Credit arrears hit a seven-year high in January and were up 9.6% year-on-year, according to credit bureau Centrix.

The arrears are at the highest level since February 2017.

Centrix managing director Keith McLaughlin said in the company's latest monthly Credit Indicator that the rise in credit arrears reflected seasonality following the festive season and summer holiday break.

"There are 480,000 consumers across the country in arrears," he said.

McLaughlin also noted that the percentage of mortgages in arrears climbed to 1.47% in January 2024, up from 1.40% in December and reaching the highest level reported since pre-Covid.

This equates to over 21,800 mortgage accounts past due, up 16% year-on-year.

Separately, Reserve Bank (RBNZ) figures for January released last week showed that the amount of non-performing mortgages had risen by over 10% in the month.

McLaughlin said the percentage of vehicle loans in arrears also climbed - to 6.0% in January, up 5.0% year-on-year. Credit card arrears also rose to 4.9% - "although this remains low compared to historical levels".

"Interestingly, telco/communications arrears have reached a new high of 11.7% as households fall behind on these account repayments. Personal loans and Buy Now Pay Later arrears also climbed to 9.9% and 9.0% respectively," he said.

Kiwi businesses saw defaults and liquidations climb overall in January 2024, with retail trade seeing the biggest number of liquidations followed by construction, hospitality and transport. Overall business defaults were up 28% year-on-year in January 2024, while company liquidations were up 16% over the same period.

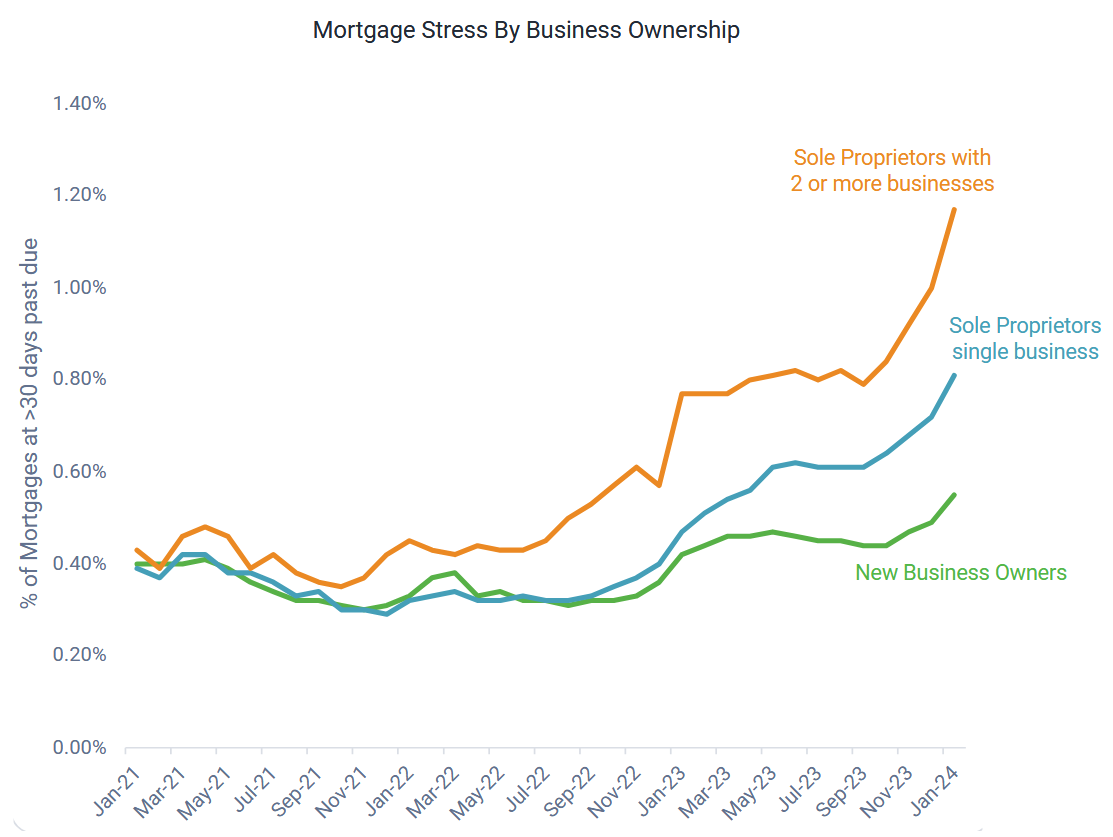

"We’ve also observed an upswing in mortgage stress for a sole proprietor [of a business], with many needing to leverage their home equity to continue funding their businesses – a concerning trend that could spell trouble for these owners in the long term.

"It’s clear the cost-of-living is continuing to impact Kiwi households and businesses across the country."

McLaughlin said the financial strain "skews towards the younger demographics".

"Those under 25 years old are more prone to cash flow problems due to likely lower incomes, limited savings and less financial experience.

"We are now starting to see the squeeze flow onto 30-40 year olds, who are likely more financially stable but have perhaps used their buffers."

McLaughlin said that alongside climbing arrears, demand for credit was also up in February 2024. This was driven by increased interest in credit cards and Buy Now Pay Later products.

There was also an uptick in mortgage enquiries, which could point towards a warming of the real estate market in 2024.

43 Comments

It's been boiling away for the past year, the pressure has now started to seep through.. not too long before there is an implosion..

Hard to argue against that prediction if monetary policy stays the same.

This is info the Banks and REAs do not want disclosed!

-Their rampant greed over the last 6 years is coming home to roost and many will be liquidated as a result........for the people, it will be a crash landing in flames.

We will have 25,000+ delinquent mortgages later in 2024.....

The banks giving out rope "extend and pretend" will end soon, as the reel is fully spooled.

-Their rampant greed over the last 6 years is coming home to roost...

Wrong. Banks creating credit to speculate on house prices has been going on for waaayyy longer than 6 years. More like 30 years. The sheeple have been led to believe that banks have just been acting as financial intermediaries. They don't understand that this has been pure expansion of the money supply.

Exactly, everyone should be familiar with this chart, set it to maximum and there is your exact reason why house prices double every 10 years.

https://tradingeconomics.com/new-zealand/money-supply-m3#:~:text=Money%…

Due to globalisation and .the shifting of global manufacturing to China, we have got away with this without significant inflation or a collapse in the USD for close to 40 years.

Those days are gone, never to return.

Agree since the 1980s houses have been outpacing average earnings. It could not go on..... but it did for 40 years until 2021.

Then from 2012 this had housing even further disconnect from average earnings and again from the last 6 years, it went up another gear.

It could not go on..... but it did for 40 years until 2021.

Go to max:

New Zealand Residential Average Sale Price (tradingeconomics.com)

So detached from average household earnings and rental earnings.

This Market had been bid up into the sky........now there is daylight under it and its collapsing. Like the Roadrunner birdie running in the air.....

It's in the most epic reset of our lifetimes now, much larger drops are due in 2024-2026. These crashes take on average - 6 years to hit bottom....

Banks continue to protect their loan books by ongoing extend and pretend on delinquent mortgages. Circa 480000 if news is correct. Banks must indeed be scared witless, scared of the ponzi unraveling. Key moving on may be a big sign.

Time for those holding their shares time to exit me thinks.

Banks must indeed be scared witless, scared of the ponzi unraveling

Everybody should be scared. You're part of the collateral damage, whether you protested or not.

Given recent prifits they could easily heavilg discount loan rates for many people, even if only temporarily. Moral hazart.. yeah nah just facing the reality that they've crated to many currency units.

2024 and into 2025 is going to see the real pressure come on people. Many have been trying to keep their heads above water while dealing with these higher rates and the higher cost of living. Many using their savings to stay afloat.

With the last chunk of mortgage holders refixing into higher rates this year, interest rate lag effect kicking in for the current refixed higher rate borrowers, higher cost of living, dwindling savings and increases in unemployment, the worst is yet to come for the NZ economy.

Lots of geopolitical risks as well which could impact NZ which we need to keep an eye on. It really is a volatile environment out there. These tough periods won't last forever though but we are in for a bumpy ride ahead.

DOOM

Ha ha not doom but the reality of the current economic and geopolitical situation we are facing. Its not the end of the world. Just another volatile period in history.

Not doom. More return to reality after extended drunken debt bender.

More return to reality after extended drunken debt bender

Has this 'reality' existed in your lifetime? When?

Sure. 1987 Share market collapse, Asian Crisis 1997, Dot Com bust, GFC. To young to remember Wall Street Crash 1929. Interesting all completely underpinned by excessive debt not supported by income. Sound familiar....

I see. Periods of crisis are the 'reality'.

Periods of actions and consequences vs. state protection and bailout of "investments".

Reality from the stupidy of excessive debt crushing society. Inflation in range is fine. Everyone expects it. It's capital gain leverage chasers that bring the resets buy overdoing it due to greed.

We are way past due for one.

Yes given the leverage and excesses.....much more excessive in NZ, than the epic Japanese rise in real estate excesses of the 1980/90s (and they had 100m living there, in much the same size of NZ)

Our crash requires a much bigger drop.......

Probably there are a lot of people who over-extended themselves and bought into a lifestyle they couldn't afford to keep up. Remember that during covid there was often a belief that the world that many of these new trends would be permanent, whether they be economic or lifestyle ones.

Anyone want a cheap boat, EV, campervan, Ranger?

Oh no, Ford Ranger drivers are going to be driving even more angrily than they currently do. The n in Ranger always seems redundant.

"Those under 25 years old are more prone to cash flow problems due to likely lower incomes, limited savings and less financial experience.

"We are now starting to see the squeeze flow onto 30-40 year olds, who are likely more financially stable but have perhaps used their buffers."

The financial stress by age group is pretty stark.

Arguably those that had more opportunity to take advantage of long term asset price increases and purchase them at lower DTI's, and when more resources were available and hence cheaper in relative terms, have far more equity to borrow against and hence less financial stress if interest rates rise. This leaves younger business owners whom many will have borrowed against their family home to fund their business, far more prone to financial stress as it is more likely that family home was a higher relative DTI than those in older age brackets who did the same thing.

Just like those who worked thru the dot com crash and the GFC. #cycles

Slowly, then all of a sudden.....

HiGhEr For LonGer - durr

Why are you slurring?

Before people get carried away in a doom loop, step back and consider the role of the RBNZ.

The RBNZ remit is to ensure financial stability.

At present the OCR is contractionary at 5.5%.

Inflation over the last two quarters (3?) has been within the 1-3% range.

The RBNZ considers a neutral OCR to be about 2.75%.

That means the RBNZ can cut between 2.75% (to neutral) and 3.0% (slightly stimulatory) and suddenly everything changes. Note I said "changes". I am not suggesting it would change for the better.

The time for OCR cuts was last November. Last week would have been good too. April will be too late, as will May. Had the RBNZ done two cuts of 0.25% further damage could have been minimized while 0.5% below current retail mortgage rates (~7.0%) isn't enough to start another property frenzy.

Sensible comment. It seems like the RBNZ have become allergic to making meaningful changes since the disastrous over lowering of interest rates during the pandemic.

RBNZ seems to be signaling. First a message to the banks to consider their margins. Then a plea to Stats NZ to get the CPI data out faster and more accurately. The beating drums are so loud now they can be heard from inside the top floors of the RBNZ. Just waiting on an excuse to cut now. With a pile of forex cash on standby to stop the dollar falling too hard when they do.

My thinking also. And the world has realised the ineptitude of the RBNZ so there will be vultures circling to short the dollar, putting more pressure for them to be tight lipped on signalling a drop in the OCR.

Like I said - a 0.25% cut in November 2023 was the time to do it.

The vultures would have taken little or no interest as further cutting could have been spread over a much longer period - and would most likely have come at uneven and less predictable intervals - thereby eliminating the potential of the 'short squeeze'. With every MPS since passing without a cut just lines up more vultures waiting for the inevitable larger cuts. The RBNZ's MPC needs to get some real currency traders to help them. Economists think long term. Traders think in the near, and very near, term.

"Inflation over the last two quarters (3?) has been within the 1-3% range."

Completely wrong. The two quarter and three quarter averages are both well over 4 percent annualised. Please correct your comment.

Q2 2023 1.1% Q3 2023 1.8 % Q4 2023 0.5%. If Q1 2024 comes in at near Q4 2023 then we will be under 4% easily.

I will not correct it. It is 100% accurate.

I said quarters. You introduced annualized.

Is the RBNZ's inflation target 1-3% annual inflation, or quarterly?

Is the RBNZ's job to look backwards all the time and only adjust policy settings when targets have been met? No.

They're allowed to make predictions and set monetary accordingly. It a crying shame they use models that are overly influenced by the past.

It wold have helped mortgage holders re fixing in that period but its too late now, either RBNZand Politicians know nothing and understand less or its a deliberate strategy, I think the latter and recollect Marie Antoinettes end - history does repeat.

If you think there will be a soft landing at this stage you have rocks in your head.

Yep. The spec crowd has overloaded the economy trying to exploit its need for shelter. The economy cannot bear the weight of their debt and greed, and you have what is unfolding.

The bigger the party, the bigger the hangover.

Keep hearing rumours of some big spec builders about to topple.....

There are some awful dog boxes around for sale. I feel sorry for those that already bought - they will get a caning too.....

The bad data continues to flow through but let's just keep focusing on non tradable inflation. It's all that matters.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.