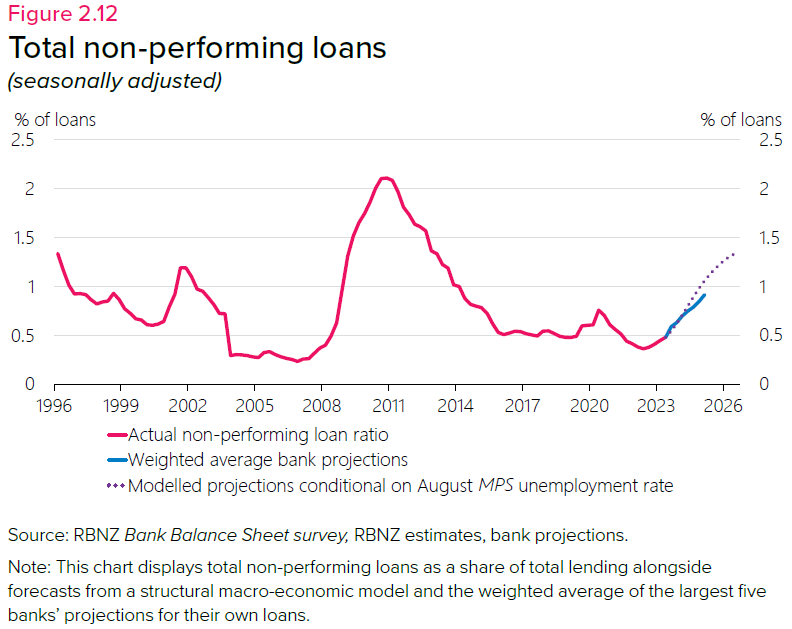

The country's big five banks are projecting that non-performing loans as a share of their lending could more than double from current levels over the next year, according to the Reserve Bank (RBNZ).

In its latest six-monthly Financial Stability Report the RBNZ says the big banks are saying the non-performing loans (NPLs) as a share of lending could rise to around 1% by early 2025, which is more than double their current levels. It is, however, still well below the sorts of levels seen after the Global Financial Crisis.

"Our analysis of loan performance also suggests a similarly negative outlook, based on the economic outlook from the [RBNZ] August Monetary Policy Statement, with unemployment rising to 5.3%," the RBNZ says.

"It is important to note that if economic conditions deteriorate by more than projected, then lending stress could be more severe."

In terms of just housing lending, there was a fairly sharp rise in non-performing housing loans in the early part of this year, but it has levelled off more recently, to leave the percentage of non-performing loans making up around 0.4% of the banks’ books - much less than the circa 1.2% levels seen after the Global Financial Crisis.

However, the big five banks are projecting that their levels of non-performing housing loans will keep moving up from here - to 0.7% of their mortgage books (weighted average calculated by the RBNZ) by the first quarter of 2025.

The RBNZ says overall, financial distress amongst households or businesses is rising from a low level as budget pressures increase for many borrowers.

"Households have been able to adapt by reducing discretionary spending and working with their banks to manage the increased debt servicing burden. Even so, financial stress is expected to rise, based on our projections and those of banks."

The RBNZ said more borrowers are likely to fall into arrears over the coming year, given there can be long lags between an increase in debt servicing costs and borrowers falling behind on their obligations.

"In addition, if unemployment continues to increase and domestic economic activity continues to slow, some indebted households will have fewer options to avoid missing their debt repayments."

The report says that around two-thirds of the mortgage debt that was fixed at very low interest rates during the early stage of the pandemic has now rolled over to higher interest rates, "with this process expected to continue over the next year".

"The effective mortgage rate, which is an average rate paid across the stock of all mortgage lending, is expected to reach 6.4% by mid-2024, from its low point of 2.9% in late 2021.

"Higher interest rates are placing an increased strain on indebted households’ budgets. The average share of their disposable income going to interest payments is expected to rise from a low of 9% in 2021 to around 18% by the middle of 2024.

"While this would still be well below previous periods of financial stress, such as in the late 2000s, the adjustment to higher interest rates is likely to be felt more strongly by certain cohorts of borrowers. An example is those who borrowed to purchase houses at high debtto- income ratios in 2020 and 2021, when the housing market was at its peak and interest rates were below 3%."

The RBNZ expects an increasing share of borrowers will face significant debt servicing stress.

It says that evidence from previous financial cycles has shown households with multiple forms of debt generally prioritise mortgage and utility bill payments ahead of other expenses when faced with debt servicing stress.

"Recently, borrowers with a mortgage and other forms of debt are missing repayments on non-mortgage debts to a greater extent than non-mortgaged borrowers. This suggests debt servicing strains faced by mortgaged households may be greater than shown simply by mortgage arrears.

"For many households that borrowed in 2020 and 2021, current interest rates exceed the test rates used by banks to assess affordability, and some may be particularly vulnerable to debt servicing stresses.

"Households that borrowed at high debt-to-income (DTI) ratios over this period are at risk, with estimated debt servicing ratios (DSRs) for borrowers from these two years expected to rise to around 50% by late 2023.

"While household incomes have grown strongly in recent years, further increases in interest rates may result in a larger rise in loan defaults. Banks report that the arrears which have occurred to date have largely been associated with unexpected individual events, such as illness or job loss, rather than hardship due to higher interest rates alone. However, there is a portion of lending still to reprice to higher interest rates and this will create more financial difficulties for some borrowers."

The RBNZ notes that house prices have stabilised "in spite of ongoing tight lending conditions" and housing market activity has picked up in recent months.

"On a seasonally-adjusted basis, house prices fell an average of 15% between their peak in November 2021 and trough in March 2023, and have since risen around 3%." Recent gains have been modest, "and prices remain within the range of sustainable levels suggested by the indicators we monitor".

The RBNZ says the recovery in prices and sales activity has been "broad-based across regions", and inventories of properties for sale have been gradually declining.

"Several factors explain the recent rise in house prices, partly reflecting the large net immigration New Zealand is currently experiencing.

"While shorter-term mortgage interest rates have continued to climb, longer-term rates have generally stabilised over the past six months. The test interest rates at which lenders assess prospective borrowers’ ability to make repayments have increased only slightly further to around 8.75% to 9%, largely maintaining buyers’ borrowing capacity.

"Moreover, high inflation is also being reflected in asset prices, including housing, and household incomes. Compared to the median household disposable income, median house prices have fallen from a ratio of 11 times to around 9 times. House prices relative to incomes have fallen more strongly in Auckland, with this ratio now back at levels last seen in 2013."

The RBNZ says that work continues on developing a framework for imposing restrictions on high debt-to-income (DTI) mortgage lending, which would complement the current loan to value ratio (LVR) policy by focusing on "a different dimension of risk".

"Banks are developing reporting and management systems so that DTI restrictions could practically be implemented by April 2024. We are currently assessing how a DTI tool could be calibrated alongside LVRs and intend to consult publicly on potential DTI settings in early 2024."

The RBNZ says the full impact of previous interest rate increases globally is still to be seen.

"The full impact of previous monetary policy tightening is yet to be seen and there is a risk further tightening will be needed to bring inflation back within central banks’ targets. Pockets of stress are likely to emerge globally as debt servicing costs continue to increase."

This is the statement the RBNZ released with the report:

New Zealand’s financial system remains strong as it adjusts to a higher interest rate environment, Deputy Governor Christian Hawkesby says in releasing the November 2023 Financial Stability Report.

The full impact of previous interest rate increases globally is still to be seen. A weakening in global demand, particularly in China, has contributed to lower key commodity prices for New Zealand, and we are monitoring developments in the Middle East closely, Mr Hawkesby says.

“New Zealand households continue to face higher mortgage repayments. So far, the vast majority of borrowers have been able to manage these increases, but we know some people are struggling and falling behind.”

Businesses continue to service debt, although the dairy and commercial property sectors are facing challenges, partly due to higher debt servicing costs and other factors.

Our assessment is that New Zealand’s financial sector is strong and well placed to handle both the current adjustment to higher interest rates and more severe economic scenarios.

Importantly, this means our financial institutions are well positioned to take a long-term perspective and support their customers through current and future challenges.

82 Comments

Classic bank speak. Rate rises are working. We may need more.

Don't you mean code for wait and watch and no rise in November.

Yeah sounds like banks are wanting the complete opposite (no rate increases) making projections like this... It's just been shown that new mortgage lending is low aswell...

As soon as he says rates have peaked, rates will drop. Even if he believes we will hold or that the next move will be down he needs to say tightening might be required to avoid a rapid drop in rates happening too quickly.

They've overdone it and they don't even know it yet!

The effective mortgage rate being lower than the OCR shows how much pain is still to come

RBNZ - too little too late/too much too soon, carry on regardless why spoil a perfect record of beomg wrong everytime, Orr is the Bank lead by a Muppet.

Those living in bliss that the recent "floor" in house prices is sustainable can't say they weren't warned.

I'm sure for a growing number, the higher cost of banks money are beginning to be felt however, the overall effects are yet to manifest themselves in higher unemployment, distressed loans, forced sales. Soon they'll be actually reported and undeniable by those in denial. While many will be scraping by with overtime and second jobs, the ability to access this will diminish as work drops off.

You would benefit from some therapy RP.

A typical Te Kooti response. It doesn't always have to turn into a personal attack s--t-show does it?

It wasn't a personal attack, you are always so negative on housing/renting/NZ/the economy. It must be draining.

The commitment from RP is strong... day in & day out anti-spruiking...

Being honest is negative when it doesn’t suit the spruik.

Convenient narrative for the vested desperado.

Hard to be positive when fundamentals so out of whack.

At least he didn't play the race card on you this time RP :).

It’s gaslighting - ignore.

Overtime and second jobs is a good point, probably a little underestimated. The gig economy is a very real thing for many younger people, involving mixing up jobs and roles.

I think performance bonuses are also underestimated, and many of those will be under pressure.

This was all potentially preventable back in 2016, had debt to income ratios requested by the RBNZ been allowed by the then Minister of Finance.

As a result of that single decision, this will result in potentially thousands of owner occupiers who purchased in 2020 - 2022 being collateral damage. This will cause cashflow stress, mental stress and unfortunately, some will resort to self harm.

This will likely also lead to an increase in demand for social housing.

They can personally give their thanks to Bill English and John Key, in addition to the others since then.

REINZ median house price data shows things started rising nicely under Clark/Cullen, continued albeit with a button off with Key/English due to GFC. Then Labour lit the fuse to send pricing into orbit.

And who refused the DTI tool in 2016...?

RP you are right - age acquires knowledge and experience - Centrix reports 447,000 current NZ active credit accounts are in arrears. We are in the Gap stage where the lightning has struck but the house has not yet burnt down just a smouldering in the shed. I suspect Q1 Q2 2024 will see the fire getting going and it will get hot.

"Those living in bliss that the recent "floor" in house prices is sustainable can't say they weren't warned."

FWIW

"It is not surprising that other forecasters are now approaching my expectation of prices rising 10% next year from 5% this year. 2025? Probably 15% or thereabouts."

https://www.oneroof.co.nz/news/tony-alexander-expect-house-prices-to-ri…

In the immortal words of Tag Team…

Whoomp! (There it is)

The residential property price bulls can choose to purchase from the residential property price bears.

Is duration to fully realised impact approximately the average duration of the fixed mortgage rate, i.e. ~12-18 months post rate change? Are there other significant contributing factors?

Very close as history proves.

Why as a subscriber am I seeing ads from TSB which I can not seem to remove despite logging off and back in via Press Patron?

Are you giving money to Aussie banks?

Its the new buy NZ scheme sponsored by MBIE :-)

I'm how getting ads on those stupid pop up 'news' videos too (on my pc).

The news segments themselves only appeared a couple of months ago, and now they're playing ads.

I want an option to turn them off.

Agreed, I'm logged in via presspatron and getting TSB ads at the bottom of my screen on a PC. Could this be rectified interest.co.nz

It does feel a lot like the calm before the storm with those in the know failing to really dig into what is happening and what may unfold - or maybe they just dont really know how to address the issues - who said its the unknown unknowns that will get you?

things will get worse before OCR cuts.

True.

But I expect the RBNZ - for the benefits of the banks - to start talking about cuts to provide hope for those just hanging by a thread.

"But I expect the RBNZ - for the benefits of the banks - to start talking about cuts to provide hope for those just hanging by a thread."

"Our job, ultimately, is financial stability, so it's the resilience of the banking sector. Why we put these on was to make the banks more robust to a decline in prices," Bascand, the bank's head of financial stability said.

"That's not our job; we don't have a consumer protection role. We have a role which says we want to reduce the risk of a big blow up, not the fact that a few people are going to get burnt.

"A few people are going to get burnt, probably. That's what happens when you buy at the top of the market. Somebody will find it will not keep going up in the way they expected."

https://www.stuff.co.nz/business/99408539/reserve-bank-warns-its-not-ou…

"could rise to around 1% by early 2025, which is more than double their current levels." - it could rise to 10% if we get 10% unemployment. It feels like we may be heading that way unless we get a rate cut very soon.

Some people have the memory of a Goldfish. Not so long ago the RBNZ were trying to "Engineer a recession" well guess what they still are it just takes years. Things are going to get a lot worse for a whole lot of people as their mortgages roll over by the end of 2024 onto the new rates. Those people that are expecting big rate cuts are going to be out of luck.

I don’t see anywhere near 10% happening. Perhaps 5.5-6% max.

With respect to immigration, one of its benefits is that as work dries up, people on work visas will need to leave. It does offer somewhat unheralded benefits in protecting the employment of kiwis. While I am opposed to mass immigration, if I am to be objective I should also acknowledge such benefits.

I think structural factors, which you have previously mentioned, will also limit unemployment.

Not unexpected. The real question is what are the banks going to do about it. Perhaps they will use some of their massive profits to prop up the non performing loans rather than let true market price discovery take place via mortgagee.

Protect their parasitic ponzi income at all costs...

What are the chances they come knocking on the taxpayer door / threatening and demanding a la Cyprus if the ship really hits the flan, or leverage the benefit of revolving door relationships?

Yip with John Key there doing the bidding for ANZ after being in the National government that was claiming such expensive houses was a good problem to have/a sign of success.

That guy is dodgy as they come. As they say the smiling assassin - always does what is right for John.

You mean a bail in - probably socialise the losses

With the profits going to West Island they can bail themselves out. Nil tax payer bailout.

What are the odds, given party connections...?

"The real question is what are the banks going to do about it."

Banks are assisting cashflow stressed borrowers to buy time in 2 ways:

1) extending maturity of mortgages

2) allowing borrowers to go from P&I to interest only for a period of time. (I've heard some instances where it could be up to 5 years)

There are borrowers who do not have either of those options available given their circumstances and the bank may request that the borrower sell the security for the mortgage. At the extreme, the borrower is unable or unwilling to sell the security (i.e residential dwelling), in which case the lender starts proceedings which will ultimately result in a mortgagee sale.

But there's not an uptick in Interest Only loans on RBNZ C32....unless an existing loan switched to IO does not feature in this data?

Don't know how this data is compiled or the categorisations used by banks that gets reported into C32.

One thing to note is that there has been an increase in interest only and revolving credit to businesses from a year ago.

For borrowers who meet certain criteria, they may get classified as business customers, rather than retail customers. This might be the category that non owner occupiers get categorised into by the banks.

For many small businesses, residential dwellings are used as security for business loans.

https://www.rbnz.govt.nz/statistics/series/registered-banks/banks-asset…

THE BANKS ARE NOT TELLING THE TRUTH!!!!

Toxic loans will NOT stop at 1% ! Wishfull thinking much!

Distressed loan rates are skyrocketing (behind the scenes) ......with more rope is being fed out, in the forlorn hope people can set anchor before the rocks are struck.

No bank wants this news publicised! The back office is shisting hard bricks.

When it's this bad.....they just have to LIE LIE LIE.

You'll been warned!

The banks have all the numbers mate, they know exactly what people can take stress wise. The big unknown is unemployment which is very much influenced by sudden huge external shocks and they cannot factor that in. Its simply business as usual for now, stop trying to spread fear.

ZERO! 0%! chance the bad loans stop at 1%. ZERO.

Lets revisit this later in 2024, to see how this really pans out.

When its this bad, the banks just have to lie!

This thread reminds me of a scene out of The Big Short with the mortgage brokers try to convince everyone that the world is great and there’s nothing to worry about.

https://youtu.be/_4KrHwvtxrc?si=VkRwlLSEv0jL5-2V

Rewatched The Big Short recently. Still flabbergasted.

Haha yes perhaps this scene is even better!

My pick is around 3% bad loans at the peak, this is what the US suffered during the GFC. LVRs will protect us somewhat.

I think most of the risk will come from people who used mortgage top-ups for consumer spending, or who maxxed out their leverage for property speculation, during that 2020-2022 period.

The period was narrower than 2020, I purchased then its not a problem. A very small percentage will have over committed themselves and those that cannot now pull their heads in on discretionary spending will be in trouble. The first 5 to 10 year of a new mortgage are always pretty rough anyway, you have to adapt.

Well done on not being a part of the 3%, yet. The worst is still to come. Most will be fine, with some pain as you say, but it will be catastrophic for the few.

Yep its going to be really bad for some people, but at the same time a lot of people have made bad financial as well as bad life decisions. You are where you are for a reason, some people need to think about that or else you get to 50 and think WTF happened. Still a lot of people my age very unhappy but have refused to change over the years.

You are where you are for a reason

While in part true, you have to give credence that there were parasites out there giving mortgage advice that we would be going in to negative interest rates or near 0 and lulling many into feeling confident in their purchasing decisions. It ultimately comes down to one doing their own research however there's validity to the counter argument.

There was one key premise by buyers of residential real estate. Based on that belief, buyers of residential real estate were willing to choose to take on large amounts of mortgage debt to finance their purchase.

"almost all of the country became possessed by the idea that home prices could never fall significantly. That was a mass delusion, reinforced by rapidly rising prices that discredited the few skeptics who warned of trouble. Delusions, whether about tulips or Internet stocks, produce bubbles. And when bubbles pop, they can generate waves of trouble that hit shores far from their origin." - Warren Buffett on the US housing bubble.

So what happened in NZ that caused buyers to believe that home prices in NZ could never fall significantly and gave buyers confidence to choose to buy and gave confidence to choose to take on large amounts of mortgage debt to finance that purchase?

These are some of the reasons given in the mainstream media, property market commentators, property market promoters, real estate agents, property market mentors & other sources as to why property prices in Auckland will not fall by much and that there is a low probability that property prices will fall dramatically:

1) during the GFC, house prices in Auckland fell only 7-10%

2) over the past 50 years, house prices in Auckland have averaged 7.2% per annum (or commonly referred to as house prices doubling every 10 years). This trend can be expected to continue into the future - https://youtu.be/Agp9xFWoBX4?t=172

3) there is a shortage of underlying housing in Auckland, so property prices won't fall by much - https://www.interest.co.nz/property/97513/auckland-councils-chief-econo…

4) there is a growing population which means that there will be more demand for houses - https://www.stuff.co.nz/business/106883553/house-prices-have-fallen-but…

5) we have inward immigration which means more demand for houses

6) Auckland is an attractive city with an attractive lifestyle - that makes it desirable and attracts foreigners to move to Auckland and hence raise the demand for houses

7) we mustn't forget either the vested interests in ongoing stability. No government, central bank or trading bank with mortgage exposure wants materially lower house prices. Nor does an incumbent Beehive want falling house prices going into an election campaign https://www.stuff.co.nz/business/110499233/think-house-prices-are-going…

8) the economy is doing well, with low unemployment, and house prices don't fall when unemployment is low - https://www.stuff.co.nz/business/110499233/think-house-prices-are-going…

9) there has been insufficient construction of new builds to meet the housing shortage - https://www.stuff.co.nz/business/106883553/house-prices-have-fallen-but…

10) there are high construction costs to building a house. House prices cannot fall below their construction cost. - https://www.stuff.co.nz/business/106883553/house-prices-have-fallen-but…

11) people don't sell their houses at a loss - https://www.stuff.co.nz/business/106883553/house-prices-have-fallen-but…

12) continued inflation means that house prices will continue to rise in the future

13) The fact is, debt levels have barely changed from the beginning to the end of those 10 years, compared to GDP levels, compared to household assets, compared to household disposable incomes. And much more importantly, debt servicing is very much easier now, an item that is almost universally overlooked. We are not pushing out to unsustainable levels now, and even if they creep up a little, we are far from that point. https://www.interest.co.nz/opinion/95894/if-you-think-new-zealands-hous…

14) in aggregate household debt servicing is low in New Zealand - currently at just under 8% of disposable income of households - https://www.rbnz.govt.nz/statistics/key-graphs/key-graph-household-debt

15) property market participants & commentators who have been correct in their predictions about recent property price trends have more credibility and hence their predictions of upward prices are believed by a wider audience (such as Ashley Church, Tony Alexander, Ron Hoy Fong, Matthew Gilligan, etc). - https://www.stuff.co.nz/business/84322204/all-predictions-of-an-aucklan…

16) previous warnings about a house price crash have been wrong - property prices have continued rising upward significantly since these warnings were given, so there is little reason to believe these warnings.(such as Bernard Hickey) - https://www.stuff.co.nz/business/84322204/all-predictions-of-an-aucklan…

17) its unlikely Auckland prices collapse. I think the main two reasons though are: a) Affordability has been this bad, and worse, in the past and it only resulted in about a 10% drop. b) The number of homes built over the last decade has been too low and will take some time to recover

18) Not a single person who bought 10 years ago has ever regretted buying / have you met anyone who has bought a house and regretted buying it?

Some other beliefs about investing in real estate:

a) Buy land, they're not making any more of it / there is a finite amount of land

b) Time in the market is more important that timing the market

c) Landlords grow rich in their sleep

d) Owning a home is a keystone of wealth

e) Don’t wait to buy real estate, buy real estate and wait.

f) The best investment on earth is earth.

g) 90% of all millionaires become so through owning real estate

h) Everyone wants a piece of land. It’s the only sure investment. It can never depreciate like a car or washing machine. Land will only double its value in ten years

i) Buying real estate is not only the best way. It is the quickest way and the safest way, but the only way to become wealthy

j) Real estate is an imperishable asset, ever increasing in value. It is the most solid security that human ingenuity had devised. It is the basis of all security and about the only indestructible security

k) Land monopoly is not only monopoly, but it is by far the greatest of monopolies; it is a perpetual monopoly, and it is the mother of all other forms of monopoly.

l) The best time to purchase a house was 20years ago and the second best time is now

m) No one has ever regretted buying property / have you met anyone who has regretted buying property?

n) you can never lose with property

o) you never go wrong with bricks and mortar

p) house prices always go up / never go down

q) rent is dead money

r) people should own their own home over renting

s) everyone needs somewhere to live so property will always be in demand and property prices will rise

t) there is an underlying housing shortage so property prices will not go down by much

A commenter on interest.co.nz on why housing bubbles in other international markets were not relevant to NZ:

1) USA - fraud and overbuilding

2) Ireland - economy collapse, unemployment to 16%

3) Spain - economy collapse, unemployment to 26%

4) Japan - literally the modern formative lesson on 'dont hike rates in to a bubble'. Following this lesson all major economies instead cut rates to reset yields and if needed monetize.

none of these are examples that are relevant to NZ.

What were property commentators saying at or just after the peak?

1) Tony Alexander - 19 reasons why there's no crash - December 2021

https://ndhadeliver.natlib.govt.nz/delivery/DeliveryManagerServlet?dps_…

2) Catherine Masters - July 2022

Why the New Zealand housing market is nowhere near crash point

https://www.oneroof.co.nz/news/why-the-new-zealand-housing-market-is-no…

3) Ashley Church - April 2022

Four reasons the housing market won't crash

https://www.oneroof.co.nz/news/ashley-church-four-reasons-the-housing-m…

4) Kelvin Davidson - Dec 2021

“But will prices actually fall? I’m not convinced because in the past a serious housing downturn has come with a recession, but no one is suggesting that and unemployment is low at 3.4 per cent.”

https://www.stuff.co.nz/life-style/homed/real-estate/127305870/what-lie…

5) Nov 2021 - Here's why it might be fruitless to pin your hopes on a house price crash

https://www.stuff.co.nz/business/300449314/heres-why-it-might-be-fruitl…

You must be the guy who runs the house price crash porn feed, you know way too much......

"You must be the guy who runs the house price crash porn feed"

Assuming that you're referring to this one - https://aucklandpropertyrealitycheck.substack.com/welcome

That substack is run by someone else who is a former real estate agent though I have seen some of my shared links on interest.co.nz reposted there.

Thats cool , I don't disagree with much you present, the worst is still to come, people loosing everything right now due to business failures.....

People have different observations, different lived experiences and have different interpretations as a result of those lived experiences.

People are free to disagree in discussions about issues / points of view. However they should be able to explain their line of reasoning supporting the reason for their line of thinking. Mature open minded people discuss issues and opposing points of view in a mature and respectable manner.

There are some lines of reasoning that are inherently flawed which is the purpose of highlighting these in the above posts. This is how house price risks in New Zealand got to extreme levels.

There are also commenters with financial self serving interests promoting their business interests - due to the inherent bias, conflicts of interest, and motivations of these commenters, these commenters are best to be ignored, or dismissed.

Name calling and bullying by commenters are completely unacceptable. These people should be ignored. Every commenter on here is likely to be adult aged, however some have the maturity level equivalent to a young child in the school playground. These people show others that they have the maturity level of a young child in the school playground by what the commenter chooses to comment and post.

Mature open minded people can't have an intelligent adult discussion with immature closed minded disrespectful people.

Irrespective of vested interests, I am of the view that we need refocusing on productive enterprise and egalitarian policies that benefit the majority instead of the current that benefit the few. Lower the house prices, great, manage immigration better to relieve pressure on infrastructure, incentivise investment in business over housing, fund more community incenttives and promote active engagement in local and central government initiatives, prioritise education so the mistakes made and behaviours & views ingrained in certain age groups/generations can be improved in the next generation. Better living New Zealand

If you factor in sticky inflation at 5% + the whole debt equation looks dire.

price inflation, or wage inflation?

There will be plenty of massaging and fudging going on.

Wouldn't their reporting requirements make this difficult to disguise something like that unless there was a massive fraud reporting underway?

Shush, let the DGMs rant, its entertaining.

Welcome back Hemi/Hawkesbay

Banks: we do not foresee any risk of an unforseeable crises occurring in the near future.

made me smile def uptick.... NZs biggest risk is we collective believe that national can fix our massively overprices houses and rural farms with anyone loosing a lot of money..... The truth is that most of our land has to loose 30-40% more before we can become internationaly competitive or desirable for educated immigrants.... ( the immigrants we are getting now are those who simply have 40k to brief an accredited company....)

Dare we say it for schitts and giggs.....transitory XD

Any guesses when covid-19 "buffers" will run out?

The RBNZ FSR mentions buffers a lot but is quite vague as to how large they are. The banks have a better idea but its still largely a guess.

Note that these "buffers" include stuff like new cars, plant, machinery, etc. that can be sold and traded down and/or done without as there is now less demand.

EDITED:

C'mon folks.

The running out of these buffers could be the ticking timebomb everyone is overlooking (or pretending isn't going to be a contributing factor).

Anyone dealing with 2nd hand cars, equipment, machinery, surplus stock/goods, etc. seeing an increase in activity? None?

What about trademe ads for 2nd hand stuff? Going up? Down? Staying the same?

the craft brewing industry is out of buffer, failures will litter the road.....

It is a very interesting industry when digging deeper. Hard to make a wage as a business owner without having a brewpub and online platform to sell direct to the consumer for any hint of a profit margin that is worthwhile. When needing additional staff it is difficult to provide a meaningful wage unless already well established and to get to this stage, you need to rely on getting brand loyalty through not only a good product, but more often clever marketing these days in a highly competitive environment. I see the opportunity in the semi craft market, or craft at a moderate price circa $20 a box but to get the economies of scale is a challenge McCashins in Nelson are doing well so far with their Stoke brand and Rochdale cider.

In an efficient market sometimes loans fail. It would be kore concerning if everyone paid all the time because banks risk profile would be seen as too conservative.

I have done a lot of offshore sailing, as you sail through the eye of a cyclone you are happy that you survived the first half, but you spend the entire calm tying things down on deck, you are only half way to the other side.....more adversity is to face us all, enjoy the calm

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.