By Siah Hwee Ang*

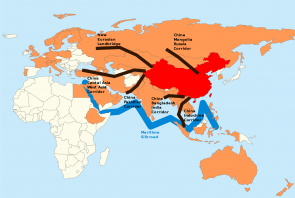

The One Belt One Road (OBOR) Initiative has already been around for four years, yet the 21st-century Maritime Silk Road (The Road) has really only featured for two of those years.

The ongoing disputes around the South China Sea has no doubt brought about The Road’s slow progress.

The map of The Road has left South Pacific nations confused, as there does not seem to be a route linking The Road to Oceania.

It would not be until late 2016 and early 2017 that more clarity surfaced surrounding this route.

Keeping an eye out for what’s happening in Asia around The Road has since become more useful than ever for New Zealand and its companies.

The Road involves the ASEAN nations. Six of the 10 ASEAN nations are amongst NZ’s top 20 trading partners in the last year.

ASEAN represents a high growth region in global economic growth in the next decades. As such, NZ is looking to enhance its trade relationship with ASEAN.

Keeping track of what ASEAN does along The Road, especially considering our relationship, both economic and geopolitical, makes sense.

But let’s not forget about Japan and South Korea, NZ’s fifth and sixth largest trading partners.

Both countries have been relatively quiet around work within the OBOR.

Japan in particular, has explicitly expressed the view that working with China is possible under the OBOR framework, provided it can put forward some conditions around which OBOR activities will operate.

That has not gone down well in Beijing.

Keeping an eye on these developments is critical as China, Japan and South Korea are three of the four largest economies in Asia.

Hong Kong’s role in the OBOR, especially the Road cannot be underestimated.

The Special Administrative Region represents the intersection of Eastern and Western cultures, and is a strong hub with major strength in financial services, professional services and shipping. These competencies tick all the boxes for involvement in OBOR.

Further, it is also in the process of finalising a free trade agreement with ASEAN, strengthening its position in Asia.

Hong Kong acts as a platform for access to the OBOR, so NZ companies should make it a priority to engage with Hong Kong.

In the meantime, activity along The Road is slowly mounting in Southeast Asia.

Below is a roundup of some of the activities we have seen to date.

Technological partnerships

As with the activities on the Belt, technological partnerships feature on The Road.

A prominent example is Alibaba’s purchase of Singapore-based e-commerce player Lazada.

We should also see investments from other companies such as JD.com and Tencent in Southeast Asia, the new stomping ground for technological firms.

Infrastructural development

In Malaysia, various infrastructural projects are linked to The Road. These include the Kuala Lumpur-Singapore High Speed Rail, the Melaka Gateway, and an oil pipeline linking Bagan Datuk to Bachok, amongst others.

Indonesia signed several agreements with China around OBOR in the OBOR Forum held in May in Beijing.

In particular, there was a financing agreement on the Jakarta-Bandung high-speed railway project.

Just last month, the Thai government approved a US$5.2 billion project to build a high-speed railway to connect Bangkok to Nakhon Ratchasima and finally to Laos.

Thailand will cover the construction costs, but China will be responsible for the engineering and design.

Special Economic Zones

Myanmar’s Thilawa Special Economic Zone and Kyauk Pyu Special Economic Zone are good examples of OBOR collaborative activity involving foreign investments, foreign technologies, and local manpower.

The US$10 billion Kyauk Pyu Special Economic Zone is expected to create 100,000 jobs in the northwestern state of Rakhine, one of Myanmar’s poorest regions.

It is expected that more such special economic zones will be created along The Road. NZ companies should work out how those work for privileged access.

The rise of The Road

Technological partnerships, infrastructural development and special economic zones are just some examples of what The Road represents.

Port management and shipping partnerships also feature strongly on The Road given its geography.

Other countries also see markets along The Road.

For example, The Philippines sees great export potential for its electronics products and tropical fruit, as well as access to Central Asia markets as The Road extends to The Belt.

Singapore sees its role as providing services along the way, along similar lines with what Hong Kong provides.

Documented benefits are scarce but the matter of fact is that activity is slowly increasing along The Road.

As with the Belt, there are multiple ways to engage along the Road.

Given its proximity, NZ and NZ companies would do well to keep tabs of some of the ways we can engage moving forward.

(This article is the third of a four-part series on China’s One Belt One Road Initiative)

(This article is the second article of a four-part series on China’s One Belt One Road Initiative). The first is here.

*Professor Siah Hwee Ang holds the BNZ Chair in Business in Asia at Victoria University. He writes a regular column here focused on understanding the challenges and opportunities for New Zealand in our trade with Asia. You can contact him here.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.