By Suhaimi Mohamad*

I love free stuff. Who doesn't? Credit card issuers play on this sentiment offering potential ‘gifts’ to their customers to get them shopping because they know it works a charm with consumers.

According to statistics from creditcard.com, about 60 percent of consumers have a rewards credit card. I expect the numbers are similar for New Zealand.

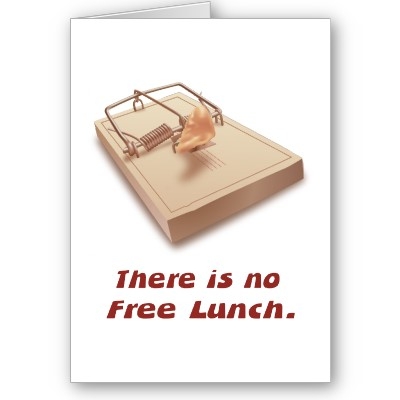

Reward cards are popular because they give the illusion of getting something for nothing. Some might regard them as a bonus for consumption that you were going to do regardless. Do the math and peel back the layers of bizarre psychology at play and you'll find another story.

What I discovered is they're really just a trap. Why? Because you become so obsessed with the carrot at the end of the stick you end up beating yourself with the stick by virtue of turning into mindless shopper. The reward isn't so much a reward as it is a bait to lure customers with the mirage of getting ‘free’ items?

I used to have a reward credit card and was very happy to redeem a Bosch electric powered drill to fulfill my DIY needs. It took me a year and half to accumulate the points by loading every possible purchase on credit card and also re-prioritising less important purchases in order to accelerate point collections.

After sometime, I had another dimension of measuring value of the reward, and realised that I was on the losing side of this game.

Allow me to explain:

Premium cost of reward cards

In order to get a reward, reward card holders have to pay an extra premium cost compared to a basic card. A premium could be in a form of a higher interest rate, a shorter interest-free period or a higher annual fee. (Compare credit card policies and offerings here).

Here's a few examples:

- Higher interest rate - ASB Low Interest With Reward Mastercard is 15.15%, or 2.45% higher than the 12.70% interest of ASB Low Interest Mastercard without a reward.

- Interest-free period – A BNZ Classic Reward Plus is offering only 44 days interest-free period, or 11 days shorter than the 55 days BNZ Classic Everyday Mastercard, the card without reward.

- Higher annual fee - The National Bank Thoroughbred Gold Visa credit card holders costs $95.00 per year, or $20.00 higher fee than the $75.00 of the National Bank Gold Visa, the standard card without reward

Balance due after interest-free period lapsed.

Based on the data published by RBNZ, there are large proportions of credit card balances which have not been paid off within the interest-free period and this is an inherent danger of a reward systems.

No chart with that title exists.

In March 31, 2012, about 66.7% or $3.575 billion worth of credit card debt was outstanding and incuring interest. If you do go the rewards route, you need to be hyper vigilant about paying your balance off on time to avoid interest charges on outstanding balances after interest-free period is over. If it's not obvious why, the additional interest cost reduces the value of the reward. The span of extra interest cost depends on how much and how long the balance has been remained outstanding.

The longer you take to repay the debt is the right choice only from the perspective of the credit card issuer. To steer you in this direction, they highlight the minimum amount to pay on your statement. If you want to see how much that method of repayment will end up costing you, check out our minimum repayment calculator to see how long it takes to pay an outstanding balance of $1,000. Depending on which credit car you have, it can take anywhere between 5.3 years to 43.2 years.

Value of reward cards

To test the value of these enticing rewards card, I decided to see how much I would have to shell out for free bread maker; specifically I was after a Breville bakers oven model BBM 100. The oven would be a good choice of an electrical appliance for my kitchen.

I wanted to find out whether it was worth collecting the points to earn it for "free" or cheaper to buy on on-line.

I gathered the following data;

| Breville bakers oven model BBM 100 | |

| Total points required | 18,700 Hotpoints |

| Credit card (with reward) | Westpac Standard |

| Annual fee | $44.00 |

| Credit card without reward | ANZ Standard |

| Annual fee (without reward) | $25.00 ($19.00 cheaper |

| Total time to collect reward | 2 years |

| Price quoted by Priceme.co.nz | $119.00 + shipping at Magnessbenrow on-line store |

| Hotpoint rate | 1 point for every dollar |

Based on the above data, I have to spend $157.14 in order to collect $1.00 value of the reward. This is based on Breville BBM 100 reward point to dollar ratio. (18700/$119 = $157.14).

Since I have a plan to collect enough points in two years, I have to add $19.00 premium per year for having a credit card with reward attached.

Total spending on reward credit card in two years to cover the cost of reward card premium and to get a ‘free’ gift is as follows;

| Reward credit card | Year 1 | Year 2 |

| Total purchase (18,700/2) | $9,350 | $9,350 |

| Annual fee premium (157.14 X $19.00) | $2,986 | $2,986 |

| Total amount to spend | $12,336 | $12,336 |

I was left with some nagging questions:

- What would be the price of Breville bakers oven model BBM 100 at the end of year two? Perhaps 80%, or lesser to the current retail price considering devaluation of retail market price.

- Will I be able to pay my credit card bill about $1,000 a month for 2 years without leaving any amount outstanding to avoid the extra interest charge for unpaid balance after the interest-free period is over?

- What happen to the point collected if I decided to terminate my card before making redemption? Will the credit card issuer compensate me?

Since there are too many questions in my head, I was happy to click a Buy Now price of a new unwanted Christmas gift of a similar bread maker on TradeMe for $80.00. Not only have I stopped obsessing with points and redeemable "free goods" but I'm saving money too.

----------------------------------------------

*Suhaimi Mohamad is interest.co.nz's long-time interest rate analyst and watcher.

22 Comments

Probably the bigger incentive to spend is not so much the reward scheme but rather the ease of spending the credit card enables.

All depends on how you use the card. Pay off the card in full every month, spend more than the break even amount (i.e. rewards vs fees), use the credit card to pay for everything possible. My credit card requires me to spend about $9000 p.a. to "break even", which I can do if I use the card everywhere.

Also depends which reward programme you choose. Air NZ Airpoints is very attractive since the flight costs the same whether you use airpoints or cash (not like your breadmaker example). You can also collect airpoints at flybuys merchants, on Air NZ flights, at hotels and rental car companies. It adds up quickly!

we've got the gold version of the hot points thing. You still have to spend a ton but it's not quite as bad. If you use the Amex card they give you for 'free', then you get 1.75 hotpoints per dollar spent, meaning to 'earn' a dollar I have to spend $89.79 instead of the $157 you do. In my case the card pays for itself as I spend more than $9000 on it per year. The groceries cover that alone as all major supermarkets take amex.

Of course what you don't see is that amex charges the retailer a hideous commission, and the retailer must cover that by increasing prices. But everybody pays those inflated prices regardless of payment method so you may as well get in and perpetuate it. Self-reinforcing!

It'll be interesting to see what happens if/when the supermarkets start charging credit card surcharges.

The only mistake you seem to have made is to buy things you otherwise would not have bought, in order to get more points. If you are buying things you would defintitely buy anyway, and your total spend is likely to be over the break even threshold, then you are likely to be better off with a rewards card (although worth checking interest rate differentials if you are unlikely to pay the card off in full each month).

HotPoints and most rewards programmes have plenty of rewards options, including shopping gift cards, so before you cancel the card, make sure you redeem whatever points you have.

Might want to tell Amanda then Suhaimi

I'm guessing here, but I'd say the majority of people fall into the trap of just buying stuff indiscriminately to get the reward instead of being disciplined and selective about their purchases made on credit. Credit cards are a loaded gun in some people's hands because it leads to mindless consumerism and in many cases amnesia about the real costs of borrowing.

But I hear what you are saying and I do know many sensible individuals who have made credit cards work in their favour but they're the exception not the rule.

BTW, I am still looking for a guest blogger from our readership, any takers?

Topics are wide ranging?

How you are saving for retirement?

How you got out of debt?

Why you love or loath credit cards?

How you fast-tracked the mortgage?

You know where to find me.

Amanda

"but I'd say the majority of people fall into the trap of just buying stuff indiscriminately to get the reward instead of being disciplined and selective about their purchases made on credit."

wow really? I always thought it was just the odd random who does that... I always figured a credit card is like an eftpos card that gives u rewards; just always make sure the limit is lower than the emergency fund in your eftpos account and you never have to pay interest...

I spend about 30-40k on my credit card each year. Each month it is paid in full. National Bank provide a 1% ($400) cash back. I never pay a cent of interest. Perfect.

So.........you spend 30-40k just to make $400? Have I got that right? If you can pay it off every month then...................WHY not just pay for it all with your cash each month?

You do realize how ridiculous your logic is on this? They are using you via onselling your purchase information to 3rd parties. My god man, wake up. Just pay for your shit the normal way! Cash

And withdrawing $40,000 pa at ATMs is better logic? I'd be quite happy if my bank paid me $400 a year for spending what I'd normally spend anyway.

Justice,

He is spending the $40k anyway, and he's paying the balance off in full every month in full, so no interest. Follow your advice, and he would be $400 worse off for nothing. Yes the bank have his data, and they may use it, but not obviously to affect him in a negative way, other than he might get a few offers which are somewhat relevant because they've used his data.

My advice: dont spend so much and invest more! That is surely a more sound suggestion Stephen

I travel a lot with my employment. Expenses are charged to my credit card, and repaid to me by my employer, and I get the benefit of the rewards system.

I travel a lot with my employment. Expenses are charged to my credit card, and repaid to me by my employer, and I get the benefit of the rewards system.

Exactly so. Absolutely ALL of our expenditure (shopping, travel, bills) we run through our Nat Bank Thoroughbred credit card. Oustanding amount is paid by DD each month so interest is never paid (and we get 6 weeks interest free period). In the 5 years we have had it have always spent in excess of $50K on the card, so accruing the maximum cash back - $500. After card fees (joint) of $120 thats $380 to the good for the benefit of using their CC (add in maybe another $100 benefit from interest earned during 6 week interest free periods), brings the net benefit to $480.

Oh and NB Gold card provides pretty good travel insurance on purchased holidays/trips (as long as 50% or more of cost is accrued using said CC). Not having to purchase travel insurance as a result saves us an extra $400-500.

So net benefit to us of using NB Thoroughbred card? Between $900-1000. And it doesnt cost a cent.

Its not difficult. You just have to make them work for you - not the other way around.

I heard somewhere that those of us using our cards as you describe above are part of what has driven interest costs higher for those that don't pay off the full balance before interest is charged.

Makes sense as I can't fathom how Visa is making anything but a significant loss on us over many years. We use the free travel insurance regularly as well. Last time we went overseas the travel agent wanted to charge us an additional 2% to pay by credit card - and so what we had to do was provide Visa with their invoice which showed both a cash and a credit price so that we could pay cash and still take advantage of the free travel insurance.

Yes you are right Kate they are still screwing somebody - whether its the dingbat who doesnt pay off the full amount every month or the poor old merchant that they nail for a percentage on each transaction (and of course there are those nasty currency conversion charges on overseas purchases - but they all try and pull that one). But hell, if Nat Bank/Visa set their card up like that, you would be a fool not to screw them in return by doing the above.

I spend a lot on the Credit Card. (20-30 K pa) Happy to receive the points.

I have seen the points as a tiny bonus. Without the points I would use the card in exactly the same way. And I never pay interest.

I noted with alarm that sometimes taking the points means you pay a higher fee. That had not occured to me before and I will be checking that out carefully. (It's a Westpac Gold Mastercard) Thanks for the valuable headsup.

Sorry Suhaimi but I think the c/card rewards are hugely beneficial. My wife and I have joint Westpac gold cards (which includes the AMEX earning 1.75 points). We run our own business and put personal and business expenses on the cards (and claim our business expenses back) - We spend $120K annually and don't pay a cent in interest charges.. We think the best rewards are the vouchers e.g. petrol / department stores as they are essentially cash - you can hold onto the vouchers until the stores run specials and/or until you need to buy something. We also benefit from free worldwide travel insurance which we use frequently. I don't know what our savings are by using these cards, but imagine in the thousands.

since firms are charged fees by the likes of amex,visa etc should there be a discount for paying cash

that would be a nice reward

Money for nothing

is changing to BNZ kiwisaver for flybys worth it or not.

well it depends on your circumstances

from my perspective it is worth consideration

my family live off my credit card & by doing nothing different

but change to BNZ gold card & kiwisaver

the best scenario i can see is if you use a

BNZ gold AMEX card & you spend $20 you receive 1 flyby point

Account fee $40 half yearly includes interest free days up to 55

card gets paid back in full monthly interest free

every day to day purchases is done via the card

including utilities & bills debited to the card

our monthly spend of $2500 = 125 flybuys points

shop at flybuys shops to increase flybuys points

per annum 1500 flybuys = $280 worth of kiwisaver flybys

add the govt member tax credit. $140

for a total of $420 in kiwisaver

I find reward card very useful. In fact, most credit cards with rewards programs are aimed at cardholders with good credit and larger incomes, the BankAmericard Better Balance Rewards card targets consumers with lower incomes and fair-to-poor credit,

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.