Here's my Top 10 links from around the Internet at 12.20 pm in association with NZ Mint.

I welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

I'll pop the extras into the comment stream.See all previous Top 10s here.

I'm hoping John Key reads todays top 10 and has a good chew over the warnings about a hard landing. Does he have a Plan B if China can't save the world?.

1. The problem with 'free' trade - A new US study reported in the Wall St Journal has found the damage done by cheap Chinese imports is far deeper than previously expected.

The damage in the form of the transition costs for those who lost their jobs was actually worth up to two thirds of the benefits of cheap stuff.

And a lot of the cost is borne by the government in the form of dole payments, food stamps and sickness benefits. And that cost gets passed on to future generations in the form of higher debt.

There is a growing body of research showing that the speed of change required when economies are truly opened up is overwhelming the ability of an economy (and society) to adjust.

The guts of the problem is that people are much harder to shuffle around the globe than capital and goods.

People like jobs and stability. Children need it too.

When your job is wiped out by some multi-national corporate at the click of a mouse it's hard (and expensive for some) to adjust. And the costs are borne much more by poor to middle class voters/workers than the owners of capital who reap the rewards.

Here's the WSJ:

The study, conducted by a team of three economists, doesn't challenge the traditional view that trade is ultimately good for the economy. Workers who lose jobs do eventually find new work or retire, while the benefits from trade, such as lower prices, remain. The problem is the speed at which China has surged as an exporter, overwhelming the normal process of adaptation.

The authors calculate that the cost to the economy from the increased government payments amounts to one- to two-thirds of the gains from trade with China. In other words, a big portion of the ways trade with China has helped the U.S.—such as by providing inexpensive Chinese goods to consumers—has been wiped out. And that estimate doesn't include any economic losses experienced by people who lost their jobs.

"There are really huge adjustment costs to local communities that were far worse than people had appreciated," said David Autor of the Massachusetts Institute of Technology, who conducted the study with Gordon Hanson of the University of California, San Diego, and David Dorn of the Center for Monetary and Financial Studies in Madrid.

2. Fed the lender of last resort for everyone again - Bloomberg points this out in a good analysis of how the US Federal Reserve is stepping into the breach again.

The Fed is the lender of last resort when US money market funds run away from European banks, who still need to roll over their US dollar short term funding lines.

This is one of the mechanisms that turns Europe's debt crisis into the world's debt crisis.

Three years after the collapse of Lehman Brothers Holdings Inc., money-market borrowing rates for dollars are rising, leading the Fed and European Central Bank to make the currency available to Europe’s institutions for as many as three months. U.S. prime money-market funds cut their exposure to euro-zone bank deposits and commercial paper, or short-term IOUs, to $214 billion in August from $391 billion at the end of last year, according to JPMorgan Chase & Co. data.

The failure of regulators worldwide to address European banks’ fragile dependence on short-term funding is “putting the Fed in a really awkward position,” said Karen Shaw Petrou, managing partner at Federal Financial Analytics, a Washington regulatory research firm whose clients include the biggest U.S. banks. The swaps with Europe “are an extremely advantageous political football” for critics of the Fed, she said.

After the criticism earlier this year of lending to overseas institutions -- including Arab Banking Corp., part- owned by the Central Bank of Libya, after Lehman collapsed in 2008 -- New York Fed researchers said U.S. branches of foreign banks were among the biggest borrowers from the discount window because they lack deposit bases. The window is the Fed’s oldest backstop-lending tool.

In an April 13 post on the New York bank’s research blog, the researchers said these institutions have relied more heavily on so-called wholesale funding for dollars, including the money markets and foreign-exchange swaps. Supporting these banks helped maintain foreign investment in the U.S., they said.

3. Chinese hard landing - Societe Generale Asian equity strategist Todd Martin told Bloomberg in this video interview on September 23 that listed property developers in China appear to be going into some sort of meltdown as regulators crack down on their unofficial lending channels and the cheap unofficial money is gone. Check the chart below on number 4.

"It looks like this cash crunch in China is starting to pick up momentum. There's several indications that we're going into a new down phase in the credit cycle," Martin says.

"We're teetering right now and the market is getting very scared."

His most interesting comments start around 2 minutes 33 seconds on the video here. (I tried to embed but it's one of those ugly videos that starts automatically) HT Doug via email.

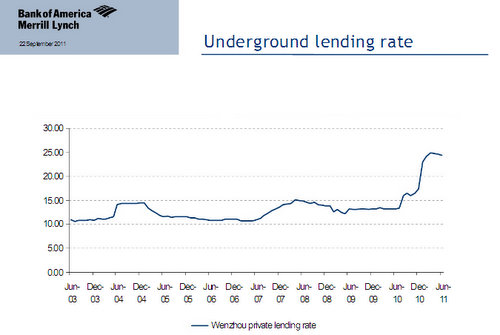

4. More on the Chinese hard landing - Zerohedge says Bank of America/Merrill Lynch's top rated analyst David Cui has warned of a hard landing in China in this presentation pack delivered to clients earlier on Wednesday.

This chart below caught my eye. It shows the underground lending rate in Wenzhou doubling this year to 25%. The official banks have cracked down on lending. So many developers have gone to trusts and other 'shadow' lenders that sound a lot like our property finance companies.

Here's Zero's take and the way Merrill headlined the note:

Earlier today Bank of America released a presentation and a conference call in which the firm's head of China equity strategy David Cui spoke about the dreaded "China Hard Landing" or the event that would kill all decoupling dreams for ever and ever, and probably lead to a world depression. It seems that the latest down move in the market is being partially attributed to just this notification finally making the rounds.

Here's what Merrill said:

Cui sees significant Chinese specific financial market risks that could trigger lower than expected Chinese growth. He sees that those financial market risks as having increased considerably. He will expand on this on the call, but he sees these financial stresses as having a very high probability of triggering lower than expected growth. That lower growth could well be sub 7%, and therefore by Chinese market standards would be termed a “hard landing”, clearly a HUGE issue for all global markets."

The full presentation is below.

China the Systematic Risks 11090934[1]

5. Is Ukraine about to default ? - Zerohedge, which can be a tad excitable, reckons Ukraine is on the verge of defaulting on its sovereign after stopping payments to everything else in government so the latest interest payment can be made.

6. Here's an idea - Rumpelstatskin writes at Macrobusiness about collaborative consumption where instead of buying new stuff people share their stuff with others, via house swaps and the like. Amanda has already pointed to this idea, suggested by Rachel Hotsman, before, but this is a good list.

It starts to answer the questions about peak oil and about mindless debt-fueled consumption.

Economic downturns provide a massive incentive to utilise the existing capital stock more efficiently. The creative destruction of retail is revealing new ways to optimise floor space and new business models to utilise buildings more efficiently. In downturns households will also consolidate to better utilise their available space. But this wave of innovation is not limited to buildings but applies to capital in its most broad sense.

The revolution in capital efficiency is coming to households across the world via web-based sharing. Vehicles, driveways, books, tools, bikes, even clothes – if the good is durable it can be shared at minimal cost there is a website that will allow you to participate in the new economy of collaborative consumption.

7. Land protests in China - Gordon Chang writes at WorldAffairsJournal about how Beijing's inability to stop local governments seizing land to sell to developers is causing more and more social instability in China.

Last week, authorities in southern Guangdong Province managed to quell violent protests that had erupted over illegal landgrabs by officials. The disturbances were triggered by a rumor that officials in Wukan had seized a village-owned pig farm and sold it to a developer for more than one billion yuan. The protests soon spread to nearby villages.

On Wednesday morning, villagers in Wukan had surrounded the local Communist Party headquarters. By Thursday night, they had besieged a police station and blocked roads. By the time the 2,000 or so demonstrators had disbanded, they had fought hundreds of riot police, overturned six police cars, injured a dozen police officers, and ransacked a government office. They had attacked a local restaurant, a textile factory, and a farm. They demanded fair elections and the return of their land. Villagers did all this while holding banners and shouting slogans. They used bricks, sticks, and their fists.

For years, illegal land seizures have been the root cause of tens of thousands of protests across China. The Communist Party knows the issues, and it even knows what it can do to prevent the disputes. Yet it has not been able to take steps to actually address grievances, either in Wukan or elsewhere, because of the weaknesses inherent in its form of one-party rule. There is too much economic incentive for local cadres to conspire with developers and too little institutional accountability, so officials continue to seize land until peasants rebel, as they did last week in Guangdong.

The authorities were able to cool off tensions in Wukan and the surrounding villages by employing coercion and their traditional delaying tactics. But one day—in Wukan or elsewhere—villagers will take to the streets and not give up until they march all the way to Beijing.

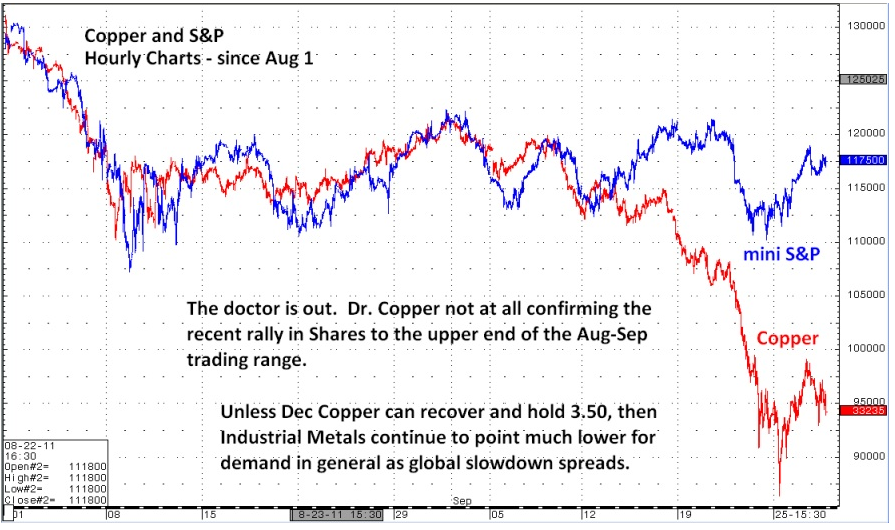

8. Another China hard landing warning - Here's Gary Shilling warning of deflation and a hard landing in China via BusinessInsider. The violent fall in the copper price in the last week is a sign. It's often described as 'Dr Copper' for being the metal that has a PHD in economics and often indicates early any slowing of global demand.

"I'm agnostic on the precious metals. We have in our portfolios been short copper. Copper peaked out in February and it's down about 25% from its peak. I think it will go a lot lower. As you pointed out, copper goes into almost anything manufactured. It's a great indicator of global industrial production. What I think will really knock the pinnings out from under all commodities is a hard landing in China, which is what we're forecasting."

"[The Chinese] are trying to cool off a red-hot economy. They're worried about the property bubble and the high inflation rate. They are affecting a soft landing and with their crude economic tools it's tough. Bear in mind, the Fed, with more sophisticated tools, tried, by my reckoning, 12 times in the post World War II era to cool off the economy without precipitating a recession. They only succeeded once. What are the chances for China?"

9. Just get rid of democracy - The level of disfunction in America's political system is causing some to wonder about democracy itself. Here's former White House economics official Peter Orszag and now Citigroup executive saying via The New Republic that more autocracy is needed.

In an 1814 letter to John Taylor, John Adams wrote that “there never was a democracy yet that did not commit suicide.” That may read today like an overstatement, but it is certainly true that our democracy finds itself facing a deep challenge.

So what to do? To solve the serious problems facing our country, we need to minimize the harm from legislative inertia by relying more on automatic policies and depoliticized commissions for certain policy decisions. In other words, radical as it sounds, we need to counter the gridlock of our political institutions by making them a bit less democratic.

10. Totally Jon Stewart on Barack Obama and whether Linkedin helps the unemployed...and Justin Bieber heckling the President...

29 Comments

Data from the Bank for International Settlements show that Europe's banks have lent $1.3 trillion to Eastern Europe, $900bn to emerging Asia and almost $500bn to Latin America. The danger is a "sudden stop" in lending.

So we''ll add another point of danger to the growing list....

Meanwhile everyone will just carry on......

regards

This one is for you , steven :

www.icenews.is/index.php/2011/08/29/icelandic-carbon-storage-experiment-about-to-begin/

GBH - you need to study geology, physics and math.

That's a thimbleful, compared to the Lake Tekapo-ful we pump out yearly.

It also takes energy to do.....which is energy that won't be available to power your world.

It's a red herring - perhaps approriate.

Gummy, 7billion ppl and growing have decided that they are quite happy to make humans extinct in about 150 years, this capture is a minor process and probably wont matter if the effects of Peak oil dont destroy our society in the first instance in the next 20 years first....

Me I look at my children and I think oh sh*t....

:(

Hope you sleep well at night....

regards

7 billion people have not decided to make the humans extinct . Each individual has decided to live their life , as best they can .

And , much alike me , most of them look at their children and think " oh , I love you so " ... Your kids must be real brats, steven , for you to think " oh shit " when you look at them .

I sleep well at night , a nice sea breeze , and the gentle lap of the ocean , just metres away .. bliss !

Steven some people saw this coming so decided not to have kids. One day you will realize that all that happens has not been by accident. You are happy to blame 7bn people , when in fact it's only a handful over time who have decided this is how it will be.

Most people have no idea what is going on , and are kept stupid. Ignorance is no excuse, but to point finger at the majority its just getting sad now. Wakey Wakey , nice easy animated short film for you to look at.

http://www.youtube.com/watch?v=tGk5ioEXlIM&feature=youtube_gdata_player

GBH - have you ever done anything to help another human being other than yourself ? Your posts while , online you could be a granny from the gold coast , reek of smugness!

Another cracker from Ambrose.

Thanks for the link

cheers

Bernard

http://www.johnmauldin.com/images/uploads/pdf/mwo092611.pdf

Some more from Gary shilling

A good read, Roelof. "the shrinking house appreciation that was tapped earlier to fund oversized spending, the postwar babies’ (have a) desperate need to save for retirement..." Cash accumulation and debt repayment are going to strangle asset, especially property, prices.

Re # 6 Freecycle is a great example and is pretty active in New Zealand

Find New Zealand groups at http://www.freecycle.org/group/NZ

#1 - WSJ's economics commentators still in denial;

"It's not like we can look to the past and ask ourselves what happened last time this happened, because there wasn't a last time," he said.

Wrong. All they had to do was read/understand Marx on capital - and then put it in context.

Plenty of others have.

But then for MSM America to acknowledge that the 'father of communism' foretold where capitalism would take society - just wouldn't do, would it!

#9 - just get rid of democracy

I've said this before, but I cannot see how democracy will survive as we head past the peak (oil, and therefore everything) into a future where there no longer more and more, but instead less and less. For such a transition strong leadership is required; a democracy is too slow; by the time all the democratic meetings are scheduled and the forms have been submitted, it's already too late. A strong single leader on the other hand can potentially take quick and decisive action. Unfortunately, most* dictators seem to be nutcases and hence any quick and decisive actions they take are not for the greater good.

* with the exception of Singapore.

Sorry, as per the Dilbert cartoon the other day that should read:

"As it turns out, most* dictators seem to be nutcases and hence any quick and decisive actions they take are not for the greater good." :-)

I have thought for a very long time that the democratic process has been 'captured'. Politicians have become too adept at bribing voters with their own money, and the average voter is incapable of seeing it (or anything much else). All that dumbing down has been done for a very good reason.

As you rightly say democracy will not survive peakoil anyway, but going on past performance the alternatives will not necessarily be nice.

We don't need autocracy in place of democracy: we need freedom - a libertarian minarchy and laissez faire capitalism.

Every other solution has been tried, most of them ending in the mass grave.

That is true , Mark ... but because of it's nature , it is impossible to bribe the voters into going for a libertarian minarchy and laissez faire capitalism .

........ therefore it will never come to pass , and that is a pity .

Start digging , methinks !

You “two BB- farts” you better look into reality : Looking into current developments on many fronts – the world will never recover again, simply because among the powerful in societies ethic and moral requirements and standards don’t prevail.

Until that matter isn’t sorted out, libertarian monarchy and laissez faire capitalism are the wrong combination for a better world.

I said Libertarian minarchy, NOT monarchy.

We've never had laissez faire capitalism: what we have now is crony capitalism, which is Keynesian socialism: the planned economy, planned society that is founded on lobbying and the earning of monopoly rents through collusion with the State and game playing regulation. That's what is responsible for the growing gap between rich and poor.

We've never had freedom, though we did come close to the classical liberal society.

You've got to think for yourself, Kunst. Don't let big State cry babies like Kim Jong here twist your mind to thinking Nanny can fix all your problems. She's an evil bitch, and a slaver. So is Kim Jong. And that Marxist Morgan.

My point too . When Bernard Hickey cackles on about the failure of unfettered capitalism ..... I get rarked up , because we never had it . We had an appalling crony-capitalism , with massive doses of government intervention in the markets , and central bankers' incompetence .

Mr Hickeysterical and his doom laden band of gloomsterisers want to revive the theories of Karl Marx . They need to watch some docos on the Discovery Channel of life under Stalin , to dissauge them of that little delusion .

[ Walter Kunz is an old " BB " fart too , for what it's worth ]

Yes, what Bernard doesn't realise is the form of crony/Keynesian capitalism IS Marxism.

So will that.....its just a Q of what collapses first.....

What you miss is most ppl see the advantage in grouping together....and where free to do so, will do so.....

regards

Retailing continues to get crushed. BBQ Factory just went under:

http://www.nbr.co.nz/article/mild-winter-blamed-bbq-factory-receivershi…

Appropraite really.....large seller of CO2 relasing equipment fails due to the "un-seasonally" mild winter....

regards

Now , this is a brilliant use of pension funds , the Icelanders are showing us the way forward ...

www.icenews.is/index.php/2011/09/28/26839/

.... Gummy doesn't plan to retire there anyway , Thor be praised !

Why Iceland? Lost your cod-piece?

FT promoting break up of big 4 accounting firms. Finally gaining traction Accounting gangs are being shown up for that are quasi criminal entities preying on society through legislative advantage. The amount of fines they are paying, the criminality they are involved in in the Uk alone is staggering.

New Zealand should get on with breaking them up, I know one could be called Price, another Waterhouse and maybe another Coopers . That would be a good start, no need to say what they can do just break up the concentration. All the talk about need for scale and expertise is a load on nonsense. They are a bunch of separate firms, individuals colluding to rig prices and services, all with the backing of government.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.