OBR

Reserve Bank's risk appetite may have increased, but it has a 'very low appetite for events that could create systemic risks,' new Governor says

19th Dec 25, 5:00am

2

Reserve Bank's risk appetite may have increased, but it has a 'very low appetite for events that could create systemic risks,' new Governor says

[updated]

Reserve Bank consultation details possible changes for its open bank resolution policy

5th Sep 24, 9:17am

Reserve Bank consultation details possible changes for its open bank resolution policy

Deposit insurance expert Geof Mortlock details concerns about New Zealand's incoming depositor compensation scheme

24th May 24, 10:01am

12

Deposit insurance expert Geof Mortlock details concerns about New Zealand's incoming depositor compensation scheme

[updated]

Treasury says depositor compensation scheme fund to build up over 20 years, covering 0.8% of protected deposits

9th May 24, 10:00am

5

Treasury says depositor compensation scheme fund to build up over 20 years, covering 0.8% of protected deposits

After years of work involving thousands of staff & hundreds of millions of dollars, the big four banks say they've met the RBNZ's new outsourcing requirements

14th Nov 23, 5:00am

9

After years of work involving thousands of staff & hundreds of millions of dollars, the big four banks say they've met the RBNZ's new outsourcing requirements

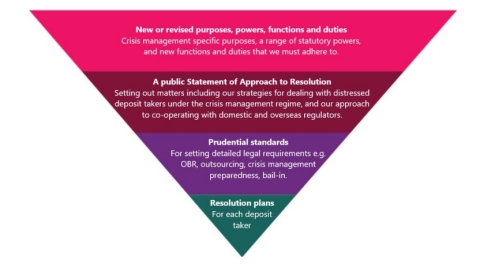

Reserve Bank to prepare and maintain a plan for dealing with every deposit taker in case it fails

4th Nov 23, 9:20am

15

Reserve Bank to prepare and maintain a plan for dealing with every deposit taker in case it fails

Deposit insurance expert suggests $100k cap will need to be increased over time to maintain inflation-adjusted value

23rd Aug 23, 2:33pm

8

Deposit insurance expert suggests $100k cap will need to be increased over time to maintain inflation-adjusted value

RBNZ to review Open Bank Resolution policy settings once depositor compensation scheme is launched

17th Dec 22, 10:00am

25

RBNZ to review Open Bank Resolution policy settings once depositor compensation scheme is launched

ANZ NZ CEO says NZ's biggest bank to be ready for new RBNZ outsourcing requirements ahead of schedule, but would've liked to spend the money on customer services

9th May 22, 4:44pm

2

ANZ NZ CEO says NZ's biggest bank to be ready for new RBNZ outsourcing requirements ahead of schedule, but would've liked to spend the money on customer services

Government bails on bail-in, ditching the opportunity to give the Reserve Bank a tool to shield taxpayers in the event of a bank becoming distressed

4th Feb 22, 10:32am

38

Government bails on bail-in, ditching the opportunity to give the Reserve Bank a tool to shield taxpayers in the event of a bank becoming distressed

Beefed up RBNZ bank failure powers under the incoming Deposit Takers Act to include statutory bail-in and statutory management

23rd Apr 21, 2:33pm

32

Beefed up RBNZ bank failure powers under the incoming Deposit Takers Act to include statutory bail-in and statutory management

Government consultation paper probes the cost & size of deposit insurance fund needed in move from an 'uncertain implicit guarantee' to a 'managed explicit guarantee'

5th Apr 20, 6:02am

87

Government consultation paper probes the cost & size of deposit insurance fund needed in move from an 'uncertain implicit guarantee' to a 'managed explicit guarantee'

Document obtained by interest.co.nz highlights the different wave lengths Treasury and the RBNZ are on as they design a deposit protection regime

18th Feb 20, 5:00am

31

Document obtained by interest.co.nz highlights the different wave lengths Treasury and the RBNZ are on as they design a deposit protection regime

RBNZ slams Treasury for ‘deep-seated confusion’ behind Treasury's view the RBNZ's bank capital proposals were too high, and it should've waited for a deposit protection regime to be developed before making a final decision

20th Dec 19, 10:00am

21

RBNZ slams Treasury for ‘deep-seated confusion’ behind Treasury's view the RBNZ's bank capital proposals were too high, and it should've waited for a deposit protection regime to be developed before making a final decision

Finance Minister confirms govt's deposit insurance plans, reveals plans for new RBNZ governance, Aussie-style bank director & executive accountability, levies to help fund RBNZ, a single deposit takers regime & more

18th Dec 19, 10:27am

66

Finance Minister confirms govt's deposit insurance plans, reveals plans for new RBNZ governance, Aussie-style bank director & executive accountability, levies to help fund RBNZ, a single deposit takers regime & more