Below is a statement from Minister for Small Business Stuart Nash.

Better protection against late payments

New legislation is being proposed which aims to reduce the stress and financial hardship caused by late payments to small businesses.

The Minister for Small Business Stuart Nash is considering stricter rules around payment practices between businesses. “Late payments from large organisations to smaller suppliers can be crippling for these businesses,” Mr Nash said.

“I am prepared to legislate if necessary to set minimum standards for payment terms. Today I have released a discussion document which sets out options for further action. I want to hear feedback from those affected before taking next steps.

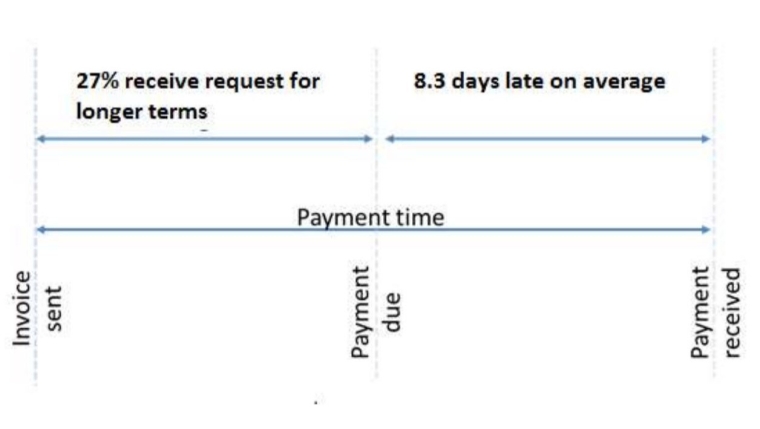

“Late payments impede business growth yet are common. They are often imposed on a small business by larger enterprises which have greater bargaining power. Late payments effectively force small suppliers to be a source of free credit.

“When small businesses are paid late, many owners have to resort to personal savings or take out bank overdrafts to cover their business expenses. Research by Xero indicates that on any given day more than half of small businesses are owed at least $7,000.

“Cashflow is king yet late payments or extended payment terms are undermining the small business landscape. In the discussion document I am inviting comment on two proposals that could improve business-to-business payment practices:

·A maximum payment term of 20 days to ensure small businesses are reimbursed for their services more quickly.

·The right for small businesses to charge interest on overdue invoices and debt recovery fees for late payments.

“Other options in the discussion document include a disclosure regime requiring large businesses to publicly report on their payment terms and payment times, or whether there should be a voluntary code of practice.

“The government is also stepping up to take the lead on prompt payment practices. It is setting a target for government departments to pay 95 per cent of domestic invoices in 10 business days, by June 2020.

“The proposed changes would significantly improve business-to-business cash flow, and give small businesses more power to address and recover late payments.

“Small business is a vital part of New Zealand’s economy, bringing innovative and essential products and services to the market, and employing more than 600,000 people.

“The proposed action on late payment practices and oppressive payment terms is the latest government initiative designed to make the business climate easier and fairer for small and medium enterprises.

“Across government we have:

·moved to stamp out unfair trade practices with changes to the Fair Trading Act;

·set up a Venture Capital Fund to support business expansion

·introduced research and development tax credits;

·revitalised provincial economies with more than 530 projects through the Provincial Growth Fund;

·begun a $12 billion upgrade to vital infrastructure like roads and rail, and public education and health facilities;

·levelled the playing field on GST for small retailers, like booksellers, who compete with offshore suppliers;

·established systems that allow for e-Invoicing to get underway;

·moved to relax the rules allowing tax losses to be carried forward to future years;

·removed the debt burden for apprenticeships and tertiary training to boost the supply of skilled workers;

·created new online tools on the business.govt.nz site to make it easier to access finance and build capabilities and skills of business owners, amongst other measures.

“Submissions are open till Tuesday 14 April,” Mr Nash said.

The discussion document and details for how to make a submission can be found on the MBIE site here.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.