floor could be called. We are still nowhere near THAT point. Keep your eyes to the front Nifty1

Calm down RP... does it trigger you to see the reality of what National/RBNZ are actually doing to prop up the property market? Or would you prefer to put your head in the sand and believe they're out to make property more affordable for everyday kiwis...

Rhetorical question for you. Why are you suggesting I'm wound up, triggered or whatever when I'm not? The point here is that, to your own detriment, you've become too cynical towards your pro-property Government. Do you feel alienated and angry yourself?

It's just a lazy way to discredit or undermine the person rather than actually arguing the point.

Would be like people in a debating chamber responding to their opponent with "ur just mad bro".

That said, does this mean neither of us got an upvote from you? - DAMN!

RP - your comments suggest you're triggered when you ignore what was said and go on some tangent about me being pro-property & telling me to keep my eyes to the front (whatever that means) ...

How about comment on the Govt/RBNZ July policy changes and the potential impact that could have going forward...

It seems you simply ignore what's taking place, perhaps as it doesn't suit your narrative?

Nifty1, I think your imagination has got the better of you. I suggest you try and remain positive that this could be an avenue for some into sustainably affordable home ownership. Try not to be so cynical. Bishop has some excellent initiatives that even I wasn't expecting.

Again, eyes to the front. That rear vision mirror your so obsessed with is doing you more harm than good!

Oh - and the July policy changes were flagged some time in advance and that still didn't provide a sustainable floor under house prices. For investors, the figures don't stack. As for Brightline - unintended consequences are more likely the outcome here.

edit

CCCFA argument is absolutely credible. It’s something that investors have to wait for. The others I agree demand can be measured upon expectation.

Why do most talking about the housing market in the doldrums when in many places it is very steady?

The housing market is all of New Zealand and yet the happiest city in Nz, continues to outperform.

Auckland and Wellington prices went crazy for too long and it is only going back to where it should be fundamentally.

It was being held up by cheap finance and too much immigration, so not surpriding is it?

Down down down, in ponzi town. How's that negative leverage working out for spec land?

FROM Core Logic In June, Auckland's negative turn was prolonged, down 1.2% over the month, and takes the quarterly fall to 2.6% - the largest quarterly drop in prices since August last year.

So I called -10% Dec23 to Dec 24, the last Q was on track, The Dec Q will easily cancel out the first Q.

Baptists call that we are within 1-2% of the bottom, is clearly wrong , as are others of flat markets etc etc

Its going down like a fat dog on wet lino

It’s interesting to speculate as to what if any impact Bishop’s announcement will have on the market. I think it will be limited. But….

We might start seeing developers getting a ‘little’ more active again in buying sites in Auckland (in the existing urban area). I have done some quick numbers, and developing small units (with no minimum floor areas) looks quite feasible and profitable.

What's the demand for shoe box apartments and who's going to provide the lending to buy these? Where's the infrastructure coming from? How long is this all going to take?

The July policy changes are something that's actually going to impact the property market in the short term, yet people want to focus on this distraction by Bishop...

Shoe box apartments - don’t the banks have a 38 sq m minimum? The new rules will allow 2 bedroom apartments to be built at say 43-45 sq m (realistic minimum) rather than 50. And factoring in removing the balcony requirement, that could mean new 2 bedroom flats selling for circa 600k rather than 700-750+ in Auckland That will be quite an appealing investment option (returns potentially around 5-6%), as well as a more attainable option for FHBs.

The rules certainly won’t come in over night - probably will be around November once all the processes are completed - and sure it’s going to take time for smaller units to actually get consented and built. So not such a factor in the next 1-2 years, more likely 3 years+.

43-45 sqm is ridiculously small for a 2 bedroom... can't see many buyers or banks wanting that, especially if land is 'flooding the market' & dragging down property values. Perhaps more emergency housing in the works...

I have lived in that size when younger, with my wife and son (when a baby). Yes it was tight but it was ok, with good design. Btw I assume one bedroom as a single, a small bathroom, a small kitchen and no corridor wastage.

Again, yes tight but possible.

And a one bedroom apartment can easily be done at 35-40 sq m rather than 50

I have also lived in small apartment but location has to make up for lack of space. Mine were always waterfront, sea views, balcony, near parks and close to town and local bars.

These may work if they are built in the right locations but 600K for a 45m square apartment with no balcony in Hendo isn't going to be worth that. Maybe, Kingsland, Devonport, Takapuna, Mission Bay, St Heliers, but I haven't seen those suburbs being targeted for cheap apartments.

Of course not.

But it’s realistic for apartments of those sorts of sizes to be built and sold for that sort of price in places like Ellerslie, Panmure, Avondale, New Lynn, Pakuranga etc. Up and coming areas with good access and ok (and hopefully improving) amenity

Really? I don't think any of those places are worth 600K for a 45m apartment with no balcony. At a push Avondale would be a maybe given Eke Panuku's and KOs plans and the transport links but the other's? If you're a young professional FHB look at the equivalent apartment in Europe or OZ. You could be living in a genuine proper city, not a soulless suburb.

I never said that represents great, or even good value. But that’s the economic reality. A 50-60 sq m apartment currently sells in those sorts of locations for 700-750k plus.

As you should know by now, I have said many times that it’s only through the government building homes subsidised en masse for FHBs (like post WW2) that anything remotely affordable will be realised. But that’s too ‘left wing’ for a centrist Labour party isn’t it

But like ‘JimboJones’ you don’t seem to carefully read what I say.

I thought you both want density? Do you both think that the market will magically deliver affordable density in beautiful central locations ????

well you are completely naive if you do

And no storage. Great for short term airbnb and emergency housing.

Grim reading for RE agents, vendors, and house owners.

The interesting part is the increase of the number of houses for sale, because it coincides with the first week of July, meaning the beginning of the reduced brightline tax period of 2 years. It will be interesting to see if the next few weeks maintain or even increase the high number of houses for sale.

At least a 1/3rd of them are not really for sale are they.....

Will the predicted flood eventuate?

It’s interesting to watch old grumpy defend his patch. Surely he has better things to do like put in flood protection measures on his magnificent piece of land.

Riverhead up 10% in the last year.....doesn't it infuriate the defeatists? "It's different this time"......yeah right!!!!

The problem slowing Riverhead is what's known as.... 'chicken or egg, which comes first'? Houses have been prevented from being built because there's no infrastructure, but there's no infrastructure because there's not that many houses.

However, there is a plan in place to develop 75.5 ha of land in Riverhead.

Interesting. Homes.co.nz has Riverhead down 13.6%???

https://homes.co.nz/map/riverhead/riverhead?searchLoc=%60fj_Fodth%60@

realestate.co.nz has Coatesville up 11.5%.

https://www.realestate.co.nz/insights/auckland/rodney/coatesville

Little lesson there, Coatesville is not Riverhead..... One of the reasons Coatesville is higher priced is there are many larger LSBs, its not really urban at all

Riverhead abuts Coatesville, and much of it is rural, including my place.

Yes but Riverhead is not up like you said. So another little exaggeration/lie?

I heard prices were up in Adelaide which abuts New Zealand so prices in Pakarunga must also be up.

Depends where you look. OneRoof has Riverhead up from $1.4m to $2.87m in the last 3 years with a near vertical spike in 2024. Hard to believe, but that's what the chart says. Possibly larger chunks of land changing hands.

Remember Aunty Helen's MUL, the Metropolitan Urban Line? She said urban development would cease at Whenuapai out West, but the new government says the reins are off, and urban sprawl can continue.

When McDonalds opens in Kumeu, that's all you really need to know. They've arrived at the same conclusion as me.

It is very hard to believe. You're right, there most certainly is a vertical spike in 2024 but it's from very low sales volume.

There's a property that sold for $4.23m (14% above 2021 RV) and one that sold for $1.51m ($35k below 2021 RV). ($4.23m + $1.51m) / 2 = $2.87m

Yes, maybe a few valuable pieces of land changing hands recently.

Up 103% in 3 years with the chart spiking north in the last 7 months.

I heard the Maserati dealership in Christchurch sold a Ghibli last week. That means the average price of a 4 door sedan in Christchurch is $150k.

Or possibly those with some real money driving a stake in the ground, knowing what might be around the corner.

"Fortune favours the brave"

https://homes.co.nz/address/riverhead/riverhead/53-diamond-lane/bKGj4?s…

Not a bad bit of dirt to be fair... plenty of room for a few chooks... but I challenge that you "will make a killing" unless we get another property boom

My guess is the vendor was very happy to get out with a small loss after transaction costs. Well done on negotiating a $200k discount from listed price.

What infrastructure has been approved?

The Fletchers/Neil/Matvin development hasn't been approved, it's on the drawing board as I said, lots of it, and this doesn't include the retirement village, school, roading, intersections or anything else.

Go for a drive up SH16 to Waimauku. When you pass Westgate going North, note the new industrial subdivision on your right. Check out what's happening at Westgate and on the other side of the road. The road is being widened from Kumeu to Waimauku. A bypass is going to be built from Waimauku to Westgate, the land has already been acquired.

I'm not here to sell Riverhead or the West, I'm merely debating the notion that real estate's going to crash and burn, which it isn't.

https://www.aucklandcouncil.govt.nz/UnitaryPlanDocuments/02-pc100-s32-r…

Fletchers cannot borrow the money to get projects moving. I am aware of a project currently on ice because of their weak balance sheet.

I'd like to see proof of that please. Can you also check out the other developers, Matvin and Neil.

Matvin intend building the retirement village, 422 apartments.

https://www.nzherald.co.nz/business/botanic-riverhead-422-unit-project-…

Why is that guy paddling a kayak down the middle of the road?

Fletchers would never admit that. A close friend who works for a company that was about to carry out work for Fletchers has kept me informed. Anyone can see they are fiscally weak and work out that Banks are wary. We are talking billions of debt here. Like Ryman. Like many home owners. Borrowed too much when rates were low.

Many retirement villages are on hold, this one will be the same.

So you can't provide proof that Fletchers are on the ropes financially, and your post is all BS...right?

Have you had a look at their balance sheet?

I didn’t say they were on the ropes financially. Just that they currently cannot borrow large amounts of money like they used to as they have debt servicing issues. Mistakes were made. The CEO and some of the directors have walked the plank. Banks are wary. Ask any commercial landlord or valuer.Last week I bought some shares in Fletchers. And in Kathmandu and Sky City. It’s interesting to see who are currently buying shares in them including the Super Fund.

I can see you're not an accountant...give it up. People like you never succeed because you're too timid.

You are right I am not an accountant but I can read a balance sheet.

Fletchers EBIT last year was $800 million. And $756m the year before. Fail.......!!!!

Fletchers themselves have just predicted FY24 ebit around $500m. Hence their current predicament. Debt around $2b. That takes some servicing. Ask Ryman. Their share price reflects poor governance and poor management. They are looking for new directors and a CEO. And in order to shore up their balance sheet they have not paid dividends since late last year. They cannot pay out dividends to shareholders as that money is needed to run the business itself.

Everyone here can quite clearly see you're no bean counter. Maybe that's why you're an 'ex-agent'.

Where am I wrong? That’s a huge drop in EBIT. Hence the share price plunge. I do not have to be an accountant to see the situation FB are currently in. I was never an agent either.

When the data presented can't be disputed they resort to mud-slinging and slander.

Fools lack the ability to realise they're the fool in real-time.

Of course EBIT by definition excludes interest payments so is not impacted by the cost of servicing debt. Looks like Moody's downgraded them in June.

.

The Fletchers/Neil/Matvin development hasn't been approved

Don't you mean the development was declined by Auckland Councillors? Sure they may appeal, but what will have changed if they resubmit?

Maybe Riverhead's done and areas such as this 85ha "development" need to be left as low density impervious surface coverage for the region. It is effectively a drain pipe for Coatesville's runoff.

Unfortunately I'm unable to predict the future, but I like to try.

When I built my house on the waterfront at West Harbour before anything was there, there were lots of sceptics like you. One of them sidled up to me as I was building and said..."nothing will ever happen out here".

I love that story.

So you moved from Developer to Drainage Business? Winger.

There is aways work to be done in the drainage Plains. Stilts and Herons love them and work hard in them:)

So you subdivided old man Luckens farm.....

I didn't, but I did know a guy who was sub-dividing land there. I purchased 3 sections from him, and one privately a few years later

Go for a drive up SH16...that's a laugh,Mon-Fri Sh16 from before Kumeu all the way into the city is grid locked until around 10.00am and is the same in the other direction from 3.00pm onwards.

Just like the rest of the city.

And it's going to get worse when they widen SH16 from Westgate to Kumeu and re-arrange the roundabout at the corner of SH16 and the Riverhead-Coatesville Highway. There's huge developments on the drawing board out there.

When McDonalds opens, you know that things are about to happen.

Have you got a Garmin GPS Wingman, a cool feature is you hold the signal strength area top left for 5 seconds and then it jumps into the satellites and you wait for a minute or two and you get the elevation of your building spot to within 3 meters. My place is 127 meters above sea level, nice and elevated with controllable runoff.

No I don't have a Garmin, but I do know that if my new house in Riverhead goes underwater, the whole of Auckland will be awash. Because it's elevated about 30 or 40m above Riverhead township and very close to Coatesville, where properties change hands for mega moolah.

It's got great North facing views btw, I can't wait to get there. I was carefully observing this property before I purchased it, a habit of mine. During the storm in late January 2023, I drove over to witness it first hand. The very picturesque stream nearby did rise a tad, but there was no flooding.

Looking at a topographical map, the contours indicate my property is about 40m above sea level.

That should set your mind at ease and ensure you don't lose any sleep.

The odds of making money on property are surprisingly good, esp. if you buy in a downturn. And that won't include any rent.

Since 1992, house prices have gone up 6.4% on average, but short term it's less certain.

https://www.oneroof.co.nz/news/revealed-the-surprising-odds-of-homeowne…

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.