More banks are falling into line now with 25 basis points (bps) rate cuts. ASB is the latest, and that now more or less completes the current phase of mortgage rate reductions.

The ASB change has two interesting features; first, it now offers the lowest six month rate of any bank, at 6.99%.

And second, it now reprises a sub-6% rate, offering 5.99% fixed for five years.

The last time any bank offered a fixed home loan rate below 6% was Heartland's three year fixed 5.95% in June 2023. For the majors, it was Kiwibank's 5.85% one year fixed offer ending December 12, 2022. So, it's been a while.

ASB has also chiselled away at its term deposit rates as well.

TSB also trimmed some rates. And it has matched ASB with a 6.99% six month offer.

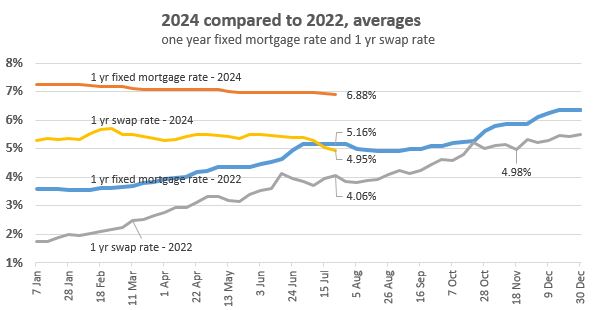

In a step back, we can note that since the last no-change Reserve Bank (RBNZ) Monetary Policy Review, the one year swap rate has fallen 34 bps. And that is more than the 25 bps cuts to mortgage and term deposit rates that are flowing through.

So without any RBNZ moves, other than a subtle signal via a slight change of wording, the market is charging lower and starting to price in not only a rate cut at the full MPS on August 14, but another at the review on October 9. But remember, market pricing signals are not infallible; they are always fluid and data, especially inflation data, have a major influence on these 'bets'.

Now the one year swap rate is back to where it was at the end of November 2022 (just prior to the RBNZ Official Cash Rate (OCR) hike on November 23, 2022, when the OCR was hiked +75 bps).

At that time in November 2022, most main banks were offering 5.99% one year fixed mortgage rates. Kiwibank was at 5.89%; Heartland was at 5.49%.

Now the rate trajectory is lower, from a higher starting point. Here is how 2024 looks like about July 20, compared to 2022, as that swap rate sinks:

But it is still Heartland Bank's 20 bps cut that gives it the lowest position of any bank for all the terms they offer; 12, 18, 24 and 36 months fixed,

Having noted that, we should also note that Heartland Bank's offer is online only. As such, there is no wiggle-room for negotiation with them. And brokers don't get paid by Heartland so there is no incentive for them to offer you these rates. You would have to go direct via their online process.

But almost all other banks will have some flexibility in their rate offers. So the carded rates are just the start. Negotiate. How flexible they may be will depend on the strength of your financials. And don't forget, banks have savvy tools at hand to 'know' the likely valuation of your property, so if the LVR is near 80% you may not find them very accommodating for a lower rate. With falling house prices, the point where low equity premiums start applying is shifting around as well. Beware.

And the carded rates we report here can be different to the rates banks might offer in their banking app. We would like readers to reveal what their banking app shows as the potential offer rates. Please add that market intelligence in the comment section below.

A quick check of the wholesale swap rate chart below gives a clear understanding of where funding costs are heading.

One useful way to make sense of the changed home loan rates is to use our full-function mortgage calculator which is below. Term deposit rates can be assessed using this calculator.

And if you already have a fixed term mortgage that is not up for renewal at this time, our break fee calculator may help you assess your options. Break fees will be minimal in a rising market. But they become important in a falling market.

Here is the updated snapshot of the lowest advertised fixed-term mortgage rates on offer from the key retail banks at the moment. Updated with Kiwibank changes effective Monday.

| Fixed, below 80% LVR | 6 mths | 1 yr | 18 mth | 2 yrs | 3 yrs | 4 yrs | 5 yrs |

| as at July 22, 2024 | % | % | % | % | % | % | % |

| ANZ | 7.05 | 6.85 | 6.69 | 6.49 | 6.35 | 7.14 | 7.14 |

|

6.99 -0.25 |

6.85 -0.26 |

6.69 -0.20 |

6.49 -0.26 |

6.35 -0.04 |

6.29 -0.10 |

5.99 -0.30 |

|

7.05 | 6.85 | 6.65 | 6.49 | 6.39 | 6.39 | 6.39 |

|

7.05 | 6.85 | 6.49 | 6.39 | 6.39 | 6.39 | |

|

7.05 | 6.89 | 6.79 | 6.75 | 6.39 | 6.39 | 6.39 |

| Bank of China | 7.05 | 6.85 | 6.75 | 6.49 | 6.29 | 6.29 | 6.29 |

| China Construction Bank | 7.19 | 7.09 | 6.89 | 6.75 | 6.49 | 6.40 | 6.40 |

| Co-operative Bank | 7.05 | 6.79 | 6.69 | 6.49 | 6.35 | 6.35 | 6.35 |

| Heartland Bank | 6.69 | 6.49 | 6.35 | 6.15 | |||

| ICBC | 7.19 | 7.05 | 6.79 | 6.69 | 6.59 | 6.49 | 6.49 |

|

7.24 | 7.14 | 6.89 | 6.49 | 6.35 | 6.19 | 6.19 |

|

6.99 -0.30 |

6.85 -0.14 |

6.89 -0.30 |

6.49 -0.26 |

6.39 -0.26 |

6.39 -0.20 |

6.39 -0.20 |

Fixed mortgage rates

Select chart tabs

Daily swap rates

Select chart tabs

Comprehensive Mortgage Calculator

100 Comments

Skiing anyone?

Good riddance to the 7's!

Time to get some well priced Auckland properties under contract.

Hope everyone is positioned for the upturn, probably too busy moaning about everything tho lolz!

🥂

You first….

Ditto…(note the spin in the headline!)

https://www.oneroof.co.nz/news/phone-bidders-drive-up-the-price-of-hami…

now that's a deal! i know the area well...wow.

Phone bidders didn't "drive up" shit when the property sold for 60% of CV.

They don't even try to be impartial.

Just called the travel agent and told them to cancel the premium economy fares to Europe for the "big holiday" (have to have something to look forward to after coming back to the drab weather here from Fiji). It's business or bust.

Might also swing past the Audi dealer on the way home from seeing the chaps at the lodge 🥂

Que the FOMO talk about house prices rocketing away again as i-rates fall.

Will the RBNZ do anything about it? i.e. adjust LVRs/DTIs. Or will they be asleep at the wheel again?

What's "Que" ?

Abbreviated version of the DGMers new catipulation catch phrase. "Que Sera, Sera" :)

yes that's right

Cheeky buggers haven’t lowered their 6m app rate or the 1y and 18m from last week’s little trim for loyal customers. Also haven’t given anything off the 5y.

6m - 6.95%

1y - 6.72%

18m - 6.62%

2y - 6.49%

3y - 6.35%

4y - 6.29%

5y - 5.99%

Or… hopefully they’ll just take a bit of time to feed through app discount rates…

Staff rates are 30bp lower than carded rates so you should be able to get something around the 5.7 mark today, but I would hazard a guess that locking a 5y term now is a bad idea

Kiwibank have lowered their rates, but still only offering carded rates in the app.

Edit: They've dropped the generic offering via the broker channel, but only barely.

6m was 6.99, now 6.95.

12m was 6.85, now 6.72

24m was 6.65, now 6.45

36m+ was 6.49, now 6.35.

I just rang and that is what she quoted me too

Is it just me or did my innocuous question get deleted with no feedback from the editor

Pardon me?!?

Flying High, at this rate you'll need to chose yet another pseudonym.....

Its all good grandpa. You should stress out about your own issue, TD income

Not at all. I'm more stressed over grandkid/s I never even knew I had 😆🤣👍

Nice one!

Alzheimer's?

Ha-ha, nope. Not even having a Biden moment! No grandkids.

Go on RP, we know you've 'planted some trees' around the world in your younger days :P

😆🤣

Historically 5.99% is a low rate - for anyone aged 50 or older we have seldom seen rates below this and given that historically the OCR has seldom gone below 4.9% then perhaps 5.99% for 5 years is not too bad an option?

I fixed 5 years 5.99% on a 2013 purchase and wasn't worried at all.

Although house was a third the price it is now so mileage may vary, my income x3 since then too so guess much for much next.

Not a bad hedge against a geo event or trump going nuts with tariffs against everyone pumping inflation there back up.

Six months time could be a completely different story

Old yeller wants some customers 🟨

Mea Culpa Zwifty?

This is all smoke and mirrors. Just called ASB today, they won't give me less than 6.95. That is a higher rate than I could get in the app 4 weeks ago!

So basically the banks are now just advertising rates that you could get before, they haven't actually lowered rates at all. Despite wholesale rates going down significantly.

Yep, this. All they've done is lowered their carded rates to match what they were already offering in app. The real cuts will come though.

Down down down she goes.

Silence of the DGM muppets.

Gosh, you've STILL got baggage. Do you appreciate the economic circumstances that will accompany these lower rates? Lending demand is down. I think owing to known time lag of interest rate settings themselves and the cost of living crisis in general and joblessness, under-employment, we are not at the bottom of this downturn yet. Think 3Q next year for ensuing and sustainable economic recovery (edit) but that does not necessarily include the type of house price recovery some here are drooling for.

Doesn't take much for the usual spruiker celebrations to prematurely commence.

Meanwhile in reality: 'Sell it before the bank does': Housing market stress 'growing'

It's certainly a Spruiker fest ain't it? These poor folk must be under immense pressure. Now it's on show for all to see - embarrassing.

Who doesn't want lower interest rates if you have a mortgage, whether your under pressure or not.

Or does lower interest rates reduce your pension?

go away with your silly comments and back to counting your grandchildren.

Ouch!

lower interest rates

- bad for house prices (unaffordable)

- bad for investment in productive businesses

- bad for rental price (for renters)

- bad for tax payers (leads to more expensive and less investment infrastructure and public services)

- bad for public housing

- bad for social adhesion

- bad for crime

sorry, did i miss that its good for property investors.

i get your points but there are a few on here that are questionable.

It really depends what you are referring to as "lower"

like 2% lower... not that bad. 6.5% lower...bad.

With that argument you could say "bankrupt the whole economy so hose prices go down".

- it really depends how low they are.

- lower interest rates allow business to grow and become more productive, keep prices down.

- rent price is more related to house price, not interest rates.

- how does lower interest rates make infrastructure more expensive?

- bad for public housing, again related to house price.

- bad for crime? how?

Its also good for FHB.

The bright side might be:

Good for those who borrowed to invest in a productive business, good for councils as they also pay interest, less pressure for price and rate rises, good for consumers disposable income leading to greater spending in the economy and a multiplier effect, good for those who want work, good for landlords and therefore for tenants

all the article really says is this RE has seen more people forced to sell, it doesn't really put a number on it.

There are always people who get forced to sell.

It does also say the mortgagee sales remain low at 24 in the last quarter compared to 750 in the quarter of the GFC.

although it DOES say the amount of house behind payments is up 12% comapared to pre-pandemic...interest rates were 3% then.

The headline obviously got your attention.

The article outlines that many are desperately trying to sell their houses before the banks force them to become a mortgagee statistic. The number of mortgagee sales is a lagging indicator to the currently growing housing market stress.

It doesn’t provide a number of how many people represent this camp, but what we do know is -

- They've likely depleted all savings

- Their hardship assistance from the bank has expired

- They’re trying to sell into a buyer’s market with a large overhang of unsold properties

- There’s been a big jump in listings in the first two weeks of July - up 49% from the same time last year.

“There are always people who get forced to sell.”

This is a generalised statement completely ignoring the growing trend in forced sales, the market they’re selling into, the lack of demand at current prices and the rapidly deteriorating economy.

This is not speculation - this is the reality being reported.

sure it exists, not as bad as you think. its more of a headline that you like.

How many of these are mortgagees vs how many are investors just selling at a loss.

most investors probably aren't even selling at a loss if they bought before 2021.

They could just be having to reduce debt because they cant service it.

there is a big difference.

Every sentence you just typed is speculation.

Woah…both of you make good points but I wouldn’t be throwing stones…you’ve called him out for speculation yet one of your bullet points starts with “They've likely” 😂😂

It was from the article mentioned by a CoreLogic economist:

Kelvin Davidson, chief property economist at property research firm CoreLogic, said sales due to interest rate stress were often a lagged indicator, because it took time for people to get through savings and other options before they reached a point where they had to sell.

it pretty obvious if they're a mortgagee that they have used their saving isn't it?

it like saying mortgagees are likely not able to service their debt.

Like What??

We’re referring to the people desperately trying to sell their house before it becomes a forced mortgagee sale.

A surge in houses being listed for sale continues - and in some cases, it is because people are selling before they are forced to, some real estate market participants say.

She said she had had several clients who had said if she was not able to sell the house, it would be turned into a forced sale.

"I've had a [person] saying 'Brooke is going to sell it or the bank is'… it's something I've seen numerous times."

It does also say the mortgagee sales remain low at 24 in the last quarter compared to 750 in the quarter of the GFC.

How is that speculation when its written in the article that you linked?

The slippery games you lot play...

That sentence seems to be missing from the post I'm clearly responding to ?

by RookieInvestor | 22nd Jul 24, 1:44pm

sure it exists, not as bad as you think. its more of a headline that you like.

How many of these are mortgagees vs how many are investors just selling at a loss.

most investors probably aren't even selling at a loss if they bought before 2021.

They could just be having to reduce debt because they cant service it.

there is a big difference.

- There’s been a big jump in listings in the first two weeks of July - up 49% from the same time last year.

Its speculation assuming that these are mortgagee sales.

And where did I allude these being mortgagee sales?

I'm describing the conditions of the market these people are trying to sell in.

Retired Poppy, you should stay retired mate and zip it, you’ve had your 10 seconds in the sun.

Just have to laugh at you guys - “ this time it’s different, higher for longer, stagflation etc etc. hence - muppets. More time on your hands than brains. I happily welome lower rates and appreciation of my assets, go have a cry.

You realise how childish you look making comments like this?

Rastus the only children were the people on the doom gloom wagon with their embarrassing petty comments.

Embarrassing petty comments like "zip it" and "go have a cry." you mean?

Call a spade a spade, these folk have preached nonsense for the last wee while and deserve to be put in their place.

They simple don’t understand the cycle concept.

OK - while you’re calling spades (over 10 - 30 basis point reductions - see chart)

Can you please explain the "cycle concept" which has a property price falls of 30%+ ??... I simple don't understand

I'd prefer a future of NZ with affordable housing that our children can afford without relying on their parents or gargantuan levels of debt to be able to afford one. If your assets go up in value, great for you pal, I genuinely wish you the bets of success in your endeavours and hope you succeed, but if they drop or even stagnate for a few years, this will be for the betterment of all. Personally I couldn't care less if my house goes up or down in value, my life goes on day to day. The needs of the many outweigh the needs of the few.

Of course we all want to see lower interest rates. What makes me laugh was Spruikers were also less considered in their thought processes at the height of stupidity in 19/20/2021 when the cheap money binge was in full swing. Now, here they are expecting those days of foolish unproductivity to return tomorrow. The fact is - they simply won't.

Uneducated madness - its unbelievable. Will they ever learn?

i think the prices will come back to there in next 3-5 years.

but that level of growth is unlikely unless another destructive government duo like Ardern and Robertson is elected.

What makes me laugh was Spruikers were also less considered in their thought processes at the height of stupidity in 19/20/2021 when the cheap money binge was in full swing

A lot of people in this time were FHB and probably knew nothing about money cycles and were used to "cheap money". what frustrates me is there were people that knew about it and there was very little warning to these FHB.

On the other hand the investors who bought should have known better and that was a big risk for them.

Cancel culture?

Iceman, retirement is not for me. I chose to work full time. Typical of Spruikers, they blurt before facts gathered.

Interest rates have stayed higher for longer than many anticipated. With the world on a military crusade and many a trade barrier being built by the day, it's too early to bury the stagflation flag.

Retired Poppy continues to show his ignorance. Interest rates have not stayed higher for any longer than anyone smart expected. Go look at the interest rate chart that frequently cents posted around this site. It was a sharp upward spike and is already on the down. If you think it’s not on the way down you’re totally deluded - but then again I wouldn’t be surprised.

You've really got yourself quite wound up haven't you? You can say I'm all sorts of things if it helps.

Yes, without argument, interest rate reductions form welcome relief to the indebted, hopefully not too late for many. Interest rates have remained higher for longer as the calls for RBNZ to drop the OCR have proved in vain. International wholesale rates also stayed higher for longer as inflation in some areas has proved stubborn.

Facts.

I’ve got my self wound up LOL.

Mate, let me remind you that you were the one that replied to my comment with a whole paragraph and got their panties twisted.

Jesus. You don’t even know what you do.

Keep digging Iceman 😆🤣

You'll be surrounded by Chinese real estate before you know it.

I can see how triggered you got, great effort and your essay replies mate.

It’s just the internet, don’t take my words so seriously.

After the bank laid you off you mean, then came out of the "retirement"

No, that's also incorrect ❌

Wow - where did all those spruiker upticks come from? I didn't realise that there were 15 still trying their best to cope with the housing crash. Rates are not plummeting any time soon.

As noted, these so called "cuts" are meaningless as much of these are simply the rates you could get in the app.

No, app rates have gone down too. There have been some real cuts.

BNZ haven't - other than 18 month which is 0.1 lower. And 6 month is higher.

The only other real drops I have heard from ASB & ANZ is 6.72 for the one year. Which is just .13 lower than what was offered previously on apps. I mean, I'll take it, but hardly the drops they are being made out to be..

More cuts coming, best 6 month rate wins the business.

So the retail rates are getting cut from all banks, well ahead of the OCR cuts.

Yep basically the 25bps cut has already happened so like I said August for rate cuts, my prediction was out by like 1 week.

Forgoing the swap market, they will be loss* leaders to get the biz.

* loss isn’t actually a loss.

Well ahead or just ahead? What do you reckon, OCR cut next month?

Well, I called for the first OCR cut to happen in August 2024, back in June 2023, I stood by it for over a year, even when the RBNZ said late 2025 and when many on here mocked me. So I'm not going to change my call now.

Assuming you can negotiate down the standard 30 bps to 5.7%, that is actually not a bad five year rate in a world full of uncertainty.

No surprise... current swap rates are indirectly reflecting a mainstream realistic assessment of where rates are going to be in the future, and deposit and mortgage rates are simply reflecting the recent significant drops of swaps across the horizon spectrum.

Someone explain to the spruikers that rates going down is a bad sign for the economy.

Because you can't explain your own beliefs?

Because you don't understand why rates go up and why they come down.

Enjoy watching the house market keep retreating despite these drops.

If the rate drops are really sharp you should be worried for the economy and the value of any portfolio you've dumbed into over the last decade of unatural price increases.

And you like your own comments

You know you have no idea what you are talking about so you don't like yours.

DGM Getting mad

So would you be if you woke up today and found that someone had pissed on your Cornflakes.

It's a forum people. Have discussion and share views, learn different lenses but let's not all go to petty squabbling. I may not agree with some off Rookie's views, but it's nice to some more positivity on the topics without the arrogance.

Thats not a good explaination.

If rates come down very sharply and we risk deflation I will be worried.

Rates haven't dropped sharply yet an there is no major sign of that happening.

Lower rates allow people to spend more on business, allow business to borrow and invest and become more productive and profitable.

There is a balance.

Good googling there bud

Thanks! I didn't google any of it so that's a nice compliment

Rates go up and down because of various factors, inflation, supply and demand, economic growth, cost of borrowing, economic stimulation.

Although I don't understand it in its entirety, I understand there are many things that affect them.

It means the economy is gone. Yea we know lol. It has been screwed for the last 9months.

The giant at the top of the interest rate beanstalk is only just waking up now to chop it down.

What really matters are the real rates, and they have been tightening over the past year with the dropping CPI. In Jan, 2022, real rates reached -6.15%, the most accommodative conditions ever. Since then, they've been climbing, turning positive only last October after being negative since mid-2019, and just hit 2.2% this month, levels we last saw around early 2016. Here are a few facts since the introduction of the OCR in March 1999:

- After tightening, the RBNZ never kept the OCR at its peak for more than 12 months. We are now in the 15th month of the peak at 5.5%, the longest in history.

- The RBNZ increased the OCR by 2100%, the highest increase in history. With all the long and variable lags, we haven't seen the full impact yet.

Some examples of these impacts

-

PMI: In free fall. June's PMI hit the lowest level for a non-COVID month since February 2009. According to NZIER, 73% of manufacturers said profits are declining, the worst reading in history (data goes back to 1969). Plus, 39% of manufacturers are planning to lay off staff, the worst since the GFC

-

PSI: sinking. June's PSI hit the lowest level for a non-COVID month since the survey began in 2007

We are seeing GFC-like numbers and some of the worst readings in history before even the start of the fireworks

The final last ditch effort to get fools to fix long. Gotta love the compassion and caring shown by the banks

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.