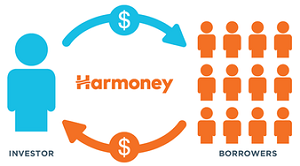

Peer-to-peer (P2P) lender, Harmoney, is set to reward investors for lending to borrowers who buy loan repayment protection.

It plans to launch its Payment Protect product in full at the beginning of next year, having already made it available to borrowers and some investors.

The move comes hot on the heels of Squirrel Money launching its P2P lending service last month, which includes mandatory loan repayment protection for all its borrowers.

Harmoney says borrowers can buy either full or partial Payment Protect, which will cover them if they can’t make loan repayments due to involuntary redundancy, bankruptcy, disability, terminal illness, or death.

The fee they pay is calculated as a percentage of the loan amount.

If a borrower repays their loan in full before the end of their originally set term, without having any payments waived, they are rebated pro rata using a formula prescribed by the Credit Contracts and Consumer Finance Act.

Investors, who lend to borrowers with Payment Protect, are expected to have their yields enhanced by 1.82%.

They also earn the Payment Protect fee borrowers pay, and interest (less Harmoney fees and claims).

However, investors have to pay Harmoney a 20% sales commission for arranging Payment Protect as well as a 15% management fee for managing the product on behalf of investors.

Harmoney says Payment Protect is essentially a “waiver”, rather than an “insurance” product, with the pricing and benefits to the borrower being similar to consumer credit insurance products offered in the personal loan market.

It is worth noting Harmoney already aims to reduce risk for investors by using fractionalisation, which spreads their investments over hundreds, or even thousands of individual loans.

Squirrel on the other hand, matches individual investors with individual borrowers. However, when a Squirrel borrower repays their loan, a small portion of the interest paid goes into the Squirrel Money Reserve Fund or Loan Shield. Money in this fund will be used to repay investors if borrowers miss a repayment.

9 Comments

Interesting stuff. Harmoney seem to be getting a bit of bad press about rescheduling loans in a not too transparent way. As I understand it someone who has a 3 year loan and has made a few payments gets a letter asking if they would like a 5 year loan for a bit more as their credit risk has been improved by their regular payments. Something like that anyway. As I understand it the old loan is repaid if they take out a new loan and the investor is pinged for the Harmoney fee on the principle repayment. So the investor ends up getting significantly less than the expected return as advertised by Harmoney.

I may have misunderstood this and be spreading malicious nonsense but it would be good to know what is going on.

Aha, found the link:

http://www.nzherald.co.nz/personal-finance/news/article.cfm?c_id=12&obj…

Wow damaging article for harmoney. I just checked my loan book. Dozens of loans paid back in full. Seems like a double whammy for mom and pop investors. Aside from the fees, the risk of default is highest in the first few months. Mom and pop shoulder the burden of that high risk period at the start, and then the high yielding milk and honey loan is taken away from them. That’s annoying!

Yes. I just divided my fees by my interest. I have paid 6% of the gross interest in fees! Not sure what to make of it all.

Am I correct in assuming that the majority of Harmoney loans are unsecured? From what I can gather they don't seem to be registering any financing statements on the personal properties securities register. This is standard stuff now in the finance sector. If this is the case and they've lent $100m+ in no time that would scare the living crap out of me.

Are these entities being run by imbeciles. It's totally illegal to have mandatory loan protection insurance! What on earth is going on. Comcom will be knocking on squirrels door before long.

Wonder what will happens to his nuts? :)

Kane2 - its reported here incorrectly - we don't have insurance. We run a provisioning/reserve fund to protect investors from losses the same way a bank provisions. We have no insurance product on our loans. But a reserve fund in a way acts like insurance.

It would seem that Harmoney are taking a fee on return of capital on the early repayment of a loan.

the borrower and Harmoney win, Investor looses

I think harmony has forgotten what being dead is - If your dead you do not care about

paying your loans back - having an insurance seems like selling umbrellas at the beach on a sunny day?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.