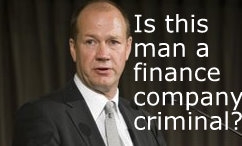

In an extraordinary move, the Securities Commission has released a statement saying it has nearly completed an investigation into the Hanover group of companies and might lay criminal charges against directors in the New Year. Directors of the Hanover companies included Mark Hotchin, Greg Muir, David Henry and Tipene O'Regan.

Hours after the Securities Commission announcement former Hanover independent director and Chairman Greg Muir resigned from the chairmanship of Pumpkin Patch, where he had been due to stand for re-election next week.

The commission said given public and media speculation, it was in the public interest for it to clarify the status of its investigation into Hanover Finance.

"Commission staff are near completion of their investigation into Hanover Finance Limited, United Finance Limited and Hanover Capital Limited," the Securities Commission said.

"The investigation has been complex and involves a team including investigators, forensic accountants, financial analysts and lawyers. Commission Members, who have been kept informed of progress of the investigation, will meet before Christmas to decide whether criminal charges will be laid against directors of the companies."

"Although no decision has yet been made, it is likely any charges will be laid in the new year."

Watson not a director

Current or former directors of one or all of Hanover Finance, Hanover Capital and United Finance have included former co-owner Mark Hotchin, Greg Muir, David Henry, Sir Tipene O'Regan, and Bruce Gordon. Companies Office records don't show the other former co-owner, Eric Watson who has lived overseas for several years, as ever being a director of any of the three companies.

However, a 2007 Hanover Finance prospectus notes it was signed on behalf of Hanover Financial Services Ltd and Hanover Group Ltd by the duly appointed agent of those companies and the directors who weren't also directors of Hanover Finance being Watson and Dennis Broit.

Meanwhile, a Securities Commission spokesman said the regulator had previously issued statements suggesting it may lay criminal charges against companies or individuals when it had been in the public interest to do so. The spokesman didn't provide any examples but added that the Securities Commission had publicly stated that it had been investigating failed finance companies, including Hanover.

Property financier Hanover froze NZ$554 million owed to 16,500 investors in 2008. Investors' subsequently approved a moratorium proposal that pledged to pay them back over five years. Then a year later, in December 2009, Hanover investors agreed to swap their Hanover debentures for shares in Allied Farmers valued at 20.7 cents each which are now worth just 1.9c each.

See background story on Hanover here

Muir leaves the patch

Meanwhile, Pumpkin Patch chairman Greg Muir said he would not seek re-election at the annual meeting next week, where he was due to face opposition from some investors.

“I am proud of Pumpkin Patch’s achievements during my time as Executive Chairman and Chairman of the Board. Over this period the Company has produced significant total market returns with turnover and earnings more than doubling. I have enjoyed contributing to this iconic New Zealand company and am particularly proud of its continued growth and development," Muir said.

“Despite the stellar performance of the Company, it would appear that my leadership of the Pumpkin Patch Board is drawing attention away from the business itself. Rather than allowing this to continue I have decided it would be in the best interests of the Company for me not to seek re-election," he said.

Muir joined Pumpkin Patch in 2004 as Executive Chairman as it listed on the NZX. In 2008 he stood down from his executive role but remained Chairman of the Board of Directors. Muir is currently CEO of Tru-Test.

(Updates add more detail, including comments from Securities Commission spokesman, Resignation of Greg Muir as Pumpkin Patch Chairman).

15 Comments

If they did that would be awesome, I doubt it though, justice in this country is ridiculous.

MH is trying to sell all his assets here and now living overseas - see the connection?

It would also have the added benefit of removing one of the last pathetic whines available to the ever decreasing band of Hubbadites ie. 'What a disgrace it is you are picking on our Messiah when rogues like Hotchin aren't charged'.

Is it just me or is the fact that the Securities Commission issue a statement dated "19th December 2010" just a little worrying that attention to detail is a little inept among our financial regulators?

Is anyone aware of the Securities Commission ever previously putting out a statement saying it is investigating a company/companies or individuals and MIGHT lay criminal charges? I think this statement is unprecedented...

Perhaps they are laying the groundwork for imminent charges in the SCF case? As I mentioned above Hubbadites have been very free with the accusation that their man has been targeted and yet other rogues appear to have escaped. Perhaps the comment is a bone thrown in their direction to placate the inevitable whine-fest should charges be laid before xmas against Hubbard?

FYI, I've just updated the story. The Securities Commission says it has done this before but didn't give me any examples. Andy, I think Hubbard's fate is in the SFO's hands more so than the Securities Commission...

Gareth , it is somewhat unusual , firstly investigators should never make speculative comments as it could prejudice their case in the courts, and secondly there are risks around being found 'guilty by media speculation' in the public domain if the media make a thing of it.

Given their comments , one would expect arrests and charges today ( Monday) , as any delay would bring a minefield of counter - claims

If they believe there is a case to answer , why not just arrest the buggers, take away their passports and then release them on bail pending completion of investigations. Upon arrest the charges can simply say 'Fraud' and details can come out in court

Cheers Boatman. I was thinking there could be a risk of prejudice. It seems the timing of their announcement may have been targeted at Greg Muir and his potential re-election as chairman of Pumpkin Patch. Well, he's gone from there now, but it could be a big price to pay if they've prejudiced their overall case...

Hopefully the Securities Commission and SFO will take these guys all the way through the courts and hammer them with maximum penalties - and not just the usual slap with a wet bus ticket.

These guys need maximum attention if the financial markets can move forward with any surety and any chance of support from investors for the next version of finance companies to be created - and beleive me the market is suffering through lack of capital and finance which is holding back the economy.

Bust his ass.

Won't happen Bob , because the Law is an ass .

that's a frikkin ace nom de guerr there bob. do you have a law blog?

LOL LOL LOL LOL - Never going to happen!!!

smacks of incompetence or desperation - either the SFO has nothing to go on or they are rather stupid.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.