By Sheryl Sutherland*

First, read this. Now let’s examine the building blocks you need to utilise to get started investing.

Asset Classes

Every prospectus or offer you read about refers to asset classes. Different assets perform differently; for example, property offers different returns to shares. Some will give you capital gain and fixed interest investments give you income.

Cash

Cash usually refers to money that is accessible, such as the folding stuff you’ve got tucked under the mattress, or the money in your savings account. Cash investments are low risk, low return and best used for short-term goals, or if you feel you may have to call on your funds at short notice.

Fixed Interest

Fixed interest investments such as government stock or debentures are next on the risk scale. Typically, these are utilised by investors who want a fixed rate of return over a longer term, or for those who are setting up a diversified portfolio and who have a set investment term in mind. The return on these investments is higher than that of cash.

Bonds are classified as debt instruments. This simply means that you loan money to a company, or a financial institution, and it pays that money back together with interest. The advantages as an investor are:

• you receive regular income from interest payments

• your capital investment is paid back to you at the end of a specified term

• these investments are much less volatile than equities (shares) with less risk of losing principal.

There is a downside with bonds: if you had bought bonds at say five per cent return and a new series is issued at say seven per cent, you would have made a loss.

Property

Most of us automatically think of our own homes, but property investment is quite different. Investing in property can range from buying a rental property, to commercial or industrial buildings, to a block of flats. Property typically gives the best returns in times of high inflation or when demand is high. Interestingly, despite our perception that property is ‘safe’, it is cyclical, and is actually somewhat riskier than we often think. Investing in property may, however, provide you with tax advantages.

Shares

Shares are also referred to as equities or stocks – the term ‘stock’ originated from loans made to merchants whose ships were bringing back stocks (goods) from other countries. Shares became available to the English public in the eighteenth century when trade, particularly with India, was growing quickly.

Today, if you buy shares, you buy a piece of a company. In return for your investment, the value of your shares may increase and you may also be paid a dividend. A dividend is returned to you in the form of an interest payment or in the form of additional share(s).

Historically, shares offer the best return of the main asset classes but carry a higher degree of risk. The risk inherent in shares is volatility or sharp change in value, particularly in the short-term. The performance of the share price is reliant on company management and the overall economy. In addition, people generally purchase shares when prices are high, instead of buying when prices are down. Historically, women have not been purchasers of shares, somewhat to their detriment. Shares are certainly a long-term investment, say five years at least.

Commodities

Commodities are global contracts for bulk goods such as metals, energies, foods, and financial instruments. Metals include gold, nickel, and aluminium; energies include oils, coal, electricity; foods include pork bellies, coffee, orange juice; financial instruments are currencies, share market indices and interest rates. These investments are speculative and for the individual investor they should be utilised through a managed fund – also often called a unit trust (more on those later). Wealthy investors have been using hedge funds (commodity funds) since the 1940s. At that time, one needed at least a million dollars to invest; now these investments can be utilised by small investors like you and me, starting at $100 per month.

Although the underlying investments are risky, commodities can provide stability in a portfolio as their growth is not correlated to equity or share market movement. In the past, and currently, many fund managers and investors have used fixed interest and cash to smooth out the volatility of the market.

Growth or Income

Each asset class will provide you with different combinations of growth (capital gain) or income and, not surprisingly, different taxation implications. Growth refers to an increase in value, for example if you buy a house for $120,000 and sell it for $150,000 you have a capital gain of $30,000. If you rent the house out, the rent you receive is income. Capital gain is generally a one-off profit derived on sale, while income is a stream of money, like your salary.

Examples of growth investments are property, shares, and commodities. Income investments are fixed interest and property, if there is a rental income. Shares can also provide an income stream in the form of dividends. Generally, share and property investments provide higher growth and less income than fixed interest investments.

Potential Income and Growth

| Investment Sector |

Volatility | Income Potential |

Growth Potential |

| Cash & Term Deposits | Very low | Moderate | Very low |

| Fixed Interest | Low to moderate | High | Low |

| Property | Moderate to high | Moderate | Moderate |

| Shares | Moderate to high | Low | Moderate to high |

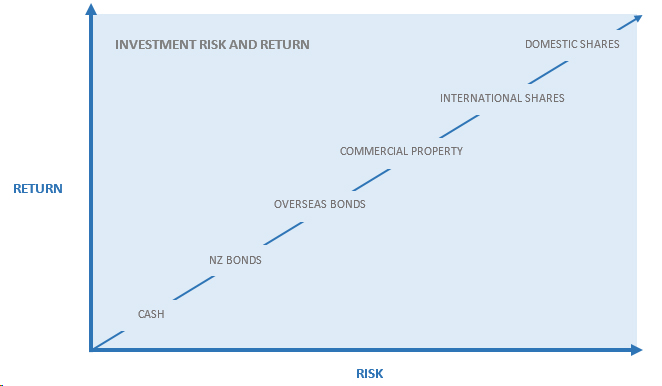

Risk and Return

There is an old saying: nothing ventured, nothing gained. Bear in mind that you will need to take some risk to make a profit. If you understand the risks, you won’t get a nasty surprise when you see the value of your investments fall. There is no way that your investments will grow steadily at the same rate all the time. Think about the fluctuations you see in mortgage rates, for example, or in bank interest rates. No return or rate is immutably fixed.

The most important thing to understand is the type of risk you may face in the course of investing. Risk is too complex to measure by any one standard. There is the risk of your investment not earning as much in one place as another, or of earning less than you anticipated.

Management risk exists because of the way a company or government performs. Your investments can be subject to currency risk. Values will fluctuate according to the value of the New Zealand dollar. Geopolitical events will affect your portfolio: the threat of war, acts of terrorism, or threatened epidemics may all affect prices.

Political risk is also a strong factor. A change of government or political instability usually has the effect of driving markets down. Market risk is the risk of the market as a whole being depressed. This is known as a bear market. I have experienced at least eight bear markets of varying lengths – they are a great time to buy!

Even investments like bonds are vulnerable to risk. If interest rates go up when you have an investment at a lower rate than that offered by the market, the value of your bond will decline. Usually, higher rates are linked to inflation, which means also that the money you are earning on these investments will buy less.

Now don’t get too depressed by all this, because the level of risk you take is related to your timeframe. Generally, the longer the timeframe the lesser the level of risk. Perceptions of timeframes vary according to the individual – some people view six months as long-term! In the financial world, time-frames are roughly as follows: short-term – eighteen months to three years, medium-term – three to five years, long-term – five to seven years.

The value of a high-risk investment lies in the fact that it is associated with higher returns. Levels of risk are different depending on the type of investment; cash has a very low risk, while shares or property have a higher level of risk in the short term, with shares out-performing other asset classes in the long term – see the following graph.

Liquidity

Liquidity refers to the ability an investor has to realise funds within a short timeframe. Most investments can be realised in the case of an emergency, but it is wise to consider having at least some of your funds in a cash deposit or a cash management fund – more on this later. Property, for example, is highly illiquid: you have to sell it to release your equity (the portion the bank doesn’t own). In the case of shares, they can certainly be sold quickly (at market) if necessary, but you will have to take whatever price is offered.

Timeframes and Risk

The level of risk or volatility of an investment is linked to the investing timeframe. The longer the timeframe, the lower the risk you are taking. The following table gives a guide to investment sectors. This will help you select the timeframe and asset class suitable for your investment goals.

Market Timing and Cycles

You have probably heard the saying “Buy on the low, sell on the high”; you may have even heard investors claiming to have done just that! It’s about as valid as ‘get rich quick’. If we were able to manage either I’d be the first to tell you. Believe me, this does not work.

The Breakdown

1. Cash

Downside:

There is a risk the return from your investment will be insufficient to keep pace with inflation, and thereby the purchasing power of your money could decline.

Upside:

Returns tend to be very stable and suit a capital preservation approach. Normally you have ready access to your funds.

Time Horizon:

Short-term

Risk Indicator:

Low risk

2. Bonds and Debentures

Downside:

Fixed interest securities that are repriced daily may incur capital losses when interest rates rise. There is also a risk that the issuer of the security may default on payment in respect of the security.

Upside:

Suitable if you require mainly income from your investments with opportunity for capital gains from time to time.

Time Horizon:

3-5 years

Risk Indicator:

Low to medium risk

3. Property

Downside:

Some volatility in return may be experienced, particularly in terms of listed property securities. Liquidity can be limited with direct property investments.

Upside:

Moderate growth potential with steady income.

Time Horizon:

3-5 years

Risk Indicator:

Medium risk

4. Balanced Funds

Downside:

There is a risk that through having exposure to all sectors you will not obtain the higher returns available to more aggressive strategies.

Upside:

Less volatile than the more aggressive strategies.

Time Horizon:

3-5 years

Risk Indicator:

Medium risk

5. Shares – Global

Downside:

Share prices can decline in value, especially over the short term.

Upside:

Offer long-term returns that typically out-perform other asset classes.

Time Horizon:

5+ years

Risk Indicator:

Medium to high risk

6. Shares – Specialist or Geographic

Downside:

Greater volatility than global shares.

Upside:

Can out-perform global portfolios.

Time Horizon:

7+ years

Risk Indicator:

High risk

*Sheryl Sutherland is director of The Financial Strategies Group, and author of Girls Just Want to Have Fund$ – Every Women’s Guide to Financial Independence, Money, Money, Money Ain’t it Funny – How to Wire your Brain for Wealth, and co-author of Smart Money – How to structure your New Zealand business or investments and pay less tax. You can contact her here.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.