This article is a re-post from Fathom Consulting's Thank Fathom its Friday: "A sideways look at economics". It is here with permission

By Joanna Davies*

Spending money to flaunt one’s success is nothing new.

Indeed, the phrase “conspicuous consumption” was coined over one hundred years ago by economist and sociologist Thorstein Veblen.

Nowadays, these overt displays of wealth and exuberance tend to be referred to as ‘peacocking’. Although a term originally coined to describe the act of attracting a mate with tactics to distinguish oneself from the crowd, it’s now used more generally to describe overt, attention-grabbing behaviour.

But the terminology isn’t the only aspect to have changed. With the advance of social media, these ‘displays’ now have a much larger potential audience than in Veblen’s time.

Indeed, whether showcasing a well chiselled set of abs or #livingyourbestlife on a once-in-a-lifetime holiday (every few weeks), the Instagram lifestyle is rife in every part of modern society. There are even websites which detect and advise on the most popular hashtags to use in your post in order to enhance exposure. And while that may massage the ego of the peacock, economic theory suggests that it may come at a cost.

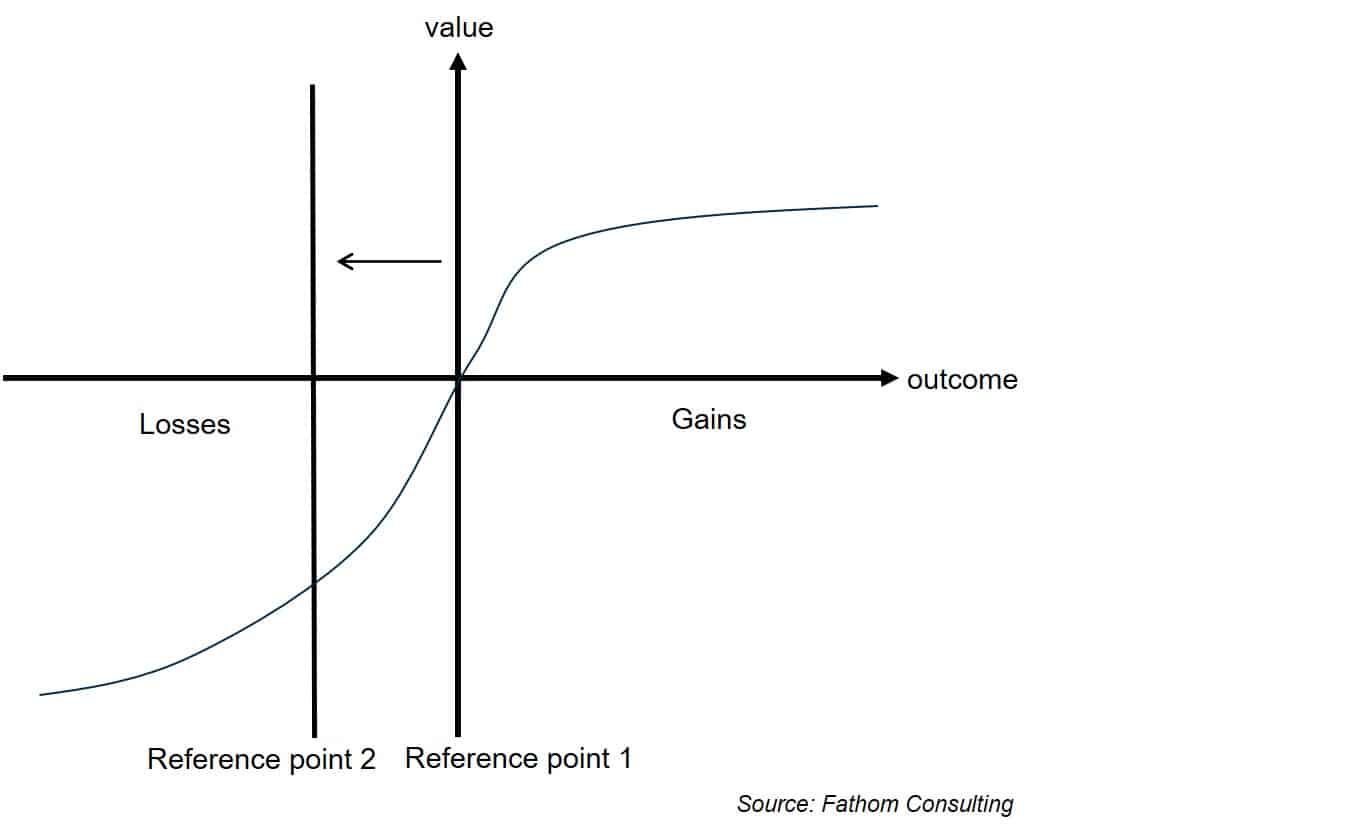

Indeed, according to prospect theory, devised in 1979 by psychologists Daniel Kahneman and Amos Tversky, people think in terms of expected utility, relative to a reference point. In other words, they form decisions based on the potential value of gains and losses, rather than the final outcome. But what if that reference point becomes distorted, with views about our own wealth and wellbeing relative to others undermined by the content of social media platforms? Amongst all the peacocking and ‘fake news’, determining what’s accurate and what isn’t, let alone where we stand within the spectrum, is undeniably difficult.

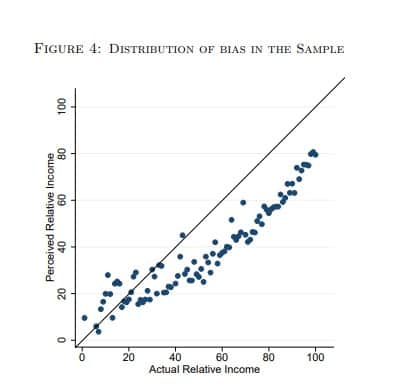

This modern-day challenge is reflected in a chart that is currently doing the rounds on Twitter. Courtesy of a paper authored by Mounir Karadja et al. and published in the Review of Economics and Statistics, the chart reveals that the vast majority of Swedes believe that they are poorer, relative to others, than they actually are. In other words, they underestimate where they sit on the income distribution, with almost 70% misjudging by more than ten percentage points. The study found that this was common across groups, although those that were younger, poorer and less educated proved to be more misinformed, with their expectations further from reality.

Sadly, the authors didn’t test for social media exposure, but they did conduct a second survey. This time, the aim was to ascertain whether those distorted views shape individual policy preferences. To this end, prior to testing, they randomly informed a subsample of the participants of their true relative income position. What they found was that in learning they were richer than they had originally thought, participants’ appetite for redistributive policy waned, bringing me back to where I left off… prospect theory.

According to this theory, people feel the loss of something more keenly than the gain of an equivalent amount, rendering them loss-averse. For example, winning £200 in a pub quiz would feel pretty good, not least because my general knowledge is poor. But if I were subsequently strong-armed into buying the entire pub a round of drinks, costing £100 of my winnings, it would feel like a net loss, even though in reality I remain £100 up. We don’t weight gains and losses linearly, and in that interim period my reference point shifted, just as it did for the Swedish survey participants when they were informed of their true income position.

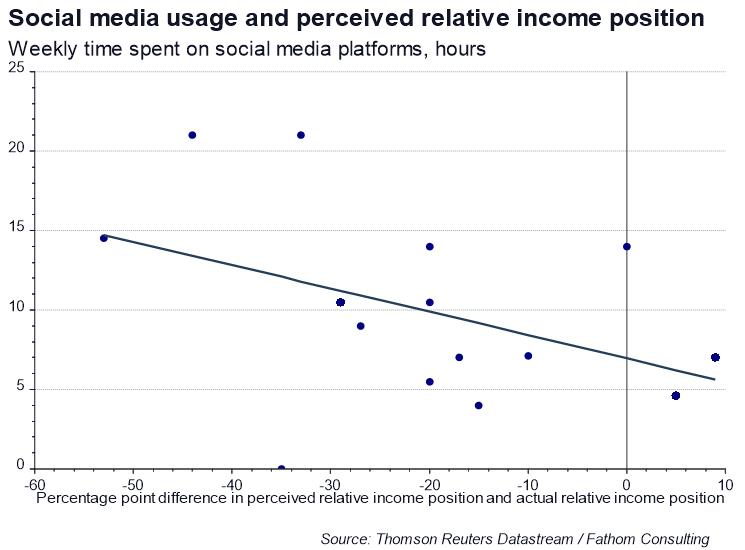

What does this mean in the context of social media? Theory implies that as we are typically loss-averse, fear of failing to ‘keep up with the Joneses’ may make us more willing to take on risk. To the extent that social media, through both giving ‘peacocking’ a global stage and making a lucrative industry out of it,[1] accentuates this sense of falling behind, it may be distorting our reference point.

My own, admittedly small, sample[2] certainly seems to confirm the link between increased time spent on social media and the underestimation of one’s position along the income distribution. This leftward shift as we underestimate our relative position, in this case in terms of wealth, but it could also apply to popularity, relationship success, career satisfaction etc., is illustrated in the chart above. Here, where theory suggests losses are felt more keenly and greater risk is taken, we might find the explanation for enigmas like the global credit binge and the negative impact of social media on mental health!

[1] Think the Kardashians and numerous other celebrity influencers on social media.

[2] If you want to test your own perception, try the OECD’s Compare your income tool.

Jonanna Davies is an economist at Fathom Consulting in London, England. This article is a re-post from Fathom Consulting's Thank Fathom its Friday: "A sideways look at economics". It is here with permission

8 Comments

This chap took things a little too far. Or maybe it was worth it?

Wallace Te Ahuru was not afraid to flaunt his extravagant lifestyle on social media. >

https://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=12168561

He got off fairly lightly considering. Probably will only serve about 20 months in jail.

What is ignored is whether there is any recoveries, re-compense, repayments, or fines, or if he simply went bankrupt

What interesting and original thinking. ...... their "appetite for redistributive policy waned"

The social media part is huge when comparing life styles. My wife often shows me a picture of friends taking a ski holiday and says “ why does everyone get to do this and not us “ as if to blame me not our agreed financial decisions . I say “ not everyone else is, out of all your Facebook friends only one family is”. A few days later she will show me a picture of a different family doing something else extravagant. I just groan.

Sounds like you need to trade her in for a lower maintenance model...

The social media part is huge when comparing life styles. My wife often shows me a picture of friends taking a ski holiday and says “ why does everyone get to do this and not us “ as if to blame me not our agreed financial decisions . I say “ not everyone else is, out of all your Facebook friends only one family is”. A few days later she will show me a picture of a different family doing something else extravagant. I just groan.

I'm in a DINK relationship recently having build a house we wonder how some of our neighbours are SIWK (single income with kids) can afford nicer houses. Probably the following factors into it:

1) They've got more debt, higher LVR. In which case they'll have fun paying that mortgage for 30 years.

2) We pay 33% tax on both incomes but they're often tradesmen who can do cash jobs and realise their income as capital gains. In addition to paying no tax on their tiny income they can also milk those working for families credits! Thanks Helen & John! Absolute bludgers and we need to add that CGT and scrap WFF.

3) They've been lucky enough to buy property at the boom stage of the cycle.

Do #2 and #3 apply to her friends? Of course the tax free capital gains are totally unfair but best to just improve your lot rather than direct the resentment at your spouse. Perhaps during the vowels she heard in sickness and wealth.

Best thing to do is disengage with social media. Far better for mental health: https://www.forbes.com/sites/alicegwalton/2018/11/16/new-research-shows…

The problem today is so many measure their own status in terms of how much money they have relative to those around them. A poor proxy measure.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.