By David Chaston

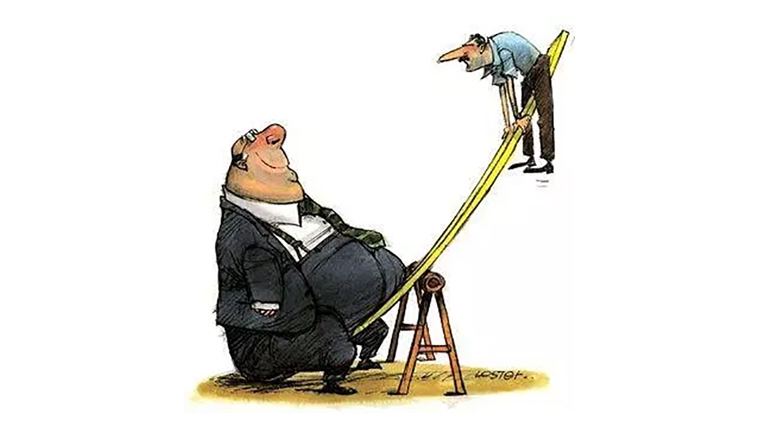

Deposit insurance, (or a bank deposit protection regime), is just the latest example of how the baby boomer generation is capturing all the benefits and protections the State can provide.

This is in stark contrast to what other generations manage to win.

As the boomer generation is wealthy, it is also embedding inequality, and exposing how ineffective the have-nots are at the public policy table.

The essential public policy bargain the deposit insurance scheme brings is that the taxpayer promises to make good depositor losses.

It also means depositors are freed from taking 'risk' into account when they park their money.

This type of free pass undermines individual responsibility.

It also allows banks to claim that they no longer need to hold more capital and that excessive leverage isn't putting customer deposits at risk.

The moral hazards are immense. And they are benefiting just one section of society. And the other sections aren't awake to the liabilities being imposed on them.

It is a classic case of selfish generational capture.

Life comes with risk. Sensible decision making requires you assess these risks and change your behaviour to accommodate them.

But it is entirely selfish to use your democratic weight to impose socialised costs on everyone else to protect your private gains. Deposit insurance is just that - wanting risk-free benefits at no personal cost.

But I reckon there will be a sting in this capture: the cost will appear as sharply lower interest rate offers for savers.

Lower interest rates are a bad thing, even if I am the only one saying it.

Low interest rates mean low investment yields become the norm. And that juices up asset prices. And that is very bad for society - for everyone except those holding assets.

For example, a 5% interest return on a million dollar asset is an annual cost (or return) of $50,000.

But if that $50,000 return is happening when interest rates fall to 2%, then the $1 million asset is revalued to $2,500,000. The extra $1.5 million just falls out of the sky and into private hands. ($2,500,000 at 2% = $50,000.)

Those that don't have $1 million to start with don't participate. Those that do get rich quick.

Low interest rates hurt society in other ways too. They mean that new investment, public or private, needs a much lesser justification. Over time projects with very low returns-on-investment get done. There are many more of them, especially in the pubic sector. Voices clamour for their pet project to be funded, and just because the cost of funding is very low. Because returns were never robust in the first place, these are the types of projects that fail even the low standards and can much more easily slip into a loss than those with solid returns. In the end, society 'invests' more of its capital than can ever result in benefits. Our already problematic productivity problem turns negative - we spend more on inputs than we get back in outputs. Waste balloons.

When interest rates are sensible and higher (but not too high - that brings other problems), better quality projects get approved. And even if they don't quite work out as planned, the under-performance doesn't result in losses, just lower returns.

We need higher interest rates. We need banks to be capitalised better. And we don't need deposit insurance because we don't need the generational benefit capture and inequality that comes with it. Those of us who have had a lifetime to build assets just need to be thankful for our good fortune, accept the risks involved, and try and leave the playing field more level for others that follow. Screwing the scrum in our own favour at the expense of others should be beneath us.

71 Comments

A capital gains tax to pay for deposit insurance sounds like a fair deal to repair this imbalance. What do you say David?

Would there be any chance that the tongue of the generational self licking ice cream cone is getting tired?

Fun fact - when South Canterbury Finance was bailed out it was for more than all the treaty settlement payouts at the time. Most investors knew they would go under - but there zero risk of a loss so they poured money in to get the high interest rates. A handy wealth transfer from the taxpayer to the already well off. Thanks suckers....

A few thoughts:

1. Every developed country has a deposit insurance scheme, we are behind the curve in not having one already.

2. The notion the average person has the credit analysis skills to assess a banks credit worthiness is comedy. The credit ratings agencies often get this wrong so how can an average person be expected to surpass their performance.

3. The baby boomers have the majority of their wealth in property not bank accounts.

4. The cap on insurance is so low it would benefit a wide net of people. If anything because of the low threshold the wealthy are penalised.

David you need a stronger argument, your current one is constructed like swiss cheese.

Yes I thought something around the level of a minimum house deposit on an average FHB property would be something palatable to most. Agree with your point 4, which kind of counters the point in the article that people need to be aware of the risk of depositing money in the bank.

In reality $50K is nothing because if the guarantee was ever triggered, because of our 4 big trading banks having failed, then NZ’s financial position and/or plight, would obviously already be catastrophic, worse than 1929. NZ$50K would translate to about 50K Venezuelan Bolivars.

1. The fact that other countries do it does not mean we are "behind the curve". If you are right then you are right regardless of what others say.

2. To some degree I agree with this. However, I think free people should make their own mind up and that includes being informed.

3. Perhaps why the baby boomers have their wealth in property is, in part, because of low interest rates. Deposit insurance will push saving interest rates lower.

4. The cap is low. However, it seems like it is there for the middle class only. Anyone with more will go else where and most poor people don't have $50k at the bank anyway.

The problem with deposit insurance is that it doesn't actually do what it purports to do in an efficient and fair way.

Anyone with more will go else where and most poor people don't have $50k at the bank anyway.

Based on ressearch undertaken annually in the past 12 years (ME Bank), 50% of Aussie h'holds have less than $10K in the bank. 70% have less than $50K.

About 25% have less than $1000,

Depending on your definiton of poor, 10K of cash savings is not great for half the population's h'holds.

https://www.mebank.com.au/news/household-financial-comfort-report/

Glitzy,

I agree with every word. However,I am less polite than you. David Chaston knows full well that most depositors have no ability to discriminate among the various banks. many simply do not know of the existence of the Dashboard and would find it useless even if they did know. His argument is,in my view,dishonest.

I have asked this question of the RB and not surprisingly,got no proper answer. How is that every country with deposit insurance has decided that the risk of moral hazard is trumped by the need to ensure that there is no need for investors to create a 'run on the bank' should they fear that their bank might be in trouble,followed by contagion as other depositors take fright?

My respect for David Chaston has diminished sharply.

It would be a good question to be put to the RBNZ. How many unique hits on their dashboard by week since it's inception.

"But it is entirely selfish to use your democratic weight to impose socialised costs on everyone else to protect your private gains. Deposit insurance is just that - wanting risk-free benefits at no personal cost"

What about part of society playing a speculative game of capital gains with our housing market and hiking rents - but not being willing to pay for the social costs associated with this private gain? e.g. paying capital gains tax to support those who they've left behind? John Key used the democratic weight of the greedy property owning class to remain in power - why would this be different for those who want to protect their savings?

....and remember the banks really really need those deposits! I think they are David Chaston’s words too!

Why should deposit holders be forced to prop up the banks when they get into trouble! We are after all giving the banks business loans by depositing our hard earned cash with them!

Well said Independent observer!

Yes money should be safe in the bank, it is the job of the bank. That is why you put your money there instead of under your mattress. Otherwise it's like giving your money to the mafia just for safe keeping. Where is the difference !?

I tend to agree with the overall thrust of David's argument here. However, as we have seen the chance to level the playing field has been consistently avoided by governments. One way would be to reduce tax on income and increase it on wealth - yet this was not even considered by the TWG as it was effectively ruled out by the government. Deposit insurance is a populist measure that on the surface seems good but isn't that good when all the factors are considered. But I think the banks will go along as it is the cheaper alternative than increase capital.

Isn't a capital gains tax a tax on wealth - not income? i.e. the thrust of the TWG recommendation?

Still a tax on income (gains) in economic terms, just technically windfall / unearned income (vs. earned income).

The argument is wrong.

NZer's can insure almost everything else - house, car, health etc.

Bank deposit insurance should be available.

OK.. you pay for it. That's the difference... you pay to insure your house, car etc... its your choice.

We will all be paying for bank deposit insurance

"Why pay for it when someone else can", the entitlement of these deposit holders is disgusting especially given many NZers are living hand to mouth. This is just one of the many perks given to the baby boomers for their votes.

you are taking about bank deposits a lot people who have bank deposits are not the ones who are over leveraged or any debt at all they are not speculators and have not created this mess for ten years we watched interest rates drop as the gamblers rolled the dice now savers are being victimized well the money in deposits is all tax payed which is more than can be said for capital gain on property the grantee is there to stop bank runs when the interest rates go to zero its the debtors that should be paying

Exactly - like any other insurance.

1 Year ANZ credit default swap is 8 basis points, 3 years 26bp.

Quite happy to pay for it.

The consumer effectively pays for any insurance

The point is that it is not available. Its absurd.

Typical comment from one who wants others to pay for them.

The Banking system have proved yet again that they are willing to take risks with other peoples money

The idea that the average consumer has the information available (or even the knowledge and expertise) to assess the risk of their deposit in a financial institution is so laughable it hurts.

Even if the average New Zealander deems all the banks too risky, what practical alternative do they have? Modern society basically forces everyone to use a bank account.

The solution is that the RBNZ should be properly supervising the banks and ensuring they are well capitalized, they are lending responsibly, and not overexposed to any one sector. Unfortunately, until recently the RBNZ seems to be failing miserably.

But that has come about because of the perception of safety. If people really were concerned about the safety of their deposits, they would be looking for a bank that had good quality simple loans. But if every bank is insured and government backed, you may as well go with that one that puts all your money in convoluted ‘financial instruments’ (designed so even the reserve bank doesn’t understand) it because they are paying an extra 0.2% interest.

David, how can it be argued this proposed deposit insurance benefits the wealthy, when only amounts up to a max of 50k are being considered? I suggest that there's many a boomer sitting on vast amounts of cash in excess of 50k, mortgage free plus additional properties to boot. Subject to decisions on how the scheme being policed, the insurance may only cover $50k per individual as opposed to per deposit (various banks) anyway....

As for the investment scrum being screwed. I think the chances are growing that many late arrival wannabes are about to be screwed over by their own decisions. I liken it to a chilly backdraft, a symptom of the yawning wealth divide (a shortage of affordable homes/surplus of unaffordable homes). It was all created by the same herd who suffered from FOMO. The rapid capital gains could not go on forever. Many have leveraged their finances as though their unique decisions were somehow insulated from equity losses (foolproof).

Surely a deposit insurance reduces the risk of bank runs. In the absence of one, what happens to the cost of funds if deposits start heading to countries that do have deposit insurance? Look what happened to interest rates in Greece and Turkey.

These days anyone who has money in a bank is the wealthy. Most of us have the opposite.

$50k shouldn't be considered as an investment. You need that buffer in case you got ill or lost your job.

Societies choose to use taxpayers' money to mitigate all sorts of risks. Most developed countries, rightly or wrongly, include the deposit loss risk in there too.

If one wants to make a case against a deposit guarantee scheme, solid economic / financial arguments need to be brought up, rather than ideological ones (such as “poor” vs “wealthy”, inter-generational animosity, “inequality”, etc). As it is, the article would more appropriately belong to an ideological website, rather than a financial one.

Besides, the proposed deposit guarantee limit is not more than $50k (and possibly as low as $30k), so why the storm in a tea cup?!

Lastly, having a deposit guarantee scheme and carrying out a strong oversight of the banking system are not mutually exclusive.

May I disagree. Most depositors are not sophisticated investors and 85% of people will still think that the bank is simply keeping their money safely in a locked vault that they can access it at any time.

Depositor insurance and the low cap are actually a sensible move to protect the majority who have very little interest in banking, so long as they can ‘tap and go’ and the money gets transferred. This will protect the majority should the reckless lending behaviour, particularly from offshore parents, lead to an event. Weatpac’s Australian loan book that peaked at 50% interest only loans at the end of 2017, would be one of a number of risks.

AThe benefit to NZ is that those with large cash holdings and a an appetite for low risk, will likely diversify and move their deposits around the banking system. This will hopefully reduce our current dependence on 4 overweight Australian firms - who I have no doubt would support (could have written) the position that you take in the article.

Addendum

If the world does get sticky, but we remain the only nation to have bail-in and no guarantee, then the risk of large numbers of people emigrating their cash holdings from our shores would be devasting to the banking system.

I would imagine that a good number of residents of NZ would have the ability to diversify abroad quite quickly if ever the Aussie banks looked shaky.

Just to put some alternative views out there. I’m for it providing we know at what point the guarantee is applied. After bail-in or before?

Good point Joe. Pre/post-OBR needs to be absolutely clear. A deposit guarantee is basically saying "your money is safe and will be protected by the government in a black swan event". So if it only protects what you have left after the bank gives you a haircut then it has to be advertised in exactly those terms.

The other thing that would need to be clear is what entity exactly the guarantee applies to. Is it the individual depositor? Each account? Per bank? All banks within an overarching ownership?

My guess is that a lot of folks with $30k-$50k in bank deposits are pensioners barely scraping by on returns in "investments" keeping a little bit of "safe" money just in case.

For example, a 5% interest return on a million dollar asset is an annual cost (or return) of $50,000.

But if that $50,000 return is happening when interest rates fall to 2%, then the $1 million asset is revalued to $2,500,000. The extra $1.5 million just falls out of the sky and into private hands. ($2,500,000 at 2% = $50,000.)

Those that don't have $1 million to start with don't participate. Those that do get rich quick.

Hmmmm... investment horizons have everything to do with discounted NPV.

A to be issued $100.00 10 yr bond with a 5% coupon rate and a current 5% discount rate, prices at $100

A to be issued $100.00 10 yr bond with a 5% coupon rate and a current 2% discount rate, prices at $127.07

A to be issued $100.00 1 yr bond with a 5% coupon rate and a current 5% discount rate prices at $100

A to be issued $100.00 1 yr bond with a 5% coupon rate and a current 2% discount rate prices at $102.96

I used a semi annual payment bond calculator.

Yep, David has used a perpetuity calculator when referring to bank interest rates. (50k / 0.02 = 2.5mm). Its not however relevant to bank deposit rates nor to the deposit insurance argument. I'm not really sure why it's mentioned at all.

Exactly - talking at cross purposes.

Nonetheless, so called "rich" bank depositors would have to come up with an extra $1.5 million, if they happened to be O/N OBR risk averse types, to continuously accrue the annual $50,000 receipt if interest rates suddenly dropped from 5% to 2%.

This is the much ignored capital cost reality associated with falling interest rates. The rising present value costs of meeting fixed liability outgoings are enormous. Wages, pensions, and insurance are obvious victims.

“As the boomer generation is wealthy,”

All of them? Are you sure about that! Have you spoken to debt councillors and citizens advice centres or the salvation army and asked them how their baby boomers are doing? I think you would be shocked at the feedback you would get from those people on the ground!

Time to take those rose tinted glasses off David - all is not well out there!

The core problem is that so many New Zealanders of all generations treat existing residential property as fair game for speculative investment, and the banks are more than happy to assist them. It’s a Ponzi scheme now, with a huge influence on our economy and it’s poorer members, many of whom are baby boomers.

Here's a suggestion.

Make the deposit insurance apply only to approved banks - ones that either have conservative capital buffers, or that have separate 'sub-banks' firewalled from speculative lending.

Then have a public education campaign informing everyone that their money is only truly safe in one of these institutions. It could be a boon for smaller lenders that play it safe.

No sorry David but we really need some type of protection for peoples life savings. We all know that there's a high risk at the moment with global housing markets that both us and our neighbors banks (Oz and China) that are resident in NZ have become very dependent on property. Even the 2008 Global Finical Crisis was brought about by toxic assets generated by the housing industry via soft lending practices (Mostly in the US).

Now we're seeing Australia relaxing it's regulations and moving along the road of soft lending.

Plus the younger generations are probably the most vulnerable with them desperately trying to save up for their own homes and their own life pensions. Most of the Boomers here have had the advantage of squirreling away their money in to property, and have paid off their mortgage on their residential home. The worst thing that could effect them is that they switch to a reverse mortgage if things get really bad.

here ya go https://debtmanagement.treasury.govt.nz/individual-investors/kiwi-bonds…. Pays almost nothing, but thats what ya get in this market

No, they want 17% return with money guaranteed, same as the Government provided to SCF investors.

Hey why not have a public policy that pays out if your rental property drops in value too? Or some kind of guaranteed minimum tax free capital gain on a rental (10% sounds fair for all that ‘hard work’).

Insurance is a bad thing? What a joke

That's not my interpretation of the article.

What he's really saying is that it should be the banks and their shareholders who pay for a more secure financial system (via higher capital requirements and lower profits), rather than the general public of New Zealand.

That would be equitable, given the RBNZ's penchant for lowering depositor returns via state mandated intervention, while at the same time acknowledging the increasing risk associated with banks' loan portfolios.

Yes compulsory insurance can be a bad thing. Some people might not want to pay to insure against the very small risk of a bank failure.

We don’t even have compulsory car or house insurance, why have compulsory insurance on one of the most unlikely events (unless the government know something we don’t)

Well, I’m sorry – but if there’s a coherent, well-constructed argument in David’s piece, I’m struggling to find it.

I can only assume he’s having a bit of fun and seeing what bites.

I agree. There are so many holes in his article I think he is just taking the mickey out of the self appointed experts who comment on this blog. If he is serious please say so (DC?), and i'd then like to ask him some questions on the assumptions he has made.

This is a very bad idea. There is no reason to pick a safer bank. It removes one aspect which banks can compete on for deposits.

Couldn't agree more.

I enjoy your articles David. If deposit insurance comes in, watch the share prices of NZ property companies rocket.

Great article David. Sums it up nicely. You should be on prime time explaining it to the masses!

(The economic system) does need higher interest rates.

Its impossible. Higher rates would only collapse debt.

That said, all systems based on endless growth must collapse eventually.

We have depleted our energy base & mineral ores and continue to add exponentially more people...

Historically when energy consumption per capita goes backwards trouble ensues ...

Deposit insurance is another case of boomers having one more slice of cake. They have had far more than their share.

But physics doesnt care either way about bank deposit insurance.

We have not depleted our energy and mineral base if we had the prices would be through the roof The idea of deposit insurance is simply one of mindless political expediency. Beware of politicians bearing gifts and promises, they have nothing other than other peoples money.

It was through the roof ... in 2008 ... Oil was $140+ a barrel and climbing...

Since then lack of affordability (ie deflationary pressure) keeps forcing the price back down.... despite trillions pumped into the financial system

https://www.macrotrends.net/1369/crude-oil-price-history-chart

There is no Goldilocks price left which suits both producer and consumers

The point being that without cheap energy inputs, real growth is impossible

An excellent article David. Continuing interest rate repression undermines the fundamental basis of capitalism, the cost of capital. The endless interventions by Governments and Central Banks has created an appalling environment which favours only the wealthy. And yes politicians are making crazy decisions based on the low cost of money. Yes we desperately need higher interest rates to reverse massive malinvestment. The situation has become so bad that many pension funds in the US which are required by law to hold low risk portfolios i.e cash are now being told its acceptable to default on their payments obligations. Yes asset price have been massively juiced. This is going to end in tears. www.interest.co.nz/opinion/99061/john-mauldin-mauldin-economics-argues-…

Such a Pathetically ignorant article I think it was written as a joke. For eg., Read up on how the FDIC operates in the US. Deposit insurance is such a sound policy it NEVER makes the news and everything makes the news in the days of trumpeter governing.

The US Government has not lost a cent since FDIC was instigated in 1934. This includes 134 bank failures in 2009 after the GFC, because the premiums are paid by the banks , not the Govt. Yes, an extremely small portion of their interest may be adjusted for it but the banks have so much room to maneuver with this as the spreads are fantastically high it is irrelevant.

The Govt. based overseeing agency should incorporate the duties of bank oversight as well. To say a Mom and Pop depositor should know about all the illegal shenanigans performed by most of the Australian owned banks is asinine.

Totally a pathetically written article. He does not have the first clue about how deposit Ins. benefits the financial stability of a country. That's why most other countries have had it FOR YEARS. The moral hazard is non existent argument. Where did this guy come from?????

It is quite wrong to say that in the US "the premiums are paid by the banks, not the Govt.". The US has its OCR at 2.5% and yet their banks pay depositors less than 1% (actually much less than 1% - I know because I am one of them). It is depositors who pay, not the banks. This is the consquence of deposit insurance.

If you want risk-free, invest in Kiwi Bonds (or in a fund that invests in Government bonds). If you want a better return, you will have to take some risk. If you expect the taxpayer to insulate you from risk in a bank, you are involved in a public policy moral hazard by looking for private protection at a cost provided by society. Plus you will get a nasty surprise when the yields drop away to risk-free status when deposit insurance comes. You don't need a risk-free bank when you have access to risk-free Kiwi Bonds. If you don't take that option up, you can be criticised for seeking something-for-nothing.

“If you expect the taxpayer to insulate you from risk in a bank”

I expect sound regulatory control and oversight to firstly insulate me from risk – with all the bells/ whistles and penalties that come with it – to the point where “failure is not an option”.

I admit to having little knowledge as to the exact workings of the insurance and related risk/underwriting etc – but if failure is taken to a 200 year event then I’m puzzled why a 3% or thereabouts return subsequently becomes less than 1%.

A credit union in the US will give a much (as in much!) better return than a “bank” in the US – whilst still providing similar FDIC insurance through the National Credit Union Insurance Fund (NCUSIF).

David I like this article for the sole reason that you have made mention of inequality. I think those giving you a serve on capital gains are quite right also. Good to have the discussion out in the open though.

Charles Hugh Smith paints the picture quite well. https://www.oftwominds.com/blogjune19/burnout6-19.html

My daughter and nephew are suffering as he says. Professionals in the mid 20's doing moderately well, but suffereing fatigue from long hours they have to work. But their brothers and sisters will probably never get on the property train if it remains as it is. My father is behaving exactly as described in his article also.

quite

Super cities are just more efficient consumption hubs .... nothing more.

the economic system MUST... generate .... more ... WASTE

So add population, pile em close & pump them up with Debt and watch the waste production miracle begin

On mass there is no way for a country to "unlock" supposed house wealth from these super cities ... Its fictional income where a few cash in and the intergenerational burden of the Ponzi is passed on until the burden is too high

David I take exception to your statement that Baby boomer generation is capturing all benefits and protection that the State can provide.

Since the restructuring of this Country's Economic system in 1984 etc their has been a lot of financial hollowing out of the so called Baby Boomers wealth. These are the people that built this country.

The Politicians have a lot to answer for

"Since the restructuring of this Country's Economic system in 1984 etc their has been a lot of financial hollowing out of the so called Baby Boomers wealth"

Say what?

Good stuff David. You lit the fire with this one. I too, have been going on about interest rates (cost of money) being far too low for far too long. Of itself, it will probably be seen in hindsight as the beginning of the end of the current system. Spooky!!! As for term deposit guarantees, that's another issue in my mind. I'm a boomer but I still want my (lousy) 3.25%. However, if I was living in Germany I'd be getting a fraction of that, so we'd better be careful what we wish for. One of the articles points, I think.

May not be 50k yet. I seem to recall that the amount was 30-50k per institution.

I suppose that the next move will be that most of the NZ banks will amalgamate so that will reduce the amount of payout.

Let's take a step back. What is the primary purpose of deposit insurance?

https://en.m.wikipedia.org/wiki/Bank_run

If you think this can't happen in New Zealand, then look back at 2008/2009 GFC, when the finance companies had difficulties renewing their maturing debentures, as debenture holders did not roll over their maturing debentures, and this ultimately led to many finance company bankruptcies. Many retirees lost their entire investments in debentures issued by finance companies. I heard a story about a retiree who had diversified amongst a number of finance companies and lost most of their investments.

Also recall, that during 2008/2009, the NZ government guaranteed bank deposits to prevent a bank run by depositors. The NZ government also guaranteed some bonds issued by NZ banks - it was the only way for some banks to access the bond market. If the banks had been unable to refinance their debt obligations and experienced bank runs by depositors, the 2008/ 2009 period would have likely been a lot worse that it was due to the likelihood of an even larger credit contraction.

So if there is no deposit insurance, what will depositors likely do if there is concern about bank liquidity and bank solvency? What would you do if you were told that the bank in which you held your deposits was in financial trouble? To avoid potential loss, many depositors would withdraw their bank deposits - some would keep the cash at home, some would buy government bonds, some might buy other assets with a store of value such as gold, jewellery. Some might move the deposits to bank accounts overseas - for example, bank accounts in Hong Kong allow deposits denominated in NZD. Some might move their cash to Australian banks to take advantage of the deposit guarantee there (I know there are some questions raised on this by DFA, but that is another issue).

In the modern day of the internet, social media and mobile phones, news or a credible rumour of a bank in trouble would spread quickly. A credible rumour might result in withdrawing funds first, verify later.

If there is no bank deposit insurance, and a bank run results in a systemic risk in the banking system,

1) the government may need to guarantee bank deposits like they did in 2008/ 2009 to stop a bank run (and the banks will likely pay for the deposit insurance) or

2) the government may need to recapitalize the banks, then the cost may ultimately be borne by taxpayers - similar to the recapitalization of BNZ in late 1980's / early 1990's.

FYI, here are the details of the Crown Retail Deposit Guarantee Scheme when it was launched in October 2008

https://web.archive.org/web/20081014133953/http://www.rbnz.govt.nz/fins…

I suspect that David has liquidated his property assets and now has a lot of cash in the bank earning a paltry sum. This has no doubt brought about the sudden revelation that, why yes, higher interest rates would certainly be for the common good!

I hope David will answer these questions;

"...latest example of how the baby boomer generation is capturing all the benefits and protections the State can provide." While the Government has decided to put this in place David, why not argue that the banks should have to fund it? Any insurance company would then want some significant oversight to ensure their liability would be unlikely to be called upon. This doesn't just protect the Boomers, indeed much commentary is about how the Boomers have too much money, it protects everybody and anybody with up to $50 K in the bank. However I believe the banks should be providing the protection not the Government and taxpayer. The banks are after all, public companies (rather than Government owned) and their shareholders should be carrying this risk. It may make them a little more cognisant of the activities of the bank. This move actually protects people at the bottom end of the banking spectrum, rather than embedding inequality to protect the wealthy.

I am really concerned with the assumption you have made re the $1 million asset returning $50 K. By what assumption do you inflate it's value to $2.5 mil? Is it simply that the required return is $50 K? But if interest rates drop from 5% to 2% the the return will drop to $20 K. This is a problem with the financial system. A $1 mil asset is a $1 mil asset and unless the market changes the value of that asset cannot change, so the rate of return will be based on the interest rate and will drop. Besides the bank pays interest on money not an asset. Again $1 mil is $1 mil.

As to interest rates, I agree that we should have higher rates, but it is the banks who have driven them down. There has been much debate on how risky bank practices have been in recent years (since the GFC) but interest rates have done nothing but fall. There is little to no competition between banks other than a race to the bottom. Depositors have received little to no risk premium on their money despite all this commentary, and the revelation that deposits are legally the banks property and not the depositor's!

I would guess what you are really railing against is how banks are regulated and are able to fleece their customer base, and the tax payer with a fair degree of impunity, and on that matter i fully agree!

Should there be a major bank collapse under the current system, I suspect most bank depositors losing their savings might well be pensioners. We are being told to save for old age, because the NZ pension alone is not enough. So what would happen if many pensioners lose their savings? The welfare system (taxpayer) would have to help out in the probably numerous cases where basic living/housing expenses can no longer be met by using savings/interest earnings after having undergone the 'haircut'.

It seems that poverty and inequality always comes at a cost to the taxpayer. So perhaps the question is more about where is the most sensible balance than a straight yes/no.

Why would banks, who are authorised to create loans out of thin air ever get into trouble? At worst they simply will be less profitable if bad debts go up given these loans didn't cost them a cent and must surely dwarf any interest payments due to deposit holders.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.