By Amanda Morrall (email)

1) Whoever said money can't buy happiness

Research suggests that money (beyond a certain threshold ;$75K is supposedly the sweet spot) won't buy you happiness. Canadian behavioural economist Michael Norton challenges that theory. He suggests that actually money does buy happiness, it's just a matter of what you're spending it on. In this TED talk (thanks JS) Norton discusses how those who spend their money on others actually report higher happiness levels than those who spend it on themselves. He tested this hypothesis by giving people money and seeing how they spend it. Those who lavished it on someone else got the biggest bliss for their buck. Interestingly, the amount of money didn't make a great deal of difference either; even five bucks spent on someone else had the effect of making the donor happy(er).

Give it away and reap the benefits.

2) What gold won't buy

Reuters finance blogger Felix Salmon decides to test ebook "In Gold We Trust" author Matthew Bishop's contention that no one ever rejects gold by hitting the streets of New York with a wafer thin gold bar (SIM cardesque in size) to see what it'll buy. He discovers that the 1 g bar (worth about US$52) is pretty worthless to most merchants, save those who own their businesses. The video (HT our CS) is pretty funny.

3) Lifestyle versus income

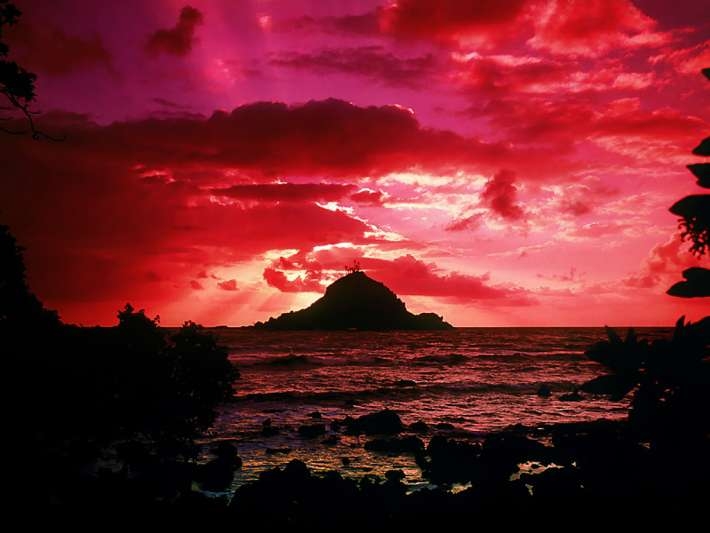

I muse quite often about quitting Auckland and moving to Gisborne where I could afford to buy a house and escape the rat race. My colleagues roll their eyes as I have yet to visit Gisborne and also I have only surfed once, not very successfully. There are other remote spots on the NZ map I have laid eyes on and could definitely see myself living in quite happily were it not for some key logistics that I can't ignore at this juncture in my life. Still, the whole lifestyle vs income debate is intriguing, huh? In his latest blog financialsamurai weighs up whether to quit San Francisco and move to Hawaii, sacrificing money for time. Hmmm Hawaii.

4) Predatory banks

The Age reports on how Aussie banks are exploiting personal data to prey upon consumers when they're at their most vulnerable. New technology essentially allows the banks to compile detailed personality and demographic profiles on consumers so when they're ripe for credit, the banks will pounce on them offering to extend their limits or pushing personal loans. I was set upon last week myself by MasterCard which was pushing credit card insurance and also coaxing me to up my limit, which has magically grown to $10K without me even trying.

I am trying to clarify today whether these data mining practises are allowed to take place in New Zealand. Stay tuned. Thanks Doug for bringing this to my attention.

5) DIY

I know there's a lot of potential self harm with DIY jobs but Australians managing their own super funds would appear to be doing a good job of it. According to this article from the Canberra Times, DIYs in balanced portfolios posted 9% returns last year compared with their professionally managed counterparts which returned 0.1% over the same time. The superior returns had to do with DIYs holding a larger proportion of cash, almost 25% compared to 6%. Whether the tables will turn if and when equities recover will be interesting.

There are still no self-managed super options in KiwiSaver that don't come with ridiculously high fees.

To read other Take Fives by Amanda Morrall click here. You can also follow Amanda on Twitter@amandamorrall

5 Comments

The most powerful aphrodisiac for women is "power". The second most powerful aphrodisiac for women is "danger". Money is often mistaken for power. Power and danger are not happy bedfellows with happiness. Men usually smarten up to this long before women do. Sorry for your friend.

Loved the danger until I found out about the pain. Now im into massage and painkillers.

Some women get it wrong and go for the faraway look in the eyes - usually the sign of an adventurer, not a bread-winner. I went for one with the faraway-look too, rarer in females, methinks.

Lifestyle vs happiness? I can't think of anyone I'd trade places with, and we don't make half your 'sweet 75k', not even close. Interestingly, we got to Hawaii last year, good to see but here is better. Met a fellow who sailed like we do, is off-the-grid with a pelton-wheel just like us...... but envious? no.

i work alongside 3 people who not only work 40 hour weeks but also claim the pension along with their partners

their is no subject on earth that they cannot moan about.

too hot.too cold,too dear ,too much not enough too sore is how the daily news goes.

well i've got news for them you are a long time dead so stop moaning and enjoy while you can.

Some women make their own success in life and enjoy the benefits of their hard won financial security without using some man and his money as their crutch. Far better you choose kindness and respect over the shallow illusion a bit of cash provides - and this goes for both sexes...

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.