Did somebody say interest rate cuts?

Well that's what new mortgage customers are hoping that the Reserve Bank (RBNZ) is going to be saying very soon - judging by the recent behaviour.

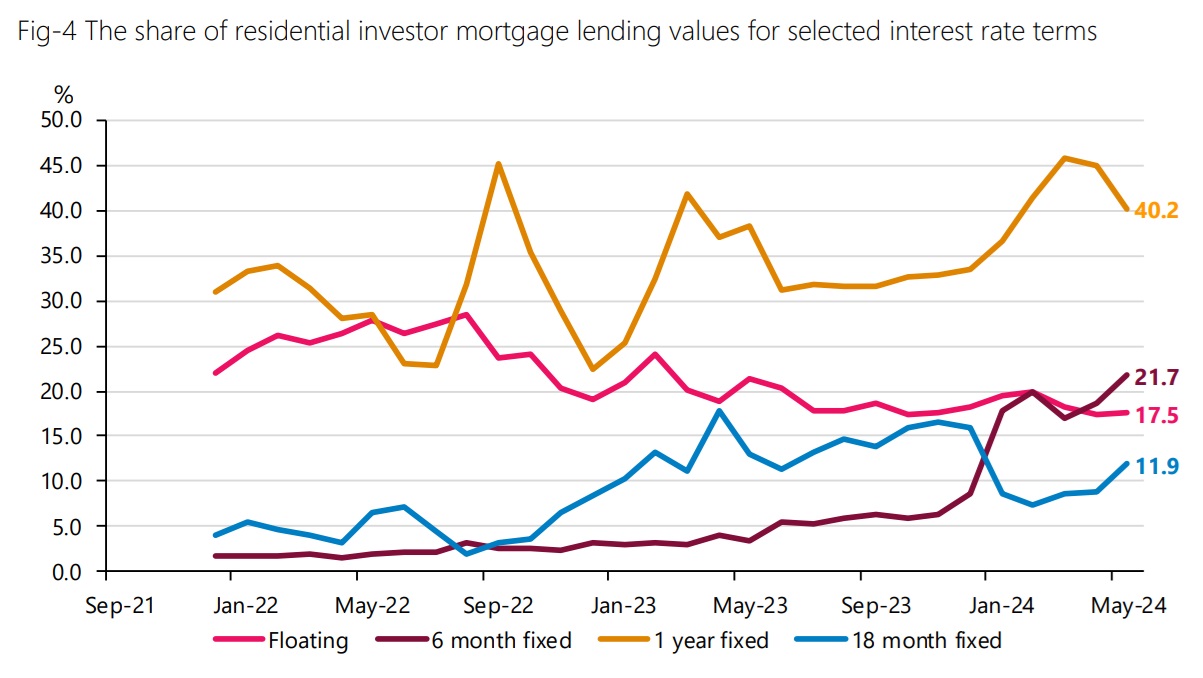

New monthly figures from the RBNZ show that in May about one in six mortgages for owner-occupiers and one-in-five investor mortgages were taken out for a six-month fixed term rate.

That's a new high in a data series that admittedly has only been running since 2021.

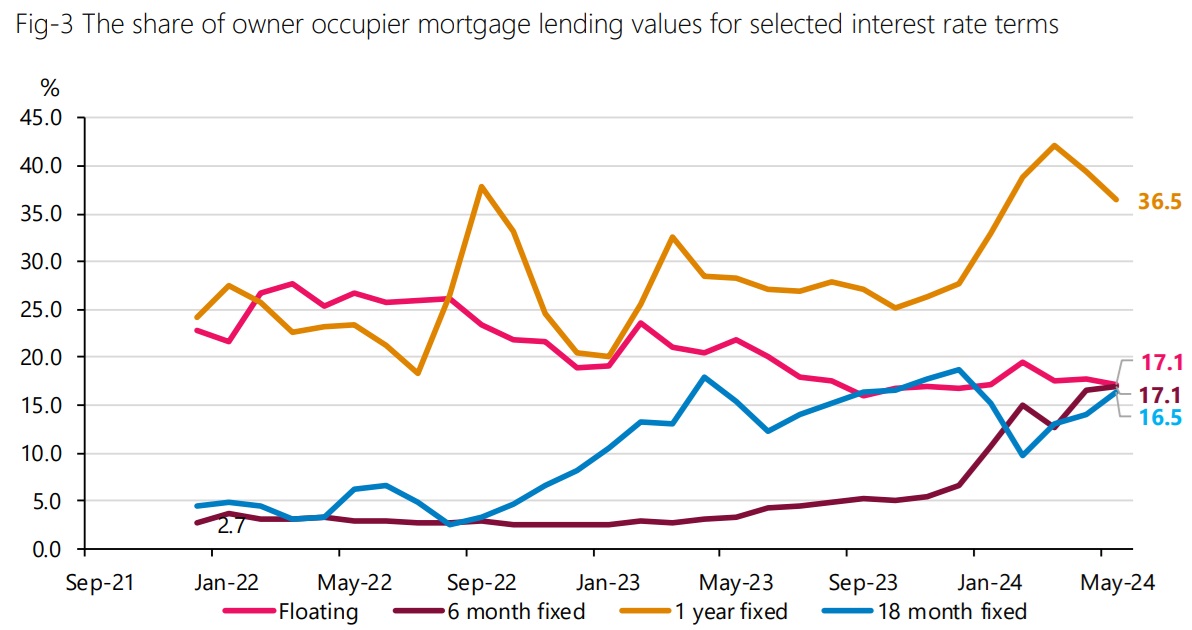

The RBNZ's latest figures outlining the fixed rate term durations of newly uplifted mortgages show that for owner occupiers taking up mortgages in May the share on six-month fixed terms rose to a new historical high of 17.1%. Meanwhile for investors, the figures for six-month fixed terms rose from 18.7% to 21.7%.

It should be immediately stressed that the one-year term remains the most popular. But what is remarkable about the appetite for the six month terms is that it's developed very suddenly. Go back to May 2023 for example and just 3.4% of new owner-occupier mortgages were taken out on six month fixed terms.

As referred to above, the RBNZ introduced the C71 data series, which details mortgages as they are actually drawn down and for what terms they are fixed for last year. It only goes back as far as 2021, but offers interesting insight into what the borrowers are thinking - and also shows to some extent what offers the banks have been pushing at various times.

These are pivotal times for interest rates. With the Reserve Bank (RBNZ) reviewing the Official Cash Rate (OCR) on Wednesday, July 10 and then the Consumers Price Index (CPI) inflation figures for the June quarter being released a week later on July 17, we will soon know more clearly what the chances are for meaningful mortgage rate cuts sooner or later.

The RBNZ of course has been pushing back against speculation of rate cuts soon, with it forecasting that the OCR won't be cut until the second half of NEXT year.

But that's not what the financial markets have been speculating. They've been more than fully pricing in an OCR cut THIS November. In addition the financial markets see about a 50-50 chance the first OCR cut will come in October, while there's now even a better than quarter chance priced in for a first cut as soon as next month.

Little wonder then that particularly since the start of this year and increasingly so in recent months, the mortgage customers have been taking the punt that rate cuts will come sooner rather than later and therefore opting for short term fixed mortgages - even for periods, such as six months, that were previously perennially unfashionable.

At the same time this has meant that longer terms that were 'hot' at one time have become currently unfashionable. However, the marked reductions in take-up of longer duration fixed rate mortgages that we've seen in recent months did tail off somewhat in May - with some of the longer term durations seeing increases. Clearly not everybody's waiting and holding their breaths for imminent OCR cuts.

According to the RBNZ's summary of the latest data, total residential mortgage lending was $7.1 billion in May, up 18.5% from $6 billion in April.

The share of total new residential lending on fixed interest rate terms increased to 82.3%, up from 81.9% in April.

New owner occupier lending increased to $5.2 billion in May.

As stated above, one-year fixed terms continued to be the most popular term of owner occupier lending, accounting for 36.5% of all new lending. But this was down from 39.4% in April. The 18-month term, which was also previously unfashionable, but has enjoyed recent popularity, saw an increase in percentage uptake in May to 16.5% from 14% in April.

The share of owner occupier lending on fixed terms above 18-month fixed terms increased or held steady. For example, the share of two-year fixed increased to 8.8% from 8.6%, and the share of three-year fixed terms increased to 3.1% from 2.8%. Four-year fixed terms held steady and are at a historical low at 0.3%.

New residential investor mortgage lending rose to $1.8 billion in May. one-year fixed terms continue to be the most popular, making up 40.2% of new lending, though down from 45.0% in April24.

The share of 18-month term increased from 8.9% to 11.9% in May, whereas two-year fixed terms declined from 7.8% to 5.9%.

32 Comments

My mortgage (currently at 2.89%) comes up for renewal in August. I am indeed contemplating whether to re-fix for 6 months or 1 year. But I think more importantly, if your mortgage was fixed for 3 years or longer, you can probably get a cash back worth several thousands of $.

I assume that would be for those who fixed for the unfashionable" don't touch it with a bargepole", 5 years at 2.99% in 2021? I mean, why would they? After all some very respected experts were tipping a negative OCR had to come. The same thinking applies today. No one expects the OCR to rise, just as they didn't at 0.25% in 2021. Yet here we are. Singing along to the same song of hope and futility.

What does 5 years fixed give a borrower? Certainty. Not the rate per se, but security of funding. Who know how much lending the banks will be wanting to do in, say, 6 months time. "I'm sorry. But the bank ratios have changed, and we need you to refinance with another lender and repay us" etc. It happens....

Agree. The future is looking extremely volatile.

Nz has some serious local economic and social issues to work through - at the same time the rest of the world is very unstable in every respect.

Not a time I am keen to have debt whatever the rate . I am not sure many serious commentators would wager much on a specific outcome by this time next year

Not a time I am keen to have debt whatever the rate

Debt free is the new drug free, it’s literally life changing.

" After all some very respected experts were tipping a negative OCR had to come."

Indeed they were...unfortunately it cannot work. Makes one wonder why the RBNZ would investigate and require banks to provide for?

Window dressing?

Crazy that no binary commenter here can fathom the option of splitting your mortgage into 5 and fixing for 6, 12, 18, 2 and 5. Do that and sleep like a log knowing you didn’t make the wrong decision.

It’s not one or the other for god sake, there are risk mitigation strategies all over.

That assumes you have a guaranteed life trajectory for the next 5 years....many dont and like some flexibility, even at a cost.

That’s fine and they should factor it into their risk model. But anyone advocating for all in on one term is an idiot.

Then, I'm an idiot who got things right and saved $10's of thousands ! I'm such an idiot that I have been making money off the banks by paying 2.89% to them whilst they have been paying me 5.49% for my term deposit. I'm a happy idiot !

"splitting your mortgage into 5 and fixing for 6, 12, 18, 2 and 5. Do that and sleep like a log knowing you didn’t make the wrong decision."

You will equally know that you didn't make the right decision. It comes down to personality, some are more risk averse, others like to go for the win.

The ones that 'bet' on the 6 month rate during Jan to April have lost that bet, and paid extra for it.

Yep. I fixed at 6.89% for 6.months in April. Was offered 6.85% for the year. I will need rates to come down by 0.1% by October for my call to have been right. Time will tell.

"The ones that 'bet' on the 6 month rate during Jan to April have lost that bet, and paid extra for it"

How so, JC. Can you back up your claim with some numbers ?

Yvil, my partners mortgage comes up in August as well after the 3 years is up and I have told her to lock in the 6 month. Rates will be down by Feb 2025 for sure.

They probably will be down in 6 months, they probably will be down by even more in 1 year.

Not sure what offer you have got, but ASB only had 0.1% difference between 6 and 12 months. 6 months seems the best choice to me, otherwise the 18 month which is a lot lower. The12 month seems the worst option.

Buying when interest rates are up and driving a hard bargain generally pays off. This is from Barfoots, West Harbour and Hobsonville Branches........

“From a price perspective, June’s trading was positive with the median price at $1,020,000 hovering around where it has been for the previous three months,” said Barfoot & Thompson Director, Stephen Barfoot.

“Compared to the median price for June last year, it was 2.5 percent higher.

“The average sales price was more robust, edging up 4.5 percent over that for May to $1,236,336, which is 12.6 percent ahead of where it was this time last year."

June's median price was $220,000 below the record high of $1,240,000 achieved in November 2021.

Barfoot's average selling price in June was $1,236,336, the highest it has been since December 2021.

The high average price was most likely the result of the high proportion of sales at the top end of the market in June.

"A feature of June's trading was the strength of sales in the top price segments, with 61 or 9% of sales being above $2 million, with 19 of of those sales being above $3 million, Barfoot & Thompson director Stephen Barfoot said.

Barefoot are the most cunning of Spruikers..... but the editors here can see through it

does it go to show that most people are taking information (forecasts) from the same place?

if someone completely new to financing, knew nothing about economics was to take out a loan today, with no advice at all, what period do you think they would fix for?

I know some people that fixed for 5 years last year (i know it made me squirm too).

Its just statistics

The average bloke is not that smart, by definition half are thicker.....

Pretty sure those 5yr fixers will be regretting that pretty soon. Once inflation is well back within target (will be announced by stats NZ in October if not this month), I can’t see how the RBNZ could keep rates so far above neutral.

Rates really are neutral now aren't they ? The halcyon daze of covid never to be seen again.

So you think that the economy, employment, businesses are going fine now, with the current rates ? Com'on, the current rates are very clearly restrictive, not neutral.

"Rates really are neutral now aren't they ? "

No. They are not.

The RBNZ says the OCR has been 2.5% to 2.25% above their neutral OCR rate since they lifted the OCR to 5.5% over a year ago.

The contraction in the economy confirms this beyond doubt.

Today is not the day to take out a loan. The fall is accelerating right now. Wait 3 months, then fix for 6 months or a year at most. Or a combination of that.

Yeah cos rates are so high... Actually they are not. We are in the lower end of normal. Here is a link to the last 50 yrs. So, to bet the farm and risk it all on further central bank debt supression....or not.

Your comment is right but also very miss leading. If you look at the total debt in the system now i would bet that interest rates are the highest they have ever been or close to it. The interest rate is always relative to the debt in the system.

Also correct, but I think that just shows what a dangerous situation we have put ourselves in.

Rock is going to meet hard place, one way or the other.

Interest rates are nowhere even near the highest they've ever been. Back in the '80's mortgage rates got to 25% and some got even higher.

This current period will prove to be one of life's great opportunities in real estate.

True but I think rates will drop into the 6% range within 12 months. This will be the new normal for a long time to try and get some market stability.

I would suggest the correlation on the interest rates and volume of debt is more to do with global banking interests keeping the host "just" stays alive as it extracts the maximum profit.. They have over done supporting over cooked leverage post GFC, hence low rates by whoever is pulling the strings at the Fed. Lets remember, banks does not put a gun to your head and demand you sign. They do demand you acknowledge you were advised to get legal advise on your responsibilities under their loan contract.

All fluffy unicorns and rainbows during periods of positive leverage, but very very unpleasant during negative leverage.

The average rent around Auckland seems to be about $800/week...... $41,600 p.a....and that's after tax.

I'd much sooner be paying that off a mortgage than giving it to a landlord. Especially, given that now isn't a bad time to drive a hard bargain and take a punt.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.