Some Kiwi households and businesses are "walking an economic tightrope", according to credit bureau Centrix.

In the firm's latest monthly Credit Indicator Report, Centrix managing director Keith McLaughlin said since the start of this year "we’ve seen a degree of uncertainty and yo-yoing across a number of our credit indicators".

"But the clear takeaway is arrears are rising."

He said in the latest month overall consumer arrears exceeded levels last seen in 2019 for the first time with 11.7% of the active credit population behind on repayments.

"This includes double digit arrears for both unsecured personal loans (10%) and Buy Now Pay Later accounts (10.4%) as people continue to feel the pinch of the current economic climate.

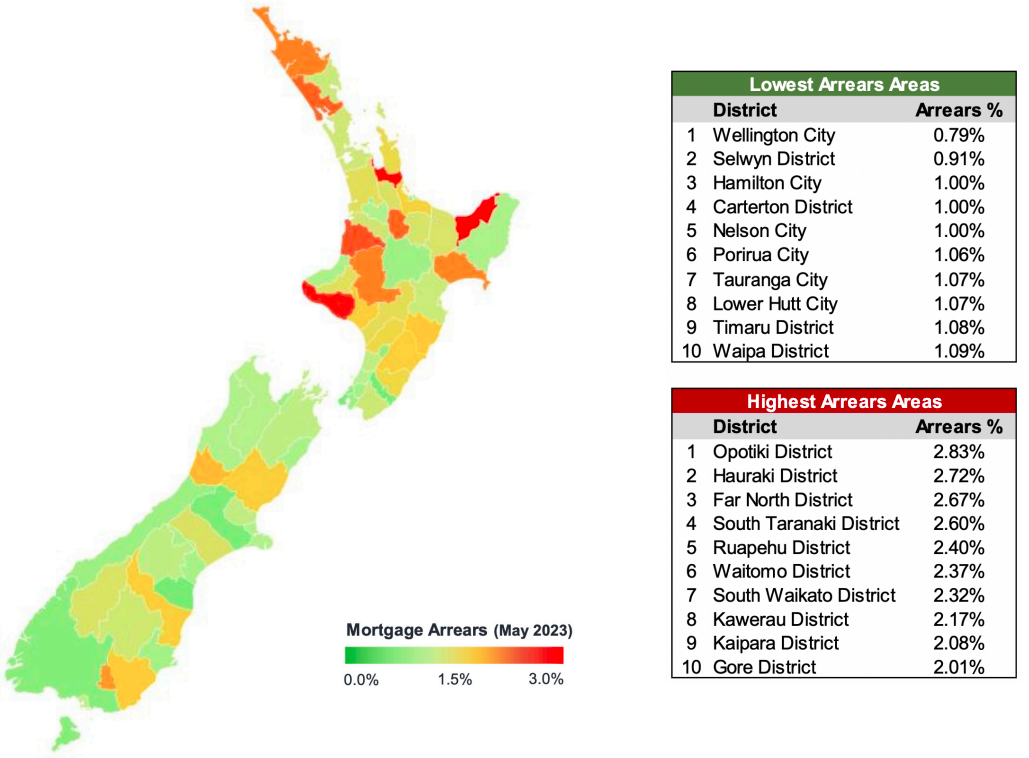

"Furthermore, mortgage delinquencies rose to 1.32% - the highest level reported since March 2020 with 19,500 mortgage accounts reported past due."

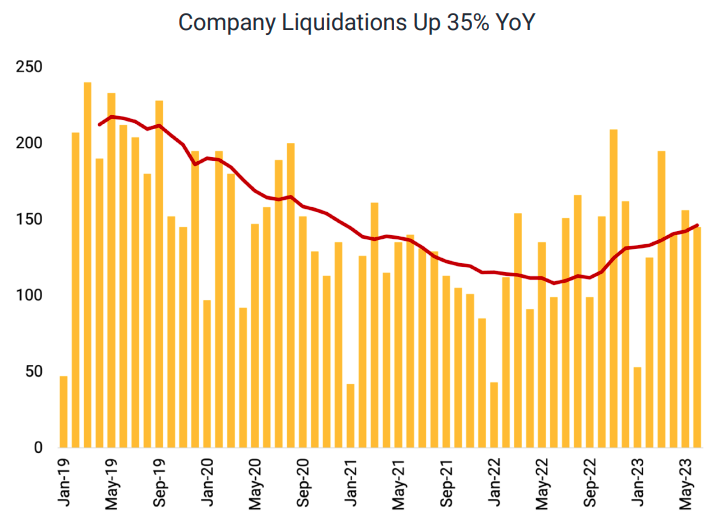

In terms of the business sector, McLaughlin said a climb in credit defaults was seen across several sectors, including the property/rental industry, hospitality, retail trade and construction. Overall company liquidations were also up 35% year-on-year.

"There’s no question some Kiwi households and businesses are walking an economic tightrope," McLaughlin said.

"While homeowners contend with rising mortgage interest rates and the financial squeeze, business owners are grappling with downturned activity and spending."

McLaughlin said "it’s no secret" a recession was the Reserve Bank’s goal to help curb spending.

"What remains to be seen is how the rest of 2023 plays out for consumers and businesses on the front line."

And he had some advice:

"Falling behind on repayments now can cause headaches in the long term for both consumers and businesses alike. Credit checking potential customers and suppliers, for example, can help reduce the possibility of accruing bad debt. And if you’re at risk of falling behind on repayments, speak with your creditors to come to an agreement to avoid becoming considered a lending risk in the future."

In terms of some of the detailed figures referred to above, Centrix says consumer arrears rose to 11.7% of the active credit population in May – up from 11.3% in April 2023 and marking a return to pre-pandemic levels. Arrears in May 2023 were up 4% year-on-year with the number of people behind on repayments rising to 426,000. This is up 15,000 month-on-month (411,000 in April 2023).

Looking to home loan arrears, mortgage delinquencies rose to 1.32% - the highest level reported since March 2020. There are 19,500 mortgage accounts past due, which is up 34% on a year-on-year basis, as more consumers face the challenges of rising interest rates and the current economic climate. The highest mortgage arrears were recorded in the Opotiki district (2.83%), followed by the Hauraki district (2.72%) and the Far North district (2.67%).

Business credit demand remains up 3% year-on-year in June 2023, improving for the transport, financial and support services sectors. However, credit defaults increased almost universally as the property/rental industry saw defaults up 22% year-on-year. Additionally, both hospitality and retail trade saw credit defaults up 17% year-on-year, and 16% year-on-year for construction.

"It is Important to note that a credit default is a lag indicator – the arrears position occurs several months prior to a default being lodged. Furthermore, company liquidations are up 35% year-on-year," Centrix says.

70 Comments

Expect higher and higher numbers of credit defaults related to business, RESIDENTIAL and commercial propriety, as the biggest and most dangerous credit fueled asset boom IN MODERN HISTORY goes completely tiitsup and busts in the most spectacular fashion.

It's obvious this path that was laid.

Those who have not deleveraged by now??? ....... will be jamming the exits, and Crashing (further) any "Debt Fueled" asset prices in 2023 - 2027.

It's as clear as clean air!

Not surprising. I know a lot of SME owners here whose businesses and their own mindset are under varying states of distress.

Teetering would be a good word to use.

Some will fall over and some will survive - just.

So what should a company do during these very tough times to survive?

Sell the property.

malamah, I was asking what a business should do, in reply to HM's post "I know a lot of SME owners here whose businesses and their own mindset are under varying states of distress"

Nothing to do with property. So what should a business do ?

If it was your business, what would you do?

Anecdotally it seems many restaurants and cafes are closing up at the end of their leases with high staff costs and the looming recession. Seems the smart option unless they have confidence they will last another multi year lease

I think thats the only logical choice, folks wont pay $40 for eggs benedict regardless of the fixed costs of the Cafe. Do commercial leases even dip much in recession? $1000 a week or so for a tiny cafe with 4 tables or so must be difficult and rely on takeaway coffee/food.

It is my business and I know exactly what I'm doing in these tougher times to keep sales up, I was actually curious as to what other people wold suggest. What would you suggest CN ?

I've done alright, no debt... no problems

Juzz - And that good planing is something boomers and those who listened and acted understood but few youngsters listened and will now prove they were young enough to know everything and will shortly discover they understood nothing.

My mistake - I had assumed owning an investment property was a business.

I know, there are so many assumptions on these threads, chief of which is that everything is about property.

Based on the number of businesses financed against property I'd say it's pretty closely related

I own an SME, import wholesale. We are down 30% in sales, lease has just been renewed, 30% increase. I keep all staff at above inflation pay rises. Personally I have no debt, so no great need to extract excessive cash out of the business. We are maybe one of the lucky ones, still showing a profit. We are sitting on a pile of stock, southward management of this is our lifeline.

NZ albeit the world

Never recovered from the lockdowns which were completely unnecessary

For a virus that has never been proven to exist

You’ve really got to be a special kind of stupid to believe this.

I can see the other side of the coin, plenty of people never caught it or else showed zero symptoms. You could be left thinking that Covid has wasted years of your life and 3 years later there are still restrictions in place. Its time to forget about it and move on. There are other viruses still killing millions more people and nobody even mentions them anymore. We have turned into a fear driven woke society.

Does anyone else think this guy is the sin-binned Carlos67? What say you Zwifter?

I would recommend using a shower cap under their tinfoil hats. Apparently Aluminium Oxide is carcinogenic.

Probably is, that's why they stopped making frying pans and pots out of Aluminium. If you didn't move to stainless steel decades ago.......

Big fan of my carbon steel pan

Mixing carbon with iron makes steel, fwiw you cant have steel without carbon. Carbon makes steel hard, high carbon steels are hard and brittle. Cast iron is just high carbon composition steel.

Yeah I am aware but thats what they're generally called. Probably to distinguish it from Stainless steel pans and cast iron. E.g carbon steel wok, carbon steel baking pan etc.

Carbon-steel cookware can be rolled or hammered into relatively thin sheets of dense material, which provides robust strength and improved heat distribution. Carbon steel accommodates high, dry heat for such operations as dry searing. Carbon steel does not conduct heat efficiently, but this may be an advantage for larger vessels, such as woks and paella pans, where one portion of the pan is intentionally kept at a different temperature than the rest. Like cast iron, carbon steel must be seasoned before use, usually by rubbing a fat or oil on the cooking surface and heating the cookware on the stovetop or in the oven. With proper use and care, seasoning oils polymerize on carbon steel to form a low-tack surface, well-suited to browning, Maillard reactions and easy release of fried foods. Carbon steel will easily rust if not seasoned and should be stored seasoned to avoid rusting. Carbon steel is traditionally used for crêpe and fry pans, as well as woks.

Aluminium is a neurotoxin. Might explain some of the delusional comments, although it seems your shower cap advice may have arrived too late?https://www.technologynetworks.com/neuroscience/news/aluminum-exposure-…

We have turned into a fear driven woke society.

Agreed, and for those who lost their jobs and in some instances houses due to the mandates, there is a level of anger that could be understood there entirely given the waste of time and govt money that ongoing COVID vaccines are, as well as vaccine related injuries that have ruined some peoples lives. Personally I know two people with confirmed heart conditions as a result and if you saw them and the lack of life they can live as a result, you'd understand the anger in every way. Just like vendors unrealistic expectations in housing currently, reality doesn't change just because one chooses not to see it.

But I digress, we have a govt which throws money at everything and thinks it magically whisks up results. The level of culpability is irrefutable for Labour, time for a new direction with new ideas and a cultural shift in NZ to the betterment of all and not the betterment of housing speculators :-)

Really want to know how they gene sequenced something that doesn't exist.... I've watched all the CSI type shows, and even for them that'd be a stretch.

Almost a haiku

Syllables gone astray, friend

Count them, if you can

Retribution and Revenge arrives Oct 2023.

DEBT... DEBT...DEBT... something that lost its meaning and people indulged in it, without understanding the repercussions...it's now starting to bite them.. but there is no where to hide

Poor financial decision making has been actively encouraged by banks, governments and spruikers for a long time now, to the point where a lot of people thought they were in fact being financially intelligent by loading up on 'cheap debt', leveraging up on 'paper wealth' and spending money the don't have on things they don't need. These people have been walking the tightrope for some time, however it's only now they are starting to realise they are not wearing a harness and the wind is starting to blow.

They'll have you know that it's the Government fault for taking away the ability to deduct a huge expense that is mortgage interest debt, as it's a genuine business expense.

If only it was, an ACTUAL, PRODUCTIVE business.......

True. Someone who derives income from a Rental Property has never really been defined as a business by IRD. They're an individual, just like if someone makes money out of shares they're not a business either. They derive an income FROM business i.e. commercial activity, but they're not A business.

Individual -> Customers not registered for GST or PAYE and not belonging to large enterprises (LE) or non-profit organisations (NPO).

- This includes individual customers receiving income from business (eg, rental property, shares) but not registered for GST or PAYE.

Do you remember Venn diagrams and sets from school Nzdan? Because you've conveniently chosen the wrong subset to suit your narrative.

Yeah I remember Venn diagrams. Prior to mortgage interest deductibility changes you would have 3 equally overlapping circles. In the middle would be borrowing costs.

- Individual - Shares

- Individual - Property

- Business - Expenses

However, the Government correctly identified that an Individual borrowing to invest in existing property is not investing in businesses. So they effectively renamed one of the circles to "Individual - New Property", which keeps builders employed producing houses etc.

In your original statement you forgot all the properties that are owned by LLCs and Trusts, which are clearly not individuals.

Have we all become debt junkies unable to operate without the fix. Just the way the banks want it and their profits underline that.

There has been no major penalties for excessive debt for decades, with central banks bailing out the speculative via lower and lower rates and printing. Aka rather than exiting the drug we have injected ourselves and the economy like mindless junkies unable to stop.

Musics stopping, its time to go cold turkey, how many addicts are to far gone to survive...?

The reality is many need debt just to get by to purchase neccesaties for their family...

And the volume of those people defaulting eclipses property owners.

Yet they're total ignored by moral crusaders.

An investor puts money they own somewhere to earn off it.

Somebody who borrows money to put it somewhere to earn off it is not an investor.

I expected the liquidations chart to have more or an uptick in 2023. Looks like it just normalising to pre-Covid levels.

Lots of Chicken Little comments above. While I get the sentiment, unemployment needs to come through first.

Or a mortgage re-fixes at a vastly higher rate. The thump can occur for many reasons. Being un-employed can be both a cause and a result.

This would have been the case already come 2009 if the western world didn't undertake QE to print their way out of it. Like having another beer at 5am, it only prolongs the pain and makes it worse down the road, and here we are, with the economic hangover steadily kicking in. Watch carefully on how Blackrock advise to get out of this one, as they were the main drivers of influence for the QE of the GFC and you can bet they'll be advising now on what benefits them and their shareholders most.

In a Investors Facebook page 2 days ago.

Question: Does anybody know if at the age of 50, whether any banks would give a mortgage for an investment property to an individual?

We purchased 4 rental properties in our late 50's borrowing 100%. Were given 30 year loans so yes they do. About 3 years ago.

I hope they're okay.

Sounds like a BS story to be fair, banks have been clamping down on interest only mortgages over the past decade.

Unless they have huge amounts of equity and really high incomes.

Then again you read it on Facebook so it couldn't be a lie.

Nothing in there says interest only. To me, it sounds like they had plenty of equity, maybe a freehold house who knows? Hence 100% borrowing.

But you're right, just like on this website, it's the internet. I could say I'm Chuck Norris and you'll have to take my word for it.

If someone makes a claim the burden of proof is on them to substantiate it if they want people to take their word for it.

Okay okay we get it dude. I was sharing an anecdote like people frequently do on this site, no need to drill down much further than that.

I can give you the Facebook link to the author if you like, then you can report back once you have proof of their claim.

Ah yes, the highly enlightening and not at all weird tendency to scour other message outlets for snippets on property investors to share with the group.

Don't spend a lot of time on FB so I'll join your imagination about the demise of these people * wrings hands *

Okay, so when people use Facebook the "newsfeed" displays posts from groups/pages they have "liked" or "followed". No need for the individual to scour groups for misery porn.

Not imagining any demises per se, but 100% lending for 4 rental properties in someone's late 50's I thought was an interesting anecdote to share and could be risky lending. Maybe they have a household income of $1m who knows?

Why are you investing so much time breaking down what was a simple anecdote? Did I upset you in a previous article or something? You seem so tightly wound up.

Chuck Norris can still get a 125 percent mortgage on a $2-million rental portfolio without providing proof of earnings.

Chuck Norris is exempt from healthy homes legislation, his rental properties maintain a 21 degree temperature & 50% relative humidity all year round without a primary heating source, insulation or extractor fans.

When banks lend to Chuck Norris, he charges them interest

Chuck Norris is the Prophet

Your positions aren't mutually exclusive.

I know people who fit that narrative - had large equity positions from selling out of Auckland, own their own home outright, weren't required to put down a deposit for their far-flung rentals, in their 50s. but that was 8-9 years ago.

They will have income and or equity to support the loan. On the face of it someone with neither would not qualify, even for a single house loan.

"On the face of it someone with neither would not qualify, even for a single house loan."

Likely see more cases of mortgage fraud coming to light.

NZ Dan, why do you read Property Investors pages on FB ?

I clicked "like" on a couple of pages about 3 years ago, when I was considering buying a rental. I also signed up to PropertyTalk forums.

But I never went ahead. Those pages still show up on my news feed.

To better understand the property investment market?

"We purchased 4 rental properties in our late 50's borrowing 100%. "

Will these multi-property owners be unable to hold on?

How many multi-property owners will be unable to hold on?

Both graphs show that Consumer Arrear Trends and Company liquidations were at their lowest over the Covid period, meaning more importantly over the lockdown periods, which sounds crazy. This is simply evidence that both fiscal and monetary support policies were much too high. In other words, the money paid out by the government and the reduction of the OCR and large QE by the RBNZ, were far in excess of what was needed to neutralise the losses caused by the lockdowns.

100% Agree.

The governmint did what a government must. Why the RBNZ got involved was idiotically and mind-numbingly stupid! It beggars believe.

"There are 19,500 mortgage accounts past due"

Key question: how many of these house owners will be unable to hold on?

Don't think that many leveraged property buyers of 2020-2021 anticipated this potential outcome.

Remember those property promoters with their vested financial self interest? Well they did what they needed to do to get financially compensated, and are now working on their next commission payment, whilst leaving a trail of collateral damage (many will be owner occupiers who have their future financial security at risk - e.g leveraged owner occupier buyers with little time left in their working lives). Some of these leveraged house owners may be forced to sell (& lose their entire equity deposit saved over their lifetime, as they may be in negative equity), some may need social housing - these families may be facing not only cashflow stress, but also mental stress.

The banks will know.

But they'll not tell anyone to preserve the status quo. "Look over there - A unicorn." Any distraction suites the banks and we have an election coming up to do it.

Anyone feeling stress can clearly blame the face in the mirror. The pandemic driven 0-2% debt could not continue long term, and probably should never have occurred.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.