By Bernard Hickey

Put down your coffee and croissant and pick up a pen. Now, put a note in your diary to ring your banker to ask for a better deal on your mortgage.

Seriously.

Banks are now desperate to keep your business and are frantically doing deals with customers behind the scenes to stop them defecting to rivals.

That means you shouldn't be paying the advertised rate for your floating rate or fixed rate mortgage. Expect your bank to match the best rate on the market and threaten to leave if they don't. See all the bank advertised rates here.

It hasn't always been like this.

Back in the olden days before the freeing up of New Zealand's banking system, it was much harder to get a loan. Those with grey or no hair will remember all the hoops that had to be jumped through and often the need to resort to borrowing via a soliticitor. Your bank manager was someone who had to be feared and genuflected to, not the other way around.

There was also a time in late 2008 and through 2009 when banks retreated into their shells in the worst of the financial crisis. Lending standards were toughened up and margins for some of the riskier types of lending were increased.

Those days are long gone.

The Reserve Bank's half-yearly Financial Stability Report released this week showed the banks are sitting on a cash pile worth NZ$49 billion that they're desperate to lend out. That's more than double their cash pile in late 2008.

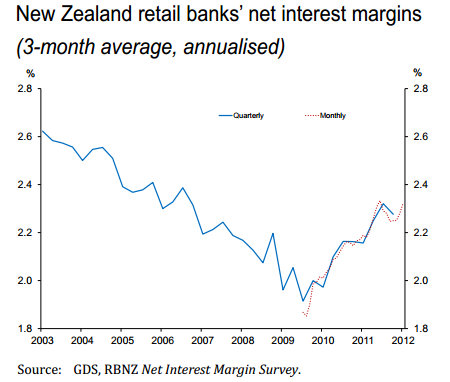

The report also reports the banks can afford to give you a better deal. Bank net interest margins, which are the profits they make between the cost of their borrowing and their returns from lending, have rebounded from 1.87% in September 2009 to 2.32% in March. That's largely because most customers have switched from fixed rates, which are less profitable for the banks, to floating rates. There is plenty of fat there for the banks to burn through to keep your business.

Banks now know that to keep growing profits they have to either poach business from their rivals or reduce their operating costs. That's because they can no longer just sit there and watch their profits rise with the tide of a fast-growing mortgage market. Mortgage lending growth has collapsed from around 14% in 2007 to barely above 2% in 2012.

Retaining business is now even more important than growing business because there is so little growth.

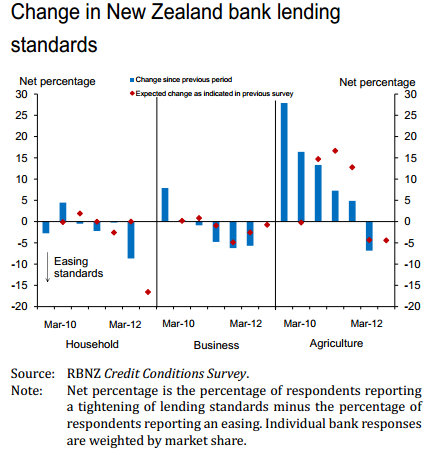

The Reserve Bank is already seeing signs of this more intense competition in the form of a relaxation of lending standards. There's two ways a bank can win a mortgage: cutting the price with a lower interest rate or offering to lend more to a riskier customer by relaxing credit standards. Many are now doing both.

The central bank's quarterly survey of lending standards showed the biggest easing of standards in the March quarter since the onset of the Global Financial Crisis. It also showed lending officers expected an even bigger easing in the June quarter. That means it is now much easier to get a 90% plus home loan or to borrow an even larger multiple of your income.

But for most people who already have a floating mortgage and don't want to borrow more, the best way to take advantage of these easier conditions and more competitive banks is to simply go to your bank manager and ask for lower rate.

The biggest opportunity is for those with floating mortgages. They are often put into 'set and forget' mode because they don't have a natural trigger for renegotiation when the term of a fixed mortgage expires. That means many borrowers are paying the advertised floating rate, which is around 5.7% for most banks. Don't pay that rate. Go straight to your banker and demand a rate of less than 5.4%. That's what most banks will agree to when pushed by a broker. If they don't move, then move to another bank.

Just like the L'Oreal ad says, do it because you're worth it. And the bank can afford it.

And as Rachel Hunter also famously said, it won't happen overnight, but it will happen.

25 Comments

Nice article BH. But it's left me a little scared as I have typically done the opposite to what you have suggested ;)

Fyi-My bank offered my 0.55% off the advertised floating rate for a recent property deal valid for 3 years. And I didn't even threaten to leave.

Serious question- what is your latest prediction for house prices? Are you sticking to -15%?

Regards

28_29 year old

I'm sticking to that prediction, but I'm much more bearish than most about the global outlook.

I don't see the messes in Europe, America and China ending well.

It'll come. But 15% not that bad.

Prices doubled from 2002 to 2007.

cheers

Bernard

I see 4 x that...

;]

regards

" ..... I have typically done the opposite to what you have suggested .. "

Being the Bernard Hickey contrarian has stood you well up until this point : Why change your stance and believe him now ?

... central bankers around the world are still quantitative easing .... China has just announced a new stimulatory package ......Oz is easing ......Bernanke will do the same in USA if necessary ... even the recalitrant Germans are admitting to expanding their inflation band ....

It may not be right nor responsible , but it is what they're actually doing .

Gummy

How do you think all this extending and pretending and pumping and inflating is going to end?

Do you think savers will put up with it?

Do you think growth will return to make these problems go away?

Do you think the structure of the population will change?

What happens when the music stops?

cheers

Bernard

... " extending and pretending and pumping and inflating " ...... are we talking about finance here , or a B grade porno ?

Here's the thing Bernard : Austerity creates the very thing that it's supposed to cure ....... it leads downwards to less production and inevitably to more debt .......

..... and the Germans are ignoring that lesson from the 1930's . They have a high-brow idea of how finance ought to be conducted ....... completely ignoring the fact that reality does not match their text book theories .

The reality is that the Greeks lied about their finances & their intentions , to gain admittance to the EU & to the eurozone in the first instance .

28_29 yr old - you should have pushed for at least another 0.25 off that rate. Hit them again!

Bernard - will you be posting something about your view of the European situation seeing as you have just spent some time there?

bigblue

Here's my most recent view on this post visit

Essentially, I think the euro area is buggered unless the Germans step up and bail everyone out. Pronto.

cheers

Bernard

And I think you'll see Angela M. and Christine L. sitting on a rock somewhere discussing what could have been before the ...German People wear that one.

The irony...? the successful economy might see a revolt before the defaulters.

What do you recommend to those whe took your brother in laws advice one year ago and fixed for 2 years at 6.2%.

Hi,

Do a spreadsheet, I mean who has a crystal ball? it was at reasonable deal at the time still isnt that bad...floating is <6%, just....so after 1 year it has cost 0.25%? yet those ppl had the "peace of mind". I stayed floating, interestingly Im wondering if given Greece etc fixing at 4.99% for 1 year doesnt make sense.

regards

Keriwin

Don't quite know where you got that idea from. I said a year ago to float.

Here's what I wrote in my Brother in Law's guide from July last year:

So here's what I say my brother in law should do with his NZ$400,000 mortgage with a floating rate of 5.75%:

The short version is I reckon he should stay floating, but should go back to his bank to threaten to leave and get a discount out of the bank. The banks have been offering floating rates as low as 5.60% through brokers to new borrowers and he should get the same. See all the advertised mortgage rates here.

cheers

Bernard

I need some advice please...I would probably characterise myself as an attractive banking proposition (more than $500k in debt, high equity %) and currently have a good chunk of that on floating rate. At the time of taking out the loan the bank offered a 0.50% off their published floating rate (5.75%). Now it seems the market is more competitive and I want to get them to sharpen their pencil. Can someone in a similar situation please tell me if I am being realistic asking for another 0.25% discount, or is this unlikely? it would be good to know before I ask as I can be a bit more demanding/aggressive with the question...thanks!

Be very aggressive. Threaten to move and if nothing happens just do it.

They are desperate for your business right now.

cheers

Bernard

It's a fair call Bernard. Have just been offered 4.85% fixed for 1 year (40bps discount) on top of 5.24% for floating. This was with no negotiation, ~85% LVR. It does help that I worked for a Bank for 5 years and so some old contacts advised me what could be acheived.

It is pretty simple.

"He who dares Rodney, he who dares..."

Jandel , as my fixed mortgages come up i'm letting them float and they are sitting on the 30 day bill rate plus bank margin 2.4 % , not sure how i ended up with this deal but am currently very happy with it.

During the height of the GFC banks were more lenient with those showing more loyalty , i personnally would be very cautious about threatening to go elsewhere , they will remember .

"Don't pay the asking rate. Go straight to your banker and demand a lower rate..."

Hey Bernard, whose side are you on? I'm a saver/investor and I've tried the "demand of your banker" technique to screw an extra percentage point or two of interest out of the sods for my deposits, but to no avail. Maybe you have another strategy for saver/investors, if so please share it with us.

Plebian

Right now the banks are cashed up and desperate to lend and win mortgage market share.

I am on your side though. I'd love to see the banks pay more for deposits.

That's why I've written I think the Reserve Bank should force the banks to fund more of their lending locally from term deposits. That would do the trick.

cheers

Bernard

I do understand what you are saying Bernard. If inflation added a significant dimension to the equation then savers would have course to be even more upset.

Plebian - you should consider bonds or defensive stocks (think Vector/Trustpower) should you wish a better return, assuming you can cope with the slight additional risk...

Thanks for that ITYS. I do hold a selection of bonds, mostly in my 2f category, i.e., fuel and food, but there is not much on the horizon in terms of new issues.

Any advice for those of us on fixed rates?

Currently have 2 yrs to go before my mortgage comes off its fixed rate term. And at 7.25% its a bit of a sore point considering what they are at now. Maybe its just the luck of the draw.

Break your fixed rate. Take the hit. Go Floating. Push the expense down the road. Take the savings now. At 7.25% - you must have fixed for 4 or 5 years back in 2009? Did you not read interest.co.nz before you fixed last time?!

Bernard, would you expect westpac to go any lower for their customers on their revolving credit mortgage rates?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.