Here's my Top 10 links from around the Internet at 7.30 pm (sorry/bit frantic today) in association with NZ Mint.

I welcome your additions in the comments below or via email tobernard.hickey@interest.co.nz.

I'll pop the extras into the comment stream. See all previous Top 10s here.

My must read today is #2, which is a slightly wonky but very scary look at China's slumping housing market.

1. Way too lax - Michael Field reports at Fairfax about how New Zealand (and Russia) have been kicked off a European Union white list for countries safe from money laundering because our controls on fraudulent companies opening up through our Companies Office are too lax.

Gareth Vaughan has also done multiple articles on our site about our Companies Office company formation system being abused.

Now we've paid the price by being tarred with the same brush as Russia as a haven for money launderers.

This follows up on a case Michael Field cited of a NZ registered company that washed US$680 million through a Latvian account.

The comments below from Commerce Minister Craig Foss are a worry. This Latvian scam company was only struck off after it failed to file an annual return.

And Foss says there's a crack unit at the Companies Office keeping New Zealand safe...

Sounds like a Tui ad to me.

Here's the detail from Michael Field:

On the Auckland shell company accused of laundering $680m at a Riga bank, Foss said it was removed from the register in 2010 because it failed to file an annual return.

"As part of these efforts, the Ministry of Economic Development's Companies Office operates a dedicated Corporate Risk Profiling team to mitigate and, where possible, prevent the misuse of New Zealand-registered companies for overseas criminal activity," Foss said.

"Where a potential high-risk company is identified, the Corporate Risk Profiling team verifies the identity of the shareholders and directors concerned, and the residential address of the directors.

"The team also undertakes compliance visits to ensure that high-risk companies comply with the requirements of the Companies Act, particularly around the keeping of company records at the company's registered address."

2. It's going pear shaped - Michael Pettis writes from China about how the property market there is unravelling, courtesty of Macrobusiness.com.au.

The market is not poised to recover, but will continue to see greater downward pressure on prices; and real estate investment is likely to flatten out or start falling, erasing several percentage points of GDP growth.

At the end of 2011, total floor space “under construction” was roughly 4.6 times the floor space sold that year. Assuming it typically takes three years to build a unit, from start to finish, that suggests about a year and a half worth of excess inventory hidden somewhere in the pipeline. The ratio for residential property was 4.0, which suggests that, while there may be about a year’s worth of unsold inventory in the housing market, the overhang in commercial real estate is even steeper. Although in absolute terms, it’s the housing overhang that matters).

3. Oh dear - New York Times reports JP Morgan's 'Whale' of a synthetic credit trading loss has grown US$1 billion in recent days...

4. 'Don't even think about it' - There's been quite a few Germans talking aloud lately about letting Greece exit the Euro as if it it wouldn't hurt anyone much.

Malaysia's central bank governor tells Bloomberg here that the consequences could be apocalyptic. And he should know.

“The consequences for that to happen I believe will be unimaginable for Europe, therefore a solution has to be found to address the situation,” Zeti said. “I believe that such a solution can be found.”

Zeti was assistant central bank governor responsible for economics, reserves management, money market and foreign exchange operations when Thailand devalued the baht on July 2, 1997. The ringgit fell 89 percent in the next six months, and it was Zeti who announced Malaysia’s capital controls in 1998 as acting governor, drawing the ire of the International Monetary Fund.

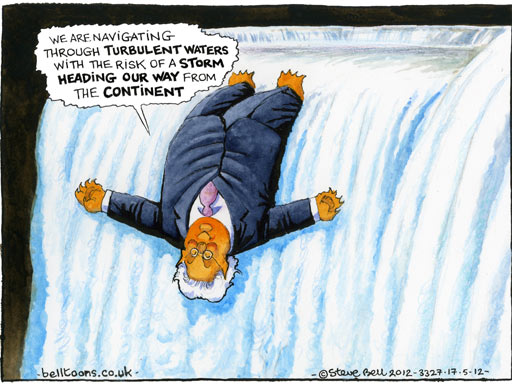

5. 'Be afraid. Be very afraid' - British Prime Minister David Cameron is also more than a little worried about what 'Grexit' would mean.

Here's the FT.com from a clearly nervous Cameron:

David Cameron, Britain’s prime minister, will on Thursday warn that the single European currency could unravel in a way that “carries huge risks for everyone” unless the eurozone’s 17 members move rapidly towards full fiscal and political union.

“The eurozone is at a crossroads,” Mr Cameron will tell a business audience in the north-west of England. “It either has to make up or it is looking at a potential break-up.

And here's the latest via Reuters on a big outflow of deposits from Spain's 4th largest bank in the last week.

And, agagin via Reuters, here's the head of the International Institute of Finance, Charles Dallara, saying 'Grexit' would be 'somewhere between catastrophic and Armageddon'.

The damage to the rest of Europe from Greece leaving the euro would be "somewhere between catastrophic and Armageddon", the chief negotiator for the body representing private sector holders of Greek bonds said on Wednesday.

"There has been a pickup of deposit flight from Greece," Dallara told reporters, but added he thought this could be stabilised "once you get a new government in place, if that government reaffirms its intention to remain in the euro zone".

"I think that it (a Greek exit) is possible, but I wouldn't call it inevitable and I wouldn't even call it likely because the costs for Greece, for Europe and for the global economy are likely each in their own way to be immense," Dallara said in a speech. "The pressures on Spain, Portugal, even Italy and conceivably Ireland could be immense and the need for Europe to step up with much greater support for the banking systems would be substantial."

6. Something's very wrong in China - The WSJ reports on a collapse in state bank lending in China in April.

When growth in China's economy slows, government leaders typically call on state-owned banks to make loans to rev up activity. But that tactic may not work this time. Bank lending plunged in April, according to the People's Bank of China, and has remained weak in May, bankers and borrowers said.

The decline owes to companies being wary about borrowing when demand is uncertain and profits are evaporating. The fall also is due to Chinese banks' unwillingness to lend to companies in problem markets—like exporters, or companies out of favor with the Chinese government, such as property developers, and practical difficulty shifting loans to new priority areas like small businesses.

The result: China's banks can't turbocharge the economy as they have in the past.

It seems the average debt overhang after financial crises since the early 1800s has been 23 years. I wonder if Reserve Banks and Treasuries have rebuilt their economic models to take account of this.

“Wishful thinking,” said Carmen Reinhart, a senior fellow at the Peterson Institute for International Economics in Washington, who knows a thing or two about debt. “You seldom grow your way out of debt. The historic experience is very rare.”

Reinhart, along with husband Vincent R. Reinhart, chief U.S. economist at Morgan Stanley, and Harvard University economist Kenneth Rogoff offer some sobering advice for the struggling euro countries, as well as other nations, in an April working paper, “Debt Overhangs: Past and Present.”

To summarize the major findings: Forget about growing your way out of debt. Too much debt depresses growth, often for as long as two decades. Debt isn’t solely a cyclical phenomenon. Real interest rates may be as low during debt overhangs as they were before.

8. Here's a link to that paper - And the abstract below

We identify the major public debt overhang episodes in the advanced economies since the early 1800s, characterized by public debt to GDP levels exceeding 90% for at least five years. Consistent with Reinhart and Rogoff (2010) and other more recent research, we find that public debt overhang episodes are associated with growth over one percent lower than during other periods. Perhaps the most striking new finding here is the duration of the average debt overhang episode.

Among the 26 episodes we identify, 20 lasted more than a decade. Five of the six shorter episodes were immediately after World Wars I and II. Across all 26 cases, the average duration in years is about 23 years. The long duration belies the view that the correlation is caused mainly by debt buildups during business cycle recessions. The long duration also implies that cumulative shortfall in output from debt overhang is potentially massive. We find that growth effects are significant even in the many episodes where debtor countries were able to secure continual access to capital markets at relatively low real interest rates. That is, growth-reducing effects of high public debt are apparently not transmitted exclusively through high real interest rates.

9. Will China grow old before it grows rich? - That's the question posed in this in-depth BBC feature on China's ageing population (and economy)

The average age goes up as countries develop, because people live longer and have fewer children. But in China, the one-child policy has triggered a rapid decline in the birth rate.

"The speed of ageing in China is unique," says Professor Peng Xizhe, a leading demographer at Fudan University. China has taken just 20 years to reach an age profile that took Britain or France 60 or 70 years, he says. New figures show that one in four permanent Shanghai residents is now retired.

The rest of China is catching up - by the year 2050, a third of Chinese people, 450 million, will be aged over 60.

10. Totally a 12 year old Canadian girl talking about Canada's debt, its banking system and the 'financial enslavement of Canadians.' Hope Amanda is watching.

Included without comment, except to say Canada was one place where the Social Credit movement was strong in the 1920s and 1930s. There is more and more of this talk bubbling up from the netherworld.

72 Comments

No.10 is fascinating for a few reasons.

Surely there are some real bankers who contrubute to this blog who will argue and pick holes in this girls argument?

The floor is yours bankers....... have your say now............

Sometimes it is easy to look favourable on something when it fits your existing beliefs, and for me this girls talk would qualify. What I was thinking all the way through was did she really understand what she was saying, or was it simply rehearsed? I didn't reach a conclusion and would say treat it with caution.

You don't hear anyone oposing a system of public credit, they cant because the maths doesn't support our current system, about the only thing you hear is crickets in the distance from anyone in media (I am talking about you Bernie) economics or politics.

If you have kids, you will know that even the brightest will have trouble rehersing such a long and complex speech, if they have no understanding of it.

I would argue that she does understand the central theme, but perhaps when questioned, some facets she may struggle with (many adults do!).

Would be interesting to see her in an interview. Even so, an outstanding achievement for a 12 year old - and for her Dad who may have assisted.

The main point being that they are both correct: banks and Govnt are in collusion to continue financial enslavement of the masses - but we all know that anyway!

"The main point being that they are both correct: banks and Govnt are in collusion to continue financial enslavement of the masses - but we all know that anyway!"

Hmm, I'm not sure which is more alarming; that the banks and government are in collusion to continue financial enslavement of the masses, or the fact that this is commonly known and accepted!

Both are alarming and troubling, don't you think? But, well, that's Capitalism for you!

I followed the Occupy protests thinking "could this be it? Finally a mass protest against the system" - albeit perhaps one without a viable alternative? But look what happened to that.... it slowly petered out - largely, I suspect, not because people didn't agree with it, but because most people are too scared to protest for fear of losing their pitiful enslavement (i.e. get arrested, lose job and income) and perhaps some large amount of lethargy (one of the 10 deadly sins that our Govnt and society also peddles with overly-complex democratic systems).

It's a terrible, terrible, beautiful, awesome complex system that will proabably never change - however, as the 12 yr old in the video above quotes Margaret Mead "Never doubt that a small group of thoughtful, committed citizens can change the world. Indeed, it is the only thing that ever has."

I have formulated the actual we are being robbed in a major way, it is mathematically proveable. I am not so sure about the public credit business, but it has to be better than we have now. The biggest difficulty we have going forward is matching money to declining resources, which included working age people.

Main main point was the uncertainty in the sensational way the girl is represented. Could be she is clever enough to really get it, but it needed a Q&A session to establish that.

"I followed the Occupy protests thinking "could this be it? Finally a mass protest against the system" - albeit perhaps one without a viable alternative? But look what happened to that.... it slowly petered out "

I'm getting a very different impression - between 30,000 and 200,000 people at protests in Madrid alone recently. http://occupywallst.org I think OWS is just getting started. It has however died almost completely in mainstream media.

Yes, actually I revise my statement, the mainstream media (was?) has carefully managed to portray a movement that was slowly dying and of course, according to them - is now dead. Any remaining protestors reported by the mainstream (read - right wing press) media are of course the crazy, toothless, vagrants (a bunch of wackos obviously) - But still, even though there are pockets of protests, public support for the movement has slumped http://www.guardian.co.uk/commentisfree/cifamerica/2012/may/14/occupy-wall-street-people-power-popularity

That report tends to focus on New York. The movement is global, and judging by what I've read there are large numbers of European protestors.

Whether it will be some small faction from Occupy that are responsible for major changes in the future nobody can say. Just look at the numbers protesting today though, compared with five or ten years ago. Something is happening on our little planet.

A good dose of unemployment will see it rise again here, which will happen in time.

lol @ scarfie. We are all a cheerful bunch here aren't we? But I appreciate the discussion, and everyone's comments. I accidentally came across one of those loon sites proclaiming that the end of the world is due May 27, 2012. I am not going to link to it as I don't want to give it link credit, but you can find it at the-end dot com ;0) I couldn't help wondering if the European crisis was somehow tied up in that!

Social Credit is a ludicrous concept and about the only monetary system imaginable that would be worse than the current one. It is forgivable for a 12-year-old girl to fall for it but adults should know better than to believe in a free lunch.

The suggestion that the state should control the money supply and dole out (and I use that term deliberately) interest-free money to special interest groups should ring alarm bells to anyone with any understanding of economics.

Unfortunately, this bizarre movement's continued popularity shows there are plenty of people who have none whatsoever.

Isn't it understood that the 'state' in the form of a central bank already controls the money supply? That is the way main-stream economic theory models it, in any case.

Does it seem sensible to you that every dollar 'saved' in your bank account is by necessity owed by somebody else to another bank. Without this debt neither exists, the savings or the credit which was put up for the loan. In fact it is very obvious from this that today, every time a bank makes a loan of credit somebody (mostly the bank) is benefiting from a free-lunch, of course we know that sometimes this free-lunch costs somebody else (tax payers) quite a lot of bailout money.

Hey Nic, you have been a bit quiet lately. Been on holiday? or just better things to do?

Working quite hard at the moment.

Social Credit is Iain Parker's raison d'etre....... are you suggesting that he's got the same IQ as a 12 y.o. Canadian school girl ?

....... the girl will be offended by that inference !

Very low Roger – very low !!

.... why Walter ? ...... she seemed a nice kid , kind of smart ........ apart from the social credit nonsense , of course ......

[ ... I have it on good authority that the world ends on May 27 .... mark it on your calender ...... you'd feel a complete fool if you woke up on the 28'th and the world had ended , but you'd slept through and missed it .. ]

Ask and you shall receive [reposted, like the video itself]:

If, as posited, the banks have indeed set out to do-over the general populace, why then are the heads of the various banks so comparatively un-rich? Many are paid tens of millions, and some are worth hundreds of millions, but if a handful of banks in each country essentially calls the shots for the whole country, that seems a pittance of a payoff. Why aren't all the bank heads billionaires, given they've gone to such lengths, supposedly, to screw everyone else over? (Reminds me of Dr Evil in the first Austin Powers movie - "I'll destory the world unless you pay me...one million dollars!" [laughter])

Secondly, bank-haters would do well to take a lesson in financial accounting. Yes, bank credit is created from nothing - the bank splits zero into a positive number (an asset for the bank - the IOU from the customer), and a negative number (the liability - the funds they provide to the customer which will almost inevitably be transferred to another bank). However, banks simply cannot create credit ad infinitum. (Thank double-entry accounting for that.) If they could - and that's what these banking conspiracy theorists would have you believe - then why are there bank failures? How can a bank crash if it's able to create credit out of thin air? Surely it would just create a trillion dollars or whatever and just rescue itself, right?

In truth, credit creation comes at a risk. If enough people default on their loans, banks can, and do, go down. Bank credit isn't interchanged between banks - government securities are – so when a bank places bank credit into your account, they stand to lose something more than made-up computer numbers if you don’t repay. If borrowers don’t repay, they’ll soon go broke – liabilities exceeding assets.

As for enslavement, few loans are taken out at the point of a gun. Look at the current looming mortgage war in NZ - the banks are desperate to attract business and gain market share. If we were enslaved, why bother competing so fiercly? Truth is, the power rests with the consumer in the first instance. It only take the loss of something as simple and nebulous as trust to take a bank down within hours.

As long as executives and directors aren't held liable for bank failures the incentive is for loan growth at any cost. All the CEO's of failed banks in the US walked with huge amounts. The HoD of JP Morgan who just got fired for the $2b trading loss walked with over $30m. Would be the same in Australia and NZ just smaller numbers.

Is some of the mortgage and consumer credit that has been extended verging on odious, if its lent for short term gain by banks more concerned about their profits from the interest and fees than the long term effect it would have on not just individual consumers but also the nations they are citizens of?

What about ANZ offering $1000 enticements to borrowers to spend on household goods for their new home if they take out a mortgage over $100,000 or the way banks have sent unsolicited credit cards in the past. Pretty hard to resist the candy being dangled in front of you all the time.

"Truth is, the power rests with the consumer in the first instance. It only take the loss of something as simple and nebulous as trust to take a bank down within hours."

This may be true but simply put, there is no alternative for the consumer. It's a mass conspiracy!! Afterall, you have little choice unless you are happy building a camp hut in a field and prepared to live mid 17th century lifestyle.

The broad-brush reality is, we are stuck with what is largely a corrupt and very broken system. It will continue to be so until the majority of people are hurting badly enough to threaten mass civil unrest - only then will the powers that be pay heed.

Of course that will never happen. Instead, many faceless bureaucrats will tinker with the internal systems, move credit notes around, shift public faces about, make PR statements and create policies that will continuously morph - in short do whatever it takes to continue the status quo. Why? Because it's all we know and fear of change is not just found in the consumer, it's rooted in the entire human psyche and that translates to every system that functions for our species. The question is, as an individual, how to protect and mitigate = live a full happy life and do your best, sure.... or roll your sleeves up.... ;-)

"How can a bank crash if it can create credit out of thin air?"

As you allude to yourself, there is a risk that there comes a point when there is no-one left to lend to and current loans start to default. That is the end of the credit cycle (depression) as opposed to just the end of a business cycle (recession). The mechanism by which they create money for nothing has broken down and collapsed.

So now the banks can't even give it away and their fierce competition, as you put it, is the proverbial fighting over deck chairs on the Titanic.

I agree "enslavement" is an exaggeration, but it is a rip-off since we could indeed provide credit via a national bank without interest going to private interests.

I don't think it is a conspiracy theory to say the global banking industry is ripping us all off in this way. It's just a political point. No-one's using some kind of reverse logic to find imaginary bad guys behind the curtain. It is quite simple and perfectly legal (I'm father to a bright 12 year old too and I reckon this Canadian does get it because she couldn't pull it off otherwise. I couldn't even do that myself!).

Thanks for the miss-representation, PI_Rimmer. Next time just stick to representing your own ideas, not miss-representing other peoples.

However, banks simply cannot create credit ad infinitum. (Thank double-entry accounting for that.) If they could - and that's what these banking conspiracy theorists would have you believe - then why are there bank failures?

Of course these 'conspiracy theorists' don't believe that banks can simply do this ad-infinitum, and nobody else should either. However you do make a good point, bank failures and a lot of inflation is caused by banks doing this as frequently as they possibly get away with.

As for enslavement, few loans are taken out at the point of a gun.

Of course this is true, most bank robbers don't anticipate paying the money back in any case. However there are many near necessities to be a success in life, and for nearly anybody these can not be achieved without taking a loan from a bank. These include, housing, university education and the means to run a business. Just prior to the credit crisis bank credit made up more than 97% of all the money supply in most developed countries. It is nigh on impossible for the economy or an individual to function on the remaining 3%. Keep your savings under a matress and you will only be effected by the inflationary pressure this process brings and will avoid many of the other potential consequences of the credit system.

$1,305,000 for a Housing New Zealand state house:

http://www.nzherald.co.nz/property-investment/news/article.cfm?c_id=292…

Why does Housing NZ own any properties in Remuera still? They would have been getting perhaps $50 to $80pw from the property which would barely pay the rates.

Fortunately HNZ are selling some, but look at this property in Grey Lynn that HNZ are selling which was occupied by a hoarder for decades:

http://www.realestate.co.nz/1786949

It will easily sell above $750k, but HNZ would have let it for perhaps $50pw so they are really just the enabler for the tenant to live in that squalor.

HNZ need to be actively selling many more houses into the Auckland Central market and replacing them with more economical modern housing on the fringes on transport routes.

It's a no brainer. Selling 1000 houses per year for 10 years at an average $750k and spending $250k to build a fringe house achieves 5 things:

- it increases revenue by $500m per year

- it directly boosts building activity by $250m per year of which a significant amount is tax and wages

- it indirectly boosts building activity by perhaps as much as another $250m per year with those substandard ex states being renovated or replaced

- it improves the standard of Housing NZ's rental stock

- increased supply of private housing stock in Central Auckland and to an extent controls house price inflation

Instead things remain largely the same and housing NZ silently enables substandard housing to be the norm in NZ while house prices soar.

Did you by any chance see the Hobsonville item on TVNZ tonight? Phil Heatley's confused at the best of times but aside from him clearly not knowing what the heck they were doing about affordable housing .. the example of an 'affordable' place in Hobsonville (they only built 17) was a $395,000 attached townhouse on a 250m2 section - and the section part (I assume) wasn't included in that purchase price because that component of the property was a capital and interest repayment deferral for 10 years deal.

Frankly I felt sorry for the 20 year old who had been sucked into that mortgage and scheme.

Here's the place;

http://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=10805332

Section price was included in the $395,000.

And one purchaser's comment:

She says Hobsonville Point was always more about location and its investment potential as a rental property for her and Patrick, a property manager. Within about five years, once she is back to her original job as a barrister, they want a bigger three- or four-bedroom house with more space outside for Ollie and possibly a brother or sister to play.

And JK on canning of the scheme;

http://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=10806703

Key from second link :

"So we think the capacity for lower income New Zealanders to own their own home is greatly enhanced by the fact interest rates are lower.

"If you have a look at the average home owner in New Zealand, they are paying about $200 a week less in interest than they were under the previous Labour Government."

Is this man stupid, arrogant or both?- not that I believe he or his government has any real input into the level of interest rates. He is captured by the banking cartel, as was Labour.

Stupid - sure on an intellectual basis - but he's more than smart enough to know how to serve his masters well.

Reminiscent of the 'talk up' language of the US 'property owning nation' ideology promoted by Bush at the behest of the banks .. have we got our own sub-prime lending scheme in the making? The deferred payment of the land component of that example could well be the precursor to such a model to be re-worked via the private sector.

Kate...! and indeed anyone who might be interested, I will share a story I have from a very reliable source involving John Boy... Nameless about Mr Brown.

A conversation by telephone between the two involving a certain angst on the part of John boy to get Mr.Brown to behave and do as asked.

When the response was not in favor of John Boy ,he said to nameless..." Well just sack him then"

nameless said'' You cant sack a duly elected official"

John Boy said (incredulously) why not...?

nameless said " because you can't "

John Boy...(disturbed now) but I thought we could do anything we want...!

Now because he's got a rapsheet as a top forex trader...never assume it comes with any political savy.......funny enough though ,He does think like an Elitist...."just sack him " ha !

OOOOOPs!!! hope that cat got back in the bag gettin sources and players all over the show......I have a cold..! yep thats it....stuffed up.

Not surprised one bit - as they did sack the duly elected Environment Canterbury Council - put dear old reliable Dame Margaret in to do their bidding and get the irrigation for the corporate dairy conversions going down there. Now that they're having it their way with the consents process - we taxpayers are to pay for it.

And the proposed amendments to the LGA suggest they plan to pave they way (i.e. make it more 'legitimate') for a few more sackings.

Kate, Kate: Ecan took over 19 years to not produce the very thing they were freaking well there for: a water plan. And, to boot, had a perfectly split (rural conservative/urban screamingly greeningly) elected body, which of course ensured a perfect stasis.

Say what you like about Dame Margaret, but within the space of two years she has lit enough touchpapers between enough toes to have achieved:

- the aforesaid Plan

- Zoning committees which are locally representative

- movement on the measuring and allocation of water (Ecan had, stupidly, used a First-up Best-dressed algo up till recently)

- wound back a whole lot of the self-congratulatory/expensive image and hype

- collaborated with iwi and locals in such long-term projects as reversing the slow death of Lake Ellesmere.

And so on. Ecan used to be referred to as ECan't. No more.

@waymad - along with others you purposefully miss the bigger point.

Not surprised one bit - as they did sack the duly elected Environment Canterbury Council

I hope we are not deteriorating towards a fascist state - why over 19 years (presumably a few voting cycles) did the voting public not change their minds about their preferred appointees, according to you?

Because, as you may have spotted in my exposition, the rural/urban constituencies exactly cancelled each other out, no matter what the mythical 'average voter' may have in fact desired.

This was and is a recipe for stasis, baked into the structure.

And stasis, indecision, deer-in-the-headlights is exactly what voters got, for electoral cycle after cycle.

So, absent structrural change (which has now been imposed from without), just exactly how was this electoral impasse to have been resolved, and over what time-frame, my good fellow?

It may have been 19 years worth of electoral stasis as you refer to it - but it was 100s of years prior to that which had formed the Canterbury Plains into the tussock grassland that it is cross-sected by the braided river systems that they are.

http://www.youtube.com/watch?v=1Dh-WOlFkHg

Resolved for whom and in whose favour absent the democratic process? - I guess vigilantism is a logical conclusion for those not favoured by diktat in your world.

Key seems to have no intellectual/moral/philosophical anchor point and certainly no interest in political economy and history. Really beginning to think he is the architype of the hollow man. Scary.

Mental Kate, just Mental

I was at a development in Northern Adelaide today, starter 2.5 bedroom townhouses circa 100 square metres on 220 sq m allotments selling for about 220K (land and house)

Now THAT is affordable

NZ is a beautiful country but its economy and governance is a joke

Did you see this one, Matt?

http://www.nzherald.co.nz/property/news/article.cfm?c_id=8&objectid=10806413

"It would be interesting to know what's driving this new wave of Asian investment - ... Around 80 per cent of that room was Asians," he said.

Combine that comment with this headline (which by the way got absolutely no 6 o'clock news coverage);

http://www.stuff.co.nz/business/industries/6938888/New-Zealand-removed-from-EU-white-list

The EU's white list was revised on February 8, leaving Australia on but New Zealand off.

Words definitely got round, I'd say.

Thanks Kate. As a proud kiwi NZ's decline saddens me deeply. Its even more apparent when you are out of the country, observing from a distance. Unfortunately most of NZ has fallen for the "charm" of that smug, smiley but gutless Mr Key

NZ - so much potential unrealised

Got that right Matt, NZ's biggest problem right now is the bunch of complete muppets running the place.

Good to see then given your comments above that as a proud kiwi, Matt in Adelaide, that you have stood your ground and remained in New Zealand to fight the good fight for the betterment of your country instead of running to Australia with your tail between your legs. And you dare to criticise the leadership of this country.........

.... sometimes a small distance from the fray helps one see a little clearer ...... and from where I'm sitting , it appears that NZ has managed to muddle through , despite the amazing incompetence of its politicians , for decades now ..... generations , infact ..

Imagine how the country would get cracking , on a rip & a tear , with politicians and local councils just a step or two above that level of " mindnumbing incompetent boof-heads ! "

Will never happen, gummy, not when the political inclinations of the average New Zealander is socialist and bewildered green and the State, and hence the society, exists only to serve and better them for little effort on their own part. I read a very interesting comment by Sam Morgan in the business section of the NZ Herald yesterday while I was taking lunch. It was a thunderously insightful comment and he hit the nail right on the head. Shame that those who don’t live in NZ can’t read it!

Pity that we cannot see that comment by Sam Morgan , I had a peruse around the Herald's website , but no luck .

..... bear in mind , of course , some of us are only away from Godzone for a limited time : When the Gummster family return the little boss will be a qualified chef , and moi hopes to have completed certificates in driver operations and in mining .

Thought that'd impress the Greens ! ..... Gummy returning with a ticket to drive a turbo-charged monster truck around the mine site ...... aha ha haaaaa .....

For those that don't live in NZ; :-)

http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=10806547

Sam's comments are toward the end of the article.

knew you would bite David with an absurb nationalistic / rightist jibe.

Long live the empire dear David! Jolly good show. Are you going to start a Golden Dawn in NZ?

If the govt and previous govt had governed properly I would still be in NZ (trust me for sevral years I lobbied local and central govt for change, so I'm by no means an "instant quitter"). One individual (me) can't change incompetent govt. I work in an industry - the development sector- that relies hugely on govt policy. The govt's housing and planning policy is abysmal, And until they get their act together development is going to be a dead duck

Answer this question - as a national party supporter can you honestly put your hand on your heart and say National have delivered on their promises? Remember, david, the Nats were slamming LAbour 5 years ago for all their regulation and limitations on development. What has meaningfully changed? Nothing - ZILCH

Oh yeah, they also belittled labour on migration to Australia- ha ha!

And belittled Labour's economic performance

What is the unemployment rate and GDP growth again?

Remember I actually voted for national first time around

I look forward to your defence of your sweetheart John Key's performance David

And I want rational defence not biased ideologically driven drivel

Are you going to start a Golden Dawn in NZ?

Are you? Would seem a little difficult for you to do so since you don't live in this country. Your views on New Zealand are irrelevant. You don't live here. You don't contribute to this society. Why would anybody living here want to take any notice of what you have to say? Your opinions are as relevant as any fair weather friends......in other words, not very. And if you don’t like hearing the truth about that, then tough.

"And I want rational defence not biased ideologically driven drivel"

Haha, good luck!

I was in the room and 80% asian is a total exaggeration.

That's rich givern all the internet scams that have come out of the Baltic states. Of course I don't see Latvia saying it doesn't want our EU bailout money as a result.....................

Some do-good-er will tell you that poor people have rights too and why shouldn't they be allowed to live in Remuera (not that most other hard working people can afford to however).

I think they should sell the whole lot of state houses in NZ - must be worth a few billion...

Interesting example of spending v austerity that bears a resemblence here given Chch.

http://krugman.blogs.nytimes.com/2012/05/17/spending-and-growth/

regards

"It's austerity measure which gets colony countries off the ground."

Interesting point but I dont fully agree with, as colony countries while probably having a simpler lifestyle than the home country really have/had the big advantage of virgin territory and un-touched easy access resources as the biggest advantage by far IMHO.

"war-fined countries like Germany into the financial powerhouse positions" If that was WW1 clearly and well documented as not so. Not so sure on after ww2, really I thought that Germany was mostly let off the hook because they didnt want to make the mistake they made in the aftermath of ww1...but sure show that....

"tax etc and it's the spending and overheads and softways that trips them up." Ppl really sacrificed for their future but the expectation is there would be a better future if only for their next generation(s). Hence its not surprising that they want things softer and better and fair enough IMHO.......take a step back but what are you really wanting to achieve? ie the end goal? because context is important. Tax, forget it its not the issue...when you look at what the Govn spends it spends in 3 large areas, education, OAPs and welfare...govn money itself is actually pretty minor....So ppl want education, want healthcare and want a saftey net, thats a choice they make....they also chose the most efficient way to give it to them and public spending would cleary seem to do that for the first 2 at least....context....

Welfare is of course the hot potato, but really if you want society to hold together and prosper it has to be there IMHO....just what is the effective alternative? I cant see one myself.

Of course all of the above assumes cheap and easy access to materials which after peak oil and indeed peak many things isnt going to be possible.....which also begs the Q just how will ppl react when they see/realise they will be facing hardship with no future benefit prospect unlike whenthe colonised....ouch comes to mind.

regards

#4 Shame on You....The Governor of Malaysia's Central Bank is a SHE !!! This is patently clear in the Bloonberg article...photos and all !!!

China: It is also patently clear that China is into a hard landing (ie for Chinese standards, any growth less than 5% is considered "Hard")...the trouble with ALL Goverments (Democratic or Dictators alike) and Central Bankers think they can direct the economy like thay drive a car....Hubris and arrogance moves their actions...except that they also destroy lives...Think of the Greek suicide rate !!

Growing a nations way out of debt. Never really happens. #7.

Borrowing to rev things up works sometimes. But is suicidal if there is no later debt reduction.

The way politics work. Governments are capable of borrowing. But incapable of doing the following disciplined thing that is required.

So todays platitudes alway become tomorrows "balls up". Again.

Perhaps an example of the 'gifter' you are referring to would be US banks. A man comes to the bank and asks for a loan he really cannot afford to service on a house that's going up in value. The bank gives him a loan. The bank wraps this loan and many others up into a packaged called a collatorised debt obligation (CDO). This is then sold off to investors via ING/ANZ here in New Zealand. People listening to their financial advisors here in NZ buy shares in the scheme. The US bank no longer holds the risk having sold off the mortgage and having made a profit in the process. Then the house prices go down (you and/or others may not believe me, but it's true, house prices CAN go down). When the man can no longer pay his loan, the true worth of the CDO becomes apparent and the investor in NZ loses some/all their initial investment. US bank $++, NZ investor $--. Well that's how it worked for me.

China's old-before-rich demographics are decade-old news to dedicated members of the VRWC. As Glenn Reynolds likes to say, the future belongs to those who show up for it...

" ..... as a wise master builder I have laid the foundation , and another builds on it . But let each one take heed how he builds on it . " ( 1 Corinthians 3 : 10 ) ......

God was lucky , very bloody lucky ........ from these wise words I deduce that he got his construction approved & completed before the RMA and the Christchurch City Council came into being ......

....... good lawd !

The budget should be balanced, the Treasury should be refilled, public debt should be reduced, the arrogance of officialdom should be tempered and controlled, and the assistance to foreign lands should be curtailed, lest Rome become bankrupt.

People must again learn to work instead of living on public assistance."

- Cicero, 55 BC

Fine - let's try the roman way of refilling the treasury. Off the uppity rich, and the occasional aristo, and seize their property. They used to loot rich temples, as well.

At least they had some temples to loot. All we have is leaky homes and a few crappy malls amongst a greater planning disaster.

Doesn't anybody care about the real issues in life , around here ? ........ yesterday was " International Against Homophobia Day " ...... and you guys missed it , ... poof , ... it's come & gone ....

...... and Donna Summer ...... dontcha shed a tear that not only is disco dead & buried , but so too the Queen ( not to be confused with the story , above ) of disco ....

Life most certainly is queer , friends ......

Oddly enough GBH it was wear something Purple Day to show support for ...uh ...um I've forgotten but that's not important...what's important is ...uh ...er...... oh yes that's right...! to have some suitable attire socked in the back of your smalls draw for yesterday next year.......

Be prepared.

...... you know what May 18 is , Count ? ...... " International Museum Day " ...... seriously , I do not make this stuff up ......

Better head off home and display your affection , cuddle the mummy ... ...

Museum Day ..you say...! is.. thart i fact........I should exibit a bit more.....

respect.

May 19 : Malcolm X Day : A holiday in the USA

May 20 : International Metrology Day : Celebrating the day that 17 countries signed the metrics alliance in 1875 , to remove our feet , and have them replaced by metres ....... ouch !

Well, gummy, I certainly didn't let such an important day go by unnoticed. I donned my shortest sequenced shorts and spent the day with some very queer people. Yes, Labour and Green voters! Don’t worry, I was wearing gloves. And we all sat around watching a biography of a well known member of the New Zealand Labour Party.

Well DB , I spent the day feeling a little gay .....

.... a circus of homosexual midgets was in town !

Boom boom !!!

'Poof and it was gone..' sheer brilliance GBH!

Of course SoreL.....it helps to be dyslexic...so that looks quite normal to me....and Stevo.

How much does it cost to buy a new zealand politician?

In reponse to Kate (Peter Thiel and $20 million of taxpayers money) and GBH (governmental incompetence) .. is it sheer incompetence? or are there brown-paper-bags full of folding stuff being handed (over) under the table while you are watching their lips move.

Not so very long ago there was a media uproar about Kimble.Dot.Com being arrested and then it came later out that he had bought his way into new zealand followed by a 50,000 worth of vote buying (in a brown paper bag) handed to John Banks as a lobbyist.

In this past week there have been even more sinister goings on with a guy who has bought himself a new zealand politician or two. He has multiple identities, multiple passports and so it goes on ... read for yourself ... no media uproar .. business as usual .. thats the way business is done in new zealand now ... in brown paper bags

What price a tame MP

http://www.stuff.co.nz/national/crime/6943391/Tycoon-boasted-of-his-MP-mates

http://www.stuff.co.nz/national/crime/6950133/Case-of-a-well-connected-millionaire

Follow the money in the second link.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.