The amount of housing stock for sale is at a 10 year high and average asking prices are tumbling, according to the latest data from property sales and rental website Realestate.co.nz.

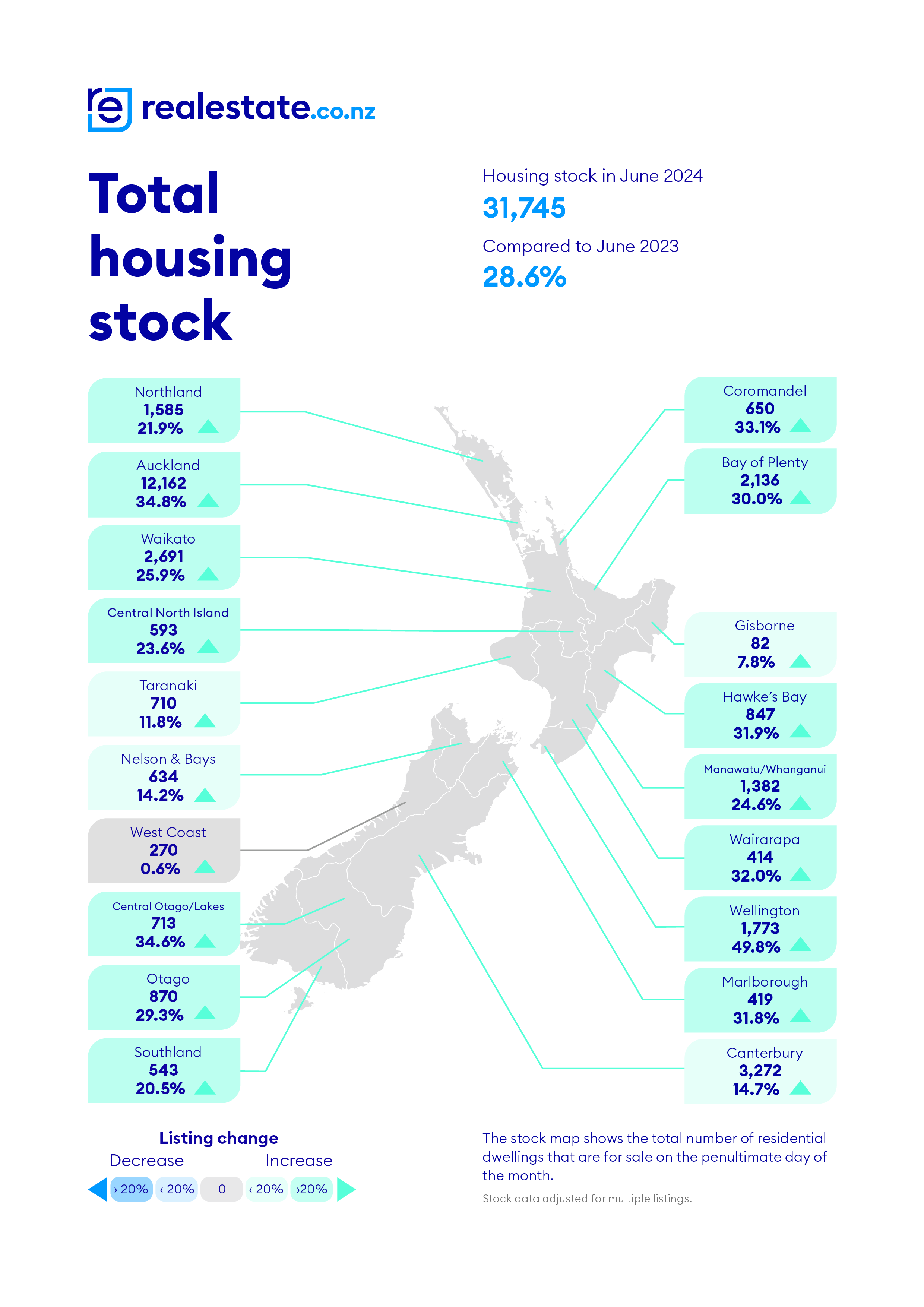

The website had 31,745 residential properties available for sale at the end of June. That's up 28.6% compared to June last year, and the highest level of stock for sale on the website for the month of June since 2014.

Around the regions, the biggest increase in stock for sale was in the Wellington region where the number of properties for sale was up a whopping 49.8%. Next was Auckland +34.8%, Central Otago/Lakes +34.6%, and Coromandel +33.1%.

Eight regions had annual stock increases above 30% and none had less stock for sale compared to a year ago. See the chart below for the full regional stock details.

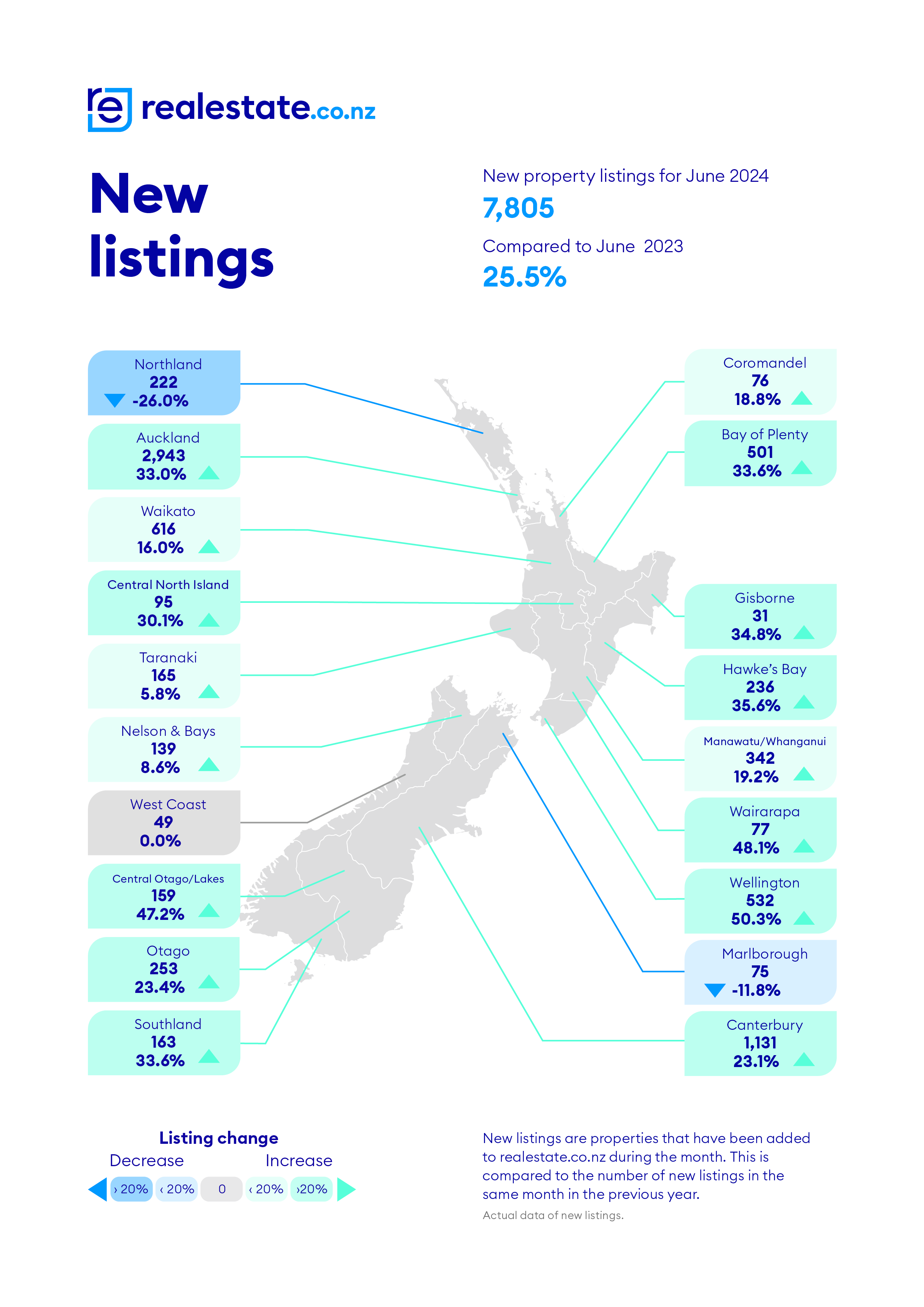

New listings remained strong in June at 7805, up 25.5% nationally compared to June last year, with all regions except Northland, Marlborough and West Coast posting increases.

New listings were up more than 30% compared to a year ago in Auckland, Bay of Plenty, Gisborne, Hawke's Bay, Central North Island, Wairarapa, Wellington Region, Central Otago/Lakes and Southland. See the second chart below for the full regional figures.

The above figures suggest the market remains firmly in buyers' favour, which is also being reflected in average asking prices on the website which have been tumbling since March.

The national average asking price, non-seasonally adjusted, for properties advertised on Realestate.co.nz has declined for the last four consecutive months and was $837,241 in June. That's down $90,071 since February.

In Auckland, the country's largest housing market by far, the average asking price has also declined for four consecutive months to $1,012,050 in June, down $107,735 since February.

The average asking price in Auckland is now perilously close to dipping under $1 million.

Even in Central Otago/Lakes, which is the country's most expensive region and arguably its most buoyant, the average asking price has declined for three consecutive months, and at $1,392,221 in June was down by $192,790 compared to February.

However the slide in asking prices does have a silver lining.

It suggests vendors are now being more realistic in their pricing expectations and are reducing their asking prices to meet the market, which of course will be a welcome development for buyers and encourage them to bargain hard when negotiating a price.

•You can have articles like this delivered directly to your inbox via our free Property Newsletter. We send it out 3-5 times a week with all of our property-related news, including auction results, interest rate movements and market commentary and analysis. To start receiving them, register here (it's free) and when approved you can select any of our free email newsletters.

193 Comments

But but the vested said it was not true....

everything selling around riverhead over cv.... /sarc

In Auckland, the country's largest housing market by far, the average asking price has also declined for four consecutive months to $1,012,050 in June, down $107,735 since February.

we will see -10% Dec 23 to Dec 24

TAs survey says 1% of buyers are still showing signs of FOMO. So things must be looking up for prices.

Food for thought:

1) Conventional economics says as prices fall, demand increases. Interesting how falling prices don't increase demand for houses in reality.

A net 2% of agents say they are seeing fewer first-home buyers looking to make a purchase and a net 21% are seeing fewer investors. Buyers are becoming more scarce.

Again, a clear explanation for the easing in demand can be found in new worries about employment with 57% of agents citing job worries as occupying buyers’ minds. Worries about interest rates however continue to creep lower. Forty-two per cent of agents say buyers are worried about borrowing costs which is well down from the 91% peak in October 2022 but still obviously something people have concerns about.

A record low 1% of agents said that buyers are displaying FOMO – fear of missing out. That is as good as saying no buyer feels that they need to be in a hurry to make a purchase. There is an important message in that for sellers. Hard bargaining on your part and refusal to accept buyer conditions will likely yield no sale and one’s property staying on the market and becoming “stale”.

https://www.oneroof.co.nz/news/tony-alexander-odds-of-pre-christmas-rat…

2) Also conventional thinking in economics is that supply should be decreasing when prices fall. Yet there is an increase in the listings for sale

The amount of housing stock for sale is at a 10 year high and average asking prices are tumbling, according to the latest data from property sales and rental website Realestate.co.nz.

1) Conventional economics says as prices fall, demand increases. Interesting how falling prices don't increase demand for houses in reality.

Well, if the price is the cost of servicing a mortgage...

he says the opposite actually in his latest article, he says buyers should negotiate and if sellers wont meet the buyers conditions then the property likely wont sell.

Isn't that just common sense for any transaction for any item.

TAs survey says 1% of buyers are still showing signs of FOMO. So things must be looking up for prices.

I don't get how that would imply " so things must be looking up for the prices"

he says the opposite, sellers will have to come down to meet the buyer.

Sorry was just some sarcasm.

I suspect at its peak we had 90%+ fomo numbers.

Compare with 1% probably says all we need to know about our housing marker.

interesting how quickly that flipped right.

Now people only have foe - fear of economy.

RookieInvestor: "... he [Tony Alexander] says buyers should negotiate and if sellers wont meet the buyers conditions then the property likely wont sell."

OldSkoolEconomics: "Isn't that just common sense for any transaction for any item."

No, OldSkoolEconomics, that's incorrect.

For homogenous items of higher value (e.g. cars) it holds true to some degree.

But unique items of higher value (e.g. houses) it takes just one buyer to fall in love and the price difference to what the majority of other potential buyers would pay can be dramatic. Even in areas where all houses and sections are alike (1950s government suburbs) spending a few 000's on a patio to separate a property from the surrounding ones pays off.

Golly. 13 thumbs up for that bit of folksy wisdom? Sheesh.

🎣

I see less of denial and more of cherry picking and plenty of speculation

Especially I'm seeing a new trend of speculative articles going "house prices will take off once interest rates start to fall. Which may be sooner than predicted, btw"

The last time I've seen such a concentrated effort in the media was about a year ago. That time it was "green shoots spotted for spring, after election. The bottom of the market is here"

It's leaking into the more independent outlets, the likes of RNZ as well. Not talking about NZME, it's obvious how those guys make their money

Good luck to them... people are worried for jobs, have limited access to capital and just watched prices fall $100k+.

In the background the likelihood of black swan events is rising..

The UK, US and Aus are all either keeping rates level or raising.

We have elections coming fast in several key western nations that are tipped to see unknowns or risky parties voted in.

Wars and military spending are on the increase.

Investment in AI is through the roof

100 year climate events are now 1 year events.

I wouldn't be buying anytime soon

Does anyone know who is actually running the USA and all its wars (trade ones and hot ones) at the moment? Because it sure isn't Mr Biden.

The eunuchs have taken over the palace.

Don't worry, once Trump is in no-one will be able to tell who is eunuch or not as everyone will be wearing diapers to fit in with the Big Man.

Weird thing to say given that it is Biden that looks like he needs 24 hour nursing.

Perhaps, but it is Trump who is known to wear diapers. You can even buy 'Real men wear diapers' t-shirts to show your support.

Just more pro-Democrat fake news I'd say.

The war in the middle east is essentially being run from Israel, with AIPAC pulling the necessary levers of the machinery (i.e. the politicians) in the US.

With regard to the Ukraine, this is the more typical domestic neocon influence at work.

The current administration itself is just trying to mount an aging dude (i.e. wannabe cowboy) on a horse named 'Campaign' that already bolted.

The voters are busy arguing over whose interests are currently being - or going to be - served, without realising that this part is just incidental.

"Especially I'm seeing a new trend of speculative articles going "house prices will take off once interest rates start to fall. Which may be sooner than predicted, btw"

The last time I've seen such a concentrated effort in the media was about a year ago. That time it was "green shoots spotted for spring, after election. The bottom of the market is here"

It's leaking into the more independent outlets, the likes of RNZ as well. Not talking about NZME, it's obvious how those guys make their money"

Attempts by those with their vested financial self interests to change house price expectations, create a fear of missing out and improve confidence to persuade potential buyers to transact.

The property promoters are marketing that property prices are going to rise as they're in need of revenues for their business and personal incomes.

But.. but... vested interest still think prices are going up

These headlines are getting more triggering by the day!

Northland bucking the trend. Have noticed a large decrease in last couple of months of properties for sale and increase in amount shown as "sold"

He said it showed that Northland agents were particularly struggling. Over the six months to March, they listed 2128 properties for sale but delisted about 969.

https://www.1news.co.nz/2024/07/03/auckland-house-sellers-giving-up-rat…

Attention bargain hunters - it's lowball time! Indications are prices are indeed falling big time. Northland will not be spared.

Same same in Hamilton's northern suburbs, at least 30% delisted. Is that a healthy market?

Delisted through shear frustration at the absence of fools. If seriously for sale - vendors need to ditch the denial, meet the market for what it's really worth and create some decent sales volumes. Perhaps a genuine and sustainable floor can then be called.

"Delisted through shear frustration at the absence of fools. If seriously for sale - vendors need to ditch the denial, meet the market for what it's really worth and create some decent sales volumes"

There are time constrained sellers and non time constrained sellers.

Non time constrained sellers can withdraw and wait for higher prices. Here is one such example.

He and wife Sarah had dropped the price to as low as they were prepared to go and had a huge amount of publicity. “We weren’t prepared to drop it any further. We had done open homes most Sundays for about five months,” he said.

Unfortunately, the Nashs were unable to sell their home before settling on the courthouse so are now planning to rent the house out.

https://www.oneroof.co.nz/news/ex-cabinet-minister-pulls-house-from-sal…

Those under a time constraint will need to meet the market as they are unable to wait. Here is one such example.

https://www.trademe.co.nz/a/property/residential/sale/auckland/papakura…

On Notice From Third Tier Lender

The vendors need to sell quickly,

Desperate Sellers Needing to Sell

The flipside of that is that people who are willing to meet the market now may end up better off than those hold-outs who sell into capitulation a few years from now.

A bit like the place near us. Turfed the good tenants (young hard working family that had recently migrated here, kids at the school a couple of houses down) to put the property on the market. 3 months later, off the market, back to renting it out.

"Turfed the good tenants (young hard working family that had recently migrated here, kids at the school a couple of houses down) to put the property on the market."

Unfortunate for tenant.

Easier to renovate and sell a vacant property with open home timing and state of presentation to potential buyers at open home. Shorter settlement time also for a vacant property.

Some of the same economic commentators that played down the risk of inflation and interest rate rises in early 2021 are also some of the same people that told everyone in late 2023 that the bottom of the property market was coming.

Probably some cross over with the "you can't time the market" crowd all of a sudden becoming the "bottom is in" crowd.

To be fair, the bottom of the market is still coming.

Spruikers, last August, the light you saw at the end of the tunnel was just another train.

I actually laughed. Thanks.

To be fair we need the bottom of the market to be as far away as possible to restore affordability and reduce societal harm.

The Auckland market has a large number of new homes, where developers will only advertise 1 townhouse in a group of (say) 10,. There is 3,500 new homes on trademe - so the actual number of available homes is larger than the numbers listed

Yeah, all the sardine stuff people don't want. Auckland is quickly becoming unlivable. Regularly 2hour drive bombay to greenlane, trains regularly out of action, crazy town.

At the moment but when rail maintenance is done and CRL it will suddenly feel a lot better. You could easily see a situation where standalone houses fair better then townhouses, mainly land, but also preference for a decent backyard.

Let me push back on this. The demographic that prefers and can afford this (Caucasian) is a dwindling proportion of Auckland's population, and in younger cohorts, moving overseas.

Backyards are culturally part of the kiwi psyche, but increasingly limited to Boomers. Young couples and families now just don't have time or inclination to maintain a large section.

I know ragging on townhouses is popular here, but they're here to stay as part of the housing typology.

Yes and obviously much more affordable, and therefore attainable. Not that they are affordable of course. But relative to a detached house on a full section they are

Young families would like a back yard space to play with their kids, have a bbq and kick a ball around in, thanks.

Prob will always now be that a larger section is unlikely to be affordable (in reach of the work..) except for the high income earners.

Population growth, lack of funds for infrastructure maintenance and growth and climate chane means the cheaper housing is going to be intensified in certain locations and will lack land.

The good old days where every family had a 3 bedder on a full section are long gone.

Nope, not in Auckland.

They will happily trade off a backyard for proximity to work/school/amenities and be able to spend more time with their kids and less time in traffic. They are happy to use the local park/football club to kick a ball around.

The reason why some townhouses are not selling selling to young families is because they are still to expensive, and/or haven't been built close to amenities, and/or are miles away from work/schools/city centre/rapid public transport.

Affordable ones that are big enough and close to amenities and close to city centre/rapid public transport are being snapped up by young families.

They will happily trade off a backyard for proximity to work/school/amenities

I mean this is part of the boiling frog analogy where you simply have to accept a worse and worse deal because there isn't much choice otherwise. After all when you're saying "proximity" in this context you're still talking a minimum twenty to thirty minute drive, particularly if some of your kids have to go to primary school in one direction and high school in another direction.

It's not a worse and worse deal. You get all the amenities and opportunities that a city can offer vs living in the wop wops. If people really valued big sections with an backyard we would be seeing a flight from cities to rural nowheres. Location, location, location.

Except people are buying some leaky townhouse in hobsonville and still having to drive an hour to get into work..

I was not hating on townhouses, just saying if full site houses fall in value it implies townhouses have to fall in value, as many (read most) would rather have the space for the same money, now you are free to disagree, I do not care.

Now that we've got density uplift, full sites are dropping in value because it's less profitable/unprofitable to develop them with townhouses.

For a couple of years, the marginal buyer of residential single home sites were developers who would pay overs for single house sites knowing they'd get a good margin on the townhouse sales.

So the driving factors all overlap.

"For a couple of years, the marginal buyer of residential single home sites were developers who would pay overs for single house sites knowing they'd get a good margin on the townhouse sales."

That is certainly the belief by the profit motivated developers. However not everything goes to plan as market conditions and expected costs and selling prices can change from original calculations. When a business model relies on cheap debt, some projects become uneconomic in the face of rising inflation and rising interest rates.

Some of these small developer buyers at the peak have been making large losses. Here is one example.

Rawson said he had already taken a massive hit on the project. The total cost was $2.35m, which includes the cost of buying the property, subdividing, renovating both houses, putting in new driveways, connecting services, and upgrading the stormwater and sewer. He estimated he would be lucky to get $1.44m back.

“We are taking a $500,000-plus hit. It’s a big loss.”

The house had been sitting empty for seven months while the various consents and sign-offs were completed and they didn’t want to pay any more in holding costs, he said, which was one of the reasons the marketing campaign was only two weeks.

https://www.oneroof.co.nz/news/real-estate-bosss-1-reserve-gamble-as-de…

"For a couple of years, the marginal buyer of residential single home sites were developers who would pay overs for single house sites knowing they'd get a good margin on the townhouse sales."

A property promoter / property investor / property wholesaler mentioned recently that previously land prices in the Wellington area were 700 - 800 per sq mt of land, then property developers were paying up to 2,000 per sq m at the peak. Now development sites are being offered to him with land prices in the 800 -900 per sq mt.

Yet the commonly held belief is that land prices don't fall due to scarcity factors (i.e the "they're not making any more land, land prices rise with inflation" case).

The reason the developers did what they did was because for their cohort group, there was a scarcity of that type of property, and as you say, they thought it was just a cost plus that the townhouse purchasers would pay. So it's more an overbid up, but there is a scarcity so they are falling as now it is the relative scarcity of that type of buyers.

In jurisdictions that have fewer land use restrictions, there is very little difference in the input price of the land irrespective of whether it has one house or more.

So if it is $800 m2 with one house, then it is still $800 m2 even if can take more than one house.

"as now it is the relative scarcity of that type of buyers."

Yes, less buying competition by developers.

For a property with a large subdividable section, developers can always pay more and outbid an owner occupier buyer, and a property investor in the long term rental market.

Millennials still favour them as it is what they grew up with

Auckland has the fourth largest foreign-born population in the world - 40% at last census.

You can't extrapolate cultural trends from the past - Auckland is no longer a New Zealand city in the traditional sense.

The popularity of Stonefields as a suburb is case in point.

When townhouse owners enjoy the benefit of noisy neighbours who park their cars inconsideratley the lack of storage space and a yard for kids to play in, the quarter acre section with 3-4 Bed house will become attractive and sought after.

''increasingly limited to boomers. Young couples and families now just don't have the time''

Ah yes the great intergenerational wealth transfer?

I guess my boomer parents do have a 600m2 house and space for chickens, so regularly give us eggs etc.

Them some expensive eggs.

Auckland is quickly becoming unlivable

https://www.eiu.com/n/contact-us/ someone should let the poor buggers know - they still have it totally wrong, they reckon we're still top 10 https://www.eiu.com/n/vienna-secures-its-position-as-the-worlds-most-li…

These rankings are completely meaningless.

40 percent of Kiwis leaving high school are deemed functionally illiterate by several studies and this index gives Auckland a 100% score on education.

Also, how can Auckland have similar scores on infrastructure as Vienna, Zurich and Osaka?

Aren’t these usually done to inform corporate decisions around expat staff, or something like that?

Auckland would be wonderful if you were earning big international money, lived centrally etc etc

But for the everyday struggler?

Yes, it is meaningless as it does not survey the people who live in the city full-time.

It is just used to work out total remuneration packages for corporate incomings.

So if you are coming from London, they will give you a larger travel and relocation allowance, than if you had been relocated to Bogata, Columbia.

And the Bogata remuneration package would include more personal security allowance than you would need living in Ackland, although that difference between the two will be shrinking.

All this adds up to a total worldwide ranking for corporate high fliers.

Wait you believe the paid for popularity contests that are more fabricated then my partners favourite corset.

And some of them are listed for rent in order to get some cashflow at the expense of wear and tear on those units. And which in some cases may reduce the desirability of living in that development for owner occupiers.

maybe but will allow them to negotiate even more to get a better price.

What is interesting is that the prices are still too high to provide an appropriate return on the investment. My rule of thumb a house is worth 1,000 times the weekly rental (equates with 5% gross return). This is the pattern elsewhere, but not Auckland.

Which is still way over the old Olly Newland ratio of 700. He believed in actually covering all the outgoings as well as making an economic return.

There isn't much to say other than 'we need this correction' and not just a shallow one. For the first time in living memory, we actually have the political class being brave enough to verbalise what needs to happen. And if it does, then kudos, Chris Bishop, and you will have served your country well.

Yep. It it's not wiping it's nose and making a return to boot then it's either speculation, tax avoidance, laundering or a combo of all there.

Yep Housing Crash Chris (HCC) is hitching his wagon to the already confirmed property crash and wants to ride this jolly event into the lows sometime in 2027 / 2028.

Suggest the emerging swamplands of Kumeu and Riverhead can be renamed, as to what they formerly were known as: RiverKumSwampville?

Has ring to it?

Sounds like the location for the adult film industry to set up shop 😂

Added to my lexicon of thumb rules. Thanks!

You need to stop using that rule of thumb and look at ROI.

What is a 5% Gross yield and Capital growth negative at the moment, and when it does bottom out could then only increase at the rate of inflation, ie no further speculative gains?

The key going forward will be to find properties you can add real value-added amenity value to.

Anyone who doesn't rent their property out for fear of "wear and tear" is a fool. Everything is in a state of decay. Leaving it sitting there rotting, not getting rent is hardly different from having someone living in it most of the time.

They're not a fool, they rarely exist. They're just narcissists who fabricate these claims to bolster their image and project a sense of superiority or success; to fill their deep need for admiration and validation; and to present themselves as wealthy/unconcerned with financial matters.

Guaranteed those who go around claiming or threatening to leave their properties empty due to "scumbag tenants", probably have a) very good tenants and b) a huge amount of debt preventing them from even considering the idea.

Williams Corp in Christchurch have turned all of their unsold townhouses into AirBnB. Apparently Council AirBnB restrictions dont apply to the likes of WC, just like planning rules dont apply to the likes of WC. Like I'm 100% sure I wouldnt be allowed to build 8 townhouses on my single section in the suburbs and rent them all out on AirBnB.

So typical, it's not what you know, it's who you know.

Speaking of developers, has anyone heard what is going on with the Stonewood Key JV?

I see that the Stonewood Key website is offline and now redirects to Stonewood Developments.

Who Airbnb's in Christchurch in July 🤔

I already concluded that Auckland was borderline unlivable in the early 2000's...thing is though that people just acclimatize over time. First a 30 min drive to work is acceptable. Then 45 mins. Then an hour. Then an hour fifteen.

yep - boiling the frog

Historically 30 minutes from centre is the standard. This is reflected in the historical size of towns and cities when walking, cycling, rail, and motorcars became available. Once beyond 30 minutes, the situation becomes very undesirable.

"The Auckland market has a large number of new homes, where developers will only advertise 1 townhouse in a group of (say) 10,. There is 3,500 new homes on trademe - so the actual number of available homes is larger than the numbers listed"

In a buyer's market, developers selling don't want to flood the market, so they restrict supply of listings for sale to a single unit at a time as long as they're in a position to do so.

If the developer is in cashflow difficulties, then that is a different set of circumstances.

my remark was more about the quantum of homes available for sale - and that is probably under estimated by the realestate website. Why would you pay for the listing costs and successful?

Yesterday a valuer told me there were 20-30 lifestyle properties for sale in just one area east of the city I live in. All $1.2 to $1.8m. Not selling of course. Increased repayments to the bank the main factor for going on the market and for not selling.

you near hamilton?

not sure if he is, but I am. Also on lookout for lifestyle. Looking in covid times there was damn all and silly prices being paid for some pretty undesirable stuff. I suspect it was rural novice buyers.

One I checked out last year sold, but back on market within months and re- sold with another $100k +off. First buyer dodged a bullet at a price, second buyer will be feeling sick by now.

Each rural buyer will have different requirements, i.e. Horsey set vs just a few sheep etc. you really need to know your market, understand flood planes, understand fencing and water requirements etc. Also understand your own ability to take the place forward. Yard jobs get big on 3-4H. ie do you own a chain saw, can you use it.

You need to go into things with eyes wide open.

This highlights the trouble with the "lifestyle block" classification. Anything from 0.4Ha up is being called lifestyle, and I've seen even smaller from time to time as well. 20Ha+ is also being classified as lifestyle sometimes, but a 20Ha orchard/vineyard is a significant enterprise. It comes down to contour, soils, and the buyer's abilities and finances.

I'm of the opinion that if the land won't earn you income, and/or reduce your outgoings by enabling a level of self-sustenance, then it's just buying you a larger garden to maintain. I'm surrounded by examples - I have five neighbours spread around my boundary, of which two are working the land and running viable enterprises, two are happy with stock grazing their small paddocks, and one spends most of his spare time mowing lawns, fretting over weeds, and complaining that rural stuff is happening around him.

Yes There’s a reason that many call those blocks a ‘life sentence’.

Or "No style, no life"

Its "just an Itsy bitsy gully right? " "oh Yeah, they are motivated vendors alright"

be careful what you quote for. we don't want GFC again.

US instigated trade war then possibly actual hot war with China. Gonna be bigger than the GFC.

Buying a lifestyle property prob all seems a rosy idea in a boom(unless your mortgage free and seriously cashed up) when employers will let people cruise and wfh... and the house price is always rising.

In the bust it's gonna be a big problematic anchor.

Can make sense. Family member, FHB, purchased one with a second home. That brings in good rent. He's self employed and needs space and buildings, so some very nice tax advantages to go with it.

Except housing is always long term and if you are living in it then it is still better then renting. If you brought a 600k property 6 years ago and it went up to 1mil but then has dropped 100k in "market" value down to 900k and is less then CV what have you actually lost?

One good thing about the drop in house prices is its increases the supply of houses which is finally stabilising/slowly dropping rent inflation (FINALLY).

As Net Migration rapidly falls back as well (more favourable terms for landlords), slight easing in interest rates (SLIGHT) this should have some significant downside on rental prices.

The govt is also talking about dropping the accom supplement somehow.. which will help with downward pressure on rental prices... in a market with too many houses (what we have now) is a great time to reprioritise tax spending on infrastructure over supporting rental and house prices (both of which which chris B wants to lower).

All good stuff for the country and long term productive economy and standrd of living... except for the DGMs (DGMs being rhe REAs and greedy landlords who favor the sort of rich poor divide thats getting trump and right wing elected overseas, increaing crime and getting our kids to leave).

Govt running two systems which is bonkers, accom supp and income tested rents. Needs to move to one.

It's a good idea. The merger could look at ways to reduce costs at the same time.

I like how nats are sorting taxes and cutting house prices and rents based on logic. I see they also stopped the immigration visas for relatives.... more pressure of infrastructure and people's incomes.

Just need to see a sensible CGT policy and we will start to see common sense prevail and they will storm the next election

Not fan of cap gain. Many reasons, but one s the motivator of govt/CBs to create inflation - which is a tax.

Prefer a land tax built into rating system - provided the actual tax take does not rise overall, just the net widened.

A LT does not rely on inflation and is a reliable and consistent tax. CG to unpredictable, avoidable and provides no tax when markets are flat..

Agreed. otherwise what is the incentive to take risk of employing people and paying tax if it just leads to higher direct tax. Land tax is about redirecting capital away from shelter, and into productive activity.

The uk, au, USA all have CGT.

They all have way more successful economies than us and less housing bubbles. No point reinventing the wheel here. Just get it done.

A rather silly comment.

Nothing to aspire to with regards the housing markets or tax systems in any of those countries.

NZ has the best GST system in the world - and we did 'reinvent the wheel to get it done' to get it.

We have a huge house price bubble, serious issues with inequality in a large part due to house prices and a real lack of productive business which is crippling our economy. Not to mention our smart kids are leaving for au in droves as a result of our policies.

Gst aside. Not sure how we can say our tax situ is in any way helpful or better than anyone else's. Unless we are proud of jow many graduates we lose to the aussies and their crap tax system and rubbish quality of life

So crap that most kiwis who head over there don't come back for a decade or three.

Exactly my pint

The uk, au, USA all have CGT.

They all have way more successful economies than us and less housing bubbles. No point reinventing the wheel here. Just get it done.

they are also not a tiny island in the middle of nowhere...

Not sure that excuse still holds in a world where so much of the economy can be digital and done remotely. Our proximity these days is far less important

Nz has many attributes that would attract top young talent.

Just another excuse to try to rebuild our ponzi house price scheme

CGT is nice and can be applied to a range of assets including houses quite easily.

Still makes it hard for the country to be competitive in exports.

why would you start an international manufacturing company in NZ when you can do so cheaper in, UK, Aus and US?

Proximity is import for exports, exports increase GDP, increasing GDP pays people more.

Money attracts talent.

Unless NZ somehow becomes a tech hub for the world? i imagine there is a lot of competition there internationally.

My issue with CG is that it discourages people from going where the work is (cost of moving is heavy). Much prefer to see LVT.

There was a step change as labour upped accom supplement a couple years ago which only saw a minor reaction with market rents. Suggesting that value mostly flows to tenants:

"In April 2018, the Accommodation Supplement increased as part of the Government’s Families Package. Maximum rates were increased everywhere, and more places qualified as areas with higher maximum rates. Before 2018, rates were last adjusted in 2005"

"Results suggest that, on average, around 90% of the increase in assistance stayed with Accommodation Supplement recipients as extra after-rent income. This broad finding holds for Māori and Pacific Accommodation Supplement recipients. Long-term trends for the country show no noticeable change in overall average rents around the 2018 changes, or around the previous 2005 adjustment. Accommodation Supplement increases do not appear to be an important driver of the growth in accommodation costs that is occurring."

https://www.msd.govt.nz/documents/about-msd-and-our-work/publications-r…

Housing is a form of infrastructure. Remove it and we will end up in nearly the same position as today, with a less equal burden. Middle class will get an extra bedroom and the lower will 5 families to a house instead of 2. And there will be less spending on the rental market lowering construction.

I'm one of the largest proponents of lower house prices and rents, it's not the only measure. It would be helpful if people read the studies on what they want to kill.

after two years around 90% of the extra increase in assistance was kept by Accommodation Supplement recipients as an extra increase in after-rent income.

Think about that for a moment.

All that will happen goes like this.

1. Chris Bishop announces house prices need to drop 16%

2. people want to sell to get out, thinking there will be a crash so prices start lowering faster

3. houses become a good investment again

4. people start buying again and prices come back to where they are in a years time.

Its fear mongering, how are they actually going to achieve this? slowly lowering DTI's over time?

This is a one of the worst posts I've ever read on here. Your name is suitable. Are you telling me a further drop of 16%, on top of an already 20%, will have no consequences to the banking sector or to the psychology of people that have recently bought. Investors will simply just swoop back in?

Cashed up buyers may be sitting waiting for this? Those looking to use minimal equity and leverage to bolster their portfolios would likely be out of luck in this scenario.

exactly, cashed up buyers are waiting for this, i know a few people that are.

literally had a conversation with a colleague yesterday, they're waiting to buy, wants a place for 600K but can only afford 570K, another 5% drop and he will be on it.

But you say it as though they'll just buy every property on the market. 'Cashed up investors' with enough capital to make an impact is next to zero.

This is simply just market behaviour reacting to supply and demand driven by interest rates and disposable income to service mortgages.

You can see how this process happens in fast forward on the share trading forums. A stock starts to fall, and all the talk is 'great, I can buy it cheaper', 'I can't wait until it's X dollars, what a steal'.

Then the price actually falls to those levels and the mood has soured. Suddenly the forum mood switches to what a dog the stock is, how useless the company/management are, and how they aren't investable at any price. Those who have been buying on the way down have spent up and are overallocated, often they succumb to the mood and cut their losses.

Even in the faster moving world of stocks, it can take years for sentiment to return.

TDLR: everyone knows the theory of buying low and selling high but the reality is always harder than they expect.

@tom Jones.

nope i'm saying prices wont drop 16% and scare mongering will drop prices slightly and the bargain hunters will jump in.

What do you think will happen?

But they are not bargains at these levels, in fact most are not even investments as they are not cash flow positive....

Work out at what price things turn cash flow positive for most average AKL rentals, you need another 2% yield to cover maintenance. unless its brick and tile.

Take a lesson from people who have owned many many houses Rookie, these are not good buying levels here.

If you know people who want to buy non cash flow properties, no need to get out more and meet people who understand cashflow.

they are trying to buy Homes for their families, not investors.

Auckland prices are ridiculous.

Isn't that what I'm doing?

while interest rates are this high they are not cash flow positive, when interest rates lower they might be?

As soon as they become cash flow positive, investor come back in and make it harder for FHB to get in?

Recommend you look at this and look into why. Please note the average interest rate over this period, and the artificial cost of debt suppression since the GFC circa 2008. Also note the spikes in the 80s resulting from poor financial policy in the 70s, very similar to what we have just been through.

Don't bet the farm on rates plummeting again.

Do interest not become lower over time as incomes to prices ratios increase?

Obviously there is fluctuation, but in general

Interest rates have trended lower for a few decades now. This is not a force of nature and clearly can't last forever unless we start going negative pretty quickly.

This trend coincides with the creation of the 'house prices double every X year' rules of thumb. This was not the case before the cyclical fall in interest rates.

The cost of debt has nothing to do with setting the DTi ratio. Its is a tool to allow the Reserve bank to slow or stop speculative debt rushing into and over fueling another housing boom. Its becomes how much you can rent it for, not how much you can leverage. The remainder of the money is tax paid equity.

they are trying to buy Homes for their families, not investors.

Auckland prices are ridiculous. Isn't that what I'm doing?

While interest rates are this high they are not cash flow positive, when interest rates lower they might be?

Huh? These cashed up investors are buying for their families so what does cash flow positive have to do with it?

OK Rookie, I'll take the bait. I personally think Chris Bishop is posturing, as he has read the room. It's a popularity play as he can become the voice of the frustrated FHB. Is he motivated to drop house prices, of course not! What we'll see soon is the introduction of the 40 year mortgage. (Guess who wins in this situation? Clue.. the banks!)... we'll likely start seeing more capital inflow from wealthy nations once the coalition can get that sticky foreign buyers ban removed. I personally hate it, but selling overpriced beer crates to one another and filling them up uber driving immigrants is what we do. When it's the only show in town, are they going to just let it sink? Not a chance

The only way they can gas it is to try and force the RBNZ to drop rates, but its becoming clear that Mr Orr does not want another house price explosion on his watch, and I also think the banks are wary of credit exposure now.

House price (and general economic) implosion preferred

TJ, its not unusual...

I don't think Bishop will want to prices to drop either.

but what you are suggesting with the 40 year mortgage will only double down on the situation, not make it any better?

allowing prices to go higher and loans be bigger?

Is there any Hint that they do want a 40 year mortgage?

Is there any suggestion they will re introduce the foreign buyers? (more so than they currently have?)

Are you saying renting overpriced houses to immigrants is the only thing keeping NZ going?

slowly lowering DTI's over time

They only part of your post worth reading. Otherwise why even bother with all the work to bring it in.

It depends, and if you have been listening to Bishop, then he has told you what happens next. Although whether they actually do that or not is a wait-and-see, but they have kept almost to all their election promises so far.

That is they are going to remove supply restrictions from the system so when demand picks up, supply will be able to match it more in developer real time, and thus there will be very little opportunity for speculative rentier gains like we have had in the past.

Listening to all the talk of most commenters who think this is a good idea as they are cashed up and looking to buy at the bottom - they are all doing it on the premise that a speculative status quo recovery is going to happen.

They are not listening, or if they are, they don't think the Govt. will hold true to their policy.

Anyone in this position should be running the counter scenario to see what this does for their figures.

It may not change their minds as investing in NZ property has always been underwritten by previous Govts.

But it had to end, and if you take Bishop at his word, this is it.

makes sense, and that there are a lot of commenters who are cashed up and wanting prices to drop.

RookieInvestor, what you say might happen, could happen, but only if the supply of dwellings was fixed, or seriously constrained.

From 2016 onwards NZ's Councils have been re-zoning large areas for allow for higher densities. The zoning rules used to be a straight jacket on the supply of new dwellings. That's all changed. And the change has been huge. (I've explained this in numerous posts in the past. Search for MDRS and NPS/UD.)

Take care, RookieInvestor. We're not going to be going back to a pre-2016 housing market for 30+ years.

where did you get your crystal ball? Temu?

House owners are still in denial on price because they can be - they aren't marked to market in the same way that other financial instruments are. Same thing is happening in commercial RE - the listed REIT entities have had their values slashed by up to half, but the RE agents for privately offered commercial are still asking pre-crash prices and nothing is moving.

yvil, does this begin to answer your question?

When a run starts the exits get very narrow.

https://www.nzherald.co.nz/nz/auckland-house-sellers-giving-up-rather-t…

Auckland house sellers giving up rather than taking lower prices

..."More than 35% of homes listed for sale in Auckland and Northland are subsequently withdrawn from sale, one economist says. The regions have the highest rates of “delisting” in the country."

Would be very interesting to know how many banks are supporting delisting by offering interest only, or payment holiday periods etc to avoid true price discovery. Eventually mortgagee sales will occur.

A few dozen mortgagee sales are listed on trademe right now. However, banks will hold the hand of anyone who is making a decent effort for as long as they can - it is not in the banks' interest to start a wholesale devaluation of the collateral they hold on their books nor to acknowledge that they have to expand their bad debt provisions.

Soon interest rates will start dropping, TDs will drop and the rental/investment market will look rosier. It is at that time the market will start to return.

But what if that doesn't happen? As it didn't a few decades back when Inflation looked like it was tamed, and US interest rates fell from 12% to 4.5% ( "We've got that Inflation sucker licked!") only to see that drop trigger the real price rises, and so the Prime Lending Rate went back to 21% - and all the associated commercial rates rose well above that.

I know. That's not going to happen this time - things are different. But are they really? If so, why are we here - again?

You are dreaming.

Hopium is a helluva drug..

This is what you get when Nats are elected a dumpster economy

Nats used to be the party for business & investment now they’re a pack of inexperienced ideologues who have no idea

like the alternative produced a goldilocks economy? yea right....

People should've voted wisely and think for the country instead of "what in it for me?"

Remind me who oversaw the massive increase in housing unaffordability over the last six years?

The RBNZ.

No. I didn't vote for them either.

It takes 12 to 18 months for economic policy settings to start having a significant effect on the momentum and direction of the economy. It's called lag time. If you're unhappy with where the economy is today, you better blame your own lot.

Genuine question, how are asking prices determined? It seems to me that in a lot of suburbs at least, most houses asking prices are not disclosed (e.g. tender, auction). So is there a lot of selection bias in this statistic?

Any homeowner can ask any price they want. Whether someone will pay it is another story entirely, and many vendors try tender or price by negotiation just to see what offers come in and gauge if they should put a price, but really theyre hoping someone throws in a large offer and can snap it up.

Sorry, my question wasm't clear. Average asking prices can only be measured from actual vendors who disclose an asking price (and to me that still seems like <50% of houses for sale), notwithstanding that vendors asking prices might be unhinged.

When a vendor lists a property without a price, they still provide the agent with guidance. Even if the vendor has no idea, the agent will assist in providing a 'guidance price'. When the property is entered into any of the numerous web sites that allow price searches, it is this hidden price, or price range, that is used. The public can't see the guidance price. But any member of the public can figure it out with skillful search criteria.

(I designed and wrote the core of a high performance search engine for RE way back and it got copied by many of the other firms. And yeah, I copied from google's approach. Fun project.)

I have been getting impatient for prices to fall further but started to doubt my belief - then I am reminded of the basic maths and the number of investors still convinced that "topping up" by $500/week or more is a sane strategy... and then there are days when I look at the absolute glut of properties on the market and that most of them aren't shifting and then that the auction results are getting worse (better for buyers) and then I think we are actually going to see the biggest housing crash we've ever seen and all the banks and spruikers will be sticking their fingers in the dam but once the wall breaks.. it's going to be absolute carnage.. i don't know what the trigger will be but there is mass delusion out there right now amongst "investors" as well as owners of $3m-$10m properties, all wanting out but not wanting 2021 prices..

I am not going to give it away.......

"I am not going to give it away......."

I know of one property in Auckland (seemingly owned by a non time constrained seller) who has had their property listed for sale for 18 months. They put a fixed price on it in March this year and were as they put in the marketing material "vendor meets the market"

Given that it has been over 3 months since they put the new marketing material and fixed price and the property remains listed for sale - it seems that the vendor is not ready to meet the market.

Housing Market: I am thirsty, really thirsty!

RBNZ: I have exactly a thing for you to drink (grabbing a glass of Koolaid). Here drink this stuff!

Housing Market: Thanks dad, that's really good...!

I'm thinking the prices on Homes.co.nz and trademe for Auckland can't be right and are overstated

Also 1/3 properties removed from the market as didn't sell (or owners didn't really have to sell so weren't prepared to lower price expectations to the market) but I haven't seen any mainstream media pick up that very interesting statistic.

Also are sellers better negotiators than buyers? I'm guessing they are as prices haven't dropped much. Or is it because buyers too scared to offer low prices, or maybe agents are too good at discouraging low offers and we go along with their professional opinion?

i have seen lots of properties selling around my area in the last 2 weeks, i checked what they sold for, around 9% under RV

-25% below RV in around much of the Auckland hood.

The next leg down has just begun......

according to this its 10% under RV in auckland.

Might be area specific?

https://www.oneroof.co.nz/news/why-are-homes-in-wellington-selling-for-22-below-rv-45779

Never ever use RV as a measure of value or the market. It is more irrelevant to both then asking a pigeon to guess the number on a bingo card.

what about selling below asking price?

Correct that 1/3rd where not really on the market as the owners expectations could never be meet, times have moved on.

They where really wasting everyone's time. At least it kept our brightest and best agents busy.

Can someone kindly explain how these Real Estate sites such as Real Estate.co and Trademe are able to say that asking prices have dropped??

With so many Auctions, by negotiation and Deadline sales having no asking price, it is impossible to know what the asking prices are?

How is it actually done?

Agents always put a property in a lower range to attract buyers!

Trademe produces this stat, they simply produce an average of all asking prices if stated.

It is a leading indicator, you rarely get paid more then you ask.

Sure some houses will not be included, but as long as the methodology they use is consistent month to month its telling you that asking prices are falling. Of course people may choose to offer below the 10% fall in ask....

All you spruikers who know people with cash ready to pounce should wake them up..... 10% drop in ask average is quite a bit.

No one is going to ring a bell aye....

IT GUY: "... they simply produce an average of all asking prices if stated."

This is incorrect. See my comment above.

Agents always put a property in a lower range to attract buyers!

If it's always the case, then you have a reliable statistic to benchmark off? Assume a house that would sell for $1.2m last year was put in the $900 - $1m "range" as you put it, if that house is now able to realistically achieve a $900 - $1m price tag, the agent would put it in a lower range wouldn't they? I.e. $750 - $900?

I've never listed via these sites, but I assume an "asking price" value is part of the application form?

There is an "Expected Sale Price" that agents enter when creating the for sale advert, in order to set the search engine parameters. Its not disclosed publicly but its there. A company that tried to make that info available to punters was promptly shut down by Trademe. https://www.stuff.co.nz/business/industries/127775543/trade-me-sends-wa…

It's a bit more complex that a single "Expected Sale Price".

Cash sales, length of settlement, and other terms and conditions, means the more advanced searches work off more than one price.

These more advanced search aren't usually available to the public as it requires the public to enter purchasing details that most won't enter. I'm not sure if they are used by agents in NZ but I know quite a few agents in larger cities use them.

In any market there's always outliers, you just have to find them. And then you make da moolah.

The notion that the real estate market is crashing is BS.

Riverhead median sale price is up 9.8% in the last 12 months, and median rental up 10.7%. If you're smart, you'll soon figure out why that is.

talking to people who have been in housing for longer than i have been alive.

"housing can have big dips and big booms, it can be very erratic, enjoy the ride"

Your a funny guy Winger!

Like the "stumpy" the one legged sailor, touting among the young for "let's go swim with the sharks" business.....

But I'm right though.

That's why I bought a chunk of land in Riverhead a year ago. At a massive discount.

You sound desperate and panicky wingman. I am not surprised. The market has shifted big time down since you bought. You bought at the market price when you bought. A willing buyer and a willing seller. Your purchase price would have been used by valuers since to help them value land in your area. You bought far too early. Using the word massive reminds me of Trump. He uses it a lot. I presume you admire him.

Desperate and panicky?

Hardly, I got a bargain price with a big discount. My building consent was approved yesterday, so I'll be erecting a new residence there as soon as. And since I'm going to spend another $1.5m or thereabouts on my new build, you could hardly say I'm 'panicking'.

I don't admire Trump, but he did take some huge risks and made a lot of money, something that you'll never be guilty of.

No such thing as a massive or colossal discount when the market is dropping in value. You shot your bolt too early as last year you thought it was bottoming. You could not help yourself. If in fact we believe what you say. You are sitting on a sizeable loss land value wise and there is more to come there. If in fact you have bought where you say you are you are surrounded by a lot of listings including proposed mortgagee sales. You should sell it now and cut your loss.

Well since Riverhead has gone up 9.8% in the last 12 months I don't think I'm doing too badly.

The market in Riverhead is going up, not down, and there's a huge amount of public and private works on the drawing board for that area. I paid $340k less than my neighbour and my bit of dirt is superior to his with a northerly aspect.

Everything's selling out in Riverhead, and that's why the price is going up. I've already posted here about the 'golden triangle', but you won't be interested in that because you're not in the habit of taking risks and making money.

I can't wait to get started, this is my 5th new build.

why are you so desperate to make him look bad?

Riverhead is one of the areas showing a positive sale above RV over the last 12 months on OneRoof?

maybe he is right...

what if he is making a killing, good one him.

so what if he doesn't...

Because his story gets more and more unbelievable and if he has bought in Riverhead it's in his interest to try to make it seem like a good deal so he loses less money when he tries to sell. There was another guy on here who talked up the market and how it was always a good time to buy and then he revealed he'd advised his kids to sell because he could see the market was falling.

People who come on here saying they are going to make a killing, they've bagged a bargain and it's a surefire investment are selling, they are not out to help anyone, they are trying to sucker in the next fool.

Showing 10,729 results for the Auckland region, it was about 15,000 during the 2008 GFC.

"Showing 10,729 results for the Auckland region, it was about 15,000 during the 2008 GFC."

Is this the number of properties currently listed for sale in the Auckland region?

1) https://www.realestate.co.nz/residential/sale/auckland - 13,627 listings for sale

2) https://www.trademe.co.nz/a/property/residential/sale/auckland/search - 14,617 listings for sale

It was about 5,300 during the 2008 GFC. Don't ask me for my source though.

Housing is always long term and if you are living in it then it is still better then renting. If you brought a 600k property 6 years ago and it went up to 1mil but then has dropped 100k in "market" value down to 900k and is less then CV what have you actually lost? Especially since we actually need properties to drop much further then 30% in a short time to even get close to the bad joke of being "affordable". The sad part is those who recently brought & opt to sell in a year but in general property is always a long term investment that provides housing for people first and foremost (starting with owners living long term in properties and following them more temporary renters). Not part of an investment portfolio.

In Chch I’m seeing prices growing again… there’s almost a “buzz” in the market like I saw at the beginning of the post-COVID boom.

Last week I was outbid by a FHB who had obviously taken the kool-aid and was offering well above RV. The agent even offered me some words of wisdom such as “interest rates are coming down soon” and “prices can only go up from here”.

I don’t want to believe them, but they’re probably right. As long as our government continues letting thousands migrate in without any consideration of where they will live, then what else could happen but further price increases? It’s basic supply and demand.

Unfortunately, no politician has the power to stop the influx. Just imagine little ole’ NZ saying to China and India: “Sorry, but you can’t come here…”. Good luck with that!

Didn't the Chch city council dump quite a few of the greater intensification rules?

Could that be the reason?

Post earthquake, the intensification rules took a big jump up. So where are they now? I have no idea. Anyone?

It’s starting .. not a word outside of interest.co ..just goes to show the enormity of the situation .. crraaaccck ..

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.