Westpac has raised most of its key fixed home loan rates today (Friday), following on from BNZ's rate rises Thursday.

And Heartland Bank has chimed in this week with some fixed rate reductions.

These come despite little recent change in wholesale swap rate levels at the short end, and no recent changes in term deposit offer rates.

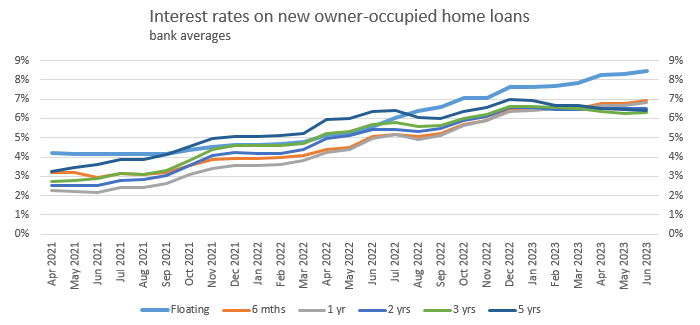

Home loan interest rates have been rising since the Reserve Bank (RBNZ) started to raise its benchmark Official Cash Rate (OCR) in October 2021. And floating rates have pretty much followed that.

On fixed rates, banks have fallen into a habit of making much smaller changes but more frequently, and this has the 'advantage' of keeping them a low target.

So it is worthwhile to take a look at how carded mortgage rate offers have changed over this period. We are in a low-activity period in our housing cycle with unusually low transaction volumes and a once-in-a-generation event (or once in two generations?) of falling house prices.

What we have ended up with is a very narrow rate curve with rates for most terms bunched together, and in fact with some of the longer rates lower than the shorter ones.

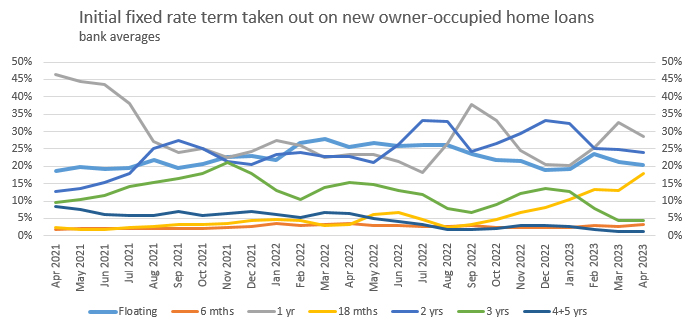

But we have also recently had a data drop from the RBNZ that allows us a new perspective on how new borrowers focus on the fixed terms they choose. There is more variability here than you might expect.

Surprising (to me at least) is now much floating rate commitments still feature for new borrowers. This is still the most expensive mortgage rate you can have, and with each OCR change it kicks in quickly. But in April 2023, more than 20% of all these new mortgages were put on this rate. And it is not as though this is a changing proportion. When the RBNZ data starts in April 2021, it was 19%.

In April 2021, almost half of all new mortgages went on a one year fixed rate. Back then the average bank rate was 2.25%. The popularity of the one year fixed term fell from there but by April 2023 it is still taken up by 30% of borrowers. The average bank rate rose to 6.65%. And this is when the average three year rate is lower at 6.35%.

However, the really big movers have been the rise in popularity of the two year rate, from about 13% of all loans then to about a quarter now. The 18 month term rose from 2% then to 18% now. Giving up share has been the longer rates. The volumes in the four and five year fixed terms has never been material, but the three year fixed term garnered 10% in April 2021, and held that for some time, even rising slightly. But recently it has dropped in popularity with a thud, now down to under 5% in April 2023.

Currently, the Co-operative Bank has the most competitive six month fixed rate.

(Update: Earlier versions listed the lowest rates incorrectly. This version is now corrected.)

For one to three years fixed it is now Heartland Bank that has the lowest rates on offer.

Few people take out four and five year fixed rates so these comparisons make little impact, but for the record it is ICBC and Westpac with the current lowest.

For the popular one year fixed rate you give up only six basis points (bps) by taking a Kiwibank carded offer, but almost 50 bps by taking the ASB carded offer.

For the increasingly popular 18 month fixed offers, the lowest is 30 bps from the best main bank carded rate.

For two years fixed, going with the 'best' main banks, ANZ and BNZ, will mean their carded rates are 29 bps higher than Heartland Bank.

Obviously you should negotiate and shop around. Most banks will discount their carded rates if you have strong financials. You shouldn't need them but if you are uncomfortable negotiating, a broker can often be helpful. But be aware some brokers won't offer you the best over the whole market, only the banks they have approved connections to in their "lending panel". And clearly bank mobile managers are there to pitch their company's product.

One useful way to make sense of the changed home loan rates is to use our full-function mortgage calculator which is also below. (Term deposit rates can be assessed using this calculator).

And if you already have a fixed term mortgage that is not up for renewal at this time, our break fee calculator may help you assess your options. But break fees should be minimal in a rising market.

Here is the updated snapshot of the lowest advertised fixed-term mortgage rates on offer from the key retail banks at the moment.

| Fixed, below 80% LVR | 6 mths | 1 yr | 18 mth | 2 yrs | 3 yrs | 4 yrs | 5 yrs |

| as at June 16, 2023 | % | % | % | % | % | % | % |

| ANZ | 6.99 | 6.99 | 6.75 | 6.49 | 6.29 | 7.19 | 7.09 |

|

7.09 | 7.05 | 6.75 | 6.59 | 6.49 | 6.39 | 6.29 |

|

6.99 | 6.99 | 6.75 +0.10 |

6.49 | 6.29 +0.30 |

6.29 +0.10 |

6.29 |

|

6.75 | 6.65 | 6.59 | 6.29 | 6.29 | 6.29 | |

|

7.09 | 6.99 | 6.75 +0.06 |

6.59 +0.14 |

6.29 +0.20 |

6.19 +0.20 |

5.99 |

| Bank of China | 6.59 | 6.49 | 6.39 | 6.29 | 6.19 | 6.09 | |

| China Construction Bank | 6.76 | 6.70 | 6.59 | 6.55 | 6.40 | 6.40 | 6.40 |

| Co-operative Bank [*FHB special] | 6.59 | 6.45* | 6.59 | 6.45 | 6.29 | 6.29 | 6.29 |

| Heartland Bank | 6.40 -0.25 |

6.45 -0.20 |

6.20 -0.15 |

5.95 -0.04 |

|||

| HSBC | 7.09 | ||||||

| ICBC | 6.75 | 6.59 | 6.49 | 6.29 | 6.09 | 6.09 | 6.09 |

|

6.99 +0.20 |

6.99 +0.20 |

6.84 | 6.59 | 6.29 | 6.59 | 6.69 |

|

6.99 | 6.99 | 6.75 | 6.49 | 6.39 | 6.29 | 6.29 |

Fixed mortgage rates

Select chart tabs

Daily swap rates

Select chart tabs

Comprehensive Mortgage Calculator

18 Comments

David is there any data to show how much of that floating are in offset and revolving credit facilities?

Also new builds. You generally don't get to fix until it's finished.

BNZ were unofficially offering 4.99% not that long ago. It seems the banks have decided not to compete at the moment.

I took a punt and fixed long due to prevailing uncertainty as to economic outlook. I fully expect double digit interest rates in the next few years. USA needs to address its beyond trillion dollar debt at some point. The rest of the world will suffer when it does.

USA needs to address its beyond trillion dollar debt at some point

Beyond trillion? Try $32 trillion, or 120% of GDP. And counting.

Completely unsustainable and no plan to address it.

You don't think there will be another financial crisis of some kind that causes them to bust out the old playbook of dropping interest rates and money printing again? Things are looking pretty wobbly...

Doubt they will embark on more QE without lifting taxes to take it back out of the economy when required. Debt based consumption needs to be addressed and the only way to do that is by making it unaffordable to do so,, ie higher interest rates.

That is socially unpalatable. The only way out of this is to print money and devalue the currency.

Fiat currency is guaranteed to devalue over time, it is literally the central banks mandate.

Great article about the debt death spiral:

https://jameslavish.substack.com/p/-whats-a-debt-spiral-and-is-the-us

Despite the fact that 3-5y mortgages are cheaper than all others, people are eating the shorter term mortgages in an assumption of lower interest rates within 3 years. I suspect it tells you more about the condition of the market than we suspect.

Yip… and people would be smart to go shorter at higher rates at the moment.

There is a reason why banks are offering lower rates at longer terms currently and it’s not to save you money.

When the rates went down, the house prices went up real real quick and fast. None of the RE agents complained or their vendors.

Now rates are going up fast but vendors and their RE agents want the same high price or even higher. Dillusional??

Seems every fool expects a greater fool to bail them. Surely we’re close to exhausting the supply.

Pays to shop around with insurance too

I recently procured a property with insurance being arranged through Westpac's underwriters

Who wanted the sellers Insurance company

Information relating to any claims on the property

Policy number

This failed to materialize and after being keel hauled subsequently approached AA

Too make along story short there was a $1000.00 discrepancy between premiums

All done over the phone

No sales pitch here

Just saying

I am moving away some of my insurances from the bank, got a much better deal plus a cash back.

Co-op is raising rates on Monday unfortunately

Last week there was an event which flew a bit under the radar. The lastest Treasury Auction saw the offerings exceeding the ask by a factor 3. (400M asked; 1.2B offered). But the auction yielded rates still 0.25% above the previous auction, some 2 weeks ago. This means financiers of New Zealand Debt see an increasing risk profile and are demanding a higher premium. Our enormous account deficit and this behaviour of the debt financiers will make certain that short term interest rates will stay higher for longer and therefore it wonders me why so many people still stay with short term interest periods.

Descending wedge forming on the 10 and 7 year swap. Good sign. If they break lower then shorter terms should follow.

On a completely different subject ... Changing one's mortgage provider isn't really possible when banks are using 'test rates' way beyond what is reasonable (i.e. far north of 5 year fixed rates). So many are stuck with their existing providers. Unless - they've got huge spare cash flow - in which case I suspect very good rates are got 'off card'. So .... Bugger all competition is evident in NZ's banking sector.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.