It’s difficult to compare the residential property markets in different countries, even countries as similar as Australia and New Zealand. Within each country there are wide variations between inner city and suburbia, between city and region, and between houses and apartments.

To complicate the analysis, the reporting of property price movements in the two countries is sometimes based on average prices, sometimes on median prices, and sometimes on multi-factor indices.

Nevertheless, some general trends are evident in recent years.

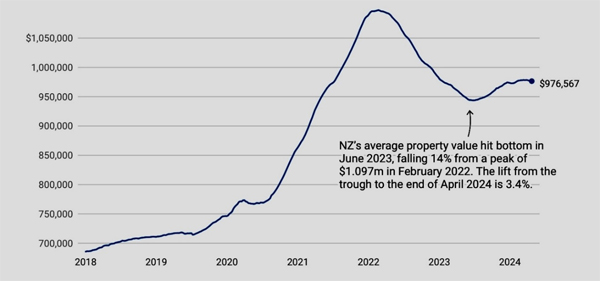

In New Zealand the property market was rising when Covid-19 hit in early 2020. Unsurprisingly, the uncertainty triggered by the pandemic led to an immediate but small dip in property prices.

That dip proved short-lived and was followed by a dramatic rise from the second half of 2020 through to early 2022. From that peak, prices fell as rapidly as they had risen, eventually giving up nearly half the previous rise by mid-2023. Since then, there has been a very tepid recovery, and the market is still about 10% below its 2022 peak.

Average NZ Property Value 2018-2024

Source: OneRoof

(While the figures from different sources contain some variations, they all reflect the same basic pattern – see for example data from Barfoots, REINZ House Price Index and the QV House Price Index.)

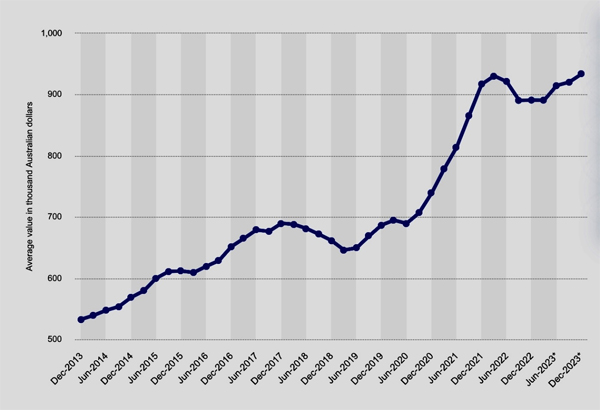

The position in Australia was similar in terms of direction but the size of the movements was different. Like NZ, the arrival of the pandemic led to a small and brief dip in the property market followed by rapid growth from mid-2020 to early 2022. However, that growth was below what NZ enjoyed.

From the peak, the Australian market fell but less than in NZ and over a shorter period – about 5% over six months versus 14% over eighteen months. Since the trough, house prices in Australia have been rising steadily such that the market has fully recovered from the losses of 2022 and is now at an all-time high.

Average Australian House Price 2013-2023 ($,000)

Source: Statista

While the property market in each country has gone through a boom/bust/recovery cycle over the last four years, there are two major differences.

First, NZ saw a greater rise and then a more sustained fall. What explains that? The small size of the NZ market may have contributed to its volatility and the pandemic may have had a relatively greater impact in NZ. Probably more significant was the larger (and earlier) rise in the official cash rate in NZ – from 0.25% in August 2021 to 5.5% by May 2023. By comparison, the RBA cash rate in Australia rose from 0.10% in April 2022 to 4.35% in November 2023.

The second major difference between the two markets is the nature of the ‘recovery’ stage. It has been much weaker in NZ than in Australia. This is demonstrated by the figures for both housing markets released by CoreLogic last week for the year to April 2024.

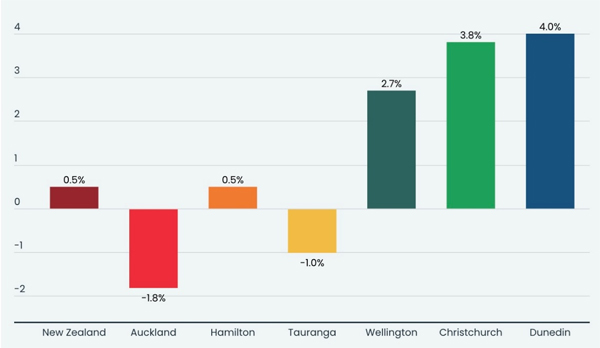

CoreLogic House Price Index – New Zealand

Annual change to April 2024

Source: CoreLogic

Kiwi house price growth nationwide for the last year was a meagre 0.5%. Prices in Auckland actually fell by 1.8%.

CoreLogic’s NZ Chief Property Economist, Kelvin Davidson describes the current situation as a ‘buyers’ market’ with house prices ‘lacking any strong momentum’. He said that ‘the big picture theme of an ‘underwhelming upturn’ for the property market this year and possibly into 2025 remains on track’.

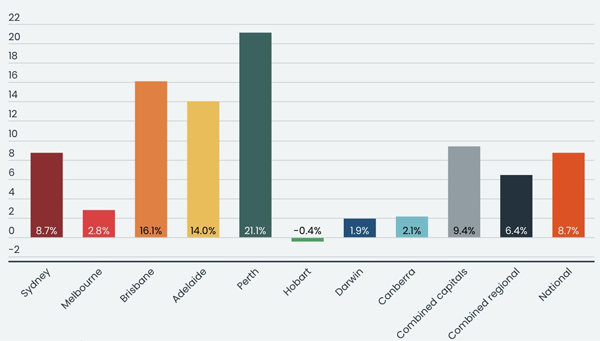

Davidson’s assessment of the kiwi market is in stark contrast with the results for Australia where house prices hit a new high in April.

CoreLogic Home Value Index – Australia

Annual change to April 2024

Source: CoreLogic

Nationwide house price growth in Australia was 8.7% for the year to April. Perth, Brisbane, and Adelaide recorded robust rises of 21.1%, 16.1%, and 14% respectively.

It’s interesting to consider how booming house prices in these three cities might influence kiwis contemplating a move to Australia. It might be disconcerting and temper migration losses, or it might reinforce the view that there is more upside across the ditch.

One fascinating development is the relationship between house prices in Brisbane and Melbourne. Rapid growth in the former versus stagnation in the latter means the median house price is now the same in both cities. According to realestate.com.au, prices are ‘up 60.7% in Brisbane since the start of the pandemic, compared to 16.5% in Melbourne’.

That’s a remarkable change.

What explains the contrasting market trajectories in NZ and Australia over the last year?

No doubt the interest rate differential between the two countries continues to impact on the respective property markets. A related factor is the relative strength of the two economies. Neither is booming but Australia is marginally better off, thanks in large part to the ongoing strength of its exports.

Two factors are consistently identified as contributing to the rebound in Australian house prices over the last year – very high levels of immigration and a shortfall in the construction of new homes. They are central to the ‘supply and demand’ equation.

These factors appear just as relevant to the kiwi housing market. On a per capita basis, NZ has experienced even higher levels of immigration than Australia. And in terms of a failure to build sufficient new homes in recent years, NZ looks no better than Australia. Against this background, it might be argued that the NZ market should have recovered more strongly.

The counterarguments are that, despite the tepid recovery, NZ house prices are still far higher than they were when the pandemic struck, and current interest rates still represent a formidable challenge to many existing borrowers and potential borrowers. Furthermore, house prices in NZ, as in Australia, are higher than in many (most) comparable countries.

So where to from here for the NZ and Australian property markets? The short answer is it’s very hard to tell.

The most extraordinary event in the last four years was the dramatic spike in Australasian house prices during a worldwide pandemic when both countries had closed their borders. If nothing else, that underscores the difficulty of predicting house prices.

*Ross Stitt is a freelance writer with a PhD in political science. He is a New Zealander based in Sydney. His articles are part of our 'Understanding Australia' series.

113 Comments

Personally, I think a lot of New Zealanders (with money) as well as others have gone to Australia, causing more pressure on their housing market. Here, I think we will have a delayed increase in the housing market as there is just less money in the economy. I feel that when new build additions to the market fall of a cliff as they will as it is financially not viable, existing stock will start to increase in value. From what I hear in the industry, swathes of builders & related trades have gone to Australia. This will also cause pressure on NZ house prices in the near future.

Yes exodus from Auckland to the regions or Australia.

https://www.oneroof.co.nz/news/new-plymouth-homeowners-slashing-prices-…

sure any minute now prices will rise.... sure....

While it was initially a bitter pill for some sellers to swallow, she said they eventually got their heads around the fact they were buying and selling in the same market so were also paying less for the next property.

which is why you will see no quick bounce. Its going to be a cold winter for those not listening to the market.

A sensationalist story about having to drop prices 10% below market peak which is where the market is. The figures quoted look large but when you are talking about multi million dollar properties, then what is quoted is inline with general trends.

Lets face it almost all OneWoof articles are sensationalist They paid 1.9mil in 2018 and dropped in a pool , say 100k, its only worth 2-2.2 down from the original ask of 2.85 thats 650k... lets watch this one and see what it eventually sells for. 1/3 from peak is common.

Just means the original ask was fanciful. And also irrelevant.

I think the market is about 20% below peak, realistically. At least in Auckland. People thinking it’s only 10% below peak is why they can’t sell. I am seeing that over and over, where I live and amongst acquaintances.

Realistic prices - in general - are about where they were in early 2020, before the boom.

we’ve thought about selling, and when we’ve thought about that I have said to my wife we’d be doing very well to get 5% more than what we paid in 2019. From what I am hearing where we live, people are expecting at least 10% more. The 4 townhouses that have been for sale, for 2-3 months, haven’t shifted, with seemingly very little interest….

A reminder too that a 20% fall in prices effectively cancels out the preceding 30% gain.

Not what that graph shows though. ;-)

Average….

When looking at median for lower & upper quartiles of the housing market the graph is much the same. The massive explosion in market values still has nowhere near receded in fact the drop looks like only a minor correction on the silly speculation allowed near covid when both LVRs, were dropped and banks had massive amounts more capital to lend. Labours added law to make lending far more difficult to owner occupiers & FHB did make it harder to borrow funds (including for renovation & repairs) but overall we are seeing no massive drop in the market compared to the insane rise in prices over 2 years. You can thank Labour for protecting landlords and promoting the largest increase in their wealth in decades.

The RBNZ inflation calculator reports 20% inflation in the 4 years from Q1 2020 to Q1 2024, which seems low to me.

I agree with your 20%, and I'd suggest we are something like 50% below the peak after inflation.

How would the banking system have held up to a 50% nominal decline in house prices I wonder, how committed are central banks to fighting inflation.

In the ‘near future’ - hmmmm. I would say in about two years’ time, is that near future? There’s a huge amount of stock hitting the market, and peoples’ ability to buy is severely constrained.

Retail interest rates will need to be at least 1.5-2% lower to see a significant shift upwards in the market. Late 2025/early 2026?

TA's latest report says its a solid buyers market, with buyers now worried about job security.

If that's the best thing a Master Spruiker of his caliber can say..... things are dire.

Long gone are the green shoots of recovery musings.

The hopium supply has run dry and he is back to regular weet bix.

6 to 8 ocr cuts? RB will probably cut more slowly than they rose. And of course retail banks will drag their feet on passing on, so at least 2 years for those sort of mortgage reductions I’d think

It’s just a matter of 2 different OCRs isn’t it?

Not "just" OCR.

I travel regularly to visit family in Oz. Attitudes are markedly different there towards people getting off their own backside & taking responsibility for their own life (as NZ used to be up till ~40years ago).

Add in population critical mass & a wealthier economy substantially based on digging holes in the backyard to send refined dirt overseas.

Take away a plethora of pork barrel federal and state rorting levys & taxes that everyone else considers an economic deadweight (eg stamp duties).

And where else would disaffected Ozzies want to go to get a better life? Definitely not NZ.

Add in population critical mass & a wealthier economy substantially based on digging holes in the backyard to send refined dirt overseas.

Plenty of water cooler stories about huge salaries in the mining industry for unqualified people who're willing to 'give it a go.'

Not sure that rocking up is the reality in 2024.

But you could be lucky.

Medical staff with little to no training and experience are paid twice as much. That is pretty much a vast difference that makes just turning up worthwhile even if you are unskilled, or just dipping your toes in an industry until you get your feet under you & being more set up in Aus. After all ageing population means there is always the demand for more employees, and many companies have moving costs provided.

Medical staff with little to no experience. Only in Aussie.

Catch is you're probably assigned to deal with the psychotic and adrenaline-juiced meth addicts.

So same as many parts of NZ except double pay

by Audaxes | 28th Nov 22, 2:04pm Kiwibank economists believe the interest rate hikes that have already been delivered will have a huge impact on households and discretionary income will evaporate for many mortgagees [sic]. When wasn't this the global plan?

The Rentier Economy is a Free Lunch

You’ve had, for the last – really since the 1980s, but even since World War 1 – this movement to prevent industrial economies from being low cost. But the objective of finance capitalism, contrary to what’s taught in the textbooks, is to make economies high cost, to raise the cost every year.

That actually is the explicit policy of the Federal Reserve in the United States. Turn over the central planning to the banking system to essentially inflate the price of housing, with government guaranteed mortgages, up to the point where buying a home is federally guaranteed up to absorbing 43% of the borrower’s income.

Well, you take that 43%, you take the wage withholding for social security and healthcare, you take the taxes; the domestic market shrinks and shrinks. And the finance capital strategy is exactly what it is in the United States today, in Europe. Shift all of the money away from the profits of industrial capital that are reinvested in making new means of production. To expand capital into a shrinking economy where the financial sector intrudes more and more into the economy of production and consumption and shrinks the economy. Hudson

Sydney is the jewel in the crown, you can’t compare other Aussie states, let alone NZ.

Sydney is not a state, it's a city.

NSW is mostly Sydney, everything else is just an exhurb with wine country nearby.

NZ is just ahead by about 6 months with Australia having a stronger dead cat bounce fuelled by immigration including from NZ. Once the economic fat lady begins to sing there the story will be much the same.

Yeah maybe. They do seem to have a quite incredible amount of economic resilience.

Running continuous trade surpluses will do that to an economy.

Running continuous trade surpluses will do that to an economy.

What's your take on iron ore exports to China? Dead duck or gift that keeps on giving?

Not the greatest article TBH. Failure to build new homes in NZ???? It’s been a boom!

There is a lot of good info that we may not have considered or been aware of

From the peak, the Australian market fell but less than in NZ and over a shorter period – about 5% over six months versus 14% over eighteen months. Since the trough, house prices in Australia have been rising steadily such that the market has fully recovered from the losses of 2022 and is now at an all-time high.

Yeah and a ridiculously misinformed comment, that’s fundamental to the core thrust of the article.

👍🤙

Weren't you planning to be more positive. You are in the property industry and have wide knowledge and contacts I assume. Youre just the person to write an article or series of articles for interest.co

Happy clappy

Well how about it doing a series on interest.co ?

Perhaps you think we would all dissect your articles and the mask would slip 🤔

Nothing to gain by it. I have done articles in the past for various publications. Seldom paid and doesn’t offer any meaningful business value, nor does anyone listen. I have done lots of voluntary things throughout my career, time for others to take up the mantle.

We would have a lot to gain by it, almost without exception you act like you're the smartest guy in the room

The differing states and regions within each state have very different pictures, but yes Aussie is currently stronger then NZ.

A bit like Auckland , Taranaki, Queenstown have different stories to tell.....

Mortgagee sales ticking up. (Was circa 40-50 a few months ago.)

78 at https://www.realestate.co.nz/residential/sale?by=latest&k=mortgagee

76 at https://www.trademe.co.nz/a/property/residential/sale/search?search_str…

Some of those have been mortgagee tendor's for some time now... but there are some interesting new ones from Barfoot coming up first week of June, with little selling over winter and a growing number of people who are being forced to move on, prices can go only one way over then next 4-5 months.

The ones that have been sitting around don't affect the overall trend.

And don't forget, mortgagee sales generally run to fixed timelines that are quite short - shorter than the time ordinary sales are sitting around for at this time. Ergo, any rise becomes understated when compared to non-mortgagees sales.

Now why can't we hear that darn canary anymore.....oh

I see I wasn't far off in my August till October 2023 time to buy prediction. Looks like prices started rising from June 2023 in the graph above.

When do you recommend people sell Zwifter?

Never once you find your dream home.

You might be a bit premature celebrating victory on this prediction.

Easy to criticise, so what's your prediction for the next below June low other than telling everyone to wait ? How long are you prepared to wait ? There are people on here that have been waiting 20 years that still will not admit they F**ked up.

I simply claimed it’s too early to justify if your prediction was correct.

How about you try and explain your reasoning for declaring early victory here?

“There are people on here that have been waiting 20 years that still will not admit they F**ked up.”

Really? What percentage of people are these Zwifter? Keen to see your data.

Seems like a very extreme example to highlight the "other side" to your prediction.

Groan another data junkie. So basically you refused to answer my question, how long do you advise people to wait now before buying a house ?

And you’ve still provided zero context why your prediction is correct. Yet you were so confident that you decided to pat yourself on the back by posting in this public forum about it.

So maybe you could firstly explain your original post to everyone? (it’s the reason we’re here).

What about if these people waited?

One in eight Auckland homes on market were bought during boom, may sell for loss

That's history, being a time lord I would expect more about the future from you not the past.

So, 7 in 8 are making money and 1 in 8 "may" sell at a loss. Outstanding odds.

Not according to some people on here. May sell at a loss, only if you have to sell right now, just wait 5 years.

Did you actually read the article or stop at the headline?

Using simplification as your chosen form of deduction is completely flawed in this scenario. You aren’t considering:

1. The 7 in 8 “making money” haven’t actually sold yet.

2. New listings are already outpacing new sales.

3. Increasing numbers of home owners struggling to pay their mortgages (more future sales?)

4. Uptick in people losing their jobs

5. Interest rates remain high

6. Inflation is tracking behind RBNZ forecasts

But it’s clear you’re not here to provide a balanced opinion on anything property related.

"But it’s clear you’re not here to provide a balanced opinion on anything property related."

LOL, so you actually do not realise that you only chose to focus on the 13% data you want (1 in 8), but you do not want to look at the the much bigger 87% (7 in 8) And then you say my view is "unbalanced". Unreal !!!

7 in 8 are making money and 1 in 8 "may" sell at a loss. Outstanding odds, period.

Please explain how the 7 in 8 “are making money” if they haven’t actually sold yet?

It was my very first point…

Speculative capital gains. All untaxed as well..."I didn't mean to make a gain".

Better than average comment

From the article:

"The data from property website OneRoof shows 13 per cent of almost 11,000 Auckland homes listed for sale in recent months were purchased during the market’s boom period from September 2020 to January 2022."

The more interesting question and statistic would be:

1) Of those purchased during the markets' boom period from September 2020 to January 2022,

2) and that are currently listed for sale

What percentage are being sold below their purchase price?

That percentage would likely be quite high. Those with their vested financial interest would likely not like to see that statistic publicly available due to their vested selfish financial interests.

Would these buyers be better off if they had waited?

So, you're saying that 87% of houses listed for sale have been bought before 2020 are going to sell at a large profit!

So, you're saying that 87% of houses listed for sale have been bought before 2020 are going to sell at a large profit!

No. That interpretation of my earlier comment would be 100% incorrect.

For sake of clarity, in my earlier comment there was 0% reference to residential properties purchased before 2020.

You're funny (and extremely biased). So, we cannot look at all the data, but only the one you choose, the 13 % that were bought between 2020 and 2022, we can't talk about the other 87% because it doesn't suit you.

Ive been renting for 18 years, dont really feel I fked up. Sailing round the south pacific for the next 6 months, no fixed abode in NZ. Lifes pretty sweet actually !

Auckland looks like an outlier, doesn't it?

Could that be the new Unitary Plan of 2016 having an ongoing effect with greater density buildings? Why, Yes, I think it is. Most cities in Oz must do the same as they're not building in places where people want / need to live. NZ already has through the NPS/UD and other initiatives. (But the high OCR - stupid economics - is keeping development down.)

What’s the basis for your comment that Auckland is an ‘outlier’, and the basis for that being the Unitary Plan? Because prices are down? Yet so are Tauranga’s.

I would say it’s almost totally a product of unaffordability.

Tauranga likewise had a mini building boom. I.e. more supply.

And so did Christchurch.

You place far too much weight on the impact of planning regulation.

Interesting thought, and I agree. Greater density leading to more supply (and other benefits such as reduced sprawl, better public transport viability) seems to be reducing upward price pressure. But also Auckland leads the rest of NZ resi property market, and perhaps it’s just showing what will happen elsewhere over the coming year

Mortgage stress: One in eight Auckland homes on market were bought during boom, may sell for loss

Just a reminder that using high interest rates to tackle inflation has the effect of transferring wealth from the indebted to those without debt. And we wonder why the rich are getting richer? Why do we - like lemmings - endorse an economic policy that does this? Do we have no sense of fairness?

The article says: 'Similarly, credit company Centrix reported the number of people behind in their mortgage payments had jumped to 21,800 in January."

And 21,800 is likely to be just the beginning as unemployment mounts.

Let's compare that to the number of properties for sale at this time. Realestate.co.nz reports circa 41,000.

Sobering, huh?

But let's lay the blame where it is really needed. Outdated and untargeted tools like the OCR that we've been suckered into thinking is necessary to reduce inflation when what it really does is transfer wealth from the have-nots to the haves. Time to wise up people.

As I've said below, this is plain BS. A low OCR transfers wealth from the have-nots to the haves. A high OCR is the best outcome for the have-not. My guess is that you are a "have" who likes to view themselves as a "have-not" because you only have 1-2 properties, not the vast property portfolio you were envisaging when debt was cheap.

It's about the "net". See my comment below.

(And guess away all you like. It just makes you look nasty.)

Wealth effect or wealth illusion? The other therapeutic effect of lower-for-longer interest rates is the wealth effect. By driving up the value of future cash flows with lower rates of interest, all manner of assets – stock, bonds, and houses – increase in value and, thereby, can stimulate our marginal propensity to consume. More simply put, the imperative was to make rich people richer so as to encourage their consumption. It is not so hard to imagine negative side effects.

There are the obvious distributional effects between those who have assets and those who do not. Returning house prices in California to their 2005 levels may be good for those who own them, but what of those who don’t?

There are also harder-to-observe distributional consequences that flow from the impact of lower-for-longer interest rates on the value of our liabilities. This is most easily observed in pension funds.

Consider two pension funds, one with a positive funding ratio and one with a negative funding ratio. When we create a wealth effect on the asset side of their balance sheets we also drive up the value of their liabilities. Lower long-term interest rates increase the value of all future cash flows – both positive and negative. Other things being equal, each pension fund will end up approximately where they started, only more so.

The same is true for households but is much more ominous, given the inequality of wealth with which we began the experiment. Consider two households: one with savings and one without savings. Consider also not just their legally-defined liabilities, like mortgages and auto-loans, but also their future consumption expenditures, their liability to feed and clothe themselves in the future.

When the Fed engineered its experiment to promote the wealth effect, the family with savings experienced an increase in the present value of their assets and also an increase in the present value of their liabilities. Because our financial assets are traded in markets and because we receive mutual fund and retirement account statements, we promptly saw the change in the value of our assets. We are much slower to appreciate the change in the present value of our liabilities, particularly the value of our future consumption expenditures.

But just because we don’t trade our future consumption expenditures on the stock exchange does not mean that the conventions of finance do not apply. The family with savings likely ends up where they started, once we consider the necessity of revaluing their liabilities. They may more readily perceive a wealth effect but, ultimately, there is only a wealth illusion.

But what happened to the family without savings? There were no assets to go up in the value, so there is no wealth effect – real or perceived. But the value of their future consumption expenditures did go up in value. The present value of their current and expected standard of living went up but without a corresponding and offsetting increase in assets, because they don’t have any. There was no wealth effect, not even a wealth illusion, just a cruel hoax.

https://www.grantspub.com/files/presentations/FISHERGRANTSREMARKS15MAR17...

The rich have far more debt than the poor, so your comment is either misinformed or deliberately misleading. The indebted rich love to pretend they are poor and will lose out to some mythical debt-free wealthy class if interest rates stay high. The reality is that in a financialised economy debt and wealth are strongly linked - very few wealthy people have got there without a lot of borrowing, and actual poor people don't have the assets to secure anything more than a small debt. A high OCR is good news for the working poor, just as a decade of low OCR was disastrous for them.

It's about the "net". I.e. assets - liabilities.

re ... "... just as a decade of low OCR was disastrous for them. "

You meant "just like a decade of a low OCR ... without adequate lending & banking controls while maintaining a tax & banking system that encourages speculation in unproductive residential property", Right?

I know it's about the net, and the net wealthy have much more debt than the net poor, so my point still stands. Most property owners have significant equity and large debt. Most renters have very little equity or debt.

I'm not sure what kind of inequality you are worried about but it seems to be inequality between rich people with debt, and rich people without debt. To which I say who cares - the inequality that matters, and that is destroying our social fabric, is the inequality between those with assets and those without. A high OCR undoubtedly reduces that inequality.

Durr I'm a homeowner I want inflation to erase my debt don't fight it durr

Please name a time in the past when the world has been fair. It never has and never will. Go to Africa (recently came back from) and the majority there would class our poor lucky. It's all how you look at the situation. I cried cause I had no shoes then I saw a man with no feet.

What's your point? We don't bother trying to solve inequality because life's not fair? Let's see how well that ends.

So, 7 in 8 are making money and 1 in 8 "may" sell at a loss. Outstanding odds.

Yvil, do you understand the composition in a mortgage book, ie size of lending and age...... hint the bigger lending is... recent.

if this moves to 1 in 5.... how does that impact banks. I note that many banks wrote past provisions back onto profit BUT increased future provisions....

I wonder what the negative equity position % looks like?

The interesting observation is that the odds given by the previous person are 7 out of 8 of being profitable.

Yet that commenter has also claimed that they don't own residential property.

Have they voted one way with their calculation of odds and comments, yet voted an entirely opposite way with their own money?

Sequere pecuniam.

??? Owning or not owning a residential property has got nothing to do with knowing basic maths, i.e. being able to deduct that if 1 in 8 properties may sell at a loss, then 7 in 8 will sell at a profit.

Also if you're referring to me, then you're wrong, I do own my own house, and I never said that I didn't.

"I do own my own house, and I never said that I didn't."

Let me clarify my comment. The word that was mentioned specifically was "rentals". This could be interpreted as:

1) non owner occupied residential property for long term market

2) non owner occupied commercial property

Does it include

1) non owner occupied residential property in the short term market?

2) non owner occupied residential property in the student housing market, boarding house market?

3) other commercial residential accommodation rented to social housing providers? emergency housing providers? other purposes such as during COVID.

From memory there was a comment about renting out motel rooms at some point.

by Yvil | 13th Mar 24, 11:31am

(btw, I don't own any rentals in NZ any more)

being able to deduct that if 1 in 8 properties may sell at a loss, then 7 in 8 will sell at a profit.

To infer from that ratio, that those are the current odds for a buyer today is flawed.

Let me illustrate by way of an example

The ratio of profitable sales to total sales in 2021 was well over 90%. However property buyers in 2022 had a probability of loss well over 10% due to the high elevated house price risks. The ratio of buyers who purchased in 2022 who are selling today who are loss making are likely to be much higher than 10%.

"Let me clarify my comment. The word that was mentioned specifically was "rentals". No it wasn't you said: "Yet that commenter has also claimed that they don't own residential property.". No word about rentals.

Also what a waste of time for the rest of your comment, but congratulations for figuring out that Motels rent out rooms, outstanding discovery!

There seems to be a misunderstanding.

The explanation above was an attempt to understand what you meant by the term "rentals".

Some may include motel rooms rented as emergency housing as rental accommodation (as it is rented to an emergency housing provider) rather than operating a traditional motel business. Different people have different definitions.

I don't know what your definition of rentals includes.

I was trying to understand if you were including the motel rooms in your definition of "rentals" when you said you don't own any "rentals" anymore.

The other point about the 7/8 historical sales ratio as being profitable in the last quarter as useful as an indicator of "odds" or the probability of current buyers being profitable in the future is incorrect. The 2021 example illustrates that point.

CN - new, are you "extremely biased" as someone said earlier

I suspect you're a passionate supporter of lower house pricing. As am I, I would love to see lower house prices but none of the powers that be want to work to make that happen. Hopefully the coalition will

All NZ property booms begin in Auckland. So things are looking pretty grim right now.

Looks like that but not actually the case. The booms begin where jobs are being created.

Keep your eyes on China, hearing that things turning worse re employment, especially young grads

I'll be keeping my eyes out for developments in any progression of a BRICS currency. Many are trying to remove themselves form the USD knowing full well that it relies on the world having faith in it, and if not supported, will crash hard with the debt level in the US and take down anyone else relying on that currency. Risk mitigation on the largest scale.

Youth unemployment rates in China have been a serious issue there for a couple of years

For the boomers, this recession and house price drop could have a massive impact on retirement. many thought they could downsize as and wehen they wanted at ever increasing prices. How often have you been told its better to pay off the mortgage then invest in shares.... well this time we are going to have a huge number of boomers wanting to release cash from homes, but who will be able to afford them? DTIs are going to limit debt to 6 times income and your partner not working due to having kids is going to be a massive limit to credit.

Entry level homes are going to be well bid by FHBers and downsizers.... but who are going to buy the upper 2 quartiles, ie 1/2 the market?

Demographic reality will make for interesting times.

The common factor is that we both operate under the same dysfunctional housing policies that we have inherited via Commonwealth law.

This causes supply vs demand restrictions in the system resulting in the classic boom and bust cycle by a multiple greater than it should be.

Everything else acts as an accelerant to this underlying issue.

Australia, now having a Labour Govt with more command and control policies, is now doubling down on previous failed policies. Thinking not that they are wrong policies, but the failure is due to them not doing enough of these policies fast enough.

https://www.theguardian.com/society/article/2024/may/11/migrant-care-wo…

We have this same problem in NZ, there are a lot of unemployed migrants due to corrupt recruiters and false opportunities, these people are unlikely to save any aspect of the NZ housing market. I think Migrant unemployment is going to be a major NZ story H2 / 24

Especially since the migrants coming in NZ under the labour hire scammers often are going into low wage jobs and will need significant government benefits to live on such wages, especially if they have family.

But hey Labour gave all migrants in NZ at the time full access to NZ benefits. I know of many in NZ govt paid housing, with govt benefit incomes, with government funded education courses that end with more time on government benefits. It is pretty depressing when we didn't even have housing available for kiwis and we are left with real deadly tradeoffs now. Where kiwis are denied any support when they need it but those recent arrivals have full benefit support. A bit of a damn NZ messed up immigration so badly we created a larger need for welfare under 65 and more low wage work categories with a rising cost of living. Just look at the hospitality sector, building sector or our existing care industries that already border on harmful living conditions for all workers involved.

Since those coming in under labour hire scams are going to be eligible for pension benefits soon we have massive ballooning costs of pension benefits as we only increased our ageing population, but reduced incentives to work for that category. Which means more cuts to those who literally cannot access work and truly need support.

60-65 years is going to be a pain point with redundancies, and virtually no chance to re enter the workforce at 60 unless its casual pak n save etc

Er most 60-65 year olds are still working in sedentary roles in offices, admin & management etc. Far fewer actually have to leave work and even fewer cannot get another sedentary role in offices, admin & management. Hence most of the largest wages go to those over retirement age. Only those who intentionally quit & stay out of job market actually fail to regain work when able. Even in highly discriminatory industries: fashion and IT find most workers are able to transition to easy laid back, well paid work across all number of industries, none of which are check out counters or front of house staff. If you are looking for work try healthcare sectors or infrastructure support. Try admin & HR. The possibilities for a cushy desk job are endless for able bodied ex admin staff.

Also the checkout counter is good enough for a disabled person or cancer sufferer undergoing radiation treatment apparently so those over 65 should not turn their noses up at it. After all they have the physical advantage over someone who is literally disabled, cannot reach their arms up to the counter and given an eol of less then a few years due to illness.

Thanks that produced a smile

NZ always lagged AU by about 6 to 12 months

Wont be much different this time around

The Australian inflation rate to March 3.6%, the NZ inflation rate to March 4.00%

National NZ average mortgage rate 7.35%

NAB Australian floating rate average 6.84%

There's not much in it. I'd say you would have to put the difference in housing sales activity and price levels down to the level of economic activity in each country/area and the availability of credit.

New Zealand is always more puritanical - credit is being restricted by the CCCFA and the Reserve Bank has everything tied down as hard as they can. The Australians can see that inflation is easing so they are more relaxed about the population's borrowing so their housing market activity is offsetting any export revenue decrease. Whereas NZ has tight credit, reducing exports and austerity-lite fiscal measures.

We are doing opposite things so we are going in opposite directions. NZ needs to ease credit restrictions and govt spending cuts now.

Australia also has one of the best super scheme in the world which can be converted to a self managed fund in property

Plus they have resources that they actually ultilise so have more wealth

Plus their Reserve Bank made better decisions than ours

That said NZ could be like that going forward if we made some bold decisions

I am amazed that , as far I can tell, no one has mentioned the foreign buyers ban in NZ

More media commentary reinforcing the stupid notion that higher house prices are good. “However, that growth was below what NZ enjoyed.”

Why do we enjoy rising house prices so much when it leads to despair among the young, excess financial burden and stress among many of those repaying mortgages (and rent), and an uncompetitive economy for all as capital is misused and higher wages are required for people to simply accommodate their families.

“However, that growth was below what NZ endured” would be more accurate.

Yeah it's like "Yay now our kids are going to have to leave the country or not have kids of their own, those overseas are less likely to come back, and instead we're going to have to bring in more people from Asia, because thankfully we've kept house prices up high... winning!"

Was my first thought too.

Here we go with another ‘The good times are back as house prices rise’ or ‘Gloom sets in as house prices slide.’

How about a ‘First home buyers rejoice as barriers to entry return to sane levels’?

Do we really hate young people that much?

The other factor with average house prices across the 2 countries is what do you get for your money.

Google a $1m house in Auckland and compare that with a $1m house on the Gold Coast or Adelaide.

Vastly different!

Not only are our houses overpriced they are also rubbish by first world standards.

And if you are living in Gold Coast of Adelaide you'd be earning a lot more than here in the same job. So a better house and easier to pay for. It's a double win.

How much of this is going on I wonder.

https://www.theguardian.com/australia-news/2023/feb/13/no-questions-ask…

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.